Escolar Documentos

Profissional Documentos

Cultura Documentos

Thesun 2009-09-02 Page10 Timing Is Crucial For The Implementation of GST

Enviado por

Impulsive collectorDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Thesun 2009-09-02 Page10 Timing Is Crucial For The Implementation of GST

Enviado por

Impulsive collectorDireitos autorais:

Formatos disponíveis

10 theSun | WEDNESDAY SEPTEMBER 2 2009

business

Felcra welcomes

suggestion on

setting up of

consortium

Timing is crucial for

KAMPUNG GAJAH: Felcra

Berhad welcomes the sugges-

tion by Prime Minister Datuk

Seri Najib Abdul Razak for it to

cooperate with Felda and Risda

in setting up a consortium to

the implementation of GST

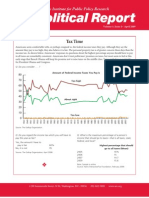

carry out various high-impact by Anthony Dass Fiscal Budget % of GDP

downstream activities.

Its chairman, Datuk Tajuddin WHAT is Goods and Services Tax (GST)? It is 5

Abdul Rahman, expressed confi- a tax charged on the supply of most goods and

dence that the move would open services made in the home country and on the

more room for the agency to importation of goods into the home country. 0

carry out activities which could As consumers, they will pay GST on all

generate income for settlers in taxable goods and services, except zero-rated

an effort to eliminate hardcore and exempted goods and services. -5

poverty. For businesses, they will charge GST on

“At present, each of the all taxable goods and services. GST acts as a

agencies spend more than RM1 part of a larger tax restructuring exercise that -10

billion a year to import fertilisers Fergie enables the authorities to shift their reliance

through middlemen because we won’t from direct to indirect taxes, while spreading

don’t have the purchasing power, across the population. -15

but through this cooperation, we spend The value-added tax or VAT is like GST

can get the supply directly,” he pg 29 and has several features making it attractive.

told reporters at the handing over VAT is viewed as a tax on consumption and -20

of a cheque for RM65.8 million, not on income. Thus, it encourages savings

1971

1973

1975

1977

1979

1981

1983

1985

1987

1989

1991

1993

1995

1997

1999

2001

2003

2005

2007

2009

to be disbursed for payments and investments compared to consumption.

of dividends to Felcra settlers in Also, VAT is a self-policing mechanism that

Perak yesterday. will discourage evasion of taxes.

The cheque was handed For instance, the retail sales tax and income

over to Perak Information, Rural tax are subject to greater tax evasion compared It is possible if global recovery is on a cal will to adhere to a broad-based tax system

Development, Poverty Eradica- to VAT or even GST. firmer note, exhibiting a ‘V’-shape growth by not giving in to pressures for multiple

tion and Plantation Commit- Malaysia plans to introduce GST with the trend. Is this achievable? Current economic exemptions or rates that will only complicate

tee Chairman Datuk Saarani objective to have a wider revenue base and figures are mixed, suggesting that the risk of the tax system.

Mohamad. ease the prolonged budget deficit, averag- an anaemic global recovery remains. That Finally, if GST is applied on a broad base

Tajuddin said Felcra, Felda ing at 4.1% of GDP between 1998 and 2008. means one cannot rule out the possibilities for that includes essential goods like food, water

and Risda would meet soon Expectations are for the budget deficit to swell a ‘W or double-dip’ or an ‘L’-shape recovery. and electricity, it will erode the lower income

to discuss the proposed to between 7.6% and 8.0% this year, to address Should global growth lean towards any of the purchasing power on their daily expenses,

cooperation, adding that he the country’s economic recession that ema- two possibilities, greater stimulus measures especially if their wages/salaries are not

believed the cooperation nated from the global financial crisis. and further monetary easing will come into adjusted upwards.

would further strengthen the The government intends to trim its deficit force. Malaysia is no exception. As such, the As such, it is important to take into consid-

economy of the three agencies. next year by reducing operating expenditure risk for higher deficit could not be discarded eration the issue of timing for the implementa-

– Bernama that makes up about 75% of total expenditure. absolutely for Malaysia. Nonetheless, on the tion. It is to avoid possible backlash as GST

positive note is the ‘will-power’ to reduce the can also be viewed as ‘regressive tax’.

budget deficit. With the current challenging global and

Underpinned by uncertainties, it is impor- domestic economic environment, the fear of

tant to look at several pertinent issues before potential political backlash could not be ruled

implementing GST. out. Thus it appears that GST may not come

First, the authorities will need time to into force for the next two to three years.

change the current taxation system.

Second, the government will have to be in Anthony Dass, an economist by training, is

a better fiscal position i.e. budget surplus in Head of Research at Inter-Pacific Research. The

order to create comfort and affordability when views expressed in this article are entirely his

foregoing collection of tax and non-tax. own. He may be reached at anthony@interpac.

Third, the government must have the politi- com.my.

RM1.3bil in investment

for Penang in H1

by Opalyn Mok Despite being upbeat about the economic

newsdesk@thesundaily.com situation, Lee said there is still no certainty yet as

“nobody is sure how sustainable the economic

GEORGE TOWN: The total investment in Penang recovery is going to be”.

for the first half of this year is only RM1.3 billion, He also said the Penang Career Assistance and

which is about 13% of last year’s total investment Training (CAT) Centre has a total of 2,084 job-seek-

of RM10.2 billion. ers registered with it and 3,730 vacancies posted

InvestPenang Bhd executive committee chair- by employers.

man Datuk Lee Kah Choon said the figure may “Out of the 2,084 registrants, we have matched

seem low but is in tandem with the trend when 1,661 with potential employers,” he said.

compared with the international and national The Penang CAT Centre currently offers

investment environment. several training programmes in collaboration

“We have to look in terms of the overall foreign with Penang Skills Development Centre (PSDC)

direct investment (FDI) at the international level to where fresh graduates can choose programmes

see how much it has also reduced,” he said. such as Precision Machining Technology (PMT),

Lee said the FDI for the whole of Malaysia will Water Management Certification and Industrial

also have to be taken into account considering Skills Enhancement Programme (Insep) involv-

the recent uncertain economic climate. ing design and development and supply chain

Meanwhile, he said the job situation in the management.

state is looking up as retrenchments have de- Successful applicants receive monthly allow-

clined in the last few months. ances of up to RM1,000 each while undergoing

According to Lee, the retrenchment figures in the training.

the state peaked in February this year with a total “The centre is also offering an attachment

of 1,632 layoffs but the figures have since gone programme in collaboration with Penang Water

down to 222 last month. Supply Corporation (PBA), Penang Development

“Based on these figures, we can say that the Corporation (PDC), Seberang Perai Municipal

job situation here has stabilised and we hope that Council (MPSP) and Penang Island Municipal

it will stay that way,” he said. Council (MPPP).

Lee said currently, the unemployment rate in “The total positions offered by these agencies

the state is about 3%, which is about the same as are 474 and we have filled 61 of these positions,”

the national unemployment rate. he said.

“In Penang, there are actually growth in job op- The state government has also set aside a RM3

portunities in certain sectors such as the tourism million fund for a micro-credit scheme to assist

industry involving hotels, hospitality services and the disabled, single parents or those interested

restaurants,” he said. in venturing in micro businesses.

Você também pode gostar

- CEA State of The Economy August 2008Documento47 páginasCEA State of The Economy August 2008karishma_bhayaAinda não há avaliações

- Arvind Virmani (Views Are Personal)Documento47 páginasArvind Virmani (Views Are Personal)vikashmishra011Ainda não há avaliações

- PIA Reports GraphDocumento1 páginaPIA Reports GraphFoto ShackAinda não há avaliações

- Source: WDI, 2006: Indonesia: GDP Riil Per Kapita 2000 100, (RP)Documento2 páginasSource: WDI, 2006: Indonesia: GDP Riil Per Kapita 2000 100, (RP)Ananda KhairiaAinda não há avaliações

- Political Report April 2009Documento7 páginasPolitical Report April 2009American Enterprise InstituteAinda não há avaliações

- Organizational Environments and CulturesDocumento34 páginasOrganizational Environments and CulturesTân NguyênAinda não há avaliações

- WHO Polio Incidence DataDocumento21 páginasWHO Polio Incidence DataAdrian WingAinda não há avaliações

- Prob RecDocumento1 páginaProb Recapi-254669145Ainda não há avaliações

- Probability of US RecessionDocumento1 páginaProbability of US RecessionDaniel NguyenAinda não há avaliações

- Malaysia Vs SingaporeDocumento16 páginasMalaysia Vs SingaporeAndrew Qi WenAinda não há avaliações

- Description: Tags: PresentnassgapDocumento32 páginasDescription: Tags: Presentnassgapanon-856265Ainda não há avaliações

- The Dynamics of U.S. Crude Oil ProductionDocumento7 páginasThe Dynamics of U.S. Crude Oil ProductionMario Alejandro Mosqueda ThompsonAinda não há avaliações

- Cci2002 CTCDocumento1 páginaCci2002 CTCSmatrou RouchamouxAinda não há avaliações

- 151021-Korean Auto Industry (GENIVI) - KimDocumento14 páginas151021-Korean Auto Industry (GENIVI) - KimjavisAinda não há avaliações

- Mariana Mazzucato Beyond Markert FailureDocumento36 páginasMariana Mazzucato Beyond Markert FailureFrancisco Gallo MAinda não há avaliações

- The Economic Future Just HappenedDocumento21 páginasThe Economic Future Just Happenedigor1824100% (2)

- Trainiing BeckhoffDocumento45 páginasTrainiing BeckhoffĐại TrầnAinda não há avaliações

- Floods: The Awesome Power (Suzanne Van Cooten, PH.D)Documento39 páginasFloods: The Awesome Power (Suzanne Van Cooten, PH.D)National Press FoundationAinda não há avaliações

- Macroeconomics: An IntroductionDocumento17 páginasMacroeconomics: An IntroductionRaj PatelAinda não há avaliações

- Article Themathofvalueandgrowth UsDocumento13 páginasArticle Themathofvalueandgrowth UsZeehenul IshfaqAinda não há avaliações

- Cci2003 CTCDocumento1 páginaCci2003 CTCSmatrou RouchamouxAinda não há avaliações

- MS - ThemathofvalueandgrowthDocumento13 páginasMS - ThemathofvalueandgrowthmilandeepAinda não há avaliações

- 8153 20574 1 SMDocumento17 páginas8153 20574 1 SMgilang assyifaAinda não há avaliações

- Treasury Tax RecieptsDocumento3 páginasTreasury Tax Recieptskettle1Ainda não há avaliações

- Medical Professional Liability/ Claims-Made Reserving: Casualty Loss Reserve SeminarDocumento34 páginasMedical Professional Liability/ Claims-Made Reserving: Casualty Loss Reserve SeminarDarshiniAinda não há avaliações

- Ethanol Production VijaySinghDocumento40 páginasEthanol Production VijaySinghaz33mAinda não há avaliações

- NP TE L: Corporate FinanceDocumento23 páginasNP TE L: Corporate Financevini2710Ainda não há avaliações

- Sistema Nacional DE Estadísticas Sobre Ejecución de La Pena: Informe AnualDocumento26 páginasSistema Nacional DE Estadísticas Sobre Ejecución de La Pena: Informe AnualjavierAinda não há avaliações

- Financial Frictions and Total Factor Productivity. C. UrrutiaDocumento39 páginasFinancial Frictions and Total Factor Productivity. C. UrrutiacarlosAinda não há avaliações

- Manufacturing Performance and Services Inputs: Evidence From MalaysiaDocumento25 páginasManufacturing Performance and Services Inputs: Evidence From MalaysiafatincameliaAinda não há avaliações

- S1-12-Doble-Failures-analyses - 10th IndiaDoble PaperpresentationsDocumento14 páginasS1-12-Doble-Failures-analyses - 10th IndiaDoble PaperpresentationsRAVINDERAinda não há avaliações

- New Economic Policy of IndiaDocumento58 páginasNew Economic Policy of Indiathulasie_600628881Ainda não há avaliações

- Initial Public Offering: Project By:-Dangar Amit WRO number:-WRO0586791 ICAI NavasariDocumento24 páginasInitial Public Offering: Project By:-Dangar Amit WRO number:-WRO0586791 ICAI NavasariFenil RamaniAinda não há avaliações

- Impact of Foreign Exchange Reserves On Nigerian Stock MarketDocumento8 páginasImpact of Foreign Exchange Reserves On Nigerian Stock MarketAaronAinda não há avaliações

- Globalización Económica y Cadenas Globales de Valor Estadistica de Dinamarca-2013Documento27 páginasGlobalización Económica y Cadenas Globales de Valor Estadistica de Dinamarca-2013raul jonathan palomino ocampoAinda não há avaliações

- Business Statistics: A Decision-Making Approach: Analyzing and Forecasting Time-Series DataDocumento60 páginasBusiness Statistics: A Decision-Making Approach: Analyzing and Forecasting Time-Series DataNamitAinda não há avaliações

- Unit 15Documento89 páginasUnit 15aashiqjohnson1786Ainda não há avaliações

- The Incredible Shrinking Universe of StocksDocumento29 páginasThe Incredible Shrinking Universe of StocksErsin Seçkin100% (1)

- AEI's Political Report May 2011: The Latest Polls On Obama, The Military, and The EconomyDocumento6 páginasAEI's Political Report May 2011: The Latest Polls On Obama, The Military, and The EconomyAmerican Enterprise InstituteAinda não há avaliações

- 2003 Bosi-Giarda-Onofri OverviewBudgetPolicy WPDocumento22 páginas2003 Bosi-Giarda-Onofri OverviewBudgetPolicy WPAntonio Annicchiarico RenoAinda não há avaliações

- DeficitDocumento2 páginasDeficitlkjfdoiAinda não há avaliações

- Cci2000 CTCDocumento1 páginaCci2000 CTCSmatrou RouchamouxAinda não há avaliações

- LA8 - EnriqueGarcia Latin AmericaDocumento19 páginasLA8 - EnriqueGarcia Latin AmericaMOGABO1Ainda não há avaliações

- Fall Chinook Summary 1977 - To - 2015Documento1 páginaFall Chinook Summary 1977 - To - 2015Mark SherwoodAinda não há avaliações

- Green Economy & Trade: Industrial Policy: Challenges and OpportunitiesDocumento2 páginasGreen Economy & Trade: Industrial Policy: Challenges and OpportunitiesLida PinzonAinda não há avaliações

- Can We Get Rid of Palm OilDocumento3 páginasCan We Get Rid of Palm OiljaboerboyAinda não há avaliações

- SaezFig2 2007Documento1 páginaSaezFig2 2007WilliamAinda não há avaliações

- Long Run Correlations Money and Prices During HyperinflationsDocumento25 páginasLong Run Correlations Money and Prices During HyperinflationsYuliya KulikovaAinda não há avaliações

- Progress Toward Ending Polio and Withdrawing Oral Polio Vaccine Type 2Documento114 páginasProgress Toward Ending Polio and Withdrawing Oral Polio Vaccine Type 2uptpkm jeruklegiduaAinda não há avaliações

- The World Map of Political Conflicts: CONIAS Risk IntelligenceDocumento19 páginasThe World Map of Political Conflicts: CONIAS Risk IntelligenceFerrari MihailescuAinda não há avaliações

- LIMA PULUH TIGA MINYAK DAN GAS (HULUDocumento15 páginasLIMA PULUH TIGA MINYAK DAN GAS (HULUZenAinda não há avaliações

- Aborto e CancerDocumento7 páginasAborto e CancerLara MarianaAinda não há avaliações

- (15 Jan) Income Inequality in ASEAN Countries - by Rajah RasiahDocumento12 páginas(15 Jan) Income Inequality in ASEAN Countries - by Rajah Rasiahupnm 1378Ainda não há avaliações

- (Why) Should We Use SEM? Pros and Cons of Structural Equation ModelingDocumento22 páginas(Why) Should We Use SEM? Pros and Cons of Structural Equation ModelingSarah GracyntiaAinda não há avaliações

- Moeller Et Al. JFDocumento26 páginasMoeller Et Al. JFbenjaminAinda não há avaliações

- Wpiea2023218 Print PDFDocumento49 páginasWpiea2023218 Print PDFShuvankar JanaAinda não há avaliações

- Does Our Food Security Still Depend On The Rainfall?: September 2018Documento3 páginasDoes Our Food Security Still Depend On The Rainfall?: September 2018api-478747207Ainda não há avaliações

- Coaching in OrganisationsDocumento18 páginasCoaching in OrganisationsImpulsive collectorAinda não há avaliações

- Global Added Value of Flexible BenefitsDocumento4 páginasGlobal Added Value of Flexible BenefitsImpulsive collectorAinda não há avaliações

- KPMG CEO StudyDocumento32 páginasKPMG CEO StudyImpulsive collectorAinda não há avaliações

- Islamic Financial Services Act 2013Documento177 páginasIslamic Financial Services Act 2013Impulsive collectorAinda não há avaliações

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsDocumento5 páginasIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorAinda não há avaliações

- HayGroup Rewarding Malaysia July 2010Documento8 páginasHayGroup Rewarding Malaysia July 2010Impulsive collectorAinda não há avaliações

- Global Talent 2021Documento21 páginasGlobal Talent 2021rsrobinsuarezAinda não há avaliações

- Futuretrends in Leadership DevelopmentDocumento36 páginasFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- HayGroup Job Measurement: An IntroductionDocumento17 páginasHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDocumento4 páginasHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- Emotional or Transactional Engagement CIPD 2012Documento36 páginasEmotional or Transactional Engagement CIPD 2012Impulsive collectorAinda não há avaliações

- Stanford Business Magazine 2013 AutumnDocumento68 páginasStanford Business Magazine 2013 AutumnImpulsive collectorAinda não há avaliações

- Strategy+Business - Winter 2014Documento108 páginasStrategy+Business - Winter 2014GustavoLopezGAinda não há avaliações

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDocumento15 páginasHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaAinda não há avaliações

- Flexible Working Good Business - How Small Firms Are Doing ItDocumento20 páginasFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorAinda não há avaliações

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDocumento117 páginasCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Hay Group Guide Chart - Profile Method of Job EvaluationDocumento27 páginasHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- Compensation Fundamentals - Towers WatsonDocumento31 páginasCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- Megatrends Report 2015Documento56 páginasMegatrends Report 2015Cleverson TabajaraAinda não há avaliações

- Developing An Enterprise Leadership MindsetDocumento36 páginasDeveloping An Enterprise Leadership MindsetImpulsive collectorAinda não há avaliações

- Managing Conflict at Work - A Guide For Line ManagersDocumento22 páginasManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuAinda não há avaliações

- Strategy+Business Magazine 2016 AutumnDocumento132 páginasStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- HBR - HR Joins The Analytics RevolutionDocumento12 páginasHBR - HR Joins The Analytics RevolutionImpulsive collectorAinda não há avaliações

- 2016 Summer Strategy+business PDFDocumento116 páginas2016 Summer Strategy+business PDFImpulsive collectorAinda não há avaliações

- 2015 Summer Strategy+business PDFDocumento104 páginas2015 Summer Strategy+business PDFImpulsive collectorAinda não há avaliações

- Talent Analytics and Big DataDocumento28 páginasTalent Analytics and Big DataImpulsive collectorAinda não há avaliações

- Deloitte Analytics Analytics Advantage Report 061913Documento21 páginasDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorAinda não há avaliações

- 2012 Metrics and Analytics - Patterns of Use and ValueDocumento19 páginas2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorAinda não há avaliações

- IBM - Using Workforce Analytics To Drive Business ResultsDocumento24 páginasIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorAinda não há avaliações

- TalentoDocumento28 páginasTalentogeopicAinda não há avaliações

- CBT TestDocumento18 páginasCBT TestJulieBarrieAinda não há avaliações

- Building & Town Planning: Gtu Subject Code: 130603Documento21 páginasBuilding & Town Planning: Gtu Subject Code: 130603snehakhedekarAinda não há avaliações

- CAT FFM Course Notes PDFDocumento251 páginasCAT FFM Course Notes PDFMISS AYIEEN100% (1)

- BSN FON JIMS Final TestDocumento4 páginasBSN FON JIMS Final TestpriyaAinda não há avaliações

- Bus Org NotesDocumento37 páginasBus Org NotesHonorio Bartholomew ChanAinda não há avaliações

- Apple IphoneDocumento34 páginasApple IphoneShyrah SaiAinda não há avaliações

- Bader and Overton CompetitionDocumento4 páginasBader and Overton CompetitionJulien SiinoAinda não há avaliações

- Oral-COm WK 1Documento3 páginasOral-COm WK 1bernadette domoloanAinda não há avaliações

- Peril in Pinebrook COMPLETEDocumento22 páginasPeril in Pinebrook COMPLETEEdgardo Vasquez100% (1)

- M.Tech - Name of The Branch Seminar Presentation On "Study of Concrete Using Crumb Rubber With Partial Replacement of Fine Aggregate" Presented byDocumento17 páginasM.Tech - Name of The Branch Seminar Presentation On "Study of Concrete Using Crumb Rubber With Partial Replacement of Fine Aggregate" Presented byPrajay BhavsarAinda não há avaliações

- Orthodox Calendar 2020Documento76 páginasOrthodox Calendar 2020ECCLESIA GOC100% (2)

- BT EggplantDocumento13 páginasBT EggplantWencey Anne MallapreAinda não há avaliações

- TAPATI 2018 El Gran Festival de Rapa Nui - Imagina Isla de PascuaDocumento9 páginasTAPATI 2018 El Gran Festival de Rapa Nui - Imagina Isla de Pascuajiao cheAinda não há avaliações

- Elementis Selector Chart AdditiveDocumento14 páginasElementis Selector Chart AdditiveEugene Pai100% (1)

- Davino Lavin: Soul Binder 5 Hermit Humano VarianteDocumento4 páginasDavino Lavin: Soul Binder 5 Hermit Humano Variante123abcdefgAinda não há avaliações

- Aakash-Bhora-Surja-Taara TabDocumento7 páginasAakash-Bhora-Surja-Taara TabKanai SinghaAinda não há avaliações

- Eoir 33 Change of AddressDocumento2 páginasEoir 33 Change of Addressm.canodaciogluAinda não há avaliações

- Jaiswal 2015Documento18 páginasJaiswal 2015MalikAinda não há avaliações

- The Frog Prince (Modern)Documento5 páginasThe Frog Prince (Modern)Esteban PalacioAinda não há avaliações

- Ertyuikjrewdefthyjhertyujkreytyjthm VCDocumento2 páginasErtyuikjrewdefthyjhertyujkreytyjthm VCCedrick Jasper SanglapAinda não há avaliações

- Health LeadsDocumento42 páginasHealth LeadsJohnAinda não há avaliações

- Cirrus DwgsDocumento14 páginasCirrus DwgsRowan BirchAinda não há avaliações

- DBL PDFDocumento5 páginasDBL PDFfiatauroAinda não há avaliações

- MV SSI BRILLIANT Daily Report 04 - 12.11.2023Documento16 páginasMV SSI BRILLIANT Daily Report 04 - 12.11.2023DanielAinda não há avaliações

- Land Use and Zoning Plan for Proposed 30-Unit BedsitterDocumento1 páginaLand Use and Zoning Plan for Proposed 30-Unit BedsitterHoyi BepuAinda não há avaliações

- "Who Can Shave An Egg?" - Beckett, Mallarmé, and Foreign Tongues.Documento29 páginas"Who Can Shave An Egg?" - Beckett, Mallarmé, and Foreign Tongues.Aimee HarrisAinda não há avaliações

- Tiger Grass Pollen Remover Con Wood Working Machine-IRCHEDocumento50 páginasTiger Grass Pollen Remover Con Wood Working Machine-IRCHEchikret_1023000% (1)

- Will Jackson CV 2018 WebsiteDocumento1 páginaWill Jackson CV 2018 Websiteapi-25454723Ainda não há avaliações

- Editing ScriptsDocumento17 páginasEditing ScriptssisyololoAinda não há avaliações

- Beginners Method For Solving The 5x5 CubeDocumento2 páginasBeginners Method For Solving The 5x5 CubeVikrant Parmar50% (2)