Escolar Documentos

Profissional Documentos

Cultura Documentos

Real Estate and Construction Sector in The UAE

Enviado por

Roshan de SilvaDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Real Estate and Construction Sector in The UAE

Enviado por

Roshan de SilvaDireitos autorais:

Formatos disponíveis

Centre for Case Studies

3227 For Centre use only

Real Estate and Construction Sector in the UAE: Growth Strategies

Case prepared by Professor B. Rajesh KUMAR,1 Abhas AGARWAL and Rajat KHULLAR

Real Estate and Construction Sector in the UAE

Macro perspective Gulf Cooperation Council (GCC) The Gulf Cooperation Council, commonly known as GCC, was established in 1981 to promote cooperation among the GCC nations as part of a unified economic agreement. GCC members include the countries of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates. In 2008, GCC nations combined Gross Domestic Product totalled $1.1 trillion, with Saudi Arabia being the largest contributor, with approximately 47%, followed by UAE at 23%, Kuwait at 14% and Qatar at 10%.

B. Rajesh Kumar is an Assistant Professor at the Institute of Management Technology, Dubai International Academic City, Dubai, UAE.

HEC Montral 2010 All rights reserved for all countries. Any translation or alteration in any form whatsoever is prohibited. This case is intended to be used as the framework for an educational discussion and does not imply any judgement on the administrative situation presented. Deposited with the HEC Montral Centre for Case Studies, 3000, chemin de la Cte-Sainte-Catherine, Montral (Qubec) Canada H3T 2A7.

Real Estate and Construction Sector in the UAE: Growth Strategies

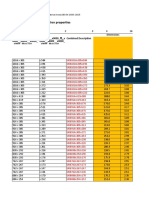

Nominal GDP Values for GCC Countries (in US billion dollars)

Kingdom of Saudi Arabia United Arab Emirates Kuwait Qatar Sultanate Of Oman Kingdom Of Bahrain 2000 188.00 70.60 37.70 17.80 19.90 7.97 2001 183.00 68.70 34.90 17.50 19.90 7.93 2002 189.00 75.30 38.10 19.40 20.30 8.49 2003 215.00 88.60 47.90 23.50 21.80 9.75 2004 2005 2006 250.00 316.00 357.00 104.00 133.00 163.00 59.40 31.70 24.80 11.20 80.80 102.00 42.50 52.70 30.90 35.70 13.50 15.80 2007 384.00 180.18 112.00 71.04 40.39 18.84 2008 468.00 260.14 158.09 102.30 52.58 21.24

Construction and Real Estate Sector in GCC Nations

Strong crude prices over the last five years have played a significant role in boosting the economic growth of GCC nations, and even now, oil is still the major contributor to the economies of these nations. However, there has been a gradual shift in focus away from a reliance on the hydrocarbon sector and towards diversification. This shift has given a significant boost to many sectors, with one of the most important areas to have emerged being the construction and real estate sector. In tandem with the increasing contribution of construction and real estate activity to the GDP, credit distribution to this sector increased astronomically due to close links with increasing construction activity.

United Arab Emirates

The United Arab Emirates, or UAE, is a constitutional federation formally established on December 2, 1971. UAE consists of seven emirates: Abu Dhabi, Dubai, Sharjah, Ajman, Umm al-Qaiwain, Ras al-Khaimah and Fujairah. The UAE presently has one of the most rapidly growing economies and one of the largest GDPs and energy consumption per capita in the world. The UAEs major sources of revenue are petroleum and natural gas, with Abu Dhabi having the highest share compared to other emirates. As a key to achieving sustainable growth, the local government started encouraging the non-oil sectors to reduce their reliance on oil and gas. At Dh467.9 billion, the UAEs non-oil sector contributed around 64% of total GDP in 2007. The UAEs economy posted growth of 7.5% in 2008, despite a global recession. Total GDP at current prices amounted to Dh 929.4 billion in 2008, compared to 729.7 billion in 2007. The countrys impressive economic growth can be attributed to key factors such as the strong oil market, active development of public joint stock companies, increased involvement of free zones and buoyant local stock markets, together with the launch of a number of significant new projects. One of the major beneficiaries of this drive has been the infrastructure and real estate sector.

HEC Montral

Real Estate and Construction Sector in the UAE: Growth Strategies

In 2007, the construction and real estate sector each accounted for 8% of total GDP. Construction and real estate sector in the UAE In the last five years, the GCC has experienced a record boom in the infrastructure sector. Construction projects in the GCC exceeded $1 trillion, with two-thirds of the projects being undertaken in the UAE. The construction and real estate sector in the UAE posted double-digit growth on a year-on-year basis and contributed 15% to GDP. The unprecedented growth in the UAEs construction and real estate sector had Dubai and Abu Dhabi observing the highest increase in the number of construction projects. Dubai has seen a major boom in the construction and real estate sector, making it a hub for some of the worlds biggest construction companies, including Nakheel PJSC and Emaar Properties PJSC. Abu Dhabi is also a major hub for construction companies, including Aldar Properties PJSC. Significant construction projects have also been carried out in other emirates. Diversification remains the key to achieving sustainable growth in the UAE and the government is firmly focused on encouraging the non-oil sector to maintain its major role in the countrys economy. Proof of the massive boom in economic activity throughout the country is apparent in the high concentration of cranes in Abu Dhabi and Dubai. It is no surprise, therefore, that the construction sector grew by an impressive 25.6% in 2007, compared to 2006. The United Arab Emirates (UAE) accounts for 23% of the GCCs economy. It remains the driving force behind the economic transformation of the GCC into a global hub. In nominal terms, the CAGR of UAEs real estate and business services sector witnessed record growth of 20% during the 2003-2007 period. The sectors key drivers include, among others: a growing expatriate population, ample liquidity and a friendly regulatory environment. Moreover, as a regional hub for investments, the UAE attracts international companies to establish offices. Abu Dhabi, Dubai and Sharjah have been the main beneficiaries of the exceptional growth in construction and real estate projects, mainly due to the liberalization of real estate and property laws, which has generated unprecedented development in this sector. The creation of free zones has also acted as a major catalyst for local and foreign investment by offering incentives such as 100% foreign ownership, one-stop locations for paperwork and other procedures, exemption from import duties and taxes, full repatriation of capital and profits, and, in some cases, subsidized water and energy prices. This sector has been buoyed by the increasing investment in infrastructure, due to the countrys positioning as an attractive tourist destination in addition to the increase in residential and nonresidential units. Both sectors accounted for 16% of GDP in 2007.

HEC Montral

Real Estate and Construction Sector in the UAE: Growth Strategies

Projects such as the Jumeirah Beach Residences, one of the worlds largest synchronized real estate developments; the Jumeirah Palm, one of the worlds largest manmade islands; Aldars massive Abu Dhabi Central Market project; Burj Khalifa, the magnificent Sheikh Zayed Grand Mosque; and mega projects such as Saadiyat Island, Al Reem, Jebel Ali Palm, Deira Palm; Al Maktoum International Airport, Dubai World Central and Dubailand, all reflect the rapid development phase being experienced by the UAEs construction sector. Abu Dhabi Abu Dhabi is the largest emirate in the UAE, covering most of its territory. Discovery of oil and gas transformed this emirate into one of the worlds richest locations. The wealth derived from oil and gas resources has been poured into major investments aimed at spurring and maintaining development in this emirate. Abu Dhabi is observing a reduced dependency on oil wealth due to the large number of economic activities being carried out that contribute to GDP. The real estate and construction sector has received the largest chunk of total investments, indicating that this sector is a priority in this emirate. It is estimated that the government will spend about $200 billion on the new infrastructure and development projects in the coming five years.1 The government of Abu Dhabi has initiated changes in its foreign ownership laws in order to encourage greater investment. The concept of freehold property is still not allowed in this emirate for non-GCC nationals. In order to manage the development process throughout the emirate, Abu Dhabi developed a Plan Abu Dhabi 2030: Urban Structure Framework Plan in 2007, aimed at planning infrastructural and environmental development and thus transforming it into a contemporary Arab city. Aldar Properties PJSC actually rejuvenated the real estate sector in Abu Dhabi with the announcement of the development of the Al Reem Development Scheme, followed by the Al Raha Development project. According to experts at the MEED Conference 2007, the construction and real estate sector in Abu Dhabi would surpass Dubai, since it is the wealthiest emirate in the UAE. The main high-level economic activities in Al Gharbia, which covers five-sixths of the emirate, are construction and real estate, oil and gas, and agriculture. Recently, the UAE government invested around $26.7 billion in development projects. Al Ain, the fourth largest city in the UAE, is a natural hub for trade and business due to its proximity to Oman. It encompasses mainly scale industries and includes a Coca-Cola bottling plant and cement works. Recently, with the launch of the Plan Al Ain 2030, the government announced the development of residential, community, neighbourhood, district centres, educational, healthcare, leisure, and commercial facilities.2

1 2

UAE Year Book 2009. Source: http://www.arabianbusiness.com/557093-building-al-ain.

HEC Montral

Real Estate and Construction Sector in the UAE: Growth Strategies

Major projects in Abu Dhabi1 i. ii. Yas Island Aldar Properties PJSC Approx. $39-billion project. Developed on an area of about 25 million square metres. Mainly comprised of theme parks, Ferrari World Abu Dhabi, and Warner Bros. Expected to complete in 2014. Saadiyat Island Tourism, Development and Investment Company Approx. $27-billion project. Developed on an area of 27 million square metres with 19 km of beachfront. Includes residential areas, hotels, and cultural and leisure areas. Incorporates development of six islands: Cultural District Al Marina Saadiyat Beach South Beach Saadiyat Park, and The Wetlands Expected to complete by 2018. Khalifa Port and Industrial Zone Abu Dhabi Ports Company Also known as Mina Zayed Port and slated to replace this port by 2012. Estimated value of approx. $24 billion. Construction of port and industrial zone to be done separately. Developed to cater to almost all the major industrial sectors. Expected to complete in 2028. Masdar City Project Abu Dhabi Future Energy Company Touted as a zero-carbon city. Approx. $22 billion project. Aimed at becoming a net-zero carbon area. Developed on an area of approx. 6 million square metres. Includes research and technology labs and institutes, commercial areas, service and transportation areas, and shopping, leisure and cultural areas. Expected to complete by 2016. Al Raha Beach Aldar Properties PJSC Approx. $13 billion project. Built on the mainland coast, 11 km long. Developed area of about 12 million square metres. Expected to provide housing to approx. 120,000 people. Expected to complete in 2014.

iii. iv. v. -

Source: www.zawya.com.

HEC Montral

Real Estate and Construction Sector in the UAE: Growth Strategies

Other major projects in Abu Dhabi Company Project Aldar Properties PJSC Al Raha Beach Aldar Properties PJSC Motor World Sorouh Real Estate PJSC Reem Islands Sorouh Real Estate PJSC Gate District Sorouh Real Estate PJSC Lulu Islands Tourism Development and Investment Company The Lagoon Club Hotel (TDIC) and Residencies Abu Dhabi Municipality and Town Planning Mohammed Bin Zayed Department City Capitala Zayed Sports City Development Mubadala Development Company MGM Grand Mubadala Development Company Sowwah Island (Phase 1) Abu Dhabi National Exhibitions Company Capital Centre (ADNEC) Abu Dhabi Municipality and Town Planning Emerald Gateway Department Dubai scenario Dubai is globally recognized as the international hub of the Middle East region. UAEs second largest emirate, Dubai is a bustling, cosmopolitan city with a population of over one million and a well-established global reputation as the tourism and business capital of the region. The stable political environment, multicultural society (comprising some 200 nationalities), sound infrastructure and excellent lifestyle are just some of the facets that have contributed to Dubais global reputation. The boom in the real estate and construction sector can be attributed to the influx of expatriates from all over, which has turned the city into a hub for some of the best projects in the world. The Dubai economy has undergone tremendous structural changes in the last two decades. This has been reflected in the pattern of sectoral production in the context of an environment characterized by a modern infrastructure, efficient financial markets, complete transportation and telecommunication networks and free trade-oriented public policy. The Dubai strategic plan of HH Sheikh Mohammed bin Rashid Al Maktoum envisages sustaining real economic growth at a rate of 11% per annum to reach a GDP of US$108 billion in 2015 and to increase per capita GDP to US$44,000.1 Value $13 billion $3 billion $10 billion $3 billion $2 billion $400 million $7 billion $6 billion $3 billion $3 billion $2 billion $2 billion

www.uaeinteract.com/economicdevelopment (Broken link).

HEC Montral

Real Estate and Construction Sector in the UAE: Growth Strategies

Dubai GDP by sector in 2008 Sector Non oil Oil sector (mining and quarrying) GDP

Source: Dubai Statistical Centre

Value (million AED) 295,226 6,370 301,596

Percentage 97.89 2.11 100.00

According to a report by the real estate consultancy Colliers International, Dubai witnessed a high y-o-y growth rate of about 80% by Q3 2008, as compared to Q3 2007. However, the global slowdown caused a reduction in growth levels in the last quarter of 2008, although the economy still posted net growth due to good performance in the first three quarters. Moreover, Dubai was the first emirate in the UAE to introduce the concept of freehold real estate projects. This made Dubai a prominent and important centre for business and property investments across the world. By 2007, Dubais construction and real estate sector was contributing about 24% to the GDP. Some of the main macroeconomic reasons for the real estate and construction boom were support for strong domestic and regional economic growth, high levels of liquidity and major, emirate specific reform processes oriented towards economic integration, liberalization and diversification and away from its declining hydrocarbon-based resources. As a result, property demand and prices in Dubai have increased more than tenfold over the last eight years. The specific microeconomic reasons for the increasing housing demand in Dubai can be attributed to the following factors: 1. Strong population growth: The emirates expected strong population growth of 7% p.a. over the period 2008-2012 is one of the most common arguments used to justify this demand. Analyzing the emirates current population composition, a significant portion of the existing or incremental population is not the target market for most of the current affluent housing projects under development. 2. High number of people per dwelling versus that of developed countries: The average number of people living per dwelling (5.5) in Dubai provides a skewed picture when compared to developed countries, mainly due to the demographic mix of the citys population and disparity in living standards. 3. A low mortgage to GDP ratio: UAE has a relatively low mortgage to GDP ratio of 8% compared to developed countries (averaging around 53%).The mortgage to GDP ratio for Dubai stands at 23%, more than twice that of UAE. 4. Investment by foreigners is a major factor in driving demand, with key incentives including: (1) a zero tax regime; (2) residence visa sponsorship by developers; (3) lack of restrictive regulations; and (4) strong domestic and international marketing campaigns. Relatively high rental yields in the residential property market have also helped influence investor sentiment. Moreover, speculation for short-term gains in a heated market has also contributed to demand.

HEC Montral

Real Estate and Construction Sector in the UAE: Growth Strategies

Major projects in Dubai1 i. ii. iii. iv. Jumeirah Gardens City Meraas Development Approx. $95 billion project. Expected capacity of 60,000 residents. Comprised of developments to be constructed on natural land and seven islands. Includes development of residential units, offices, retail spaces, entertainment and infrastructure facilities. Expected to complete by 2024. Burj Khalifa Tower Emaar Properties PJSC Part of the $20-billion Downtown Burj Dubai project. Approx. $1 billion project. Worlds largest tower, with an official height of 818 metres. Includes residential, office, retail and hotel areas. Opened in 2009. The Dubai Mall Emaar Properties PJSC Part of the $20-billion Downtown Burj Dubai project. Developed on an area of 1 million square metres. Includes retail outlets (1,200), department stores (2), Gold Souk Stores (220) and food and beverage outlets (150). Project completed in 2008. Dubai land Tatweer Approx. $64-billion project. Developed on an area of 279 million square metres. Includes 45 major projects and 200 sub-projects. Comprised of residential, shopping, hotels, theme parks, sports complexes, and cultural facilities. Some of the third-party projects undertaken are: o Global Village o Universal Studios o DreamWorks o Six Flags o Legoland o Marvel o Six Flags Expected to complete by 2020. Dubai Land Community Development Bawadi Approx. $54.5-billion project. Developed over an area of 139 million square metres. Includes development of hotels, shopping malls, and other leisure facilities. Development of the worlds largest hotel, the Asia-Asia.

v. 1

www.zawya.com

HEC Montral

Real Estate and Construction Sector in the UAE: Growth Strategies

vi. -

Major developments: o Asmaran Development o Bawadi/Al Ghurair Shopping Mall o Galadari Palace Hotel & Resort Major FINANCING SOURCES: o Bawadi (Tatweer) - $22 billion o Emaar Properties PJSC- $1 billion o Other financial institutions Expected to complete in 2014. Dubai World Central (DWC) Approx. $33-billion project. Developed over an area of 140 million square metres. Includes the following major developments: o Airport to be developed over an area of 55 million square metres. o Aviation City: Approx. $1.4-billion project. Developed over an area of 6.7 million square metres. o Commercial City: Approx. $32-million project. Developed over an area of 14.5 million square metres. o Dubai Logistics City: Approx. $2.2-billion project. Developed over an area of 25 million square metres. Includes development of $410-million office park project. o Golf City: Approx. $200-million project. Developed over an area of 15.8 million square metres. o Residential City: Approx. $6.5-million project. Developed over an area of 8 million square metres. Expected to house approx. 900,000 people. o Grand Central Expected to complete by 2020.

HEC Montral

Real Estate and Construction Sector in the UAE: Growth Strategies

Other major projects in Dubai Project Palm Triology The World Mina Rashid Dubai Waterfront Dubai Marina Cultural Village Business Bay Arabian Canal Development The Lagoons Northern Emirates These emirates mainly include Sharjah, Ajman, Ras Al Khaimah, Fujairah and Umm Al Quwain. These northern emirates accounted for 18% of the UAEs GDP in 2008. Also known as the cultural capital of UAE, Sharjah is the third largest emirate and accounts for 47% of the industrial GDP of UAE. It has become a cost-effective residential alternative to Dubai, although foreign ownership is still restricted. Nujoom Islands, also referred to as Stars Islands, is the largest commercial, residential and tourism development project in the city of Sharjah. Major projects in Sharjah Project Al Nujoom Islands Sharjah Marina Hamriyah Power and Desalination Plant Sahara City Al Wasit Power Station Conversion Developer Al Hanoo Holding Company Burooj Properties Sharjah Electricity and Water Authority Al Nahda Real Estate and Trading Company Sharjah Electricity and Water Authority Value $5 billion $4 billion $2.8 billion $1.6 billion $1.1 billion Developer Nakheel PJSC Nakheel PJSC Nakheel PJSC Nakheel PJSC Emaar Properties PJSC Dubai Properties Dubai Properties Limitless Sama Dubai Value $14 billion $12 billion $3.5 billion $6 billion $13.6 billion $6.5 billion $11 billion $18 billion $14 billion

Ras al-Khaimah Ras al-Khaimah is the fourth largest emirate in the UAE. The absence of major oil resources has led it to shift its focus to developing its industrial sector. It is the UAEs largest cement producer and the worlds largest ceramics producer, in addition to being a major agricultural producer in the UAE. In order to kick-start development processes and economic activities, the freehold concept was introduced, attracting both foreign and expatriate investors. Some of the major projects in RAK are RAK Gateway City, Al Marjan Island, Dana Island, Mina Al Arab, Saraya Island. 10

HEC Montral

Real Estate and Construction Sector in the UAE: Growth Strategies

Fujairah Fujairah is the fifth largest emirate in the UAE. Local industry is mainly comprised of cement, stone crushing, and mining. In recent years, there has been an increase in construction activity, mainly aimed at supporting these industries. There has been a focus on commercialization to support the enactment of free trade zones, which is the major reason behind the flourishing construction activities around the emirate. Moreover, in order to promote tourism, there have been proposed developments of hotels and resorts in the emirate. Some of the major projects in Fujairah are Fujairah Refinery, Abu Dhabi Crude Oil Pipeline, Fujairah 2 Independent Water & Power Provider (IWPP), Fujairah 1 IWPP Extension and Al Fujairah Paradise. Umm al-Quiwain Umm al-Quiwain, the least populated and second smallest emirate in the UAE, initially did not show much interest when the attention was focused on other emirates such as Dubai and Abu Dhabi. However, as it started to absorb overflowing demand from other emirates (especially Dubai), which were undergoing huge development, construction and business activities started to rise, especially in free trade zones, and property prices started to rise in this northern emirate as well. But unlike the major construction and real estate projects undertaken in other emirates, Umm al Quiwain saw a relatively smaller number of large projects at the outset. But as the rules were modified to attract investors, a number of huge development projects were launched, which resulted in Umm al-Qaiwain being tipped as The Next Dubai. Other factors included good infrastructure, less stringent rules and a booming market. Some of the major projects are Al Salam City, Umm Al Quwain Marina and White Bay. Ajman Ajman, the smallest emirate in the UAE, did not see a construction and real estate boom until 2005. But recently it has witnessed phenomenal growth in all major sectors. Land and space constraints in key emirates led to price increases, making investors shift their attention to Ajman for real estate investment opportunities. As the only emirate in the UAE after Dubai to allow freehold property, Ajman attracted a large number of investors, resulting in major investments in numerous towers and making it the market leader in the northern emirates in terms of the real estate projects on offer. Moreover, as in other emirates, tourism is also a major reason why this beautiful emirate saw strong growth in real estate and construction. Some of the major projects in Ajman are Ajman 1, Emirates City, Ajman Marina, Al Zorah Development and Al Tallah City.

Current Scenario

September 2008 marked the end of the unprecedented period of growth experienced by the UAE in the previous five years. The property market slowed down, jobs were cut, rents and property prices started to decline and numerous projects were halted or cancelled. HSBC reduced its loan value ratio to 70% from 85% and Lloyds TSB stopped loans for apartment purchases and lowered its loan-to-value ratio on villas in the UAE to 50%.There was a 49% increase in real

HEC Montral

11

Real Estate and Construction Sector in the UAE: Growth Strategies

estate mortgage loans?? from AED 58.8 billion in December 2007, to AED 87.5 billion by June 2008. The final quarter of 2008 saw the earnings of Dubai real estate companies fall by approximately $671 million. According to Mazaya, the general price index for real estate transactions executed in the UAE continued to follow a downward trend from September 2008 onwards. The major challenges facing the construction and real estate sector at present are falling property prices, a lack of mortgage availability and a serious confidence crunch in the market. Construction has been halted for one year on Dubais Nakheel Tower, which was supposed to be the worlds tallest tower on completion. Nakheel has put a hold on several flagship projects such as the Turnip International Hotel and Tower. Projects such as Gateway Towers, Trump Towers and Frond N Villas on Palm Jumeirah have also been delayed.1 Some of the main consequences of the global slowdown are: A sharp drop in off-plan sales compared to projects nearing completion; Dubai is the emirate most affected by the downturn: 15-30% drop in the price of freehold properties; 10-25% decrease in office rents; Other emirates have proved more resilient to the downturn; Decline in overall demand and slowdown of financial activity.

Dubai debt crisis On November 25, 2009, Dubai shocked the financial world by announcing that it was planning for a debt standstill at Dubai World, which is the governments flagship holding conglomerate. Creditors of Dubai World and Nakheel, builder of Palm Shaped Islands, agreed to a standstill on billions of dollars of debt, marking the start of a $26-billion debt restructuring process. This news sent ripples through financial markets, denting equities and currencies. Out of Dubais total obligations of $80 billion, $59 billion of liabilities were associated with Dubai World alone and a $4-billion repayment was due to Nakheel on December 14, 2009. Stock markets crashed around the world. The FTSE 100 and Germanys Dax plunged by 1.05%, Frances CAC 40 slid 0.99% and the Dow Jones remained flat. Nakheel requested suspension of trading of its Islamic Bonds. Banks were hit hard, with major banks like RBS sliding 4.45%, while Lloyds dropped even further, falling by 5.89%. Standard & Poors and Moodys investors downgraded the rating of all government-related issues in Dubai. The UAE Central Bank announced the setting up of a facility to aid all local and foreign banks operating in the UAE with extra liquidity. Subsequently, the Dubai government denied any responsibility for the debt of Dubai World, dashing the initial hopes of creditors that the emirate would guarantee its obligations.

1

www.estatesdubai.com.

HEC Montral

12

Real Estate and Construction Sector in the UAE: Growth Strategies

Subsequently, Abu Dhabi provided a bailout of $10 billion to help prevent Dubai World from defaulting on $4 billion in debt. The announcement instilled confidence in European banking stocks led by Standard Charted Plc, HSBC Holding Plc, Royal Bank of Scotland Plc.

Growth Strategies of Real Estate and Construction Companies

Emaar Properties PJSC Emaar Properties PJSC is one of worlds largest real estate companies. The company was established in 1997 and listed on the Dubai Financial Market in 2000. It is also listed on the Dow Jones Arabia Titans Index and the S&P IFCG Extended Frontier 150 Index. The company is primarily engaged in real estate development and the acquisition and management of residential and commercial properties. Emaar is a majority shareholder in Amlak Finance, a major Islamic financing company, in addition to being a 30% shareholder in Dubai Bank, a major retail and commercial bank. Emaars business spans the markets of Europe, North America, North Africa, pan-Asia and the Middle East. Growth strategy The company has been active in expanding its presence across various developed as well as emerging economies, in line with its Vision 2010 goal of becoming one of the most valuable companies in the world. The company mainly targets the high-end and well-off populace in the regions where it is present. One of the companys strategies has been brand building of the countries in which it operates in order to promote them as an attractive destination for people around the world. Thus, its growth strategy relies on geographic expansion and business segmentation. Strategic partnerships and acquisitions have been a key driver in the companys unprecedented growth. Landmark projects such as the development of 150 malls in MENA and the Indian subcontinent, the Cairo Gate Project in Egypt along with diversification into the education sector through the Singapore-based Raffles campus all reflect the growth potential of Emaar group. Areas of expertise: 1. Real Estate Management General Property Management Shopping Malls Management

2. Construction and Design 3. Education Childcare, Elementary and Secondary Schools Colleges and Universities

4. Financial Services

HEC Montral

13

Real Estate and Construction Sector in the UAE: Growth Strategies

Banking General Financial Services

5. Health Care Services 6. Leisure and Tourism Hotels, Motels and Resorts

Major milestones: 1. Year 2006: Established Emaar Education and Emaar Healthcare New major projects launched: - $500 million Dead Sea Project in Jordan. - Arabian Ranches Project in the UAE. - $3.3 billion Umm Al Quwain Project. - Projects in Tunisia, Libya, and Syria. 2. Year 2007: Planned a $40 billion share listing on London Stock Exchange. Nakheel PJSC Nakheel PJSC was founded under the guidance of the ruler of Dubai in order to support the transformation of Dubai into a world-class city. The companys most well-known waterfront projects, The Palm Islands and The World Islands, have helped Nakheel grow into a worldrenowned real estate developer. Nakheel is a part of Dubai World, which is owned by the Dubai government. Nakheel has benefitted from its vast range of operations, which have gradually allowed it to develop its expertise in a number of areas: 1. Real Estate Management General Property Management Shopping Malls Management

2. Construction and Design 3. Leisure and Tourism Hotels, Motels and Resorts Travel Agencies and Tour Operators Electronics and Appliances Retailers

4. Retailers

HEC Montral

14

Real Estate and Construction Sector in the UAE: Growth Strategies

Nakheel faced a major blow when its owner, Dubai World, requested postponement of Sukuk payments to its financers. After a $10-billion bailout package by Abu Dhabi, it was able to make Sukuk repayments. Aldar Properties PJSC Established in 2004, Aldar Properties PJSC (Aldar), is recognized as one of the largest real estate developers in Abu Dhabi. Its main area of activity is the development of retail, residential, commercial, entertainment, and hospitality properties and it is the second largest real estate company in terms of total assets in the Gulf region. Growth strategies As Abu Dhabis flagship real estate developer, Aldar has significant backing from the government, which encourages it to diversify economically. The year 2009 marked a restructuring of its strategies, with an emphasis on redesigning projects to address middle market requirements. Aldar plans to expand its operations in both emerging and mature international markets, but its current focus is on development in Abu Dhabi, which is in line with the governments growth strategies and the implementation of Abu Dhabis 2030 plan. Major events Aldar is currently developing the 5.2 million m2 Al Raha Beach project, worth US$18 billion. Moreover, it is also involved in building an optimal mix of residential, retail, office and leisure projects. Aldar owns over 50 million square metres of land at strategic locations throughout Abu Dhabi and has already announced more than US$72 billion worth of developments. On February 10, 2009, Aldar Properties revealed that, although its already announced projects were on track, it was considering changing its strategy for its new projects in order to target the middle market. Aldar is presently working on one of the biggest projects on Yas Island occupying 24.9 million m2, it includes a Warner Bros. and a Ferrari theme park. Aldars real estate projects are estimated to have exceeded US$72 billion, with the entire portfolio slated to be completed and delivered over a period of seven to 10 years. Aldars Al Raha Beach resort is on track for timely completion by 2014, and the Yas Island project is also likely to be completed on schedule. In January 2009, Aldar appointed John Buck International as its portfolio managing agent to provide the company with commercial property management services. In December 2008, Aldar signed an MoU with the National Bank of Ras Al Khaimah to provide mortgage services for the companys investors in the Al Raha Beach and Yas Island projects. In November 2008, Aldar signed exclusive agreements with the Ritz-Carlton Hotels Co., wherein the latter would manage the development of hotels in Abu Dhabi. Even in the current negative environment, Aldar Properties has maintained its leadership position in the real estate segment within the region.1

1

http://www.menafn.com/updates/research_center/UAE/Equity_val/taib260209ev.pdf. (Broken link)

HEC Montral

15

Real Estate and Construction Sector in the UAE: Growth Strategies

Areas of expertise: 1. Real Estate Management General Property Management Shopping Malls Management

2. Construction and Design 3. Education Development Elementary Schools Investment Banking Basic Materials and Industrial Products 4. Financial Services 5. Industrial Manufacturing 6. Health Care Services 7. Leisure and Tourism Hotels, Motels and Resorts Gift and Souvenir Retailers 8. Retailers

Future Scenario1

Growth in the UAE property market has slowed down significantly since the recession hit. Initially, the prices of upcoming projects (i.e., proposed projects) witnessed abrupt growth, mainly due to speculation, as one could invest in such properties by paying a minimal amount and then selling off to achieve profits. This trend was supported by cheap and readily available capital. But now the credit crunch has caused difficulties for upcoming projects. The lack of available credit and panic selling have led to a further correction of property prices in Dubai. However, the property and real estate market in emirates like Abu Dhabi is still strong due to a resilient economy backed by huge oil income and cash reserves. Also, property demand has not fallen significantly, with the result that rental prices have not yet been affected to a very large extent. As already mentioned, many projects have been cancelled or delayed and this slowdown may continue in the short term due to the economic crisis. The forecast for primary macroeconomic factors like the expected GDP growth has also been revised from double-digit to single-digit figures.

http://www.scribd.com/doc/11720534/global-investment-house-report-on-uae-real-estate-jan-2009.

HEC Montral

16

Real Estate and Construction Sector in the UAE: Growth Strategies

In addition, layoffs have caused the expatriate population to shrink in the UAE, especially in Dubai, which has dragged down property prices due to lower demand. This phenomenon may continue for some time. On the other hand, properties that were previously out of reach for many people now seem to be more accessible, and this may be positive news for people who were not able to invest and enter the market earlier. In an attempt to stabilize the market, the government is introducing various regulations making it more friendly for end users rather than speculators. The government will continue to back the sector with legislation and liquidity as and when needed. Moreover, a fall in the price of construction materials signals an opportunity for companies to complete the projects already in the pipeline with minimum costs. According to a study by the Dubai Chamber of Commerce and Industry, there are signs of optimism among top business leaders. As the recession fades and the market begins to stabilize, the outlook is still positive, especially for long-term investors. The recent corrections and amendments towards a complete recovery are expected within 12-18 months, with encouraging signs of recovery in 2010.

Initiatives by the Government

The UAE federal government took proactive steps by introducing policies aimed at ensuring market stability and maintaining investor confidence. One of the major initiatives involved pumping in $33 billion and guaranteeing protection of bank deposits and foreign and national banks from credit risks. The federal government also merged the countrys largest mortgage lenders: Amlak Finance and Tamweel, and two Abu Dhabi-based banks: Real Estate Bank and Emirates Industrial Bank, to form a combined entity called Emirates Development Bank. The aim of this move was to create a stronger entity and reduce the costs of funding which were high for Amlak Finance and Tamweel. The Abu Dhabi government launched an AED 500-million joint venture between lender Abu Dhabi Finance and Abu Dhabi Commercial Bank, Aldar, Mubadala Development Co., Sorouh Real Estate and the Tourism Development & Investment Co., which will offer mortgages with loan-to-value ratios as high as 85% and debt service ratios of up to 55%. The Dubai Lands Department and the Real Estate Regulatory Agency (RERA) introduced new measures aimed at reducing speculation and stabilizing the market. We believe that more measures will follow, which will restore investors confidence in the market. Among the new measures introduced: - Law No. 13 of 2008 regulating Initial Property Registration in Dubai, from the Real Estate Regulatory Agency (RERA), which is a mandatory system of preregistration for off-plan sales contracts for real estate units at the Land Department.

HEC Montral

17

Real Estate and Construction Sector in the UAE: Growth Strategies

The Land Department recently issued a circular stipulating that in the case of the cancellation of a contract between a purchaser and a developer, the developer may retain up to 30% of the contracts value or the units purchase price. This means that off-plan buyers wishing to cancel purchases will have to obtain a cancellation notification from the developer and forfeit 30% of the total value of the unit. The previous 5% cap imposed on rents in Dubai was removed, and Decree No. 1 for 2009 was introduced to regulate rentals in Dubai. The new decree, which applies to both residential and non-residential properties, prevents increases in rents during 2009 for tenants who are renewing rental contracts signed in 2008 as long as the rental value in 2008 was equal to, or lower by a maximum of 25% than, the average rents in the recently introduced index of RERA.

2010-10-07

HEC Montral

18

Real Estate and Construction Sector in the UAE: Growth Strategies

Appendix Financial Highlights by Company

Current Ratio Emaar PJSC Nakheel PJSC Aldar Properties PJSC Return on Assets Emaar PJSC Nakheel PJSC Aldar Properties PJSC Return on Equity Emaar PJSC Nakheel PJSC Aldar Properties PJSC Earnings per Share Emaar PJSC Nakheel PJSC Aldar Properties PJSC Debt Equity Ratio Emaar PJSC Nakheel PJSC Aldar Properties PJSC 2006 0.035 0.039 0.005 2007 0.165 0.116 0.608 2008 0.126 0.178 2.589 2006 1.046 1.422 0.724 2007 1.079 5.718 1.097 2008 0.502 0.598 1.394 2006 0.208 0.012 0.382 2007 0.176 0.054 0.121 2008 0.084 0.006 0.448 2006 0.152 0.009 0.245 2007 0.119 0.038 0.086 2008 0.051 0.003 0.069 2006 2.173 4.793 1.634 2007 2.720 4.506 3.059 2008 1.738 3.061 2.023

HEC Montral

19

Real Estate and Construction Sector in the UAE: Growth Strategies

References

FENTON, Suzanne (2009). Construction looks set to pick up, Gulf News, April 3. FENTON, Suzanne (2009). Dubai Shines despite global crisis, Gulf News, April 8. UPPAL, Rachna (2009). Report says Dubai on right economic path, Gulf News, April 21. HUSSAIN, Shakir (2009). Construction Real Estate easing manageable, Gulf News, April 29. RAHMAN, Saifur (2009). Worst is over for Dubai: Bu Amim, Gulf News, May 14. http://www.emaar.com/index.aspx?page=emaaruae-downtownburj-thedubaimall. http://en.wikipedia.org/wiki/Dubai_Mall. http://www.ft.com/cms/s/0/ad2d37ee-da2b-11de-b2d5-00144feabdc0.htm. http://www.insead.edu/alumni/newsletters/March2008/NaamanAtallahinterview.htm. http://news.bbc.co.uk/2/hi/8385164.stm. http://www.scribd.com/doc/11720534/global-investment-house-report-on-uae-real-estate-jan2009. http://www.scribd.com/doc/11720514/global-investment-house-report-on-gcc-real-estatefebruary-2009. http://www.zawya.com/cm/profile.cfm/cid1001023. http://www.zawya.com/marketing.cfm?zp&p=/projects/project.cfm/pid170807085112&ref=proje cts. http://www.zawya.com/marketing.cfm?zp&p=/projects/project.cfm/pid201106114403&ref=proje cts. http://www.zawya.com/marketing.cfm?zp&p=/projects/project.cfm/pid030907082638&ref=proje cts. http://www.zawya.com/marketing.cfm?zp&p=/projects/project.cfm/pid241008102638&ref=proje cts. http://www.zawya.com/marketing.cfm?zp&p=/projects/project.cfm/pid60000001079&ref=projec ts. http://www.zawya.com/cm/profile.cfm/cid1003365. http://www.zawya.com/marketing.cfm?zp&p=/projects/project.cfm/pid071107103304&ref=proje cts. http://www.zawya.com/marketing.cfm?zp&p=/projects/project.cfm/pid080808090059&ref=proje cts.

HEC Montral

20

Você também pode gostar

- Ey Economic Cities Wave of Growth in Saudi ArabiaDocumento26 páginasEy Economic Cities Wave of Growth in Saudi Arabiashimaa magdyAinda não há avaliações

- Expo 2020Documento4 páginasExpo 2020Saher SeherAinda não há avaliações

- Design of A Novel Carbon-Fiber Ankle-Foot Prosthetic Using Finite Element ModelingDocumento16 páginasDesign of A Novel Carbon-Fiber Ankle-Foot Prosthetic Using Finite Element ModelingThomson JohnyAinda não há avaliações

- Dubai Earthquake Code UpdatedDocumento3 páginasDubai Earthquake Code UpdatedShamim Ahsan ZuberyAinda não há avaliações

- GCC Markets Monthly Report - June-2023Documento10 páginasGCC Markets Monthly Report - June-2023Nirmal MenonAinda não há avaliações

- Design and Analysis of Prosthetic Foot Using Additive Manufacturing TechniqueDocumento8 páginasDesign and Analysis of Prosthetic Foot Using Additive Manufacturing TechniqueEditor IJTSRDAinda não há avaliações

- Assignment PcnsDocumento6 páginasAssignment PcnsPathum ChathurangaAinda não há avaliações

- Issue 23 DecemberDocumento72 páginasIssue 23 DecemberOutdoorUAEAinda não há avaliações

- INDIA - UAE Trade RelationDocumento20 páginasINDIA - UAE Trade RelationAditya LodhaAinda não há avaliações

- UAE Food and Water Security Policy G20Documento4 páginasUAE Food and Water Security Policy G20Gill Wallace HopeAinda não há avaliações

- IMOA AnnualReview 2022 2023Documento28 páginasIMOA AnnualReview 2022 2023PUTODIXONVOL2Ainda não há avaliações

- SR Annual Report 2022 Digital enDocumento83 páginasSR Annual Report 2022 Digital enAlaa Mohamed100% (1)

- Curriculum Vitae - Doc - JIJO PHILIPDocumento4 páginasCurriculum Vitae - Doc - JIJO PHILIPIndia_JIPHAinda não há avaliações

- Uae Fruit VegetablesDocumento2 páginasUae Fruit VegetablesDesi BhaiAinda não há avaliações

- Dubai Construction Sector EngDocumento29 páginasDubai Construction Sector EngXicoFernandoAinda não há avaliações

- GAIN Report: United Arab Emirates Poultry and Products Annual Poultry Meat Report 2003Documento11 páginasGAIN Report: United Arab Emirates Poultry and Products Annual Poultry Meat Report 2003Aziz MalikAinda não há avaliações

- Assignment Help DubaiDocumento2 páginasAssignment Help DubaiAssignment Help DubaiAinda não há avaliações

- JEEN GEORGE Dubai 9.00 Yrs PDFDocumento2 páginasJEEN GEORGE Dubai 9.00 Yrs PDFRamanujan IyerAinda não há avaliações

- Visa White Paper UAE ECommerce LandscapeDocumento42 páginasVisa White Paper UAE ECommerce LandscapeSharjahmanAinda não há avaliações

- Yas Island Phase 2, Zone K - Garden Crescent - Part 1 - Technical Proposal - 2010.04.19Documento92 páginasYas Island Phase 2, Zone K - Garden Crescent - Part 1 - Technical Proposal - 2010.04.19arunava sarkarAinda não há avaliações

- Residential Construction in The UAE To 2019 Market ForecastDocumento8 páginasResidential Construction in The UAE To 2019 Market Forecastnitika6390Ainda não há avaliações

- Alef PrequalificationDocumento40 páginasAlef PrequalificationAlef ArchitecturalAinda não há avaliações

- Tourist Guide DubaiDocumento32 páginasTourist Guide DubaiPradyumna PathakAinda não há avaliações

- 'NEXtCARE Egypt - Reimbursement FormDocumento1 página'NEXtCARE Egypt - Reimbursement FormMohyee Eldin RagebAinda não há avaliações

- Etisalat Annual Report 2010 PDFDocumento2 páginasEtisalat Annual Report 2010 PDFPatty0% (1)

- Profile First Western General Contracting & TradeDocumento132 páginasProfile First Western General Contracting & Tradeajs2625Ainda não há avaliações

- MARJAN INCREMENT PROGRAM Roof Waterproofing Rev. 00ADocumento14 páginasMARJAN INCREMENT PROGRAM Roof Waterproofing Rev. 00AFaraaz MohammedAinda não há avaliações

- IFoA Directory of Actuarial Employers 2016-17-14102016Documento22 páginasIFoA Directory of Actuarial Employers 2016-17-14102016Mian BialAinda não há avaliações

- DMCC Free Zone Services Schedule of Charges 2020: New RegistrationDocumento18 páginasDMCC Free Zone Services Schedule of Charges 2020: New RegistrationMazen IsmailAinda não há avaliações

- Sme Guide 2010 PDFDocumento59 páginasSme Guide 2010 PDFNay Lin100% (1)

- Mostafa Yassin CVDocumento4 páginasMostafa Yassin CVMostafayassinAinda não há avaliações

- SteelMint Steel Report As On 22 Nov 11Documento6 páginasSteelMint Steel Report As On 22 Nov 11salam747Ainda não há avaliações

- GPCA Annual Report 2021Documento50 páginasGPCA Annual Report 2021ebook ebookAinda não há avaliações

- Al Falah Steel Pre-Qualification 2016Documento252 páginasAl Falah Steel Pre-Qualification 2016Ayubkhan2Ainda não há avaliações

- 2013 Construction Week Power 100Documento5 páginas2013 Construction Week Power 100RishiShahAinda não há avaliações

- Calgary Project Consultants, DubaiDocumento18 páginasCalgary Project Consultants, DubaiManish GuptaAinda não há avaliações

- Bid Evaluation Report Final With Signatures FinalDocumento46 páginasBid Evaluation Report Final With Signatures FinalAchizitii Caritas MoldovaAinda não há avaliações

- 5 Primary Questions You Should Address While Writing An SOP Letter For Canada Student VisaDocumento8 páginas5 Primary Questions You Should Address While Writing An SOP Letter For Canada Student VisaADANNA NWACHUKWUAinda não há avaliações

- NCC Final EAP SubmissionDocumento8 páginasNCC Final EAP SubmissionKamlesh Kumar0% (1)

- GCC Construction Contractors ReportDocumento12 páginasGCC Construction Contractors ReportmunaftAinda não há avaliações

- Hazared DefinationDocumento1 páginaHazared DefinationAtiq R RafiAinda não há avaliações

- Engineering Estimate Tender Data CenterDocumento23 páginasEngineering Estimate Tender Data CenterSidik mattganAinda não há avaliações

- UAE Meat DemandDocumento8 páginasUAE Meat Demandsarwar41ssAinda não há avaliações

- Prequalification PDFDocumento225 páginasPrequalification PDFNandanaAinda não há avaliações

- DASA UG 2014 Brochure Webver 1.1Documento29 páginasDASA UG 2014 Brochure Webver 1.1albasudAinda não há avaliações

- 2019/2020 Hospital Projects in The MENA Region: Towards Sustainable GrowthDocumento18 páginas2019/2020 Hospital Projects in The MENA Region: Towards Sustainable GrowthKumar KishlayAinda não há avaliações

- ICC ToDo ListingDocumento6 páginasICC ToDo ListingrmdarisaAinda não há avaliações

- DEWA - Govt Companies As On 20-04-2015Documento4 páginasDEWA - Govt Companies As On 20-04-2015Syed Azam Kareem100% (1)

- UaeDocumento8 páginasUaeAnand ArgAinda não há avaliações

- Alnjm Pre Qualification 2022Documento85 páginasAlnjm Pre Qualification 2022Anas SalamaAinda não há avaliações

- Guide To Working in Dubai by WorkAbroad - PHDocumento23 páginasGuide To Working in Dubai by WorkAbroad - PHSyed ImranAinda não há avaliações

- Dubai Food SectorDocumento17 páginasDubai Food SectorprisharAinda não há avaliações

- Is It Worth It UAE Qatar Expenses Vs PackageDocumento29 páginasIs It Worth It UAE Qatar Expenses Vs Packageandruta1978Ainda não há avaliações

- EBC PortfolioDocumento20 páginasEBC PortfolioAamir ShahzadAinda não há avaliações

- UAE Solar ResourceDocumento38 páginasUAE Solar ResourceFarooq MizaAinda não há avaliações

- B.palmer's Final Dubai PowerpointDocumento15 páginasB.palmer's Final Dubai Powerpointgummybear7Ainda não há avaliações

- Burj DubaiDocumento20 páginasBurj DubaiBhavik MakwanaAinda não há avaliações

- Civil Inspection Engineer Jobs in Hill International Middle East LTD in Abu Dhabi - United Arab Emirates PDFDocumento6 páginasCivil Inspection Engineer Jobs in Hill International Middle East LTD in Abu Dhabi - United Arab Emirates PDFrbewalesAinda não há avaliações

- d400047b-86b0-49f3-b83d-7fe0b342b61eDocumento2 páginasd400047b-86b0-49f3-b83d-7fe0b342b61eYasir JamshedAinda não há avaliações

- Economic SectorDocumento5 páginasEconomic SectorAhmed HarbAinda não há avaliações

- Universal Beams (UB), Section Properties Dimensions & PropertiesDocumento6 páginasUniversal Beams (UB), Section Properties Dimensions & PropertiesRoshan de SilvaAinda não há avaliações

- Hot-Finished Circular Hollow Sections, Section Properties Dimensions & PropertiesDocumento20 páginasHot-Finished Circular Hollow Sections, Section Properties Dimensions & Properties_darkangel26_Ainda não há avaliações

- Hot-Finished Circular Hollow Sections, Section Properties Dimensions & PropertiesDocumento20 páginasHot-Finished Circular Hollow Sections, Section Properties Dimensions & Properties_darkangel26_Ainda não há avaliações

- Question List On Tendering (Part 1 of Procurement and Tendering)Documento3 páginasQuestion List On Tendering (Part 1 of Procurement and Tendering)Roshan de SilvaAinda não há avaliações

- Question List On Contract AdministrationDocumento6 páginasQuestion List On Contract AdministrationRoshan de SilvaAinda não há avaliações

- Steel Section WeightDocumento25 páginasSteel Section WeightRoshan de Silva100% (1)

- Assignment - MappingDocumento1 páginaAssignment - MappingRoshan de SilvaAinda não há avaliações

- Cost Planning at A GlanceDocumento1 páginaCost Planning at A GlanceRoshan de SilvaAinda não há avaliações

- UKCDocumento10 páginasUKCRoshan de Silva0% (1)

- Sr. Professional Category Foreacast (Manpower) Until 10/12 After 10/12 Jan Feb A Manpower A.1 DirectDocumento2 páginasSr. Professional Category Foreacast (Manpower) Until 10/12 After 10/12 Jan Feb A Manpower A.1 DirectRoshan de SilvaAinda não há avaliações

- IT# Description QTY Unit: Materials Plant Hire ManpowerDocumento1 páginaIT# Description QTY Unit: Materials Plant Hire ManpowerRoshan de SilvaAinda não há avaliações

- Results PhotographyDocumento1 páginaResults PhotographyRoshan de SilvaAinda não há avaliações

- Estimation Sheet: Project: HV Cable Condition Assessment Qtn. / Job No: MQ3475Documento4 páginasEstimation Sheet: Project: HV Cable Condition Assessment Qtn. / Job No: MQ3475Roshan de SilvaAinda não há avaliações

- Lighting and Small Power Works at New Ablution Room and New Male ToiletDocumento10 páginasLighting and Small Power Works at New Ablution Room and New Male ToiletRoshan de SilvaAinda não há avaliações

- Price AdjustmentsDocumento9 páginasPrice AdjustmentsRoshan de Silva100% (1)

- Main Contractor - Larsen and Toubro Limited Sub Contractor - Danway EMEDocumento7 páginasMain Contractor - Larsen and Toubro Limited Sub Contractor - Danway EMERoshan de SilvaAinda não há avaliações

- Water Treatement PlantDocumento1 páginaWater Treatement PlantRoshan de SilvaAinda não há avaliações

- Our Next 5 Year Forecast: UAE Driving LicenseDocumento1 páginaOur Next 5 Year Forecast: UAE Driving LicenseRoshan de SilvaAinda não há avaliações

- Excel QS FMT Cash Flow - LaborDocumento1 páginaExcel QS FMT Cash Flow - LaborRoshan de SilvaAinda não há avaliações

- Daily Activity Report: Date Project Contract No. Project Completion DateDocumento2 páginasDaily Activity Report: Date Project Contract No. Project Completion DateRoshan de SilvaAinda não há avaliações

- Geotechnical LayersDocumento1 páginaGeotechnical LayersRoshan de SilvaAinda não há avaliações

- Excel QS FMT Cash Flow - MaterialDocumento1 páginaExcel QS FMT Cash Flow - MaterialRoshan de SilvaAinda não há avaliações

- Division 1 - Generally: Desert Mirage Building Works, Landscape & InfrastructureDocumento1 páginaDivision 1 - Generally: Desert Mirage Building Works, Landscape & InfrastructureRoshan de SilvaAinda não há avaliações

- Elie Saab Grand Bleu Tower at Emaar BeachfrontDocumento32 páginasElie Saab Grand Bleu Tower at Emaar BeachfrontNeeraj SethiAinda não há avaliações

- Emaar Misr Price Range Announcement FinalDocumento8 páginasEmaar Misr Price Range Announcement FinalAbdoKhaledAinda não há avaliações

- Project Charter of Burj KhalifaDocumento19 páginasProject Charter of Burj KhalifaEESHA AGARWALAinda não há avaliações

- Hicc CasestudyDocumento19 páginasHicc CasestudyB-05 ISHA PATEL0% (1)

- Aesthetics Study of Art and Beauty PDFDocumento193 páginasAesthetics Study of Art and Beauty PDFChorlie Querabo Doce100% (1)

- The Dubai Mall Newsletter Issue 10 2007Documento24 páginasThe Dubai Mall Newsletter Issue 10 2007Nasser HussainAinda não há avaliações

- The Book - Design Days Dubai 2014Documento101 páginasThe Book - Design Days Dubai 2014designdaysdubai100% (1)

- Adh - Rak - Al - Marjan - Fact - Sheet 2Documento1 páginaAdh - Rak - Al - Marjan - Fact - Sheet 2anna.cxacAinda não há avaliações

- Dubai AquariumDocumento2 páginasDubai AquariumSoumia DouaisAinda não há avaliações

- Dubai Mall Case StudyDocumento6 páginasDubai Mall Case Studytomyhanson12100% (1)

- Emmar 2014 Business StrategyDocumento45 páginasEmmar 2014 Business StrategyAlok Anand Narayan Tripathi100% (4)

- Spaze Towers Pvt. LTD.: List of Real Estate Developers/real Estate Companies in Delhi/NCRDocumento2 páginasSpaze Towers Pvt. LTD.: List of Real Estate Developers/real Estate Companies in Delhi/NCRRavi Teja ChillaraAinda não há avaliações

- BrochureDocumento16 páginasBrochureaaa777dxbAinda não há avaliações

- Dubai Real Estate - OverviewDocumento99 páginasDubai Real Estate - OverviewaafeeAinda não há avaliações

- India UaeDocumento11 páginasIndia UaeTanisha KalraAinda não há avaliações

- Ventures Onsite Project 10072023 64ab946938f94Documento28 páginasVentures Onsite Project 10072023 64ab946938f94nilufarAinda não há avaliações

- The Cove DCH BrochureDocumento24 páginasThe Cove DCH BrochureGraze DAinda não há avaliações

- Values. Tech. Results.: Better Better BetterDocumento32 páginasValues. Tech. Results.: Better Better BetterM. UsmanAinda não há avaliações

- Emaar MGF Land Limited DRHP FINAL PDFDocumento851 páginasEmaar MGF Land Limited DRHP FINAL PDFsree24034354Ainda não há avaliações

- Digital Greens BrochureDocumento10 páginasDigital Greens BrochureAgosh Goyal0% (1)

- MY Project ReportDocumento36 páginasMY Project ReportSonu Jangir100% (1)

- DUBAI - Burj KhalifaDocumento15 páginasDUBAI - Burj Khalifaghoshmonika100% (1)

- Corporate Profile PDFDocumento32 páginasCorporate Profile PDFArifHadiAinda não há avaliações

- 410371503proj Completed - Without ValueDocumento23 páginas410371503proj Completed - Without ValueBinesh MenonAinda não há avaliações

- Burj Khalifa ProjectDocumento22 páginasBurj Khalifa Projecthurmat zahrah100% (2)

- AE2 Group .SKY. Assessment 1 (Final) PDFDocumento9 páginasAE2 Group .SKY. Assessment 1 (Final) PDFAng Chern XingAinda não há avaliações

- 2007 - Q1 NewsletterDocumento20 páginas2007 - Q1 NewsletterKisara YatiyawelaAinda não há avaliações

- ValuStrat Q1 2016 Dubai Real Estate Research Report WEB PDFDocumento7 páginasValuStrat Q1 2016 Dubai Real Estate Research Report WEB PDFkrishnaAinda não há avaliações

- Noor E-Brochure PDFDocumento23 páginasNoor E-Brochure PDFAnonymous 2rYmgRAinda não há avaliações

- PALM GARDENS GURGAON - 9213098617 / 9873471133 - GoogleDocumento4 páginasPALM GARDENS GURGAON - 9213098617 / 9873471133 - GooglePriti GuptaAinda não há avaliações