Escolar Documentos

Profissional Documentos

Cultura Documentos

Legal Ownership Vested in Trustees Must Be Balanced by Identifiable Equitable Ownership

Enviado por

Tom ChanDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Legal Ownership Vested in Trustees Must Be Balanced by Identifiable Equitable Ownership

Enviado por

Tom ChanDireitos autorais:

Formatos disponíveis

Student ID: 600056389 Trust Law

Law LLB

Legal ownership vested in trustees must be balanced by identifiable equitable ownership.

Critically discuss this statement and the difficulties inherent in it in relation to the interests of beneficiaries under discretionary trusts.

What is the practical importance of determining where the beneficial interest lies in discretionary trusts?

Word Count: 1999

Trust exists as a mechanism that assists equity. The essence of a trust is the imposition of an equitable obligation on a person who is the legal owner of property (a trustee) which requires that person to act in good conscience when dealing with that property in favor of any person (the beneficiary) who has a beneficial interest recognized by equity in property.i Trust law has become increasingly prominent in present society where the safeguard of personal assets is of utmost importance. The law has evolved and branched out to incorporate several different types of trust. Among them, the discretionary trust that this essay is concerned with can be differentiated in that its legal emphasis is not placed on specified beneficial or equitable ownership commonly seen in regular trusts, as characterized by the quote above.

Student ID: 600056389

Law LLB

The key characteristics of the discretionary trust are evident when contrasted with the fixed trust. The fixed trust refers to situations in which the trust provision requires that the property be held for a fixed number of identifiable beneficiaries.ii Under the fixed trust the trustee is under the imposition placed by the trust instrument where the beneficiaries are identifiable. In contrast, under the discretionary trust it is debatable whether the beneficiaries can be said to have any individual proprietary interests in the trust property before the trustee exercises their discretion. As Lord Reid stated in Gartside v IRCiii you cannot tell what any one of the beneficiaries will receive until the trustees have exercised their discretion. The trustee holds a legal dispositive duty to dispose of the trust property regarding the exact amount that each beneficiary receives if any at all. However, this power of absolute discretion remains subject to the terms of the trust instrument. Although the importance of identifiable equitable ownership cannot be stressed enough, it is the lack of this trait that provides the discretionary trust with the tools that make this trust so flexible. In comparison, the fixed trust, also a type of express trust, mirrors the opposite of the discretionary trust. The performance of the fixed trust may be hindered due to the obligation of the trustee to perform the precise terms stated in the trust instrument. In the face of unpredictable circumstances the fixed trust would not be able to adapt in time. On the other hand, the discretionary trust retains its elasticity and the trustee can react in suitable way.

Student ID: 600056389 The original reason for the popularity of the discretionary trust was that it

Law LLB

allowed for tax savings, though this no longer remains the primary benefit. The nature of the discretionary trust does not allow creditors to claim trust property from beneficiaries, as they hold no claim to any specific part of the trust. Additionally, this can work against beneficiaries in that trustees may deny incompetent beneficiaries from accessing the trust funds. Although if a trust falls dormant due to a long period of inactivity by the trustees the courts retain the right to replace them.iv At all times the trustee remains bound under a legal fiduciary obligation to carry out the intentions of the initial trust instrument under its explicit terms.v

Following on, we will now analyze the seminal case of McPhail v Doultonvi that is essential to our understanding of the beneficial interest in the discretionary trust. In this case, the trust property was to be given to employees, ex-officers or ex-employees of the Company or any relatives and dependants of any such persons. The phrase in question was relatives and dependants, and thus a relevant test had to be sought to ascertain the beneficiaries. Previous authority pointed towards the case of IRC v Broadway Cottages.vii The complete list test derived from this case required that an absolute list of beneficiaries to be identified by the trustees. Should the trustee not exercise their duties then this would mean the beneficial owners hip would unavoidably be shared equally among all beneficiaries. As Lord Wilberforce stated, equal division is surely the last thing the settlor ever intended: equal divisions among all probably would produce a result beneficial to none.viii This became one of the major criticisms of the test. Furthermore,

Student ID: 600056389

Law LLB

the test was criticized as being too family-oriented, as it did not consider the possibility of a large class of beneficiaries.

Subsequently, the is or is not test formulated in the case of Re Gulbenkianix was applied. Due to the shortcomings of the complete list test, Lord Wilberforce rephrased a new test for certainty of beneficiaries based on the principles of Gulbenkian, Can it be said with certainty that any given individual is or is not a member of the class.x However, the problem with this test lay in the fact that if a particular beneficiary could not be categorized as being is or is not within the class then the trust in its entirety would be nullified. The case of Re Baden (No 2)xi highlighted this issue and led to the Court of Appeal mitigating on the behalf of their decision in McPhail. The case of Re Baden (No 2) also concerned the ambiguity of the term relative. Interestingly, Lord Sachs in his judgment instead placed the onus on the beneficiaries to prove them selves to be a relative under the terms of the trust. Once the class of persons to be benefited is conceptually certain it then becomes a question of fact to be determined on evidence whether any postulant has on inquiry been proved to be within it; if he is not so proved, then he is not in itxii This approach preserved the literal sense of the test while placing the evidential burden on the claimant to prove whether or not they are a relative. Lord Sachs made it clear in his judgment that its fulfillment did not ensure validation, and there would remain trusts in which the provisions would be so vague that it would be impossible to determine their true meaning.

Student ID: 600056389

Law LLB

This Court of Appeal judgment actually returned to the prior logic of the Re Allenxiii case. In this case, the Court of Appeal had sought to validate trusts in which a substantial number of beneficiaries could be ascertained. Lord Megaw held that the trust would be valid even if there were doubts regarding potential beneficiaries as long as a distinct core group fulfilled the provisions of the trust. This illustrated the principal concern of the is or is not test. That the existence of a substantial number of people who satisfy the trust would be overshadowed by the emphasis placed on determining whether someone is within the class of beneficiaries.xiv It is evident that in regards to the discretionary trust, it may be more relevant to put greater emphasis on the eligibility of the beneficiary to receive the trust property rather than the specific beneficial interest.

Can the beneficiaries be said to have any proprietary interest in the trust property before the trustee exercises their discretion in favor of any one of them? This conceptual problem remains as to the rights of the beneficiaries before the trustee has disposed of the trust property. It can be argued that prior to disposal, the beneficiaries actually have no interest in the trust.xv If however, the trustee exercises their discretion and allocates a portion of the property to the beneficiary, the beneficiary then has absolute rights over the identified property. This is where the discretionary trust contradicts the title quotation. Whereas the fixed trust entitles beneficiaries to have identifiable equitable title over the trust property, the discretionary trust does not allow individual proprietary entitlement. Rather, the trust property should be seen in its entirety and the class of beneficiaries should have a collective entitlement

Student ID: 600056389

Law LLB

to the property. Under this principle formulated in Saunders v Vautier,xvi an adult beneficiary (or a number of adult beneficiaries acting together) who has (or between them have) an absolute, vested and indefeasible interest in the capital and income of property may at any time require the transfer of the property to him (or them) and may terminate any accumulation.xvii

Thus, the difficulty lies in determining whether propriety rights exist before the moment of disposition, though this will also rely heavily on the terms of the trust. Professor Thomas clarified this positionxviii and his view was subsequently followed in the Richstar Enterprises Pty Ltd v Carey (No 6)xix case. Under the circumstances of an exhaustive discretionary trust it would be possible to exercise the rights of beneficiaries under the requirements of the Saunders v Vautier principle. Such a discretionary trust would be close-ended as the trust property would need to be exhausted and the entire class of beneficiaries would be identifiable. The basis of Professor Thomas argument first emerged in the case Re Nelsonxx and then Re Smith,xxi where Romer J stated that you treat all people put together just as though they formed on e person, for whose benefit the trustees were directed to apply the whole fund. Although this may seem to apply to discretionary trusts there are many situations in which the criterion cannot be fulfilled and thus the principle not applicable.

Firstly, there are instances where the class of beneficiaries cannot be identified, for example if under the terms of the trust there may be new members incorporated into the class.xxii Secondly, the discretionary trust is not

Student ID: 600056389

Law LLB

exhaustive. Since the trustees of discretionary trust have no duty to make a particular distribution, or indeed any distribution to any specific individual, the rights of the beneficiaries are limited to compelling the trustees to consider whether or not to make a distribution in their favor and to ensuring the property administration of the trust. This is true even if the discretionary trust only has one beneficiary.xxiii Thus, it can be seen that individual beneficiaries cannot have individual equitable rights to the trust property as their rights are in competition with one another. Lord Reid commented in Gartside v IRC that two or more persons, cannot have a single right unless they hold it jo intly or in common. But clearly the objects of a discretionary trust do not have that: they are in competition with each other and what the trustees give to one is his alone.xxiv Under the principles of Gartside v IRC it is clear that if a class of beneficiaries cannot ascertain that they constitute the entirety of the equitable interest then they have no rights under Saunders v Vautier to the trust property. As Lord Wilberforce stated no doubt in a certain sense a beneficiary under a discretionary trust has an interest: the nature of it may, sufficiently for the purpose, be spelt out by saying that he has a right to be considered as a potential recipient of benefit by the trustees and a right to have his interest protected by a court of equity.xxv Thus, beyond the means of the Saunders v Vautier principle, beneficiaries under the discretionary trust retain the right to have their claims to trust property considered by the trustees and will be protected by the courts against any abuse of power by the trustees.xxvi

It is important to note the difference between a trust and a power. Trustees under a trust are obliged to carry out their duties under the trust instrument.

Student ID: 600056389 Donees under a power can exercise this duty at their absolute discretion.

Law LLB

Thus, fundamentally, it is incompatible to compare the discretionary trust with any other trust as it poses as a paradox to regular trusts. Rather than the onus being placed on the beneficial interest of the beneficiary, in discretionary trusts, the right of the beneficiaries to be considered eligible for the trust property holds far greater significance. The flexibility under the discretionary trust allows for greater room for maneuvering within the confines of the trust instrument. Taking into account the incompatibility between the principles of fixed trusts as seen in the title quotation and discretionary trusts, rather than acting as a challenge, the discretionary trust has carved out its own niche within the spectrum of trust law.

Student ID: 600056389

Law LLB

G Thomas and A Hudson, The Law of Trusts, (2nd Edition, first published 2010, Oxford University Press), para 1.01

i

G Thomas, Thomas On Powers, (2nd Edition, first published 2012, Oxford University Press), para 3-03 et seq.

ii iii

Gartside v IRC [1968] AC 553 Re Lockers Settlement [1977] 1 WLR 1323 A Hudson, Equity and Trusts, (7th Edition, first published 2012, Routledge), para. 3.5.4 McPhail v Doulton [1970] 2 WLR 1110 IRC v Broadway Cottages [1955] Ch 20 McPhail v Doulton [1971] AC 424 (at 451)

iv

vi

vii

viii

ix

Re Gulbenkain [1968] Ch 126 McPhail v Doulton [1971] AC 424 (at 454) Re Baden (No. 2) [1973] Ch 9 Re Baden (No. 2) [1973] Ch 9, 19 Re Allen [1953] Ch 810 Re Baden (No. 2) [1973] Ch 9, 22 Murphy v Murphy [1999] 1 WLR 282 Saunders v Vautier (1841) 4 Beav 115 Re Holts Settlement [1969] 1 Ch 100, 111 Thomas, 1998, 6-268 & Thomas and Hudson, 2004, 184 et seq

xi

xii

xiii

xiv

xv

xvi

xvii

xviii

xix

Richstar Enterprises Pty Ltd v Carey (No 6) [2006] FCA 814 Re Nelson [1928] Ch 920 Re Smith [1928] Ch 915 Re Traffords Settlement [1985] Ch 34, 40, per Peter Gibson J

xx

xxi

xxii

Parkinson and Wright, Equity and Property in Parkinson ed, The Principles of Equity, Law Book Co, 2003, 60, citing Re Weirs Settlement Trusts [1971] Ch 145

xxiii xxiv

Gartside v IRC [1968] AC 553 at 605-606 Gartside v IRC [1968] AC 533, 617

xxv

Student ID: 600056389

Law LLB

xxvi

Gisborne v Gisborne (1877) 2 App Cas 300

Bibliography Cases 1) Gartside v IRC [1968] AC 533 2) Re Lockers Settlement [1977] 1 WLR 1323 3) McPhail v Doulton [1970] 2 WLR 1110 4) IRC v Broadway Cottages [1955] Ch 20 5) Re Gulbenkain [1968] Ch 126 6) Re Baden (No. 2) [1973] Ch 9 7) Re Allen [1953] Ch 810 8) Murphy v Murphy [1999] 1 WLR 282 9) Saunders v Vautier (1841) 4 Beav 115 10) Re Holts Settlement [1969] 1 Ch 100 11) Richstar Enterprises Pty Ltd v Carey (No 6) [2006] FCA 814 12) Re Nelson [1928] Ch 920 13) Re Smith [1928] Ch 915 14) Gisborne v Gisborne (1877) 2 App Cas 300 15) Re Weirs Settlement Trusts [1971] Ch 145 Books 1) G Thomas and A Hudson, The Law of Trusts, (2nd Edition, first published 2010, Oxford University Press) 2) G Thomas, Thomas On Powers, (2nd Edition, first published 2012, Oxford University Press) 3) A Hudson, Equity and Trusts, (7th Edition, first published 2012, Routledge) 4) Parkinson and Wright, Equity and Property in Parkinson ed, The Principles of Equity, Law Book Co, 2003 Online Journals 1) Simon Kerry, Control of Trustee Discretion: The Rule in Re HastingsBass, UCL J.L. and J. 2012, 1(2), 46-79, <http://login.westlaw.co.uk/maf/wluk/app/document?&srguid=ia744c09 70000013bfff3ab41b4d3af1c&docguid=I738E06202EFC11E2A7EFE39 7B51E53A3&hitguid=I738E06202EFC11E2A7EFE397B51E53A3&rank =14&spos=14&epos=14&td=3723&crumbaction=append&context=11&resolvein=true> 2) Nicholas Hopkins and Emma Laurie, The Value of Property Rights in Social Security Law, J.S.S.L. 2009, 16(4), 180-206, <http://login.westlaw.co.uk/maf/wluk/app/document?&srguid=ia744c09 a0000013bfffa43e4a0869243&docguid=IEC04F8819EA711DF95DFFE 090DE0BD65&hitguid=IEC04F8819EA711DF95DFFE090DE0BD65&r ank=1&spos=1&epos=1&td=1&crumbaction=append&context=20&resolvein=true>

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Caveat To A Last Will and Testament GeorgiaDocumento7 páginasCaveat To A Last Will and Testament GeorgiaHugh Wood100% (8)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Charitable TrustsDocumento30 páginasCharitable TrustsDominic Grell100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Wills&Succession (Sylabus 6-5-13)Documento6 páginasWills&Succession (Sylabus 6-5-13)Donna SamsonAinda não há avaliações

- Padura v. BaldovinoDocumento4 páginasPadura v. BaldovinoJustin MoretoAinda não há avaliações

- Special Proceedings SyllabusDocumento6 páginasSpecial Proceedings SyllabuslostinmilwaukeeAinda não há avaliações

- Revenue Court Appeal and Argument Against RTC EntryDocumento20 páginasRevenue Court Appeal and Argument Against RTC EntrySridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (2)

- Ok - Neri vs. AkutinDocumento2 páginasOk - Neri vs. AkutinKristine JoyAinda não há avaliações

- 19 Intestate Estate of Borromeo v. BorromeoDocumento3 páginas19 Intestate Estate of Borromeo v. BorromeoTricia Montoya100% (1)

- Specpro Case DigestsDocumento16 páginasSpecpro Case DigestsDianne ComonAinda não há avaliações

- G.R. No. 193374Documento3 páginasG.R. No. 193374Lean Manuel ParagasAinda não há avaliações

- Hiba Under Muslim Law PDFDocumento12 páginasHiba Under Muslim Law PDFAjit Anand100% (4)

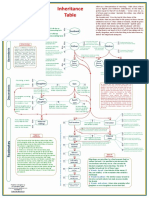

- Table of Islamic Inheritance PDFDocumento1 páginaTable of Islamic Inheritance PDFSuru Suresh25% (4)

- Family Law AssignmentDocumento11 páginasFamily Law AssignmentAmithabAinda não há avaliações

- Wills Act 1997: Version No. 016Documento42 páginasWills Act 1997: Version No. 016happyjohn2013Ainda não há avaliações

- Balanay Jr. Vs MartinezDocumento3 páginasBalanay Jr. Vs Martinezpja_14Ainda não há avaliações

- Ramchandra Ganpatrao Hande Alias ... Vs Vithalrao Hande & Ors On 29 March, 2011Documento11 páginasRamchandra Ganpatrao Hande Alias ... Vs Vithalrao Hande & Ors On 29 March, 2011Abhishek BAinda não há avaliações

- 13 - Santos v. LumbaoDocumento23 páginas13 - Santos v. LumbaoZymon Andrew MaquintoAinda não há avaliações

- Edroso v. Sablan, 25 Phil. 295: Xiii. Reserva Troncal. Art. 891Documento50 páginasEdroso v. Sablan, 25 Phil. 295: Xiii. Reserva Troncal. Art. 891Ursulaine Grace FelicianoAinda não há avaliações

- Art. 1015 1070Documento14 páginasArt. 1015 1070Rianna VelezAinda não há avaliações

- Future InterestsDocumento2 páginasFuture Interestsapi-257776438Ainda não há avaliações

- Inheritance and SuccessionDocumento8 páginasInheritance and Successionamit HCSAinda não há avaliações

- Family Law Final ProjectDocumento15 páginasFamily Law Final Projectratna supriyaAinda não há avaliações

- The Indian Trust Act-LawDocumento8 páginasThe Indian Trust Act-LawPranitDAinda não há avaliações

- 83 - Ex - III - 1a - 2023 - Compassionate Ground RulesDocumento10 páginas83 - Ex - III - 1a - 2023 - Compassionate Ground RulesSiva GuruAinda não há avaliações

- Family Law 2 by Riya MittalDocumento32 páginasFamily Law 2 by Riya MittalriyaAinda não há avaliações

- An Inheritance That Cannot Be Stolen: Schooling, Kinship, and Personhood in Post-1945 Central PhilippinesDocumento31 páginasAn Inheritance That Cannot Be Stolen: Schooling, Kinship, and Personhood in Post-1945 Central PhilippinesAngeline VielAinda não há avaliações

- Will Et SocietyDocumento481 páginasWill Et SocietybartomaniaAinda não há avaliações

- 13 - Chapter 6 PDFDocumento32 páginas13 - Chapter 6 PDFpraharshithaAinda não há avaliações

- Romeo Tomas Deed of Extra JudicialDocumento6 páginasRomeo Tomas Deed of Extra Judicialcharlyn eve leongsonAinda não há avaliações

- Alejandrino v. CADocumento10 páginasAlejandrino v. CAjagabriel616Ainda não há avaliações