Escolar Documentos

Profissional Documentos

Cultura Documentos

Value Added Tax Notes

Enviado por

wuxiaojiDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Value Added Tax Notes

Enviado por

wuxiaojiDireitos autorais:

Formatos disponíveis

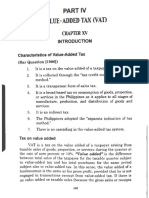

GUIDE NOTES ON VALUE-ADDED TAX VALUE-ADDED TAX Q. WHAT IS THE NATURE AND CONCEPT OF VALUE-ADDED TAXES?

* VAT is a percentage tax. There is a percentage fixed by law which will be applied to the gross selling price in order to arrive to the VAT to be paid. [CIR v. Seagate Technology (Philippines), GR No. 153 !!, 11 "e#. $%%5.& is a case on a clai' (o) ta* )e(+n,-c)e,it o( allege, +n+tili.e, inp+t /0T pai, on capital goo,s (o) the pe)io, 1 0p)il 111 to 3% 2+ne 1111. It e*plaine, the concept of a valueadded tax, th+s3 Viewed broadly, the VAT is a uniform tax ranging, at present, from 0 percent to 1 ! levied on every importation of goods, whether or not in the course of trade or business, or imposed on each sale, barter, exchange or lease of goods or properties or on each rendition of services in the course of trade or business as they pass along the production and distribution chain, the tax bei ! "i#ite$ % "& t% the 'a"(e a$$e$ t% )(*h !%%$)+ ,-%,e-tie) %- )e-'i*e) b& the )e""e-, transferor or lessor.

Co''+nications I'aging Co)po)ation o( the Philippines v. CIR explained valueadded tax in this wise$ .The VAT is a tax on consumption+ a i $i-e*t tax that the ,-%'i$e- %/ !%%$) %)e-'i*e) #a& ,a)) % t% hi) *()t%#e-). /nder the VAT method of taxation, which is i '%i*e-ba)e$, an entity can subtract from the VAT charged on its sales or outputs the VAT it paid on its ,(-*ha)e), i ,(t) and i#,%-t). 0or example, when a seller charges VAT on its sale, it issues an invoice to the buyer, indicating the amount of VAT he charged. 0or his part, if the buyer is also a seller sub1ected to the payment of VAT on his sales, he can use the invoice issued to him by his supplier t% !et a -e$(*ti% %/ hi) %3 VAT "iabi"it&. The difference in tax shown on invoices passed and invoices received is the tax paid to the government. I *a)e the tax % i '%i*e) -e*ei'e$ ex*ee$) that % i '%i*e) ,a))e$+ a tax -e/( $ #a& be *"ai#e$.2

Q4 DEFINE AND DIFFERENTIATE INPUT TAX AND OUTPUT TAX. The case of CIR v. 4eng+et Co)po)ation defined .input tax2 and .output tax.2 I ,(t tax O(t,(t tax "nput VAT or input tax represents the 3hen that person or entity sells his4its actual payments, costs and expenses products or services, the VAT-registered incurred by a VAT-registered taxpayer in taxpayer !e e-a""& becomes liable for connection with his purchase of goods 1 ! of the selling price as output VAT or and services output tax. Thus, 5i ,(t tax5 #ea ) the 'a"(ea$$e$ tax ,ai$ b& a VAT--e!i)te-e$ ,e-)% 6e tit& i the *%(-)e %/ hi)6it) t-a$e %- b()i e)) % the i#,%-tati% %/ !%%$) %- "%*a" ,(-*ha)e) %/ !%%$) %- )e-'i*e) /-%# a VAT--e!i)te-e$ ,e-)% 5ence, 5%(t,(t tax5 i) the 'a"(e-a$$e$ tax % the )a"e %/ taxab"e !%%$) %)e-'i*e) b& a & ,e-)% -e!i)te-e$ %-e0(i-e$ t% -e!i)te- ( $e- Se*ti% .78 %/ the 9%"$: Tax C%$e.

"t is an indirect tax that may be shifted or passed on to the buyer, transferee or lessee of the goods, properties or services. As such, it should be understood not in the context of the person or entity that is primarily, directly and legally liable for its payment, but in terms of its nature as a tax % *% )(#,ti% .

#ituations that may arise$ %&eneral 'rinciples(

..

I/ at the e $ %/ a taxab"e 0(a-te- the %(t,(t taxe) *ha-!e$ b& a )e""e- a-e e0(a" t% the i ,(t taxe) ,a))e$ % b& the )(,,"ie-)+ % ,a&#e t i) -e0(i-e$. I/ at the e $ %/ a taxab"e 0(a-te-+ the %(t,(t taxe) ex*ee$ the i ,(t taxe)+ the ex*e)) ha) t% be ,ai$ b& the )e""e-. "f the input taxes exceed the output taxes, the excess shall be carried over to the succeeding *uarter or *uarters "f the input taxes result from 2e-%--ate$ or e//e*ti'e"& 2e-%--ate$ t-a )a*ti% ) or from a*0(i)iti% %/ *a,ita" !%%$) any excess over the output taxes shall be refunded to the taxpayer %- credited against other internal revenue taxes.

1. ). +.

Q4 HOW CAN A VAT-REGISTERED TAXPA;ER RECOVER ITS INPUT VAT?

The VAT system of taxation allows a VAT-registered taxpayer to recover its input VAT either by

* ,iting CIR v. Seagate Technology (Philippines), the case of Panasonic

%1( passing on the 1 ! output VAT on the gross selling price or gross receipts, as the case may be, to its buyers, or

SEC. 105. Persons Liable.

Any person who, in the course of trade or business, sells barters, exchanges, leases goods or properties, renders services, and any person who imports goods shall be subject to the valueadded tax (VA ! imposed in "ections #$% to #$& of this 'ode. he value-added tax is an indirect tax and the amount of tax may be shifted or passed on to the buyer, transferee or lessee of the goods, properties or services. his rule shall li(ewise apply to existing contracts of sale or lease of goods, properties or services at the time of the effectivity of )epublic Act *o. ++#%. he phrase ,in the course of trade or business, means the regular conduct or pursuit of a commercial or an economic activity, including transactions incidental thereto, by any person regardless of whether or not the person engaged therein is a non-stoc(, nonp-rofit private organi-ation (irrespective of the disposition of its net income and whether or not it sells exclusively to members or their guests!, or government entity. he rule of regularity, to the contrary notwithstanding, services as defined in this 'ode rendered in the .hilippines by nonresident foreign persons shall be considered as being course of trade or business. Q4 UNDER .ST PARAGRAPH OF SEC .7<+ WHAT ARE THE VAT-A=LE TRANSACTIONS? CS056, I7P8RT0TI8N 0N9 S6R/IC6S& 1. . ). +. #ale, barter, exchange of goods or properties Transactions deemed sale "mportation of goods Cdoes not have to be exercised in the ordinary course of busines)D #ale of services and use or lease of properties

% ( if the input tax is attributable to the purchase of capital goods or to 6ero-rated sales, by filing a claim for a refund or tax credit with the 7"8.

#imply stated, a taxpayer sub1ect to 1 ! output VAT on its sales of goods and services may recover its input VAT costs by passing on said costs as output VAT to its buyers of goods and services but it cannot claim the same as a refund or tax credit, while a taxpayer sub1ect to 0! on its sales of goods and services may only recover its input VAT costs by filing a refund or tax credit with the 7"8. Q4 I""()t-ate i ,(t tax+ %(t,(t tax a $ VAT ,a&ab"e 9 ,orp, manufacturer, sold goods to :, a retailer, for 100,000 plus vat of 1 ,000 %so : bought it for 11 ,000( Then, : resold the goods to ;, end-consumer for 1<0,000 plus VAT of 1=,000 %so ; bought it for 1>=,000( ?n the part of :, the retailer, -5is "@'/T TA9 is 1 ,000 because this tax was passed on to him when he bought goods from 9 ,orp. -5is ?/T'/T TA9 is 1=,000 because this is the tax he passed on to ;. -"n this case, : will pay for4ultimately be liable for the vat of >,000 on the sale because the output tax is greater than the input tax. %see $n, sit+ation in (i)st page) Q4 I""()t-ati'e ,-%b"e# 9C%-U tia : 9 is a VAT registered person. 5e bought goods from : for 1 ,<00, exclusive of VAT. 9 then sold these goods to consumer ; for 1<,000, exclusive of the VAT %a( 5ow much is the VAT payable by 9 to the 7"8A 9Bs purchase has an input tax of 1,<00 %1 ,<00 x 1 !( and his re-sale transaction has an output tax of 1,=00 %1<,000 x 1 !( The VAT payable by 9 is the difference of the output tax and the input tax thus it is )00 %1=001<00( %b( 5ow much can 9 claim as a tax creditA 9 may claim the 1,<00 input tax on his purchase as a tax credit. This is why it was deducted from 1,=00. %c( ,an ; claim a tax creditA @o. 5e is the end-consumer. 5e ultimately bears the tax burden.

Q4 UNDER PAR 1+ VAT IS AN INDIRECT TAX. DISTINGUISH =ETWEEN LIA=ILIT; FOR THE TAX AND =URDEN OF THE TAX. * The case of Conte* Co)po)ation v. CIR made a distinction between the two concepts. "t provided CC,ontex ,orporation v. ,"8, &8 @o. 1<11)<, Euly 00+.D

At this 1uncture, it must be stressed that the VAT is an indirect tax. As such, the amount of tax paid on the goods, properties or services bought, transferred, or leased may be )hi/te$ or ,a))e$ % by the seller, transferor, or lessor to the buyer, transferee or lessee.

/nliFe a direct tax, such as the income tax, which primarily taxes an individualBs ability to pay based on his income or net wealth, an indirect tax, such as the VAT, is a tax on consumption of goods, services, or certain transactions involving the same . The VAT, thus, forms a substantial portion of consumer expenditures.

time. 0urther, in indirect taxation, there is a need to distinguish between the liability for the tax and the burden of the tax. As earlier pointed out, the amount of tax paid may be shifted or passed on by the seller to the buyer. o What i) t-a )/e--e$ i )(*h i )ta *e) i) %t the "iabi"it& /%- the tax+ b(t the tax b(-$e . "n adding or including the VAT due to the selling price, the seller remains the person primarily and legally liable for the payment of the tax. 3hat is shifted only to the intermediate buyer and ultimately to the final purchaser is the burden of the tax. State$ $i//e-e t"&+ a )e""e- 3h% i) $i-e*t"& a $ "e!a""& "iab"e /%- ,a&#e t %/ a i $i-e*t tax+ )(*h a) the VAT % !%%$) %- )e-'i*e) i) %t e*e))a-i"& the ,e-)% 3h% ("ti#ate"& bea-) the b(-$e %/ the )a#e tax. It i) the /i a" ,(-*ha)e- %- *% )(#e- %/ )(*h !%%$) %)e-'i*e) 3h%+ a"th%(!h %t $i-e*t"& a $ "e!a""& "iab"e /%the ,a&#e t the-e%/+ ("ti#ate"& bea-) the b(-$e %/ the tax. LC%(-)e %/ b()i e))L is what is usually done in the management of trade or business. 3hat is clear therefore, based on the aforecited 1urisprudence, is that Lcourse of businessL or Ldoing businessL connotes regularity of activity. "n the instant case, the sale was an isolated transaction. The sale which was involuntary and made pursuant to the declared policy of Government for privatization could no longer be repeated or carried on with regularity . "t should be emphasi6ed that the normal VAT-registered activity of @H, is "ea)i ! ,e-)% a" ,-%,e-t&. This finding is confirmed by the 8evised ,harte of the @H, which bears no indication that the @H, was created for the primary purpose of selling real property. The conclusion that the sale was not in the course of trade or business, which the ,"8 does not dispute before this ,ourt should have definitively settled the matter. Any sale, barter or exchange of goods or services %t i the *%(-)e %/ t-a$e %b()i e)) is not sub1ect to VAT.

The decision contained an explanation of VAT, to wit$

A brief reiteration of the basic principles governing VAT is in order. VAT is ultimately a tax on consumption, even though it is assessed on many levels of transactions on the basis of a fixed percentage. "t is the end user of consumer goods or services which ultimately shoulders the tax, as the liability therefrom is passed on to the end users by the providers of these goods or services who in turn may credit their own VAT liability %or input VAT( from the VAT payments they receive from the final consumer %or output VAT(. The final purchase by the end consumer represents the final linF in a production chain that itself involves several transactions and several acts of consumption. The VAT system assures fiscal ade*uacy through the collection of taxes on every level of consumption, yet assuages the manufacturers or providers of goods and services by enabling them to pass on their respective VAT liabilities to the next linF of the chain until finally the end consumer shoulders the entire tax liability. :et VAT is not a singular-minded tax on every transactional level. It) a))e))#e t bea-) $i-e*t -e"e'a *e t% the tax,a&e-A) -%"e %- "i B i the ,-%$(*ti% *hai . 5ence, as affirmed by #ection GG of the Tax ,ode and its subse*uent incarnations, the tax i) "e'ie$ % "& % the )a"e+ ba-te- %ex*ha !e %/ !%%$) %- )e-'i*e) b& ,e-)% ) 3h% e !a!e i )(*h a*ti'itie)+ i the *%(-)e %/ t-a$e %- b()i e)).

Q4 WHAT IS >EANT =; ?IN THE COURSE OF TRADE OR =USINESS@? * The case of CIR v. 7agsaysay 5ines, Inc &8 @o. 1+>G=+. involved the sale by the @ational Hevelopment ,ompany of five of its vessels to Iagsaysay Jines, "nc. The issue was whether such sale was within the coverage of VAT. The #upreme ,ourt found that the sale of the vessels was not in the ordinary course of trade or business. As such, the transaction was outside the coverage of VAT.

That the sale of the vessels was not in the ordinary course of trade or business of @H, was appreciated by both the ,TA and the ,ourt of Appeals, the latter doing so even in its first decision which it eventually reconsidered. 3e cite with approval the ,TABs explanation on this point$ "n I#,e-ia" '. C%""e*t%- %/ I te- a" Re'e (e , &.8. @o. J-KG +, #eptember )0, 1G<< %GK 'hil. GG (, the term Lcarrying on businessL does not mean the performance of a single disconnected act, but means conducting, prosecuting and continuing business by performing progressively all the acts normally incident thereofM while L $%i ! b()i e))L conveys the idea of business being done, not from time to time, but all the

These transactions outside the course of trade or business may invariably contribute to the production chain, but they do so only as a matter of accident or incident. As the sales of goods or services do not occur within the course of trade or business, the providers of such goods or services would hardly, if at all, have the opportunity to appropriately credit any VAT liability as against their own accumulated VAT collections since the accumulation of output VAT arises in the first place only through the ordinary course of trade or business(

* "n "#$ v. (ony )hilippines, #nc., #ony 'hilippines engaged the services of several advertising companies. Hue to #ony 'hilippinesB dire economic conditions, #ony "nternational #ingapore handed #ony 'hilippines a dole-out to answer for the expenses payable to the advertising companies. #ony 'hilippines was thereafter assessed deficiency VAT for the transaction, i.e., dole-out, between #ony "nternational #ingapore and #ony 'hilippines. The #upreme ,ourt ruled that the dole-out or subsidy from the (ingaporean company to the )hilippine company neither constituted a sale of goods or properties, nor a sale of services . 5ence, #ony 'hilippines was not liable to pay VAT on the same. C,"8 v. #ony 'hilippines, "nc., &8 @o. 1K=>GK, 1K @ov. 010.D

** "n the case of CIR v. C0, ,?IA#N8,?, being a non-stocF non-profit organi6ation, contended that it 3a) %,e-ati ! % a -ei#b(-)e#e t-%/-*%)t ba)i) , that it) %,e-ati% ) 3e-e %t ,-%/it-%-ie te$ a $ %t ?i the *%(-)e %/ t-a$e %/ b()i e)) ,2 and that therefore, it was not liable to pay VAT. The #upreme ,ourt held that #ection 10< of the 1GGK Tax ,ode was clear and unambiguous in stating that even non-stocF non-profit organi6ations were liable to pay VAT on the sale of goods or services. ***N. . ooch !ifference of "#$ v. %agsaysay v. "#$ v. "&, "omaserco'

106(A)(*) +ero-,ated Sales of Goods

(1! he following sales b& VAT-re istered persons s%all be sub"e#t to -ero per#ent (0.) rate3 (a! Export Sales. - he term ,export sales, means3 (#! he sale and actual shipment of goods from the .hilippines to a foreign country, irrespective of any shipping arrangement that may be agreed upon which may influence or determine the transfer of ownership of the goods so exported and paid for in acceptable foreign currency or its e0uivalent in goods or services, and accounted for in accordance with the rules and regulations of the /ang(o "entral ng .ilipinas (/".!4 (1! "ale of raw materials or pac(aging materials to a nonresident buyer for delivery to a resident local export-oriented enterprise to be used in manufacturing, processing, pac(ing or repac(ing in the .hilippines of the said buyer,s goods and paid for in acceptable foreign currency and accounted for in accordance with the rules and regulations of the /ang(o "entral ng .ilipinas (/".!4 (5! "ale of raw materials or pac(aging materials to export-oriented enterprise whose export sales exceed seventy percent (+$2! of total annual production4 (6! "ale of gold to the /ang(o "entral ng .ilipinas (/".!4 and (7! hose considered export sales under 8xecutive 9rder *9. 11%, otherwise (nown as the 9mnibus :nvestment 'ode of #;&+, and other special laws. Q4 DISTINGUISH =ETWEEN VAT RATING AND CERO-RATING.

SEC. 106. Value-Added Tax on Sale of Goods or Properties. (A! )ate and /ase of ax. - here shall be levied, assessed and collected on every sale, barter or exchange of goods or properties, value-added tax e0uivalent to twelve percent (#12! of the gross selling price or gross value in money of the goods or properties sold, bartered or exchanged, such tax to be paid by the seller or transferor. (#! he term , oods, or !properties! shall mean all tan ible and intan ible ob"e#ts $%i#% are #apable of pe#uniar& esti'ation and s%all in#lude3 (a! )eal properties held primarily for sale to customers or held for lease in the ordinary course of trade or business4 (b! he right or the privilege to use patent, copyright, design or model, plan, secret formula or process, goodwill, trademar(, trade brand or other li(e property or right4 (c! he right or the privilege to use in the .hilippines of any industrial, commercial or scientific e0uipment4 (d! he right or the privilege to use motion picture films, tapes and discs4 and

(e! )adio, television, satellite transmission and cable television time. he term ! ross sellin pri#e! means the total amount of money or its e0uivalent which the purchaser pays or is obligated to pay to the seller in consideration of the sale, barter or exchange of the goods or properties, excluding the value-added tax. he excise tax, if any, on such goods or properties shall form part of the gross selling price. Q4 WHAT IS A ?SALE OF GOODS OR PROPERTIES@? * The case of CIR v. 4eng+et Co)po)ation explained VAT rating vis-as-vis 6ero-rating in principle, as well as by way of illustration, to wit$ I t-a )a*ti% ) taxe$ at a .1D -ate 9VAT -ati !: , when at the end of any given taxable *uarter the output VAT exceeds the input VAT, the excess shall be paid to the governmentM when the input VAT exceeds the output VAT, the excess would be carried over to VAT liabilities for the succeeding *uarter or *uarters.

?n the other hand, t-a )a*ti% ) 3hi*h a-e taxe$ at 2e-%--ate do not result in any output tax. "nput VAT attributable to 6ero-rated sales could be refunded or credited against other internal revenue taxes at the option of the taxpayer.

To illustrate, i a 2e-%--ate$ t-a )a*ti% + when a VAT-registered person %.taxpayer2( purchases materials from his supplier at '=0.00, 'K.)0 of which was passed on to him by his supplier as the latterBs 10! output VAT, the tax,a&e- i) a""%3e$ t% -e*%'e- P8.E7 /-%# the =IR, in addition to other input VAT he had incurred in relation to the 6ero-rated transaction, th-%(!h tax *-e$it) %- -e/( $). 3hen the taxpayer sells his finished product in a 6ero-rated transaction, say, for '110.00, he is not re*uired to pay any output VAT thereon. I the *a)e %/ a t-a )a*ti% )(bFe*t t% .7D VAT+ the taxpayer is allowed to recover both the input VAT of 'K.)0 which he paid to his supplier and his output VAT of ' .K0 %10! the ')0.00 value he has added to the '=0.00 material( by passing on both costs to the buyer. Thus, the buyer pays the total 10! VAT cost, in this case '10.00 on the product. C,"8 v. 7enguet ,orporation, &8 @os. 1)+<=K O 1)+<==, = Euly 00<.D Q4 DISTINGUISH =ETWEEN VAT EXE>PTION AND CERO-RATING. The case of Conte* Co)po)ation v. CIR enumerated two ways by which a transaction could have preferential treatment under the VAT system, namely$ %1( VAT exemptionM and % ( 6ero-rating.

The seller of exempt goods properties or services )ha"" %t bi"" a & %(t,(t tax. Nxemption only removes the VAT at the exempt stage, and it 3i"" a*t(a""& i *-ea)e+ -athe- tha -e$(*e the t%ta" taxe) ,ai$ b& the exe#,t /i-#A) b()i e)) %- % --etai" *()t%#e-). The-e i) % "& ,a-tia" -e"ie/ be*a()e the ,(-*ha)e i) %t a""%3e$ a & tax -e/( $ %- *-e$it /%- i ,(t taxe) ,ai$. Q4 Di)ti !(i)h bet3ee t-a )a*ti% ).

/nder 6ero-rating, all VAT is removed from the 6ero-rated goods, activity or firm C"nD 6ero rating, there is total )elie( for the purchaser from the burden of the tax

2e-%--ate$ t-a )a*ti% ) a $ e//e*ti'e"& 2e-%--ate$

The case of CIR v. Seagate Technology (Philippines) addressed this issue. "t stated that the difference is primarily as to their source. ;ero-8ated Ce-%--ate$ t-a )a*ti% ) generally refer to the export sale of goods and supply of services. The tax rate is set at 6ero. Nffectively ;ero-8ated E//e*ti'e"& 2e-%--ate$ t-a )a*ti% ) -efer to the sale of goods or supply of services to persons or entities whose exemption under special laws or international agreements to which the 'hilippines is a signatory effectively sub1ects such transactions to a 6ero rate. Again, as applied to the tax base, such rate does not yield any tax chargeable against the purchaser. The seller who charges 6ero output tax on such transactions can also claim a refund of or a tax credit certificate for the VAT previously charged by suppliers.2 E//e*ti'e 2e-% -ati !, on the contrary, is intended to benefit the purchaser who, not being directly and legally liable for the payment of the VAT, will ultimately bear the burden of the tax shifted by the suppliers

Nxemptions from VAT are granted by express provision of the Tax ,ode or special laws. /nder VAT, the transaction can have preferential treatment in the following ways$

3hen applied to the tax base, such rate obviously results in no tax chargeable against the purchaser. The seller of such transactions charges no output tax, but can claim a refund of or a tax credit certificate for the VAT previously charged by suppliers

Vat Exe#,t Sa"e) 9Vat-Exe#,t: #imply put, the VAT is removed at the exempt stage %e.g. point of the sale, barter, etc(

Ce-% Rate$ Sa"e) 9Ce-% Rati !: These are sales by VAT-registered persons which are sub1ect to 0! rate, meaning the tax burden is not passed on to the purchaser. A 6ero-rated sale or transaction by a VAT-registered person, which is a taxable transaction for VAT purposes, $%e) %t -e)("t i a & %(t,(t tax %still a ta*a#le t)ansaction)

Applying the ,estination p)inciple to the exportation of goods, a(t%#ati* 2e-% -ati ! is primarily intended to be en1oyed by the seller who is directly and legally liable for the VAT, maFing such seller internationally competitive by allowing the refund or credit of input taxes that are attributable to export sales.

A VAT-8egistered purchaser of VATexempt goods4properties4services which are exempt from VAT i) %t e tit"e$ t% a & i ,(t tax % )(*h ,(-*ha)e.

The i ,(t VAT on the purchases of a VAT-registered person with 6ero-rated sales may be a""%3e$ as tax *-e$it) or refunded

106(A)(*)(a) Export Sales

Q4 What i) the *-%))-b%-$e- $%*t-i e?

* According to CIR v. Toshi#a In(o)'ation 6:+ip'ent (Phils.), Inc., the 'hilippines adheres to the cross-border doctrine which means that .no *&T shall be imposed to form part of the cost of goods destined for consumption outside of the territorial border of the taxing authority. 5ence$ actual export of goods and services from the 'hilippines to a foreign country must be free of VATM ?n the other hand, those destined for use or consumption within the 'hilippines shall be imposed with ten percent %10!( Cnow 1 !D VAT. Additionally, sales made by an enterprise within a non-N,?;?@N territory, i.e., ,ustoms Territory, to an enterprise within an N,?;?@N territory shall be free of VAT.

The case of Intel Technology Philippines, Inc. v. CIR is a claim for tax refund4credit of alleged unutili6ed input VAT on local purchases of goods and services which are attributable to export sales for the second *uarter of 1GG=. To prove that it was engaged in the .sale and actual shipment of goods from the 'hilippines to a foreign country and therefore entitled to tax credit of input VAT, "ntel Technology presented documentary evidence such as )(##a-& %/ ex,%-t )a"e)+ )a"e) i '%i*e)+ %//i*ia" -e*ei,t)+ ai-3a& bi"")+ a $ ex,%-t $e*"a-ati% ) . And, to prove that payment was made .in acceptable foreign currency or its e*uivalent in goods or services, and accounted for in accordance with the rules and regulations of the 4ang<o Sent)al ng Pilipinas %7#'(,2 a *e-ti/i*ati% %/ i 3a-$ -e#itta *e) was presented by "ntel Technology The #upreme ,ourt found that "ntel TechnologyBs evidence sufficiently established that it was engaged in export sales.

C,"8 v. Toshiba "nformation N*uipment %'hils.(, "nc., &8 @o. 1<01<+, G Aug. 00<.D

//106(A)(*)(a)(1) A#tual S%ip'ent of Goods fro' t%e P%ilippines to a 0orei n Countr& (+,T)1 he sale and actual shipment of goods from the

.hilippines to a foreign country, irrespective of any shipping arrangement that may be agreed upon which may influence or determine the transfer of ownership of the goods so exported and paid for in acceptable foreign currency or its e0uivalent in goods or services, and accounted for in accordance with the rules and regulations of the /ang(o "entral ng .ilipinas (/".!<< Q4 Gi'e exa#,"e) %/ ex,%-t )a"e) i the /%-# %/ a*t(a" )hi,#e t %/ !%%$) /-%# the Phi"i,,i e) t% a /%-ei! *%( t-&. * Toshi#a In(o)'ation 6:+ip'ent (Phils.), Inc. v. CIR is a claim for tax refund4credit of alleged unutili6ed input VAT on local purchases of goods and services which are attributable to export sales for the first and second *uarters of 1GGK. C@?TN$ This is different from the Toshiba ,ase previously cited.D "n the case at bar, the CIR, in the Eoint #tipulation of 0acts and "ssues, a$#itte$ that T%)hiba 3a) a -e!i)te-e$ VAT e tit& a $ that it 3a) )(bFe*t t% 7D VAT % it) ex,%-t )a"e). Jater, in his Iotion for 8econsideration of the adverse ,ourt of Tax Appeals decision, the CIR 3%("$ a-!(e that T%)hiba 3a) %t e tit"e$ t% it) *"ai# /%- tax -e/( $6*-e$it be*a()e it 3a) VAT-exe#,t and its export sales were VATexe#,t t-a )a*ti% ) (CIR a)g+e, this ;ay #eca+se i( the e*po)t sales ;e)e /0T e*e'pt, then it ;o+l, #e entitle, to clai' any c)e,it ()o' inp+t ta*) The #upreme ,ourt ruled that Toshiba was a registered VAT entity and its export sales were sub1ect to 0! VAT. N%te$ 8emember, a 6ero-rated sale by a VAT-registered person, which is a taxable transaction for VAT purposes, shall not result in any output tax. 5owever, the input tax on his purchases of goods, properties or services related to such 6ero-rated sale shall be available as tax credit or refund in accordance with these regulations CToshiba "nformation N*uipment %'hils.(, "nc. v. ,"8, &8 @o. 1<K<G+, G Iar. 010.D

N%te$ 4ase, on Sec 1%!, e*po)t sales, o) sales o+tsi,e the Philippines, a)e s+#=ect to /0T at %> )ate i( 'a,e #y a /0T?)egiste)e, pe)son. @hen applie, to the ta* #ase, the %> )ate o#vio+sly )es+lts in no ta* cha)gea#le against the p+)chase). The selle) o( s+ch t)ansactions cha)ges no o+tp+t ta*, #+t can clai' a )e(+n, o) ta* c)e,it ce)ti(icate (o) the /0T p)evio+sly cha)ge, #y s+pplie)s. Additionally, /nder #ections 10> %A(% (%a(%1( in relation to 11 %A( of the Tax ,ode, a taxpayer engaged in 6ero-rated or effectively 6ero-rated transactions may apply for a refund or issuance of a tax credit certificate for input taxes paid attributable to such sales upon complying with the following re*uisites$ %1( the taxpayer is engaged in sales which are 6ero-rated %liFe export sales( or effectively 6ero-ratedM % ( the taxpayer is VAT-registeredM %)( the claim must be filed within two years after the close of the taxable *uarter when such sales were madeM %+( the creditable input tax due or paid must be attributable to such sales, except the transitional input tax, to the extent that such input tax has not been applied against the output taxM and %<( in case of 6ero-rated sales under #ection 10>%A(% (%a(%1( and % (, #ection 10>%7(, and #ection 10=%7(%1( and % (, the acceptable foreign currency exchange proceeds thereof had been duly accounted for in accordance with 7#' rules and regulations. "t is added that, Lwhere the taxpayer is engaged in 6ero-rated or effectively 6ero-rated sale and also in taxable or exempt sale of goods or properties or services, and the amount of creditable input tax due or paid cannot be directly or entirely attributed to any one of the transactions, it shall be allocated proportionately on the basis of the volume of the sales C"ntel Technology 'hilippines, "nc. v. ,"8, &8 @o. 1>>K) , K Apr. 00K.D

106(A)(*)(a)(*) Sale of ,a$ 2aterials to a 3onresident 4u&er for 5eli6er& to a ,esident Lo#al Export-7riented Enterprise1 "ale of raw

materials or pac(aging materials to a nonresident buyer for delivery to a resident local exportoriented enterprise to be used in manufacturing, processing, pac(ing or repac(ing in the .hilippines of the said buyer,s goods and paid for in acceptable foreign currency and accounted for in accordance with the rules and regulations of the /ang(o "entral ng .ilipinas (/".!4

106(A)(*)(a)(8) Sale of ,a$ 2aterials to Export-7riented

Enterprise1

"ale of raw materials or pac(aging materials to export-oriented enterprise whose export sales exceed seventy percent (+$2! of total annual production4 Q4 Gi'e a exa#,"e %/ a )a"e %/ -a3 #ate-ia") t% a ex,%-t-%-ie te$ e te-,-i)e. * #ection 10>%A(% (%a(%)( of the 1GGK Tax ,ode pertains to the sale of raw materials or pacFaging materials to an export-oriented enterprise 3h%)e ex,%-t )a"e) ex*ee$ 87D %/ t%ta" a (a" ,-%$(*ti% . 3ith respect to the extent of the relief, the #upreme ,ourt held that$ Thus, the 7D -ate a,,"ie) t% the t%ta" )a"e %/ -a3 #ate-ia") %- ,a*Ba!i ! #ate-ia") t% a ex,%-t-%-ie te$ e te-,-i)e and not F()t the percentage of the sale in proportion to the actual exports of the enterprise.2 CAtlas ,onsolidated Iining and Hevelopment ,orporation v. ,"8, &8 @o. 1+> 1, < #ept. 00K.D

resident in the .hilippines, paid for in acceptable foreign currency and accounted for in accordance with the rules and regulations of the /ang(o "entral ng .ilipinas (/".!.

106(A)(*)(#) +ero-,ated Sales pursuant to Spe#ial La$s or :nternational A ree'ents 106(4) Transa#tions 5ee'ed Sale1 106(4)(1) Transfer 3ot in t%e Course of Trade or 4usiness of Goods>Ser6i#es 7ri inall& :ntended for Sale>?se in t%e Course of Trade or 4usiness 106(4)(*) 7t%er Transa#tions1

hese are3 (#! transfer to shareholders=investors as share in the profits of a VA -registered person=entity4 (1! transfer to creditors in payment of debt4 (5! consignment of goods, if actual sale is not made within %$ days following the date such goods were consigned4 and (6! retirement from or cessation of business, with respect to inventories of taxable goods existing as of such retirement or cessation. Q4 Gi'e a exa#,"e %/ a t-a )a*ti% $ee#e$ )a"e ( $e- thi) ,-%'i)i% . * "n San Ro:+e Po;e) Co)po)ation v. CIR, #an 8o*ue 'ower ,orporation was engaged in the )(,,"& %/ e"e*t-i*it& t% the Nati% a" P%3e- C%-,%-ati% . #uch sale of service *ualified as a 6ero-rated transaction under #ection 10=%7(%)( of the 1GGK Tax ,ode. A portion of #8',Bs claim for tax refund4credit for alleged unutili6ed input VAT was att-ib(tab"e t% a ?)a"e@ %/ e"e*t-i*it& t% NPC that 3a) #a$e $(-i ! the te)ti ! ,e-i%$ )%#eti#e i 1771, for which #8', was paid an amount of 'hp + .< million. The issue was whether such .sale2 *ualified for 6ero-rating. The #upreme ,ourt held that although the .sale2 was not a commercial sale or in the normal course of business, it was a .transaction deemed sale2 under #ection 10>%7(%1( of the 1GGK Tax ,ode. "t thus *ualified for 6ero-rating. C#an 8o*ue 'ower ,orporation v. ,"8, &8 @o. 1=0)+<, < @ov. 00G.D .7I9C: Cha !e) i %- Ce))ati% %/ Stat() %/ a VAT-Re!i)te-e$ Pe-)% .7I9D: Sa"e) Ret(- )+ A""%3a *e)+ a $ Sa"e) Di)*%( t) .7I9E: A(th%-it& %/ the C%##i))i% e- t% Dete-#i e the A,,-%,-iate Tax =a)e (ec. +,-, *alue-&dded Tax on #mportation of Goods

106(A)(*)(a)(9) Sale of Gold to t%e 4SP

Q4 Gi'e a exa#,"e %/ a )a"e %/ !%"$ t% the =SP. CIR v. 4eng+et Co)po)ation is a claim for tax refund4credit of alleged unutili6ed input VAT on 7enguet ,orporationBs sale of gold to the 4ang<o Sent)al ng Pilipinas for the period 1 August 1G=G to )1 Euly 1GG1. C@?TN$ At the time the sub1ect transaction was made, the treatment of sale of gold to the 7#' as export sales was merely based on 7"8 issuances. Today, such treatment is already contained in the 1GGK Tax ,ode.D C,"8 v. 7enguet ,orporation, &8 @os. 1)+<=K O 1)+<==, = Euly 00<.D

106(A)(*)(a)(5) Export Sales under t%e 7'nibus :n6est'ent Code of 1;<= and 7t%er Spe#ial La$s

Q4 Gi'e a exa#,"e %/ ex,%-t )a"e) ( $e- the O# ib() I 'e)t#e t C%$e %/ .GH8 a $ %the- ),e*ia" "a3). "n Panasonic Co''+nications I'aging Co)po)ation o( the Philippines v. CIR, 'anasonic produced and exported paper copiers and their sub-assemblies, parts, and components. "t was registered with the 7oard of "nvestments as a preferred pioneer enterprise under the ?mnibus "nvestment ,ode of 1G=KM it was a registered VAT enterpriseM and its export sales were 2e-%--ate$. C'anasonic ,ommunications "maging ,orporation of the 'hilippines v. ,"8, &8 @o. 1K=0G0, = 0eb. 010.D

106(A)(*)(a)(6) Sale of Goods to Persons En a ed in :nternational S%ippin or Air Transport 7perations 106(A)(*)(b) 0orei n Curren#& 5eno'inated Sale 1

he phrase ,foreign currency denominated sale, means sale to a nonresident of goods, except those mentioned in "ections #6; and #7$, assembled or manufactured in the .hilippines for delivery to a

P$ Hoes VAT apply on every importation of goodsA * "n explaining value-added tax, CIR v. Seagate Technology (Philippines) stated that VAT shall be imposed on every importation of goods, whether or not in the course of trade or business. This is unliFe VAT on sale of goods or properties which must be in the course of trade or business. ?therwise, the person4transaction shall not be liable to pay VAT. 'ertinent portion of the decision read$ .Viewed broadly, the VAT is a uniform tax ranging, at present, from 0 percent to 10 percent Cnow 1 percentD levied on every importation of goods, whether or not in the course of trade or business, or imposed on each sale, barter, exchange or lease of goods or properties or on each rendition of services in the course of trade or business as they pass along the production and distribution chain, the tax being limited only to the value added to such goods, properties or services by the seller, transferor or lessor.2 C,"8 v. #eagate Technology %'hilippines(, &8 @o. 1<)=>>, 11 0eb. 00<.D (ec. +,., *alue-&dded Tax on (ale of (ervices and /se or 0ease of )roperties .7H9A: Rate a $ =a)e %/ Tax P$ 3hat is a .sale of services2A * "n CIR v. Sony Philippines, Inc., #ony 'hilippines engaged the services of several advertising companies. Hue to #ony 'hilippinesB dire economic conditions, #ony "nternational #ingapore handed #ony 'hilippines a dole-out to answer for the expenses payable to the advertising companies. #ony 'hilippines was thereafter assessed deficiency VAT for the transaction, i.e., dole-out, between #ony "nternational #ingapore and #ony 'hilippines. The #upreme ,ourt ruled that the dole-out or subsidy from the #ingaporean company to the 'hilippine company neither constituted a sale of goods or properties, nor a sale of services. 5ence, #ony 'hilippines was not liable to pay VAT on the same. C,"8 v. #ony 'hilippines, "nc., &8 @o. 1K=>GK, 1K @ov. 010.D ** A+e.on City v. 04S?C4N 4)oa,casting Co)po)ation dealt with VAT-able sales of .services of franchise grantees of electric utilities, telephone and telegraph, radio and television broadcasting and all other franchise grantees except those under #ection 11G of this ,ode.2 C@?TN$ #ection 11G of the Tax ,ode imposes a percentage tax, in the form of a )! franchise tax, on radio and television broadcasting companies whose annual gross receipts $% %t ex*ee$ 'hp 10 million. #uch franchise holders, however, has the option of paying )! franchise tax or 1 ! VAT. ?n the other hand, radio and television broadcasting companies whose annual gross receipts ex*ee$ 'hp 10 million are governed by #ection 10= of the 1GGK Tax ,ode. They are liable to pay VAT, and do not have the option to choose between paying franchise tax or VAT.D A7#-,7@, being a broadcasting company with yearly gross receipts exceeding 'hp 10 million, was found liable to pay VAT. CPue6on ,ity v. A7#-,7@ 7roadcasting ,orporation, &8 @o. 1>>+0=, > ?ct.

00=.D *** #ection 10= of the 1GGK Tax ,ode defines .sale of services2 as .the performance of all Finds of services in the 'hilippines for others for a fee, remuneration or consideration,2 including .supply of technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaFing, venture, pro1ect or scheme.2 "n the case of CIR v. C0, ,?IA#N8,? was a non-stocF non-profit organi6ation engaged in the sale of services of such nature. 5owever, ,?IA#N8,? argued that its sales of services were not sub1ect to VAT because although it charged a fee for such sales, the organi6ation was operating on a reimbursement-of-cost basis and hence, did not derive profit from such sales. The #upreme ,ourt held that any sale of services for a fee, remuneration or consideration is sub1ect to VAT, regardless of any profit derived therefrom. C,"8 v. ,A, &8 @o. 1 <)<<, )0 Iar. 000.D **** .#ale of services2 includes .lease of motion picture films, films, tapes and discs.2 "n CIR v. S7 P)i'e Bol,ings, Inc., #I 'rime and 0irst Asia were engaged in the business of operating cinema houses. At issue was whether cinema operators4proprietors were liable to pay VAT, on top of the amusement tax imposed by the 1GG1 J&,. The #upreme ,ourt conceded that the enumeration of services sub1ect to VAT under #ection 10= of the 1GGK Tax ,ode was not exhaustive. 5owever, .lease of motion picture films, films, tapes and discs2 did not e*uate to .showing or exhibition of motion pictures or films.2 #I 'rime and 0irst Asia were not liable to pay VAT. C,"8 v. #I 'rime 5oldings, "nc., &8 @o. 1=)<0<, > 0eb. 010.D ***** Son.a v. 04S?C4N 4)oa,casting Co)po)ation differentiated between services rendered pursuant to an employer-employee relationship and services rendered by an independent contractor pursuant to a contractual relationship. #ubsumed under the latter, professionals such as talent and television and radio broadcasters are liable to pay VAT. C#on6a v. A7#-,7@ 7roadcasting ,orporation, &8 @o.1)=0<1, 10 Eune 00+.D .7H9=: Ce-%-Rate$ Sa"e) %/ Se-'i*e) P$ 3hat is the destination principleA Are there exceptions to the ruleA * According to CIR v. 0'e)ican 6*p)ess Inte)national, Inc.$ .As a general rule, the VAT system uses the destination principle as a basis for the 1urisdictional reach of the tax. &oods and services are taxed only in the country where they are consumed. Thus, exports are 6ero-rated, while imports are taxed.2 The decision proceeded to define .consumption2 as .the use of a thing in a way that thereby exhausts it.2 Applied to services, it means .the performance or successful completion of a contractual duty, usually resulting in the performerBs release from any past or future liability.2 Nxceptions to the destination principle are found in #ection 10=%7( of the 1GGK Tax ,ode. They are deemed exceptions because although the services are performed in the 'hilippines, upon compliance with certain re*uirements, the sales of such services are 6ero-rated.

C,"8 v. American Nxpress "nternational, "nc. %'hilippine 7ranch(, &8 @o. 1< >0G, G Eune 00<.D .7H9=:9.: P-%*e))i !+ >a (/a*t(-i !+ %- Re,a*Bi ! G%%$) /%- Othe- Pe-)% ) D%i ! =()i e)) %(t)i$e the Phi"i,,i e) .7H9=:91: Se-'i*e) Othe- tha Th%)e >e ti% e$ i the P-e*e$i ! Pa-a!-a,h P$ ,ite examples of services other than .processing, manufacturing, or repacFing of goods.2 * "n CIR v. 0'e)ican 6*p)ess Inte)national, Inc. , Amex 'hils. facilitated in the 'hilippines the collection and payment of receivables belonging to its 5ong Qong-based foreign client, Amex 5Q, and getting paid for it in acceptable foreign currency and accounted for in accordance with the rules and regulations of the 7#'. The #upreme ,ourt ruled that the facilitation services Amex 'hils. rendered in the 'hilippines fell under #ection 10=%7(% ( of the 1GGK Tax ,ode. C,"8 v. American Nxpress "nternational, "nc., &8 @o. 1< >0G, G Eune 00<.D

#ection 10 %b( where the listed services must be J/%- %the- ,e-)% ) $%i ! b()i e)) %(t)i$e the Phi"i,,i e).A The phrase .for other persons doing business outside the 'hilippines2 not only refers to the services enumerated in the first paragraph of #ection 10 %b(, but also pertains to the general term .services2 appearing in the second paragraph of #ection 10 %b(. "n short, services other than processing, manufacturing, or repacFing of goods must liFewise be performed for persons doing business outside the 'hilippines.2 C@?TN$ "n relation to CIR v. 0'e)ican 6*p)ess Inte)national, Inc. and CIR v. Place) 9o'e Technical Se)vices (Philippines), Inc. discussed above, said cases stated that *% )(#,ti% %/ the )e-'i*e) ab-%a$ i) %t a -e0(i-e#e t /%- 2e-%--ati !. 5owever, on the basis of CIR v. 4+)'eiste) C @ain Cont)acto) 7in,anao, Inc., the ,a&e---e*i,ie t %/ the )e-'i*e) #()t be $%i ! b()i e)) %(t)i$e %/ the Phi"i,,i e). D C,"8 v. 7urmeister O 3ain #candinavian ,ontractor Iindanao, "nc., &8 @o. 1<) 0<, Ean. 00K.D

.7H9=:9E: Ce-%-Rate$ Sa"e) ,(-)(a t t% S,e*ia" La3) %- I te- ati% a" A!-ee#e t) ** "n CIR v. Place) 9o'e Technical Se)vices (Phils.) Inc. , 'lacer Home ,anada engaged the services of 'lacer Home 'hils. to perform the clean-up and rehabilitation of the IaFalupnit and 7oac 8ivers in Iarindu*ue. 'lacer Home 'hils. argued that its sale of services to 'lacer Home ,anada was a 6ero-rated transaction under #ection 10=%7(% ( of the 1GGK Tax ,ode. ,iting CIR v. 0'e)ican 6*p)ess Inte)national, Inc., the #upreme ,ourt upheld 'lacer Home 'hils.B argument. C,"8 v. 'lacer Home Technical #ervices %'hilippines(, "nc., &8 @o. 1>+)><, = Eune 00K.D P$ Histinguish between 6ero-rated transactions Ce.g., #ec. 10=%7(%1(-% (D and effectively 6ero-rated transactions Ce.g., #ec. 10=%7(%)(D. * The case of CIR v. Seagate Technology (Philippines) addressed this issue. "t stated that$ .Although both are taxable and similar in effect, 6ero-rated transactions differ from effectively 6ero-rated transactions a) t% thei- )%(-*e. Ce-%--ate$ t-a )a*ti% ) generally refer to the export sale of goods and supply of services. The tax rate is set at 6ero. 3hen applied to the tax base, such rate obviously results in no tax chargeable against the purchaser. The seller of such transactions charges no output tax, but can claim a refund of or a tax credit certificate for the VAT previously charged by suppliers. E//e*ti'e"& 2e-%--ate$ t-a )a*ti% )+ however, refer to the sale of goods or supply of services to persons or entities whose exemption under special laws or international agreements to which the 'hilippines is a signatory effectively sub1ects such transactions to a 6ero rate. Again, as applied to the tax base, such rate does not yield any tax chargeable against the purchaser. The seller who charges 6ero output tax on such transactions can also claim a refund of or a tax credit certificate for the VAT previously charged by suppliers.2 The decision went on to say %under the subheading ;ero 8ating and Nxemption($ .Applying the ,estination p)inciple to the exportation of goods, a(t%#ati* 2e-% -ati ! is primarily intended to be en1oyed by the seller who is directly and legally liable for the VAT, maFing such seller internationally competitive by allowing the refund or credit of input taxes that are attributable to export sales. E//e*ti'e 2e-% -ati !, on the contrary, is intended to benefit the purchaser who, not being directly and legally liable for the payment of the VAT, will

*** "n CIR v. 4+)'eiste) an, @ain Scan,inavian Cont)acto) 7in,anao, Inc. , 7urmeister was engaged in the actual operation and management of two power barges in Iindanao. "t claimed that its transactions were sub1ect to 6ero-rating under #ection 10=%7(% ( of the 1GGK Tax ,ode. The #upreme ,ourt denied 7urmeisterBs claim on the ground that #ection 10=%7(% ( of the 1GGK Tax ,ode additionally re*uired that the payer-recipient of the services must be doing business outside the 'hilippines. "t ruled in this manner$ .The Tax ,ode not only re*uires that the services be other than Rprocessing, manufacturing or repacFing of goodsB and that payment for such services be in acceptable foreign currency accounted for in accordance with 7#' rules. Another essential condition for *ualification to 6ero-rating under #ection 10 %b(% ( is that the -e*i,ie t %/ )(*h )e-'i*e) i) $%i ! b()i e)) outside the Phi"i,,i e). 3hile this re*uirement is not expressly stated in the second paragraph of #ection 10 %b(, this is clearly provided in the first paragraph of

ultimately bear the burden of the tax shifted by the suppliers.2 %Nmphasis supplied.( C,"8 v. #eagate Technology %'hilippines(, &8 @o. 1<)=>>, 11 0eb. 00<.D P$ &ive examples of effectively 6ero-rated sales of services pursuant to special laws. * "n CIR v. 0cesite (Philippines) Botel Co)po)ation , Acesite was the operator of 5oliday "nn Ianila 'avilion 5otel. "t leased a portion of its premises to 'A&,?8 for casino operations. "t also catered food and beverages to 'A&,?8Bs casino patrons. The issue was whether Acesite could refund the VAT it paid on its rental income and sale of food and beverages to 'A&,?8. The #upreme ,ourt, pursuant to 'A&,?8Bs charter %'H @o. 1=>G and all amendments thereto(, found that AcesiteBs sale of services to 'A&,?8 was 6ero-rated under #ection 10=%7(%)( of the 1GGK Tax ,ode. C,"8 v. Acesite %'hilippines( 5otel ,orporation, &8 @o. 1+K G<, 1> 0eb. 00K.D ** "n the case of San Ro:+e Po;e) Co)po)ation v. CIR, #an 8o*ue 'ower ,orporation was engaged in the sale of electricity to @',. The #upreme ,ourt ruled that #8',Bs sale of service to @', was 6ero-rated, pursuant to @',Bs charter and under #ection 10=%7(%)( of the 1GGK Tax ,ode. "t explained the rationale for the effective 6ero-rating of @', in this manner$ ."t bears emphasis that effective 6ero-rating is not intended as a benefit to the person legally liable to pay the tax, such as petitioner, but to relieve certain exempt entities, such as the @',, from the burden of indirect tax so as to encourage the development of particular industries. 7efore, as well as after, the adoption of the VAT, certain special laws were enacted for the benefit of various entities and international agreements were entered into by the 'hilippines with foreign governments and institutions exempting sale of goods or supply of services from indirect taxes at the level of their suppliers. Nffective 6ero-rating was intended to relieve the exempt entity from being burdened with the indirect tax which is or which will be shifted to it had there been no exemption. "n this case, petitioner is being exempted from paying VAT on its purchases to relieve @', of the burden of additional costs that petitioner may shift to @', by adding to the cost of the electricity sold to the latter.2 C#an 8o*ue 'ower ,orporation v. ,"8, &8 @o. 1=0)+<, < @ov. 00G.D .7H9=:9K: Sa"e %/ Se-'i*e) t% Pe-)% ) E !a!e$ i I te- ati% a" Shi,,i ! %- AiT-a ),%-t O,e-ati% ) .7H9=:9<: Sa"e %/ Se-'i*e) /%- Ex,%-t-O-ie te$ E te-,-i)e .7H9=:9I: T-a ),%-t %/ Pa))e !e-) a $ Ca-!% b& Ai- %- Sea" Ve))e") /-%# the Phi"i,,i e) t% a F%-ei! C%( t-& .7H9=:98: Sa"e %/ P%3e- Ge e-ate$ th-%(!h Re e3ab"e S%(-*e) %/ E e-!& (ec. +,1, 2xempt Transactions P$ Histinguish between an exempt transaction and an exempt party. * CIR v. Seagate Technology (Philippines) made a distinction between exempt

transaction exempt party in this wise$ DAn exempt transaction+ on the one hand, involves goods or services which, by their nature, are specifically listed in and expressly exempted from the VAT under the Tax ,ode, without regard to the tax status -- VAT-exempt or not -- of the party to the t)ansaction. "ndeed, such transaction is not sub1ect to the VAT, but the seller is not allowed any tax refund of or credit for any input taxes paid. An exempt party, on the other hand, is a person or entity granted VAT exemption under the Tax ,ode, a special law or an international agreement to which the 'hilippines is a signatory, and by virtue of which its taxable transactions become exempt from the VAT. #uch pa)ty is also not sub1ect to the VAT, but may be allowed a tax refund of or credit for input taxes paid, depending on its registration as a VAT or non-VAT taxpayer.2 %Nmphasis supplied.( C,"8 v. #eagate Technology %'hilippines(, &8 @o. 1<)=>>, 11 0eb. 00<.D P$ &ive examples of exempt transactions. .7G9A: Sa"e %- I#,%-tati% O-i!i a" State %/ A!-i*("t(-a" a $ >a-i e F%%$ P-%$(*t) i Thei-

* 7isa'is 8)iental 0ssociation o( Coco T)a,e)s, Inc. v. 98" interpreted the provisions of the .G88 Tax ,ode. 5owever, it is instructive as to the issue of who determines or classifies a certain product, i.e., whether it is food or nonfood. According to the decision, as between the 7ureau of 0ood and Hrug and the 7ureau of "nternal 8evenue, the classification made by the latter would prevail. CIisamis ?riental Association of ,oco Traders, "nc. v. H?0, &8 @o. 10=< +, 10 @ov. 1GG+.D .7G9G: >e$i*a"+ De ta"+ H%),ita"+ a $ Vete-i a-& Se-'i*e)+ ex*e,t Th%)e Re $e-e$ b& P-%/e))i% a") * #ection 10G%&( of the Tax ,ode provides that transactions involving medical, dental, hospital, and veterinary services are VAT-exempt transactions. "n the case of CIR v. Philippine Bealth Ca)e P)ovi,e)s, Inc., it was found that 'hilippine 5ealth ,are 'roviders, "nc. did not render medical, dental, hospital, and veterinary services, but merely arranged for the same. 5ence, its services were not VAT-exempt. C,"8 v. 'hilippine 5ealth ,are 'roviders, "nc., &8 @o. 1>=1 G, + Apr. 00K.D .7G9I: Se-'i*e) Re $e-e$ b& I $i'i$(a") ,(-)(a t t% a Re"ati% )hi, E#,"%&e--E#,"%&ee

* Son.a v. 04S?C4N 4)oa,casting Co)po)ation differentiated between services rendered pursuant to an employer-employee relationship %which is an exempt transaction( and services rendered by an independent contractor pursuant to a contractual relationship %which is sub1ect to VAT(. The #upreme ,ourt ruled that #on6a was an independent contractor. As such, he was sub1ect to VAT on the services that he rendered. C#on6a v. A7#-,7@ 7roadcasting ,orporation, &8 @o.1)=0<1, 10 Eune

00+.D .7G9L: T-a )a*ti% ) Whi*h a-e Exe#,t ( $e- I te- ati% a" A!-ee#e t) t% Whi*h the Phi"i,,i e) i) a Si! at%-& %- ( $e- S,e*ia" La3)+ ex*e,t Th%)e ( $e- PD N%. <1G * "n Philippine 0'+se'ent C Ga'ing Co)po)ation v. CIR, the #upreme ,ourt held that 'A&,?8 was exempt from payment of VAT. "t cited, among others, the VAT exemption of 'A&,?8Bs transactions by virtue of its charter %'H @o. 1=>G and all amendments thereto( in relation to #ection 10G%Q( of the 1GGK Tax ,ode. C'hilippine Amusement O &aming ,orporation v. ,"8, &8 @o. 1K 0=K, 1< Iar. 011.D .7G9U: Se-'i*e) %/ =a B)+ N% -=a B Fi a *ia" I te-#e$ia-ie) Pe-/%-#i ! Q(a)i=a Bi ! F( *ti% )+ a $ Othe- N% -=a B Fi a *ia" I te-#e$ia-ie) * #ection 10G%/( of the 1GGK Tax ,ode provides that transactions involving services rendered by banFs, non-banF financial intermediaries performing *uasi-banFing functions, and other non-banF financial intermediaries shall be VAT-exempt. The case of "i)st Plante)s Pa;nshop, Inc. v. CIR pertained to a taxable period prior to the adoption of the present wording of #ection 10G%/( of the 1GGK Tax ,ode. 5owever, the decision is relevant in that it discussed the tax treatment of a pawnshop business. The #upreme ,ourt held that pawnshops are non-banF financial intermediaries. C0irst 'lanters 'awnshop, "nc. v. ,"8, &8 @o. 1K+1)+, )0 Euly 00=.D (ec. ++,, Tax "redits ..79A: C-e$itab"e I ,(t Tax P$ Histinguish between .input tax2 and .output tax.2 * The case of CIR v. 4eng+et Co)po)ation defined .input tax2 and .output tax.2 ."nput VAT or input tax represents the actual payments, costs and expenses incurred by a VAT-registered taxpayer in connection with his purchase of goods and services. Thus, 5i ,(t tax5 #ea ) the 'a"(e-a$$e$ tax ,ai$ b& a VAT--e!i)te-e$ ,e-)% 6e tit& i the *%(-)e %/ hi)6it) t-a$e %- b()i e)) % the i#,%-tati% %/ !%%$) %- "%*a" ,(-*ha)e) %/ !%%$) %- )e-'i*e) /-%# a VAT--e!i)te-e$ ,e-)% . ?n the other hand, when that person or entity sells his4its products or services, the VAT-registered taxpayer generally becomes liable for 10! of the selling price as output VAT or output tax. 5ence, 5%(t,(t tax5 i) the 'a"(e-a$$e$ tax % the )a"e %/ taxab"e !%%$) %- )e-'i*e) b& a & ,e-)% -e!i)te-e$ %-e0(i-e$ t% -e!i)te- ( $e- Se*ti% .78 %/ the 9%"$: Tax C%$e. The VAT system of taxation allows a VAT-registered taxpayer to recover its input VAT either by %1( passing on the 10! output VAT on the gross selling price or gross receipts, as the case may be, to its buyers, or % ( if the input tax

is attributable to the purchase of capital goods or to 6ero-rated sales, by filing a claim for a refund or tax credit with the 7"8. #imply stated, a taxpayer sub1ect to 10! output VAT on its sales of goods and services may recover its input VAT costs by passing on said costs as output VAT to its buyers of goods and services but it cannot claim the same as a refund or tax credit, while a taxpayer sub1ect to 0! on its sales of goods and services may only recover its input VAT costs by filing a refund or tax credit with the 7"8.2 C,"8 v. 7enguet ,orporation, &8 @o. 1+<<<G, 1+ Euly 00>.D ..79=: Ex*e)) O(t,(t %- I ,(t Tax ..79C: Dete-#i ati% %/ C-e$itab"e I ,(t Tax (ec. +++, Transitional3)resumptive #nput Tax "redits ...9A: T-a )iti% a" I ,(t Tax C-e$it) ...9=: P-e)(#,ti'e I ,(t Tax C-e$it) (ec. ++4, $efunds or Tax "redits of #nput Tax ..19A: Ce-%-Rate$ %- E//e*ti'e"& Ce-%-Rate$ Sa"e) P$ Histinguish between 6ero-rated transactions Ce.g., #ec. 10=%7(%1(-% (D and effectively 6ero-rated transactions Ce.g., #ec. 10=%7(%)(D. * The case of CIR v. Seagate Technology (Philippines) addressed this issue. "t stated that$ .Although both are taxable and similar in effect, 6ero-rated transactions differ from effectively 6ero-rated transactions a) t% thei- )%(-*e. Ce-%--ate$ t-a )a*ti% ) generally refer to the export sale of goods and supply of services. The tax rate is set at 6ero. 3hen applied to the tax base, such rate obviously results in no tax chargeable against the purchaser. The seller of such transactions charges no output tax, but can claim a refund of or a tax credit certificate for the VAT previously charged by suppliers. E//e*ti'e"& 2e-%--ate$ t-a )a*ti% )+ however, refer to the sale of goods or supply of services to persons or entities whose exemption under special laws or international agreements to which the 'hilippines is a signatory effectively sub1ects such transactions to a 6ero rate. Again, as applied to the tax base, such rate does not yield any tax chargeable against the purchaser. The seller who charges 6ero output tax on such transactions can also claim a refund of or a tax credit certificate for the VAT previously charged by suppliers.2 The decision went on to say %under the subheading ;ero 8ating and Nxemption($ .Applying the ,estination p)inciple to the exportation of goods, a(t%#ati* 2e-% -ati ! is primarily intended to be en1oyed by the seller who is directly and legally liable for the VAT, maFing such seller internationally competitive by allowing the refund or credit of input taxes that are attributable to export sales.

E//e*ti'e 2e-% -ati !, on the contrary, is intended to benefit the purchaser who, not being directly and legally liable for the payment of the VAT, will ultimately bear the burden of the tax shifted by the suppliers.2 %Nmphasis supplied.( C,"8 v. #eagate Technology %'hilippines(, &8 @o. 1<)=>>, 11 0eb. 00<.D P$ 3hat are the re*uirements for a claim for VAT refund4creditA * The cases of Intel Technology Philippines, Inc. v. CIR and San Ro:+e Po;e) Co)po)ation v CIR enumerated the re*uirements, thus$ %1( the taxpayer is engaged in sales which are 6ero-rated or effectively 6eroratedM % ( the taxpayer is VAT-registeredM %)( the claim must be filed within two years after the close of the taxable *uarter when such sales were madeM %+( the input taxes are due or paidM %<( the input taxes are not transitional input taxesM %>( the input taxes have not been applied against output taxes during and in the succeeding *uartersM %K( the input taxes claimed are attributable to 6ero-rated or effectively 6erorated salesM %=( in certain types of 6ero-rated sales, the acceptable foreign currency exchange proceeds thereof had been duly accounted for in accordance with 7#' rules and regulations C#ections 10>%A(% (%a(%1( and % (M #ection 10>%7(M #ections 10=%7(%1( and % (DM and %G( where there are both 6ero-rated or effectively 6ero-rated sales and taxable or exempt sales, and the input taxes cannot be directly and entirely attributable to any of these sales, the input taxes shall be proportionately allocated on the basis of sales volume. C"ntel Technology 'hilippines, "nc. v. ,"8, &8 @o. 1>>K) , K Apr. 00KM #an 8o*ue 'ower ,orporation v. ,"8, &8 @o. 1=0)+<, < @ov. 00G.D P$ "n claims for VAT refund4credit, what is the recFoning point for the two-year prescriptive periodA * "n 00K, the #upreme ,ourt promulgated its decision in 0tlas Consoli,ate, 7ining an, 9evelop'ent Co)po)ation v. CIR which essentially held that in claims for VAT refund4credit, the prescriptive period for filing administrative and 1udicial claims shall be two years recFoned /-%# the $ate %/ /i"i ! %/ the VAT 0(a-te-"& -et(- . A year later, in the highly publici6ed case of CIR v. 7i)ant Pag#ilao Co)po)ation, the #upreme ,ourt changed its mind and ruled that the two-year prescriptive period in claims for VAT refund4credit must be counted not from the date of filing of the VAT *uarterly return, but /-%# the *"%)e %/ the taxab"e 0(a-te- 3he the -e"e'a t )a"e) 3e-e #a$e. CAtlas ,onsolidated Iining and Hevelopment ,orporation v. ,"8, &8 @os. 1+110+ O 1+=K>), = Eune 00KM ,"8 v. Iirant 'agbilao ,orporation, &8 @o. 1K 1 G, 1 #ept. 00=.D ..19=: Ca *e""ati% %/ VAT Re!i)t-ati% ..19C: Pe-i%$ 3ithi 3hi*h Re/( $ %- Tax C-e$it %/ I ,(t Taxe) Sha"" =e >a$e

P$ 3hen are administrative and 1udicial claims for VAT refund4credit filedA * "n 00K, the #upreme ,ourt promulgated its decision in 0tlas Consoli,ate, 7ining an, 9evelop'ent Co)po)ation v. CIR which essentially held that claims for VAT refund4credit must be filed within the two-year prescriptive period. "n 010, the #upreme ,ourt came out with the controversial case of CIR v. 0ichi "o)ging Co'pany o( 0sia, Inc. which mandated compliance of administrative and 1udicial claims with b%th the two-year prescriptive period C#ection 11 %A(D a $ the 1 0-)0 day period rule C#ection 11 %,(D. ?therwise, claims would be ad1udged as either filed out of time or prematurely filed. CAtlas ,onsolidated Iining and Hevelopment ,orporation v. ,"8, &8 @os. 1+110+ O 1+=K>), = Eune 00KM ,"8 v. Aichi 0orging ,ompany of Asia, "nc., &8 @o. 1=+= ), > ?ct. 010.D ..19D: >a e- %/ Gi'i ! Re/( $

(ec. ++5, #nvoicing and &ccounting $e6uirements for *&T-$egistered )ersons ..E9A: I '%i*i ! Re0(i-e#e t) P$ "s there a difference between an invoice and an official receiptA * CIR v. 7anila 7ining Co)po)ation defined these terms, to wit$ .A Bsales or commercial invoiceB is a written account of goods sold or services rendered indicating the prices charged therefor or a list by whatever name it is Fnown which is used in the ordinary course of business evidencing sale and transfer or agreement to sell or transfer goods and services. A RreceiptB on the other hand is a written acFnowledgment of the fact of payment in money or other settlement between seller and buyer of goods, debtor or creditor, or person rendering services and client or customer.2 C,"8 v. Ianila Iining ,orporation, &8 @o. 1<) 0+, )1 Aug. 00<.D ** "n 0TCT Co''+nications Se)vices Philippines, Inc. v. CIR , ATOT was engaged in the business of providing information, promotional, supportive, and liaison services to foreign corporations. "t filed a claim for tax refund4credit for alleged unutili6ed input VAT on said sales of services and presented sales invoices to substantiate the same. "n giving credence to the sales invoices %not necessarily official receipts(, the #upreme ,ourt said that$ .#ales invoices are recogni6ed commercial documents to facilitate trade or credit transactions. They are proofs that a business transaction has been concluded, hence, should not be considered bereft of probative value. ?nly the preponderance of evidence threshold as applied in ordinary civil cases is needed to substantiate a claim for tax refund proper.2 CATOT ,ommunications #ervices 'hilippines, "nc. v. ,"8, &8 @o. 1= )>+, ) Aug. 010.D *** ?n other hand, the case of Eepco Philippines Co)po)ation v. CIR made a distinction between a VAT invoice and a VAT receipt, such that only a VAT invoice might be presented to substantiate a sale of goods or properties, while only a VAT receipt could substantiate a sale of services. 'ertinent portion of the decision read$

."n other words, the VAT invoice is the sellerBs best proof of the sale of the goods or services to the buyer while the VAT receipt is the buyerBs best evidence of the payment of goods or services received from the seller. Nven though VAT invoices and receipts are normally issued by the supplier4seller alone, the said invoices and receipts, taFen collectively, are necessary to substantiate the actual amount or *uantity of goods sold and their selling price %p)oo( o( t)ansaction(, and the best means to prove the input VAT payments %p)oo( o( pay'ent(. 5ence, VAT invoice and VAT receipt should not be confused as referring to one and the same thing. ,ertainly, neither does the law intend the two to be used alternatively.2 CQepco 'hilippines ,orporation v. ,"8, &8 @o. 1=1=<=, + @ov. 010.D ..E9=: I /%-#ati% C% tai e$ i the VAT I '%i*e %- VAT O//i*ia" Re*ei,t * #ection 11)%7(% (%c( of the 1GGK Tax ,ode provides that certain information must be indicated on the VAT invoice or VAT official receipt, and that .if the sale is sub1ect to 6ero percent %0!( value-added tax, the term R6ero-rated saleB shall be written or printed prominently on the invoice or receipt.2 The 7ureau of "nternal 8evenue, the Hivisions of the ,ourt of Tax Appeals, the ,ourt of Tax Appeals Nn 7anc, and the #upreme ,ourt has conflicting opinions on whether the term .6ero-rated sale2 must be written, stamped, or imprinted. 5owever, as enunciated in recent cases, the term .6ero-rated sale2 must be imprinted, and not merely written or stamped. ?therwise, such claims for VAT refund4credit substantiated by non-conforming VAT invoices or VAT official receipts shall be disallowed. C'anasonic ,ommunications "maging ,orporation of the 'hilippines, &8 @o. 1K0=0G0, = 0eb. 010M E8A 'hilippines, "nc. v. ,"8, &8 @o. 1KK1 K, 11 ?ct. 010M 5itachi &lobal #torage Technologies 'hilippines ,orporation v. ,"8, &8 @o. 1K+ 1 , 0 ?ct. 010M Iicrosoft 'hilippines, "nc., v. ,"8, &8 @o. 1=01K), > Apr. 011.D ..E9C: A**%( ti ! Re0(i-e#e t) ..E9D: C% )e0(e *e) %/ I))(i ! E--% e%() VAT I '%i*e %- VAT O//i*ia" Re*ei,t ..E9E: T-a )iti% a" Pe-i%$ (ec. ++7, $eturn and )ayment of *alue-&dded Tax ..K9A: I Ge e-a" ..K9=: Whe-e t% Fi"e the Ret(- a $ Pa& the Tax ..K9C: Withh%"$i ! %/ Va"(e-A$$e$ Tax (ec. ++8, )ower of the "ommissioner to (uspend the Taxpayer usiness 9perations of a

Você também pode gostar

- Tax - Vat GuidenotesDocumento13 páginasTax - Vat GuidenotesNardz AndananAinda não há avaliações

- Value Added TaxDocumento20 páginasValue Added TaxJerlene Sydney Centeno100% (1)

- Value Added TaxDocumento6 páginasValue Added Taxarjohnyabut80% (10)

- Tax II Reviewer and NotesDocumento26 páginasTax II Reviewer and NotesJett Chuaquico100% (1)

- Transfer TaxesDocumento24 páginasTransfer TaxesAlexis Dela Cruz100% (2)

- Taxation Law 2 ReviewerDocumento54 páginasTaxation Law 2 ReviewerNgan Tuy100% (2)

- VAT PhilippinesDocumento21 páginasVAT PhilippinesTonifranz SarenoAinda não há avaliações

- Tax 2 Reviewer Atty. Bolivar NotesDocumento66 páginasTax 2 Reviewer Atty. Bolivar NotesMaree BajamundeAinda não há avaliações

- Estate TaxDocumento10 páginasEstate TaxArt CrestFall ManlongatAinda não há avaliações

- Taxation Law 2 Reviewer (Long)Documento44 páginasTaxation Law 2 Reviewer (Long)Gertz Mayam-o Pugong100% (21)

- Taxation 2Documento112 páginasTaxation 2cmv mendoza100% (7)

- Excise TaxDocumento3 páginasExcise TaxAndrea JonAinda não há avaliações

- Tax2 - Ch1-5 Estate Taxes ReviewerDocumento8 páginasTax2 - Ch1-5 Estate Taxes ReviewerMaia Castañeda100% (15)

- Tax ReviewerDocumento52 páginasTax ReviewerevilsageAinda não há avaliações

- TAXATIONDocumento9 páginasTAXATIONkekadiegoAinda não há avaliações

- Bantillo, Cheska Kate M. Cid, Manuel Lionel MDocumento47 páginasBantillo, Cheska Kate M. Cid, Manuel Lionel MCHESKAKATE BANTILLO100% (1)

- Excise TaxesDocumento5 páginasExcise TaxesJoAnne Yaptinchay Claudio100% (2)

- Notes On Excise TaxesDocumento19 páginasNotes On Excise TaxesLalaine ReyesAinda não há avaliações

- Taxation 08 - Value Added TaxDocumento13 páginasTaxation 08 - Value Added TaxKara Clark100% (1)

- Documentary Stamp TaxDocumento6 páginasDocumentary Stamp TaxchrizAinda não há avaliações

- Finals Tax 2 - Answer KeyDocumento3 páginasFinals Tax 2 - Answer KeyMarvin CeledioAinda não há avaliações

- II Income TaxationDocumento8 páginasII Income TaxationNatasha MilitarAinda não há avaliações

- Transfer TaxDocumento60 páginasTransfer Taxandrei jim100% (6)

- M3 Excise Tax Students Copy Revised PDFDocumento73 páginasM3 Excise Tax Students Copy Revised PDFTokis SabaAinda não há avaliações

- 2 General Principles of Income TaxationDocumento9 páginas2 General Principles of Income TaxationDenise ZurbanoAinda não há avaliações

- Section 85. Gross Estate. - The Value of The Gross Estate of TheDocumento6 páginasSection 85. Gross Estate. - The Value of The Gross Estate of TheCharles RiveraAinda não há avaliações

- Transfer and Business Taxation - MIDTERMDocumento14 páginasTransfer and Business Taxation - MIDTERMYvette Pauline JovenAinda não há avaliações

- Value Added TaxDocumento26 páginasValue Added TaxAimee100% (1)

- Philippine Transfer Taxes and Value Added Tax-2011Documento54 páginasPhilippine Transfer Taxes and Value Added Tax-2011Chris Rivero100% (2)

- Income Taxation ReviewerDocumento65 páginasIncome Taxation ReviewerShiela100% (10)

- Accounting Periods and Methods of AccountingDocumento11 páginasAccounting Periods and Methods of Accountingmhilet_chiAinda não há avaliações

- Estate TaxDocumento23 páginasEstate TaxJonard Godoy100% (4)

- Chapter VIII Ordinary Asset and Capital AssetsDocumento3 páginasChapter VIII Ordinary Asset and Capital AssetsJasmin Alapag100% (2)

- Excise TaxesDocumento21 páginasExcise TaxesNyril TamayoAinda não há avaliações

- New Estate Tax Under TRAINDocumento19 páginasNew Estate Tax Under TRAINNica09_forever100% (2)

- Tax: TRAIN Illustrative Problems: Long Problem With FormsDocumento23 páginasTax: TRAIN Illustrative Problems: Long Problem With FormsNooroddenAinda não há avaliações

- Activity in Documentary Stamp TaxDocumento2 páginasActivity in Documentary Stamp TaxLucy Heartfilia100% (1)

- VAT ReviewerDocumento18 páginasVAT ReviewerNash Ortiz LuisAinda não há avaliações

- Week 6 - Deduction From Gross IncomeDocumento5 páginasWeek 6 - Deduction From Gross IncomeJuan FrivaldoAinda não há avaliações

- Value Added TaxDocumento20 páginasValue Added TaxKhen HannaAinda não há avaliações

- Double Taxation AgreementDocumento9 páginasDouble Taxation AgreementAmy Olaes Dulnuan100% (1)

- Donor's TaxDocumento17 páginasDonor's TaxTessie CuaAinda não há avaliações

- Individual TaxpayersDocumento3 páginasIndividual TaxpayersJoy Orena100% (2)

- University of Perpetual Help System DaltaDocumento11 páginasUniversity of Perpetual Help System DaltaDerick Ocampo Fulgencio100% (2)

- 05 Input TaxesDocumento4 páginas05 Input TaxesJaneLayugCabacunganAinda não há avaliações

- Exclusions To Gross IncomeDocumento8 páginasExclusions To Gross IncomeNishikata MaseoAinda não há avaliações

- Tax Review Q and A Quiz 1 and 2 FinalsDocumento19 páginasTax Review Q and A Quiz 1 and 2 FinalsAngel Xavier CalejaAinda não há avaliações

- Capital Gains TaxationDocumento44 páginasCapital Gains TaxationPrince Anton DomondonAinda não há avaliações

- Tariff and Customs Code of The Philippines - Test BankDocumento3 páginasTariff and Customs Code of The Philippines - Test BankTyrelle CastilloAinda não há avaliações

- Value Added Tax Ust PDFDocumento23 páginasValue Added Tax Ust PDFcalliemozartAinda não há avaliações

- Project Report On Value Added Tax VATDocumento77 páginasProject Report On Value Added Tax VATshehzanamujawarAinda não há avaliações

- 07 Chap 15 16 Mamalateo 2019 Tax BookDocumento19 páginas07 Chap 15 16 Mamalateo 2019 Tax BookJeremias CusayAinda não há avaliações

- Add To P. 44-46: Am+dg Taxation Two AddendumDocumento11 páginasAdd To P. 44-46: Am+dg Taxation Two AddendumEins BalagtasAinda não há avaliações

- Highlight of The Chapter:: Value Addition Tax (VAT) (VAT)Documento7 páginasHighlight of The Chapter:: Value Addition Tax (VAT) (VAT)Anonymous M3ODGyoAinda não há avaliações

- Lecture Notes in Taxation 2Documento52 páginasLecture Notes in Taxation 2bubblingbrookAinda não há avaliações

- VAT - GuidenotesDocumento14 páginasVAT - GuidenotesNardz AndananAinda não há avaliações

- Tax 2 Notes Finals 4Documento36 páginasTax 2 Notes Finals 4Boom ManuelAinda não há avaliações

- Up Portia SororityDocumento12 páginasUp Portia SororityHassan Diab SalahAinda não há avaliações

- Lecture Notes On Vat As AmendedDocumento7 páginasLecture Notes On Vat As Amendedbubblingbrook100% (1)

- VatDocumento50 páginasVatnikolaevnavalentinaAinda não há avaliações

- Credit Transactions ReviewerDocumento122 páginasCredit Transactions ReviewerJingJing Romero96% (68)

- Revenue Regulations No. 11-2013: Bureau of Internal RevenueDocumento3 páginasRevenue Regulations No. 11-2013: Bureau of Internal Revenuesj_adenipAinda não há avaliações

- Donors Tax CasesDocumento29 páginasDonors Tax Caseskirsten_bri16Ainda não há avaliações

- Case DigestsDocumento67 páginasCase DigestsCattleyaAinda não há avaliações

- Philippine Federation of Professional AssociationsDocumento15 páginasPhilippine Federation of Professional AssociationswuxiaojiAinda não há avaliações

- Tax 2Documento14 páginasTax 2Nash Ortiz LuisAinda não há avaliações

- 15th Congress HB 4244 RH BillDocumento25 páginas15th Congress HB 4244 RH BillmgenotaAinda não há avaliações

- Ferrer V DiazDocumento7 páginasFerrer V DiazwuxiaojiAinda não há avaliações

- Evidence Project Volume6Documento60 páginasEvidence Project Volume6wuxiaoji100% (1)

- ChildPov PPDocumento44 páginasChildPov PPwuxiaojiAinda não há avaliações

- The Universal Declaration of Human RightsDocumento4 páginasThe Universal Declaration of Human RightsmastagmailAinda não há avaliações

- Marine PollutionDocumento14 páginasMarine PollutionwuxiaojiAinda não há avaliações

- Philippine Laws On AdoptionDocumento5 páginasPhilippine Laws On AdoptionwuxiaojiAinda não há avaliações

- Human RightsDocumento18 páginasHuman RightsTAMIL100% (1)

- IPRA ReportDocumento49 páginasIPRA ReportwuxiaojiAinda não há avaliações

- Latin PhrasesDocumento9 páginasLatin PhraseswuxiaojiAinda não há avaliações

- Syllabus UCC Business Law and Taxation IntegrationDocumento9 páginasSyllabus UCC Business Law and Taxation IntegrationArki Torni100% (1)

- Đề Thi Thử KPMG Intern 2022Documento17 páginasĐề Thi Thử KPMG Intern 2022vuphuongnhung2505Ainda não há avaliações

- BIR RulingDocumento3 páginasBIR RulingyakyakxxAinda não há avaliações

- Name-Dipesh Bhattacharyya Roll No-03 Course-BBA LLB Subject-Accountancy Topic-Goods and Service Tax (GST) Adamas University DatedDocumento12 páginasName-Dipesh Bhattacharyya Roll No-03 Course-BBA LLB Subject-Accountancy Topic-Goods and Service Tax (GST) Adamas University DatedDIPESH BHATTACHARYYAAinda não há avaliações

- Customs Memorandum Order No 20-2004Documento14 páginasCustoms Memorandum Order No 20-2004Norliah OmarAinda não há avaliações

- StudentDocumento35 páginasStudentKevin CheAinda não há avaliações

- Kapatiran NG Mga Naglilingkod Sa Pamahalaan vs. TanDocumento5 páginasKapatiran NG Mga Naglilingkod Sa Pamahalaan vs. Tanabigael bobisAinda não há avaliações

- Ril Pe Price Dt. 01.11.2016Documento29 páginasRil Pe Price Dt. 01.11.2016Akshat JainAinda não há avaliações

- CASE STUDY Tanuj KumarDocumento14 páginasCASE STUDY Tanuj KumarTanujAinda não há avaliações

- 20 Current LiabilitiesDocumento15 páginas20 Current Liabilitieserica lamsenAinda não há avaliações

- Tax Invoice: VAT Reg. NumberDocumento1 páginaTax Invoice: VAT Reg. NumberAhmed MousaAinda não há avaliações

- Vol III PDFDocumento9 páginasVol III PDFmarab12Ainda não há avaliações

- Module 2. Rate, Tax, and Expenses (Legal Aspects)Documento13 páginasModule 2. Rate, Tax, and Expenses (Legal Aspects)MARITONI MEDALLAAinda não há avaliações

- Tax Law Class NotesDocumento126 páginasTax Law Class NotesANAND GEO 1850508Ainda não há avaliações

- MCQS:-: Provision Related To DeductorDocumento4 páginasMCQS:-: Provision Related To DeductorManoj BothraAinda não há avaliações

- Iii. Trade Policies and Practices by Measure (1) I: Mauritius WT/TPR/S/198/Rev.1Documento38 páginasIii. Trade Policies and Practices by Measure (1) I: Mauritius WT/TPR/S/198/Rev.1Nanda MunisamyAinda não há avaliações

- Changes in ITC Reporting in GSTR - 3BDocumento6 páginasChanges in ITC Reporting in GSTR - 3BKirtan Ramesh JethvaAinda não há avaliações

- Director Supply Chain Logistics in Chicago IL Resume John CunninghamDocumento2 páginasDirector Supply Chain Logistics in Chicago IL Resume John CunninghamJohnCunningham2Ainda não há avaliações

- Taxation and Auditing Theory NotesDocumento9 páginasTaxation and Auditing Theory Notessatya80% (5)

- CIR Vs CA, Gr. No. 119322, June 4, 1996 FactsDocumento15 páginasCIR Vs CA, Gr. No. 119322, June 4, 1996 FactsJepoy Nisperos ReyesAinda não há avaliações

- Flare Jan Feb 2010Documento102 páginasFlare Jan Feb 2010zubair_kasuriAinda não há avaliações

- Pim 1 6 2017Documento63 páginasPim 1 6 2017nessunaaAinda não há avaliações

- COMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpDocumento5 páginasCOMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpAustin Viel Lagman MedinaAinda não há avaliações

- TAX Final Round PDFDocumento7 páginasTAX Final Round PDFMaryane AngelaAinda não há avaliações

- Dharmendra Singh CV For Internal Audit ProfileDocumento2 páginasDharmendra Singh CV For Internal Audit ProfileDharmendra SinghAinda não há avaliações

- Invoice 40 Palmeto MulesoftDocumento6 páginasInvoice 40 Palmeto MulesoftSrinivasa HelavarAinda não há avaliações

- Economics For Ca-Cpt - Quick Revision VersionDocumento14 páginasEconomics For Ca-Cpt - Quick Revision VersionCA Suman Gadamsetti75% (4)

- Tax Invoice: KBK Biotech Private LimitedDocumento3 páginasTax Invoice: KBK Biotech Private LimitedUma ChennaAinda não há avaliações

- British Gas BillDocumento2 páginasBritish Gas BillSyed TouseefAinda não há avaliações

- GST Question BankDocumento109 páginasGST Question Bankneeraj goyalAinda não há avaliações