Escolar Documentos

Profissional Documentos

Cultura Documentos

Dem at Closure

Enviado por

Arun SankarDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Dem at Closure

Enviado por

Arun SankarDireitos autorais:

Formatos disponíveis

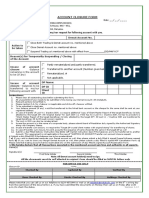

Application for Closure of Demat Account

D D M M Y Y Y Y To ICICI Bank Limited (Demat Services)

DP ID:

I / We hereby request you to close my/our account with you as per following details: Name of the holder(s) Sole/ First Holder Second Holder Third Holder

Client ID (of account to be closed)

Please tick the applicable option(s) Option A [There are no balances / holdings in this account ] Option B [Transfer the balances / holdings in this account as per details given] Transfer to my / our own Target Account Details account (Provide target account details DP ID and enclose Client Master NSDL Report of Target Account) Client Transfer to any other account CDSL ID (Submit duly filled Delivery Instruction Slip signed by all holders) Option C [Rematerialise / Reconvert (Submit duly filled Remat / Reconversion Request Form-for mutual fund units)]

Recovery of dues

Direct Debit Please debit my ICICI Bank account (A/c no. my account. Cheque Payment Cheque number..................................................................... drawn on Bank .......................................................................................... Cash Payment ) for recovery of any pending dues against

Page 1 of 2

Notes Transfer charges will be waived if account/s of transferee DP and transferor DP are the same, i.e., identical in all respects . To avail of the waiver, a Client Master List (CML) for the target account/s needs to be submitted along with the Closure Form. If a CML is not submitted, the bank account in the Bank's records will be used to recover dues that arise out of transfer of securities to the specified account.

Whether you are NRI and holding RBI approval with ICICI Bank on your saving bankNo account , NRE/NRO for trading into Indian Stock market under Portfolio Investment Scheme (PIS), request you to fill up below mentioned details: If Yes, 1. In case your residential status has changed to resident Indian from NRI, please submit a) b) 2. PIS approval cancellation request NRI Bank account (account on which PIS approval is granted) closure request along with this form Yes No

In case you wish to transfer your PIS Designation to other Authorized Dealer, please submit a) PIS approval cancellation request along with the form.

DECLARATION: In case of Account Closure due to SHIFTING OF ACCOUNT: I/We declare and confirm that all the transactions in my/our demat account are true/ authentic.

Signature(s)

Sole / First Holder Second Holder

Third Holder

To be filled in by bank officials Details of recovery at branch Direct debit Bank account no. debited ..................................................... for recovery of dues. Transaction Id .............................. Transaction Date D D M M Y Y Y Y

Cheque payment Cheque no. .......................................................................... Drawn on bank............................................................................................. Transaction Id .............................. Transaction Date Cash payment Bank a/c no. credited : 003605000732 Sr. no. ........................................... Name of the bank employee ................................................................................................................ Transaction Id .............................. Transaction Date D D M M Y Y Y Y D D M M Y Y Y Y

Signature of bank official .............................................................................................................................................................................. D D M M Y Y Y Y

(SEAL OF BANK BRANCH)

Page 2 of 3

CHECKLIST Items to be checked Name of the beneficiary owner(s) with signature(s) Status of a/c: Active/Suspended/Closed Action to be initiated by the branch If the customer's name & signature do not match withthe DP system, request is rejected If a/c was closed, the customer was informed about it Obtain PAN proof if a/c was suspended because of not complying with P AN rules Obtain proof of identity and address iIf a/c was suspended because of not complying with KYC rules If holding exists, then: Target a/c no. should be mentioned on the request Customer can request for rematerialisation If dues were pending, the customer was informed about it and the dues recovered Tick for verification by the Bank Checked

Checked

Holding in source a/c:

Checked

Pending dues

Checked

= = = = = = = = == = = = = = = = == = = = = = = = == = = = = = = = == = = = = = = = == = = = = = = = == = = = = = = = Acknowledgement We hereby acknowledge the receipt of the your request for closing the following Account subject to verification: DP ID Name of Sole / First Holder Name of Second Holder Name of Third Holder Signature of the Authorised Signatory Date Seal/ Stamp of Participant Client ID

Page 3 of 3

Você também pode gostar

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!No EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Nota: 1 de 5 estrelas1/5 (1)

- 21St Century Computer Solutions: A Manual Accounting SimulationNo Everand21St Century Computer Solutions: A Manual Accounting SimulationAinda não há avaliações

- Superlite Cash Loan - ADA FormDocumento2 páginasSuperlite Cash Loan - ADA Formvangie3339515Ainda não há avaliações

- Department of Labor: 96 19484Documento5 páginasDepartment of Labor: 96 19484USA_DepartmentOfLaborAinda não há avaliações

- Sbi MF Chota Sip Arn Euin Arvind ThakurDocumento2 páginasSbi MF Chota Sip Arn Euin Arvind ThakurARVINDAinda não há avaliações

- Baroda Pioneer Transaction FormDocumento2 páginasBaroda Pioneer Transaction FormAjith MosesAinda não há avaliações

- Statements 30APR23Documento9 páginasStatements 30APR23Mohamed MohamedAinda não há avaliações

- Comparative Study On Education Loan With Referance To Sbi & Abhyudaya Co Operative BankDocumento80 páginasComparative Study On Education Loan With Referance To Sbi & Abhyudaya Co Operative BankSachinSums75% (8)

- Demat Closure FormDocumento2 páginasDemat Closure FormHasan PashaAinda não há avaliações

- NSDL Closure Form PDFDocumento1 páginaNSDL Closure Form PDFsunilonline42Ainda não há avaliações

- NSDL Closure FormDocumento1 páginaNSDL Closure FormGuru Of ScribdAinda não há avaliações

- Account Closure FormDocumento1 páginaAccount Closure FormDineshya GAinda não há avaliações

- Application For Closure of Demat Account (NSDL/CDSL) : ( Marked Is A Mandatory Field)Documento2 páginasApplication For Closure of Demat Account (NSDL/CDSL) : ( Marked Is A Mandatory Field)Rahul SakareyAinda não há avaliações

- Account Closure Form: Customer DetailsDocumento3 páginasAccount Closure Form: Customer DetailsAyan AcharyaAinda não há avaliações

- Demat Closure FormDocumento2 páginasDemat Closure FormAnonymous Lz6f4C6KFAinda não há avaliações

- Account Closure FormDocumento1 páginaAccount Closure FormvarunAinda não há avaliações

- Process For Claiming The Unclaimed Deposit Activating The Inoperative Inactive AccountsDocumento3 páginasProcess For Claiming The Unclaimed Deposit Activating The Inoperative Inactive AccountsMahendra SinghAinda não há avaliações

- 3 FormDocumento2 páginas3 FormEngr Danish RaufAinda não há avaliações

- Service Request FormDocumento2 páginasService Request FormKowshik ChakrabortyAinda não há avaliações

- Multiple Bank Account MandateDocumento2 páginasMultiple Bank Account Mandateanaga1982Ainda não há avaliações

- Delinking FormDocumento2 páginasDelinking Formprofessionalassociates97Ainda não há avaliações

- Chap-4 Departmentalization of NBPDocumento25 páginasChap-4 Departmentalization of NBP✬ SHANZA MALIK ✬Ainda não há avaliações

- Shriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Documento48 páginasShriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Mutual Funds Advisor ANANDARAMAN 944-529-6519Ainda não há avaliações

- Ddmmyyyy: Application For Closing An Trading/ Demat Account (Resident Individual) To, Kotak Securities LTDDocumento1 páginaDdmmyyyy: Application For Closing An Trading/ Demat Account (Resident Individual) To, Kotak Securities LTDMohit SingalAinda não há avaliações

- Demat Account Closure Form (NSDL CDSL) PDFDocumento1 páginaDemat Account Closure Form (NSDL CDSL) PDFAnonymous 2P9wgBlxAinda não há avaliações

- Account Closure Request Form: D D MMY Y Y YDocumento1 páginaAccount Closure Request Form: D D MMY Y Y Yshivamkatare0Ainda não há avaliações

- NonResident AOFDocumento2 páginasNonResident AOFHatrRatAinda não há avaliações

- Kotak Bank-Closure of Savings Current Investment AccountDocumento2 páginasKotak Bank-Closure of Savings Current Investment AccountDeepanshu JetlyAinda não há avaliações

- Account Closure Request FormDocumento2 páginasAccount Closure Request FormRahul NagaonkarAinda não há avaliações

- 5062 Policy Payout FormDocumento2 páginas5062 Policy Payout Formbpd21Ainda não há avaliações

- Account Closure FormDocumento1 páginaAccount Closure FormDeepak DevaprasadAinda não há avaliações

- Multiple Bank Accounts Registration FormDocumento2 páginasMultiple Bank Accounts Registration FormgoutamAinda não há avaliações

- Stop Payment of Direct Debits FormDocumento2 páginasStop Payment of Direct Debits Formh1760472Ainda não há avaliações

- Process To Claim Unclaimed BalancesDocumento2 páginasProcess To Claim Unclaimed BalancesSenthil Kumar GanesanAinda não há avaliações

- Account Closure Request Form: Funds Required For Purchasing PropertyDocumento1 páginaAccount Closure Request Form: Funds Required For Purchasing PropertyShankar NathAinda não há avaliações

- SMTSMD Clean Outward Remittance New 07-09-2019Documento2 páginasSMTSMD Clean Outward Remittance New 07-09-2019Zakir BhovaniyaAinda não há avaliações

- Sanction LetterDocumento6 páginasSanction Lettersubhajitbarai0945Ainda não há avaliações

- Account Closure FormDocumento2 páginasAccount Closure FormYunus JamalAinda não há avaliações

- Combined Address Change FormDocumento2 páginasCombined Address Change FormsushikumAinda não há avaliações

- Declaration For Rekyc Non IndividualsDocumento2 páginasDeclaration For Rekyc Non IndividualsPartha SundarAinda não há avaliações

- Account Closure Request (Form 9)Documento2 páginasAccount Closure Request (Form 9)sujithcnrAinda não há avaliações

- Check List For OperationDocumento12 páginasCheck List For OperationSudarshan AdhikariAinda não há avaliações

- Scottrade - Acct Xfer FormDocumento2 páginasScottrade - Acct Xfer FormwlamillerAinda não há avaliações

- Client Mandate Form For Registration Through BranchDocumento1 páginaClient Mandate Form For Registration Through BranchAditya DarbarAinda não há avaliações

- Sip Ecs Appln FormDocumento1 páginaSip Ecs Appln FormEddy CoolAinda não há avaliações

- Account Closure FormDocumento1 páginaAccount Closure FormChetan ChaudhariAinda não há avaliações

- DormantDocumento1 páginaDormantbabujiAinda não há avaliações

- Final Application Form - Restructuring 2.0 - RevisedDocumento5 páginasFinal Application Form - Restructuring 2.0 - RevisedShabin ShabiAinda não há avaliações

- Request Letter - Outward Remittance (Non Import)Documento2 páginasRequest Letter - Outward Remittance (Non Import)Abhijit ShenoyAinda não há avaliações

- DP & Trading Combine Closure Request Form - 0 PDFDocumento2 páginasDP & Trading Combine Closure Request Form - 0 PDFJitendra Nath ChauhanAinda não há avaliações

- DP & Trading Combine Closure Request Form - 0Documento2 páginasDP & Trading Combine Closure Request Form - 0Harshal JadhavAinda não há avaliações

- Intern Ship Report OneDocumento10 páginasIntern Ship Report Onefitsum kirosAinda não há avaliações

- Einstructions Form ICICI BANKDocumento2 páginasEinstructions Form ICICI BANKKashmira RAinda não há avaliações

- Account Opening Department: Types of AccountsDocumento24 páginasAccount Opening Department: Types of AccountsHammad AhmadAinda não há avaliações

- Account Closing FormDocumento1 páginaAccount Closing Formrealsky77777Ainda não há avaliações

- Change of Bank Mandate Form DSP PDFDocumento1 páginaChange of Bank Mandate Form DSP PDFmaakabhawan26Ainda não há avaliações

- Hsbcuk Account Closure FormDocumento8 páginasHsbcuk Account Closure FormgaetanopetiAinda não há avaliações

- Birla SL MF SipDocumento1 páginaBirla SL MF SipShar MathewAinda não há avaliações

- Account Closure Form PDFDocumento1 páginaAccount Closure Form PDFDeepal DhamejaAinda não há avaliações

- DISCUSSION ON RECONCILATION AND ERRORS - PrintDocumento6 páginasDISCUSSION ON RECONCILATION AND ERRORS - PrintHuyền TrangAinda não há avaliações

- Ntp-Asac ASALUS Corporation: Ap Voucher Vendor Code: Vendor NameDocumento8 páginasNtp-Asac ASALUS Corporation: Ap Voucher Vendor Code: Vendor NameEloiza Lajara RamosAinda não há avaliações

- Fintech Company:Paytm: 1.financial Statements and Records of CompanyDocumento7 páginasFintech Company:Paytm: 1.financial Statements and Records of CompanyAnkita NighutAinda não há avaliações

- pc102 - Final ProjectW13 - Ramon GutierrezDocumento10 páginaspc102 - Final ProjectW13 - Ramon GutierrezEJ LacdaoAinda não há avaliações

- The Next Five Years: What Investors Can ExpectDocumento52 páginasThe Next Five Years: What Investors Can ExpectJonAinda não há avaliações

- Portfolio Management and Investment Alternatives: Shruti ChavarkarDocumento17 páginasPortfolio Management and Investment Alternatives: Shruti ChavarkarShrikant SabatAinda não há avaliações

- Fabm2 - June 17, 2021 Asynchronous Activity: Thanks, Happy Working. 3Documento7 páginasFabm2 - June 17, 2021 Asynchronous Activity: Thanks, Happy Working. 3Khaira PeraltaAinda não há avaliações

- Forex Operations: Prof S P GargDocumento25 páginasForex Operations: Prof S P GargProf S P Garg100% (2)

- FAR 1 - Midterm - Practice Questions 3Documento2 páginasFAR 1 - Midterm - Practice Questions 3Yanela YishaAinda não há avaliações

- Proforma Invoice - Simon SafetyDocumento1 páginaProforma Invoice - Simon SafetyAlex SimonAinda não há avaliações

- How To Write A Traditional Business Plan: Step 1Documento5 páginasHow To Write A Traditional Business Plan: Step 1Leslie Ann Elazegui UntalanAinda não há avaliações

- Park Bill 1Documento2 páginasPark Bill 1sourabhAinda não há avaliações

- Ch-7 Approaches of Business ValuationDocumento46 páginasCh-7 Approaches of Business ValuationManan SuchakAinda não há avaliações

- ASIIDocumento80 páginasASIIAgus DharmaAinda não há avaliações

- Co-Operative Banks Identity Through Brand Building: Presented By: Presented byDocumento10 páginasCo-Operative Banks Identity Through Brand Building: Presented By: Presented byRajiv ChoudharyAinda não há avaliações

- Chapter 10 1Documento40 páginasChapter 10 1William Masterson Shah0% (1)

- Note Receivable Part 2Documento7 páginasNote Receivable Part 2Carlo VillanAinda não há avaliações

- Annexure Circular 241 ADV-59-2022-23 ANNEXURE 1Documento49 páginasAnnexure Circular 241 ADV-59-2022-23 ANNEXURE 1sandeepAinda não há avaliações

- Finance and Accounting Basics - Interview Quest & Answers-1Documento48 páginasFinance and Accounting Basics - Interview Quest & Answers-1naghulk1Ainda não há avaliações

- Eilifsen 3rd Chap04 PPTDocumento46 páginasEilifsen 3rd Chap04 PPTtahani almuqatiAinda não há avaliações

- Tutorial 5Documento2 páginasTutorial 5Aqilah Nur15Ainda não há avaliações

- A - Updated Price List & Payment BW Food Court 10012020Documento8 páginasA - Updated Price List & Payment BW Food Court 10012020sishir mandalAinda não há avaliações

- Equity Allocated Securities: IndiaDocumento2 páginasEquity Allocated Securities: IndiaHasheem AliAinda não há avaliações

- 1 FAQs FinacleDocumento17 páginas1 FAQs FinacleVikramAinda não há avaliações

- 11 Accounts 2Documento183 páginas11 Accounts 2Sai BhargavAinda não há avaliações

- AAC Seeded ControlsDocumento8 páginasAAC Seeded ControlsvenkkatmandulaAinda não há avaliações

- Sources of FundsDocumento13 páginasSources of FundsSenelwa Anaya0% (1)