Escolar Documentos

Profissional Documentos

Cultura Documentos

Econ Project

Enviado por

Nikote EtienneDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Econ Project

Enviado por

Nikote EtienneDireitos autorais:

Formatos disponíveis

U.S.

Current Account Deficit

Group 8 Olulola Akingbade Paul Aliu Brandon Bailey Nikote Etienne Sharia Fox Keisan Griffith-Roberts

Review current account dynamics as it relates to: domestic savings and investment relative to world savings and investment; international capital flows; international growth and productivity in traded and non-traded goods; prices, interest rates and exchange rates; fiscal and monetary policy. In relation to the current-account deficit, although it has declined from an average of almost five percent of GDP in 2000 through 2007 to three percent of GDP in 2009 and 2010 domestic savings remained fairly low in relation to household consumption. Household investment stayed relatively stagnant and declined in relation to the weakening economy that occurred after the technology bubble popped and in the wake of September 11, 2001. This caused the household debt to income ratio increase from roughly 89 percent in 2002 to approximately 120 percent in 2009 (http://www.creditwritedowns.com/2012/10/us-householddebt-to-income-debt-servicing-cost-ratios.html).

International capital flows remained somewhat steady, if not increasing, due to the fact that although the US debt was increasing, domestic consumption of foreign goods was funding their economic growth. Also, in light of the global economic downturn stimulated by the Great Recession, American debt became one of the safest investments for foreign states due to the fact that the Eurozone and many Asian currencies experiences measurable declines. International growth and productivity in traded and non-traded goods did increase in growing economies due in part continued dependence on American consumption. However, trading in US goods declined due the increased value of the dollar against currencies of countries that manufactured equivalent good (i.e. the Yuan and the Yin). Per exhibit 4c, there is a significant decline in the trade balance between the USA and other nations roughly in 2002 with a slight decrease in 2009 which was most likely attributed to the depreciation of the Euro against the US dollar. This most likely caused US exports to Europe to become more viable. In relation to the current account balance, there is not truly a need to exceed payment beyond the rate of consumption due to historical precedent that in times of US decline, foreign direct investment tends to increase which supplements domestic ability to consume.

Explore interaction between current account balance and net liability position, including the effect of valuation (e.g. a depreciated dollar raising the value of foreign assets held by U.S. residents and/or firms). The interaction between current account balance and net liability position is somewhat complicated based on the fact that there are factors in each that cause them to rise respectively. To begin, the current account balance tells whether the economy is running in a deficit or a surplus, while the net liability position reflects the amount of foreign held U.S. debt. While one

is drawn more from the economic policies established by the government, the other is determined by the amount of federal debt that other nations are willing to acquire. Generally speaking, U.S. treasuries (the source of net liability) are a safer investment than most other sovereign investments. Therefore, no matter what policies the U.S. institutes, as long as there are securities available for sale on the open market, the U.S. is unable to control the amount of net liability growth short of removing treasuries from the open market.

http://www.american.com/archive/2009/march-2009/q-a-how-to-think-about-the-u-s-dollar As the graph above implies however, there is some correlation between the current account balance and the net liability position. Even in times when one would expect a the current account to decline, such as after the September 11th terrorist attacks, foreign investment inflates the balance. If you recall, during that time, the U.S. exchanges as well as many foreign markets were in turmoil. It would be expected that the current account balance would diminish following the trend of the previous years. Instead, the account had a positive movement, generally attributed to an increase in foreign purchases of U.S. treasuries. Again, in that time of economic

turmoil, foreign investors still saw the United States as the safest investment. This, however, promotes a trend that entices the U.S.A. to maintain its current negative account balance because it relies of foreign investments to provide capital required to function at its current rate. In relation to the valuation of the U.S. dollar following that same crisis in addition to the bursting of the dot com bubble some time earlier, it declined against most of the prominent currencies (the GBP and the Euro in particular). Due to the decrease in the value of the dollar, the value of these denominated investments in U.S. portfolios increased. Additionally, this same devaluation caused the price of U.S. exports to decrease. This, in turn, caused the export/import ratio to move in a more positive direction. As the chart indicates, from 2001 to 2002, there is a noticeable increase in the amount of U.S. exports to foreign consumers. This same trend occurred again in 2007/2008 at the outset of the mortgage backed securities crisis which led to the recent severe recession. Again, there was an influx of foreign investment that caused the current account to trend up while at the same time a weakening of the dollar causing U.S. exports to increase.

Explore parallels with previous periods of U.S. external imbalance. The current external imbalance in the US economy is not a new phenomenon. The US has run long-term deficits in both its current account and NIIP. The most notable periods of external imbalance in US history include: the Global Gold Standard (GGS) of 1870-1914, the Interwar Period (IWP) of 1914-1939, the Bretton Woods period (BW) 1959-1971, Twin Deficits period (TD) of the 1980s, and the period of Escalating Current Account Deficit (ECAD) of 20002005.

The three earliest periods, GGS, IWP, and BW, were all characterized by some degree of dollar inflexibility. The GGS fixed major currencies against each other by pegging them to gold. During the IMP period, the US and UK agreed to exchange their currency for gold at a fixed rate. The BW system pegged the dollar to gold at a specified rate and pegged other currencies to the dollar. This inflexibility prevented the currency markets to adjust naturally to other changes in the economy. As a result, both monetary and fiscal policies were implemented to prevent economic downturn. These policies proved unsuccessful in the long run and all of these periods ended in either harsh recessions or depressions. The TD and ECAD periods were characterized by expansionary fiscal policy. The federal government lowered taxes and increased government spending. During the TD period, the Federal Reserve kept interest rates high to protect against inflation. During the ECAD periods, the Federal Reserve cut interest rates. In both periods, the goal in lowering taxes was to increase consumption and spur GDP growth. This was successful in the short run but led to significant increases in the trade deficit in the long run. During the BW and TD periods, major economies of the time attempted to regulate the currency market through various policies and activities. European policy makers in the BW period forbade open purchases and sales of foreign exchange. This was an attempt to control the US current account and correct a dollar scarcity problem. In the TD period, the dollar appreciated significantly. This caused members of the G5 (France, West Germany, Japan, UK, and the US) to take action. They worked to devalue the dollar against the Deutsche Mark and the Yen. Their actions were successful and the dollar depreciated significantly over the next two years.

Similarly, foreign economies have also invested into the US in order to protect their own interests. In the BW period, foreign central banks acquired short-term liquid claims on the US. The US no longer had the means to cover its long-term foreign investments with the surplus of the current account. This was done as a balancing measure. During the ECAD period, the US current account was essentially funded by foreign investment. Asian countries in particular bought US debt to prevent the dollar from depreciating against their currency. This served to keep their export sectors, patronized largely by the US, healthy. Upon close inspection, many similarities are present among prior periods of external imbalance. Inflexibility of the dollar, fiscal policy of lowering tax receipts while increasing government spending, and foreign intervention all characterize multiple periods of imbalance. Whether these characteristics are causes of the inflexibility or simply correlated is beyond the scope of this question, but it is definitely food for thought.

Is Warren Buffetts decision to bet against the dollar a good one? The global economy runs on the currency of the United States of America, the dollar. Today the world central banks hold about two thirds of their reserves in U.S. dollars. From China to Chile, Norway to Nigeria, most commodities are priced in American currency and much of world trade is invoiced in dollars as well. In sum, the dollar is the lifeblood of the international financial system. However, the recent economic development in the United States has raised several questions about the long term future of the US dollar. This has triggered various speculative activities by both traders and investors. Notable among this event is the decision of world famous investor and chairman of Berkshire Hathaway Inc., Warren Buffet to bet against the dollar.

Betting against a currency is simply the act of making a investment decision with the belief that the value of that currency will depreciate or weaken in the near future. Warren Buffett recently travelled to South Korea for a factory opening and called the country a hunting ground for investments. He also pronounced post-earthquake Japan a buying opportunity, and then traveled on to India, where he said he was eyeing more acquisitions. This is Buffetts way of betting against the U.S. dollar. Armed with about $38 billion of cash at Berkshire Hathaway, he can use dollars now to buy companies that will generate profits in other currencies for years to come1. The future weakening of the dollar seems imminent for some obvious reasons. One is the present record current account deficit. Another key factor is the slow rate of economic recovering which led to the introduction of Quantitative Easing. With the recent decision of the Federal Reserve to commit $40 billion monthly to purchase mainly Mortgage Backed Securities in the Quantitative Easing 2 program, it is evident that the dollar is further set to depreciate in value. In addition, crude oil also plays a key role in the worth of the dollar since it is globally priced in US dollar. According to the International Monetary Fund, over the long run a one percent depreciation of the dollar is connected to gains for oil of more than one percent. Oil is bought and sold in dollars, forcing exporters to raise prices to compensate for a less potent currency. Some exporters also recycle oil revenue into other currencies. Higher crude prices also worsen US trade balances, pressuring the dollar. Investors concerned that quantitative easing will lead to runaway inflation and debased currencies have also flocked to commodities as a hedge2.

Unless the US Government takes urgent measures to address the record deficits, the value of the dollar will significantly weaken in the near future. This will consequently lessen the worth of dollar investments. In view of these factors, Warren Buffets decision to bet against the dollar can be counted as a good one from an individual perspective. [i]

Why has the U.S. developed such large current account deficits? As economic policy of the United States is primarily characterized by spending in excess of revenues, importing in excess of exports and no sign of short term balance, the country has found methods other than export, investment or taxation revenues to finance its economic condition. The country has turned to issuing United States Treasury Securities, leveraging national assets, and reliance on the appreciation of foreign owned assets to prevent the loss of investor confidence in the country and further finance national spending. As the current account deficit and consumption continue to grow in relation to revenue streams, the current state has become a double edged sword. On one hand, the United States has fostered and supported the growth of many of its trade partners and developing economies; on the other, the looming threat of the countrys insolvency in light of mounting issuance of Treasury securities, particularly to Asian banks (Edwards, p. 220), has threatened the worldwide economy and in turn caused the deficit to grow and capital inflows to perpetuate through the fear of failure and avoidance of the collapse. By looking at several key economic indicators, the above mentioned state of the perpetuated failure to maintain a balanced budget is further exemplified. In essence, the United States current account imbalance is being financed through two means, the leveraging of American assets and the issuance of United States Treasury Securities;

both of which become large liabilities to the U.S. and global economy. Despite the threat of the loss of investor confidence, the current mounting of debt is further perpetuated by the world wide reliance on the value of the dollar as a reserve currency, as well as the U.S.s position as a major consumer and vehicle for global economic growth. With a current account deficit in 2010 of $470.2 billion, consisting of net trade deficit of $500 billion, factor income of $165 billion, and negative Cash Transfers of $ 136 billion (Alfaro & Tella, p. 16), this financed by net bond issuance in 2010 alone of $1.5 trillion with $2.5 trillion becoming due by the end of fiscal year 2011 (U.S. Treasury, pp. 14-19). Although the Balance of Payments in the United States, has consistently been negative for over a decade, investment in U.S. Securities and assets continues to grow. This reflects the above mentioned fear of failure of the United States economic system and suspected resulting ripple effect on the global economy. For example, according to the United States Treasury, in 2010 major holders of United States Treasuries in summation held over $4.1 trillion including China and Japan held $1.1 and $ 0.82 trillion respectively. In addition, the worldwide use of the dollar as a reserve currency of $9.3 trillion places particular risk on foreign governments and central banks of devaluation of the dollar, which will become inevitable if default and/or a loss in investor confidence occurs. In addition, as one of the top international importers of foreign goods as well as a major facilitator of global growth through investment and consumption, a halt in financing of U.S. spending may stunt or even shrink global growth as a whole.

Is the U.S, current account deficit in 2005 sustainable? Is it an economic problem, political problem or both?

In 2005 the US current account continued to worsen as it reached a deficit of 746 billion dollars and its NIIP at a deficit of 1,932 billion dollars. If this trend continues, the US economy would not be able to sustain it however for a number of reasons. Firstly, the US current account deficit continues to be funded by foreign investment. Foreign owned US assets totaled 13,894 billion dollars as compared to 11,962 billion dollars in US owned assets abroad. By 2006, total foreign holdings of US Treasury securities totalled 2,087 billion dollars. This dependency on foreign investment would cripple the US economy if it were to cease. There was no guarantee that Asian central banks would continue to support the dollar. Many of them were becoming more worried about the effects that further worsening of the US economy could have on their own economies. This was seen as Yoon Jeung Hyun, South Koreas top banking regulator, hinted at a gradual move away from this system. Furthermore, some countries were also worried about whether the US economy would continue to be a secure holding for foreign currency in U.S. dollar assets. THe heads of Japan and Chinas publicly admitted that they were worried about the US economy and were considering diversifying their currency holdings. Secondly, the US ability to repay interest commitments was dwindling. This was due to a large percentage of exportable goods being non-trade goods, which further would lead to a depreciation of the dollar over time. In the tradeables sector, extra export capacity generated could be used to service debt but in the non tradeables sector this is not so. In 2004 economists Ostfeld and Rogoff estimated a possible depreciation of the trade weighted dollar of up to 40% or more. This depreciation would result in a larger debt in foreign currency terms. This problem of an unsustainable current account deficit would be both an economic and political problem. Firstly, it would impact the US economically through further depreciation of

the dollar, a worsened current account, increased unemployment, and an eventual collapse of the US economy. On the political side, this economic fallout would pose a severe threat to any partys re-election campaign. Key issues such as unemployment rates, strength of the US dollar, national debt, and the US GDP levels all have an impact on a incumbent partys re-election chances. 2005 was the first year in the Republicans second term in office and with three more years their future seemed bleak.

How can the U.S. reduce its current account deficit? What are the global implications? There are a number of ways that the U.S. can reduce its current account deficit, some more favorable than others. One way, is to encourage the devaluation of the U.S. dollar. This method would certainly lead to favorable conditions for the U.S. concerning their debt and current account deficit issues but would seriously impact the investment condition for the rest of the world. Another option to decrease the account deficit is to increase public and private saving

via monetary and/or fiscal policy or reduce national investment. This solution is derived from the basic national income identity equation but requires that aggregate demand to remain unchanged in the process. To reduce the current account deficit, the U.S. can work to ensure the depreciation of the dollar to a value more reflective of its worth. Of course, the dollar is still looked at as the global currency due to involvement in global trade so a deep and rapid depreciation would be detrimental to the global economy. Looking at the current trend, the U.S.s mounting liabilities to foreign debtors has not gone unnoticed. Major holders of U.S. treasury bonds have begun to reconsider the security of the the dollar as previously mentioned in in this paper. Wei Benhua, the Deputy Chief of the State of the State Administration of Foreign Exchange, is among foreign officials how have voiced concerns over the U.S.s trade deficit saying that the U.S. should, put its own house in order before blaming others. The issue however, is that China does not necessarily want the current trade deficit plaguing the U.S. to change. Imports are 16% of GDP, $14.7 trillion dollars (Exhibit 2a). Of that 16%, Asia has been the supplier of more than 30% of U.S. imports since 2002, and 38% of U.S. imports in 2010. In 2010, China was responsible for 19% of U.S. imports. It goes without saying that this current account imbalance has benefitted China a great deal. In addition to this, China is the biggest holder of U.S. treasury bonds (Exhibit 9a). All of this simply means that China will undoubtedly be the most resistant to any changes that would result in the devaluation of the dollar. As the dollar depreciates, Chinese investment in the dollar will lose value. Nonetheless, there has been a continued devaluation of the dollar since 2002 against foreign currencies (Michael Mussa, p581). As financial obligations continue to grow for the U.S., the small question of how and when the U.S. will pay this debt back begins to grow into a

big question. The dollar will continue to deteriorate in real value as the U.S. becomes more of a questionable investment. In more organic market conditions, the exchange rate for a dollar could have already reached a level where the value of the dollar is more properly reflected. Because China has been purchasing large amounts of U.S. treasury bonds, they have been able to prevent the appreciation of their currency against the dollar, and the depreciation of the dollar against theirs. So, in order to depreciate the dollar to a level more reflective of its real value, the U.S. should refrain from offering treasury bonds to China and other asian countries. By diversifying the debt holdings of U.S. bonds, the depreciation of the dollar may be able to take its natural course. Also, un-purchased bonds are subject market conditions and competing rates. The issue with this solution is execution. How would the U.S. be able to prevent China from purchasing U.S. treasury bonds on the open market. Pressure from the U.S. alone is not enough to keep China from continuing to manipulate the exchange rate in this way. Imposing tariffs or quotas on China would only instigate a trade war and the U.S. relies on the imports from China very heavily as mentioned before. The best approach would be through international organizations like the U.N. or the WTO that can pressure China from all sides in the interest of the world economy. In all actuality, China has not done anything wrong. The bonds are available to anyone willing to buy them. Nonetheless, this practice is to the detriment of the U.S. current account and therefore unhealthy for the many economies that are supported by U.S. consumption and investment in the long run. Allowing the depreciation of the dollar will undoubtedly have direct positive effects on the U.S. economy. Imports become more expensive as the dollar weakens making foreign goods more expensive. This helps to switch reliance over to domestic products as they become more affordable by comparison. Export levels are likely to decrease as a result. In addition, U.S. goods

become more affordable to foreign markets, increasing export levels. The idea is to implement a plan to increase exports to a level greater the imports. However, negative effects of the depreciation of the dollar are not absent. As the value of the dollar declines, the value of U.S. treasury bonds declines. At this stage the U.S. is still considered by many to be the center of economic activity in the world. A great deal of this has to do with the fact that a major portion of the worlds investments are denominated in dollars. As the dollar declines, it becomes less of a viable investment and can lead to a revaluation of the U.S. as the center of trade for the world. This means less foreign investment and financing in times of need. Looking at the national income accounting identity, in order to decrease the current account deficit, national savings has to increase or investment needs to decrease. Raising national savings means reducing private consumption and/or government spending. Using monetary policy the government can simply decrease or maintain the money supply in order to encourage savings. As savings increase, consumption decreases. Via fiscal policy, the government can curb their spending and increase savings. A prime example of how the U.S. got itself into this predicament is its wartime spending. Essentially, the government spends trillions on weapons. The U.S. may not use those weapons but still has to pay to maintain them continuously. This is a decision that has to be made by the President of the U.S. and then be supported by congress. By raising national savings, there is more money available to retire debt and less consumption. Less consumption means the amount of imports should decrease creating a current account surplus. Less debt means that there is less U.S. capital flowing out of the domestic economy to pay foreign debtors. Another important consideration is inflation and its domestic effects. As the value of the dollar decreases, the inflation rate increases, decreasing domestic demand thereby curbing excess

spending and decreasing U.S. consumption. As the value of the everyday consumers disposable income decreases, it becomes feasible to predict that expenditures on items other than bills and necessities will also decrease. Each method to reversing the U.S. current account deficit has its drawbacks backs. This is a reality that the U.S. and the global economy has to except. If the U.S. is to deal with their current account imbalance, a negative impact is going to be felt on some level around the world. However, motivation for a resolution to be reached is trumps any personal agendas. The U.S. current account deficit is not sustainable and in the long-term could lead to the collapse of the dollar. This is obviously a worse case scenario but, if it were to happen the effects would be exponentially worse than those of anyone of the solutions presented.

References Martin Feldstein, The role of currency realignments in eliminating the US and China current account imbalances, Journal of Policy Modeling, Volume 33, Issue 5, SeptemberOctober 2011, Pages 731-736, ISSN 0161-8938, 10.1016/j.jpolmod.2011.07.005. (http://www.sciencedirect.com/science/article/pii/S0161893811000615)

Eiji Ogawa, Takeshi Kudo, Asymmetric responses of East Asian currencies to the US dollar depreciation for reducing the US current account deficits, Journal of Asian Economics, Volume 18, Issue 1, February 2007, Pages 175-194, ISSN 1049-0078, 10.1016/j.asieco.2006.12.007. (http://www.sciencedirect.com/science/article/pii/S1049007806001898)

Michael Mussa, The dollar and the current account deficit: How much should we worry?, Journal of Policy Modeling, Volume 29, Issue 5, SeptemberOctober 2007, Pages 691-696, ISSN 01618938, 10.1016/j.jpolmod.2007.06.005. (http://www.sciencedirect.com/science/article/pii/S0161893807000750)

Edwards, S., Dominguez, K., & Pierre-Olivier G .(2005). Is the U.S. Current Account Deficit Sustainable? If Not, How Costly is Adjustment Likely to Be? Brookings Papers on Economic Activity, 1, pp. 2-3.

1The Washington Post 2. The Financial Times (September,2009)

Você também pode gostar

- Airport Airline Depart Arrive Duration Miami American AirlinesDocumento1 páginaAirport Airline Depart Arrive Duration Miami American AirlinesNikote EtienneAinda não há avaliações

- Phocas Food And-Beverage EbookDocumento11 páginasPhocas Food And-Beverage EbookNikote EtienneAinda não há avaliações

- Defending Cyberspace and Supply ChainDocumento24 páginasDefending Cyberspace and Supply ChainNikote EtienneAinda não há avaliações

- The Outsourcing GameDocumento9 páginasThe Outsourcing GameNikote EtienneAinda não há avaliações

- Financial ModelingDocumento6 páginasFinancial ModelingNikote EtienneAinda não há avaliações

- Marketing Team 3 PreziDocumento18 páginasMarketing Team 3 PreziNikote EtienneAinda não há avaliações

- Financial Modeling Homework GuidelinesDocumento21 páginasFinancial Modeling Homework GuidelinesNikote EtienneAinda não há avaliações

- Fall 2013 Financial Modeling AssignmentsDocumento21 páginasFall 2013 Financial Modeling AssignmentsNikote EtienneAinda não há avaliações

- Financial Modeling-Exam 1 Review This Exam Contains 14 Questions Worth 20 PointsDocumento3 páginasFinancial Modeling-Exam 1 Review This Exam Contains 14 Questions Worth 20 PointsNikote EtienneAinda não há avaliações

- Social Domain of Mens HealthDocumento2 páginasSocial Domain of Mens HealthNikote EtienneAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Assignment 1Documento2 páginasAssignment 1chanus19Ainda não há avaliações

- Winning Trading StrategiesDocumento36 páginasWinning Trading StrategiesMEGAT MUAZAM SYAH BIN ABD RAHMAN SYAH83% (6)

- Financial and Managerial AccountingDocumento1 páginaFinancial and Managerial Accountingcons theAinda não há avaliações

- Golden Stocks PortfolioDocumento6 páginasGolden Stocks PortfoliocompangelAinda não há avaliações

- AfarDocumento14 páginasAfarPaulo MiguelAinda não há avaliações

- Forex ScamDocumento4 páginasForex ScamfelixaliuAinda não há avaliações

- Erpm 1Documento33 páginasErpm 1Nivethitha NarayanasamyAinda não há avaliações

- Nuisance of TranslucenceDocumento9 páginasNuisance of TranslucenceTumisang MasalelaAinda não há avaliações

- 14.127 Behavioral Economics. Lecture 11: Introduction To Behavioral FinanceDocumento13 páginas14.127 Behavioral Economics. Lecture 11: Introduction To Behavioral FinanceBánh GạoAinda não há avaliações

- Yale UniversityDocumento37 páginasYale UniversitySanchirmaa Sukhbaatar0% (1)

- Emir RTSDocumento24 páginasEmir RTSArun Kumar SikriAinda não há avaliações

- March Appointment & ResignationDocumento37 páginasMarch Appointment & Resignation17as1913106Ainda não há avaliações

- FinQuiz Level2Mock2016Version3JuneAMQuestionsDocumento33 páginasFinQuiz Level2Mock2016Version3JuneAMQuestionsDavid LêAinda não há avaliações

- EBL Annual Report 2018Documento308 páginasEBL Annual Report 2018TasnimulAinda não há avaliações

- PWC Derivative Hedge Accounting PDFDocumento385 páginasPWC Derivative Hedge Accounting PDFprashant sarodeAinda não há avaliações

- Bond Spreads - Leading Indicator For CurrenciesDocumento6 páginasBond Spreads - Leading Indicator For CurrenciesanandAinda não há avaliações

- Bruce Greenwald InterviewDocumento9 páginasBruce Greenwald Interviewkirit0Ainda não há avaliações

- Top 10 Private Sector Banks by AssetsDocumento129 páginasTop 10 Private Sector Banks by AssetsrohitcshettyAinda não há avaliações

- TREIT Circular 2010Documento110 páginasTREIT Circular 2010sladurantayeAinda não há avaliações

- Sbi Life Insurance Ajmer ": A Project Report ONDocumento65 páginasSbi Life Insurance Ajmer ": A Project Report ONdeepak_keswani86Ainda não há avaliações

- CRISIL Mutual Fund Ranking MethodologyDocumento7 páginasCRISIL Mutual Fund Ranking MethodologyJoydeepSuklabaidyaAinda não há avaliações

- The Cboe S&P 500 Putwrite Index (Put) : Month End Index Values, June 1988 To May 2007Documento13 páginasThe Cboe S&P 500 Putwrite Index (Put) : Month End Index Values, June 1988 To May 2007alexjones365Ainda não há avaliações

- CV Nasir AbbasDocumento3 páginasCV Nasir AbbasMarci KelleyAinda não há avaliações

- Licensees List Update January 2018 1 PDFDocumento14 páginasLicensees List Update January 2018 1 PDFMónika FeketeováAinda não há avaliações

- Rolling and Jamming With BollingerDocumento62 páginasRolling and Jamming With BollingerPrakashAinda não há avaliações

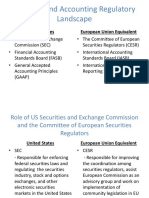

- Financial and Accounting Regulatory LandscapeDocumento7 páginasFinancial and Accounting Regulatory LandscapeDiana Mindru StrenerAinda não há avaliações

- Lec 8Documento32 páginasLec 8Zahid NazirAinda não há avaliações

- Ias33 PDFDocumento26 páginasIas33 PDFJorreyGarciaOplas100% (1)

- Bank of Mauritius Act 2004 - 20090810Documento41 páginasBank of Mauritius Act 2004 - 20090810Dominique83Ainda não há avaliações

- Valuation of Asset For The Purpose of InsuranceDocumento13 páginasValuation of Asset For The Purpose of InsuranceAhmedAli100% (1)