Escolar Documentos

Profissional Documentos

Cultura Documentos

Argentina - Monetary Policy and GDP

Enviado por

Eduardo PetazzeTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Argentina - Monetary Policy and GDP

Enviado por

Eduardo PetazzeDireitos autorais:

Formatos disponíveis

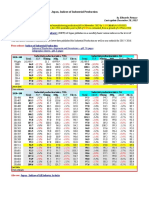

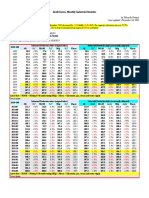

Argentina Monetary Policy and GDP

by Eduardo Petazze

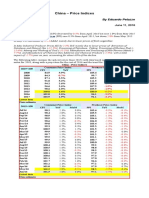

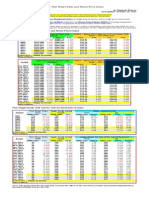

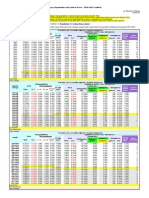

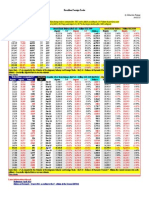

The following tables contain monthly information on the evolution of monetary aggregates (Mo), and the reserves of the Central Bank of Argentina

(BCRA) and its comparison with the Domestic Demand data (from the GDP new methodology), all expressed in current pesos.

The ratio "Mo/Daily Domestic Demand" shows periods of over-expansion of the money supply in terms of the needs of currency to cover normal

commercial transactions (when the standardized variable is more than 1.00).

The ratio "Mo/FX Reserves Balance" shows periods of spurious emission without backed in net liquid FX assets (when the standardized variable is

moe than 1.00)

Monthly Data:

Month

Jan-93

Feb-93

Mar-93

Apr-93

May-93

Jun-93

Jul-93

Aug-93

Sep-93

Oct-93

Nov-93

Dec-93

Jan-94

Feb-94

Mar-94

Apr-94

May-94

Jun-94

Jul-94

Aug-94

Sep-94

Oct-94

Nov-94

Dec-94

Jan-95

Feb-95

Mar-95

Apr-95

May-95

Jun-95

Jul-95

Aug-95

Sep-95

Oct-95

Nov-95

Dec-95

Jan-96

Feb-96

Mar-96

Apr-96

May-96

Jun-96

Jul-96

Aug-96

Sep-96

Oct-96

Nov-96

Dec-96

Jan-97

Feb-97

Mar-97

Apr-97

May-97

Jun-97

Jul-97

Aug-97

Sep-97

Oct-97

Nov-97

Dec-97

Jan-98

Feb-98

Mar-98

Apr-98

May-98

Jun-98

Jul-98

Aug-98

Sep-98

Oct-98

Nov-98

Dec-98

Jan-99

Feb-99

Mar-99

Apr-99

May-99

Jun-99

Jul-99

Aug-99

Sep-99

Oct-99

Nov-99

Dec-99

Jan-00

Feb-00

Mar-00

Apr-00

May-00

Jun-00

Jul-00

Aug-00

Sep-00

Oct-00

Nov-00

Dec-00

Jan-01

Feb-01

Mar-01

Apr-01

May-01

Jun-01

Jul-01

Aug-01

Sep-01

Oct-01

Nov-01

Dec-01

Jan-02

Feb-02

Mar-02

Apr-02

May-02

Jun-02

Jul-02

Aug-02

Sep-02

Oct-02

Nov-02

Dec-02

Jan-03

Feb-03

Mar-03

Apr-03

May-03

Jun-03

Jul-03

Aug-03

Sep-03

Oct-03

Nov-03

Dec-03

Jan-04

Feb-04

Mar-04

Apr-04

May-04

Jun-04

Jul-04

Aug-04

Sep-04

Oct-04

Nov-04

Dec-04

Jan-05

Feb-05

Mar-05

Apr-05

May-05

Jun-05

Jul-05

Aug-05

Sep-05

Oct-05

Nov-05

Dec-05

Jan-06

Feb-06

Mar-06

Apr-06

May-06

Jun-06

Jul-06

Aug-06

Sep-06

Oct-06

Nov-06

Dec-06

Jan-07

Feb-07

Mar-07

Apr-07

May-07

Jun-07

Jul-07

Aug-07

Sep-07

Oct-07

Nov-07

Dec-07

Jan-08

Feb-08

Mar-08

Apr-08

May-08

Jun-08

Jul-08

Aug-08

Sep-08

Oct-08

Nov-08

Dec-08

Jan-09

Feb-09

Mar-09

Apr-09

May-09

Jun-09

Jul-09

Aug-09

Sep-09

Oct-09

Nov-09

Dec-09

Jan-10

Feb-10

Mar-10

Apr-10

May-10

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Nov-11

Dec-11

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Jun-12

Jul-12

Aug-12

Sep-12

Oct-12

Nov-12

Dec-12

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Feb-14

Mar-14

Apr-14

May-14

Jun-14

Jul-14

Aug-14

Sep-14

Oct-14

Nov-14

Dec-14

Daily

domestic USD=$ARG

demand

621.07

1.0000

632.45

1.0000

643.83

1.0000

588.88

1.0000

599.48

1.0000

607.48

1.0000

652.42

1.0000

661.12

1.0000

662.77

1.0000

646.02

1.0000

647.63

1.0000

656.25

1.0000

723.38

1.0000

733.01

1.0000

744.10

1.0000

673.53

1.0000

683.71

1.0000

687.20

1.0000

728.26

1.0000

731.97

1.0000

733.30

1.0000

720.23

1.0000

721.54

1.0000

719.68

1.0000

779.73

1.0000

777.72

1.0000

768.67

1.0000

669.69

1.0000

661.89

1.0000

662.13

1.0000

702.90

1.0000

703.16

1.0000

706.36

1.0000

698.92

1.0000

702.11

1.0000

706.74

1.0000

759.98

1.0000

764.99

1.0000

773.66

1.0000

705.58

1.0000

713.57

1.0000

719.05

1.0000

766.25

1.0000

772.13

1.0000

778.46

1.0000

769.47

1.0000

775.78

1.0000

785.78

1.0000

846.84

1.0000

857.75

1.0000

863.52

1.0000

794.06

1.0000

799.40

1.0000

806.24

1.0000

863.56

1.0000

870.95

1.0000

878.98

1.0000

861.54

1.0000

869.48

1.0000

871.74

1.0000

917.13

1.0000

919.51

1.0000

923.84

1.0000

856.99

1.0000

861.03

1.0000

859.94

1.0000

917.49

1.0000

916.33

1.0000

908.80

1.0000

875.78

1.0000

868.58

1.0000

865.82

1.0000

899.60

1.0000

896.74

1.0000

894.48

1.0000

817.99

1.0000

815.93

1.0000

815.47

1.0000

874.61

1.0000

874.12

1.0000

877.90

1.0000

869.37

1.0000

873.12

1.0000

868.49

1.0000

893.46

1.0000

888.72

1.0000

885.79

1.0000

814.72

1.0000

812.03

1.0000

817.37

1.0000

870.56

1.0000

876.28

1.0000

879.83

1.0000

856.46

1.0000

859.94

1.0000

857.68

1.0000

890.65

1.0000

888.32

1.0000

872.85

1.0000

821.28

1.0000

806.98

1.0000

798.61

1.0000

825.54

1.0000

816.98

1.0000

805.31

1.0000

759.80

1.0000

748.95

1.0000

744.34

1.0000

747.89

1.4000

743.29

2.1500

769.16

2.9500

809.00

2.9500

837.16

3.6000

854.86

3.8000

882.51

3.6800

901.17

3.6200

918.85

3.7500

901.04

3.5500

918.72

3.5700

939.76

3.3630

967.22

3.2400

989.37

3.1817

1,004.56

2.8710

1,042.22

2.8547

1,058.22

2.8825

1,074.44

2.7940

1,096.07

2.8797

1,112.87

2.9720

1,141.56

2.9055

1,156.80

2.8632

1,186.63

2.9770

1,214.67

2.9345

1,239.72

2.9428

1,269.02

2.9243

1,285.30

2.8550

1,314.59

2.8452

1,331.45

2.9642

1,353.47

2.9607

1,371.08

2.9760

1,393.76

3.0003

1,410.34

2.9825

1,413.57

2.9782

1,430.40

2.9510

1,452.01

2.9738

1,494.93

2.9253

1,517.52

2.9327

1,551.83

2.9233

1,595.41

2.9133

1,631.48

2.8877

1,663.80

2.8908

1,680.49

2.8628

1,713.78

2.9117

1,757.62

2.9125

1,769.21

3.0097

1,814.47

2.9735

1,845.46

3.0315

1,900.62

3.0637

1,933.08

3.0728

1,965.70

3.0808

2,016.39

3.0438

2,050.42

3.0868

2,084.25

3.0848

2,129.81

3.0748

2,164.95

3.0972

2,188.20

3.1043

2,164.02

3.0933

2,187.25

3.0693

2,246.06

3.0695

2,326.35

3.1063

2,388.90

3.1010

2,428.31

3.1007

2,495.05

3.0898

2,536.21

3.0785

2,604.50

3.0908

2,686.73

3.1195

2,759.08

3.1558

2,840.32

3.1495

2,858.45

3.1477

2,942.62

3.1442

2,991.32

3.1510

2,999.38

3.1557

3,049.02

3.1587

3,119.88

3.1653

3,309.30

3.1635

3,386.21

3.0978

3,422.87

3.0242

3,459.43

3.0305

3,496.88

3.0288

3,512.84

3.1302

3,473.36

3.3790

3,489.21

3.3690

3,502.99

3.4537

3,493.55

3.4875

3,507.34

3.5595

3,535.58

3.7135

3,646.83

3.7198

3,676.19

3.7465

3,727.14

3.7952

3,762.31

3.8305

3,814.45

3.8525

3,904.48

3.8427

3,922.60

3.8190

4,015.18

3.8102

4,098.90

3.7967

4,200.73

3.8230

4,288.33

3.8598

4,378.82

3.8763

4,549.10

3.8862

4,645.10

3.9268

4,761.10

3.9318

4,875.97

3.9395

4,997.73

3.9497

5,079.84

3.9607

5,055.17

3.9570

5,138.22

3.9840

5,267.13

3.9758

5,436.56

4.0008

5,572.95

4.0305

5,698.80

4.0520

5,938.30

4.0805

6,072.40

4.0887

6,161.69

4.1110

6,196.13

4.1430

6,287.23

4.1995

6,391.49

4.2045

6,415.48

4.2355

6,521.87

4.2807

6,615.92

4.3032

6,669.33

4.3362

6,765.51

4.3565

6,846.88

4.3785

7,106.21

4.4148

7,191.68

4.4713

7,312.57

4.5253

7,358.39

4.5833

7,482.09

4.6347

7,632.60

4.6942

7,736.71

4.7655

7,892.34

4.8338

8,014.77

4.9173

8,230.81

4.9768

8,358.49

5.0445

8,549.93

5.1223

8,763.73

5.1840

8,964.45

5.2837

9,101.86

5.3852

9,163.39

5.5065

9,303.84

5.6713

9,420.19

5.7915

9,453.49

5.9108

9,571.71

6.1360

9,760.06

6.5180

10,173.47

8.0182

10,373.66

7.8782

10,465.98

8.0098

10,496.20

8.0015

10,589.61

8.0777

10,707.19

8.1740

10,750.63

8.3760

10,869.99

8.5750

10,998.17

8.7900

11,009.55

8.9800

11,139.38

9.1950

11,307.03

9.4000

BCRA data million pesos

FX Reserves

Mo

Net

Liabilities

9,142.5

11,288.4

0.0

9,010.5

11,402.4

0.0

8,764.6

11,532.8

0.0

9,079.6

11,018.5

0.0

9,127.0

11,251.8

0.0

9,666.2

11,206.7

0.0

10,056.4

12,563.9

0.0

10,100.6

14,027.9

0.0

10,220.9

13,071.3

0.0

10,004.8

13,251.5

0.0

10,116.9

13,268.0

0.0

12,173.2

15,088.8

0.0

11,444.8

15,122.6

221.6

11,317.4

15,082.9

167.3

11,204.7

14,589.4

188.3

10,978.5

14,152.3

233.7

10,935.7

14,514.8

240.3

11,395.5

14,606.8

237.7

11,871.8

15,207.6

231.6

11,344.3

14,985.8

202.9

11,380.7

14,553.6

205.2

11,429.7

14,422.5

204.5

11,274.4

14,323.4

223.0

13,316.6

16,048.6

197.5

11,728.3

13,811.2

2,743.5

11,327.7

13,096.1

3,183.1

10,851.2

10,216.3

2,337.0

11,069.5

11,520.3

3,230.0

10,783.9

10,917.5

2,911.2

11,186.9

12,622.0

2,453.4

11,876.5

12,821.5

3,068.0

11,371.3

11,286.0

2,291.9

11,113.5

12,853.4

1,856.5

11,102.2

12,215.7

1,590.8

11,056.1

12,292.5

684.5

13,050.0

15,980.3

718.6

12,208.7

14,595.4

663.2

12,093.6

15,548.9

646.1

11,959.6

15,466.1

643.7

12,043.0

14,622.7

644.9

12,184.5

14,257.5

643.6

12,804.1

15,957.3

637.0

13,220.1

14,631.6

5.7

12,379.1

14,192.3

3.8

12,221.7

14,371.4

1.4

11,881.1

13,516.7

1.3

12,061.5

13,933.9

1.6

14,030.4

17,650.7

29.2

13,194.5

16,149.1

2.1

13,144.1

16,847.4

1.6

13,370.8

15,201.5

3.2

13,221.6

14,255.3

3.1

13,440.4

15,533.8

7.4

14,041.2

16,902.1

2.5

14,525.9

16,743.2

2.8

14,295.0

15,831.2

14.6

14,192.2

15,709.8

11.0

14,216.3

16,253.0

16.8

14,185.6

16,145.0

27.8

15,965.7

17,938.0

9.0

14,714.7

15,888.6

10.8

14,574.8

17,039.9

30.9

14,484.6

16,819.5

36.3

14,697.6

16,394.5

25.8

14,721.5

16,850.9

6.9

15,013.2

17,219.8

25.0

15,618.5

19,655.1

6.6

15,184.0

17,358.2

18.8

14,373.8

16,135.2

6.8

14,320.2

16,443.7

6.4

14,493.4

16,740.4

8.0

16,370.2

19,404.4

22.0

14,966.8

16,891.9

8.4

14,600.1

18,779.2

11.6

14,542.3

17,382.0

8.9

14,271.3

16,451.3

68.5

14,157.5

16,585.6

65.0

14,084.5

17,429.5

32.5

14,731.1

16,507.4

59.1

14,304.6

15,867.0

47.7

13,938.6

15,588.7

48.1

13,921.2

16,957.1

50.8

13,869.9

17,601.9

51.0

16,492.8

19,014.6

31.5

14,588.6

17,318.6

48.4

13,988.9

17,065.0

48.8

13,641.9

17,427.8

44.3

13,904.6

15,192.8

45.4

13,529.9

15,467.3

45.1

13,748.8

17,391.1

61.3

14,292.4

16,802.4

55.7

13,637.0

15,357.2

42.7

13,567.8

15,936.3

45.9

13,355.1

15,784.1

46.6

13,330.0

15,678.8

47.1

15,054.2

18,346.7

22.8

13,845.6

19,092.5

51.2

13,690.0

16,338.8

57.7

13,554.0

16,554.6

125.9

13,283.9

15,604.5

54.7

12,978.5

14,164.7

50.8

13,066.6

21,557.3

6,619.9

13,038.2

16,783.7

4,231.1

11,471.5

14,445.0

4,376.4

10,942.9

21,468.5

5,856.1

10,427.1

18,304.7

4,550.3

10,150.7

14,801.9

4,182.0

10,959.8

14,912.8

5,787.2

10,960.5

19,505.0

4,958.6

12,934.6

29,822.3

1,375.6

14,032.6

37,061.2

44.1

14,809.9

35,903.9

46.7

15,030.3

36,667.5

70.0

14,747.9

36,591.4

77.4

15,058.6

33,069.7

141.2

14,915.6

32,949.5

188.8

14,856.8

35,266.1

295.7

15,187.7

35,083.3

449.2

16,074.3

35,778.9

1,076.5

18,801.7

35,230.7

1,014.1

18,583.7

30,214.9

978.4

18,886.9

32,734.6

1,300.7

19,416.7

30,193.1

1,560.5

19,844.4

31,319.9

1,481.6

20,726.7

32,784.9

2,176.6

22,246.1

34,040.3

2,282.7

24,012.5

38,831.6

2,448.1

24,872.7

40,371.7

2,748.8

25,320.2

38,949.8

3,158.7

25,682.2

36,940.0

3,114.7

26,690.8

40,138.1

3,622.4

30,315.8

41,432.7

3,766.6

28,546.0

43,908.8

3,909.1

28,835.4

43,874.3

4,316.7

29,282.0

42,840.8

4,383.2

29,295.6

44,854.8

5,107.4

30,228.6

49,526.7

6,918.9

31,606.3

51,653.7

7,847.5

32,032.1

53,783.2

8,433.3

31,839.3

54,254.8

8,627.5

31,855.1

54,374.2

8,990.9

31,946.0

55,377.5

9,067.3

32,746.5

55,926.5

8,386.9

37,624.2

58,445.4

8,047.8

35,677.6

58,929.6

7,918.6

35,737.1

60,982.4

9,019.1

36,183.8

59,460.1

5,535.5

36,667.6

60,905.4

7,007.4

37,793.4

63,832.0

6,267.5

39,636.0

66,643.7

5,447.0

40,807.7

71,876.6

5,331.7

41,128.7

73,531.0

5,433.7

41,731.9

74,605.7

5,731.9

42,872.7

79,906.5

5,607.4

43,336.1

78,876.5

5,895.5

48,337.3

85,120.7

6,545.6

46,526.5

60,327.1

6,555.6

46,558.3

63,094.9

6,915.2

46,607.6

66,393.7

7,168.0

47,201.0

68,186.3

7,060.1

47,681.8

74,587.4

7,448.1

49,837.1

78,637.1

7,006.6

51,004.8

80,637.2

7,251.6

50,579.9

84,858.7

7,194.6

51,052.6

87,074.9

7,303.2

51,638.8

89,963.6

9,082.9

52,777.7

93,092.6

7,557.3

59,222.4

98,342.4

7,378.4

56,818.2 104,809.6

7,307.6

57,191.9 108,340.7

6,836.7

59,340.5 114,264.7

6,675.0

59,069.6 119,291.0

7,360.7

59,893.8 124,933.7

7,054.7

62,997.3 133,395.5

6,371.9

65,150.9 137,894.2

6,716.9

64,864.5 136,208.3

7,994.8

64,755.2 135,092.0

7,965.6

64,985.7 135,357.8

8,305.6

66,147.4 141,053.6

8,592.2

74,803.7 145,479.4

8,376.6

70,804.0 150,406.2

8,431.7

71,170.4 155,607.1

9,255.8

71,989.8 159,738.4

10,318.7

72,373.3 158,962.2

10,991.8

72,712.6 150,520.1

9,996.7

74,329.1 143,702.6

10,520.3

74,526.9 144,089.5

9,790.8

73,895.2 142,630.4

11,546.3

73,384.9 147,504.8

12,018.0

73,714.5 151,863.0

13,832.3

74,681.7 155,221.5

16,737.9

84,086.3 160,209.1

17,195.6

79,004.8 163,951.2

19,237.3

78,266.8 167,391.7

19,092.3

75,964.7 172,717.8

22,014.5

76,371.4 172,485.9

25,439.7

77,258.9 174,389.2

24,513.9

80,782.1 174,685.7

25,324.6

82,183.9 176,300.2

26,424.2

81,354.6 182,819.1

29,511.6

81,310.0 184,617.5

29,495.1

82,563.1 186,768.1

27,224.8

84,957.5 188,939.8

26,314.0

98,065.3 182,111.0

27,835.6

94,051.8 183,985.2

28,572.7

92,720.6 184,341.5

26,492.5

93,945.0 183,970.4

38,284.0

92,559.6 186,789.9

42,760.3

95,520.3 192,026.4

43,542.0

99,751.6 193,603.4

41,722.4

103,737.5 201,178.0

32,886.3

103,925.1 198,850.9

37,283.9

106,982.8 202,490.2

38,085.6

111,627.1 205,445.5

42,745.4

114,167.5 206,757.7

41,329.4

124,534.6 207,497.2

39,158.7

127,152.1 210,513.6

41,209.8

128,079.4 210,867.9

37,294.2

127,882.8 207,861.7

35,260.4

129,904.6 212,229.6

35,758.3

132,482.0 212,861.5

35,061.0

141,826.3 212,504.1

33,637.4

145,880.5 215,112.7

32,182.6

146,904.8 209,935.9

32,726.2

148,277.6 204,244.9

30,570.2

148,746.7 201,257.4

32,187.4

154,872.4 196,721.3

23,446.6

173,056.4 199,025.8

24,636.3

167,387.7 202,027.5

29,098.3

167,611.6 203,212.4

28,980.4

170,426.5 206,814.4

30,681.7

170,966.7 210,895.9

30,606.8

175,148.2 209,583.6

27,238.3

188,366.6 209,188.8

23,688.9

196,405.5 213,991.7

26,635.6

198,752.5 208,620.3

29,356.3

201,206.8 211,159.6

31,236.0

203,264.6 215,320.8

36,770.1

208,726.0 217,849.3

39,035.8

237,009.6 211,971.7

41,632.5

226,764.4 211,659.6

40,227.2

225,059.3 209,843.9

38,700.4

233,013.0 206,947.2

38,771.3

227,290.9 204,334.8

41,334.5

230,232.7 203,284.4

41,993.2

242,624.5 198,793.5

42,798.6

250,075.2 203,497.9

45,697.9

251,758.8 207,415.4

47,507.8

255,428.5 200,919.6

51,869.0

256,960.6 195,515.3

54,783.7

259,977.6 187,894.0

57,623.9

289,208.3 198,205.1

71,333.6

274,206.1 222,489.0

88,779.0

270,173.7 217,012.9

70,159.0

266,195.0 216,320.7

66,380.0

267,782.0 225,802.3

58,215.0

266,719.0 230,553.7

59,435.0

278,565.7 237,127.7

61,275.6

281,542.5 246,006.4

63,915.5

282,903.3 253,233.3

66,226.8

283,495.1 260,184.4

68,631.8

283,658.6 265,973.1

70,642.1

283,587.5 272,268.1

72,696.3

283,588.9 278,339.7

74,630.7

Balance

11,288.4

11,402.4

11,532.8

11,018.5

11,251.8

11,206.7

12,563.9

14,027.9

13,071.3

13,251.5

13,268.0

15,088.8

14,901.0

14,915.6

14,401.1

13,918.6

14,274.4

14,369.1

14,976.0

14,782.9

14,348.4

14,217.9

14,100.4

15,851.1

11,067.7

9,912.9

7,879.3

8,290.3

8,006.3

10,168.6

9,753.5

8,994.1

10,996.9

10,624.9

11,608.0

15,261.7

13,932.3

14,902.7

14,822.4

13,977.8

13,613.9

15,320.3

14,625.8

14,188.5

14,370.0

13,515.4

13,932.3

17,621.6

16,147.0

16,845.8

15,198.3

14,252.2

15,526.4

16,899.6

16,740.5

15,816.6

15,698.8

16,236.2

16,117.2

17,929.0

15,877.8

17,009.0

16,783.1

16,368.8

16,844.0

17,194.8

19,648.5

17,339.4

16,128.4

16,437.3

16,732.5

19,382.4

16,883.6

18,767.6

17,373.1

16,382.9

16,520.6

17,396.9

16,448.3

15,819.3

15,540.6

16,906.4

17,550.9

18,983.1

17,270.2

17,016.3

17,383.5

15,147.4

15,422.1

17,329.8

16,746.7

15,314.5

15,890.4

15,737.5

15,631.6

18,323.8

19,041.3

16,281.1

16,428.7

15,549.9

14,114.0

14,937.4

12,552.6

10,068.7

15,612.4

13,754.4

10,619.9

9,125.6

14,546.3

28,446.7

37,017.1

35,857.3

36,597.5

36,514.0

32,928.6

32,760.7

34,970.3

34,634.1

34,702.3

34,216.6

29,236.5

31,433.9

28,632.6

29,838.3

30,608.3

31,757.6

36,383.5

37,622.9

35,791.1

33,825.2

36,515.6

37,666.1

39,999.7

39,557.6

38,457.7

39,747.4

42,607.8

43,806.2

45,349.8

45,627.3

45,383.3

46,310.2

47,539.7

50,397.6

51,011.0

51,963.3

53,924.7

53,898.0

57,564.5

61,196.7

66,544.8

68,097.3

68,873.8

74,299.1

72,981.0

78,575.1

53,771.5

56,179.8

59,225.7

61,126.2

67,139.3

71,630.5

73,385.6

77,664.1

79,771.7

80,880.7

85,535.3

90,964.0

97,502.0

101,504.0

107,589.7

111,930.3

117,878.9

127,023.6

131,177.3

128,213.6

127,126.4

127,052.3

132,461.5

137,102.9

141,974.5

146,351.3

149,419.7

147,970.4

140,523.4

133,182.3

134,298.7

131,084.1

135,486.8

138,030.8

138,483.7

143,013.5

144,713.9

148,299.4

150,703.4

147,046.2

149,875.3

149,361.2

149,876.0

153,307.5

155,122.4

159,543.3

162,625.8

154,275.5

155,412.5

157,849.0

145,686.4

144,029.6

148,484.4

151,881.0

168,291.7

161,567.0

164,404.5

162,700.1

165,428.3

168,338.4

169,303.8

173,573.7

172,601.3

176,471.3

177,800.5

178,866.7

182,930.1

177,209.7

173,674.7

169,070.0

173,274.7

174,389.4

172,929.2

174,232.0

176,132.7

180,289.2

182,345.4

185,499.9

187,356.1

179,264.1

179,923.6

178,550.6

178,813.5

170,339.2

171,432.4

171,143.6

168,175.9

163,000.3

161,291.2

155,994.9

157,800.0

159,907.6

149,050.6

140,731.6

130,270.1

126,871.5

133,710.0

146,853.9

149,940.7

167,587.3

171,118.7

175,852.1

182,090.8

187,006.5

191,552.5

195,331.1

199,571.8

203,709.0

Summary

Long-term average

Memo: Standard deviation

January 1993

June 2001

July 2001

June 2003

July 2003

December 2011

January 2012

December 2013

January 2014

December 2014

Colors for monitoring signals:

frozen

cooled

normal

Last data

Own provisional estimate

Own estimate based on official data

Own estimate USD:$Arg projected as is future financial market (Rofex)

Central bank parameters

Mo/Domestic Demand

Mo / FX Reserves

days

Standard

times

Standard

14.7

-1.36

81.0%

-0.10

14.2

-1.48

79.0%

-0.16

13.6

-1.64

76.0%

-0.26

15.4

-1.19

82.4%

-0.05

15.2

-1.24

81.1%

-0.09

15.9

-1.07

86.3%

0.07

15.4

-1.19

80.0%

-0.13

15.3

-1.23

72.0%

-0.39

15.4

-1.19

78.2%

-0.19

15.5

-1.18

75.5%

-0.27

15.6

-1.14

76.3%

-0.25

18.5

-0.42

80.7%

-0.11

15.8

-1.09

76.8%

-0.23

15.4

-1.19

75.9%

-0.26

15.1

-1.28

77.8%

-0.20

16.3

-0.97

78.9%

-0.16

16.0

-1.05

76.6%

-0.24

16.6

-0.91

79.3%

-0.15

16.3

-0.97

79.3%

-0.15

15.5

-1.17

76.7%

-0.23

15.5

-1.17

79.3%

-0.15

15.9

-1.08

80.4%

-0.12

15.6

-1.14

80.0%

-0.13

18.5

-0.43

84.0%

0.00

15.0

-1.28

106.0%

0.71

14.6

-1.40

114.3%

0.98

14.1

-1.51

137.7%

1.73

16.5

-0.92

133.5%

1.60

16.3

-0.98

134.7%

1.64

16.9

-0.83

110.0%

0.84

16.9

-0.83

121.8%

1.22

16.2

-1.01

126.4%

1.37

15.7

-1.11

101.1%

0.55

15.9

-1.08

104.5%

0.66

15.7

-1.11

95.2%

0.36

18.5

-0.44

85.5%

0.05

16.1

-1.03

87.6%

0.12

15.8

-1.10

81.2%

-0.09

15.5

-1.18

80.7%

-0.11

17.1

-0.79

86.2%

0.07

17.1

-0.78

89.5%

0.18

17.8

-0.60

83.6%

-0.01

17.3

-0.74

90.4%

0.21

16.0

-1.04

87.2%

0.11

15.7

-1.12

85.1%

0.03

15.4

-1.19

87.9%

0.13

15.5

-1.16

86.6%

0.08

17.9

-0.59

79.6%

-0.14

15.6

-1.15

81.7%

-0.07

15.3

-1.22

78.0%

-0.19

15.5

-1.18

88.0%

0.13

16.7

-0.89

92.8%

0.28

16.8

-0.85

86.6%

0.08

17.4

-0.70

83.1%

-0.03

16.8

-0.85

86.8%

0.09

16.4

-0.95

90.4%

0.21

16.1

-1.01

90.4%

0.21

16.5

-0.93

87.6%

0.12

16.3

-0.97

88.0%

0.13

18.3

-0.48

89.0%

0.16

16.0

-1.04

92.7%

0.28

15.9

-1.09

85.7%

0.06

15.7

-1.13

86.3%

0.08

17.2

-0.77

89.8%

0.19

17.1

-0.78

87.4%

0.11

17.5

-0.69

87.3%

0.11

17.0

-0.80

79.5%

-0.14

16.6

-0.91

87.6%

0.12

15.8

-1.09

89.1%

0.17

16.4

-0.96

87.1%

0.10

16.7

-0.88

86.6%

0.09

18.9

-0.33

84.5%

0.02

16.6

-0.89

88.6%

0.15

16.3

-0.98

77.8%

-0.20

16.3

-0.99

83.7%

-0.01

17.4

-0.69

87.1%

0.10

17.4

-0.72

85.7%

0.06

17.3

-0.74

81.0%

-0.10

16.8

-0.84

89.6%

0.18

16.4

-0.96

90.4%

0.21

15.9

-1.08

89.7%

0.18

16.0

-1.05

82.3%

-0.05

15.9

-1.08

79.0%

-0.16

19.0

-0.31

86.9%

0.09

16.3

-0.97

84.5%

0.02

15.7

-1.11

82.2%

-0.06

15.4

-1.20

78.5%

-0.18

17.1

-0.79

91.8%

0.25

16.7

-0.89

87.7%

0.12

16.8

-0.85

79.3%

-0.15

16.4

-0.95

85.3%

0.04

15.6

-1.16

89.0%

0.16

15.4

-1.19

85.4%

0.05

15.6

-1.15

84.9%

0.03

15.5

-1.17

85.3%

0.04

17.6

-0.67

82.2%

-0.06

15.5

-1.16

72.7%

-0.36

15.4

-1.19

84.1%

0.00

15.5

-1.16

82.5%

-0.05

16.2

-1.01

85.4%

0.05

16.1

-1.03

92.0%

0.26

16.4

-0.96

87.5%

0.11

15.8

-1.10

103.9%

0.64

14.0

-1.53

113.9%

0.97

13.6

-1.64

70.1%

-0.45

13.7

-1.61

75.8%

-0.26

13.6

-1.65

95.6%

0.37

14.7

-1.36

120.1%

1.16

14.7

-1.38

75.3%

-0.28

17.4

-0.70

45.5%

-1.24

18.2

-0.50

37.9%

-1.49

18.3

-0.48

41.3%

-1.38

18.0

-0.57

41.1%

-1.38

17.3

-0.74

40.4%

-1.41

17.1

-0.79

45.7%

-1.23

16.6

-0.91

45.5%

-1.24

16.2

-1.01

42.5%

-1.34

16.9

-0.84

43.9%

-1.29

17.5

-0.68

46.3%

-1.21

20.0

-0.06

54.9%

-0.94

19.2

-0.26

63.6%

-0.66

19.1

-0.29

60.1%

-0.77

19.3

-0.23

67.8%

-0.52

19.0

-0.30

66.5%

-0.56

19.6

-0.16

67.7%

-0.52

20.7

0.11

70.0%

-0.45

21.9

0.41

66.0%

-0.58

22.4

0.52

66.1%

-0.58

22.2

0.47

70.7%

-0.43

22.2

0.48

75.9%

-0.26

22.5

0.55

73.1%

-0.35

25.0

1.16

80.5%

-0.11

23.0

0.68

71.4%

-0.41

22.7

0.61

72.9%

-0.36

22.8

0.62

76.1%

-0.25

22.3

0.50

73.7%

-0.33

22.7

0.60

70.9%

-0.42

23.4

0.76

72.2%

-0.38

23.4

0.77

70.6%

-0.43

22.8

0.64

69.8%

-0.46

22.6

0.57

70.2%

-0.44

22.6

0.58

69.0%

-0.48

22.9

0.65

68.9%

-0.49

25.9

1.39

74.7%

-0.30

23.9

0.89

69.9%

-0.45

23.5

0.81

68.8%

-0.49

23.3

0.75

67.1%

-0.54

23.0

0.67

68.0%

-0.51

23.2

0.72

65.7%

-0.59

23.8

0.88

64.8%

-0.62

24.3

0.99

61.3%

-0.73

24.0

0.92

60.4%

-0.76

23.7

0.86

60.6%

-0.75

24.2

0.98

57.7%

-0.85

23.9

0.89

59.4%

-0.79

26.2

1.46

61.5%

-0.72

24.5

1.04

86.5%

0.08

24.1

0.94

82.9%

-0.04

23.7

0.85

78.7%

-0.17

23.4

0.78

77.2%

-0.22

23.3

0.74

71.0%

-0.42

23.9

0.90

69.6%

-0.46

23.9

0.91

69.5%

-0.47

23.4

0.77

65.1%

-0.61

23.3

0.76

64.0%

-0.64

23.9

0.89

63.8%

-0.65

24.1

0.95

61.7%

-0.72

26.4

1.51

65.1%

-0.61

24.4

1.03

58.3%

-0.83

23.9

0.91

56.3%

-0.89

24.4

1.03

55.2%

-0.93

23.7

0.84

52.8%

-1.01

23.6

0.83

50.8%

-1.07

24.2

0.97

49.6%

-1.11

24.2

0.98

49.7%

-1.11

23.5

0.80

50.6%

-1.08

22.8

0.63

50.9%

-1.06

22.7

0.61

51.1%

-1.06

22.5

0.55

49.9%

-1.10

25.0

1.17

54.6%

-0.95

23.6

0.83

49.9%

-1.10

23.3

0.76

48.6%

-1.14

23.1

0.69

48.2%

-1.15

21.9

0.40

48.9%

-1.13

21.5

0.30

51.7%

-1.04

21.7

0.36

55.8%

-0.91

21.5

0.32

55.5%

-0.92

21.1

0.22

56.4%

-0.89

20.9

0.16

54.2%

-0.96

21.2

0.24

53.4%

-0.99

21.4

0.28

53.9%

-0.97

24.0

0.92

58.8%

-0.81

22.6

0.58

54.6%

-0.95

22.3

0.51

52.8%

-1.01

21.5

0.30

50.4%

-1.08

20.9

0.17

51.9%

-1.03

21.0

0.19

51.5%

-1.05

21.7

0.35

54.1%

-0.96

21.8

0.39

54.8%

-0.94

21.3

0.26

53.1%

-1.00

20.8

0.14

52.4%

-1.02

21.0

0.20

51.7%

-1.04

21.2

0.22

52.2%

-1.02

23.9

0.90

63.6%

-0.66

22.4

0.53

60.5%

-0.76

21.6

0.34

58.7%

-0.81

21.5

0.30

64.5%

-0.63

20.3

0.02

64.3%

-0.64

20.6

0.08

64.3%

-0.63

21.0

0.17

65.7%

-0.59

21.3

0.25

61.6%

-0.72

20.8

0.13

64.3%

-0.63

21.1

0.20

65.1%

-0.61

22.1

0.45

68.6%

-0.50

22.2

0.48

69.0%

-0.48

23.6

0.84

74.0%

-0.32

23.4

0.77

75.1%

-0.29

23.0

0.67

73.8%

-0.33

22.4

0.54

74.1%

-0.32

21.9

0.40

73.6%

-0.33

21.8

0.38

74.5%

-0.30

23.0

0.68

79.3%

-0.15

23.5

0.81

79.7%

-0.14

23.4

0.77

82.9%

-0.03

23.2

0.73

85.4%

0.05

23.2

0.72

88.0%

0.13

23.7

0.86

89.4%

0.17

26.2

1.45

99.2%

0.49

25.1

1.19

96.8%

0.41

24.8

1.11

96.2%

0.39

24.9

1.14

96.8%

0.41

24.1

0.94

94.8%

0.35

24.4

1.01

96.1%

0.39

25.8

1.36

101.5%

0.57

26.7

1.59

104.8%

0.67

26.6

1.55

110.9%

0.87

26.4

1.50

111.8%

0.90

26.3

1.48

113.8%

0.96

26.4

1.53

116.7%

1.06

29.6

2.30

139.1%

1.78

27.6

1.80

132.3%

1.56

26.9

1.64

131.5%

1.53

27.3

1.72

138.6%

1.76

25.9

1.40

139.4%

1.79

25.7

1.34

142.7%

1.89

26.7

1.58

155.5%

2.31

27.3

1.73

158.5%

2.40

27.1

1.68

157.4%

2.37

27.1

1.69

171.4%

2.82

27.2

1.71

182.6%

3.18

27.2

1.70

199.6%

3.73

29.6

2.31

228.0%

4.64

27.0

1.65

205.1%

3.90

26.0

1.43

184.0%

3.22

25.4

1.28

177.5%

3.02

25.5

1.30

159.8%

2.44

25.2

1.22

155.9%

2.32

26.0

1.42

158.4%

2.40

26.2

1.46

154.6%

2.28

26.0

1.42

151.3%

2.17

25.8

1.36

148.0%

2.06

25.8

1.36

145.2%

1.97

25.5

1.28

142.1%

1.87

25.1

1.19

139.2%

1.78

Central bank parameters

Mo/Domestic Demand

Mo / FX Reserves

days

Standard

times

Standard

20.3

-0.00

84.0%

0.00

4.1

1.00

31.0%

1.00

16.2

-0.99

87.4%

0.11

17.1

-0.78

64.0%

-0.64

22.9

0.65

64.5%

-0.63

26.5

1.54

134.0%

1.61

25.8

1.36

160.1%

2.45

heating

overheated

PS:

Long-term average

As long-term average, the equivalent of 20.3 days of total domestic demand, market prices, it is necessary to provide adequate liquidity to

transactions in goods and services.

Average long-term notes and coins held by the public and commercial banks issued by the Central Bank of Argentina, stood at around 83.9% of net

cash reserves in gold and foreign currencies

July-2003 - December-2011

Repealed convertibility of the peso against the dollar between July-2003 and December-2011, the Central Bank maintained a prudent backup, in

liquid reserves to the monetary base. However, possibly to stimulate domestic demand, the money supply rose from 16.2 to about 22.9 days of

domestic demand at market prices. Monetary demand stimulation generally produces an increase in prices and / or quantities, in varying

proportions depending on the actual interest rate and other market confidence factors.

In the Argentine case, excessive monetary expansion, rising inflationary pressures prompted not recognized in official price indices, rather than a

sustained growth of the supply of goods and services.

January 2012- December 2013

Since early 2012 the Central Bank of Argentina implemented a negligent and reckless monetary policy, expanding the supply of money

unnecessarily to facilitate commercial transactions and spuriously issuing unbacked currency in high quality liquid assets.

January 2014 to date

Recent changes in the monetary policy of the central bank seem destined to take control and responsibility in the management of monetary variables

Monetization by the growth of reserves and / or monetization of the government deficit, delay the return of key variables to a normal state.

Also see:

Argentina GDP 1Q2014

Argentina Domestic Demand

Argentina GDP 4Q2013

Você também pode gostar

- China - Price IndicesDocumento1 páginaChina - Price IndicesEduardo PetazzeAinda não há avaliações

- Singapore - 2015 GDP OutlookDocumento1 páginaSingapore - 2015 GDP OutlookEduardo PetazzeAinda não há avaliações

- India - Index of Industrial ProductionDocumento1 páginaIndia - Index of Industrial ProductionEduardo PetazzeAinda não há avaliações

- Turkey - Gross Domestic Product, Outlook 2016-2017Documento1 páginaTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeAinda não há avaliações

- U.S. Federal Open Market Committee: Federal Funds RateDocumento1 páginaU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeAinda não há avaliações

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Documento1 páginaCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeAinda não há avaliações

- Analysis and Estimation of The US Oil ProductionDocumento1 páginaAnalysis and Estimation of The US Oil ProductionEduardo PetazzeAinda não há avaliações

- Germany - Renewable Energies ActDocumento1 páginaGermany - Renewable Energies ActEduardo PetazzeAinda não há avaliações

- Highlights, Wednesday June 8, 2016Documento1 páginaHighlights, Wednesday June 8, 2016Eduardo PetazzeAinda não há avaliações

- U.S. Employment Situation - 2015 / 2017 OutlookDocumento1 páginaU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeAinda não há avaliações

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDocumento1 páginaChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeAinda não há avaliações

- México, PBI 2015Documento1 páginaMéxico, PBI 2015Eduardo PetazzeAinda não há avaliações

- WTI Spot PriceDocumento4 páginasWTI Spot PriceEduardo Petazze100% (1)

- Reflections On The Greek Crisis and The Level of EmploymentDocumento1 páginaReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeAinda não há avaliações

- India 2015 GDPDocumento1 páginaIndia 2015 GDPEduardo PetazzeAinda não há avaliações

- U.S. New Home Sales and House Price IndexDocumento1 páginaU.S. New Home Sales and House Price IndexEduardo PetazzeAinda não há avaliações

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDocumento1 páginaUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeAinda não há avaliações

- South Africa - 2015 GDP OutlookDocumento1 páginaSouth Africa - 2015 GDP OutlookEduardo PetazzeAinda não há avaliações

- Chile, Monthly Index of Economic Activity, IMACECDocumento2 páginasChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeAinda não há avaliações

- European Commission, Spring 2015 Economic Forecast, Employment SituationDocumento1 páginaEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeAinda não há avaliações

- China - Power GenerationDocumento1 páginaChina - Power GenerationEduardo PetazzeAinda não há avaliações

- US Mining Production IndexDocumento1 páginaUS Mining Production IndexEduardo PetazzeAinda não há avaliações

- Mainland China - Interest Rates and InflationDocumento1 páginaMainland China - Interest Rates and InflationEduardo PetazzeAinda não há avaliações

- Highlights in Scribd, Updated in April 2015Documento1 páginaHighlights in Scribd, Updated in April 2015Eduardo PetazzeAinda não há avaliações

- Japan, Population and Labour Force - 2015-2017 OutlookDocumento1 páginaJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeAinda não há avaliações

- Brazilian Foreign TradeDocumento1 páginaBrazilian Foreign TradeEduardo PetazzeAinda não há avaliações

- US - Personal Income and Outlays - 2015-2016 OutlookDocumento1 páginaUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeAinda não há avaliações

- Japan, Indices of Industrial ProductionDocumento1 páginaJapan, Indices of Industrial ProductionEduardo PetazzeAinda não há avaliações

- South Korea, Monthly Industrial StatisticsDocumento1 páginaSouth Korea, Monthly Industrial StatisticsEduardo PetazzeAinda não há avaliações

- United States - Gross Domestic Product by IndustryDocumento1 páginaUnited States - Gross Domestic Product by IndustryEduardo PetazzeAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- New Markets For Smallholders in India - Exclusion, Policy and Mechanisms Author(s) - SUKHPAL SINGHDocumento11 páginasNew Markets For Smallholders in India - Exclusion, Policy and Mechanisms Author(s) - SUKHPAL SINGHRegAinda não há avaliações

- Computer Application in Business NOTES PDFDocumento78 páginasComputer Application in Business NOTES PDFGhulam Sarwar SoomroAinda não há avaliações

- Applied Econometrics ModuleDocumento142 páginasApplied Econometrics ModuleNeway Alem100% (1)

- G.R. No. 122039 May 31, 2000 VICENTE CALALAS, Petitioner, Court of Appeals, Eliza Jujeurche Sunga and Francisco Salva, RespondentsDocumento56 páginasG.R. No. 122039 May 31, 2000 VICENTE CALALAS, Petitioner, Court of Appeals, Eliza Jujeurche Sunga and Francisco Salva, RespondentsJayson AbabaAinda não há avaliações

- 132KV Siemens Breaker DrawingDocumento13 páginas132KV Siemens Breaker DrawingAnil100% (1)

- Socomec EN61439 PDFDocumento8 páginasSocomec EN61439 PDFdesportista_luisAinda não há avaliações

- SS Corrosion SlidesDocumento36 páginasSS Corrosion SlidesNathanianAinda não há avaliações

- Steps To Private Placement Programs (PPP) DeskDocumento7 páginasSteps To Private Placement Programs (PPP) DeskPattasan U100% (1)

- An-7004 IGBT Driver Calculation Rev00Documento8 páginasAn-7004 IGBT Driver Calculation Rev00Raghuram YaramatiAinda não há avaliações

- MA5616 V800R311C01 Configuration Guide 02Documento741 páginasMA5616 V800R311C01 Configuration Guide 02Mário Sapucaia NetoAinda não há avaliações

- Assignment # 4 26 CH 22Documento6 páginasAssignment # 4 26 CH 22Ibrahim AbdallahAinda não há avaliações

- Infineon ICE3BXX65J DS v02 - 09 en PDFDocumento28 páginasInfineon ICE3BXX65J DS v02 - 09 en PDFcadizmabAinda não há avaliações

- Comparing environmental impacts of clay and asbestos roof tilesDocumento17 páginasComparing environmental impacts of clay and asbestos roof tilesGraham LongAinda não há avaliações

- Ies RP 7 2001Documento88 páginasIes RP 7 2001Donald Gabriel100% (3)

- Encore HR PresentationDocumento8 páginasEncore HR PresentationLatika MalhotraAinda não há avaliações

- MatrikonOPC Server For Simulation Quick Start Guide PDFDocumento2 páginasMatrikonOPC Server For Simulation Quick Start Guide PDFJorge Perez CastañedaAinda não há avaliações

- Activity Problem Set G4Documento5 páginasActivity Problem Set G4Cloister CapananAinda não há avaliações

- Accounts - User Guide: Release R15.000Documento207 páginasAccounts - User Guide: Release R15.000lolitaferozAinda não há avaliações

- Grand Viva Question For Ece StudentDocumento17 páginasGrand Viva Question For Ece Studentapi-35904739086% (7)

- Kj1010-6804-Man604-Man205 - Chapter 7Documento16 páginasKj1010-6804-Man604-Man205 - Chapter 7ghalibAinda não há avaliações

- Converted File d7206cc0Documento15 páginasConverted File d7206cc0warzarwAinda não há avaliações

- Sierra Wireless firmware versions for cellular modulesDocumento20 páginasSierra Wireless firmware versions for cellular modulesjacobbowserAinda não há avaliações

- Chapter 6 Performance Review and Appraisal - ReproDocumento22 páginasChapter 6 Performance Review and Appraisal - ReproPrecious SanchezAinda não há avaliações

- Accor vs Airbnb: Business Models in Digital EconomyDocumento4 páginasAccor vs Airbnb: Business Models in Digital EconomyAkash PayunAinda não há avaliações

- Chrysler Corporation: Service Manual Supplement 1998 Grand CherokeeDocumento4 páginasChrysler Corporation: Service Manual Supplement 1998 Grand CherokeeDalton WiseAinda não há avaliações

- Zaranda Finlay 684 Manual Parts CatalogDocumento405 páginasZaranda Finlay 684 Manual Parts CatalogRicky Vil100% (2)

- COKE MidtermDocumento46 páginasCOKE MidtermKomal SharmaAinda não há avaliações

- Daftar Pustaka Marketing ResearchDocumento2 páginasDaftar Pustaka Marketing ResearchRiyan SaputraAinda não há avaliações

- 1Z0-062 Exam Dumps With PDF and VCE Download (1-30)Documento6 páginas1Z0-062 Exam Dumps With PDF and VCE Download (1-30)Humberto Cordova GallegosAinda não há avaliações

- Naoh Storage Tank Design Description:: Calculations For Tank VolumeDocumento6 páginasNaoh Storage Tank Design Description:: Calculations For Tank VolumeMaria Eloisa Angelie ArellanoAinda não há avaliações