Escolar Documentos

Profissional Documentos

Cultura Documentos

Factors Influencing Tourist Spending in Istria

Enviado por

Ana0 notas0% acharam este documento útil (0 voto)

32 visualizações13 páginasFACTORS INFLUENCING TOURIST SPENDING IN ISTRIA

Título original

FACTORS INFLUENCING TOURIST SPENDING IN ISTRIA

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoFACTORS INFLUENCING TOURIST SPENDING IN ISTRIA

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

32 visualizações13 páginasFactors Influencing Tourist Spending in Istria

Enviado por

AnaFACTORS INFLUENCING TOURIST SPENDING IN ISTRIA

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 13

28.

Mednarodna konferenca o razvoju organizacijskih znanosti

NOVE TEHNOLOGIJE, NOVI IZZIVI

25. - 27. marec 2009, Portoro, Slovenija

FACTORS INFLUENCING TOURIST SPENDING IN ISTRIA

Desimir Bokovi

Institute of Agriculture and Tourism Pore, Croatia

desimir@iptpo.hr

Jasmina Greni

Fakultet ekonomije i turizma Dr. Mijo Mirkovi Pula, Croatia

jasmina.@efpu.hr

Ana Teak

Institute of Agriculture and Tourism Pore, Croatia

tezak@iptpo.hr

ABSTRACT

Tourism is a major driver of economic development in Croatia. Either directly or

indirectly, tourism generates more than 25 percent of the countrys gross domestic

product and accounts for over 40 percent of all exports, placing this industry among

the key components of the national economy and foreign texchange. Croatia and

Istria possess a highly active tourism potential that needs to be valorised to a much

greater extent in order to create a distinctive identity of the tourism offering that will

lead to greater competitive ability, ensure a better position on the marketplace and

help to increase tourist spending. Average daily tourist spending per guest is a basic

indicator of tourism development for a country or destination.

In recent years, tourist spending generated in Istria, Croatias most developed

tourism destination, has been considerably lower than in other Mediterranean

destinations and some destinations in Croatia. There are number of reasons for this.

The hypothesis is that the factors impacting on the generation of such a level of

tourist spending include the existing structure and quality of basic and

complementary lower-category accommodation facilities; unsatisfactory quality and

range of services; seasonality of business and low occupancy rates; the condition of

the traffic infrastructure; dissatisfaction with the entertainment, experience and

adventure offerings; and a small number of facilities providing selective forms of the

tourism offering (theme tourism, adventure tourism, health tourism, congress and

incentive tourism, nautical and rural tourism). On the tourist market, there is an

obvious trend in the demand for specialised hotels (all-inclusive hotels, wellness, club

hotels, artistic and romantic hotels; hotels for gourmets, singles, tennis players, golf

players, etc.), with conventional hotels increasingly losing ground.

Based on research conducted, the aim of this paper is to establish and prove the

formulated hypotheses, their individual impact on the generation of low tourist

spending, and the measures and activities that can be taken to eliminate the

obstacles to achieving higher tourist spending.

Keywords: tourist spending, supply, demand, aims, measure and action

160

Domov | Home Nazaj | Back

1 INTRODUCTION

For more than a decade, Croatia, together with Istria, has been lagging in tourism industry

development and in adjusting to trends on the European and world tourist markets. This

stagnation and lagging behind in tourism is the result of the deterioration of our offering, in

terms of quality as well as quantity, relative to competitive European and, in particular,

Mediterranean countries. This negative trend in developing Croatian and Istrian tourism is the

outcome of the technological obsolescence of the tourism offering; the low quality of catering

and other services; the failure to apply European and world standards, principles and trends;

the failure to implement modern ways of organising work, management and adjustments to

the whims of tourist demand and its needs and wants; the inadequate level and quality of

managers; the failure to apply environmental norms and standards, etc. All this has combined

to cause poor tourist spending, low occupancy rates, marked seasonality of business, etc.

Market recovery, especially on the more sophisticated outbound tourism markets, will be a

very slow and difficult task if it is to be done with the existing tourism product. This is why it

is necessary to make a turnabout towards superior development solutions and to trigger a new

cycle of development. The new development concept would need to focus on how to

transform Istria from a two- and three-star destination into a four- and five-star destination. In

the twenty-first century, small countries, such as Croatia and Istria as its most developed

tourist region, that have little impact on global socio-economic trends, must seek to offer their

own specific features to whimsical tourist demand, features that are based on improved

quality and environmental, ethnical and domestic values that would make it distinctive in a

strongly competitive environment.

Therefore, the short-term and long-term policies of Istrian tourism must be viewed as visions

of a new system, visions of new relationships built not only on Istrias own values but also on

internationally transparent criteria and rules. The focus of tourism should already have shifted

from mass industry to quality. Service quality, throughout the entire tourism offering, is the

primary precondition to the further, successful development of Istrias tourism. This vision is

also contained in the paradigm of sustainable development in which development and

business efficiency hinge on designing product marketing.

In this model, the future development of tourism in Istria should seek to encourage the

restructuring of the existing tourism offering and the development of new selective forms of

the tourism offering of the highest category, such as nautical tourism, congress tourism,

hunting tourism, sports and recreational tourism, entertainment, cultural tourism, rural

tourism, excursion tourism, spiritual tourism, gastronomic tourism and other selective forms

of tourism that will serve as a platform for repositioning Istrias tourism offering on the

international tourist market.

.

2 RESEARCH METHODOLOGY

In this paper, research is based on primary and secondary sources, as well as on proven

scientific methods of domestic and foreign authors. In researching tourist spending and

spending patterns, the authors have conducted several surveys on tourists vacationing in Istria.

For the needs of a study on the development of the Barbariga tourist complex within the

company Brijunske Rivijere Pula, research was focused on tourist spending and on the

assessment of multiplier effects and consumption on other participants in Istrias and

Croatias tourism offering.

For a number of years, the Institute for Tourism Zagreb has been engaged in an ongoing

study, entitled TOMAS, dealing with the opinions and spending of tourists in Croatia and its

regions. The latest survey was conducted in 2007, the results of which will be used in this

161

paper, together with a comparison of tourist spending realised in the Istrian County with

spending in other Croatian destinations. Guest satisfaction in 2007 is also presented and

compared to results of the 2004 survey. A qualitative analysis of Istrias tourism offering is

made from a number of perspectives to identify the reasons behind inadequately low tourist

spending.

3 RESEARCH RESULTS AND DISCUSSION

Based on research conducted and on an analysis of Istrias tourism offering and the tourist

spending it generates, the factors impacting on the level of tourist spending have been

identified and proposals put forward to improve the existing offering. The hypothesis has

been confirmed stating that the greatest influence on the current level of tourist spending is

exercised by the existing structure and quality of primary and complementary accommodation

facilities; the quality and range of services provided; the dissatisfaction of tourists with the

entertainment, experience and adventure offering and with the offering of various facilities of

the selective tourism offering; and the marked seasonality of business.

3.1 Timeline of tourism development in Istria and some quantitative

and qualitative indicators of tourism supply and demand

According to data of the Bureau of Statistics, Istria a fairly small area covering a mere 2,815

km2 and accounting for 4.97 percent of Croatias territory had a total of 246,311 beds in

2007. This represents more than 30 percent of the total number of Croatias accommodation

capacities, and in the peak of the season, Istria plays host to more tourists than it has residents.

No other region in Croatia has managed to create a material basis of such magnitude. The first

beginnings of tourism in Istria date back to the time of the rule of the Austro-Hungarian

Monarchy and the construction of a railroad to Rijeka (1873) and Pula (1876). As early as

1913, district and regional tourism organisations united under the Austrian Federation for

Improving Transportation already existed in these regions. At the onset of the twentieth

century, the number of tourist resorts continued to grow every year, and in 1914, eight tourist

resorts with 67 hospitality facilities were recorded in Istria. In the period that followed,

between the two World Wars, tourism development began to decline.

1

After the end of World

War II and the annexation to the motherland of Istria, which was then under Italian rule, the

existing accommodation facilities were used to accommodate the first tourists arrivals and to

generate the first results of tourism. The 1950s saw the formation of hospitality and tourism

enterprises, catering chambers and tourism associations. The 1961-1972 period witnessed the

further dynamic development of mass tourism and the expansion of tourism of unsurmised

proportions. Small maritime and fishing towns were transformed into dynamic economic

centres with new facilities and a new structure of professions. Many hotels, tourist complexes,

motor camps, sports grounds, amusement centres and marinas were built. The adverse

economic and social movements that shook the country from 1981 to 1990 hugely influenced

tourism development. With an annual inflation of upward of 50 percent, an energy crisis,

shortages of various types of goods, etc., the tourism industry was unable to ensure the

optimum utilisation of its capacities or secure greater tourism traffic and tourist spending.

With the onset of political crisis and war activities, only about 20 percent of tourism traffic

was realised in 1991 relative to 1990. In the years that followed, up until the time stabilisation

and peace were secured for the country, tourist traffic continued to increase in Istria, which

had not been exposed to war conflicts. In line with trends on the tourist market, increasingly

greater investment is made to raising the category of accommodation facilities and improving

the overall tourism product.

1

Blaevi, I. :Povijest turizma Istre i Kvarnera, Otokar Kerovani, Opatija, 1987, p. 152.

162

Table 1: Accommodation capacities in Istria

Type of facility 2001 2003 2005 2007

Hotels 35,701 31,530 30,760 27,610

Tourist

complexes

37,410 33,947 33,656 31,534

Holiday flats 3,150 4,504 1,355 5,593

Camps 105,801 106,497 111,954 113,144

Private

accommodation

36,004 42,502 55,370 57,716

Other 2,657 6,709 10,585 10,714

TOTAL: 220,723 225,689 243,680 246,311

Source: Croatian Chamber of Economy County Chamber of Pula

Table 2: Number of tourists and overnights in the Istria County in 2000-2007 (in 000s)

Year Number

of

domestic

tourists

Number

of foreign

tourists

Total Number

of

domestic

overnights

Number

of foreign

overnights

Total

2000 147 2,016 2,163 643 13,797 14,440

2003 161 2,276 2,430 699 15,515 16,214

2005 167 2,338 2,505 686 15,964 16,659

2007 190 2,529 2,719 704 16,909 17,613

Source: Croatian Chamber of Economy County Chamber of Pula

In the above data, an upward trend in tourist traffic can be observed, in both the number of

tourist and number of overnights. The number of guests increased by 19 percent and the

number of overnights, by 17.5 percent. In 2007, some 2.7 million tourists visited Istria and

realised 17.6 million overnights, about 32 percent of all overnight in Croatia.

Qualitative aspects of tourism development in Istria

In the structure of Istrias accommodation capacities (Table 1), primary capacities (hotels,

hotel complexes, holiday-flat complexes) account for 59,144 beds or 26 percent of the total

number of beds; motor camps, for 113,144 beds or 47 percent; and private accommodation,

for 57,716 beds or 23 percent. The remaining 4 percent of beds are located in company

vacation homes, youth hotels and hostels, and in non-categorised facilities.

163

Table 3: Qualitative structure of accommodation capacities in the Istria County

Type Category Number Capacity Number Capacity

Hotels **** 3 1.471 20 8.034

*** 42 16.286 50 17.330

** 32 9.437 14 3.884

Hotel

complexes

****

2

638

4

1.770

*** 1 2.20o 5 4.823

** 11 9.956 9 8.566

Holiday flats **** - - 3 939

*** 2 233 10 1.983

** 5 1.276 6 2.794

Source: Croatian Chamber of Economy County Chamber of Pula

Three-star facilities dominate in primary solid facilities and in camps. However, with new

investments, the number of beds in four-star facilities has increased by more than 6,000 beds

and in three-star hotels, by about 1,000. The number of beds in two-star and one-star hotels

has dropped by more than 7,000. A similar trend in increasing the quality of accommodation

is also present in camps.

4 FACTORS IMPACTING ON TOURIST SPENDING IN

ISTRIA

4.1 Structure of the accommodation offering

With its tourism development grounded largely on the concept of mass tourism, Croatia

today, with its 944,076 beds and places (including also 62,089 berths in ports of nautical

tourism) numbers among the moderately developed tourist countries of the Mediterranean

basin. With more than 240,000 beds, the tourist destination of Istria is the most developed

tourist region in Croatia. However, in comparison with the structure of accommodation

capacities of other Mediterranean countries and similar destinations, Croatia and Istria are at a

disadvantage, and this is one of the primary reasons why Croatia tourism is lagging behind

and achieving low tourist spending. Namely, complementary capacities account for more than

75 percent of Croatias accommodation capacities and for about 73 percent of Istrias

accommodation capacities, whereas Italy, Greece and Spain have a considerably greater share

of primary accommodation facilities (53, 64 and 62 percent, respectively). The hotel offering

of Croatia and Istria is also at a disadvantage with regard to numbers, size and categorisation

in comparison with competitive Mediterranean countries. For example, the average size of a

hotel in Croatia is 220 beds; in Spain, 177; in France, 150; in Italy, 50; and in Austria, only

35. The total number of hotels in Croatia is exceptionally small and amounts to only 551,

whereas Austria has over 20,000 hotels; Italy, 26,800; and Spain, about 4,000.

2

In recent

years, the structure and categorisation of hotels in Croatia and Istria has undergone

considerable change. Today, 55 percent of Croatias hotels are three-star hotels; 25 percent,

two-star hotels; 17 percent, four-star hotels; and about 3 percent, five-star hotels. In Istria,

most hotels have three stars (60 percent); 23 percent of Istrias hotels have four stars, and 17

percent, two stars. The situation is similar in other types of accommodation capacities. Most

tourist complexes have two stars (60 percent), as well as most camps (31 percent). Some 25

2

Bokovi, D., Milohani, A.: Razlozi dosadanjeg zaostajanja i prijedlog koncepcije dugoronog razvoja

turizma Istre, Proceedings of the Conference Kontinentalni resursi u funkciji razvitka turizma Republike

Hrvatske, Faculty of Economic Osijek, 2002, p. 224.

164

percent of camps have three stars, and only 6 percent, four stars. In the camp offering,

Croatia is also at a disadvantage pertaining to the number and size of camps in comparison

with Mediterranean tourist countries. For example, Italy has more than 2,000 camps; Spain,

about 850; and Croatia, 228. There are 70 camps in Istria. However, relative to other

Mediterranean countries, the camps in Croatia and Istria have a far greater average capacity.

The average capacity of a camp in Istria is 1,800 places; in Croatia, 1,100; and in other

Mediterranean countries, from 500 to 800 places. If we consider the fact that guests generally

show a preference for smaller accommodation facilities, then it becomes clear why such

facilities are in greater demand and have higher occupancy rates.

4.2 Average occupancy rates

Exceptionally low occupancy rates are characteristic of Croatian hotels, including hotels in

Istria. Their average annual occupancy rate amounts to 131.5 days. In 2007, the occupancy

rate of tourist complexes amounted to 79.6 days, while the occupancy rate for private

accommodation was a mere 41.2 days. The overall occupancy rate in Croatia comes to 59.3

days

3

; in Istria, 67 days; and in the Dubrovako-Neretvanska County, 68 days.

Such low occupancy rates are conditioned by the structure, categories and quality of

accommodation capacities. All this, in turn, reflects directly on the amount of tourist spending

realised.

Because of their low occupancy rates, the dominating share of complementary capacities in

the offering camps, in particular have a highly adverse effect on the amount of tourist

spending, on business performance, etc.

4.3 Lagging of Croatia and Istria in other elements of the tourism

offering

A diverse catering offering is a significant part of Croatia and Istrias overall tourism offering.

The structure of this offering underwent substantial change with the onset on the privatisation

process. Nevertheless, the catering offering still lacks top-quality, specialised facilities with

modern furnishing, quality services and pleasant environments. Most establishments provide a

conventional, outdated food-and-beverage offering, while neglecting to heed new trends and

change on the tourist market. Out of a total of more than 2,300 catering facilities in Istria,

about 40 percent are various types of mainly conventional restaurants, 50 percent are various

types of caf bars, while only about 10 percent are entertainment facilities, discotheques,

amusement centres, terraces, etc.

Relatively well-preserved environment and resources for organic food product are

important advantages of Croatia and its tourists regions. However, little has been done to

capitalise on and valorise these advantages in designing the tourism offering. Surveys of

tourists in Istria during 2007 and 2008 show that 49 percent of respondents were interested in

ecologically produced food and were willing to pay up to 30 percent more for this type of

food in comparison to conventionally produced food

4

.

Although the Croatian tourism and hotel industries have made a comeback on the

international tourist market, the consumption of domestic input continues to decline every

year due to the considerable greater input of imported products in Croatias tourism product.

In the current situation, cheaper importation is encouraged and is the basis of commercial

orientation at the expense of home production. The performance quality of Croatian tourism

lags behind the average performance of competitive hotels in Europe and worldwide, and the

industry is falling behind in the implementation of international hotel standards for quality

3

2007 Report of the Ministry of Tourism of Croatia

4

2007 and 2008 Tourist Survey, Institute of Agriculture and Tourism Pore

165

and performance management in sales and purchasing, making it difficult to measure and

assess competitiveness

5

. Considered to be the greatest competitive advantages of Croatian

tourism, natural resources and the preserved environment should be used more effectively in

organic food product and should become a distinctive marketing brand of this destination.

The sports and recreational offering, together with the entertainment offering, plays a vital

role in the overall tourism offering and in spending. Istria was quick to recognise the

importance of these segments of the offering, which it has been developing hand in hand with

the accommodation offering

6

. Until recently, the wide range of services and facilities in the

sports and recreational offering was successful in meeting guest requirements. Today,

however, there is a feeling that certain, more sophisticated facilities and services are missing,

such as golf courses, sports halls, wellness centres, fitness centres, and active holidays and

sports animation.

As far as culture and cultural and historical heritage is concerned, Istria as a tourism

destination is rich in cultural resources. Some world-famous resources under UNESCO

patronage are located in the coastal area. However, because of the rapid development of mass

tourism since the 1970s, various selective forms of tourism, including cultural tourism, have

failed to develop to any significant degree. Culture is symbolically included as an element of

the excursion tourism offering, but only to a small extent because the sun and the sea continue

to be the primary motivation for tourist arrivals to Istria. Now when the concept of mass

tourism is changing to include various activities and experiences other than those linked to the

sun and sea, the time has finally come for cultural tourism to assume its rightful place in the

overall tourism offering and in the strategy of the future development of Croatian and Istrian

tourism.

This cultural capital, which has up until now been idle, should be capitalised on through

tourist spending. Promotional activities in coastal and rural tourism should seek to include

cultural heritage into the tourism offering and make it a travel motivation that will entice

tourists to visit and stay in Istria.

Nautical tourism and rural tourism are two other selective forms of tourism that can be further

developed in Croatia and Istria to help increase tourist spending.

Although nautical tourism has, in recent years, experienced rapid development, it is still

lagging behind with regard to the resources available and to demand on the market. Because

of its comparative advantages for developing nautical tourism, the European part of the

Mediterranean, as a place to stay and sail, is becoming more and more attractive to a growing

number of boaters

7

. The County of Istria has 11 marinas, four of which are a part of ACI,

while the others are independent or operate within hospitality and tourism companies.

Staying in the countryside and enjoying nature has become an absolute hit in tourism around

the world, and the number of people wanting to escape from urban environments is steadily

growing. In Croatia and Istria, this segment of the tourism offering has evolved into a special

product and is no longer a supplementary segment linked to maritime tourism. This segment

has ideal conditions for further development: the proximity of markets and the vicinity of the

sea, good transportation links, preserved nature, an abundance of natural attractions, many

cultural and historical monuments, a good eno-gastronomic offering, and peace and quiet. The

current capacities of rural tourism include 184 domestic establishments with 1,430 beds (in

various categories of true agritourism), located in rural holiday homes, rural family-run hotels,

5

Karamarko, N.: Izgradnja hrvatskih turistikih brendova u funkciji razvoja opskrbe i izvoza, Poslovni forum

Hrvatske- Roundtable Proceedings, Pore, 2008, p. 1.

6

Bokovi, D., erovi, S.: Restrukturiranje i prilagodba turistike ponude Hrvatske Europskim i svjetskim

trendovima, Turizam no. 2, CTB, Institute for Tourism Zagreb, 2000, p.159.

7

Vukevi, M., Dovear, R.: Izgradnja nautikog turizma kao sustava u Istri, Proceeding of the Conference

Turizam u Hrvatskoj na prijelazu stoljea, Faculty of Tourism and Foreign Trade Dubrovnik, 2000, p. 137.

166

private rooms and holiday flats in village households, where traditional dishes can be enjoyed

that are prepared in an authentic, home-made way using home-grown products

The research of the authors of this paper shows that rural Istria has a great number of

abandoned village houses, tancija (typical Istrian country-houses), etc. that could be

remodelled and refurnished to provide more than 10,000 beds under the condition that this

development neither puts the environment at any risk nor evolves into the mass tourism of the

coast.

TOURIST SPENDING

Background on tourist spending and assessment methodology

In the part of his book Tourism in the Economic System that deals with the effects of tourist

spending on aggregate consumption and economic equilibrium, Prof. B. Blaevi raises the

question: What needs to be done for tourism to actually become a pull activity that will be

distinctive as a Croatian strategic export product?

8

. This question requires not only practical

and pragmatic answers, but theoretical explanations and new insight as well. If the answers to

this question were simple and easy, there would be no conflicts between the stated opinions of

the Government and the actual policy that it applies to tourism.

The amount of spending realised is important to tourism, because tourists spend money that

they earned in places other than the place where they are temporarily staying. Calculating

tourist spending as a part of personal spending is neither an easy or simple matter. This is

because tourism is not merely a branch of industry, and tourism-related inflows do not occur

and are not recorded at a single point, but rather are dispersed over a number of points of

domestic consumption. Hence, the best way to acquire the data needed is by surveying

tourists. For the purpose of improving and developing the tourism offering of Istria, the

authors of this paper have conducted a number of surveys that provide information on how

much tourists spend on catering and tourism services

9

. However, because these surveys do not

include all tourist expenses (total spending), the data of the Institute for Tourism Zagreb

TOMAS are used.

Data on tourist spending in Croatia is also obtained through one-on-one interviews with

tourists in all counties.

The aim of research is to spot change in tourist-spending attributes, help meet new needs,

monitor trends, make comparisons with rival countries, identify activities in the destination

and travel motivations, and measure spending in the destination. The following section

presents some of the attributes of respondents and changes that have occurred relative to 2004

research results.

The socio-demographic profile of tourists to Istria: Average age 41; with 21 percent of

tourists being up to the age of 29; 52 percent in the 30-49 age group; and 27 percent in the

+50 age group. Prevalent is the middle-age group with family members. With regard to

educational background, more than 60 percent of tourists to Istria have college or higher-

education qualifications, 37 percent have secondary school qualifications, and 2.5 percent

have elementary school qualifications. In comparison to 2004 surveys, an increase in

educational levels can be observed, indicating a change in the demands of tourists who

increasingly show a preference for art, culture, experience, history, learning, etc. Family

members accompany more than 48 percent of tourists travelling to Istria, while spouses or

significant others accompany 31 percent. Family arrivals have increased by 8 percent relative

to 2004. For tourism providers, repeat visits are a crucial attribute of tourists. Results obtained

show that 31 percent of the tourists surveyed have made 3-5 visits; 23 percent, 6 and more

8

Blaevi, B. : Turizam u gospodarskom sustavu, Faculty of Tourism and Hospitality Management, Opatija,

2007, p. 328.

9

Institute of Agriculture and Tourism Pore, 2004 and 2007 Tourist Survey

167

visits; 24 percent, two visits; while 21.8 percent were visiting for the first time. The major

travel motivations of tourists surveyed include landscapes and scenery, the proximity of the

destination, favourable prices, and sports and recreation. These are also the main competitive

advantages of Croatian and Istrian tourism, which is not enough with regard to the

competition and numerous other facilities and services provided by the offering. Changes

have also taken place in the segment of pre-arrival information. The main sources of

information regarding the destination are the media (46 percent), the Internet (23 percent), and

previous visits (19 percent). The proximity of the destination determines the transportation

mode of tourists to Istria. More than 80 percent arrive by passenger car, 7.2 percent by bus,

and only 6.7 percent by air. The length of stay also underwent substantial change in 2007: it

shortened from 11.7 overnights to 9.8 overnights. Because of the prevailing beachside and

family tourism offering, the main activities for more than 70 percent of guests involve

swimming and bathing, going to caf bars and restaurants, shopping, and going on excursions.

A trend can also be observed in increased interest in health care, active holidays, engaging in

various hobbies, etc.

An assessment of guest satisfaction shows that in 2007 guests were more satisfied with most

elements of the offering than in 2004. However, the greater dissatisfaction of tourists with the

offering of the destination is linked to an inadequate supply of entertainment, culture and

shopping opportunities.

4.4 Tourist spending in the destination

This section of the paper presents data on tourist spending in the Istria destination compared

with the amount of spending realised in Croatia and other maritime counties. Data are

provided for tourist spending as per type of accommodation facility and for tourist spending

per country of origin of tourists.

Table 4: Average daily spending per person in EUR

In Croatia % In Istria %

Total spending 55.48 100 59.59 100

Accommodation 23.02 23.03

Eating in accom.

facility

4.65 5.55

Eating in

restaurants

6.98 7.19

Beverages 3.29 3.27

Shopping 9.51 17.1 10.54 17.7

Sport and

recreation

2.94 3.39

Culture 1.14 1.84

Excursions 2.97 3.88

Other 0.08 0.89

Source: Institute for Tourism Zagreb, TOMAS 2007, p. 35.

Data obtained show that total average daily tourist spending is larger in Istria by about EUR

4.0. Average daily spending is also larger per individual elements of the offering.

168

Table 5: Average daily spending per person in destinations

Destination Amount in

EUR

1. Croatia 55

2. Istria 60

3. Primorsko-Goranska County 46

4. Liko-Senjska County 44

5. Zadarska County 43

6. ibensko-Kninska County 47

7. Splitsko-Dalmatinska County 59

8. Dubrovako-Neretvanska County 88

Source: Institute for Tourism Zagreb, TOMAS 2007, p. 34.

The above data show that, apart from the Dubrovako-Neretvanska County, the greatest

average daily spending is realised in the County of Istria. There are a number of reasons for

this, the most important being the structure and quality of the accommodation offering and

other tourism offerings, the duration of the tourist season, the proximity of the market, the

accessibility of the destination, etc. It should be noted that in 2007 average daily spending in

Istria went up by 25 percent relative to spending in 2004. Viewed individually per elements of

the offering, catering services account for the greatest increase in tourist expenditure (39

percent), followed by other services (35 percent), whereas shopping expenditure dropped by

15 percent.

Table 6: Ranking of spenders in the County of Istria per

nationality

Rank Nationality Amount in

EUR

1. British 112

2. Russians 105

3. Italians 62

4. Dutch 60

5. Czechs 60

6. Hungarians 58

7. Austrians 53

8. Germans 53

Source: Institute for Tourism Zagreb, TOMAS 2007, p. 36.

The decline in the purchasing power of guests from the traditionally strongest German

market, and from the Italian and Austrian market has had a great impact on tourist spending in

the Istria destination. In recent years, the number of tourists from Great Britain and Russia has

increased, especially tourists staying in 4- and 5-star hotels and spending almost twice as

much, in all segments of the offering, as tourists from other markets.

169

Table 7.: Average daily tourist spending in Istria per type of

accommodation facility

Type of accommodation

facility

Daily spending in

EUR

1. Hotels 100

2. Tourist complexes 64

3. Private accommodation 56

4. Camps 44

Source: Institute for Tourism Zagreb, TOMAS 2007, p. 36.

The above data confirm the hypothesis that the structure and quality of the accommodation

offering has the greatest impact on realising tourist spending in the County of Istria. The fact

that hotels account for only 11 percent of Istrias total accommodation capacities, while

tourist complexes account for 13 percent; camps, for 47 percent; and private accommodation,

for 23 percent, serves to confirm the hypothesis. It is also the reason behind the current level

of tourist spending.

4.5 Suggestions for improving tourism in Istria and increasing

tourism spending

The vision of long-term tourism development in Croatia recognises the Croatian tourist space

as a destination product in response to globalisation processes

10

and implicates a

destination-focused policy. Namely, a destination, viewed in both localised and broader terms,

has a far better chance on the international tourist market, because, among other things, the

destination tourism-product makes it possible to reach target market segments and to

specialise the elements of the offering. In this model, the development of selective forms of

tourism should especially be encouraged, as the basis on which the Istrian and Croatian

tourism offerings will be positioned on the international tourist market. In addition to

eliminating weaknesses, the vision of future tourism development in Istria must seek to:

Change and improve, through restructuring, the existing structure of hotel

accommodations to increase the number of three- and four-star hotels. The

number of hotels and other types of accommodation in the two-star category

should be reduced to a minimum, that is, only one or two such facilities per

micro destination,

Restructure and reduce the size of complementary capacities (camps) in

keeping with market demand. Recommendations include reducing the size of

camps by about 30 percent, and to use this area for building 10 15 top-

category hotels,

Encourage the construction of family-run mini hotels in Istrias coastal and

rural areas

To improve the sports, entertainment and recreation offering, in particular by

building golf courses, wellness centres, sports halls, by providing sports

animation, etc.

Increase the number of marinas and berths in marinas,

10

Bokovi, D., Milohani, A. ; Razlozi dosadanjeg zaostajanja i prijedlog koncepcije dugoronog razvoja

turizma Istre, Proceedings of the Conference Kontinentalni resursi u funkciji razvitka turizma Republike

Hrvatske, Faculty of Economic Osijek, 2002, p. 224.

170

Encourage the development of various forms of rural tourism, starting with

agritourism, eno-gastronomic tourism, excursion tourism, hunting tourism, etc,

Encourage the development of theme facilities and clubs within hotel facilities

and tourist complexes,

Foster and encourage the development of culture and experiences in the

destination,

Improve the catering offering, in terms of quantity and quality,

Place emphasis in future development on environmental values and

environmental protection that foreign tourists highly appreciate. Well-

preserved natural resources should be used in organic food production, thus

creating a competitive advantage on the market,

Adopt and implement all European and world-class standards in catering and

tourism, etc.

If the above measures, lines of development and new strategies are not implemented

immediately and for the long run, it is not likely that the interest of guests in coming to Istria

and Croatia will grow. It is even less likely that tourist spending and multiplier effects from

tourism can be increased, occupancy rates and employment rates, raised, or the living

standard of the population, improved.

5 CONCLUSION

For Croatia, the last decade of the twentieth century was a time of great economic and

social turmoil and crisis, brought about by warfare and resulting in a rise of unemployment

and a drop in social and personal standards. All this impacted on the decline of tourism

development, that is, a decline of tourism in physical and financial terms and in terms of

quality. Having gradually recovered in recent years, tourism in Croatia and, in particular, in

Istria as the countrys most developed tourist region, again holds a high position. Notable are

new lines of tourism development, the introduction of high levels of quality, the

implementation of environmental, production, service and other standards valid in Europe

and worldwide.

Croatia began to lag behind in tourism development during the 1980s and this became

increasingly obvious in the decade that followed. Mass tourism, marked seasonality of

tourism operations, price increases that were not matched with an increase in the quality of

the tourism product, and other factors influenced the decline of quality in Croatias tourism

industry, and this was aggravated by the general economic and social crisis Croatia

experienced as a transition country .At the same time, other Mediterranean and European

countries were pushing far ahead of Croatia in tourism development and in adjusting to new

socio-economic trends and quality-related demands of tourists.

Modern tourists no longer wish to be a segment of mass tourism of lesser quality.

They wish to experience a special tourism product and consume selective forms of the

offering in which it will be obvious that tourists are respected and appreciated guests. The

tourism offering of Croatia and, in particular, of Istria, must gradually do away with the

concept of lesser-quality mass tourism and transform into a special, top-quality offering

geared to high-category tourists

171

REFERENCES

Blaevi, B. (2007) : Turizam u gospodarskom sustavu, Fakultet za hotelski i turistiki

menadment Opatija, pp.152

Blaevi, I (1987).: Povijest turizma Istre i Kvarnera, Otokar Kerovani, Opatija, .

Bokovi, D., Milohani, A.(2002) : Razlozi dosadanjeg zaostajanja i prijedlog koncepcije

dugoronog razvoja turizma Istre, zbornik radova znanstvenog skupa Kontinentalni

resursi u funkciji razvoja turizma Republike Hrvatske, Ekonomski fakultet Osijek,

pp.224.

Bokovi, D., erovi, S.(2000) : Rastrukturiranje i prilagodba turistike ponude Hrvatske

europskim i svjetskim trendovima, Turizam br. 2, HTZ, Institut za Turizam Zagreb, pp.

159

Bokovi, M (2008).: Turizam u gospodarskom razvoju Istre, diplomski rad, Fakultet za

turistiki i hotelski menadment, Opatija.

Bokovi, D (2000).: Multiplikativni efekti razvoja turizma Barbarige, (studija ), Institut za

poljoprivredu i Turizam Pore

Bokovi, D., Rui, P., Amidi, D (2007). : Konkurentnost ponude ruralnog turizma Istre,

HOTELink, asopis za teoriju i praksu hotelijerstva, Beograd

Bokovi, D., Vukevi, M. (2005):Suvremena organizacija i menadment u globalizacijskim

procesima, G.E.M., Sv. Katarina.

Bokovi, D., Vukevi, M. (2008): Marketing u turizmu, ekologija i menadment odrivim

razvojem, Tipomat, Zagreb.

Karamarko, N. (2008): Izgradnja hrvatskih turistikih brendova u funkciji razvoja opskrbe i

izvoza, Poslovni forum, Hrvatske, zbornik radova Okruglog stola, Pore, pp.1

Hansruedi, M.(2004): Turizam i ekologija, Masmedia, Zagreb.

Senei, J., Grgona, J.(2006): Marketing menadment u turizmu,Mikrorad, Zagreb

Kotler, P.(1994) : Upravljanje marketingom, Informator, Zagreb

Kuen, E.(2002) :Turistika atrakcijska osnova, Institit za Turizam, Zagreb.

Maga, D. (2003): Menadment turistike organizacije i destinacije,Fakultet za turistiki i

hotelski menadment, Opatija

Vukevi, M., Dovear, R.(2000) : Izgradnja nautikog turizma kao sustava u Istri, zbornik

radova Turizam u Hrvatskoh na prijelazu stoljea, Fakultet za Turizam i vanjsku

trgovinu, Dubrovnik

Institut za Turizam Zagreb(2007): Stavovi i potronja turista TOMAS.

Institut za poljoprivredu i Turizam Pore (2004/2007): Anketiranje turista u Istri

172

Você também pode gostar

- Organic Food Tourism Market IstriaDocumento10 páginasOrganic Food Tourism Market IstriaAnaAinda não há avaliações

- Impact of Productivity and Human Resourcs On Motivation in Agro Tourism ActivitiesDocumento14 páginasImpact of Productivity and Human Resourcs On Motivation in Agro Tourism ActivitiesAnaAinda não há avaliações

- Internet Usage in Collecting Information On Tourism Destinations - The Case of Istria CountyDocumento8 páginasInternet Usage in Collecting Information On Tourism Destinations - The Case of Istria CountyAnaAinda não há avaliações

- PAP050Documento7 páginasPAP050AnaAinda não há avaliações

- Internet Usage in Collecting Information On Tourism Destinations - The Case of Istria CountyDocumento8 páginasInternet Usage in Collecting Information On Tourism Destinations - The Case of Istria CountyAnaAinda não há avaliações

- Internet Usage in Collecting Information On Tourism Destinations - The Case of Istria CountyDocumento8 páginasInternet Usage in Collecting Information On Tourism Destinations - The Case of Istria CountyAnaAinda não há avaliações

- Preferences, Ways of Informing, and The Satisfaction of Tourists With Excursion Choices in Rural IstriaDocumento7 páginasPreferences, Ways of Informing, and The Satisfaction of Tourists With Excursion Choices in Rural IstriaAnaAinda não há avaliações

- The Level of Environmental Preservation of Rural Istria As A Vital Factor of Marketing and Sustainable Tourism DevelopmentDocumento12 páginasThe Level of Environmental Preservation of Rural Istria As A Vital Factor of Marketing and Sustainable Tourism DevelopmentAnaAinda não há avaliações

- Ratings of Events by Tourists and Managers, and The Development of Rural Tourism in IstriaDocumento13 páginasRatings of Events by Tourists and Managers, and The Development of Rural Tourism in IstriaAnaAinda não há avaliações

- PAP049Documento9 páginasPAP049AnaAinda não há avaliações

- Tourist Awareness and Interest of Organic Food The Case of IstriaDocumento8 páginasTourist Awareness and Interest of Organic Food The Case of IstriaAnaAinda não há avaliações

- Stability of The Phillips CurveDocumento21 páginasStability of The Phillips CurveAnaAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- International School of Asia and the Pacific Individual and Dual Sports Comprehensive ExamDocumento12 páginasInternational School of Asia and the Pacific Individual and Dual Sports Comprehensive ExamIan Santiago ParagguaAinda não há avaliações

- Diagnostic Assessment Mapeh 9Documento3 páginasDiagnostic Assessment Mapeh 9April Rose Ferrancullo RelojAinda não há avaliações

- London Marathon Records BrokenDocumento3 páginasLondon Marathon Records BrokenAna-Maria NeacsuAinda não há avaliações

- Vocabulary Booster Intermediate Sounds of Music Lead-InDocumento3 páginasVocabulary Booster Intermediate Sounds of Music Lead-InLekso LobzhanidzeAinda não há avaliações

- Rogue GuideDocumento45 páginasRogue GuideCloonyAinda não há avaliações

- When Did Born Alex Quinonez?Documento2 páginasWhen Did Born Alex Quinonez?veritojackemmAinda não há avaliações

- Seatwork 08SW01Documento8 páginasSeatwork 08SW01airamAinda não há avaliações

- Unit 6Documento15 páginasUnit 6shishirchemAinda não há avaliações

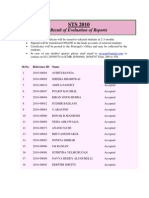

- ICMR STS 2010 Report Submission ResultsDocumento27 páginasICMR STS 2010 Report Submission ResultsManish Chandra PrabhakarAinda não há avaliações

- 5013POP Module Handbook Updated Sep 11Documento39 páginas5013POP Module Handbook Updated Sep 11Jasmina MilojevicAinda não há avaliações

- Frequency Adverbs WorksheetDocumento2 páginasFrequency Adverbs WorksheetIam. vascoAinda não há avaliações

- Sams ComputerFacts - Apple IIeDocumento73 páginasSams ComputerFacts - Apple IIeOscar Arthur KoepkeAinda não há avaliações

- Facing The Giants Film Review FinalDocumento4 páginasFacing The Giants Film Review FinalDeejay SorianoAinda não há avaliações

- Encyclopedia Needlework 0Documento8 páginasEncyclopedia Needlework 0joanae_borgesAinda não há avaliações

- TOEFL Junior: Sample QuestionsDocumento7 páginasTOEFL Junior: Sample QuestionsNgat HongAinda não há avaliações

- Corcovada - Hermeto Arr (With Elis Regina) Montreux 1979 & Articles and Interviews About Their Performance TogetherDocumento37 páginasCorcovada - Hermeto Arr (With Elis Regina) Montreux 1979 & Articles and Interviews About Their Performance Togetherzimby12Ainda não há avaliações

- Guidelines For Mr. and Ms. IntramsDocumento3 páginasGuidelines For Mr. and Ms. IntramsMarjoree Hope RazonAinda não há avaliações

- 4 Mallet Fundamentals by Garwood WhaleyNeil GroverDocumento5 páginas4 Mallet Fundamentals by Garwood WhaleyNeil Grovergizzy9dillespie0% (1)

- Ds-7200Huhi-K1 Series Turbo HD DVR: Features and FunctionsDocumento3 páginasDs-7200Huhi-K1 Series Turbo HD DVR: Features and FunctionsdamindaAinda não há avaliações

- Rolex Data Sheet PDFDocumento2 páginasRolex Data Sheet PDFfahmi1987Ainda não há avaliações

- School Phonics WorkshopDocumento21 páginasSchool Phonics WorkshopGreenfields Primary School100% (2)

- PC8000Documento8 páginasPC8000Foromaquinas100% (3)

- Traffic Signs, Road Signs PDF List For Computer Driving Learners TestDocumento4 páginasTraffic Signs, Road Signs PDF List For Computer Driving Learners TestAbhishek Sharma100% (1)

- 2 Microphone 2020Documento15 páginas2 Microphone 2020yap yi anAinda não há avaliações

- Coldplay Higher Power Song AnalysisDocumento22 páginasColdplay Higher Power Song AnalysisCamila VenegasAinda não há avaliações

- Proshea Apparel CatalogDocumento18 páginasProshea Apparel CatalogJaharudin JuhanAinda não há avaliações

- Bamboo Art (Capstone)Documento3 páginasBamboo Art (Capstone)AngelaAinda não há avaliações

- 50-42le AtsgDocumento68 páginas50-42le AtsgcherokewagAinda não há avaliações

- Hide and Seek Fun in Decodable Reader 26Documento5 páginasHide and Seek Fun in Decodable Reader 26BaxiAinda não há avaliações

- Mrs. Diniz's SpiceJet flight booking from Pune to GoaDocumento2 páginasMrs. Diniz's SpiceJet flight booking from Pune to GoaValencia DinizAinda não há avaliações