Escolar Documentos

Profissional Documentos

Cultura Documentos

Ecs2605 - Study Unit 1

Enviado por

Rico BartmanDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ecs2605 - Study Unit 1

Enviado por

Rico BartmanDireitos autorais:

Formatos disponíveis

STUDY UNIT 1: THE ROLE AND STRUCTURE OF THE SOUTH AFRICAN FINANCIAL SYSTEM

1.1 DEFINITION OF THE FINANCIAL SYSTEM

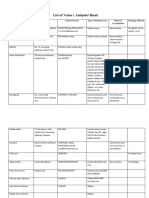

Define the Financial System A set of conventions surrounding the lending and borrowing of funds by non-financial units, and the intermediation of this function by financial institutions to: - facilitate the transfer of funds; - create additional money when required and - create markets in debt instruments so that the price and allocation of funds are determined efficiently List the 6 essential element of the Financial System+ Describe Briefly 1. Lenders and borrowers (Surplus and deficit units) 2. Financial intermediaries 3. Financial instruments 4. The creation of money 5. Financial markets 6. The price of money, interest rate Briefly describe the 5 allied participants without which the economy cant operate effectively

Distinguish ultimate borrowers and lenders Ultimate lenders and ultimate borrowers comprise the same four categories: 1. Households Individuals / families / charitable, religious and non-profit making bodies, unincorporated business e.g. farmers, retailers, partnerships, since the transactions of these businesses cannot be separated from those of their owners 2. Firms Corporate sector comprising all companies not classified as financial institutions; business enterprises engaged in the production and distribution of goods and services 3. Government Central, provincial, local government 4. Foreign Sector All organizations, persons and assets resident in the rest of the world.

Distinguish between direct investment/financing and indirect investment/financing Direct financing is when a deficit economic unit (borrower) issues financial instruments and sells these to the surplus units in the economy Indirect financing is when an intermediary concludes a transaction between a borrower and a lender Explain the role of intermediaries Financial intermediaries facilitate the flow of funds from surplus to deficit economic units, from lenders to borrowers.

Define a financial instrument and so that you can distinguish between marketable instruments and nonmarketable instruments There are two broad categories of financial instruments, equities (shares) and debt instruments A financial claim (financial instrument): A claim against a person or institution for payment of a future sum of money and/or a periodic payment of money. 1. Equities/shares 2. Debt instruments time period / maturity .See Treasury Bills, Bonds Define an investment vehicle A product used by investors with the intention of having positive returns. Investment vehicles can be low-risk, such as certificates of deposit (CDs) or bonds, or can carry a greater degree of risk such as with stocks, options and futures. Other types of investment vehicles include annuities, collectibles (art or coins, for example), mutual funds and exchange-traded funds (ETFs). Distinguish between primary and secondary markets Primary market is the market for the issue of new securities. Secondary market is the market where previously issued claims are traded. Distinguish between instruments that trade over the counter and those that trade on an exchange Some financial markets are based on organized financial exchanges, such as the JSE Ltd or the Bond Exchange of South Africa, while others are traded via direct contractual arrangements between counterparties, known as over-the-counter (OTC) trading.

Define the money market, bond market and the interbank market The debt markets also called fixed-interest markets for obvious reasons, is usually split into The Bond market, where long-term securities (term to maturity is more than one year) are issued and traded and The Money market, where short-term securities (less than a year) are issued and traded. The money market also encompasses interbank market operations and significant operations of the SARB. SARB performs open market operations to establish a desired money market shortage which it then provides via the interbank market at the SARB accommodation rate or repo rate, resulting in a powerful influence (control) on the short-term interest rate. Define the share market and the capital market Share market - The market in which shares are issued and traded either through exchanges or over-the-counter markets. Also known as the equity market, it is one of the most vital areas of a market economy as it provides companies with access to capital and investors with a slice of ownership in the company and the potential of gains based on the company's future performance. Capital Market - This is the market where financial instruments are traded whose maturity is a year or more. Some capital market instruments like bonds have maturity dates. Others like shares are perpetual instruments because they do not have a maturity date. Define the foreign exchange market and indicate the factors determining the supply and demand in this market The foreign exchange market is a financial asset (stock) market where foreign currencies are traded. In addition, foreign currency flows arising from international trade are reconciled in this market. The foreign exchange market also connects the money and capital markets in different countries. The average volume of foreign currency transactions in the foreign exchange market are generally much greater than those arising purely from international trade in goods and services. The world's currency markets can be viewed as a huge melting pot: in a large and ever-changing mix of current events, supply and demand factors are constantly shifting, and the price of one currency in relation to another shifts accordingly. No other market encompasses (and distills) as much of what is going on in the world at any given time as foreign exchange. Supply and demand for any given currency, and thus its value, are not influenced by any single element, but rather by several. These elements generally fall into three categories: economic factors, political conditions and market psychology Define the spot market and the forward market Spot market: 1. A commodities or securities market in which goods are sold for cash and delivered immediately. Contracts bought and sold on these markets are immediately effective. 2. A futures transaction for which commodities can be reasonably expected to be delivered in one month or less. Though these goods may be bought and sold at spot prices, the goods in question are traded on a forward physical market. Forward Market: An over-the-counter marketplace that sets the price of a financial instrument or asset for future delivery. Contracts entered into in the forward market are binding on the parties involved. Forward markets are used for trading a range of instruments including currencies and interest rates, as well as assets such as commodities and securities Define money Money anything that is accepted in exchange for goods and services, that serves as a unit of account and can be used for deferred payment. Money = Cash + Deposits Briefly explain the role played by the central bank in the determination of the interest rate level DEALT WITH IN STUDY UNIT 2 Define a yield curve and a time series and distinguish between the two A line that plots the interest rates, at a set point in time, of bonds having equal credit quality, but differing maturity dates. The most frequently reported yield curve compares the three-month, two-year, five-year and 30-year U.S. Treasury debt. This yield curve is used as a benchmark for other debt in the market, such as mortgage rates or bank lending rates. The curve is also used to predict changes in economic output and growth. Which allied participants are involved in the financial system?

1.2 FUNCTIONS OF THE FINANCIAL SYSTEM

Functions of the financial system and describe each briefly Provision of Credit The financial markets provide a means for raising finance for a multitude of borrowing entities. Debt markets provide for the borrowing of short- or long-term finance via a number of techniques, while equity markets provide for the raising of equity finance via the selling of shares, which represents a legally different form of liability. The pooling and Mobilization of savings The financial market provide a number of alternative for savers of funds, ranging from the direct and indirect purchase of a variety of securities through to bank deposits. Financial intermediation and risk sharing The activities of banks and other financial intermediaries allow for the transformation of financial assets to meet the needs of borrowers and savers. Facilitating the management, diversification, and trading of risk real producers can also hedge their risk using derivatives and insurance. Price discovery and the provision of liquidity Financial markets provide price discovery for the instruments found there. The frequent interaction between buyers and sellers allows for a smooth and prompt adjustment in the current price for a financial instrument, especially given the presence of market makers in banks and other institutions. Market makers are dealers who quote both buying and selling prices (bids and offers) for financial instruments. Liquidity defines the ease with which an instrument can be readily disposed of at prevailing market prices. Payment facilitation The financial markets provide the primary means of effecting payment for goods and services in an economy via a number of mechanisms ranging from cheques to electronic funds transfer. Risk pricing and transfer Financial markets provide a number of instruments and mechanisms for the trading of a wide range of risks. These risks are often transferred from hedgers, who do not wish to be exposed to the potential consequences, to a number of risk-seeking entities, ranging from speculators to risk traders. The price discovery function of financial markets referred to above extends to these instruments as well.

1.3 STABILITY OF THE FINANCIAL SYSTEM

Distinguish between price stability and stability of the financial sector, and describe each of these terms briefly Price stability is a situation in which prices in an economy don't change much over time. Price stability would mean that an economy would not experience inflation or deflation. It is not common for an economy to have price stability. Financial stability is defined as the smooth operation of the system of financial intermediation between households, firms, the government and financial institutions. Stability in the financial system would be evidenced by, firstly, an effective regulatory infrastructure; secondly, effective, well-developed financial markets; and thirdly, effective, sound financial institutions. Explain which factors led to the international financial crisis in 2007/2008 Read page 34 36 Text

1.4 FINANCIAL REGULATION

Why is regulation necessary and how is the extent of regulation determined? Instruments trading on a retail basis are regulated because it is deemed necessary for the protection of the public. The regulatory authority sometimes forms part of the government and sometimes it is an independent government agency. The Financial services Board (FSB) which is responsible for the regulation of non-banking financial activities in South Africa, is such an independent government agency. Sometimes some of the regulatory functions are exercised by a self-regulatory organization (SRO) under the supervision of the central regulator. The advantage of an SRO is that it may offer extensive expertise regarding market operations and may be able to respond more quickly than other bodies to changing market conditions. In South Africa, the exchanges operate as self-regulatory organizations. All regulators should, however, be operationally independent of political or commercial interference and accountable for the use of their powers and resources. List the elements of Regulation Establishing rules relating to a particular industry, for example issuing legislation Monitoring whether those rules are compiled with Enforcing those rules by taking action against those persons not complying with them.

List and briefly discuss the Objectives of Regulation Consumer or investor protection: In the financial markets, consumers do not have as much information as the suppliers of financial services, which make them vulnerable to exploitation and therefore regulation is needed to ensure their protection. Ensuring that securities markets are fair, efficient and transparent: The Securities and derivatives markets are essential for the growth and development of the economy of a country. Regulation is necessary to ensure that necessary confidence exists for agents to make use of the financial markets so that growth and development will not be hindered due to a lack of access to or trust in financial markets. Ensuring safety and soundness of financial institutions: The failure of one institution may affect the stability of the whole system. Regulatory requirements should be designed to address various risk factors, such as market risk, credit risk, liquidity risk and operational risk.

Ensuring systematic stability Where failure of a financial institution does occur, regulation should try to reduce the impact of the failure to the particular institution. However, as risk taking is a normal part of an active market, regulation should not stifle legitimate risk taking, but should rather promote sound risk management techniques that will allow institutions to absorb some losses without failing or affecting other institutions.

Discuss ethics in the financial markets and how this is established in the South African financial system Read page 126 Text Broad overview of the Regulatory framework in South Africa The regulatory structure in South Africa is currently fragmented, with different sections of the financial markets regulated by different institutions. Banks are regulated by the Banking Supervision department of the SARB in respect of their banking (deposit-taking) activities, while non-banking financial institutions are regulated by the FSB, independently from, but accountable to, the Department of Finance. Registration of companies takes place at the office of the Registrar of Companies, which forms part of the Department of Trade and Industry, while medical schemes are registered by the office of the Registrar of Medical Schemes, which forms part of the Department of Health. The Financial Intelligence Centre (FIC), an independent regulatory authority accountable to the Minister of Finance, is responsible for the control of anti-moneylaundering activities in the economy. Supervisory bodies like the FSB and JSE must provide the FIC with any information on money-laundering transactions that they may have as a result of their supervisory functions. The credit industry is regulated by the National Credit Regulator (NCR). The National credit act aims to promote fairness in accessing consumer credit, consumer protection and competitiveness in the credit industry. The Council for Overseeing Recognized and Statutory Ombudsman Schemes regulates the various ombudsmen created by industry or by statute. The FSB is, however, responsible for their administration.

Você também pode gostar

- Ecs2605 - Study Unit 2Documento3 páginasEcs2605 - Study Unit 2Rico BartmanAinda não há avaliações

- Ecs2603 Turial 101Documento141 páginasEcs2603 Turial 101Sylvester RakgateAinda não há avaliações

- ECO4122Z - 2021 Examination QuestionDocumento3 páginasECO4122Z - 2021 Examination QuestionRico BartmanAinda não há avaliações

- Teach English Online - Your Guide On How To Make Money & Travel The WorldDocumento29 páginasTeach English Online - Your Guide On How To Make Money & Travel The Worldnamedkk126Ainda não há avaliações

- Online Teaching GuideDocumento15 páginasOnline Teaching GuidePhạm Thị Ánh HồngAinda não há avaliações

- 1AssemblingSliceLayerCakes JamonDocumento22 páginas1AssemblingSliceLayerCakes JamonkheirenAinda não há avaliações

- Dao Kim Anh: Education BackgroundDocumento5 páginasDao Kim Anh: Education BackgroundĐào Kim AnhAinda não há avaliações

- Resume Teaching English AbroadDocumento8 páginasResume Teaching English Abroadqclvqgajd100% (2)

- 0 Curriculum Vitae Internationoal SchoolDocumento15 páginas0 Curriculum Vitae Internationoal Schoolakbisoi1Ainda não há avaliações

- PhotographyDocumento7 páginasPhotographyAlex johnAinda não há avaliações

- Ma Tesol: Teaching English To Speakers of Other LanguagesDocumento6 páginasMa Tesol: Teaching English To Speakers of Other LanguagesJulianAinda não há avaliações

- PH Wedding Reception VenueDocumento19 páginasPH Wedding Reception VenueLorielyn JalotjotAinda não há avaliações

- Debt InstrumentsDocumento45 páginasDebt InstrumentsKajal ChaudharyAinda não há avaliações

- Debt InstrumentsDocumento53 páginasDebt Instrumentskinjalkapadia087118100% (6)

- International Financial System: 2.1.1. Role of Financial MarketDocumento54 páginasInternational Financial System: 2.1.1. Role of Financial MarketADHITHYA SATHEESANAinda não há avaliações

- Assignment of IFSDocumento3 páginasAssignment of IFSvishnu sharmaAinda não há avaliações

- Financial Market and InstitutionsDocumento43 páginasFinancial Market and Institutionsdhiviraj100% (3)

- Financial Markets and Institutions 1Documento32 páginasFinancial Markets and Institutions 1Hamza Iqbal100% (1)

- Financial MarketDocumento48 páginasFinancial MarketAHUTI SINGHAinda não há avaliações

- JM ProjectDocumento54 páginasJM Projectbhavesh25jadavAinda não há avaliações

- Index Executive Summary of Capital Markets Chapter 1 Investment BasicsDocumento23 páginasIndex Executive Summary of Capital Markets Chapter 1 Investment Basicsswapnil_bAinda não há avaliações

- Markets and Interest RateDocumento18 páginasMarkets and Interest Rateahmed sakrAinda não há avaliações

- Intro To Financial MarketDocumento3 páginasIntro To Financial MarketVaishnav SanmukhiyaAinda não há avaliações

- ABIYDocumento9 páginasABIYEyob HaylemariamAinda não há avaliações

- Presented By:: Mohammad Maksudul Huq Chowdhury Branch Manager Exim Bank, Islampur Branch, DhakaDocumento43 páginasPresented By:: Mohammad Maksudul Huq Chowdhury Branch Manager Exim Bank, Islampur Branch, DhakaKazi Mahbubur RahmanAinda não há avaliações

- Financial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andDocumento43 páginasFinancial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andVivek Roy100% (1)

- A Quanittative Study of Nepalese Stock ExchangeDocumento87 páginasA Quanittative Study of Nepalese Stock ExchangenirajAinda não há avaliações

- Ch.1 Introduction: Sarma V. Nityanand, Banking and Financial System (Foundation Books, C.U.P.I. PVT - LTD.)Documento14 páginasCh.1 Introduction: Sarma V. Nityanand, Banking and Financial System (Foundation Books, C.U.P.I. PVT - LTD.)nirshan rajAinda não há avaliações

- Financial Institution and MarketDocumento21 páginasFinancial Institution and Marketmba2013Ainda não há avaliações

- Capital MarketDocumento66 páginasCapital MarketPriya SharmaAinda não há avaliações

- AssignmentDocumento30 páginasAssignmentKavita BagewadiAinda não há avaliações

- Notes - Financial Markets - OverviewDocumento10 páginasNotes - Financial Markets - OverviewNaman SaxenaAinda não há avaliações

- Introduction To Financial MarketDocumento53 páginasIntroduction To Financial MarketAddy Khan100% (1)

- Financial SystemDocumento98 páginasFinancial SystembharathAinda não há avaliações

- Fim Ug 4Documento21 páginasFim Ug 4Nahum DaichaAinda não há avaliações

- Notes On Financial SystemsDocumento62 páginasNotes On Financial SystemsamitAinda não há avaliações

- Money MarketDocumento7 páginasMoney MarketjkbilandaniAinda não há avaliações

- Financial EnvironmentDocumento20 páginasFinancial EnvironmentZahidul Islam SoykotAinda não há avaliações

- Deranatung Government College Itanagar Arumachal Pradesh Departnment of CommerceDocumento16 páginasDeranatung Government College Itanagar Arumachal Pradesh Departnment of CommerceAbhinandan soniAinda não há avaliações

- Basics of Financial ManagementDocumento23 páginasBasics of Financial ManagementCONTENT TUBEAinda não há avaliações

- Module 1 Capital MarketDocumento6 páginasModule 1 Capital MarketNovelyn Cena100% (1)

- Fi Assignment 1Documento3 páginasFi Assignment 1Burhan HadiAinda não há avaliações

- Specialized Financial Institutions.: by MKDocumento47 páginasSpecialized Financial Institutions.: by MKSarwan GulAinda não há avaliações

- Financial MarketDocumento27 páginasFinancial MarketHarshAinda não há avaliações

- Cfi1203 Module 1 Intro To Financial Markets and RegulationDocumento20 páginasCfi1203 Module 1 Intro To Financial Markets and RegulationLeonorahAinda não há avaliações

- Financial Market CH 1Documento13 páginasFinancial Market CH 1mohammadfoziya354Ainda não há avaliações

- The Main Difference Between Money Market and Capital Market Lies in The Types of Financial Instruments Traded and The Maturity of Those InstrumentsDocumento3 páginasThe Main Difference Between Money Market and Capital Market Lies in The Types of Financial Instruments Traded and The Maturity of Those Instruments251923069039 Markos HaileAinda não há avaliações

- Financial Markets and Their Role in EconomyDocumento6 páginasFinancial Markets and Their Role in EconomyMuzammil ShahzadAinda não há avaliações

- Tybbi Final ProjectDocumento76 páginasTybbi Final ProjectKarim MerchantAinda não há avaliações

- Components of Financial SystemDocumento11 páginasComponents of Financial SystemromaAinda não há avaliações

- Debt Instrument Project PDFDocumento50 páginasDebt Instrument Project PDFRohit VishwakarmaAinda não há avaliações

- FDB103 Module-1Documento51 páginasFDB103 Module-1knwb9ny78jAinda não há avaliações

- Financial Market and Institutions Lecture-1, 2, 3Documento4 páginasFinancial Market and Institutions Lecture-1, 2, 3Tyler vanPersieAinda não há avaliações

- MAS 2 Grp1 Written ReportDocumento12 páginasMAS 2 Grp1 Written ReportRenda QiutiAinda não há avaliações

- Financial Institutions and MarketsDocumento84 páginasFinancial Institutions and MarketsShreekumarAinda não há avaliações

- Lecture 1-Financial TheoryDocumento12 páginasLecture 1-Financial TheoryNe PaAinda não há avaliações

- Lending and Borrowing in The Financial SystemDocumento4 páginasLending and Borrowing in The Financial Systemtekalign100% (2)

- Financial Institutions and Market: (ACFN, 2 Credit Hour)Documento25 páginasFinancial Institutions and Market: (ACFN, 2 Credit Hour)Mikias DegwaleAinda não há avaliações

- CH04 FimDocumento4 páginasCH04 Fimfentaw melkieAinda não há avaliações

- MGT of Financial MKT & Instu CH-3Documento7 páginasMGT of Financial MKT & Instu CH-3fitsumAinda não há avaliações

- ECO 4128Z Final Ex 2019Documento5 páginasECO 4128Z Final Ex 2019Rico BartmanAinda não há avaliações

- Sample Practice QuestionsDocumento4 páginasSample Practice QuestionsRico BartmanAinda não há avaliações

- ECO 4108Z - 2018 Final ExamDocumento6 páginasECO 4108Z - 2018 Final ExamRico BartmanAinda não há avaliações

- Week 13 Practice Problems SolutionsDocumento5 páginasWeek 13 Practice Problems SolutionsRico BartmanAinda não há avaliações

- This Study Resource Was: Tutorial 1Documento5 páginasThis Study Resource Was: Tutorial 1Rico BartmanAinda não há avaliações

- Titan Global Partners Program (Global) 0401Documento38 páginasTitan Global Partners Program (Global) 0401Astrologer Aman Sodhi100% (3)

- Research ABM 12 PanditaDocumento11 páginasResearch ABM 12 PanditaMichelle PescaderoAinda não há avaliações

- Fifo Lifo WAC EgDocumento1 páginaFifo Lifo WAC EgKapil NagpalAinda não há avaliações

- TMA Divergence Indicator Script For Trading ViewDocumento5 páginasTMA Divergence Indicator Script For Trading ViewKrish Karaniya50% (2)

- Noreen 1 e Exam 05Documento4 páginasNoreen 1 e Exam 05jklein2588Ainda não há avaliações

- Objectives of Managerial EconomicsDocumento5 páginasObjectives of Managerial Economicssukul756Ainda não há avaliações

- AppEco Lesson 2Documento21 páginasAppEco Lesson 2wendell john medianaAinda não há avaliações

- Financial Derivatives: Deepak BansalDocumento53 páginasFinancial Derivatives: Deepak BansalpallaviAinda não há avaliações

- 411 Product ManagementDocumento112 páginas411 Product ManagementDeepak RoyAinda não há avaliações

- Profit Maximization Under Monopolistic Competition: Choosing The Profit-Maximizing Output and PriceDocumento5 páginasProfit Maximization Under Monopolistic Competition: Choosing The Profit-Maximizing Output and PriceCarla Mae F. DaduralAinda não há avaliações

- Lesson 4 Fair Value Gap FVG-1Documento4 páginasLesson 4 Fair Value Gap FVG-1Nguyễn Trường100% (5)

- College of Business and Accountancy: Tarlac State University Tarlac CityDocumento13 páginasCollege of Business and Accountancy: Tarlac State University Tarlac CityRazmen Ramirez PintoAinda não há avaliações

- Black and Red Simple Mind MapDocumento3 páginasBlack and Red Simple Mind MapFelicia ChayadiAinda não há avaliações

- How Do You Assess Japan As A Potential Market For ToysDocumento2 páginasHow Do You Assess Japan As A Potential Market For ToysBalachandra MallyaAinda não há avaliações

- Larry Williams Investor Profile PDFDocumento3 páginasLarry Williams Investor Profile PDFHilmi AbdullahAinda não há avaliações

- Q. How Starbucks Take Our Retail Planning Strategy and Put ItDocumento4 páginasQ. How Starbucks Take Our Retail Planning Strategy and Put ItSimran MehrotraAinda não há avaliações

- Name: Class: Date:: Cengage Learning Testing, Powered by CogneroDocumento24 páginasName: Class: Date:: Cengage Learning Testing, Powered by Cogneropoison4silenceAinda não há avaliações

- Supply and Demand Trading Rules PDF - UnBrick - IdDocumento18 páginasSupply and Demand Trading Rules PDF - UnBrick - IdEric Woon Kim Thak25% (4)

- The Five Marketing ConceptsDocumento4 páginasThe Five Marketing ConceptsBidyut Bhusan PandaAinda não há avaliações

- ZARA What Advantage Does Zara Gain AgainDocumento5 páginasZARA What Advantage Does Zara Gain AgainHitisha agrawalAinda não há avaliações

- An Analysis of Marketing Strategies of An Integrated Facility Services Company: The Case of ISS, SwedenDocumento63 páginasAn Analysis of Marketing Strategies of An Integrated Facility Services Company: The Case of ISS, SwedenFaizan ShowkatAinda não há avaliações

- Law of Equi-Marginal UtilityDocumento2 páginasLaw of Equi-Marginal UtilityGhalib Hussain100% (1)

- Maryam Ejaz Sec-A Marketing Assignment (CHP #15)Documento3 páginasMaryam Ejaz Sec-A Marketing Assignment (CHP #15)MaryamAinda não há avaliações

- Unil EverDocumento12 páginasUnil EverYunis SeptyAinda não há avaliações

- Counting Bars in Order To Detect End of CorrectionsDocumento4 páginasCounting Bars in Order To Detect End of Correctionsspaireg8977100% (1)

- What Is Market Demand? PDFDocumento14 páginasWhat Is Market Demand? PDFTHAN HAN100% (1)

- Mcom Sem 4 Advertising NotesDocumento100 páginasMcom Sem 4 Advertising Notesprathamesh gadgilAinda não há avaliações

- B2B QuizDocumento3 páginasB2B QuizKomal Khatter100% (1)

- How To Spot High-Confidence Trade Setups in A Highly Volatile MarketDocumento9 páginasHow To Spot High-Confidence Trade Setups in A Highly Volatile MarketMAKANDULU AJAAinda não há avaliações

- Assessment 1 Marketing StrategyDocumento31 páginasAssessment 1 Marketing StrategyRasha Elbanna75% (8)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successNo EverandReady, Set, Growth hack:: A beginners guide to growth hacking successNota: 4.5 de 5 estrelas4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceNo EverandValue: The Four Cornerstones of Corporate FinanceNota: 4.5 de 5 estrelas4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNo EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetNota: 5 de 5 estrelas5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNo EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityNota: 4.5 de 5 estrelas4.5/5 (4)

- Financial Risk Management: A Simple IntroductionNo EverandFinancial Risk Management: A Simple IntroductionNota: 4.5 de 5 estrelas4.5/5 (7)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNo EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNota: 4.5 de 5 estrelas4.5/5 (79)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamAinda não há avaliações

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNo EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursNota: 4.5 de 5 estrelas4.5/5 (34)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)No EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Nota: 4.5 de 5 estrelas4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialAinda não há avaliações

- Joy of Agility: How to Solve Problems and Succeed SoonerNo EverandJoy of Agility: How to Solve Problems and Succeed SoonerNota: 4 de 5 estrelas4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNo EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistNota: 4.5 de 5 estrelas4.5/5 (73)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsNo EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsNota: 5 de 5 estrelas5/5 (1)

- Creating Shareholder Value: A Guide For Managers And InvestorsNo EverandCreating Shareholder Value: A Guide For Managers And InvestorsNota: 4.5 de 5 estrelas4.5/5 (8)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNo EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistNota: 4 de 5 estrelas4/5 (32)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNo EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNota: 4 de 5 estrelas4/5 (20)