Escolar Documentos

Profissional Documentos

Cultura Documentos

Bawany Air Products LTD

Enviado por

Dostmuhammad01Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Bawany Air Products LTD

Enviado por

Dostmuhammad01Direitos autorais:

Formatos disponíveis

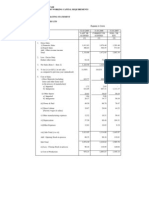

Financial Statement Analysis of Non Financial Sector 2012

Bawany Air Products Ltd.

Items

A.Non Current Assets (41+A3+A5+A6+A7)

1.Capital work in

progress 2.0perating

fixed assets at cost

3.0perating fixed assets after deducting accumulated depreciation

4.Depreciation for the

year 5.Intangible

assets

6.Long term

investments 7.0ther

non-current assets

B.Current Assets (B1+132+133+B4+B5)

1.Cash & bank

balance

2.Inventories

3.Trade Debt

4.Short term

investments 5.0ther

current assets

C.Current Liabilities (C1+C2)

1.Short terrn Secured

loans 2.0ther current

liabilities

D.Non-Current Liabilities (D1+D2+D3+D4+D5)

1.Long term secured

loans 2.Long term

unsecured loans

(Thousand Rupees)

2007

2008

183.837

186.609

186.150

3.Debentures/TFCs

282.397

183.837

3.421

0

3.029

0

186.609

13.

7

6

6

8.116

9

2

2

69.

763

6.867

131.157

63.033

68.124

41.598

7.187

11.500

0

24.816

22.164

68.205

68.205

41.

598

31.

537

68.

205

68.

205

(46.041)

0

(36.668)

99.445

99.445

0

81.217

81.217

75.171

13.908

73.952

61.264

24.273

16.115

4.485

7.265

15.724

15.724

_

69.

763

73.135

0

(24.410)

63.033

71.859

0.07

19.90

9.99

0.40

145..946321

0.13

14.946

91.05

5.48

-1 1.97

-70.79

-26.83

_

73.97

3.647

(11.845)

355

o

o

86.

762

71.

61

7

161

.32

1

74.

559

7.811

77.180

77.180

9.082

209.508

209.508

12.996

20.892

(9.372)

1

0

(24.062)

348

14.038

30.560

192

3.258

5.782

22.008

258

2.781

4.676

15.611

17.858

17.080

16.166

(12.276)

7.992

4.676

11.631

38.

442

48.

718

48.

718

7.172

30.

644

93.

773

68.

205

68.

205

295.694

205.419

o

(46.041)

48.

187

25.

568

5.6

56

13.

137

(9.

373

)

93.

039

19.

912

(221121...38

0

.

0

8

1

7

.

9

8

9

.

5

1543901)

35

06

2012

204.422

293.399

198.640

14.

114

81.

597

42.

018

39.

579

74.

645

44.

001

133.412

79.902

53.509

49453

13.137

i).Capital Reserve

ii).Revenue Reserve

3.Surplus on revaluation of fixed

assets F.Operation:

1.Sales

i).Local sales (Net)

ii).Export Sales (Net)

2.Cost of sales

i).Cost of material

ii).0ther input cost

3.Gross Profit

4.General, administrative and other

expenses i).Selling & distribution

expenses

ii).Administrative and other

expenses 5.Salades, wages and

employee benefits 6.Financial

expenses

of which: Interest expenses

7.Net profit before tax

8.Tax expense (current year)

9.Total amount of dividend

10.Total value of bonus shares

issued .Cash flows from

operations

G.Miscellaneous

1.Total capital employed (E+D)

2.Total fixed liabilities (Dl'-D3)

3.Retention in business (F7-F8-F9)

4.Contractual Liabilities (G2+C1)

H.Key Performance Indicators

1.Acid test or quick

ratio[(B1+B3+84) to C]

2.Financial expenses as % of sales (F6 as %

of Fl) 3.Trade Debt as % of sales (83 as %

of Fl) 4.Assets turnover ratio [F1 to (A+B)]

5.Current ratio (B to C)

6.Cost of goods sold to sales (F2 as %

of Fl) 7.Debt equity ratio [(CD) to E]

8.Retum on assets [F7 as % of avg.

(A+B)] 9.Retum of equity (F7 as %

of avg. E)

7

.

3

0

9

4.Employees benefit obligations

5.0ther non-current liabilities

E.Shareholders Equity

(E1+E2+E3) 1.Issued,

Subscribed & Paid up capital

iyOrdinary Shares

ii).Preference shares

2011

219.455

3.454

18.879

658

1.500

9.533

17.683

1.602

1.098

9

1

4

2010

268.055

182.695

4.002

288.185

4.

621

91.

398

16.

175

75.

223

2.Reserves

2009

1, 05 1

3.410

19.580

168

.41

8

44.

9.887

50.045

28.308

21.737

66.738

33.912

32.

828

109.

647

75.0

25

75.0

25

196.055

638

21;4

1972..420

0 3 5

0 7

3.218

21.094

8

45

77

8

1.

8.245

10

.51

4

48.

95

9

26.

89

4

22.

06

5

5

8.2

14.

04

312

77

143

12

20.3

32.873

10

117.313

75.025

75.025

22.531

195.

248

195.

248

_

14

6.5

32

61.

437

85.

095

48.

718

23.

552

185

..22

688

4

19.

214

3.4

73

3.0

22.531

19.757

209.970

209.970

161.021

65.180

49

85.

94

84

27.

84

8

6.9

43

20.

90

5

28.

09

3

92

7.0

22.

273

2.0

40

48

6.5

29

15.

-

28

Você também pode gostar

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawNo EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawNota: 3.5 de 5 estrelas3.5/5 (4)

- Pages From BsaDocumento1 páginaPages From BsaSyed Abdul QadirAinda não há avaliações

- Pakistan Petroleum Overall: A.Non-Current Assets (A1+A3+A5+A6+A7)Documento16 páginasPakistan Petroleum Overall: A.Non-Current Assets (A1+A3+A5+A6+A7)0300MalikamirAinda não há avaliações

- Financial Statement Analysis of Non Financial SectorDocumento6 páginasFinancial Statement Analysis of Non Financial SectorTayyaub khalidAinda não há avaliações

- Petroleum BSA 06 10Documento44 páginasPetroleum BSA 06 10Haji Suleman AliAinda não há avaliações

- SEBI Apr 25 2011Documento2 páginasSEBI Apr 25 2011reachsubbusAinda não há avaliações

- Ισολογισμοσ Φυτοθρεπτικη Χρησησ 2012 EnDocumento1 páginaΙσολογισμοσ Φυτοθρεπτικη Χρησησ 2012 Env_tsoulosAinda não há avaliações

- IBF QuestionDocumento13 páginasIBF QuestionSaqib JawedAinda não há avaliações

- Accounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Documento1 páginaAccounting Year Ended 31st March (Audited) 2011 2011 2011 Quarter Ended 30th September (Unaudited) Six Months Ended 30th September (Unaudited)Jatin GuptaAinda não há avaliações

- CMA Format Munjal ShowaDocumento13 páginasCMA Format Munjal ShowaMohit KumarAinda não há avaliações

- Barwa Real Estate Balance Sheet Particulars Note NoDocumento28 páginasBarwa Real Estate Balance Sheet Particulars Note NoMuhammad Irfan ZafarAinda não há avaliações

- Trial Balance 2012 EngDocumento1 páginaTrial Balance 2012 EngYiannis BarasAinda não há avaliações

- V-Guard Industries LTD 150513 RSTDocumento4 páginasV-Guard Industries LTD 150513 RSTSwamiAinda não há avaliações

- 1 Af 101 Ffa Icmap 2013 PaperDocumento4 páginas1 Af 101 Ffa Icmap 2013 PaperZulfiqar AliAinda não há avaliações

- 4.JBSL AccountsDocumento8 páginas4.JBSL AccountsArman Hossain WarsiAinda não há avaliações

- Year Ended/Ending On March 31 No - of Months: ActualDocumento14 páginasYear Ended/Ending On March 31 No - of Months: ActualVinod JainAinda não há avaliações

- Paradocs Bis S.A.R.LDocumento0 páginaParadocs Bis S.A.R.LAnti-corruption Action CentreAinda não há avaliações

- Analysis of Apollo TiresDocumento12 páginasAnalysis of Apollo TiresTathagat ChatterjeeAinda não há avaliações

- Karnataka Bank Results Sep12Documento6 páginasKarnataka Bank Results Sep12Naveen SkAinda não há avaliações

- 16 Format of Financial Follow Up Report SbiDocumento4 páginas16 Format of Financial Follow Up Report SbiSandeep PahwaAinda não há avaliações

- Cement2001 2006Documento1 páginaCement2001 2006Mahnoor KhanAinda não há avaliações

- Schedule VIDocumento3 páginasSchedule VITempting SidAinda não há avaliações

- 3 JBCMLDocumento42 páginas3 JBCMLArman Hossain WarsiAinda não há avaliações

- iPAY International S.A. 2014Documento20 páginasiPAY International S.A. 2014LuxembourgAtaGlanceAinda não há avaliações

- CMA DataDocumento35 páginasCMA Dataashishy99Ainda não há avaliações

- 1.accounts 2012 AcnabinDocumento66 páginas1.accounts 2012 AcnabinArman Hossain WarsiAinda não há avaliações

- AF21-036 BCKiT Laudert2020 - 01032020 - Vi - F (E)Documento37 páginasAF21-036 BCKiT Laudert2020 - 01032020 - Vi - F (E)Nguyễn Trọng NghĩaAinda não há avaliações

- Theory For Financial Statements of A Company 2nd Puc AccountancyDocumento5 páginasTheory For Financial Statements of A Company 2nd Puc Accountancykakashihatake371Ainda não há avaliações

- Profit and Loss Account For The Year Ended 31 March, 2012Documento6 páginasProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliAinda não há avaliações

- ICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementDocumento16 páginasICICI Banking Corporation LTD.: Assessment of Working Capital Requirements Form Ii - Operating StatementbalajeenarendraAinda não há avaliações

- Table 4.1-Overall Balance of PaymentsDocumento4 páginasTable 4.1-Overall Balance of PaymentsPrasanth BalantrapuAinda não há avaliações

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Documento6 páginasStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderAinda não há avaliações

- Anexa 1. Structura Investiţiei: Resurse Ifad 1 Total, USD # Articole Total, MDL PropriiDocumento12 páginasAnexa 1. Structura Investiţiei: Resurse Ifad 1 Total, USD # Articole Total, MDL PropriiMihai PlescaAinda não há avaliações

- Fs 2011 GtbankDocumento17 páginasFs 2011 GtbankOladipupo Mayowa PaulAinda não há avaliações

- Standalone Financial Results For September 30, 2016 (Result)Documento1 páginaStandalone Financial Results For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Statement of Assets & Liabilities For The Period Ended Sept 30, 2013. (Company Update)Documento1 páginaStatement of Assets & Liabilities For The Period Ended Sept 30, 2013. (Company Update)Shyam SunderAinda não há avaliações

- Fs Q2fy13crDocumento4 páginasFs Q2fy13crAisha HusaainAinda não há avaliações

- 20.3 Hotel Corporation of India LTD.: Industrial / Business OperationsDocumento2 páginas20.3 Hotel Corporation of India LTD.: Industrial / Business OperationsskjamuiAinda não há avaliações

- Projected Balance Sheet FormatDocumento2 páginasProjected Balance Sheet FormatBuddhi Raj SharmaAinda não há avaliações

- Precision Capital S.A. 2015Documento31 páginasPrecision Capital S.A. 2015LuxembourgAtaGlanceAinda não há avaliações

- Re Ratio AnalysisDocumento31 páginasRe Ratio AnalysisManish SharmaAinda não há avaliações

- Bil Quarter 2 ResultsDocumento2 páginasBil Quarter 2 Resultspvenkatesh19779434Ainda não há avaliações

- Lead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital RequirementsDocumento13 páginasLead Bank:-State Bank of India Bank XYZ LTD Assessment of Working Capital Requirementsprateekm176123Ainda não há avaliações

- Financial Report of Construction CompanyDocumento5 páginasFinancial Report of Construction Companypawan_aggarwal_22Ainda não há avaliações

- Chapter 3Documento29 páginasChapter 3fentawmelaku1993Ainda não há avaliações

- Particulars Equity and Liabilities Shareholders' FundsDocumento6 páginasParticulars Equity and Liabilities Shareholders' FundsAnonymous MIMwLdPAinda não há avaliações

- First-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsDocumento23 páginasFirst-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsphuawlAinda não há avaliações

- Gujarat State Petronet LimitedDocumento13 páginasGujarat State Petronet LimitedAmrita Rao Bhatt100% (1)

- Letter To Shareholders and Financial Results September 2012Documento5 páginasLetter To Shareholders and Financial Results September 2012SwamiAinda não há avaliações

- Honda Balance SheetDocumento2 páginasHonda Balance SheetSyed Nabeel Hassan JafferyAinda não há avaliações

- Reliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003Documento3 páginasReliance Chemotex Industries Limited: Regd. Office: Village Kanpur, Post Box No.73 UDAIPUR - 313 003ak47ichiAinda não há avaliações

- Suggested Answers Intermediate Examination - Spring 2012: Realization AccountDocumento7 páginasSuggested Answers Intermediate Examination - Spring 2012: Realization AccountAhmed Raza MirAinda não há avaliações

- MBA Local Compnay Presentation - Financial - AccountingDocumento7 páginasMBA Local Compnay Presentation - Financial - AccountingAliza RizviAinda não há avaliações

- Financial Statements & Analysis 2024 SPCCDocumento29 páginasFinancial Statements & Analysis 2024 SPCCSaturo GojoAinda não há avaliações

- Fma (Repaired)Documento12 páginasFma (Repaired)pappunaagraajAinda não há avaliações

- Consolidated Balance Sheet: Equity and LiabilitiesDocumento49 páginasConsolidated Balance Sheet: Equity and LiabilitiesmsssinghAinda não há avaliações

- Business Finance-1 Quiz: Debt Ratio TIE Equity MultiplierDocumento2 páginasBusiness Finance-1 Quiz: Debt Ratio TIE Equity MultiplierTalha JavedAinda não há avaliações

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 páginasFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderAinda não há avaliações

- Standalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Documento16 páginasStandalone & Consolidated Financial Results, Limited Review Report, Auditors Report For September 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Nuru Ethiopia Final Audit Report 2019Documento22 páginasNuru Ethiopia Final Audit Report 2019Elias Abubeker AhmedAinda não há avaliações

- Accounting ConceptDocumento50 páginasAccounting Conceptrsal.284869430Ainda não há avaliações

- Income Tax Return E-Filing Guide (Salaried) - 2009Documento16 páginasIncome Tax Return E-Filing Guide (Salaried) - 2009Zohaib HussainAinda não há avaliações

- Commerce Mock Test 2Documento54 páginasCommerce Mock Test 2Dostmuhammad01Ainda não há avaliações

- Accounting Assumptions PrinciplesDocumento2 páginasAccounting Assumptions Principlesmuhammadtaimoorkhan100% (2)

- Commerce Mock Test 1Documento14 páginasCommerce Mock Test 1Raj Pandey IndiaAinda não há avaliações

- Commerce Mock Test 3Documento60 páginasCommerce Mock Test 3Dostmuhammad01Ainda não há avaliações

- Fundementals of FM 12 e DMCQSDocumento9 páginasFundementals of FM 12 e DMCQSDostmuhammad01Ainda não há avaliações

- Fundamentals of FMDocumento68 páginasFundamentals of FMDostmuhammad01Ainda não há avaliações

- C) PersonalityDocumento14 páginasC) PersonalityDostmuhammad01Ainda não há avaliações

- Robbinss: Mullin@cmsu1.cmsu - EduDocumento5 páginasRobbinss: Mullin@cmsu1.cmsu - EduDostmuhammad01Ainda não há avaliações

- TbankDocumento118 páginasTbankDostmuhammad01Ainda não há avaliações

- 335973Documento11 páginas335973Dostmuhammad01Ainda não há avaliações

- Im 05Documento30 páginasIm 05Dostmuhammad01Ainda não há avaliações

- Im 02Documento24 páginasIm 02Dostmuhammad01Ainda não há avaliações

- Robbins Eob11 Tif Ch01Documento35 páginasRobbins Eob11 Tif Ch01Patras NicolaeAinda não há avaliações

- Im 01Documento27 páginasIm 01Dostmuhammad01Ainda não há avaliações

- Super Regulator in Financial MarketDocumento32 páginasSuper Regulator in Financial Marketrkaran22Ainda não há avaliações

- 17 Big Advantages and Disadvantages of Foreign Direct InvestmentDocumento5 páginas17 Big Advantages and Disadvantages of Foreign Direct Investmentpatil mamataAinda não há avaliações

- Akixxxxx0p c15 PDFDocumento1 páginaAkixxxxx0p c15 PDFGanesh DasaraAinda não há avaliações

- Note 20 Mobile BillDocumento1 páginaNote 20 Mobile Billakshaybasal jainAinda não há avaliações

- The Risk Based AuditDocumento6 páginasThe Risk Based AuditHana AlmiraAinda não há avaliações

- Emerald Emerging Markets Case Studies: Article InformationDocumento22 páginasEmerald Emerging Markets Case Studies: Article InformationAliza FatimaAinda não há avaliações

- SPP Capital Market Update June 2023Documento10 páginasSPP Capital Market Update June 2023Jake RoseAinda não há avaliações

- Ch1 FundamentalsDocumento45 páginasCh1 FundamentalsFebri RahadiAinda não há avaliações

- Master Thesis 2021: Aakash Mishra URN 2021-M-10081997Documento48 páginasMaster Thesis 2021: Aakash Mishra URN 2021-M-10081997Akash MishraAinda não há avaliações

- The Budget ProcessDocumento16 páginasThe Budget ProcessBesha SoriganoAinda não há avaliações

- Session 9 - AmmortizationDocumento26 páginasSession 9 - Ammortizationjeff bansAinda não há avaliações

- Currency FuturesDocumento14 páginasCurrency Futurestelesor13Ainda não há avaliações

- CA Caspule For SBI PO Mains Part 1 PDFDocumento129 páginasCA Caspule For SBI PO Mains Part 1 PDFLakshmi SowmyaAinda não há avaliações

- All FormulaDocumento7 páginasAll FormulaLeeshAinda não há avaliações

- Post Merger People Integration PDFDocumento28 páginasPost Merger People Integration PDFcincinatti159634Ainda não há avaliações

- Subsidy Scheme For Coffee ProcessingDocumento4 páginasSubsidy Scheme For Coffee ProcessingPankaj SharmaAinda não há avaliações

- Report On Hyundai I20Documento10 páginasReport On Hyundai I20Sandarbh AgarwalAinda não há avaliações

- Ank Palermo Business Advisors Pty LTD Current & Historical Company ExtractDocumento4 páginasAnk Palermo Business Advisors Pty LTD Current & Historical Company ExtractFlinders TrusteesAinda não há avaliações

- MAIN PPT Business Ethics, Corporate Governance & CSRDocumento24 páginasMAIN PPT Business Ethics, Corporate Governance & CSRrajithaAinda não há avaliações

- Various Letters Set1Documento64 páginasVarious Letters Set1Marcus Roland50% (2)

- PA1 Mock ExamDocumento18 páginasPA1 Mock Examyciamyr67% (3)

- Mcgraw Hills Taxation of Individuals and Business Entities 2014 Edition Spilker 5th Edition Test BankDocumento24 páginasMcgraw Hills Taxation of Individuals and Business Entities 2014 Edition Spilker 5th Edition Test BankStephanieGarciawora100% (33)

- What Is CARPDocumento33 páginasWhat Is CARPWorstWitch TalaAinda não há avaliações

- Sip Ab Sapne Such Karo-Ppt-RevisedDocumento13 páginasSip Ab Sapne Such Karo-Ppt-RevisedMukesh KumarAinda não há avaliações

- WP10 2013 Distribution Income and Fiscal Incidence 18062013Documento49 páginasWP10 2013 Distribution Income and Fiscal Incidence 18062013akinky3sumAinda não há avaliações

- Aman Jaiswal MRPDocumento59 páginasAman Jaiswal MRPAli ShaikhAinda não há avaliações

- The Use and Abuse of Special-Purpose Entities in Public FinanceSteven L. SchwarczDocumento38 páginasThe Use and Abuse of Special-Purpose Entities in Public FinanceSteven L. SchwarczLisa Stinocher OHanlonAinda não há avaliações

- What Is A Zero-Coupon Treasury Bond: Guarantees The SecurityDocumento7 páginasWhat Is A Zero-Coupon Treasury Bond: Guarantees The Security88arjAinda não há avaliações

- Socio-Economic Planning Sciences: SciencedirectDocumento9 páginasSocio-Economic Planning Sciences: SciencedirectHector Dario Balseiro BarriosAinda não há avaliações

- Estimating and Costing MaterialDocumento42 páginasEstimating and Costing MaterialQuestion paperAinda não há avaliações