Escolar Documentos

Profissional Documentos

Cultura Documentos

Euro Stoxx Volatility

Enviado por

Roberto PerezDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Euro Stoxx Volatility

Enviado por

Roberto PerezDireitos autorais:

Formatos disponíveis

FACTSHEET/1

EURO STOXX 50 VOLATILITY INDICES (VSTOXX)

EURO

EURO

EURO

EURO

EURO

EURO

EURO

EURO

EURO

EURO

EURO

EURO

STOXX

STOXX

STOXX

STOXX

STOXX

STOXX

STOXX

STOXX

STOXX

STOXX

STOXX

STOXX

50

50

50

50

50

50

50

50

50

50

50

50

Volatility

Volatility

Volatility

Volatility

Volatility

Volatility

Volatility

Volatility

Volatility

Volatility

Volatility

Volatility

(30 Days) Index

(60 Days) Index

(90 Days) Index

(120 Days) Index

(150 Days) Index

(180 Days) Index

(210 Days) Index

(240 Days) Index

(270 Days) Index

(300 Days) Index

(330 Days) Index

(360 Days) Index

Stated Objective

To provide a key measure of market expectations of near-term up to long-term volatility based on the EURO STOXX 50 options

prices. The EURO STOXX 50 Index is a Blue-chip representation of sector leaders in the Eurozone. The index covers Austria,

Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain.

Unique Aspects

Part of a consistent family of volatility indices: VSTOXX based on the EURO STOXX 50 Index, VDAX-NEW based on the DAX

and VSMI based on the SMI.

Rules-based and transparent methodology, jointly developed by Goldman Sachs and Deutsche Brse AG.

Calculation of the VSTOXX family is directly derived from the prices of the underlying EURO STOXX 50 options.

The 12 VSTOXX, rolling indices of 30, 60, 90, 120, 150, 180, 210, 240, 270, 300, 330 and 360 days to expiration, are derived

via linear interpolation of the two nearest subindices.

Calculation of 8 sub-indices per option expiry (1, 2, 3, 6, 9, 12, 18 and 24 months) based on the square-root of the implied

variance.

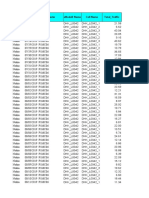

High, Low & Mean

Index

YTD

2009

2008

Since Incept.*

High

Low

Mean

High

Low

Mean

High

30 days

53.55

18.48

27.55

56.33

22.85

33.59

87.51

60 days

50.48 19.86

27.63

54.41

24.34

33.95

74.02

19.21

32.59

29.46

13.91

19.58

90 days

49.08 20.90

27.90

53.39

24.34 34.43

65.30

19.97

31.99

28.04

14.03

19.68

120 days

47.08

28.16

52.83 26.28 35.02

64.32

20.52

31.83

27.38

15.36

19.93

64.32

12.58

150 days

46.03 22.45 28.38

53.28

27.18

35.25

60.93 20.85

31.46

26.68 15.88 20.04

60.93

12.88

26.41

180 days

45.64

23.10

28.57

52.40

27.60

35.32

58.56

21.09

31.08

26.12

16.22

20.11

58.56

13.08

26.35

210 days

44.96

23.56

28.67

51.77

27.07

35.34

56.81

21.34

30.74

25.93

16.45

20.18

56.81

13.22

26.28

240 days

44.50 23.84

28.71

51.29

25.62

35.32

54.00

21.44

30.31

25.68

16.65

20.21

54.00

13.50

26.20

270 days

43.86 24.02 28.72

50.52

24.43

35.15

51.70

21.49

29.85

25.60

16.81

20.20

51.70

13.57

26.07

300 days

41.78

24.15

28.67

49.90 23.43 34.88

49.79

21.54

29.44

25.54

16.93

20.16

49.90

13.33

25.92

330 days

40.56

22.14

28.65

49.39 22.58 34.64

50.95

21.62

29.33

25.61

16.94

20.22

50.95

13.62

25.85

360 days

40.21

20.17

28.67

48.68 21.88

51.99

21.76

29.48

25.76

15.32

20.35

51.99

13.87

25.89

21.79

34.54

Low

2007

VSTOXX

Mean

High

Low

Mean

High

Low

Mean

18.06 33.68

34.74

13.41

19.67

87.51

11.60

26.16

74.02

11.66

25.78

65.30

12.00 26.00

* 4 January 1999

www.stoxx.com

30 September 2011

26.39

FACTSHEET/2

EURO STOXX 50 VOLATILITY INDICES (VSTOXX)

Index Performance & Correlation (Since Incept.)

Quick Facts

Categories

Facts

Calculation/Distribution

12 VSTOXX indices and 8 subindices are calculated every 5 seconds from 08:50 CET to 17:30 CET

Base Value / Base Date

100 as of 31 December 1991

History

Available daily back to January 1999

Date Introduced

20 April 2005 for VSTOXX (30 days) and Subindices 1 - 8

31 May 2010 for VSTOXX (60, 90, 120, 150, 180, 210, 240, 270, 300, 330 and 360 days)

www.stoxx.com

30 September 2011

FACTSHEET/3

EURO STOXX 50 VOLATILITY INDICES (VSTOXX)

Symbols

Index

ISIN

Symbol

Bloomberg

Reuters

VSTOXX

DE000A0C3QF1

V2TX

V2X

.V2TX

VSTOXX 60 days

DE000A1A4LU0

VSTX60

VSTX60 Index

.VSTX60

VSTOXX 90 days

DE000A1A4LV8

VSTX90

VSTX90 Index

.VSTX90

VSTOXX 120 days

DE000A1A4LW6

VSTX120

VSTX120 Index

.VSTX120

VSTOXX 150 days

DE000A1A4LX4

VSTX150

VSTX150 Index

.VSTX150

VSTOXX 180 days

DE000A1A4LY2

VSTX180

VSTX180 Index

.VSTX180

VSTOXX 210 days

DE000A1A4LZ9

VSTX210

VSTX210 Index

.VSTX210

VSTOXX 240 days

DE000A1A4L00

VSTX240

VSTX240 Index

.VSTX240

VSTOXX 270 days

DE000A1A4L18

VSTX270

VSTX270 Index

.VSTX270

VSTOXX 300 days

DE000A1A4L26

VSTX300

VSTX300 Index

.VSTX300

VSTOXX 330 days

DE000A1A4L34

VSTX330

VSTX330 Index

.VSTX330

VSTOXX 360 days

DE000A1A4L42

VSTX360

VSTX360 Index

.VSTX360

VSTOXX 1 Month

DE000A0G87B2

V6I1

VSTX1M

.V6I1

VSTOXX 2 Months

DE000A0G87C0

V6I2

VSTX2M

.V6I2

VSTOXX 3 Months

DE000A0G87D8

V6I3

VSTX3M

.V6I3

VSTOXX 6 Months

DE000A0G87E6

V6I4

VSTX6M

.V6I4

VSTOXX 9 Months

DE000A0G87F3

V6I5

VSTX9M

.V6I5

VSTOXX 12 Months

DE000A0G87G1

V6I6

VSTX12M

.V6I6

VSTOXX 18 Months

DE000A0G87H9

V6I7

VSTX18M

.V6I7

VSTOXX 24 Months

DE000A0G87J5

V6I8

VSTX24M

.V6I8

Index Performance VSTOXX, VDAX-NEW, VSMI

www.stoxx.com

30 September 2011

Você também pode gostar

- June Seasonality - Global Equity Indices: Changes Since The Close of The Prior MonthDocumento3 páginasJune Seasonality - Global Equity Indices: Changes Since The Close of The Prior Monthapi-245850635Ainda não há avaliações

- July Seasonality - Global Equity Indices: Changes Since End of JuneDocumento3 páginasJuly Seasonality - Global Equity Indices: Changes Since End of Juneapi-245850635Ainda não há avaliações

- Stoxx Real EstateDocumento11 páginasStoxx Real EstateRoberto PerezAinda não há avaliações

- Currency Insight 20120928101056Documento3 páginasCurrency Insight 20120928101056snehakopadeAinda não há avaliações

- Archives: Stock PricesDocumento9 páginasArchives: Stock PricesPuneit YadavAinda não há avaliações

- Kingate Euro Fund 0808Documento1 páginaKingate Euro Fund 0808Rachele VigilanteAinda não há avaliações

- Aim Day Trader 20120323Documento28 páginasAim Day Trader 20120323Philip MorrishAinda não há avaliações

- General Information Pivot Point - Support Resistance: BSE 100 Nifty Junior More F&O SharesDocumento5 páginasGeneral Information Pivot Point - Support Resistance: BSE 100 Nifty Junior More F&O SharesRaif FadhiAinda não há avaliações

- AIM Day Trader: 31 January 2012Documento28 páginasAIM Day Trader: 31 January 2012Philip MorrishAinda não há avaliações

- B06XZS2MNBDocumento30 páginasB06XZS2MNBChanAinda não há avaliações

- FTSE Vietnam Index Series FactsheetDocumento2 páginasFTSE Vietnam Index Series FactsheetAnh Phuong NguyenAinda não há avaliações

- Tybba-F: Name Roll NoDocumento27 páginasTybba-F: Name Roll NoHetviAinda não há avaliações

- 3i InfotechfinalDocumento20 páginas3i InfotechfinalDhanush KumarAinda não há avaliações

- Premium Rates - Sampoorn SamridhiDocumento1 páginaPremium Rates - Sampoorn SamridhidevjeetAinda não há avaliações

- Premium Rates - Sampoorn Samridhi PDFDocumento1 páginaPremium Rates - Sampoorn Samridhi PDFnavingAinda não há avaliações

- Aseanas 20140430Documento3 páginasAseanas 20140430bodaiAinda não há avaliações

- FLS Fa A01Documento1 páginaFLS Fa A01gaarylarenasAinda não há avaliações

- FTSE4 GoodDocumento5 páginasFTSE4 GoodJemayiAinda não há avaliações

- Equity (Nifty50) Technical Report (04 - 08 July)Documento6 páginasEquity (Nifty50) Technical Report (04 - 08 July)zoidresearchAinda não há avaliações

- Analysis of ITC Stocks Against BSEDocumento13 páginasAnalysis of ITC Stocks Against BSEAnupam GautamAinda não há avaliações

- Sales and growth comparison by quarter and yearDocumento5 páginasSales and growth comparison by quarter and yeartinkoopatrooAinda não há avaliações

- Chapter 20Documento59 páginasChapter 20Tess CoaryAinda não há avaliações

- AIM Day Trader: 20 March 2012Documento28 páginasAIM Day Trader: 20 March 2012Philip MorrishAinda não há avaliações

- Ftse 100Documento0 páginaFtse 100james22121Ainda não há avaliações

- Large International Banks Downgraded: Morning ReportDocumento3 páginasLarge International Banks Downgraded: Morning Reportnaudaslietas_lvAinda não há avaliações

- Dailycalls 26Documento7 páginasDailycalls 26Shrikant KalantriAinda não há avaliações

- Daily Calls: ICICI Securities LTDDocumento16 páginasDaily Calls: ICICI Securities LTDxytiseAinda não há avaliações

- Six Yrs Per OGDCLDocumento2 páginasSix Yrs Per OGDCLMAk KhanAinda não há avaliações

- 2q 2011 European UpdateDocumento47 páginas2q 2011 European Updatealexander7713Ainda não há avaliações

- Markets For The Week Ending September 16, 2011: Monetary PolicyDocumento10 páginasMarkets For The Week Ending September 16, 2011: Monetary PolicymwarywodaAinda não há avaliações

- Daily CallsDocumento7 páginasDaily CallsparikshithbgAinda não há avaliações

- Wayne Whaley - Planes, Trains and AutomobilesDocumento16 páginasWayne Whaley - Planes, Trains and AutomobilesMacroCharts100% (2)

- WaynewhaleyDocumento16 páginasWaynewhaleyRandy BownessAinda não há avaliações

- Morning Notes 26 July 2010: Mansukh Securities and Finance LTDDocumento5 páginasMorning Notes 26 July 2010: Mansukh Securities and Finance LTDMansukhAinda não há avaliações

- Ek VLDocumento1 páginaEk VLJohn Aldridge ChewAinda não há avaliações

- Aim Day Trader 20120103Documento28 páginasAim Day Trader 20120103Philip MorrishAinda não há avaliações

- Recession Fear Returns: Morning ReportDocumento3 páginasRecession Fear Returns: Morning Reportnaudaslietas_lvAinda não há avaliações

- MRE110926Documento3 páginasMRE110926naudaslietas_lvAinda não há avaliações

- AirtelDocumento3 páginasAirtelAkhil JayathilakanAinda não há avaliações

- Nervous Markets: Morning ReportDocumento3 páginasNervous Markets: Morning Reportnaudaslietas_lvAinda não há avaliações

- Working Capital Analysis and Key Financial Ratios of Sun MicrosystemsDocumento28 páginasWorking Capital Analysis and Key Financial Ratios of Sun MicrosystemsSunil KesarwaniAinda não há avaliações

- FTSE Emerging IndexDocumento3 páginasFTSE Emerging IndexjonfleckAinda não há avaliações

- Equity Is Not Risky in Long TermDocumento1 páginaEquity Is Not Risky in Long TermAmit Desai PredictorAinda não há avaliações

- AIM Day Trader: 20 February 2012Documento28 páginasAIM Day Trader: 20 February 2012Philip MorrishAinda não há avaliações

- Perú: Estimaciones Y Proyecciones de La Poblacion Total Por Años Calendario Y Edades Simples, 1995-2025Documento11 páginasPerú: Estimaciones Y Proyecciones de La Poblacion Total Por Años Calendario Y Edades Simples, 1995-2025Jorge HuamanAinda não há avaliações

- Towards A Solution To The Debt Crisis: Morning ReportDocumento3 páginasTowards A Solution To The Debt Crisis: Morning Reportnaudaslietas_lvAinda não há avaliações

- Time Series Analysis Methods and ComponentsDocumento11 páginasTime Series Analysis Methods and Components121Ainda não há avaliações

- MCB RatiosDocumento26 páginasMCB RatiosSadia WallayatAinda não há avaliações

- Directional Longshort Strategy Over FTSEMib Index Vs Fidelity and Schroder Italian Equities FundsDocumento1 páginaDirectional Longshort Strategy Over FTSEMib Index Vs Fidelity and Schroder Italian Equities FundsFilippo BertaccheAinda não há avaliações

- Sheiko 4 Day ProgramDocumento20 páginasSheiko 4 Day ProgramSteve HeywoodAinda não há avaliações

- CorrelationDocumento4 páginasCorrelationVentsislav TonchevAinda não há avaliações

- Valuation of Securities: Understanding Bond Prices and YieldsDocumento14 páginasValuation of Securities: Understanding Bond Prices and YieldsHedayatullah PashteenAinda não há avaliações

- Daily Share Prices: Date Open Price High Price Low Price Close Price Total No of Trades Turnover in (Rs - in Lakh)Documento3 páginasDaily Share Prices: Date Open Price High Price Low Price Close Price Total No of Trades Turnover in (Rs - in Lakh)kalaswamiAinda não há avaliações

- HSL PCG "Currency Daily": Private Client Group (PCG)Documento6 páginasHSL PCG "Currency Daily": Private Client Group (PCG)umaganAinda não há avaliações

- Spain Downgraded - Again: Morning ReportDocumento3 páginasSpain Downgraded - Again: Morning Reportnaudaslietas_lvAinda não há avaliações

- Report On Stock Trading by Mansukh Investment & Trading Solutions 27/05/2010Documento5 páginasReport On Stock Trading by Mansukh Investment & Trading Solutions 27/05/2010MansukhAinda não há avaliações

- 2 Stock Market Integration and The Speed of Information TransmissionDocumento19 páginas2 Stock Market Integration and The Speed of Information TransmissionShivanshu RajputAinda não há avaliações

- 7 Successful Stock Market Strategies: Using market valuation and momentum systems to generate high long-term returnsNo Everand7 Successful Stock Market Strategies: Using market valuation and momentum systems to generate high long-term returnsNota: 1 de 5 estrelas1/5 (1)

- Ishares Barclays Aggregate Bond FundDocumento2 páginasIshares Barclays Aggregate Bond FundRoberto PerezAinda não há avaliações

- Ishares JPMorgan USD Emerging Markets Bond FundDocumento2 páginasIshares JPMorgan USD Emerging Markets Bond FundRoberto PerezAinda não há avaliações

- Amundi Etf Global Emerging Bond Markit IboxxDocumento3 páginasAmundi Etf Global Emerging Bond Markit IboxxRoberto PerezAinda não há avaliações

- Product Details: Asset Class Name Isin Currency Exposure Use of Profits TER P.ADocumento1 páginaProduct Details: Asset Class Name Isin Currency Exposure Use of Profits TER P.ARoberto PerezAinda não há avaliações

- Amundi Etf Euro InflationDocumento3 páginasAmundi Etf Euro InflationRoberto PerezAinda não há avaliações

- Amundi Etf Euro CorporatesDocumento3 páginasAmundi Etf Euro CorporatesRoberto PerezAinda não há avaliações

- Ishares Barclays Aggregate Bond FundDocumento2 páginasIshares Barclays Aggregate Bond FundRoberto PerezAinda não há avaliações

- Ishares Iboxx $ High Yield Corporate Bond FundDocumento2 páginasIshares Iboxx $ High Yield Corporate Bond FundRoberto PerezAinda não há avaliações

- Vanguard Intermediate-Term Government Bond 3-10YDocumento2 páginasVanguard Intermediate-Term Government Bond 3-10YRoberto PerezAinda não há avaliações

- SPDR ETF Fixed Income Characteristics Guide 10.31.2011Documento5 páginasSPDR ETF Fixed Income Characteristics Guide 10.31.2011Roberto PerezAinda não há avaliações

- SPDR Barclays Capital Aggregate Bond ETF (LAG)Documento2 páginasSPDR Barclays Capital Aggregate Bond ETF (LAG)Roberto PerezAinda não há avaliações

- SPDRDocumento268 páginasSPDRRoberto PerezAinda não há avaliações

- SPDR Barclays Capital Short Term Corporate Bond ETF 1-3YDocumento2 páginasSPDR Barclays Capital Short Term Corporate Bond ETF 1-3YRoberto PerezAinda não há avaliações

- Ishares Iboxx $ Investment Grade Corporate Bond FundDocumento2 páginasIshares Iboxx $ Investment Grade Corporate Bond FundRoberto PerezAinda não há avaliações

- Vanguard Long-Term Government Bond ETF 10+Documento2 páginasVanguard Long-Term Government Bond ETF 10+Roberto PerezAinda não há avaliações

- Vanguard Short-Term Government Bond ETF 1-3YDocumento2 páginasVanguard Short-Term Government Bond ETF 1-3YRoberto PerezAinda não há avaliações

- SPDR Barclays Capital Intermediate Term Treasury ETF 1-10YDocumento2 páginasSPDR Barclays Capital Intermediate Term Treasury ETF 1-10YRoberto PerezAinda não há avaliações

- Ishares Barclays 10-20 Year Treasury Bond FundDocumento0 páginaIshares Barclays 10-20 Year Treasury Bond FundRoberto PerezAinda não há avaliações

- Lyxor ETF Iboxx Liquid High Yield 30Documento2 páginasLyxor ETF Iboxx Liquid High Yield 30Roberto PerezAinda não há avaliações

- SPDR Barclays Capital High Yield Bond ETF (JNK)Documento2 páginasSPDR Barclays Capital High Yield Bond ETF (JNK)Roberto PerezAinda não há avaliações

- Ishares Barclays 1-3 Year Treasury Bond FundDocumento0 páginaIshares Barclays 1-3 Year Treasury Bond FundRoberto PerezAinda não há avaliações

- Vanguard Long-Term Corporate Bond ETF 10+Documento2 páginasVanguard Long-Term Corporate Bond ETF 10+Roberto PerezAinda não há avaliações

- Vanguard Intermediate-Term Corporate Bond ETF 5-10YDocumento2 páginasVanguard Intermediate-Term Corporate Bond ETF 5-10YRoberto PerezAinda não há avaliações

- SPDR Barclays Capital Aggregate Bond ETF (LAG)Documento2 páginasSPDR Barclays Capital Aggregate Bond ETF (LAG)Roberto PerezAinda não há avaliações

- Vanguard Short-Term Corporate Bond ETF 1-5YDocumento2 páginasVanguard Short-Term Corporate Bond ETF 1-5YRoberto PerezAinda não há avaliações

- SPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YDocumento2 páginasSPDR Barclays Capital Intermediate Term Corporate Bond ETF 1-10YRoberto PerezAinda não há avaliações

- Ishares Barclays 7-10 Year Treasury Bond FundDocumento0 páginaIshares Barclays 7-10 Year Treasury Bond FundRoberto PerezAinda não há avaliações

- Ishares Barclays 3-7 Year Treasury Bond FundDocumento0 páginaIshares Barclays 3-7 Year Treasury Bond FundRoberto PerezAinda não há avaliações

- SPDR Barclays Capital Long Term Corporate Bond ETF 10+YDocumento2 páginasSPDR Barclays Capital Long Term Corporate Bond ETF 10+YRoberto PerezAinda não há avaliações

- Ishares Barclays 20+ Year Treasury Bond FundDocumento0 páginaIshares Barclays 20+ Year Treasury Bond FundRoberto PerezAinda não há avaliações

- Fundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110Documento227 páginasFundamental Equity Analysis - QMS Advisors HDAX FlexIndex 110Q.M.S Advisors LLCAinda não há avaliações

- Vendorcodes DataDocumento98 páginasVendorcodes DatasAinda não há avaliações

- Last Name Given Name Entity Country EmailDocumento2 páginasLast Name Given Name Entity Country EmailAmar1PatelAinda não há avaliações

- Cuentas Contables Saldo Ant. Enero FebreroDocumento48 páginasCuentas Contables Saldo Ant. Enero FebreroDaniel Felipe YlliscaAinda não há avaliações

- Traffic data for Nokia cells DHK_L0042 and DHK_L0070Documento981 páginasTraffic data for Nokia cells DHK_L0042 and DHK_L0070roniAinda não há avaliações

- Company Profile PresentationDocumento7 páginasCompany Profile PresentationbankerjudisAinda não há avaliações

- Sx5e FsDocumento4 páginasSx5e FsnealmailboxAinda não há avaliações

- Dataset 2 - Hair ColorDocumento35 páginasDataset 2 - Hair ColorHalimah SheikhAinda não há avaliações

- Directorio de Asociaciones, Cooperativas y Entidades BancariasDocumento77 páginasDirectorio de Asociaciones, Cooperativas y Entidades BancariasCENTRO JURIDICOAinda não há avaliações

- 12 Disfarma 2036 CurumaníDocumento5 páginas12 Disfarma 2036 CurumaníAMERICARES AMERICARESAinda não há avaliações

- SN Ticket Id Client Product Onu Vendor OLTDocumento564 páginasSN Ticket Id Client Product Onu Vendor OLTMilan NeupaneAinda não há avaliações

- Plantilla - Seguimiento de DevolucionesDocumento15 páginasPlantilla - Seguimiento de DevolucionesAaron ChávezAinda não há avaliações

- Correccion Notas NCD AbrilDocumento41 páginasCorreccion Notas NCD AbrilYinneth GuevaraAinda não há avaliações

- Allianz Corporate Profile BrochureDocumento28 páginasAllianz Corporate Profile BrochurejimbumbaAinda não há avaliações

- Bonus Certificate On The EURO STOXX 50Documento1 páginaBonus Certificate On The EURO STOXX 50api-25889552Ainda não há avaliações

- Retail Bonds Trading Statistics Sweden 2015Documento307 páginasRetail Bonds Trading Statistics Sweden 2015Sorken75Ainda não há avaliações

- Retail Bonds Trading Turnover and Trades 2015Documento329 páginasRetail Bonds Trading Turnover and Trades 2015Sorken75Ainda não há avaliações

- GBS - ERP Open PositionsDocumento258 páginasGBS - ERP Open PositionsVinod KumaranAinda não há avaliações

- FARGO Polyguard Overlaminate Inventory ListDocumento2 páginasFARGO Polyguard Overlaminate Inventory ListDiana LlanosAinda não há avaliações

- Lista MDocumento240 páginasLista MMaria MagicdAinda não há avaliações

- Plantilla Arbitraje FragataDocumento11 páginasPlantilla Arbitraje FragataÓscar alvearAinda não há avaliações

- Illiquid Assets Secondaries - Buy ListDocumento83 páginasIlliquid Assets Secondaries - Buy ListandresheftiAinda não há avaliações

- Dividend Derivatives EurexDocumento25 páginasDividend Derivatives EurexJustinAinda não há avaliações

- ERP Demand Jun'21Documento176 páginasERP Demand Jun'21Vamsi Krishna K0% (1)

- Theo Dõi Phân Phối Hàng: Số hóa đơn Tên cửa hàng, đại lý Mã hàng Ngày lập hóa đơnDocumento37 páginasTheo Dõi Phân Phối Hàng: Số hóa đơn Tên cửa hàng, đại lý Mã hàng Ngày lập hóa đơnKhoa ĐăngAinda não há avaliações

- Cuentas PucDocumento148 páginasCuentas PucIvon HoyosAinda não há avaliações

- Oerlikon - Welding Consumables - Air Liquide Welding - Page N° 13 - PDF Catalogue - Technical Documentation - BrochureDocumento45 páginasOerlikon - Welding Consumables - Air Liquide Welding - Page N° 13 - PDF Catalogue - Technical Documentation - BrochuresalomaodomingosAinda não há avaliações

- Futures Contract SpecificationsDocumento6 páginasFutures Contract SpecificationsDorina MohenjoAinda não há avaliações

- ProductSetUp OEXP v2Documento8 páginasProductSetUp OEXP v2Jeremy DickmanAinda não há avaliações

- Características de Los Valores Que Negocian en El Segmento de Warrants, Certificados Y Otros Productos (Sistema de Interconexión Bursátil)Documento100 páginasCaracterísticas de Los Valores Que Negocian en El Segmento de Warrants, Certificados Y Otros Productos (Sistema de Interconexión Bursátil)nicolasbaz01Ainda não há avaliações