Escolar Documentos

Profissional Documentos

Cultura Documentos

AHS Jan 2013

Enviado por

ekidenDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AHS Jan 2013

Enviado por

ekidenDireitos autorais:

Formatos disponíveis

AMN HEALTHCARE NYSE-AHS

TIMELINESS

SAFETY

TECHNICAL

1

3

4

High:

Low:

Raised 10/26/12

27.9

20.0

37.4

13.0

RECENT

PRICE

19.0

8.9

21.6

10.7

50.2 RELATIVE

DIVD

Median: 24.0) P/E RATIO 1.63 YLD

11.55 P/ERATIO 25.1(Trailing:

20.7

12.9

28.3

17.3

29.1

16.4

20.4

7.4

11.0

4.6

10.0

4.1

9.3

3.6

Nil

12.2

3.9

Target Price Range

2015 2016 2017

LEGENDS

12.0 x Cash Flow p sh

. . . . Relative Price Strength

Options: Yes

Shaded areas indicate recessions

New 1/25/02

Raised 1/11/13

BETA 1.05 (1.00 = Market)

VALUE

LINE

40

32

24

2015-17 PROJECTIONS

Annl Total

Price

Gain

Return

High

25 (+115%) 20%

Low

15 (+30%)

6%

Insider Decisions

to Buy

Options

to Sell

F

0

3

0

M

0

4

0

A

0

7

0

M

0

0

1

J

0

0

1

J

1

0

1

A

1

0

1

S

0

0

0

16

12

10

8

6

O

0

0

0

4

% TOT. RETURN 12/12

Institutional Decisions

1Q2012

37

to Buy

to Sell

35

Hlds(000) 34090

2Q2012

57

38

34535

3Q2012

67

42

35230

Percent

shares

traded

24

16

8

1 yr.

3 yr.

5 yr.

1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

-----------

-----------

-----------

7.19

.47

.34

-.08

d.10

20.38

----

8.00

d.01

d.16

-.08

2.33

28.84

----

12.24

.24

.09

-.11

6.43

42.29

NMF

NMF

--

CAPITAL STRUCTURE as of 9/30/12

Total Debt $173.5 mill. Due in 5 Yrs $173.5 mill.

LT Debt $158.0 mill.

LT Interest $20.0 mill.

(Total interest coverage: 1.8x)

(51% of Capl)

Leases, Uncapitalized Annual rentals $14.8 mill.

No Defined Benefit Pension Plan

Pfd Stock $22.6 mill. Pfd Divd Nil

4.5 mill. shs. Series A, liqu. val. $10 a sh., each

convertible into one com. sh.

Common Stock 44,386,650 shs.

as of 11/1/12

MARKET CAP: $525 million (Small Cap)

CURRENT POSITION 2010

2011 9/30/12

($MILL.)

Cash Assets

1.9

4.0

3.8

Receivables

127.5

169.2

161.6

Inventory (Avg Cst)

---Other

49.9

39.3

28.3

Current Assets

179.3

212.5

193.7

Accts Payable

45.9

49.8

43.6

Debt Due

18.3

34.6

15.5

Other

53.7

55.7

56.4

Current Liab.

117.9

140.1

115.5

18.96

1.37

1.12

-.11

7.23

40.91

21.8

1.19

--

25.40

1.52

.95

-.46

4.13

28.12

14.5

.83

--

22.19

.82

.55

-.18

4.83

28.34

27.9

1.47

--

775.7

11.6%

3.8

52.4

39.5%

6.7%

137.3

1.0

295.8

17.6%

17.7%

17.7%

--

714.2

9.6%

4.8

37.8

38.7%

5.3%

76.9

125.5

116.1

16.1%

32.5%

32.5%

--

629.0

6.7%

5.8

17.4

37.8%

2.8%

77.2

96.9

136.8

9.2%

12.7%

12.7%

--

22.63

.91

.69

-.12

6.19

31.20

22.9

1.22

--

31.28

1.31

1.02

-.28

7.07

34.58

21.8

1.18

--

34.41

1.42

1.05

-.27

8.16

33.83

20.1

1.07

--

THIS

STOCK

VL ARITH.*

INDEX

160.7

27.5

-32.7

17.4

40.1

40.9

VALUE LINE PUB. LLC

15-17

37.37

1.50

1.02

-.27

8.72

32.58

14.7

.88

--

23.28

.45

.03

-.12

5.24

32.63

NMF

NMF

--

17.59

.18

d.23

-.11

3.21

39.19

----

21.94

.53

.11

-.11

2.56

40.45

NMF

NMF

--

21.25

.65

.32

-.15

4.20

44.50

23.0

1.45

--

21.75

.85

.50

Nil

.15

4.90

46.00

Revenues per sh

Cash Flow per sh

Earnings per sh A

Divds Decld per sh

Capl Spending per sh

Book Value per sh C

Common Shs Outstg B

Avg Annl P/E Ratio

Relative P/E Ratio

Avg Annl Divd Yield

26.50

1.40

.95

Nil

.25

7.40

46.00

20.0

1.35

Nil

705.8 1081.7 1164.0 1217.2

7.5%

7.7%

7.3%

7.1%

6.2

10.3

11.7

14.4

22.2

35.1

36.5

34.4

40.2% 38.2% 39.9% 43.9%

3.1%

3.2%

3.1%

2.8%

100.1 114.9 114.4

88.5

194.8 160.5 120.4 100.2

193.2 244.6 276.1 284.1

7.0% 10.6% 10.5%

9.6%

11.5% 14.3% 13.2% 12.1%

11.5% 14.3% 13.2% 12.1%

-----

759.8

6.2%

13.8

.9

NMF

.1%

74.3

100.1

170.8

1.6%

.5%

.5%

--

689.2

3.4%

15.1

d8.1

-NMF

61.4

200.8

181.8

NMF

NMF

NMF

--

887.5

6.1%

16.4

5.0

64.0%

.6%

72.4

174.2

159.7

4.5%

3.1%

4.8%

--

945

7.5%

15.0

15.0

50.0%

1.6%

95.0

155

195

8.0%

7.5%

8.0%

--

1000

8.0%

16.0

24.0

45.0%

2.4%

130

140

225

9.0%

10.5%

10.5%

Nil

Revenues ($mill)

Operating Margin

Depreciation ($mill)

Net Profit ($mill)

Income Tax Rate

Net Profit Margin

Working Capl ($mill)

Long-Term Debt ($mill)

Shr. Equity ($mill)

Return on Total Capl

Return on Shr. Equity

Retained to Com Eq

All Divds to Net Prof

1220

9.5%

20.0

46.0

45.0%

3.8%

200

80.0

340

12.0%

13.5%

13.5%

Nil

BUSINESS: AMN Healthcare Services, Inc. provides temp. and

permanent staffing services to hospitals and other healthcare

facilities. Recruits physicians, nurses, physical therapists, and

medical technicians. Has three units: nurse & allied healthcare

staffing (64% of 11 revs, 66% of oper. income); locum tenens

(temp physician) staffing (31%, 23%); and physician permanent

placement (5%, 11%). Has about 1,840 employees (excluding

5,320 healthcare workers that are contracted to work for AMN).

EdgePoint Investment owns 16.5% of common stock; offs./dirs.,

3.0% (3/12 proxy). Chmn.: Douglas Wheat. Pres./CEO: Susan

Salka. Inc.: DE. Addr.: 12400 High Bluff Dr., Suite 100, San Diego,

CA 92130. Tel.: 866-871-8519. Internet: www.amnhealthcare.com.

AMN Healthcare appears to be showing resilience amid improving condiANNUAL RATES Past

Past Estd 09-11 tions in the healthcare staffing marof change (per sh) 10 Yrs.

5 Yrs.

to 15-17

ket. Indeed, recent results have been quite

Revenues

8.5%

-4.0%

4.0%

impressive. And chances are the company

Cash Flow

5.5% -17.5% 24.0%

Earnings

--NMF

had a solid finish to 2012, pushing fullDividends

--Nil

year totals up at a vigorous pace. Of parBook Value

2.5%

-9.5% 13.0%

ticular note, the core nurse/allied staffing

QUARTERLY REVENUES ($ mill.)

CalFull category has shown strength of late,

endar Mar.31 Jun.30 Sep.30 Dec.31 Year driven by double-digit volume increases.

2009 249.6 199.1 166.4 144.7 759.8 This largely reflects the ongoing pickup in

2010 143.3 149.3 176.3 220.3 689.2 demand for temporary nurse and allied

2011 215.8 220.6 229.0 222.1 887.5 health

professionals.

Likewise,

the

2012 226.4 235.8 243.9 238.9 945

permanent physician staffing line has

2013 240

250

255

255 1000

been benefiting from increased searches.

EARNINGS PER SHARE A

CalFull Things could be better in the temporary

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

physicians unit, however, where weakness

2009

.04

.13

d.06

d.08

.03 in some of the larger specialties continues

2010

.02

-d.23

d.02

d.23 to offset strength in smaller ones.

2011

.04

.01

.02

.04

.11

2012

.07

-.12

.13

.32 The earnings recovery should contin2013

.10

.11

.15

.14

.50 ue in 2013. Our expectation largely assumes demand remains on an upswing.

QUARTERLY

DIVIDENDS

PAID

CalFull This will hinge on such factors as a decline

endar Mar.31 Jun.30 Sep.30 Dec.31 Year

in the unemployment rate, which would

2009

prompt mobility among employed health2010

NO CASH DIVIDENDS

care professionals; an easing of hospital

2011

BEING PAID

budgeting issues; and an uptick in patient

2012

admissions, as individuals resume non2013

elective/nonurgent procedures. Meanwhile,

despite investments for strategic initiatives (discussed below), margins stand to

further expand due to firmer pricing and

greater SG&A leverage, as revenues rise.

The bottom line should get an added boost,

with debt refinancing costs (incurred in

the second quarter of 2012) out of the way.

Long-term growth prospects seem

promising. AMN is currently investing to

expand its workforce solutions offerings,

candidate recruitment capabilities, and

technology infrastructure. The strategic

initiatives should help to better position

the company for the likely rise in demand

for health professionals over the long haul,

brought about by industry trends (i.e.,

aging population, nurse shortage) and

healthcare reform.

AMN stock is a top-notch choice for

the year ahead, and has rebound

potential to spare, too. The issue has

regained some ground since early 2012,

reflecting increased investor confidence in

the companys ability to return to growth.

AMNs efforts to pay down debt with cash

flow likely havent gone unnoticed, either.

J. Susan Ferrara

January 11, 2013

(A) Based on diluted earnings. Includes noncash stock-based compensation expense: 00,

56; 01, 57; 02, 1; 03, 2. Excludes nonrecurring losses: 99, 60; 00, 7; 01, 23;

09, $3.78; 10, $1.26. Excl. inc./(loss) from dis- (B) In millions.

continued ops.: 11, (68); Q112, 2. Next

(C) Includes intangibles. In 2011: $266.9 milearnings report due mid-March.

lion, $6.60/sh.

2013, Value Line Publishing LLC. All rights reserved. Factual material is obtained from sources believed to be reliable and is provided without warranties of any kind.

THE PUBLISHER IS NOT RESPONSIBLE FOR ANY ERRORS OR OMISSIONS HEREIN. This publication is strictly for subscribers own, non-commercial, internal use. No part

of it may be reproduced, resold, stored or transmitted in any printed, electronic or other form, or used for generating or marketing any printed or electronic publication, service or product.

Companys Financial Strength

Stocks Price Stability

Price Growth Persistence

Earnings Predictability

B

40

10

25

To subscribe call 1-800-833-0046.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Superstocks Final Advance Reviewer'sDocumento250 páginasSuperstocks Final Advance Reviewer'sbanman8796% (24)

- Superstocks Final Advance Reviewer'sDocumento250 páginasSuperstocks Final Advance Reviewer'sbanman8796% (24)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Accounting 1 Review QuizDocumento6 páginasAccounting 1 Review QuizAikalyn MangubatAinda não há avaliações

- Ukrainian Gypsy Fortune TellingDocumento20 páginasUkrainian Gypsy Fortune Tellingekiden88% (8)

- Ted Weschler 2002 InterviewDocumento3 páginasTed Weschler 2002 InterviewekidenAinda não há avaliações

- Ted Weschler 2002 InterviewDocumento3 páginasTed Weschler 2002 InterviewekidenAinda não há avaliações

- Get PDF For Bill ViewDocumento4 páginasGet PDF For Bill ViewKrishna8765Ainda não há avaliações

- Assignment 001: Fundamentals of Accounting/Answer KeyDocumento65 páginasAssignment 001: Fundamentals of Accounting/Answer Keymoncarla lagon83% (6)

- A Case Study of Southwest AirlinesDocumento4 páginasA Case Study of Southwest AirlinesishmaelAinda não há avaliações

- Deloitte NL Retail Analytics FrameworkDocumento44 páginasDeloitte NL Retail Analytics FrameworkTung NgoAinda não há avaliações

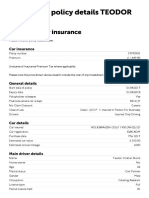

- Policy Details PageDocumento2 páginasPolicy Details PageLuci PoroAinda não há avaliações

- 5.chapter 5 - Multinational Capital BudgetingDocumento26 páginas5.chapter 5 - Multinational Capital BudgetingLê Quỳnh ChiAinda não há avaliações

- Similarities and Differences GAAPDocumento44 páginasSimilarities and Differences GAAPskyahead1003Ainda não há avaliações

- Weak El Niño Strengthens Chicken Price: UpdateDocumento9 páginasWeak El Niño Strengthens Chicken Price: UpdateekidenAinda não há avaliações

- Comments On The 15 Growth IllusionDocumento4 páginasComments On The 15 Growth IllusionekidenAinda não há avaliações

- Utilities 20-02 KBankDocumento3 páginasUtilities 20-02 KBankekidenAinda não há avaliações

- ST Petersburg Paradox and Tech Stocks 2000Documento7 páginasST Petersburg Paradox and Tech Stocks 2000ekidenAinda não há avaliações

- Return On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and ImplicationsDocumento69 páginasReturn On Capital (ROC), Return On Invested Capital (ROIC) and Return On Equity (ROE) Measurement and Implicationsbauh100% (1)

- 2012 Default Statistics and Rating Transition RatesDocumento10 páginas2012 Default Statistics and Rating Transition RatesekidenAinda não há avaliações

- Investor S HandbookDocumento19 páginasInvestor S HandbookekidenAinda não há avaliações

- May 2557 Samart AnalysisDocumento8 páginasMay 2557 Samart AnalysisekidenAinda não há avaliações

- 028 - Psims-Db Data Model v2 - 7Documento123 páginas028 - Psims-Db Data Model v2 - 7ekidenAinda não há avaliações

- Collier Report - Condominium Q3 2013Documento13 páginasCollier Report - Condominium Q3 2013ekidenAinda não há avaliações

- Alcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDDocumento1 páginaAlcoa: 5.7 20.0 Recent Price P/E Ratio Relative P/E Ratio Div'D YLDekidenAinda não há avaliações

- Seth Hamot InterviewDocumento9 páginasSeth Hamot InterviewekidenAinda não há avaliações

- Grand Strategy DeficitDocumento17 páginasGrand Strategy DeficitekidenAinda não há avaliações

- Sanyo Rice Cooker ManualDocumento21 páginasSanyo Rice Cooker ManualekidenAinda não há avaliações

- The Origins of Michael Burry, OnlineDocumento2 páginasThe Origins of Michael Burry, OnlineekidenAinda não há avaliações

- Grand StrategyDocumento4 páginasGrand StrategyekidenAinda não há avaliações

- Michael Burry Case StudyDocumento1 páginaMichael Burry Case StudyekidenAinda não há avaliações

- Feltham Ohlson 1995 Valuation and Clean Surplus Accg Oper Fin ActDocumento43 páginasFeltham Ohlson 1995 Valuation and Clean Surplus Accg Oper Fin ActXiaohu PengAinda não há avaliações

- CFA - Misuse of Expected ReturnsDocumento9 páginasCFA - Misuse of Expected ReturnsekidenAinda não há avaliações

- Graham Doddsville Issue 19 Fall 2013 FinalDocumento32 páginasGraham Doddsville Issue 19 Fall 2013 FinalCanadianValueAinda não há avaliações

- The Origins of Michael Burry, OnlineDocumento2 páginasThe Origins of Michael Burry, OnlineekidenAinda não há avaliações

- Buffett's Alpha - Frazzini, Kabiller and PedersenDocumento33 páginasBuffett's Alpha - Frazzini, Kabiller and PedersenVivian ClementAinda não há avaliações

- G&D Spring 2011 Michel PriceDocumento27 páginasG&D Spring 2011 Michel PriceRui BárbaraAinda não há avaliações

- Construction AuditDocumento26 páginasConstruction AuditSithick MohamedAinda não há avaliações

- Consumer Reports Magazine October 2010Documento67 páginasConsumer Reports Magazine October 2010realla100% (1)

- Consumers Equilibrium & DemandDocumento76 páginasConsumers Equilibrium & DemandAumkarAinda não há avaliações

- Cost Concepts & Its AnalysisDocumento19 páginasCost Concepts & Its AnalysisKenen Bhandhavi100% (1)

- B G ShirkeDocumento15 páginasB G ShirkeAbu AbuAinda não há avaliações

- History of Mergers and AcquisitionsDocumento23 páginasHistory of Mergers and AcquisitionsZeeshan AliAinda não há avaliações

- MT760 - GOLD FCO Liberty Local Miners LTD - MT 760 (5 - 10 MT)Documento8 páginasMT760 - GOLD FCO Liberty Local Miners LTD - MT 760 (5 - 10 MT)Inverplay CorpAinda não há avaliações

- Principles of Marketing Chapter 8Documento36 páginasPrinciples of Marketing Chapter 8Mahmud AhmedAinda não há avaliações

- International MarketingDocumento433 páginasInternational MarketingSenthilNathanAinda não há avaliações

- NCMSL BrochureDocumento6 páginasNCMSL Brochuremaster45Ainda não há avaliações

- Quiz 10Documento6 páginasQuiz 10Kath RiveraAinda não há avaliações

- Case Study 2 - EbayDocumento12 páginasCase Study 2 - EbayMihir MehtaAinda não há avaliações

- Food KarachiDocumento8 páginasFood KarachiFalak KhanAinda não há avaliações

- Fin-man International Corporate FinanceDocumento4 páginasFin-man International Corporate FinanceMelisa May Ocampo AmpiloquioAinda não há avaliações

- FILE 20220406 151306 Part 5 ToeicDocumento380 páginasFILE 20220406 151306 Part 5 ToeicThuy TranAinda não há avaliações

- Extinguishment of Obligation - Lecture NotesDocumento186 páginasExtinguishment of Obligation - Lecture NotesJanetGraceDalisayFabreroAinda não há avaliações

- Service Pricing and The Financial and Economic Effect of ServiceDocumento25 páginasService Pricing and The Financial and Economic Effect of ServicePietro BertolucciAinda não há avaliações

- Philippine Trust Co. Vs RoldanDocumento2 páginasPhilippine Trust Co. Vs RoldanMaribel Nicole LopezAinda não há avaliações

- SOLTEK SOLAR POWER Specification and PriceDocumento4 páginasSOLTEK SOLAR POWER Specification and PriceAlexis MalicdemAinda não há avaliações

- 31 12 17 Kakuzi PLC Annual ReportDocumento71 páginas31 12 17 Kakuzi PLC Annual ReportjohnmungeAinda não há avaliações

- Marketing Rakura TeaDocumento19 páginasMarketing Rakura TeaAnonymous G5ScwB50% (2)

- Corporate PresentationDocumento38 páginasCorporate PresentationDeep NandaAinda não há avaliações

- Starc Modular Power Recliner Sectional Sofa WithDocumento1 páginaStarc Modular Power Recliner Sectional Sofa WithellamalceaAinda não há avaliações