Escolar Documentos

Profissional Documentos

Cultura Documentos

Review - Assets 2013

Enviado por

Malou Almiro SurquiaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Review - Assets 2013

Enviado por

Malou Almiro SurquiaDireitos autorais:

Formatos disponíveis

1

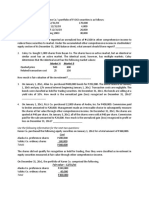

ASSETS 2013 Multiple Choice Identify the letter of the choice that best completes the statement or answers the question. 1. The Cartwright Corporation entered into a purchase contract during 2014 to purchase merchandise inventory in the future for resale. The contract contained no provisions for cancellation or revision. The total amount payable under the contract was 900,000. At the end of 2014, the estimated replacement cost of the goods yet to be purchased under the contract was 825,000. Payment on the contract is due in 2015, and the replacement cost of 825,000 likely will not increase. As a result of these circumstances, what entry, if any, should Cartwright Corporation make at the end of 2014 relating to this contract? a. Estimated loss on purchase contract ........... 75,000 Estimated liability on purchase contract .... 75,000 b. Estimated inventory ........................... 825,000 Estimated purchase contract ................. 825,000 c. Estimated inventory ........................... 825,000 Estimated loss on purchase contract ........... 75,000 Estimated liability on purchase contract ... 900,000 d. No entry should be made until 2015, when the goods are received. 2. On January 1, 2013, Herschel Locks Corporation purchased drilling equipment for 11,500. The equipment has an estimated useful life of four years and a salvage value of 200. Given this information, if Herschel uses the sum-ofthe-years'-digits method of depreciation and then trades the equipment for new, dissimilar equipment with a fair market value of 16,000 on December 31, 2014, and pays 8,000 cash in the exchange, the new equipment should be recorded at a. 16,000. b. 12,475. c. 11,590. d. 8,110. 3. The Saturn Department Store uses the retail inventory method to approximate ending inventory. The following information is available for the month of August: Cost 720,000 Retail 900,000 100,000 40,000 680,000

Cost of goods available for sale .......... Net markups (not included above) .......... Net markdowns ............................. Sales .....................................

What was the approximate inventory using the average cost estimate for inventory? a. 201,600 b. 210,000 c. 224,000 d. 230,400 4. Andrews Manufacturing Company purchased a new machine on July 1, 2013. It was expected to produce 200,000 units of product over its estimated useful life of eight years. Total cost of the machine was 600,000, and salvage value was estimated to be 60,000. Actual units produced by the machine in 2013 and 2014 are shown below. 2013 .............................................. 2014 .............................................. 16,000 units 30,000 units

Andrews reports on a calendar-year basis and uses the straight-line method of depreciation, computed to the nearest month. The amount of accumulated depreciation on this machine at December 31, 2014 would be a. 150,000. b. 135,000. c. 112,500. d. 101,250. 5. The following information is available for the Neptune Company for the three months ended March 31 of this year: Inventory, January 1 .................................. Purchases ............................................. Freight-in ............................................ Sales ................................................. 450,000 1,700,000 100,000 2,400,000

The gross margin was estimated to be 25 percent of sales. What is the estimated inventory balance at March 31? a. 350,000 b. 450,000

c. 562,500 d. 600,000 6. At the start of its business, Snell Corp. decided to use the composite method of depreciation and prepared the following schedule of machinery owned. Total Cost 275,000 100,000 20,000 Estimated Salvage Value 25,000 10,000 -Estimated Life in Years 20 15 5

Machine A Machine B Machine C

Snell computes depreciation on the straight-line method. Based on the information presented, the composite life of these assets (in years) should be a. 13.3. b. 16.0. c. 18.0. d. 19.8. 7. A company sells four products: I, II, III and IV. The company values all inventories using the lower-of-cost-ormarket procedure. The company has consistently experienced a profit margin of 20 percent of sales and expects this rate to hold for the future. Additional information, shown below, is available for the most recent year as of December 31. Original Cost 60 70 80 90 Cost to Replace 70 90 60 80 Estimated Cost to Sell 10 20 10 20 Expected Selling Prices 100 120 60 90

Product I II III IV

Using the lower-of-cost-or-market procedure, what is the reported inventory value at December 31 for one unit of Product III? a. 50 b. 60 c. 70 d. 80 8. On January 1, 2014, Carson Company purchased equipment at a cost of 420,000. The equipment was estimated to have a useful life of five years and a salvage value of 60,000. Carson uses the sum-of-the-years'-digits method of depreciation. What should the accumulated depreciation be at December 31, 2013? a. 240,000 b. 288,000 c. 336,000 d. 360,000 9. Petersen Menswear, Inc. maintains a markup of 60 percent based on cost. The company's selling and administrative expenses average 30 percent of sales. Annual sales were 1,440,000. Petersen's cost of goods sold and operating profit for the year are Cost of Goods Sold a. b. c. d. 864,000 864,000 900,000 900,000 144,000 432,000 108,000 432,000 Operating Profit

10. ABC LLC manufacturers and sells paper envelopes. The stock of envelopes was included in the closing inventory as of December 31, 2013, at a cost of 50 each per pack. During the final audit, the auditors noted that the subsequent sale price for the inventory at Juanuary15, 2014, was 40 each per pack. Furthermore, inquiry reveals that during the physical stock take, a water leakage has created damages to the paper and the glue. Accordingly, in the following week, ABC LLC has spent a total of 15 per pack for repairing and reapplying glue to the envelopes. The net realizable value and inventory write-down (loss) amount to a) 40 and10 respectively b) 45 and 10 respectively c) 25 and 25 respectively d) 35 and 25 respectively e) 30 and 15 respectively

11. On December 29, 2014, Purple Limited received a 6,000 shipment of merchandise inventory. The merchandise was correctly included in the December 31, 2014 ending inventory, but was not recorded as a 2014 purchase. The invoice for the merchandise was received and processed on January 10, 2015, and the merchandise was incorrectly included in the 2015 purchases. Purple uses a periodic inventory system and has a December 31 year end. Which of the following statements about the errors is correct? a. The December 31, 2015 retained earnings was understated by 6,000. b. The net income for 2015 was understated by 6,000. c. The net income for 2014 was understated by 6,000. d. The December 31, 2014 retained earnings was understated by 6,000. 12. On January 1, 2013, Peach Ltd. purchased a machine for 625,000. The machine had an estimated useful life of 10 years and an estimated residual value of 50,000. Peach uses the double-decliningbalance method of amortization. What would the net book value of the machine be on December 31, 2014? 1) 400,000 2) 408,000 3) 500,000 4) 510,000 13. On January 1, 2014, Big purchased a machine with the following expenditures relating to the machine: Invoice cost of machine 10,000 Freight to transport machine to BIG 500 Special concrete platform to support machine 1,000 Testing of machine prior to general use 300 The machine had an estimated useful life of 10 years, and BIG uses straight-line amortization for its equipment. What amount should be capitalized as the cost of the machinery for BIG for 2014? a. 10,000 b. 11,000 c. 11,500 d. 11,800 Ignore your answer to part l) and assume instead that the machine was capitalized at a cost of 12,000 with a residual value of 500 on the date of purchase of January 1, 2014. On January 1, 2016, the machine was then exchanged for computer equipment with fair market value of 10,000. Assuming that the exchange had commercial substance, how much would be recorded as a gain on disposal of the machine on the date of exchange on January 1, 2016? a. 0 b. 300 c. 400 d. 500 14. On January 1, 2014, Allisson Company purchased marketable equity securities for P5,000,000 to be held as FA thru OCI. The company also paid P200,000 in the form of transaction costs. The equity securities had a market value of P4,600,000 on December 31, 2014. No securities were sold during 2014. What amount of unrealized loss on these securities should be reported in the 2014 other comprehensive income? a. 400,000 b. 600,000 c. 200,000 d. 0 15. On January 2, 2011, Mark Corporation purchased photocopying machine cost of P300,000. This machine was estimated to have a five-year life with no salvage value and was depreciated by the straight-line method. On January 4, 2014, Mark determined that this machine could no longer work efficiently, that its value had been permanently impaired, and P90,000 could be recovered over the remaining useful life of the machine. In its December 31, 2014 balance sheet, how much should Mark report as carrying value of machine? a) 45,000 b) 50,000 c) 90,000 d) 150,000 16. Alex Corporation acquired 30% of Ivan Companys voting stock on January 2, 2013 for P2,000,000. During 2013, Ivan earned P800,000 and paid dividends of P500,000. Alexs interest in Ivan of 30%, gives Alex the ability to exercise significant influence over Ivans operating and financial policies. During 2014, Ivan earned P1,000,000 and paid dividends of P300,000 on April 1, and another P300,000 on October 1, 2014. On July 1, 2014, Alex sold half of its stock investment in Ivan for P1,320,000 cash.

What should be the gain on sale of this investment in Alexs 2014 income statement? a. 200,000 b. 245,000 c. 275,000 d. 320,000 17. Joseph, Inc. sells to wholesalers on terms 2/15,net 30. Joseph has no cash sales but 50% of Joseph's customers take advantage of the discount. Joseph uses the gross method of recording sales and trade receivables. An analysis of Joseph's trade receivable at December 31,2014 revealed the following: Age 0 - 15 days 16-30 days 31-60 days Over 60 days Amount 2,000,000 1,200,000 100,000 50,000 3,350,000 Collectible 100% 95% 90% 50%

what is the net realizable value of receivable at December 31, 2014? a. 3,350,000 b. 3,330,000 c. 3,235,000 d. 3,255,000 18. Ontario's accounting records indicated the following information for 2014: January 1, inventory P 2,000,000 Purchases P 7,000,000 Sales P 10,000,000 A physical count taken on December 31,2014 resulted in an ending inventory of P2,500,000. The gross profit on sales remained constant at 40% in recent years. Ontario suspect that a new employee may have stolen some inventory. On December 31, 2014, what is the estimated cost of missing inventory? a. P3,000,000 c. P500,000 b. P2,500,000 d. P - 0 19. Winterton Company purchased a building on Jan. 1, 2010 for a total of P10,000,000. The building has been depreciated using the straight-line method with a 25-year useful life and no residual value. As of Jan. 1, 2014, Winterton is evaluating the building for possible impairment. The building has a remaining useful life of 15 years and is expected to generate cash inflows of P450,000 per year. The estimated recoverable amount of the building on Jan. 1, 2014 is P5,310,000. How much, if any, is impairment loss that should be recognized on Jan. 1, 2014? a. 0 b. 2,100,000 c. 3,090,000 d. 5,200,000 20. On November 1, 2014 Allisson Company invested P600,000 in equity securities representing 20,000 ordinary shares of Mobius Company. The investment was classified as FA at PL since the company intends to sell the security for a short-term profit. On December 31, 2014 this investment has a market value of P580,000. On January 15, 2015, Allisson Company sold the investment for P630,000. What is the amount of realized gain should Allisson Company recognize on the disposal of the security? a. 0 b. 20,000 c. 30,000 d. 50,000 21. Banana Companys bank balance on its October 31, 2014 bank statement is 12,500. Bananas accountant is preparing a bank reconciliation and determined that 3 cheques issued by Banana to its suppliers for a total of 8,500 had not yet cleared the bank. Also, a deposit for 1,500 made by Banana on October 31 did not appear on the bank statement. Bank service charges of 150 appear on the bank statement, but have not yet been recorded in the general ledger. What is the adjusted balance that should be reflected in Bananas general ledger as at October 31, 2014? a. 5,350 b. 5,500 c. 19,350 d. 19,500

22. Eglinton Corporation has the following information as of Jan. 1, 2014 on its Property, Plant and Equipment account: Historical Cost Accum. Depreciation Land P 25,000,000 Buildings and improvements 150,000,000 50,000,000 Machinery and equipment 200,000,000 18,750,000 There were no additions or disposals during 2014. Depreciation expense is computed on a straight-line method over 20 years and improvements and 10 years for machinery and equipment. On Jan. 1, 2014, all of the companys property, plant and equipment Were appraised as follows: Fair values Building P 50,000,000 Buildings and improvements 225,000,000 Machinery and equipment 225,000,000 Eglinton booked the appraisal on Dec. 31, 2014. How much should Eglinton report as revaluation surplus in Property, plant and equipment under the other comprehensive income? a. 143,750,000 b. 193,750,000 c. 207,500,000 d. 318,250,000 23. On February 1, 2014, JP Corporation factored receivables with a carrying amount of P2,000,000 to Chicago Corporation. JP Corporation assesses a finance charge of 3 % of the receivables and retains 5% of the receivables. Relative to this transaction, you are to determine the amount of loss on sale to be reported in the income statement of JP Corporation for February. a. 0 b. 60,000 c. 100,000 d. 160,000 24. An inventory audit resulted in the accumulation of the following information: Per clients valuation of the physical inventory of all merchandise in the clients premises on December 31 275,000 Goods being held on consignment by client 20,000 Goods still in transit, FOB shipping point 15,000 Inventory items duplicated 3,000 Extension/footing errors (undervaluation) 4,000 How much is the inventory at December 31? a. 271,000 b. 275, 000 c. 259,000 d. 290,000 25. On January 1, 2013 Edna Company purchased equity securities to be held as FA thru OCI. On December 31, 2013, the cost and market value were: Cost Market Security X 2,000,000 2,400,000 Security Y 3,000,000 3,500,000 Security Z 5,000,000 4,900,000 On July 1, 2014, Edna Company sold Security X for P2,500,000. What amount of gain on sale of AFS securities should be reported in the 2014 income statement? a. 500,000 b. 100,000 c. 400,000 d. 0 26. Ivan owns 50% and 20% of Alex Corporations ordinary and preference shares, respectively. Alexs shares outstanding at December 31, 2014 as follows: Ordinary share P4,000,000

10% cumulative preference share

900,000

Alex reported net income of P600,000 for the year ended December 31, 2014. What amount should Ivan report as total revenue related to its investment in Alex Company for the year ended December 31, 2014? a. 0 b. 255,000 c. 273,000 d. 300,000 27. On January 1, 2014, DD acquired a new delivery truck at a cost of 40,000. It had an estimated useful life of 8 years and no residual value. DD estimated that the truck could be used for 200,000 kilometres before being sold. The truck was driven 30,000 kilometres in 2014. Which of the following amortization methods would result in the highest net book value for the truck on December 31, 2014? a) Units of production (based on kilometres) b) Double-declining-balance c) Straight-line d) Sum of the years digits 28. Mary Ann Company had the following borrowings during 2014. The borrowings were made for general purposes but the proceeds were used in part to finance the construction of a new building: Principal Interest 12% bank loan 10,000,000 1,200,000 15% long-term loan 20,000,000 3,000,000 The construction began on January 1, 2014 and was completed on December 31, 2014. Expenditures on the building were made as follows: January 1 June 30 December 31 Following the alternative treatment, the capitalizable borrowing cost should be a. 1,680,000 b. 4,200,000 c. 1,400,000 d. 1,620,000 29. On December 31, 2014, CAP had a capital asset with an original cost of 20,000 and net book value of 15,000. An impairment test on that date indicated that the capital asset had a recoverable amount (undiscounted cash flows) of 12,000 and a fair value of 10,000. How much would be the impairment loss recorded on December 31, 2014? a. 3,000 b. 5,000 c. 8,000 d. 10,000 30. On December 1, 2014, TRST sold 100 locks for laptop computers at 50 each with a 90-day unconditional right of return. Since this is a new product for TRST, it has no past history regarding estimated returns. Which of the following is true regarding TRSTs December 31, 2014 financial statement? a. Sales of 5,000 should only be recognized in 2015 when the return privilege expires. b. Sales of 5,000 should be recognized in 2014 as long as there is a reserve for returns. c. Sales of 5,000 should be recognized in 2014, with future costs accrued as an estimated liability. d. Sales should only be recognized as the related cash is collected. 31. During May 2014, Yeung Limited made an error by recording a cheque it wrote to pay for supplies at the incorrect amount of 6,400. The cheque appeared correctly on the May bank statement as 4,600. How should this cheque be presented on the May bank reconciliation? a. As a 1,800 deduction from the book balance b. As a 1,800 deduction from the bank balance c. As a 1,800 addition to the book balance d. As a 1,800 addition to the bank balance 32. A machine that was acquired at a cost of 40,000 on January 1, 2013 was sold for 28,000 on 8,000,000 8,000,000 4,000,000

December 31, 2014. It was being amortized using the double-declining balance method and had an estimated useful life of 20 years and a residual value of 10,000. What was the gain or loss on disposal that should have been recorded on December 31, 2014? a. 12,000 loss b. 4,400 loss c. 0 d. 3,700 gain 33. On January 1, 2014, Shine Co. sells its equipment with a carrying value of P160,000. The company receives a non-interest bearing note due in 3 years with a face amount of P200,000. There is no established market value for the equipment. The prevailing interest rate for a note of this type is 12%. The following are the present value factors of 1 at 12%: Present value of 1 for 3 periods Present value of an ordinary annuity of 1 for 3 periods 0.71178 2.40183

What is the gain or loss to be recognized on the sale of the equipment? a. 17,644 loss b. 122 gain c. 17,644 gain d. 40,000 gain 34. On January 1, 2013, Cooper Company is granted a large tract of land in the Cordillera region by the Philippine government. The fair value of the land is P10 million. Cooper Company is required by the grant to construct chemical research facility and employ only personnel residing in the Cordillera region. The estimated cost of the facility is P50 million with useful life of 20 years. Cooper Company should recognize in 2013 an income from government grant at a. 10,000,000 b. 2,500,000 c. 500,000 d. 0 35. CTR sells furniture wholesale to a large number of retailers. In 2014, the following transactions occurred: Sales on account 200,000 Cash collected on account 180,000 Accounts written off as uncollectable 9,000 Recoveries made on accounts previously written off as uncollectable 1,500 On December 31, 2014, the following were reported on CTRs balance sheet: Accounts receivable 65,000 Allowance for doubtful accounts 15,000 Accounts receivable, net 50,000 Assume that CTR estimates its bad debts to be 3% of credit sales. What would be the balance of CTRs accounts receivable, net as of December 31, 2014? a) 65,500 b) 71,500 c) 79,000 d) 85,000 36. On January 1,2014, Lakeshore Company has a machinery with cost of P5,000,000 and accumulated depreciation of P1,500,000. The machinery was acquired on January 1, 2011 and has been depreciated using the straight-line method with useful life of 10 years and no residual value. On January 1, 2014, Lakeshore has property tested the machinery to be impaired. The machinery has a remaining life of 5 years and is expected to generate undiscounted net cash flows of P800,000 per year. The fair value of the machinery on January 1,2014 is P3,000,000. the appropriate discount rate is 8%. The present value of an ordinary annuity of 1 at 8% for 5 periods is 3.00. Lakeshore should recognize an impairment loss in its 2014 income statement at a. 308,000 c. 500,000 b. 808,000 d. 800,000 37. On December 31, 2014, Mark Company showed the following intangible assets: Trademark 6,000,000 Patent 3,000,000 The trademark has 8 years remaining in its legal life. However, it is anticipated that the trademark will be routinely renewed in the future. Thus, the trademark is considered to have an indefinite life.

Because of an inflationary economy, the trademark is expected to generate cash flows of P200,000 per year. The appropriate discount rate is 10%. Mathematically, the discounted value of a stream of indefinite annual cash flow is simply computed by dividing the annual cash flow by the discount rate. The patent has an economic life of just 5 years because of market conditions. It is expected that the patent will generate cash flows of P500,000 per year. The appropriate discount rate is also 10%. The present value of an ordinary annuity of 1 at 10% for 5 periods is 3.79 Mark Company shall recognize in 2014 total impairment loss at a. 1,105,000 c. 5,105,000 b. 4,000,000 d. 0 38. Pido Company determined that, due to the obsolescence, equipment with an original cost of P180,000 and accumulated depreciation at January 1, 2014 of P84,000 had suffered permanent impairment, and as a result should have a fair value of only P60,000 as of the beginning of the year. Additionally, the remaining useful life of the equipment was reduced from eight years to three years. In its December 31, 2014 balance sheet, how much should Pido report as accumulated depreciation? a) 20,000 b) 104,000 c) 120,000 d) 140,000 39. Jeffrey Company has decided to expand its operations and has purchased land in Smallville for construction of a new manufacturing plant. The following costs were incurred in purchasing the property and constructing the building: Land purchase price 2,500,000 Payment of delinquent property taxes 100,000 Title search and insurance 50,000 Special assessment for city improvement on water sewer 150,000 Building permit 30,000 Cost to destroy existing building on land (P10,000 worth of salvaged material used in new building) 60,000 Contract cost of new building 7,000,000 Architect fee 200,000 Sidewalk and parking lot 100,000 Fire insurance on building 1 year 40,000 The cost of the land and building should respectively be a. 2,850,000 and 7,240,000 c. 2,800,000 and 7.290.000 b. 2,700,000 and 7,240,000 d. 2,850,000 and 7,230,000 40. An intangible asset costs P300,000 on January 1,2013. On January 1,2014, the asset was evaluated to determine if it was impaired. As of January 1,2014, the asset was expected to generate future cash flows of P25,000 per year (at the end of each year). The appropriate discount rate is 5%. What total amount should be charged against income in 2014, assuming that the asset had a total useful life of 10 years from date of acquisition? a. P30,000 b. P92,304 c. P112,048 d. P122,304 What total amount should be charged against income in 2014 assuming that as of January 1,2013, the asset was assumed to have an indefinite useful life and that as of January 1,2014, the remaining life was still indefinite? a. 0 b. P30,000 c. P92,304 d. P122,304 41. At December 31, 2014, the following data was available for a building owned by NU Company: Building cost 800,000 Accumulated amortization building 600,000 Estimated residual value at end of useful life 50,000 Estimated remaining useful life 10 years A small room was built on the back of the building at a cost of 50,000. The room was completed on June 30, 2015 and was used as office space commencing July 2, 2015. What is the effect of this expenditure on income before taxes for 2015? a. Income will decrease by 2,632 b. Income will decrease by 5,000 c. Income will decrease by 5,263

d. Income will decrease by 50,000 42. On December 31, 2014, Burgundy Corp. purchased a property with a building located thereon for 600,000. The closing statement indicated that the land value was 400,000 and the building value was 200,000. A few days after acquisition, the building was demolished at a cost of 60,000. In 2015, a new building was constructed for 2,300,000 plus the following costs: Building design 80,000 Construction superintendents salary 90,000 Implicit interest on retained earnings used during construction 50,000 At what amount should the land be reported on Burgundys balance sheet at December 31, 2015? a) 400,000 b) 460,000 c) 600,000 d) 660,000 How much of the 2015 costs related to the construction of the building should be capitalized in the building account? a) 2,300,000 b) 2,380,000 c) 2,470,000 d) 2,520,000 43. On January 1, 2014, Allisson Company purchased marketable equity securities to be held as FA at PL for P4,000,000. The company also paid commission to the stockbroker in the amount of P100,000. No securities were sold during 2014. The market value of the equity securities on December 31, 2014 is P4,500,000. What amount of unrealized gain on these securities should be reported in the 2014 income statement? a. 500,000 b. 400,000 c. 300,000 d. 0 44. In 2014, Cleo Company held the following investments in common stock: 30,000 shares of Robel Companys 100,000 outstanding shares. 15,000 shares of Ames Companys 300,000 outstanding shares. During 2014, Cleo received the following distributions from its common stock investment: - P300,000 cash dividend from Robel - P150,000 cash dividend from Ames. 31 - 10% common stock dividend from Ames. The closing price of this stock on a national exchange was P150, per share What amount of dividend revenue should Cleo report for 2014? a. 150,000 b. 450,000 c. 675,000 d. 375,000 45. On January 1, 2013, ZZ purchased equipment for 25,000 with an estimated useful life of 10 years. On December 31, 2014, it had a net book value of 20,000. Based on an impairment test, ZZ determined that future cash flows relating to the equipment would be 15,000 and fair value was 10,000. Unexpectedly, the fair value of the equipment then increased to 25,000 at the end of 2015. Which of the following is true regarding this equipment? a) It should be recorded at 10,000 at the end of 2014. b) It should be recorded at 15,000 at the end of 2014. c) It should be recorded at 20,000 at the end of 2014. d) A recovery in value of the equipment should be recorded in 2015. 46. Scotia Bank granted a loan to a borrower on January 1, 2014. The interest rate on the loan is 10% payable annually starting December 31, 2014. The loan matures in five years on December 31, 2018. Principal amount 4,000,000 Direct origination cost 61,500 Origination fee received from borrower 350,000 The effective rate on the loan after considering the direct origination cost and origination fee received is 12%. Q1. What is the carrying value of the loan receivable on January 1, 2014? a. 4,000,000 November November December 15 31

10

b. 4,650,000 c. 4,411,500 d. 3,711,500 Q2. What is the interest income for 2014? a. 400,000 b. 558,000 c. 529,380 d. 445,380 47. JOHN PAUL has been experiencing a significant increase in customers demand for its product. To expand its production capacity, JOHN PAUL decided to purchase equipment from JEROME on January 2,2013. JOHN PAUL issues a P2,400,000 5 year non interest bearing note to JEROME for the new equipment when the prevailing market rate of interest for obligations of this nature is 12%. The company will pay off the note in five P480,000 installments due at the end of each year over the life of the note. JOHN PAULs financial year end is December 31. The appropriate present value factor of an ordinary annuity of 1 at 12% for 5 periods is 3.60478. What is the carrying value of the note at December 31,2015? a. 1,440,000 b. 811,226 c. 1,480,932 d. 1,152,880 48. On January 1, 2014, Japan Company received a grant of P10 million from the British government to compensate for massive losses incurred because of a recent tsunami. The grant requires no fulfillment of certain conditions. The grant was made for the purpose of giving immediate financial support to the entity. It will take Emerson Company 2 years to reconstruct its assets destroyed by the tsunami. How much income from the government grant should be recognized by Emerson in 2014 a. 10,000,000 c. 5,000,000 b. 2,500,000 d. 0

49. FE Ltd. began operations on January 1, 2013. Merchandise purchases and alternative methods of valuing inventory for the first two years of operations are summarized below: 2013 2014 Purchases 600,000 700,000 Ending inventory Specific identification 212,000 192,000 First-in first-out (FIFO) 220,000 188,000 Average cost 216,000 190,000 Lower of cost or market (LCM) 196,000 176,000 Q1. Which of the following inventory valuation methods would report the highest net income for 2013? a) Specific identification b) FIFO c) Average cost d) Lower of cost and market Q2. What is cost of goods sold for 2014, assuming that FIFO has been used for all years? a) 632,000 b) 668,000 c) 700,000 d) 732,000 50. On January 1, 2012, Matet Corporation signed a 12-year lease for warehouse space. Matet has an option to renew the lease for an additional 8-year period on or before January 1, 2016. During January 2014, Matet made substantial improvements to the warehouse. The cost of these improvements was P540,000, with an estimated useful life of 15 years. At December 31, 2014, Matet intended to exercise the renewal option. Matet has taken a full years depreciation on this leasehold improvement.In the December 31, 2014 balance sheet, the carrying amount of this leasehold improvement should be a. 486,000 c. 504,000 b. 510,000 d. 513,000 51. On January 1, 2014, Arch Ltd. purchased 30% of the common shares of AP Inc. for 1,700,000. In 2014, AP reported net income of 880,000 and paid dividends of 600,000. The amortization of the purchase discrepancy related to this investment was 80,000 for 2014. Which of the following conditions must be met for Arch to use the equity method to report its

11

investment in AP? a. Arch owns at least 20% of the voting shares of AP. b. Arch has control over AP. c. Arch has a significant interest in AP. d. Arch is able to exercise significant influence over AP. How much income would be reported by Arch in 2014 for its investment in AP under the equity method? a. 180,000 b. 184,000 c. 264,000 d. 880,000 52. Kyla Company acquired two items of machinery as follows: ? On December 30, 2013, Kyla Company purchased a machine in exchange for a noninterest bearing note requiring ten payments of P500,000. The first payment was made on December 30, 2014, and the others are due annually on December 30. The prevailing rate of interest for this type of note at date of issuance was 12%. The present value of an ordinary annuity of 1 at 12% is 5.33 for nine periods and 5.65 for ten periods. ? On January 1, 2013, Kyla Company acquired used machinery by issuing the seller a twoyear, non-interest-bearing note for P3,000,000. In recent borrowing, Kyla has paid a 12% interest for this type of note. The present value of 1 at 12% for 2 years is 0.80 and the present value of an ordinary annuity of 1 at 12% for 2 years is 1.69. What is the total cost of the machinery? a. 5,065,00 b. 5,565,000

c. d.

5,225,000 8,235,000

53. On January 2, 2014, Renz Company traded in an old machine for a newer model. Data relative to the old and new machines follow: Old Machine Original cost 800,000 Accumulated depreciation as of January 1, 2014 600,000 Average published retail value 170,000 New machine List price 1,000,000 Cash price without trade in 900,000 Cash paid with trade in 780,000 What should be the cost of the new machine for financial accounting purposes? a. 900,000 c. 950,000 b. 980,000 d. 1,000,000 54. It is July 1, 2014 and you have decided to purchase a car. The car dealer has offered you a choice of paying all cash or making 8 payments of 5,000 per year, with the first payment due today, and each subsequent payment due annually on July 1. After the final payment you would retain ownership of the car. You would normally pay 8% interest for a car loan and you have no preference between paying cash or making annual payments. What price would you be willing to pay in cash for the car (ignore taxes)? a. 28,733 b. 29,131 c. 31,032 d. 40,000

55. Carla Received from a customer a one-year, P375,000 note bearing annual interest of 8%.After holding the note for six months, Carla discounted the note at I-Bank at an effective interest rate of 10%. If the discounting is treated as a sale, what amount of loss on discounting should a. 0 b. 5,250 c. 9,750 d. 20,250 Carla recognize?

56. Mavis Company had a machinery costing P3,000,000 when purchased on Jan. 2, 2009. Estimated useful life of the asset was for 20 years with no salvage value at the end of its useful life. Mavis uses the straight line method of the depreciation. On Jan. 2, 2014, Mavis is evaluating the machinery for possible impairment. The machinery useful life of 5 years and is expected to generate cash inflows of P500,000 per year. Mavis has determined that the rate implicit in current market transaction for similar asset is 10%. Available information as of Jan. 2, 2014 has also showed that the appropriate market price for the same asset is P1,000,000. Estimated cost of disposal, P150,000.

12

What amount of impairment loss, if any, is to be recognized? a. 0 b. 355,000 c. 450,000 d. 600,000 57. Grey Company uses declining-balance amortization and Brown Company uses straight-line amortization. Both companies commenced operations on January 1, 2014 and acquired equipment on that date. If the 2 companies are identical in all respects except for the different amortization methods, which of the following statements is true? a. Grey Company will report higher net assets at the end of the first year. b. Grey Company will report higher net income for the first year. c. Grey Company will report higher retained earnings at the end of the second year. d. Grey Company will report lower net assets at the end of the second year. 58. Several years ago, JJ issued 10,000 cumulative preferred shares with an annual dividend of 1 per share. As of December 15, 2014, dividends on the shares were 1 year in arrears. On December 16, 2014, JJ declared 20,000 of dividends on the preferred shares with a payment date of January 12, 2015. How should the dividends be reflected, if at all, in the liability section of JJs balance sheet at December 31, 2014? a) They should be presented as a 20,000 current liability. b) They should be presented as a 10,000 current liability and a 10,000 long-term liability. c) They should not be included in liabilities; they should only be disclosed in the notes. d) They should not be included in liabilities; they should only be included in the statement of retained earnings.

Você também pode gostar

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocumento7 páginasSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateAinda não há avaliações

- Quiz On InvestmentDocumento3 páginasQuiz On InvestmentDan Andrei BongoAinda não há avaliações

- Liab, SHE, CashvsAccrual, BV & EPSDocumento5 páginasLiab, SHE, CashvsAccrual, BV & EPSMimiAinda não há avaliações

- CAT Challenge - Answers PDFDocumento6 páginasCAT Challenge - Answers PDFnivea gumayagayAinda não há avaliações

- ReceivablesDocumento4 páginasReceivablesKentaro Panergo NumasawaAinda não há avaliações

- Lease ProblemsDocumento15 páginasLease ProblemsArvigne DorenAinda não há avaliações

- Quiz Week 8 Akm 2Documento6 páginasQuiz Week 8 Akm 2Tiara Eva TresnaAinda não há avaliações

- Liabilities Long TermDocumento3 páginasLiabilities Long TermEngel QuimsonAinda não há avaliações

- TOS Common Exam 2S1819Documento24 páginasTOS Common Exam 2S1819Mary Anne ManaoisAinda não há avaliações

- Q2 FarDocumento2 páginasQ2 FarSHEAinda não há avaliações

- Comprehensive Exam DDocumento10 páginasComprehensive Exam Djdiaz_646247Ainda não há avaliações

- Finacc 3Documento12 páginasFinacc 3jano_art21Ainda não há avaliações

- Quiz Discontinued OperationDocumento2 páginasQuiz Discontinued OperationRose0% (1)

- Management Accounting Ii-Budgeting Solve Each Problem Carefully. No Solution, No Credit. Time Limit: Strictly 30 MinutesDocumento2 páginasManagement Accounting Ii-Budgeting Solve Each Problem Carefully. No Solution, No Credit. Time Limit: Strictly 30 MinutesJade TanAinda não há avaliações

- Change in Unit Cost From Prior Department and Valuation of InventoryDocumento8 páginasChange in Unit Cost From Prior Department and Valuation of InventoryHarzen Joy SampolloAinda não há avaliações

- Module 4 - Ia2 FinalDocumento43 páginasModule 4 - Ia2 FinalErika EsguerraAinda não há avaliações

- Ac3b Qe Oct2014 (TQ)Documento12 páginasAc3b Qe Oct2014 (TQ)Julrick Cubio EgbusAinda não há avaliações

- Quiz Bee QuestionsDocumento19 páginasQuiz Bee QuestionsBelen VergaraAinda não há avaliações

- Chapter 3 - Revenue From Contracts With Customers (1) - UnlockedDocumento3 páginasChapter 3 - Revenue From Contracts With Customers (1) - UnlockedJerome_JadeAinda não há avaliações

- Audit of PPEDocumento6 páginasAudit of PPEJuvy DimaanoAinda não há avaliações

- Try This - Cost ConceptsDocumento6 páginasTry This - Cost ConceptsStefan John SomeraAinda não há avaliações

- Logos Are Special. They Are Not Just A Combination of Shapes, Text, and Graphics. They Tell Stories.Documento3 páginasLogos Are Special. They Are Not Just A Combination of Shapes, Text, and Graphics. They Tell Stories.Donnalyn TablacAinda não há avaliações

- Alibat Share Capital Transactions Subsequent To Original IssuanceDocumento21 páginasAlibat Share Capital Transactions Subsequent To Original IssuanceRhad EstoqueAinda não há avaliações

- Acc 111 Exam GeleraDocumento11 páginasAcc 111 Exam GeleraCheska GeleraAinda não há avaliações

- Receivables ManagementDocumento5 páginasReceivables ManagementInocencio TiburcioAinda não há avaliações

- EconomicDocumento6 páginasEconomicDaniloCardenasAinda não há avaliações

- Adms 2510 Winter 2007 Final ExaminationDocumento11 páginasAdms 2510 Winter 2007 Final ExaminationMohsin Rehman0% (1)

- Testbank-Quizlet RelevantCost2Documento12 páginasTestbank-Quizlet RelevantCost2Lokie PlutoAinda não há avaliações

- FINC 304 Managerial EconomicsDocumento21 páginasFINC 304 Managerial EconomicsJephthah BansahAinda não há avaliações

- FUNAC TheoriesDocumento5 páginasFUNAC TheoriesAlvin QuizonAinda não há avaliações

- Bastrcsx q1m Set BDocumento9 páginasBastrcsx q1m Set BAdrian MontemayorAinda não há avaliações

- UCU Audit ProblemsDocumento9 páginasUCU Audit ProblemsTCC FreezeAinda não há avaliações

- Qualifying Exam - FAR - 1st YearDocumento11 páginasQualifying Exam - FAR - 1st YearKristina Angelina ReyesAinda não há avaliações

- Far 6673Documento4 páginasFar 6673Marinel Felipe0% (1)

- Quiz InvestmentsDocumento2 páginasQuiz InvestmentsstillwinmsAinda não há avaliações

- Review Exercise ADocumento5 páginasReview Exercise AFitz Gerald BalbaAinda não há avaliações

- Should The Government Fight Recessions With Spending Hikes or Tax CutsDocumento19 páginasShould The Government Fight Recessions With Spending Hikes or Tax CutsAmbika Pandey75% (4)

- Baba2 Fin MidtermDocumento8 páginasBaba2 Fin MidtermYu BabylanAinda não há avaliações

- MASDocumento46 páginasMASKyll Marcos0% (1)

- ch17 InvestmentsDocumento38 páginasch17 InvestmentsKristine Wali0% (1)

- PAS 16 Test BankDocumento2 páginasPAS 16 Test BankLouiseAinda não há avaliações

- Quiz For CostDocumento3 páginasQuiz For CostSaeym SegoviaAinda não há avaliações

- Use Capital Letters Only Label Answers Properly Answers Must Be Handwritten Present Solutions. Submit Answers Through Messenger or EmailDocumento6 páginasUse Capital Letters Only Label Answers Properly Answers Must Be Handwritten Present Solutions. Submit Answers Through Messenger or EmailJungie Mablay WalacAinda não há avaliações

- Quiz#1 MaDocumento5 páginasQuiz#1 Marayjoshua12Ainda não há avaliações

- CFAS-MC Ques - Review of The Acctg. ProcessDocumento5 páginasCFAS-MC Ques - Review of The Acctg. ProcessKristine Elaine RocoAinda não há avaliações

- IAS 23 Borrowing CostsDocumento6 páginasIAS 23 Borrowing CostsSelva Bavani SelwaduraiAinda não há avaliações

- MASDocumento6 páginasMASIyang LopezAinda não há avaliações

- Advanced Part 2 Solman MillanDocumento320 páginasAdvanced Part 2 Solman Millanlily janeAinda não há avaliações

- Book Value Per Share Basic Earnings PerDocumento61 páginasBook Value Per Share Basic Earnings Perayagomez100% (1)

- Prelims Ms1Documento6 páginasPrelims Ms1ALMA MORENAAinda não há avaliações

- Moldez INT03 QUIZDocumento3 páginasMoldez INT03 QUIZVincent Larrie MoldezAinda não há avaliações

- Chapter 29 SheDocumento126 páginasChapter 29 SheAiraAinda não há avaliações

- Chapter 6-Exercise 9Documento5 páginasChapter 6-Exercise 9jayjay storageAinda não há avaliações

- FoA II-Individual AssignmentDocumento6 páginasFoA II-Individual Assignmentmedhane negaAinda não há avaliações

- DEPRECIATIONDocumento5 páginasDEPRECIATIONjdjdbAinda não há avaliações

- Financial Accounting III Midterm ExaminationDocumento9 páginasFinancial Accounting III Midterm ExaminationKriz-leen TiuAinda não há avaliações

- Revaluation and Impairment - Without AnswerDocumento2 páginasRevaluation and Impairment - Without AnswerEra EllorimoAinda não há avaliações

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocumento8 páginasIdentify The Choice That Best Completes The Statement or Answers The QuestionBlanch DizonAinda não há avaliações

- Remedial 01 FAR With AnswersDocumento7 páginasRemedial 01 FAR With AnswersJennifer AdvientoAinda não há avaliações

- AnswerQuiz - Module 10Documento4 páginasAnswerQuiz - Module 10Alyanna Alcantara100% (1)

- Report On The Activities of The Group 2018Documento117 páginasReport On The Activities of The Group 2018Parth PatelAinda não há avaliações

- Don Hall - PyrapointDocumento243 páginasDon Hall - Pyrapointcabaleiromedieval100% (4)

- Chestnut - Ambudheesh, Naina, Shiny, SudhanshuDocumento9 páginasChestnut - Ambudheesh, Naina, Shiny, SudhanshuRahul UdainiaAinda não há avaliações

- International Finance PDFDocumento5 páginasInternational Finance PDFDivakara ReddyAinda não há avaliações

- ForexDocumento94 páginasForexHarendra Singh BhadauriaAinda não há avaliações

- Forward Final MbaDocumento35 páginasForward Final MbaAmanNandaAinda não há avaliações

- Cox-Ross-Rubenstein Binomial OptionDocumento4 páginasCox-Ross-Rubenstein Binomial Optionhotmail13Ainda não há avaliações

- Case+Study+Solution-1+ 1Documento14 páginasCase+Study+Solution-1+ 1Muhammad Usama WaqarAinda não há avaliações

- The Gold Industry: Presented byDocumento71 páginasThe Gold Industry: Presented byRatnesh SinghAinda não há avaliações

- Financial Markets and Institutions: Lecture 1: IntroductionDocumento41 páginasFinancial Markets and Institutions: Lecture 1: IntroductionGaurav007Ainda não há avaliações

- Mission Statement For TradersDocumento13 páginasMission Statement For Tradersbarber bobAinda não há avaliações

- XBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardDocumento243 páginasXBRL Financial Statements Duly Authenticated As Per Section 134 (Including BoardVicky SinhaAinda não há avaliações

- Finman 10 DerivativesDocumento5 páginasFinman 10 DerivativesStephanie Dulay SierraAinda não há avaliações

- Project Report On Banking SystemDocumento16 páginasProject Report On Banking SystemArun Kumar0% (1)

- Fair Value Accounting: ©2018 John Wiley & Sons Australia LTDDocumento42 páginasFair Value Accounting: ©2018 John Wiley & Sons Australia LTDSonia Dora DemoliaAinda não há avaliações

- The Primary Market in IndiaDocumento34 páginasThe Primary Market in IndiaPINAL100% (1)

- Turmeric Contract Spec 08032011Documento4 páginasTurmeric Contract Spec 08032011Sivarajadhanavel PalanisamyAinda não há avaliações

- Suzanne Hone Is A Highly Accomplished Client Relationship Manager With An Outstanding Track Record of Success in Financial Services Organizations.Documento2 páginasSuzanne Hone Is A Highly Accomplished Client Relationship Manager With An Outstanding Track Record of Success in Financial Services Organizations.smhbcdAinda não há avaliações

- Ketan Parekh AccountDocumento20 páginasKetan Parekh AccountdhruvinAinda não há avaliações

- Philip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Documento117 páginasPhilip J. Romero - Tucker Balch - Hedge Fund Secrets - An Introduction To Quantitative Portfolio Management-Business Expert Press (2018)Mohamed Hussien100% (1)

- Roland Berger Study Banking Myanmar - Sept 2016Documento28 páginasRoland Berger Study Banking Myanmar - Sept 2016Michael MyintAinda não há avaliações

- Pfrs For Small EntitiesDocumento3 páginasPfrs For Small EntitiesEmma Mariz Garcia100% (2)

- 271ad759f5 Cc627ca794Documento133 páginas271ad759f5 Cc627ca794AndrySetioAinda não há avaliações

- Dont MindDocumento1 páginaDont MindAirene Talisic PatunganAinda não há avaliações

- Nadir Metal Rafineri Catalogue 2022Documento19 páginasNadir Metal Rafineri Catalogue 2022PieAinda não há avaliações

- Foreign Currency TranslationDocumento3 páginasForeign Currency TranslationMarietzaAinda não há avaliações

- Resume Awais AhmadDocumento3 páginasResume Awais AhmadAwais AhmadAinda não há avaliações

- Sample Test Chap04Documento9 páginasSample Test Chap04Niamul HasanAinda não há avaliações

- HL Master Prospectus 2017 FinalDocumento173 páginasHL Master Prospectus 2017 FinalhlamycomAinda não há avaliações

- Summer InternshipDocumento17 páginasSummer InternshipAnkit PalAinda não há avaliações