Escolar Documentos

Profissional Documentos

Cultura Documentos

6 B80 CD 01

Enviado por

Hamza NoumanTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

6 B80 CD 01

Enviado por

Hamza NoumanDireitos autorais:

Formatos disponíveis

Asset Health

Management Report

Reliabilityweb.com Insight Series

Asset Management White Paper Series

www.reliabilityweb.com www.cmmscity.com www.maintenance.org Copyright 2012 Reliabilityweb.com. All rights reserved.

July 2012

Price: $399.00

This independent research was conducted and the

report written without commercial sponsorship.

We are pleased to gain the endorsement of the

enlightened sponsors listed below whose support will allow

us to distribute this report without cost to the reader

and conduct more important research in the future.

www.reliabilityweb.com www.uptmemagazine.com

www.cmmscity.com

www.maintenance.org

Supporting Organizations

Sponsoring Organizations

www.projetech.com www.predictveservice.com

www.ivctechnologies.com

www.ivara.com

3

Table of

Contents

Section A Executive Summary ............................ 5

Section B Strategy and Policy ............................. 7

Section C Asset Health ...................................... 12

Section D Structure ............................................ 15

Section E Communication ................................. 17

Section F Document Management ................... 19

Section G Training .............................................. 21

Section H Software............................................. 22

Section I Legal Aspects .................................... 25

Section J Data Integrity .................................... 26

Section K Auditing ............................................. 30

Section L Asset Lifecycle .................................. 32

Section M Tools Used in the Asset Health

Management Process ....................... 34

Section N Work Applications ............................ 36

Section O Sensors .............................................. 38

Section P Conclusions ...................................... 39

About the Author ................................ 41

4

Charts

Chart 1 Percent of Respondents by Maintenance Organization Size ................................5

Chart 2 Percent of Respondents by Major Industry Types ................................................6

Chart 3 Count of Respondents by Major Industry Types ..................................................6

Chart 4 The Existence of an Asset Health Management Strategy or Policy ......................7

Chart 5 Level of Strategy/Policy Use by Respondent Count ............................................7

Chart 6 Degree Strategy Actually Followed by Industry ...................................................8

Chart 7 Degree Policy Actually Followed by Industry .......................................................8

Chart 8 By Size Those Organizations Without an Asset Health Management

Strategy or Policy ................................................................................................9

Chart 9 By Industry Those Organizations Without an Asset Health Management

Strategy or Policy ..............................................................................................10

Chart 10 Level of Understanding and Support of Asset Health Management ...................10

Chart 11 Health Ranking by Asset Type ...........................................................................12

Chart 12 Health Ranking by Asset Type by Maintenance Organization Size .....................13

Chart 13 Dedicated Asset Health Management Organization ...........................................15

Chart 14 Asset Health Management Assigned Responsibility ..........................................15

Chart 15 Effectively and Efciently Communicate Asset Health Management ..................17

Chart 16 Effectively and Efciently Communicate by Industry ...........................................17

Chart 17 Percent Respondents Utilizing a MOC Process (two parts) ..............................19

Chart 18 Level of Asset Health Management Training Provided .......................................21

Chart 19 Supporting Software (SW) ................................................................................22

Chart 20 Asset Health Management Software (SW) by Industry ......................................23

Chart 21 The Legal Department Is Up to Date and Assures Legal Compliance ................25

Chart 22 Data Quality by Asset Type ...............................................................................26

Chart 23 Data Quality by Industry by Asset Type (ve parts) ............................................27

Chart 24 Audit Frequency ................................................................................................30

Chart 25 What is Done with the Audit Results .................................................................30

Chart 26 Level of Attention Applied to Asset Health Management During Stages

of the Assets Lifecycle .....................................................................................32

Chart 27 Reliability Tool Use ............................................................................................34

Chart 28 Tool Usage (0 to 25%) Only by Type .................................................................35

Chart 29 Level of Application of Asset Health Management Strategies ...........................36

Chart 30 Percent of Corrective Work Resulting from Conducting PM/PdM Activities ......37

Chart 31 Sensor Use as Part of the Asset Health Management Strategy ........................38

5

Asset health management can be defned as the practce of administering

disciplines aimed at ensuring the functonality of plant systems, equipment

and components to optmize performance relatve to plant safety,

environmental impact, product quality, plant productvity, reliability and

operatng costs. The key aspect of this defniton is its focus on plant

assets, whose ultmate health will most certainly dictate the ability of any

business to produce and survive.

This survey is a compilaton of responses to twenty-seven (27) questons by

three hundred and sixty-six (366) individuals representng thirty-three (33)

industry types and sizes. The informaton obtained, therefore, brings to

light a signifcant amount of informaton and insight about this very critcal

subject. In several charts, an Other column has been provided to show

reported data that falls outside the criteria being measured. Where an

Other column has been omited, it was because data of this nature was

not relevant to the chart in queston.

Readers should fnd the results both revealing and possibly as a tool to

increase the level of interest and commitment to improving asset health

management within their own organizatons. Conversely, for those

organizatons who are treatng asset health management with the correct

degree of focus, this document should reinforce the value and the positon

they hold as industry leaders.

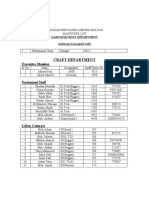

Chart 1 - Percent of Respondents by Maintenance Organizaton Size

13%

4%

6%

32%

45%

0%

10%

20%

30%

40%

50%

1000+ 750-1000 500-750 100 - 500 < 100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Maintenance Organization By Size

This chart depicts the range of responding maintenance organizatons, with

the vast majority being those with less than 500 employees. This range is

expected since plants with large maintenance organizatons are not the

norm.

Another aspect that will provide even more revealing informaton later in

this document is the respondent base by industry type. In the survey, there

A. Executive Summary

6

were thirty-three (33) industry types reported. Graphically representng

this large number did not reveal any signifcant trends due to the small

populaton within each type. However, many of the types were able to be

combined into larger, more general groupings. The results were nine (9)

major groups and one listed as Other a catch-all for those industries with

few representatves. Chart 2 indicates the populaton of the respondents

across the nine major categories and the Other category. It should be noted

that this categorizaton appears valid since the nine industry categories

represent approximately 70% of all the respondents.

Chart 2 - Percent of Respondents by Major Industry Types

4%

7%

5%

13%

17%

8%

5%

5%

3%

34%

0%

10%

20%

30%

40%

Consulting

Engr

Food

Beverage

Metals Mining Petro Chem Power

Gen

Pulp Paper Services Water

Wastewater

Other

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Maintenance Organization By Industry

Chart 3 - Count of Respondents by Major Industry Types

15

25

17

49

64

28

20

17

11

128

0

20

40

60

80

100

120

140

160

Consulting

Engr

Food

Beverage

Metals Mining Petro Chem Power

Gen

Pulp Paper Services Water

Wastewater

Other

C

o

u

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Maintenance Organization By Industry

7

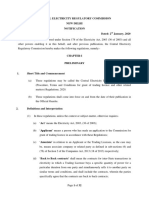

B. Strategy and Policy

Having a writen maintenance reliability asset health management strategy

and supportng policy are essental ingredients to success. Without this level

of guidance, there is litle hope that an aligned, consistent, well planned

and executed efort can truly be put into place. The charts that follow reveal

very interestng and somewhat eye-opening facts about the strategies and

policies of the respondents.

Chart 4 The Existence of an Asset Health Management Strategy or Policy

208

199

166

172

0

50

100

150

200

250

Strategy Policy

C

o

u

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Yes

No

The informaton presented in Chart 4 indicates a large percentage of

respondents that have neither a strategy nor a policy to address asset

health management related issues. For those frms that do not have

these elements in place, serious consideraton should be given to their

development; for without directon, success is virtually impossible.

Chart 5 Level of Strategy/Policy Use by Respondent Count

114

16

41

148

55

116

21

44

126

66

0 50 100 150 200 250

None Exists

Not Used

Infrequent Use

Partial Use

Continuous Use

Number of Respondents

Strategy

Policy

8

This chart drills down into those respondents who indicated that a strategy,

policy, or both were in place. It is one thing to have the elements, it is far

another to have them and use them to guide the asset health management

process. The informaton provided in Chart 5 is somewhat disturbing.

The number of respondents that have a strategy and policy but use it

infrequently or not at all, and those that do not have either of these

documents should raise a fag and energize organizatons to create and

utlize these tools.

Chart 6 - Degree Strategy Actually Followed by Industry

6. Strategy & Policy Non-Existence

Source Excel

Format axis 11B Calibri -> 0 to 50%

Labels 11 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

47%

40%

41%

61%

52%

68%

55%

65%

45%

53%

60%

59%

39%

48%

32%

45%

35%

55%

0%

20%

40%

60%

80%

100%

ConsulEng

Engr

Food

Beverage

Metals Mining Petro Chem Power

GeneraEon

Pulp Paper Services Water

Wastewater

P

e

r

c

e

n

t

a

g

e

o

f

R

e

s

p

o

n

d

e

n

t

s

ConUnuous / ParUally

Infrequent, Minimal or None Exists

Title Degree Strategy Actually Followed by Industry

6

Chart 7 - Degree Policy Actually Followed by Industry

7. Strategy & Policy Non-Existence

Source Excel

Format axis 11B Calibri -> 0 to 50%

Labels 11 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

47%

46%

41%

67%

58%

61%

48%

71%

55%

53%

54%

59%

33%

42%

39%

52%

29%

45%

0%

20%

40%

60%

80%

100%

ConsulEng

Engr

Food

Beverage

Metals Mining Petro Chem Power

GeneraEon

Pulp Paper Services Water

Wastewater

P

e

r

c

e

n

t

a

g

e

o

f

R

e

s

p

o

n

d

e

n

t

s

ConUnuous / ParUally

Infrequent, Minimal or None Exists

Title Degree Policy Actually Followed by Industry (ConEnuous / ParEal Use)

7

9

Contnuing with this very important aspect of asset health management,

Charts 6 and 7 display by industry the level of use or non-use of strategy

(Chart 6) and policy (Chart 7). The bars show: 1) contnuous or partal use,

and 2) infrequent, minimal or no use because the elements do not exist.

In the area of asset health management strategy, maintenance services in

mining, power generaton, and pulp and paper have the highest level of

use, while food and beverage, consultng, metals and water/wastewater

are on the low usage end. It is interestng to note that petrochemical, a

highly-regulated industry, shows the usage breakdown indicated.

In the area of policy use, the informaton is virtually the same by industry.

It is interestng to note those industries reportng low strategy use but

high policy use pulp and paper and water/wastewater. In these cases,

the strategy should be examined to make certain it aligns with the policy

to provide a consistent guidance and approach to the work.

Chart 8 By Size Those Organizatons Without an Asset Health

Management Strategy or Policy

55.8%

39.8%

43.5%

40.0%

33.3%

58.2%

38.7%

37.5%

26.7%

22.4%

0.0% 20.0% 40.0% 60.0% 80.0% 100.0%

<100

100-500

500-750

750-1000

1000+

Percentage of Respondents

P

l

a

n

t

S

i

z

e

"No" Strategy

"No" Policy

Chart 8 looks at strategy and policy based on the size of the maintenance

organizaton. The informaton shown indicates that the smaller the

organizaton, the less likely they are to have an asset health management

strategy or policy in place. This presents an opportunity for small

organizatons that do not have these elements in place. Asset health

management is not a size issue. It is important for all plant sizes to have

asset health and the resultant benefts it provides.

10

Chart 9 By Industry Those Organizatons Without an Asset Health

Management Strategy or Policy

53%

54%

53%

40%

42%

50%

55%

41%

55%

53%

48%

59%

35%

42%

32%

55%

41%

64%

0% 20% 40% 60% 80% 100%

Consulting /

Engr

Food &

Beverage

Metals

Mining

Petro / Chem

Power

Generation

Pulp Paper

Services

Water /

Wastewater

Percentage of Respondents

"No" Strategy

"No" Policy

Chart 9 looks at those organizatons that do not have a strategy or policy in

place by industry. The informaton provided here is a clear indicaton that

an opportunity exists across all industry types to develop these elements in

support of asset health and the reliable operaton that asset health provides.

Chart 10 Level of Understanding and Support of Asset Health Management

10%

30%

25%

12%

10%

13%

13%

2%

13%

23%

35%

14%

0% 10% 20% 30% 40%

No System in Place

No Support

Little Support

Awareness in Progress

Intermittent

Fully Support

Percent Respondents

Mgt Support

Hourly Support

Chart 10 looks across the entre respondent base at the level of

understanding and support of the asset health management system, both

by management and hourly workforce. Full support among either group is

very low. The management level of understanding and support between

fully support and awareness is encouraging. On the other hand, the low

level of understanding and support among the hourly workforce should

raise concern. Afer all, the hourly mechanics are the ones performing

maintenance on the equipment and for this reason, they should understand

and support the value obtained from asset health.

11

Insights

Charts 4 through 10 serve to raise a series of

issues that need to be addressed to improve the

foundatonal level of asset health management.

Where a strategy or policy does not exist,

one needs to be developed.

When developed, they need to be

deployed and communicated to the

organizaton in a manner that promotes

understanding and support.

Once deployed, they need to be followed. Training

will be required to accomplish this task.

Auditng needs to be in place to ensure the strategy

and policy are followed and, if not, correctve acton is

implemented to close any performance gaps that may exist.

12

C. Asset Health

Chart 11 Health Ranking by Asset Type

0.0%

20.0%

40.0%

60.0%

Very Healthy Healthy Reasonable Sick Very Sick

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Asset Health Level

Stationary

Machinery

Instrument

Electrical

Infrastructure

Chart 11 answers the queston of asset health by major equipment type.

The respondents were asked to rate each major equipment type in one of

the fve categories shown on the x-axis of the chart. The major equipment

types were all rated healthy, which is a positve indicaton. Infrastructure

(ofce buildings, storage and staging areas, structural steel, roads, fencing,

sidewalks, etc.) was rated in the reasonable category, ofset from the

other major asset types. This is obviously a common experience for the

respondents since when budgets are cut, infrastructure sufers at the

expense of the operatng equipment.

While this approach is ofen commonplace, it isnt in the best interest of the

business since many of these problems, when lef to deteriorate, can cause

equipment-related problems as well as safety and environmental issues.

13

Charts 12 - Health Ranking by Asset Type by Maintenance Organizaton Size

12. Health Ranking by Asset Type

Source ST Excel le

Format axis 11B Calibri -> 0 to 50%

Labels 11 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

Title Health Ranking by Asset Type by Size

59%

53%

75%

52%

48%

33%

40%

17%

37%

36%

9%

7% 8%

11%

16%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

StaEonary

65%

53%

79%

53%

50%

31%

47%

17%

36%

33%

4%

0%

4%

12%

17%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Machinery

Instrument

56%

87%

54%

50%

52%

40%

7%

38%

36%

33%

4%

7%

8%

13%

15%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

56%

60%

67%

46%

50%

38%

40%

21%

38%

29%

6%

0%

13%

16%

20%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Electrical

Very Healthy to Healthy Reasonable Sick to Very Sick

Statonary

12. Health Ranking by Asset Type

Source ST Excel le

Format axis 11B Calibri -> 0 to 50%

Labels 11 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

Title Health Ranking by Asset Type by Size

12

59%

53%

75%

52%

48%

33%

40%

17%

37%

36%

9%

7% 8%

11%

16%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

StaEonary

65%

53%

79%

53%

50%

31%

47%

17%

36%

33%

4%

0%

4%

12%

17%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Machinery

Instrument

56%

87%

54%

50%

52%

40%

7%

38%

36%

33%

4%

7%

8%

13%

15%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

56%

60%

67%

46%

50%

38%

40%

21%

38%

29%

6%

0%

13%

16%

20%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Electrical

31%

47%

42% 41%

34%

48%

53%

46%

37%

43%

21%

0%

13%

22%

23%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Infrastructure

Very Healthy to Healthy

Reasonable

Sick to Very Sick

Electrical

Machinery

12. Health Ranking by Asset Type

Source ST Excel le

Format axis 11B Calibri -> 0 to 50%

Labels 11 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

Title Health Ranking by Asset Type by Size

12

59%

53%

75%

52%

48%

33%

40%

17%

37%

36%

9%

7% 8%

11%

16%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

StaEonary

65%

53%

79%

53%

50%

31%

47%

17%

36%

33%

4%

0%

4%

12%

17%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Machinery

Instrument

56%

87%

54%

50%

52%

40%

7%

38%

36%

33%

4%

7%

8%

13%

15%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

56%

60%

67%

46%

50%

38%

40%

21%

38%

29%

6%

0%

13%

16%

20%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Electrical

31%

47%

42% 41%

34%

48%

53%

46%

37%

43%

21%

0%

13%

22%

23%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Infrastructure

Very Healthy to Healthy

Reasonable

Sick to Very Sick

12. Health Ranking by Asset Type

Source ST Excel le

Format axis 11B Calibri -> 0 to 50%

Labels 11 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

Title Health Ranking by Asset Type by Size

12

59%

53%

75%

52%

48%

33%

40%

17%

37%

36%

9%

7% 8%

11%

16%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

StaEonary

65%

53%

79%

53%

50%

31%

47%

17%

36%

33%

4%

0%

4%

12%

17%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Machinery

Instrument

56%

87%

54%

50%

52%

40%

7%

38%

36%

33%

4%

7%

8%

13%

15%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

56%

60%

67%

46%

50%

38%

40%

21%

38%

29%

6%

0%

13%

16%

20%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Electrical

31%

47%

42% 41%

34%

48%

53%

46%

37%

43%

21%

0%

13%

22%

23%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Infrastructure

Very Healthy to Healthy

Reasonable

Sick to Very Sick

14

Infrastructure

Instrument

Chart 12 is a representaton of asset health by asset type and maintenance

organizaton size. There is litle diferentaton in asset health by asset type

by organizaton size except when one looks at the levels of sick and very sick

for plants with less than 100 maintenance employees. For every asset type,

the level of unhealthiness increases for this organizaton size. An opportunity

exists for these frms to understand and correct these phenomena.

12. Health Ranking by Asset Type

Source ST Excel le

Format axis 11B Calibri -> 0 to 50%

Labels 11 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

Title Health Ranking by Asset Type by Size

12

59%

53%

75%

52%

48%

33%

40%

17%

37%

36%

9%

7% 8%

11%

16%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

StaEonary

65%

53%

79%

53%

50%

31%

47%

17%

36%

33%

4%

0%

4%

12%

17%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Machinery

Instrument

56%

87%

54%

50%

52%

40%

7%

38%

36%

33%

4%

7%

8%

13%

15%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

56%

60%

67%

46%

50%

38%

40%

21%

38%

29%

6%

0%

13%

16%

20%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Electrical

31%

47%

42% 41%

34%

48%

53%

46%

37%

43%

21%

0%

13%

22%

23%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Infrastructure

Very Healthy to Healthy

Reasonable

Sick to Very Sick

12. Health Ranking by Asset Type

Source ST Excel le

Format axis 11B Calibri -> 0 to 50%

Labels 11 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

Title Health Ranking by Asset Type by Size

12

59%

53%

75%

52%

48%

33%

40%

17%

37%

36%

9%

7% 8%

11%

16%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

StaEonary

65%

53%

79%

53%

50%

31%

47%

17%

36%

33%

4%

0%

4%

12%

17%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Machinery

Instrument

56%

87%

54%

50%

52%

40%

7%

38%

36%

33%

4%

7%

8%

13%

15%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

56%

60%

67%

46%

50%

38%

40%

21%

38%

29%

6%

0%

13%

16%

20%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Electrical

31%

47%

42% 41%

34%

48%

53%

46%

37%

43%

21%

0%

13%

22%

23%

0%

20%

40%

60%

80%

100%

1000+ 750-1000 500-750 100 -500 <100

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Infrastructure

Very Healthy to Healthy

Reasonable

Sick to Very Sick

15

D. Structure

Chart 13 - Dedicated Asset Health Management Organizaton

73%

12%

16%

0%

20%

40%

60%

80%

100%

Yes No Not Applicable

P

e

r

c

e

n

t

R

e

s

p

o

n

d

e

n

t

s

Chart 14 - Asset Health Management Assigned Responsibility

5%

9%

12%

12%

16%

46%

0% 10% 20% 30% 40% 50% 60%

Outside Maint. /

Engr

Engineering

Senior Leadership

Not Assigned

Divided

Inside Maint. /

Engr.

Percent Respondents

Charts 13 and 14 address themselves to the asset health management

structure. It is interestng to note that 73% of the respondents reported

a structure in place with responsibility for the health and reliability of

the plants assets. It is also interestng to note that almost 50% of the

respondents identfed the maintenance reliability organizaton as the ones

responsible for asset health.

16

Insights

There is a disconnect between the high

percentage of organizatons with a dedicated

asset health management structure and the

seemingly few with asset health management

strategies and policies in place.

Without additonal informaton, factual

conclusions derived from this data are not

possible. However, it is possible that there

is a great focus on reliability and health of

individual assets as indicated in Charts 11 and

12, but without the overriding strategy and policy. This

possibility bears some examinaton. If this is the case, then

there is work being conducted without standardizaton and

broad oversight. While keeping assets healthy in this manner

is commendable, it doesnt promote standardizaton and long-

term sustainability.

17

E. Communication

Chart 15 Efectvely and Efciently Communicate Asset Health

Management

34%

49%

17%

0%

20%

40%

60%

80%

100%

Yes No Not Applicable

P

e

r

c

e

n

t

R

e

s

p

o

n

d

e

n

t

s

Chart 16 - Efectvely and Efciently Communicate By Industry

13%

8%

18%

17%

13%

14%

19%

12%

27%

40%

56%

53%

58%

59%

57%

29%

53%

45%

47%

36%

29%

25%

28%

29%

52%

35%

27%

0% 20% 40% 60% 80% 100%

Consulting / Engr

Food & Beverage

Metals

Mining

Petro / Chem

Power Generation

Pulp Paper

Services

Water / Wastewater

Percent Respondents

Yes

No

NA

Charts 15 and 16 address communicaton of the asset health management

process. Clearly, a much larger percentage of respondents do not do an

adequate job of communicatng this vital topic, or they simply dont have

the process in place to communicate efectvely. The only industries that are

an excepton to this are pulp and paper, and consultng.

18

Insights

Communicaton is a vital component of the

asset health management efort. Without

delivery of informaton about the process -

why it is important and how each individual

can contribute - there will be a lack of

understanding and ultmate misdirecton

or process failure. Clearly, there is an

opportunity for organizatons: 1) to

improve communicaton about this subject,

or 2) if they do not have an asset health

management process, to create one and

communicate that informaton to the organizaton.

19

F. Document Management

(Management of Change - MOC)

Chart 17 (two parts) Percent Respondents Utlizing a MOC Process

53%

47%

0%

20%

40%

60%

80%

100%

Yes No

P

e

r

c

e

n

t

R

e

s

p

o

n

d

e

n

t

s

30%

55%

15%

0%

20%

40%

60%

80%

100%

Consistent Use Inconsistent Use Not Used

P

e

r

c

e

n

t

R

e

s

p

o

n

d

e

n

t

s

The two-part Chart 17 indicates the lack of a management of change (MOC)

process, as reported by the majority of the respondents. In fact, only 53% or

195, reported having a process in place, and of that number, only 30% or 60,

reported using it in a consistent manner. An MOC process is a foundatonal

element of any successful asset health management efort.

A.

B.

20

Insights

From the inital installaton of an asset into

the manufacturing process to the day it is

decommissioned, many changes take place.

How the asset is applied to the process,

what predictve or preventve strategies

are employed, how it is maintained, what

parts are used for its repair and many

other aspects are changed that ultmately

afect the asset and its performance.

For this reason, a management of change

process (MOC) is required. This process includes a

review before the change is made, documentaton of what

changes are made, training of the organizaton so the changes

are included in the work process, and addressing the changes

in the operaton and maintenance of the asset. Failure to

have this documentaton in place can lead to safety, reliability,

environmental and producton problems, all of which we want

to avoid. There is a huge opportunity for improvement in this

area.

21

G. Training

Chart 18 Level of Asset Health Management Training Provided

5%

30%

35%

14%

15%

0% 20% 40% 60%

Extensive

Periodic

Limited

None

No System

Percent Respondents

Chart 18 addresses the subject of training. Only 35% of the respondents

conducted periodic to extensive training on the topic of asset health

management. The remainder only conducted limited training (35%) or none

(29%), since they either do not do it or do not have a program in place.

Insights

Periodic training can have a measurable impact

on asset health management performance and

botom line proft.

Ongoing periodic training benefts include:

Staf retenton;

Improved productvity;

Lower maintenance costs;

Increased safety;

Increased compettveness.

People enter and leave the workforce, as well as change jobs.

In additon, a topic such as asset health management should

have a periodic refresher so its importance is part of everyones

reliability awareness. Therefore, periodic training should be

the norm, not the excepton. This lack of training among the

majority of the respondents certainly has an impact on their

understanding and support of the efort (reference Chart 10).

22

H. Software (SW) Supporting

the Analysis of Asset

Health Management Data

Chart 19 Supportng Sofware (SW)

3%

14%

17%

16%

33%

0% 10% 20% 30% 40%

Other

No SW for Need

SW Lacking

SW Insufficient

Needed

SW Exists

Percent Respondents

Chart 19 indicates that only 33% of the respondents felt they had the

required sofware to support the analysis of the asset health management

data provided. An important aspect of any asset health management system

is the data acquired, the analysis undertaken and the correctve acton

applied to assets that are becoming less than healthy.

23

Chart 20 Asset Health Management Sofware (SW) by Industry

20 Sojware by Industry Source Terry

Format axis 8B Calibri

Labels 8 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

12%

12%

20%

12%

44%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

12%

6%

35%

18%

29%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

11%

18%

18%

11%

42%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

9%

27%

20%

20%

23%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

22%

11%

26%

11%

30%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

19%

14%

0%

10%

57%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

Food and Beverage

Metals

Mining

Petro-Chemical

Power GeneraEon

Pulp and Paper

13%

7%

13%

20%

47%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

9%

9%

18%

9%

55%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

ConsulEng / Engineering

Water / Wastewater

21

20 Sojware by Industry Source Terry

Format axis 8B Calibri

Labels 8 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

12%

12%

20%

12%

44%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

12%

6%

35%

18%

29%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

11%

18%

18%

11%

42%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

9%

27%

20%

20%

23%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

22%

11%

26%

11%

30%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

19%

14%

0%

10%

57%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

Food and Beverage

Metals

Mining

Petro-Chemical

Power GeneraEon

Pulp and Paper

13%

7%

13%

20%

47%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

9%

9%

18%

9%

55%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

ConsulEng / Engineering

Water / Wastewater

21

20 Sojware by Industry Source Terry

Format axis 8B Calibri

Labels 8 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

12%

12%

20%

12%

44%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

12%

6%

35%

18%

29%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

11%

18%

18%

11%

42%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

9%

27%

20%

20%

23%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

22%

11%

26%

11%

30%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

19%

14%

0%

10%

57%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

Food and Beverage

Metals

Mining

Petro-Chemical

Power GeneraEon

Pulp and Paper

13%

7%

13%

20%

47%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

9%

9%

18%

9%

55%

0% 10% 20% 30% 40% 50% 60%

No SW for Need

SW Lacking

Acquiring

SW Insucient

Needed

SW Exists

Percent Respondents

ConsulEng / Engineering

Water / Wastewater

21

24

Chart 20 drills down with further detail as to which industries felt they

did or did not have the requisite sofware to support their asset health

management eforts. Thirty percent (30%) or less of the respondents in the

petrochemical, metals and power generaton areas reported having the

needed sofware. In all of the other industries, under 60% of the respondents

reported having the required sofware in place. The low percentage of

respondents in all areas points to the need for improvement because, in

most cases, asset health management supportng sofware is a critcal part of

the overall process.

Insights

Without analysis and resultant correctve acton,

assets can easily move from the inital signs of

health problems to those of catastrophic failure

with all of the corresponding consequences.

Computerized maintenance management

systems (CMMSs) are typically designed

with work management functons as their

primary component, however many now

on the market go beyond that and have the

capability of doing asset health management

analysis. Use of these tools should be applied to this

process. Furthermore, if the CMMS does not provide

these capabilites, the organizaton should consider acquiring

sofware that does provide this level of support. Afer all, what

is the value of having the data if it cant be converted into useful

informaton?

The queston that was not asked in the survey was: Is the

sofware efectvely and efciently used? This is a queston that

everyone should ask themselves. If the answer is no, then there

is an opportunity to make beter use of the existng tools and

hence, an improvement in asset health and its related decision-

making process.

25

I. Legal Aspects

Chart 21 The Legal Department Is Up to Date and Assures Legal Compliance

28%

46%

26%

0%

20%

40%

60%

Yes No No System

P

e

r

c

e

n

t

R

e

s

p

o

n

d

e

n

t

s

This chart indicates that the majority of respondents felt their legal

organizatons were not up to date (46%) or a system did not exist (26%) to

support the asset health management efort. An interestng perspectve that

was not acquired was the opinion of the legal organizatons. Having both

would be interestng, however, the perspectve of those needing this support

and not believing that it is available is telling.

Insights

Asset failure has the potental for a multtude of

adverse organizatonal impacts, such as safety,

reliability, environmental, reputaton and

producton. Diferent industries ofen have

diferent regulatons, but nevertheless, the

legal aspects ofen drive and support the

development of asset health management

systems that possibly would not be funded

otherwise. Therefore, it is very important that

those with legal responsibilites within an organizaton

be cognizant of the regulatons, as well as how they are

applied in the feld. Gaps between legal requirements and

feld applicatons need to be identfed and closed to prevent

future problems. Chart 21 shows that there are opportunites

for improvement in this area.

One additonal item of importance is that gaps in this area

can also have a signifcant impact on insurance coverage and

the related rates since they will be examined closely by the

insurance carriers.

26

J. Data Integrity

(The Quality of the Data)

Chart 22 - Data Quality by Asset Type

38%

50%

41%

42%

25%

31%

22%

32%

28%

45%

0%

10%

20%

30%

40%

50%

60%

Stationary Machinery Instrument Electrical Infrastructure

P

e

r

c

e

n

t

R

e

s

p

o

n

d

e

n

t

s

Excellent - Good

Poor - Very Poor

Chart 22, a composite view of all respondents, along with the fve-part Chart

23 which shows data quality by industry by asset type, show the two ends of

the data quality spectrum excellent and good versus poor and very poor.

The middle set of data the average data quality statstc which in most cases

was about 30% has been omited. While the average statstc is important,

the quality at the opposing ends of the data quality spectrum is of greater

importance.

Chart 22 shows that the quality of asset data has room for improvement.

Machinery is the highest and that would be expected due to the large

emphasis placed on the reliability of this equipment.

From what was learned in several prior charts, the level of infrastructure

data quality is extremely low. This is possibly due to the fact that not as

much atenton is placed here when compared to the equipment driving

the manufacturing process. Another less obvious reason may be that many

computerized maintenance management systems do not have the ability to

easily track plant infrastructure assets.

27

Chart 23 - Data Quality by Industry by Asset Type (fve parts)

23A - Statonary

23. Data Quallity StaEonary (VG/G vs. P/VP)

Source Terry

Format axis 11B Calibri

Labels 11 not bold

Bar gap = 100

Axis color black size 1.5

Grid mid gray /dashed

42%

35%

30%

18%

29%

20%

48%

24%

36%

21%

28%

35%

36%

37%

40%

41%

53%

54%

0% 10% 20% 30% 40% 50% 60% 70% 80%

Pulp Paper

ConsulEng / Engr

Petro / Chem

Water /

Wastewater

Mining

Food & Beverage

Metals

Services

Power GeneraEon

Percent Respondents

Excellent - Good

Poor - Very Poor

24

23B - Machinery

22%

12%

21%

35%

20%

30%

25%

12%

18%

43%

48%

48%

50%

50%

53%

57%

59%

64%

0% 10% 20% 30% 40% 50% 60% 70% 80%

Petro / Chem

Food & Beverage

Mining

Consulting / Engr

Pulp Paper

Metals

Power Generation

Services

Water /

Wastewater

Percent Respondents

Excellent - Good

Poor - Very Poor

28

23C - Instrument

32%

28%

36%

40%

38%

29%

30%

35%

32%

24%

30%

33%

40%

44%

47%

47%

50%

64%

0% 10% 20% 30% 40% 50% 60% 70% 80%

Food & Beverage

Petro / Chem

Mining

Pulp Paper

Metals

Power Generation

Services

Consulting / Engr

Water /

Wastewater

Percent Respondents

Excellent - Good

Poor - Very Poor

23D - Electrical

20%

30%

30%

29%

30%

18%

36%

36%

18%

24%

35%

39%

44%

45%

45%

50%

53%

59%

0% 10% 20% 30% 40% 50% 60% 70% 80%

Food & Beverage

Petro / Chem

Mining

Power Generation

Pulp Paper

Water /

Wastewater

Consulting / Engr

Metals

Services

Percent Respondents

Excellent - Good

Poor - Very Poor

29

23E - Infrastructure

50%

28%

60%

49%

36%

43%

24%

46%

50%

17%

20%

20%

24%

27%

29%

29%

36%

38%

0% 10% 20% 30% 40% 50% 60% 70% 80%

Mining

Food & Beverage

Pulp Paper

Petro / Chem

Water /

Wastewater

Consulting / Engr

Services

Power Generation

Metals

Percent Respondents

Excellent - Good

Poor - Very Poor

Each of the above fve charts shows by industry where asset data integrity is

in good shape or not so good shape. Clearly, there is room for improvement,

especially in the area of the infrastructure data.

Insights

Each respondents organizaton should use this

informaton to make a case for improving the

accuracy and completeness of their asset

data. While average data health is not

included in the charts, average is not good

enough and needs to be addressed along

with the data rated poor or very poor.

Actvites that should be considered as part of the

data cleansing/upgrade process include:

Detailed review and data update by asset;

Connectng the management of change process to the data

integrity efort;

Providing work processes that maintain data accuracy;

Developing communicaton and awareness eforts;

Upgrading access to the informaton in support of tmely

business decisions.

The important point to remember is that this data becomes

the informaton that is used by the organizaton to drive

the reliability decision-making process. Bad data yields bad

informaton which, in turn, yields fawed decisions that can be

costly in many shapes and forms.

30

K. Auditing

Chart 24 - Audit Frequency

21%

24%

8%

24%

24%

0% 20% 40%

No System

None

Planned (Future)

Irregular

Periodic

Percent Respondents

Chart 25 - What Is Done with the Audit Results

13%

26%

27%

34%

0% 20% 40%

No Action

Identified - Not

Always Acted Upon

Action Taken - Not Priority

Immediate Action

Percent Respondents

Auditng and the correctve acton taken to correct performance gaps are

critcal aspects of an asset health management system. Clearly, Charts 24 and

25 demonstrate that this process is lacking to some degree in 75% of those

responding to this survey. Performing an asset health management audit

does not require a great deal of efort, but it is an essental ingredient.

31

Insights

It is commendable for an organizaton

to develop and deploy an asset health

management system. However, as with any

change, close monitoring is required if one is

to be assured that what was implemented

is in fact working as an integral part of

the maintenance reliability process. This is

where auditng is required. By conductng

audits of the asset health management system,

areas where conformance to the plan and correctve acton is

necessary can be identfed.

However, auditng is only half of the efort. Timely correctve

acton to rectfy performance gaps is also required. By taking

tmely correctve acton, the organizaton can immediately

correct problems before they get worse. In additon, and

of even greater importance, is that auditng and correctve

acton clearly demonstrate to the organizaton the

importance placed on this work by the leadership team and

others involved.

32

L. Asset Lifecycle

Chart 26 Level of Atenton Applied to Asset Health Management During

Stages of the Assets Lifecycle

Chart 26 (in tabular format) describes the level of atenton or inatenton

paid to asset health management at the various stages of an assets lifecycle.

They have been categorized as follows:

Green Border High level of atenton placed on this stage of an assets

lifecycle.

Orange Border Average level of atenton.

Red Border Level of atenton indicates an opportunity for improvement.

As expected, the area of Operate/Maintain received a high (average to

excellent/good) level of atenton 84% of the respondents.

What is very interestng are the low levels of asset health management

atenton reported during the Design/Specify and Purchasing stages. This

may be because engineering does not typically include the maintenance

organizaton in this phase of the work; an oversight that can potentally cause

problems during the operate/maintain phase.

The other stage of inatenton, Decommissioning, is another opportunity

area. Many organizatons may not realize they have legal responsibility for

assets even afer decommissioning. Increased atenton at this stage may

help eliminate problems at a later date.

Design

Specify

Purchasing Install Commission

Operate

Maintain

Modify

Upgrade

Decommission

Excellent

Good

31% 20% 36% 35% 46% 36% 12%

Average 32% 36% 40% 39% 38% 36% 31%

Poor

Very Poor

31% 37% 21% 21% 12% 25% 37%

N/A 6% 7% 5% 5% 4% 4% 20%

33

Insights

It is essental that asset health management be

an integral part of each phase of the assets

lifecycle. Omitng this very important

component at any stage has the potental

for causing difcultes later on in the life of

the asset.

It is typical in many organizatons for

maintenance to play a limited role in the

design/specifcaton efort and subsequently when the

asset is purchased. All too ofen, maintainability items are

overlooked due to this lack of involvement. Organizatons

with good to excellent asset health and resultant reliability

include maintenance and garner valuable design insight

that would otherwise be missed.

The installaton and commissioning phases have slightly

more maintenance involvement than do the two prior stages.

This involvement adds value because alteratons stll can

be accomplished during this phase to improve the ultmate

health of the assets being installed. The problem is that

installaton and commissioning eforts are usually on a tght

tme frame and any major problems uncovered may not be

remedied in the tme available.

The Operate/Maintain stage has 84% of the respondents

statng their atenton in this area is good to excellent. This

response is expected since this stage is where the equipment

is actually operated and maintained. The problem is that this

area of the lifecycle is strongly afected by the prior stages.

If proper atenton is not placed on the prior stages, there is

likelihood that the Operate/Maintain stage may be fraught

with problems.

The Modify/Upgrade stage of the lifecycle also has a high

degree of atenton placed on asset health. This is very

important because without this focus, changes and/or

modifcatons could be made that, while on the surface are

improvements, in actuality may not serve the best interests

of the producton environment of which the asset is a part.

Questons that should be asked and answered by those who

ranked their involvement in this stage as high are, Do they

have a fully functonal MOC process and, if not, how can they

expect to provide adequate atenton to modifcatons and

upgrades?

Also of note is the low level of atenton in the

decommissioning stage. Ofen, assets that are taken out of

service are abandoned in place or sold as used equipment.

Each of these carries with it certain organizatonal and legal

responsibilites to ensure that if they are reused, internally or

externally, the assets are not in an unhealthy conditon that

could cause the new users serious problems.

34

Chart 27 - Reliability Tool Use

14%

32%

54%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

FMEA

27. Use of Tools CompliaEon

Source Excel

24%

31%

45%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Asset Health Report

38% 38%

24%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Std Op Plans

22%

43%

35%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

PM OpUmum

30%

44%

27%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Pre-Plans

21%

35%

44%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

RCFA

22%

29%

49%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Risk Analysis

32

The above charts fall into two distnct

categories, those associated with asset

predictve and preventve maintenance

eforts PM optmizaton, FMEA, RCFA,

Risk Analysis and Asset Health Reportng,

and those that are related to the actual

maintenance actvites performed on the

assets Pre-Plans and Standard Operatng

Plans.

M. Tools Used in the Asset

Health Management

Process

14%

32%

54%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

FMEA

27. Use of Tools CompliaEon

Source Excel

24%

31%

45%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Asset Health Report

38% 38%

24%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Std Op Plans

22%

43%

35%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

PM OpUmum

30%

44%

27%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Pre-Plans

21%

35%

44%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

RCFA

22%

29%

49%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Risk Analysis

32

14%

32%

54%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

FMEA

27. Use of Tools CompliaEon

Source Excel

24%

31%

45%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Asset Health Report

38% 38%

24%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Std Op Plans

22%

43%

35%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

PM OpUmum

30%

44%

27%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Pre-Plans

21%

35%

44%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

RCFA

22%

29%

49%

0%

20%

40%

60%

80%

100%

75 to 100% 25 to 75% 0 to 25%

Risk Analysis

32

35

Chart 28 Tool Usage (0 to 25 %) Only by Type

54%

49%

45%

44%

35%

27%

24%

0%

20%

40%

60%

80%

100%

FMEA Risk

Analysis

Asset Health

Reporting

RCFA PM

Optimization

Pre-Plans Std

Operating

Plans

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

0 to 25% Tool Focus

Chart 28 points out a very interestng fact about the low usage levels of the

diferent types of asset health management tools. Clearly, the two identfed

as maintenance-related appear to have a higher usage level than the others,

yet approximately 25% of the responding organizatons dont use these tools,

which are usually an integral part of their CMMS.

The other tools also have associated sofware, but they are more ofen

stand-alone, requiring separate purchase, training and deployment.

Nevertheless, the low level of use points to the major opportunity for

improvement of the asset health management system if these tools were

adopted as an integral part of the maintenance reliability efort.

Insights

There is a low level of use in the 75% to

100% range across all tool types, with the

maintenance types being slightly higher.

One could conclude from Charts 27 and 28

that there is opportunity in all the asset

health management tool areas. It would be

expected that as a strategy and policy were

developed and followed, improved use of

these tools would follow.

36

N. Work Applications

Chart 29 Level of Applicaton of Asset Health Management Strategies

71%

18%

7%

3%

2%

32%

39%

19%

9%

1%

43%

27%

18%

10%

2%

0%

20%

40%

60%

80%

100%

0-20% 21-40% 41-60% 61-80% 81-100%

P

e

r

c

e

n

t

o

f

R

e

s

p

o

n

d

e

n

t

s

Percent Time

PdM

PM

Reactive

Chart 29 shows three asset health management profles predictve

maintenance (PdM), preventve maintenance (PM) and reactve maintenance

by the percent that each is a part of the respondents work strategy. This

chart paints a picture that, when considered in detail, shows the strategies of

those responding have room for improvement.

The PdM profle in blue shows a low level of PdM strategies applied to the

maintenance work efort, indicated by the fact that 89% of those responding

employ this strategy less than 40% of the tme. Organizatons with a

signifcant asset health management focus would be expected to apply a

higher percentage to this approach.

The PM profle, shown in brown, shows 71% with PM strategies less than

40% of the maintenance work efort. This is similar to PdM, but more skewed

to the 21% to 40% range. This range is not out of line with what would be

expected of a functoning PM program.

The Reactve Maintenance profle, shown in green, shows 70% of the

respondents with this strategy in place less than 40% of the tme. This

amount of tme in this range for reactve maintenance is satsfactory, but it

should increase with a greater asset health management focus.

37

Chart 30 Percent of Correctve Work

Resultng from Conductng PM/PdM Actvites

72%

68%

70%

60%

65%

28%

32%

30%

40%

35%

0% 20% 40% 60% 80% 100%

Infrastructure

Electrical

Instrument

Machinery

Stationary

Number of Respondents

Greater Than 50%

Less Than 50%

The express value of preventve (PM) and predictve (PdM) work are the

correctve tasks that result from identfying potental problems and being

able to fx them before they become serious threats to the assets health.

Chart 30 shows the percent of respondents who identfed correctve

work greater than 50% (blue) and those less than 50% (gray). Tying this

to Chart 29, which indicates low PM/PdM eforts, there is opportunity for

improvement in not only conductng the PM/PdM tasks, but performing

correctve acton as a result.

38

O. Sensors

Chart 31 Sensor Use as Part of the Asset Health Management Strategy

8%

33%

41%

43%

53%

54%

59%

64%

72%

73%

78%

79%

84%

86%

0% 20% 40% 60% 80% 100%

Other

PI

DCS

Motor Analysis

NTD Inspection

Ultrasound

Flow

Pressure

Operator Rounds

Infrared

Temperature

Oil / Fluid Analysis

Vibration

Visual

Percent Respondents

Chart 31 indicates considerable use of the various means of detectng

potental asset problems. These results seem to be both a beneft to those

organizatons that use these monitoring methods and an opportunity to do

more with them.

On its own, this chart would seem to indicate a high level of atenton paid

towards protectng the health of the plants assets. Unfortunately, many of

the other charts presented in this survey point to a far diferent conclusion

about respondents atenton to asset health.

Insights

It is clear that those who responded to this

survey have many of the tools in place (Chart

31), yet the level of atenton to asset health

management is not as robust as it could

be if the strategies and related tools were

applied.

39

P. Conclusions

The 2012 Asset Health Management Survey provided here indicates that

in every industry, regardless of size, there is a very real opportunity for

improvement in this vitally important aspect of maintenance reliability work.

Where strategies and policies do not exist, they need to be developed as

the foundaton of a viable asset health management system.

When developed and deployed, strategies and policies need to be

contnuously used to provide guidance to the organizaton, as well as

demonstrate managements commitment to the process.

Even afer development and deployment, management needs to make

certain that there is a sound understanding of the concept of asset health

management and how it directly impacts the survivability of the business.

To this end, efectve and efcient communicaton and training are

essental.

The plant infrastructure, while stll reported in reasonable health, needs

atenton equal to that provided for other major asset types.

While the majority of respondents indicated an organizaton exists to

address asset health management, responses indicated in other charts

seem to suggest a more focused set of initatves and related actvites are

needed.

Where a management of change process does not exist, one needs to be

created and rigidly enforced. The lack of this process has the potental to

cause serious problems.

Sofware needs to be acquired beyond the computerized maintenance

management system sofware to support the asset health management

efort. Lack of funding should not be an issue when compared to the

negatve consequences of not having the sofware to analyze data and

identfy potental problems before they become serious.

The legal organizaton needs to beter understand and support

maintenance in the asset health management arena, assuring them that