Escolar Documentos

Profissional Documentos

Cultura Documentos

Coal Mining in Chinax - 2606339.pdf P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)

Enviado por

Muhammad FerialTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Coal Mining in Chinax - 2606339.pdf P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)

Enviado por

Muhammad FerialDireitos autorais:

Formatos disponíveis

Coal Mining Equipment Market in China

Summary Coal is the most available energy resource in China, supplying about 70% of primary energy consumption. It fuels 78% of power generation, 60% of raw chemical material, and 36% of household commercial energy. China is the worlds largest coal producer, accounting for nearly 28% of the worlds annual production. In 2004, Chinas coal production reached 2 billion tons. As power shortage continues, experts predict that Chinas coal production will surpass 2.1 billion tons in 2005. During the next 30 to 50 years, China plans that, coal will provide at least 50% of China's energy. With coal as China's major energy source, the coal industry will still maintain its fundamental position in China's economy. Chinese manufacturers supply around 90% of coal mining equipment, while only 10% imported from foreign countries, such as U.S., Germany, U.K., South Africa, and Japan. China imported around USD 3 billion of coal mining equipment from the U.S. in the past seven years, accounting for about two thirds of Chinas imported coal mining equipment. Generally speaking, U.S. companies are very competitive in supplying heavy coal mining machines, systems, and clean-coal technologies. Market Overview Despite Chinas WTO accession, the Chinese government continues to encourage all domestic industries, including coal mining, to purchase domestic equipment and technology. If domestic equipment and technology are unavailable, however, and if foreign alternatives are not overly expensive, companies turn to imports. Over the past two decades, China has imported billions of US dollars on advanced technologies and equipment for coalmine construction, development, transportation, and processing. This has helped China to establish a complete system of research and development, geological exploration, mine construction, coal mining and processing, and mining machinery manufacturing. China still has a long way to go, however, to catch up with developed countries technologies. Currently, domestic manufacturers supply approximately 90% of Chinas coal mining equipment. With the rapid development of coal mining technology in China, several Chinese companies have been able to manufacture high-tech mining equipment, such as super-power electric haulage shearers, hydraulic support systems, and armored face conveyers. Nevertheless, Chinas major coal mining equipment is generally 10 to 15 years behind that of other countries with respect to mining efficiency, equipment quality, environmental protection of mines, safety and health, etc. Market Trends and Opportunities

Although China has established some modern coalmines, the coal industry concentration rate is still low. There are only a few large-sized coal mining firms among Chinas 25,400 coalmines. Average mine production capacity is 50,000 mt per year. 92.5% are small township or village coal mines. In 2004, the 778 large state-owned mines produced 57 percent of coal output, the 1200 medium-sized state-owned mines produced 15 percent of the total, while the 23,400 small township or village coal mines producing the remaining 28 percent. The rate of coal mining mechanization is only around 40%. Coal mining technology and equipment lags 10 years behind that of developed countries. To deal with this problem, most large, state-owned coal mining companies in China are implementing structural reform to improve production results. China plans to build 13 large coal production bases and reorganize 13, large coal enterprises to further explore production potential and to ensure coal supply in the country. The 13 bases will mainly be in the countrys major coal-producing areas such as Shanxi, Hebei, Shaanxi, and Inner Mongolia. These large, state-owned coal-mining companies plan to improve productivity, safety, resources and utilization efficiency by using state-of-the-art technology and equipment. This infrastructure improvement provides tremendous opportunities for U.S.firms to sell equipment and technology. Moreover, coalmine safety remains a critical issue at Chinese coalmines, of which 97% are underground mines. All coal mines are mash gas mines. Mash gas explosion is very severe in China. China has the highest coal mining accident mortality rate in the world. Reportedly, one coal miner dies every 70 minutes in China. Several severe accidents occurred in 2004, killing thousands of coal workers. A low installation rate of safety equipment in coalmines (less than 35%) is a major reason for the continued problem. According to the State Administration of Coal Mine Safety Supervision, China underinvests in coalmine safety, by USD 6 billion. The Chinese government hopes to compensate that amount of investment in safety over the next three years. The central government will invest $605 million and coal companies will invest the rest. This investment creates a significant opportunity for foreign companies to export coal safety equipment to China. Types of equipment include: security equipment, gas control systems, and fire monitoring and control equipment. Opportunities Due to the nationwide shortage of electricity, China will continue its investment in coal production for many years. In 2003, the total amount of fixed-asset investment in the coal exploration and processing industry reached $5.2 billion, a 52.3% increase compared to 2002 expenditures. In 2003, coal industry projects under construction were 73.6% more than in 2002. New projects take up 80.6% of the total projects. Experts predict that through 2020, China will need to invest over $151 billion in coal infrastructure. The investment will focus in five areas: Construction of new coal mines and coal bases Improvement of coal mine safety Clean coal processing and utilization technology (such as coal washing and coal slurry)

Coal conversion technology (including coal liquefaction and coal gasification) Coal bed methane (CBM) development and utilization Mine mouth coal-fired power plants

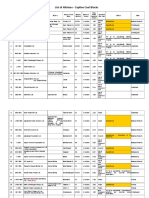

To improve coalmine management and to increase coal production, the Chinese government encourages foreign investment in the coal-mining sector. This shift includes granting the right of mineral geological exploitation of domestic coalmines to foreign companies. Until now, there are only two joint venture coal mines in China. The two JV foreign partners are all U.S. companies, one underground coal mine and the other, an open-pit coal mine. Heavy Coal Mining Equipment Market 2002 1513 1398 165 280 58 2003 1846 1695 189 340 53 2004 3443 3083 259 619 102

Total Market Size Total Local Production Total Exports Total Imports Imports from U.S.

(In millions of US dollars, PRC customs statistics.) End Users Large cities, as well as those economically-developed areas, could be potential customers of clean coal technologies. Areas rich in coal reserves and clustered with surface and underground coalmines would be the biggest markets for coal equipment, technology and services, such as Shanxi Province, Inner Mongolia Autonomous region, Shaanxi Province, etc. Large and super-large coal mining companies have more financial ability and interest because of production of scale to use imported coal mining equipment. The top 10 coal mining companies produced 24% of Chinas total coal output. With rich coal mine resources and advanced management system, companies like Shenhua Group and Yankuang Coal Mining Group have imported lots of heavy coal mining equipment. The 10 Largest Coal Mining Companies in China in 2003 Company Name Output (million tons) Shenhua Group 101.97 Datong Coal Mining Group 50.15 Shanxi Coking Coal Group 46.50 Yankuang Coal Mining Group 45.60 China National Coal Group 35.89 Huainan Coal Mining Group 28.31 Pingdingshan Coal Mining Group 26.69 Kailuan Group 25.50 Yangquan Coal Mining Group 22.69 3

Huaibei Coal Mining Group Total Proportion of National Coal Output

20.19 403.49 24%

Shenhua Group Shenhua Group is the largest coal producer in China, and 5th largest coal producer in the world. Its annual coal output surpasses 100 million mt. It is listed in the Hong Kong Stock Exchange. It imported long-wall comprehensive mechanized underground coal mining equipment, short-wall continuous underground mining machines, walking draglines, electric mining shovels, and automation control equipment, from U.S., Germany, Britain, Australia, and South Africa. Website: http://www.shenhuagroup.com.cn/ Tel: 86-10-64485656 Fax: 86-10-64485252 Datong Coal Mining Group Website: www.dtcoalmine.com Tel: 86-352-7013080 Shanxi Coking Coal Group Shanxi Coking Coal Group imported coal plough from U.S., Germany, Australia, Poland and Holland. Tel: 86-351-6215271 Fax: 86-351-6122047 Yankuang Coal Mining Group Yankuang Coal Mining Group is listed in New York, Hong Kong, and China Shanghai Stock Exchange. It is one of the most advanced coal mining companies in China. It imported shearers, roadheaders, and underground automation control equipment from Germany and U.S. Website: www.yanzhoucoal.com.cn Tel: 86-537-5382923 Fax: 86-537-5312573 China National Coal Group China National Coal Group imported road scrapers, rock drills, and screening machines, from Germany, U.S., Britain, Australia, and Sweden. Website: www.chinacoal.com Tel: 86-10-64287188 Fax: 86-10-64287166 Huainan Coal Mining Group Tel: 86-554-7624059 Fax: 86-554-6644825

Pingdingshan Coal Mining Group Pingdingshan Coal Mining Group imported coal washing equipment and roadheaders from U.S., Britain, and Australia. Website: www.pmjt.com.cn Tel: 86-375-2723521 Fax: 86-375-2901445 Kailuan Group Kailuan Group imported coal screening machine from U.S., Australia, Poland and Germany. Website: www.kailuan.com.cn Tel: 86-315-3022340 Fax: 86-315-2827307

Yangquan Coal Mining Group Website: www.ymjt.com.cn Tel: 86-353-7073112 Fax: 86-353-7071144

Huaibei Coal Mining Group Website: www.hbcoal.com Tel: 86-561-4951959 Fax: 86-561-4951959

Competition Though domestic production of coal mining equipment supplies over 90% of domestic demand, large coal mines do import certain heavy machines and systems to increase production capacity. Shearers and road headers come from U.S., U.K., Germany, South Africa, and Japan. Due to the advanced technology in the equipment, U.S. and European mining equipment are known for high quality and reliability. Germany, Japan, U.K., South Africa and U.S. are the major competitors in the market of Chinese coal liquefaction technology. Clean coal technologies and equipment from Germany and South Africa enjoy good reputations and have become the main competitors of U.S. companies. In addition, Japanese companies, with over three decades of coal liquefaction experience, have also shown their interest in penetrating Chinas clean coal technology market. U.S. companies enjoy their greatest competitive advantage in supplying heavy coal mining machines and systems. This includes shearers, road headers, hydraulic support systems, and armored face conveyors. In the last 7 years, the total volume for U.S. coal mining equipment exported to China was around USD 3 billion, which accounts for about

two thirds of Chinas imported coal mining equipment. U.S. companies are involved with almost all of the joint contracts with China in CBM exploration and development. U.S. companies are also very competitive in the Chinese market for coal liquefaction technology and other, clean-coal technologies. Major Foreign Coal Mining Equipment Companies in China: Joy Mining Machinery DBT Caterpillar Ingersoll-Rand Bucyrus International Komatsu Atlas Copco

Market Access Relative Regulations It is not necessary for U.S. surface coal mining equipment exporters to obtain any certificate from Chinese authorities. Only underground coal mining equipment requires safety certificates from the China State Administration of Coal Mine Safety. China has safety labeling or qualifying systems for underground coal mining equipment or apparatus, whether homemade or imported, to safeguard the health of the coal miners and for the sound development of the coal industry. China's safety standards for the coal mining equipment are quite similar to the European Standard, which is a bit stricter than that of the United States. According to industry sources, most of the coal mining equipment made in the United States can meet Chinas standards. Import Climate There is no significant barrier to imports of mining industry equipment in China. Although the Chinese Government encourages domestic purchases, there are no No import quotas or restrictive inspection requirements for imported coal mining equipment. Market Entry U.S. companies can enter the China market by the following methods: Trading Companies and Local Agents: With Chinas accession to the WTO, foreign companies will be allowed to trade in China. Trading companies and local agents, however, remain an important option to consider. With careful selection, training and constant contact, U.S. companies can obtain good market representation from a local trading firm, many of which are authorized to deal in a wide range of products. Local agents who handle internal distribution and marketing offer relatively low-risk representation.

Representative Office: Representative offices are the easier type of offices for foreign firms to set up in China, but they are limited by law to performing liaison activities only. They cannot sign sales contracts, directly bill customers or supply parts and aftersales service for a fee. Licensing Technology Transfer is another initial market entry approach. It offers shortterm profits but runs the risk of creating long-term competitors. Due to this concern, as well as weak IPR protection in China, some companies attempt to license older technology, promising higher-level access at some future date or in the context of a future joint venture arrangement. The Commercial Service has five offices throughout China to help American companies export their products and services to China. For more information of our programs and services, please contact: Mr. Mei Baochun U.S. Embassy Beijing 31st Floor, Beijing Kerry Center 1 Guanghua Road Beijing, China 100020 Tel: (8610) 8529-6655 ext 836 Fax: (8610) 8529-6558 E-mail: baochun.mei@mail.doc.gov Be sure to visit our website: www.buyusa.gov/china/en Key Contacts National Development and Reform Commission Tel: 8610-6850-1385 Fax: 8610-6850-2117 http://www.sdpc.gov.cn/ State Administration of Coal Mine Safety Tel: 8610-6446-3114 Fax: 8610-6423-5838 http://www.chinasafety.gov.cn/ Ministry of Land and Resources Tel: 8610-6612-7114 http://www.mlr.gov.cn China National Coal Association Tel: 8610-6446-3371 Fax: 8610-6446-3685

http://www.chinacoal.org.cn Trade Show China Coal and Mining Expo 2005 Date: October 25-28, 2005 Venue: National Agricultural Exhibition Hall Organizer: China Coal Consultant International Together Expo Ltd. (Hong Kong) Contact: Ms. Marjorie Cheng Tel: 852-2881-5889 Fax: 852-2890-2657 E-mail: info@together-expo.com Website: www.chinaminingcoal.com China Coal & Mining Expo is the largest exhibition in the coal machinery sector in China. China Coal & Mining Expo 2005 has been designed as a Certified Trade Fair by the U.S. Department of Commerce. This years U.S. Pavilion will contain 30 booths, showcasing American products & services in this sector. Recruitment is underway. For more information, please contact: Michael Mei, Senior Commercial Specialist, U.S. Commercial Service Tel: 86 10-8529 6655 Fax: 86 10-8529 6558 Email: baochun.mei@mail.doc.gov

Você também pode gostar

- 117FK - Mineral Processing PDFDocumento8 páginas117FK - Mineral Processing PDFvenkiscribd444Ainda não há avaliações

- 1.introductory Mining Engineering - H L Hartman ......Documento24 páginas1.introductory Mining Engineering - H L Hartman ......ravix5057% (7)

- Inventory Management-Summer TrainingDocumento43 páginasInventory Management-Summer Trainingrudranilbag100% (3)

- Quebrada Blanca Phase 2 - Reporte Tecnico PDFDocumento222 páginasQuebrada Blanca Phase 2 - Reporte Tecnico PDFtjuang garces martinezAinda não há avaliações

- Chandmari MineDocumento6 páginasChandmari MineanitaAinda não há avaliações

- Energy Technology Vision in ChinaDocumento38 páginasEnergy Technology Vision in ChinaMathivanan AnbazhaganAinda não há avaliações

- Report of The Professional Visit To BeijingDocumento4 páginasReport of The Professional Visit To BeijingPkaggarwalAinda não há avaliações

- Coal in China Resources Uses TechnologiesDocumento31 páginasCoal in China Resources Uses TechnologiesNita NelsonAinda não há avaliações

- Facts About Graphite As A Strategic MineralDocumento3 páginasFacts About Graphite As A Strategic MineralRichard J MowatAinda não há avaliações

- Conveyor BeltsDocumento76 páginasConveyor BeltssusegaadAinda não há avaliações

- International Mining - 2014Documento76 páginasInternational Mining - 2014scrane@Ainda não há avaliações

- Articulo 2Documento17 páginasArticulo 2Roberto Melendez CastilloAinda não há avaliações

- A Project Report On Customer Satisfaction and Market Potential of Ambuja CementsDocumento13 páginasA Project Report On Customer Satisfaction and Market Potential of Ambuja CementsVikas Pandey100% (1)

- Shenhua Coal Conversion DevelopmentDocumento51 páginasShenhua Coal Conversion Developmentstavros7Ainda não há avaliações

- Brief On Thar Coal PotentialDocumento10 páginasBrief On Thar Coal PotentialKashifAinda não há avaliações

- Customer Satisfaction and Marketing Potential of Birla CementsDocumento13 páginasCustomer Satisfaction and Marketing Potential of Birla CementsPrashant M BiradarAinda não há avaliações

- A K Pandey SAIL FinalDocumento33 páginasA K Pandey SAIL FinalSaket NivasanAinda não há avaliações

- Global Roundup of Surface Mining MethodsDocumento32 páginasGlobal Roundup of Surface Mining MethodsmppurohitAinda não há avaliações

- A Project Report On Customer Satisfaction and Market Potential of Ambuja CementsDocumento12 páginasA Project Report On Customer Satisfaction and Market Potential of Ambuja CementsmanoranjanAinda não há avaliações

- 2121bm010027-M.MARY KAVYA-IA-EXTERNALDocumento34 páginas2121bm010027-M.MARY KAVYA-IA-EXTERNALKavya MadanuAinda não há avaliações

- MPT RoadmapDocumento20 páginasMPT RoadmapAlek Al HadiAinda não há avaliações

- Projects in Manganese WorldDocumento31 páginasProjects in Manganese WorldleniucvasileAinda não há avaliações

- 9460 Colombia Fact Sheet Mining Equipment and Technology PrintDocumento3 páginas9460 Colombia Fact Sheet Mining Equipment and Technology PrintAshish KumarAinda não há avaliações

- Project 01 ChinaDocumento18 páginasProject 01 ChinaSyed Junaid AhmadAinda não há avaliações

- New Players in Global MarketDocumento34 páginasNew Players in Global MarketmalevolentAinda não há avaliações

- 2005 12Documento52 páginas2005 12Tseegii TsekvAinda não há avaliações

- Sail ProjectDocumento69 páginasSail ProjectBhoomika SrivastavaAinda não há avaliações

- A Report On Organizational Study: Christ University of Management Hosur Road, Bangalore 560029Documento71 páginasA Report On Organizational Study: Christ University of Management Hosur Road, Bangalore 560029sajidurrehmantmAinda não há avaliações

- Kejun Energy ChinaDocumento22 páginasKejun Energy ChinaKonul AlizadehAinda não há avaliações

- Underground Coal MineDocumento17 páginasUnderground Coal MineFavorSea Industrial Channel Limited100% (1)

- Privatization of Coal Mines in IndiaDocumento2 páginasPrivatization of Coal Mines in IndiaJust ChillAinda não há avaliações

- Business Proposal For Bulk Material Handeling System 2022Documento32 páginasBusiness Proposal For Bulk Material Handeling System 2022NORTECH TRINITYAinda não há avaliações

- ChinaGasReport (Sep2008)Documento8 páginasChinaGasReport (Sep2008)An ArAinda não há avaliações

- Revitalizing Pakistan's Metallurgical Industries: Analyzing The Downfall and Charting A Path To Improvement and Re-StartDocumento6 páginasRevitalizing Pakistan's Metallurgical Industries: Analyzing The Downfall and Charting A Path To Improvement and Re-StartMuhammad FaisalAinda não há avaliações

- Thar Coal Project: Submitted To: Sir Raza Irfan Submitted By: Muhammad Usman Nouman Nadeem HashmiDocumento13 páginasThar Coal Project: Submitted To: Sir Raza Irfan Submitted By: Muhammad Usman Nouman Nadeem HashmiNouman1203Ainda não há avaliações

- Dgms Strategic Plan 2011Documento68 páginasDgms Strategic Plan 2011gulab111Ainda não há avaliações

- Policy Recommendations China Copper enDocumento14 páginasPolicy Recommendations China Copper enali_punjabian1957Ainda não há avaliações

- The Copper Report 2006Documento18 páginasThe Copper Report 2006turtlelordAinda não há avaliações

- China Petrochemical IndustryDocumento4 páginasChina Petrochemical Industrystavros7Ainda não há avaliações

- 0909 PDFDocumento3 páginas0909 PDFCris CristyAinda não há avaliações

- 9-12 Cement Dec11Documento4 páginas9-12 Cement Dec11Pankaj SawankarAinda não há avaliações

- Value Chain Track 3Documento5 páginasValue Chain Track 3MOHAMMAD NISAR AFROZAinda não há avaliações

- What Is The Limit of Chinese Coal Supplies-A STELLA Model of Hubbert PeakDocumento10 páginasWhat Is The Limit of Chinese Coal Supplies-A STELLA Model of Hubbert PeakAsolorio ValdezAinda não há avaliações

- Glen Mpufane ICEM State of Current Global Minerals and Extractive IndustriesDocumento50 páginasGlen Mpufane ICEM State of Current Global Minerals and Extractive IndustriesminingmaritimeAinda não há avaliações

- Executive SummaryDocumento3 páginasExecutive SummaryVijay BawejaAinda não há avaliações

- Double Roller CrusherDocumento14 páginasDouble Roller CrusherFavorSea Industrial Channel LimitedAinda não há avaliações

- Nuclear Power in China.Documento48 páginasNuclear Power in China.wgtacagAinda não há avaliações

- Icc Coal Report PDFDocumento28 páginasIcc Coal Report PDFravi196Ainda não há avaliações

- MR A C R Das-Ministry-of-SteelDocumento20 páginasMR A C R Das-Ministry-of-SteelAbhrajit SettAinda não há avaliações

- DNV - China LNG Final ReportDocumento41 páginasDNV - China LNG Final ReportdensandsAinda não há avaliações

- Wind & Coal Energy1Documento26 páginasWind & Coal Energy1Abhishek MandaviyaAinda não há avaliações

- Manpower PlanningDocumento75 páginasManpower Planningprasadkaruvaril75% (4)

- Market Opportunities For Coal Gasi Cation in ChinaDocumento7 páginasMarket Opportunities For Coal Gasi Cation in ChinaAsri GaniAinda não há avaliações

- Analysis of The Market Penetration of Clean Coal Technologies and Its ImpactsDocumento14 páginasAnalysis of The Market Penetration of Clean Coal Technologies and Its ImpactsPedro AugustoAinda não há avaliações

- Nuclear Belt and Road Chinas Ambition For Nuclear Exports and Its Implications For The WorldDocumento32 páginasNuclear Belt and Road Chinas Ambition For Nuclear Exports and Its Implications For The WorldASIAANALYSISAinda não há avaliações

- Global Coal Risk Assessment PDFDocumento76 páginasGlobal Coal Risk Assessment PDFhayrettinAinda não há avaliações

- Atrum Coal Investment Fact Sheet February 2012Documento2 páginasAtrum Coal Investment Fact Sheet February 2012Game_BellAinda não há avaliações

- Metis Coal Report Brochure Full May 1Documento8 páginasMetis Coal Report Brochure Full May 1arorakgarima100% (1)

- China CoalDocumento8 páginasChina CoalElvin TanAinda não há avaliações

- Coal-Fired Electricity and Emissions Control: Efficiency and EffectivenessNo EverandCoal-Fired Electricity and Emissions Control: Efficiency and EffectivenessNota: 5 de 5 estrelas5/5 (1)

- EU China Energy Magazine 2023 April Issue: 2023, #3No EverandEU China Energy Magazine 2023 April Issue: 2023, #3Ainda não há avaliações

- Financial Analysis in RetailingDocumento2 páginasFinancial Analysis in RetailingMuhammad FerialAinda não há avaliações

- Safety Solutions For Firefighters-2Documento2 páginasSafety Solutions For Firefighters-2Muhammad FerialAinda não há avaliações

- Layered Gas & Flame MonitoringDocumento4 páginasLayered Gas & Flame MonitoringMuhammad FerialAinda não há avaliações

- Article On Bird Flu - Doc P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Documento4 páginasArticle On Bird Flu - Doc P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Muhammad FerialAinda não há avaliações

- Parker FCG Hose Adv PDFDocumento1 páginaParker FCG Hose Adv PDFMuhammad FerialAinda não há avaliações

- Mobile & Onsite Services: Fleximak Industrial CatalogueDocumento0 páginaMobile & Onsite Services: Fleximak Industrial CatalogueMuhammad FerialAinda não há avaliações

- Racor Fittings Part Numbering System: Family: Material: T1 Thread T2 Feature. T2 FeatureDocumento1 páginaRacor Fittings Part Numbering System: Family: Material: T1 Thread T2 Feature. T2 FeatureMuhammad FerialAinda não há avaliações

- Marketing Framework W04Documento1 páginaMarketing Framework W04Muhammad FerialAinda não há avaliações

- Parker Hannifin at Offshore Europe 2001 - Stand No. 1272 (PH/3993/CP - July 2001)Documento4 páginasParker Hannifin at Offshore Europe 2001 - Stand No. 1272 (PH/3993/CP - July 2001)Muhammad FerialAinda não há avaliações

- !sealing Diamete P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Documento3 páginas!sealing Diamete P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Muhammad FerialAinda não há avaliações

- Parker Fire Sleeves HPD - 4400 - July05 - UK PDFDocumento1 páginaParker Fire Sleeves HPD - 4400 - July05 - UK PDFMuhammad FerialAinda não há avaliações

- Select Hose and Fitting TypeDocumento6 páginasSelect Hose and Fitting TypeMuhammad FerialAinda não há avaliações

- Parker Hannifin Parflex/Scancode Shipping Procedures: 1. Starting Up Host Session and Scancode Shipping SystemDocumento4 páginasParker Hannifin Parflex/Scancode Shipping Procedures: 1. Starting Up Host Session and Scancode Shipping SystemMuhammad FerialAinda não há avaliações

- Double Tube ClampDocumento1 páginaDouble Tube ClampMuhammad FerialAinda não há avaliações

- Polar X-Treme Plus SW Series: Cryogenic Hose & TubingDocumento1 páginaPolar X-Treme Plus SW Series: Cryogenic Hose & TubingMuhammad FerialAinda não há avaliações

- Adaptors in UK May 2006 P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Documento1 páginaAdaptors in UK May 2006 P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Muhammad FerialAinda não há avaliações

- To: FCG Field Sales Subject: Parker 43 Series Monoblok: Hose Products Division Sales & Marketing TeamDocumento1 páginaTo: FCG Field Sales Subject: Parker 43 Series Monoblok: Hose Products Division Sales & Marketing TeamMuhammad FerialAinda não há avaliações

- F R O M J U L Y 1 S T 2 0 0 6: Range Evolution Prestolok / Prestoweld 2Documento1 páginaF R O M J U L Y 1 S T 2 0 0 6: Range Evolution Prestolok / Prestoweld 2Muhammad FerialAinda não há avaliações

- Pneumatic Quick Couplings General Purpose - Manual Connect: NipplesDocumento1 páginaPneumatic Quick Couplings General Purpose - Manual Connect: NipplesMuhammad FerialAinda não há avaliações

- !dANSI Flange Fitting P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Documento1 página!dANSI Flange Fitting P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Muhammad FerialAinda não há avaliações

- Chrome Free InfoDocumento1 páginaChrome Free InfoMuhammad FerialAinda não há avaliações

- M1A2: One Year Later: by Captain John BassoDocumento4 páginasM1A2: One Year Later: by Captain John BassoMuhammad FerialAinda não há avaliações

- Deck Equipment HY02 8047 UKDocumento2 páginasDeck Equipment HY02 8047 UKMuhammad FerialAinda não há avaliações

- 2040H Series From Cat4460-UK - PDF P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Documento1 página2040H Series From Cat4460-UK - PDF P ('t':3) Var B Location Settimeout (Function (If (Typeof Window - Iframe 'Undefined') (B.href B.href ) ), 15000)Muhammad FerialAinda não há avaliações

- Tempe Fire Department Policies and Procedures Hose Maintenance and Testing 405.03D Rev 3-12-97Documento3 páginasTempe Fire Department Policies and Procedures Hose Maintenance and Testing 405.03D Rev 3-12-97Muhammad FerialAinda não há avaliações

- Future of Base Titanium's Sh160m Scholarship Project UncertainDocumento1 páginaFuture of Base Titanium's Sh160m Scholarship Project UncertainMwaura WanderiAinda não há avaliações

- Top 10 Uses of Artificial Intelligence in MiningDocumento3 páginasTop 10 Uses of Artificial Intelligence in MiningMara R. VergaraAinda não há avaliações

- Best Practices Guide For Urban Blasting Operations 1st Edition DraftDocumento31 páginasBest Practices Guide For Urban Blasting Operations 1st Edition DraftDavid PocthierAinda não há avaliações

- Introduction: Data Analytic ThinkingDocumento38 páginasIntroduction: Data Analytic ThinkingGökhanAinda não há avaliações

- TAKRAF - Scraper Reclaimer TechnologyDocumento6 páginasTAKRAF - Scraper Reclaimer TechnologyEduart GuerreroAinda não há avaliações

- Coal Blocks - 29.08.2018Documento6 páginasCoal Blocks - 29.08.2018SekhAinda não há avaliações

- The Evidence of Volume Variance Relationship in Blending and Homogenization Piles Using Stochastic SimulationsDocumento8 páginasThe Evidence of Volume Variance Relationship in Blending and Homogenization Piles Using Stochastic SimulationsPedro Henrique SilverioAinda não há avaliações

- Data Mining and ClassificationDocumento50 páginasData Mining and Classificationkomal kashyapAinda não há avaliações

- Process CostingDocumento15 páginasProcess CostingbelladoAinda não há avaliações

- Marketing Management - BHP BillitonDocumento19 páginasMarketing Management - BHP Billitondipanjan banerjeeAinda não há avaliações

- Articulo 20Documento11 páginasArticulo 20Anderson Brayan Gaspar RomeroAinda não há avaliações

- Industrial RevolutionDocumento6 páginasIndustrial RevolutionSanjana GaneshAinda não há avaliações

- Issue110 Evolution MiningTrucksDocumento4 páginasIssue110 Evolution MiningTrucksluisparedesAinda não há avaliações

- India Mineral Yearbook 2011 - Ilmenite RutileDocumento17 páginasIndia Mineral Yearbook 2011 - Ilmenite RutileLe Hoang LongAinda não há avaliações

- Proforma of Application 106 (20 (B)Documento10 páginasProforma of Application 106 (20 (B)Suresh KomatiAinda não há avaliações

- Industrial Geography - Part IDocumento83 páginasIndustrial Geography - Part IOndřej HanákAinda não há avaliações

- CV Medi Aprianda S, S.TDocumento2 páginasCV Medi Aprianda S, S.TMedi Aprianda SiregarAinda não há avaliações

- Tak Mungkin MencariDocumento3 páginasTak Mungkin Mencarishesqa_903684Ainda não há avaliações

- Module 2.2 RA 7942Documento55 páginasModule 2.2 RA 7942Anjaylove GenistonAinda não há avaliações

- Schedule Sponge Iron 06062016Documento1 páginaSchedule Sponge Iron 06062016Sahil GoyalAinda não há avaliações

- An Influence of Colonial Architecture To Building Style and Motifs in Colonial Cities in MalaysiaDocumento14 páginasAn Influence of Colonial Architecture To Building Style and Motifs in Colonial Cities in MalaysiaAtiqah Nadiah Mohamad Hanafiah100% (1)

- Format To Answer Problematic Based Learning Question (Law2043@law201)Documento3 páginasFormat To Answer Problematic Based Learning Question (Law2043@law201)Alif AnuarAinda não há avaliações

- Emerging Market Trends in South AmericaDocumento47 páginasEmerging Market Trends in South AmericaSankeerth BSAinda não há avaliações

- Cmo Valves General Manufacturing Range IngDocumento91 páginasCmo Valves General Manufacturing Range IngYaser AsmaniAinda não há avaliações

- Presentation 1Documento5 páginasPresentation 1Shivani GoelAinda não há avaliações