Escolar Documentos

Profissional Documentos

Cultura Documentos

Wk2 - Can InBev Turn Budweiser Into A Global Brand

Enviado por

Arun PrakashTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Wk2 - Can InBev Turn Budweiser Into A Global Brand

Enviado por

Arun PrakashDireitos autorais:

Formatos disponíveis

Can InBev turn Budweiser into a global brand?

FRANKFURT The hourglass-shaped bottle of Brahma, a popular Brazilian beer, evokes the beautiful bodies for which the country is famous the world over. When Belgian brewer InBev introduced the brand globally in 2005, the buzz was of "ginga," a Portuguese word connoting the effortless flair that knockout Brazilian models, daring race car drivers and agile soccer players always seem to possess. But the marketing effort did not pay off. Three years later, Brahma is struggling mightily, with few solid markets outside Brazil, but that is not stopping InBev, which wants to take over Anheuser-Busch with a $46 billion bid, from talking up its next - far more ambitious - global project. Budweiser, InBev says, can become the beer that the world cracks open after a hard day of work. "There is a big international opportunity for the Bud flagship brand," Carlos Brito, InBev's chief executive, says in a video press release posted on the company's Web site. "We have operations in 30 countries around the world and that would be a great platform to develop that brand." Can InBev sell America better than it sold Brazil? The challenges are many. InBev, burned by the Brahma episode, says it has learned valuable lessons about how to market internationally, and that Budweiser already has a level of name recognition that should make it far easier to turn into a blockbuster global brand along the lines of Heineken, a major competitor. Though its reputation as a thin, watery brew puts Budweiser at a disadvantage in Europe, beer industry experts see better chances in Asia, where tastes run toward lighter beers (AnheuserBusch's Budweiser is not to be confused with the Czech beer of the same name that has battled to limit the American brand's presence in Europe). InBev's predecessor company, Interbrew, made Stella Artois, a workaday Belgian beer, into one quaffed by London nightclubbers, and that is not its only branding success. InBev turned Beck's, a middling German brand, into a international star with pumped-up marketing. "InBev supports the biggest-performing brands with big marketing budgets," said Wim Hoste, a beverage industry analyst at KBC Securities in Brussels. "I don't think they would change dramatically in that respect." One reason is that InBev aggressively cuts costs elsewhere. Soon after Interbrew of Belgium merged with AmBev of Brazil in 2004 to create InBev, South American executives adopted an accounting technique known as zero-based budgeting. The

method forces company divisions to justify costs for each year anew, rather than simply adjusting the baseline spending for the previous year. In 2006, the first year that InBev applied the budgeting formula to western Europe, it extracted cost savings of 188 million, or $293 million, in the first year. If applied on the scale of Anheuser-Busch, analysts said, zero-based budgeting could net a combined company up to $900 million over three or four years. "Anheuser-Busch would represent the largest pool of addressable cost savings remaining in the global beer industry," Melissa Earlam, a beverage industry analyst with UBS, wrote in a May 27 report. InBev's central argument for why it can succeed globally with Bud brands - primarily Budweiser and its highly successful low calorie spinoff, Bud Light, which are ubiquitous in the United States but much harder to find elsewhere - is that the American brew is almost there. Unlike Brahma, Budweiser looms large in the consciousness of many consumers outside the United States even if they cannot buy it at the corner market. Earlam of UBS pointed out that Budweiser's sponsorship of the 2006 soccer World Cup and the Beijing Olympics this year has lifted its global exposure. By contrast, InBev now markets the ill-fated Brahma on a much narrower basis, particularly to Brazilian expatriate communities in the United States and Europe, a group already familiar with the brand. "It is hard to do a multicountry launch without a top-of-the-mind awareness of consumers," Marianne Amssoms, InBev's vice president for global external communications, said. "That's the big difference between Budweiser in Brahma. Bud is known by many consumers but it is not available to all of them." InBev is very familiar with the Bud brands. Since 1998, it has brewed them under an exclusive, and permanent, licensing agreement in Canada, where Bud has since become the top-selling beer. Brito, InBev's chief, once ran its North American operations. But in Europe, on InBev's home territory, skepticism abounds that an American beer could become a blockbuster. Budweiser is viewed as a largely tasteless brew, while many Europeans, marketing experts say, have negative associations with the United States and transfer that to brands, whether Coca-Cola, McDonald's or Bud. Allyson Stewart-Allen, director of International Marketing Partners, a London consulting firm, said that while American brands can seem "aspirational" to the rest of the world, they can also evoke a "provincialism and arrogance." "The unpopularity of U.S. foreign policy has marginally affected American brands, by this arrogant assumption that what works in the United States works globally," Stewart-Allen said.

In the growing Chinese market, tastes run more to thinner beers, so Budweiser looks like it could have a better shot there. Still, many analysts wonder if an American beer can take off in the world's most populous nation. China is a place where Oktoberfest, the famous German festival, is routinely copied, complete with buxom waitresses and oom-pah bands. If heritage matters in marketing, the fascination with European tradition may trump what an American beer can bring to the table. "In the world's mind, beer comes from Europe," said Johannes Rellecke, the German head of Dragon Rouge, a marketing consulting firm based in New York. "That's just reality." InBev's international success with Beck's of Germany, which it purchased in 2002, has underscored this point. A traditional dry German pilsner from the northern port town of Bremen, Beck's was a solid German brand and a niche export product, but a muscular marketing campaign under InBev transformed it. Its advertising emphasized the brew's natural ingredients, and its adherence to the German Purity Law of 1516, which specifies that only water, hops and barley can go into beer. At the same time, it avoided a too-German identity, deftly claiming Bremen's elegant coat of arms, a silver key on a red background, as its own. Sales volumes rose 4.3 percent in Germany, and 13 percent globally in 2007, to 7.5 million hectoliters, or 198 million gallons, according to the company. InBev also led the way in Germany with new versions of Beck's, notably a milder, low-alcohol brew called Beck's Gold, that spawned many imitators in a hard-fought German market. "There used to be just a normal Beck's pilsner, but they have managed to do a lot of things without harming the original brand," said Reiner Klinz, a beer industry specialist at KPMG in Munich. The underside of the success with Beck's, according to people in the industry, was the intense pressure on the German management from InBev headquarters in Leuven, Belgium, outside Brussels, to increase profit margins. That resulted in heavy turnover, as German executives complained that the Brazilians at headquarters, who by then had come to dominate InBev's upper echelon, were used to the fat margins they earned in Latin American markets, where a few brewers have long divvied up the market.

Amssoms, the communications executive, did not deny that changes have been afoot at Beck's, but pointed out that more than 4,000 people or 15 percent of InBev's management, was promoted in 2007. "Part of changing organizations is that some people decided to look for opportunities outside the company," Amssoms said. "That's part of what happens when there is change." InBev on Wednesday told its takeover target Anheuser-Busch that it has lined up financing for a deal and reminded the U.S. brewer that "time is of the essence," Reuters reported from New York. It has been two weeks since the Belgian-Brazilian brewer started its unsolicited $46.3 billion takeover bid, but the maker of Budweiser and Michelob has yet to respond. Anheuser's board of directors met last week to discuss the proposal. In his third letter to the Anheuser chief executive, August Busch IV, the InBev chief, Carlos Brito, said his company remains available to discuss its $65-per-share offer. Brito said InBev has received commitment letters for the financing for the deal and has paid $50 million in commitment fees to a lending group comprised of Banco Santander, Bank of TokyoMitsubishi, Barclays Capital, BNP Paribas, Deutsche Bank, Fortis, ING Bank, JPMorgan, Mizuho Corporate Bank and Royal Bank of Scotland.

Você também pode gostar

- Oil Coolers Oil Coolers Oil Coolers Oil CoolersDocumento6 páginasOil Coolers Oil Coolers Oil Coolers Oil CoolersArun PrakashAinda não há avaliações

- Oil Coolers Oil Coolers Oil Coolers Oil CoolersDocumento12 páginasOil Coolers Oil Coolers Oil Coolers Oil CoolersArun PrakashAinda não há avaliações

- Ac Series Bypass Coolers: Ordering InformationDocumento1 páginaAc Series Bypass Coolers: Ordering InformationArun PrakashAinda não há avaliações

- Maintenance Manual For NDM5 ZDM5 NG LocomotiveDocumento413 páginasMaintenance Manual For NDM5 ZDM5 NG LocomotiveArun Prakash100% (1)

- Landrover Sport AutobiographyDocumento20 páginasLandrover Sport AutobiographyArun PrakashAinda não há avaliações

- NEw HX Catalogue ScannedDocumento6 páginasNEw HX Catalogue ScannedArun PrakashAinda não há avaliações

- CDI:HIDI :8DC9:CH:98DCHDA 96I:9 C6C8 6AHI6I:B:CIH: LVMH GroupDocumento38 páginasCDI:HIDI :8DC9:CH:98DCHDA 96I:9 C6C8 6AHI6I:B:CIH: LVMH GroupArun PrakashAinda não há avaliações

- Leadership, Culture and Transition at LululemonDocumento2 páginasLeadership, Culture and Transition at LululemonArun PrakashAinda não há avaliações

- Newell Rough WorkDocumento2 páginasNewell Rough WorkArun PrakashAinda não há avaliações

- Team-2 Cameron Auto Parts CaseDocumento5 páginasTeam-2 Cameron Auto Parts CaseArun PrakashAinda não há avaliações

- Notes: January 7, 2014 10:17 PMDocumento54 páginasNotes: January 7, 2014 10:17 PMArun PrakashAinda não há avaliações

- Newell Rough WorkDocumento2 páginasNewell Rough WorkArun PrakashAinda não há avaliações

- Strategy and Organization: LEGO Mindstorms: Case ThemesDocumento17 páginasStrategy and Organization: LEGO Mindstorms: Case ThemesArun PrakashAinda não há avaliações

- Beml Vendor ListDocumento30 páginasBeml Vendor ListPrashanth Kumar Nagraj Ganiga100% (1)

- Beml Vendor ListDocumento30 páginasBeml Vendor ListPrashanth Kumar Nagraj Ganiga100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Hirarc Form: 1. Hazard Identification 2. Risk Analysis 3. Risk ControlDocumento2 páginasHirarc Form: 1. Hazard Identification 2. Risk Analysis 3. Risk ControlQurratulain Syarifuddinzaini100% (1)

- Rotation and Revolution of EarthDocumento4 páginasRotation and Revolution of EarthRamu ArunachalamAinda não há avaliações

- COSL Brochure 2023Documento18 páginasCOSL Brochure 2023DaniloAinda não há avaliações

- Student Management System - Full DocumentDocumento46 páginasStudent Management System - Full DocumentI NoAinda não há avaliações

- Peptic UlcerDocumento48 páginasPeptic Ulcerscribd225Ainda não há avaliações

- Google Chrome OSDocumento47 páginasGoogle Chrome OSnitin07sharmaAinda não há avaliações

- Robert FrostDocumento15 páginasRobert FrostRishi JainAinda não há avaliações

- Journal of The Folk Song Society No.8Documento82 páginasJournal of The Folk Song Society No.8jackmcfrenzieAinda não há avaliações

- List of Notified Bodies Under Directive - 93-42 EEC Medical DevicesDocumento332 páginasList of Notified Bodies Under Directive - 93-42 EEC Medical DevicesJamal MohamedAinda não há avaliações

- Mutants & Masterminds 3e - Power Profile - Death PowersDocumento6 páginasMutants & Masterminds 3e - Power Profile - Death PowersMichael MorganAinda não há avaliações

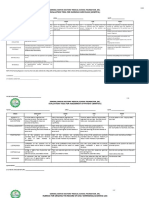

- DLL Week 7 MathDocumento7 páginasDLL Week 7 MathMitchz TrinosAinda não há avaliações

- Dialogue About Handling ComplaintDocumento3 páginasDialogue About Handling ComplaintKarimah Rameli100% (4)

- Comparing ODS RTF in Batch Using VBA and SASDocumento8 páginasComparing ODS RTF in Batch Using VBA and SASseafish1976Ainda não há avaliações

- Project Report Devki Nandan Sharma AmulDocumento79 páginasProject Report Devki Nandan Sharma AmulAvaneesh KaushikAinda não há avaliações

- Music 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Documento4 páginasMusic 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Kate Mary50% (2)

- HUAWEI P8 Lite - Software Upgrade GuidelineDocumento8 páginasHUAWEI P8 Lite - Software Upgrade GuidelineSedin HasanbasicAinda não há avaliações

- Peacekeepers: First Term ExamDocumento2 páginasPeacekeepers: First Term ExamNoOry foOT DZ & iNT100% (1)

- Apush Leq Rubric (Long Essay Question) Contextualization (1 Point)Documento1 páginaApush Leq Rubric (Long Essay Question) Contextualization (1 Point)Priscilla RayonAinda não há avaliações

- Use Reuse and Salvage Guidelines For Measurements of Crankshafts (1202)Documento7 páginasUse Reuse and Salvage Guidelines For Measurements of Crankshafts (1202)TASHKEELAinda não há avaliações

- PEDIA OPD RubricsDocumento11 páginasPEDIA OPD RubricsKylle AlimosaAinda não há avaliações

- Peer-to-Peer Lending Using BlockchainDocumento22 páginasPeer-to-Peer Lending Using BlockchainLuis QuevedoAinda não há avaliações

- Black Body RadiationDocumento46 páginasBlack Body RadiationKryptosAinda não há avaliações

- Grammar: English - Form 3Documento39 páginasGrammar: English - Form 3bellbeh1988Ainda não há avaliações

- Explained - How To Read Q1 GDP Data - Explained News, The Indian ExpressDocumento11 páginasExplained - How To Read Q1 GDP Data - Explained News, The Indian ExpresshabeebAinda não há avaliações

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocumento4 páginasSorsogon State College: Republic of The Philippines Bulan Campus Bulan, Sorsogonerickson hernanAinda não há avaliações

- Why Nations Fail - SummaryDocumento3 páginasWhy Nations Fail - SummarysaraAinda não há avaliações

- A Brief History of LinuxDocumento4 páginasA Brief History of LinuxAhmedAinda não há avaliações

- Army War College PDFDocumento282 páginasArmy War College PDFWill100% (1)

- Cui Et Al. 2017Documento10 páginasCui Et Al. 2017Manaswini VadlamaniAinda não há avaliações