Escolar Documentos

Profissional Documentos

Cultura Documentos

Answers - Chapter 2 Vol 2 2009

Enviado por

Crystin Marie TiuDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Answers - Chapter 2 Vol 2 2009

Enviado por

Crystin Marie TiuDireitos autorais:

Formatos disponíveis

CHAPTER 2

NON-CURRENT LIABILITIES

PROBLEMS

2-1.

(Ruby Corporation)

At 8%

Bond issue price

Nominal interest for 2009

Interest expense for 2009

Premium/discount amortization in 2009

Bond carrying value at December 31, 2009

Nominal interest for 2010

Interest expense for 2010

Premium/discount amortization in 2010

Bond carrying value at December 31, 2010

1,081,145

50,000

43,246

6,754

1,074,391

100,000

85,671

14,059

1,060,332

At 11%

962,280

50,000

52,925

2,925

965,205

100,000

106,342

6,342

971,547

Computations:

At 8%

Issue price = (1,000,000 x 0.6756) + (50,000 x 8.1109)

= 675,600 + 405,545 = 1,081,145

Date

06/30/09

12/31/09

06/30/10

12/31/10

A

B

=

=

A

Interest

Paid

B

Interest

Expense

C

Premium

Amortization

50,000

50,000

50,000

43,246

42,976

42,695

6,754

7,024

7,035

D

Bond

Carrying Value

1,081,145

1,074,391

1,067,367

1,060,332

Face value x 5%

Carrying value, beg of year x 4%

At 11%

Issue price = (1,000,000 x 0.5854) + (50,000 x 7.5376)

= 585,430 + 376,880 = 962,280

Date

06/30/09

12/31/09

06/30/10

12/31/10

2-2.

A

Interest

Paid

B

Interest

Expense

C

Discount

Amortization

D

Bond

Carrying Value

50,000

50,000

50,000

52,925

53,086

53,256

2,925

3,086

3,256

962,280

965,205

968,291

971,547

(Fire Company)

(a)

Issue price

Present value of face value

(4,000,000 x 0.5084)

Present value of interest payments (320,000 x 7.0236)

Issue price

(b)

Amortization Table

P2,033, 600

2,247,552

P4,281,152

Chapter 2 - Non-Current Liabilities

Date

3/01/09

8/31/09

2/28/10

8/31/10

2/28/11

(c)

03/01/09

08/31/09

12/31/09

12/28/10

2-3.

(b)

(Onyx)

(a)

Interest

Expense

299,681

298,258

296,736

295,108

Premium

Amortization

20,319

21,742

23,264

24,892

Cash

Bonds Payable

Premium on Bonds Payable

Bond Carrying

Value

4,281,152

4,260,833

4,239,091

4,215,827

4,190,935

4,281,152

4,000,000

281,152

Interest Expense

Premium on Bonds Payable

Cash

299,681

20,319

Interest Expense (298,258 x 4/6)

Premium on Bonds Payable

Interest Payable (320,000 x 4/6)

198,839

14,494

Interest Expense

Premium on Bonds Payable

Interest Payable

Cash

99,419

7,248

213,333

(Metal Corporation)

Market value of bonds

Market value of warrants

Total issue price

(a)

2-4.

Interest

Paid

320,000

320,000

320,000

320,000

320,000

213,333

320,000

5,000,000 x .98

4,900,000

5,000 x 70

350,000

5,250,000

Cash

Discount on Bonds Payable

Bonds Payable

Share Warrants Outstanding

5,250,000

100,000

Cash (5,000 x 20 x 20)

Share Warrants Outstanding

Ordinary Shares (5,000 x 20 x 15)

Share Premium

2,000,000

350,000

5,000,000

350,000

1,500,000

850,000

Issue price of bonds with warrants (1,000,000 x 1.03)

Bond price without warrants

1,000,000 x 0.3220

100,000 x 5.6502

Value of share warrants

(b)

Interest Expense for 2009 (887,020 x 12% x 10/12

(c)

Bond carrying value, March 1, 2009

Amortization through December 31, 2009

887,020 x 12% x 10/12

1,000,000 x 12% x 10/12

10

1,030,000

322,000

565,020

887,020

142,980

88,702

887,020

88,702

83,333

5,369

Chapter 2 - Non-Current Liabilities

Bond carrying value, December 31, 2009

(d)

2-5.

892,389

Cash (1,000 x 30 x 50)

Share Warrants Outstanding

Ordinary Share (30,000 x 25)

Share Premium

1,500,000

142,980

750,000

892,980

(Celeron Company)

(a)

Issue price of convertible bonds

Issue price of bonds without conversion privilege

2,000,000 x 0.5674

200,000 x 3.6048

Allocation to equity

(b)

2,000,000

1,134,800

720,960

1,855,760

144,240

Amortization Table

Interest

Interest

Date

Paid

Expense

07/01/09

06/30/10

200,000

222,691

06/30/11

200,000

225,414

06/30/11

06/30/11

06/30/12

80,000

91,386

06/30/13

80,000

92,572

06/30/14

80,000

94,316*

*Adjusted; difference is due to rounding off.

(c)

07/01/09

Premium

Amortization

22,691

25,414

11,386

12,752

14,316

Cash

Discount on Bonds Payable

Bonds Payable

2,000,000

144,240

2,000,000

144,240

PIC Arising from Bond Conversion Privilege

06/30/10

06/30/11

06/30/11

Interest Expense

Discount on Bonds Payable

Cash

222,691

Interest Expense

Discount on Bonds Payable

Cash

225,414

Bonds Payable

PIC Arising from Conversion Privilege

Discount on Bonds Payable

Ordinary Share

Share Premium

22,691

200,000

25,414

200,000

1,200,000

86,544

Carrying value,bonds converted (1,903,865 x 120/200

Face value of bonds converted

Discount on bonds payable cancelled

Value of equity converted (144,240 x 120/200)

Par value of ordinary shares issued (120 x 80 x 100)

11

Bond Carrying

Value

1,855,760

1,878,451

1,903,865

(1,142,319)

761,546

772,932

785,684

800,000

57,681

960,000

268,863

1,142,319

1,200,000

57,681

86,544

960,000

Chapter 2 - Non-Current Liabilities

06/30/12

06/30/13

06/30/14

06/30/14

Interest Expense

Discount on Bonds Payable

Cash

91,386

Interest Expense

Discount on Bonds Payable

Cash

92,752

Interest Expense

Discount on Bonds Payable

Cash

94,316

Bonds Payable

PIC Arising from Bond Conversion Privilege

11,386

80,000

12,752

80,000

14,316

80,000

800,000

57,696

Cash

800,000

57,696

PIC from Unexercised Bond Conversion Privilege

(144,240 86,544)

2-6.

(Iron Company)

Bonds Payable

Premium on Bonds Payable (450,000 x 2/20)

PIC Arising from Bond Conversion Privilege(320,000 x 2/20)

2,000,000

45,000

32,000

Ordinary Shares (1,000 x 60 x 20)

Share Premium

2-7.

1,200,000

877,000

(Lim Corporation)

(a)

Cash

Bonds Payable

Premium on Bonds Payable

5,500,000

5,000,000

200,000

300,000

PIC Arising from Bond Conversion Privilege

(b)

Bonds Payable

Premium on Bonds Payable (5,000 x 1/5)

PIC Arising from Bond Conversion Privilege

1,000,000

10,000

60,000

Ordinary Share (200 x 40 x 100)

Share Premium

300,000 x 1/5 = 60,000

(c)

Bonds Payable

Premium on Bonds Payable (5,000 x 2/5)

PIC Arising from Bond Conversion Privilege

800,000

270,000

2,000,000

20,000

120,000

Cash (2,000,000 x 1.04)

Gain on Retirement of Bonds

2,080,000

10,000

50,000

PIC from Unexercised Bond Conversion Privilege

Retirement price

2,080,000

Retirement price on account of liability

2,000,000 x 1.005

Retirement price on account of equity

Carrying value of bonds retired

Face value

Unamortized premium (50,000 x 2/5)

12

2,010,000

70,000

2,000,000

___20,000

2,020,000

Chapter 2 - Non-Current Liabilities

Retirement price of bonds (2M x 1.005)

Gain on retirement of bonds

2,010,000

10,000

Carrying value of equity cancelled

Retirement price on account of equity

Gain on cancellation taken to equity

2-8.

120,000

70,000

50,000

(Emerald Corporation)

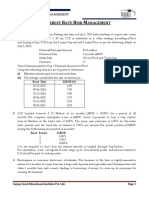

The following table may facilitate the computations required in this problem.

Date

12/01/09

06/01/10

12/01/10

06/01/11

12/01/11

06/01/12

12/01/12

06/01/13

12/01/13

06/01/14

12/01/14

Interest

Paid

300,000

300,000

300,000

300,000

300,000

180,000

180,000

180,000

180,000

180,000

Interest

Expense

269,304

267,769

266,157

264,465

262,688

156,494

155,318

154,084

152,788

151,443*

Premium

Amortization

30,696

32,231

33,843

35,535

37,312

23,506

24,682

25,916

27,212

28,557

Bond

Carrying Value

5,386,072

5,355,376

5,323,145

5,289,302

5,253,767

5,216,455

3,106,367

3,081,685

3,055,769

3,028,557

3,000,000

*Adjusted; difference is due to rounding off.

(a)

Carrying value, December 1, 2006 (see, table)

5,323,145

____5,640

5,317,505

Amortization for one month (33,843 x 1/6)

Carrying value, December 31, 2010

(b)

(c)

Interest Expense for year 2010

January 1-June 1, 2010 (269,304 x 5/6)

June 1-December 1, 2010

December 1-31, 2010 (266,157 x 1/6)

Total

224,420

267,769

_44,360

536,549

Carrying value of bonds retired on December 1, 2011

5,253,767 x 2/5

Carrying value of bonds retired on April 1, 2012

2,101,507

____9,950

2,091,557

(d)

Carrying value of bonds retired

Redemption price (2,000,000 x 1.04)

Gain on redemption of bonds

2,091,557

2,080,000

11,557

(e)

Carrying value of remaining bonds, December 1, 2011

Amortization through December 31, 2011 (24,682 x 1/6)

Carrying value of remaining bonds, December 31, 2011

3,106,367

4,114

3,102,253

(f)

On bonds redeemed:

Amortization through April 1, 2012 (37,312 x 4/6 x 2/5)

January 1-April 1, 2012 (262,688 x 2/5 x 3/6)

2012

52,538

203

On remaining bonds

January 1-June 1, 2012 (262,688 x 3/5 x 5/6)

June 1-December 1, 2012

December 1-31, 2012 (155,318 x 1/6)

January 1-June 1, 2013 (155,318 x 5/6)

13

131,344

156,494

25,886

129,432

Chapter 2 - Non-Current Liabilities

June 1-December 1, 2013

December 1-31, 2013 (152,788 x 1/6)

Interest Expense

2-9.

(Ohio Company)

Interest

Expense

1,014,730

999,908

983,901

966,613

473,971

463,889

Premium

Amortization

185,270

200,092

216,099

233,387

126,029

136,111

(a)

Effective interest (12,734,120 50,000) x 8%

Nominal interest (10,000,000 x 12%

Amortization of premium for 2009

(b)

Carrying value of bonds on December 31, 2012 (see table)

(c)

Carrying value of bonds called (11,849,272 x 5/10)

Call price/retirement price (5,000,000 x 110%)

Gain on retirement of bonds

(d)

Interest Expense for year 2014 (see table)

(e)

Unamortized premium on bonds payable, Dec. 31, 2014

5,662,496 5,000,000

2-10.

154,084

25,465

308,981

Partial Amortization Table

Interest

Paid

1,200,000

1,200,000

1,200,000

1,200,000

600,000

600,000

Date

01/01/09

12/31/09

12/31/10

12/31/11

12/31/12

12/31/13

12/31/14

______

366,262

Bond Carrying

Value

12,684,120

12,498,850

12,298,758

12,082,659

11,849,272

5,798,607

5,662,496

1,014,730

1,200,000

185,270

11,849,272

5,924,636

5,050,000

874,636

463,889

662,496

(Sim Company)

Partial Amortization Table

Date

03/01/09

09/01/09

03/01/10

09/01/10

03/01/11

09/01/11

03/01/12

09/01/12

(a)

Nominal

Interest

Effective

Interest

Premium

Amortization

85,000

85,000

85,000

85,000

85,000

85,000

85,000

88,335

88,485

88,642

88,806

88,977

89,156

89,343

3,335

3,485

3,642

3,806

3,977

4,156

4,343

Carrying amount of the bonds, December 31, 2009

88,335

3,335

1,966,335

2,323

1,968,658

(c)

Retirement price (at face value)

Accrued interest (2,000,000 x 8.5% x 4/12)

Amount of cash paid on June 30, 2012

2,000,000

56,667

2,056,667

(d)

Carrying value, March 1, 2012 (see table)

Amortization through June 30, 2012 (4,343 x 4/6)

Carrying value, June 30, 2012

Retirement price (at face value)

1,985,401

2,895

1,988,296

2,000,000

(b)

Interest expense recorded on September 1, 2009

Discount amortization recorded on September 1, 2009

Carrying amount of the bonds, September 1, 2009

Bond

Carrying value

P1,963,000

1,966,335

1,969,820

1,973,462

1,977,268

1,981,245

1,985,401

1,989,744

Amortization through December 31, 2009 (3,485 x 4/6)

14

Chapter 2 - Non-Current Liabilities

Loss on retirement of bonds

2-11.

11,704

(Lim Company)

(a)

Issue price of the bonds

Principal

Due Date

Due

12/31/10

2,000,000

12/31/11

2,000,000

12/31/12

2,000,000

12/31/13

2,000,000

12/31/14

2,000,000

Selling price of bonds

(b)

Principal

Due

Interest

Due

800,000

640,000

480,000

320,000

160,000

Amount

Due

2,800,000

2,640,000

2,480,000

2,320,000

2,160,000

Amortization Table

Interest

Effective

Due

Interest

Due Date

12/31/09

12/31/10

2,000,000

800,000

12/31/11

2,000,000

640,000

12/31/12

2,000,000

480,000

12/31/13

2,000,000

320,000

12/31/14

2,000,000

160,000

*Adjusted; difference is due to rounding off.

1,088,392

882,999

672,159

455,218

231,296

Present Value

PV Factor

0.8929

0.7972

0.7118

0.6355

0.5674

2,500,120

2,104,608

1,765,264

1,474,360

1,225,584

P9,069,936

Discount

Amortization

Carrying

Value, end

P9,069,936

7,358,328

5,601,327

3,793,486

1,928,704

-0-

288,392

242,999

192,159

135,218

71,296*

(c)

12/31/09

12/31/10

12/31/11

2-12.

Cash

Discount on Bonds Payable

Bonds Payable

9,069,936

930,064

Interest Expense

Discount on Bonds Payable

Cash

1,088,392

Bonds Payable

Cash

2,000,000

10,000,000

288,392

800,000

2,000,000

Interest Expense

Discount on Bonds Payable

Cash

882,999

242,999

640,000

Bonds Payable

Cash

(Blue Sapphire Corporation)

(a) Issue price of the bonds

Principal

Due Date

Due

12/31/09

2,000,000

12/31/10

2,000,000

12/31/11

2,000,000

12/31/12

2,000,000

Selling price of bonds

(b)

Due Date

01/01/09

12/31/09

12/31/10

12/31/11

Principal

Due

2,000,000

2,000,000

2,000,000

2,000,000

2,000,000

Interest

Due

960,000

720,000

480,000

240,000

Amount

Due

2,960,000

2,720,000

2,480,000

2,240,000

Amortization Table

Interest Due

Effective

Interest

960,000

720,000

480,000

15

695,004

513,804

337,308

Present Value

PV Factor

0.9259

0.8573

0.7938

0.7355

Discount

Amortization

264,996

206,196

142,692

2,740,664

2,331,856

1,968,624

1,646,400

P8,687,544

Carrying

Value, end

8,687,544

6,422,548

4,216,352

2,073,660

Chapter 2 - Non-Current Liabilities

12/31/12

2,000,000

240,000

*Adjusted; difference is due to rounding off.

166,340*

73,660

-0-

(c)

01/01/09

12/31/09

Cash

Bonds Payable

Premium on Bonds Payable

Interest Expense

Premium on Bonds Payable

Cash

Bonds Payable

Cash

12/31/10

8,000,000

687,544

695,004

264,996

960,000

2,000,000

2,000,000

Interest Expense

Premium on Bonds Payable

Cash

Bonds Payable

Cash

2-13.

8,687,544

513,804

206,196

720,000

2,000,000

2,000,000

(KFC Delivery Service)

(a)

6,949,800/9,000,000 = 0.7722

This present value factor for three periods is

under the rate of 9% (Table II, Present Value of a Single Payment). Hence,

effective yield for this transaction is 9%.

(b)

Date

09/01/09

08/31/10

08/31/11

08/31/12

Amortization

9% x 6,949,800 = 625,482

9% x 7,575,282 = 681,775

9% x 8,257,057 = 742,943*

Carrying Value of Note

6,949,800

7,575,282

8,257,057

9,000,000

*Adjusted; difference is due to rounding off.

(c)

Interest expense for 2009 (625,482 x 4/12)

208,494

Carrying value, September 1, 2009

Amortization through December 31, 2009

Carrying value, December 31, 2009

6,949,800

280,494

7,158,294

(d)

09/01/09

12/31/09

09/01/10

12/31/10

09/01/11

12/31/11

Land

Discount on Notes Payable

Notes Payable

6,949,800

2,050,200

9,000,000

Interest Expense

Discount on Notes Payable

208,494

Interest Expense (625,482 -208,494)

Discount on Notes Payable

416,988

Interest Expense (681,775 x 4/12)

Discount on Notes Payable

227,258

Interest Expense (681,775 227,258)

Discount on Notes Payable

454,517

Interest Expense (742,943 x 4/12)

Discount on Notes Payable

247,648

16

208,494

416,988

227,258

454,517

247,648

Chapter 2 - Non-Current Liabilities

09/01/12

2-14.

Interest Expense (742,943 247,648)

Discount on Notes Payable

495,295

495,295

(JFC)

(a)

2009

6,949,800 x 9%= 625,482

625,482 x 4/12

625,482 x 8/12

6,949,800 x 1.09 = 7,575,282

7,575,282 x 9%= 681,775

681,775 x 4/12

681,775 x 8/12

7,575,282 x 1.09 = 8,253,057

8,253,057 x 9%= 743,135

743,135 x 4/12

Totals

2010

2011

208,494

416,988

227,258

454,517

_______

208,494

_______

644,246

247,712

702,229

(b)

Notes Payable

Accrued interest (208,494 + 644,246)

Total, December 31, 2010

6,949,800

852,740

7,802,540

(c)

Non-current Liabilities

Notes Payable

Accrued interest (208,494 + 644,246)

December 31, 2010

6,949,800

852,740

7,802,540

Current Liabilities

Accrued interest

Total, December 31, 2011

6,949,800

1,554,969

8,504,769

(d)

09/01/09

12/31/09

12/31/10

12/31/11

12/31/12

2-15.

Land

Notes Payable

6,949,800

6,949,800

Interest Expense

Interest Payable

208,494

Interest Expense

Interest Payable

644,246

Interest Expense

Interest Payable

702,229

208,494

644,246

702,229

Interest Expense (adjusted)

Interest Payable

Notes Payable

Cash

495,231

1,554,969

6,949,800

9,000,000

(Wendys Catering Service)

(a)

Present value of note (800,000 x 3.2397)

(b)

Date

Principal Due

Amortization

4/01/09

3/31/10

800,000

233,258

3/31/11

800,000

182,252

3/31/12

800,000

126,654

3/31/13

800,000

66,076*

*Adjusted; difference is due to rounding off.

17

2,591,760

Carrying Value of Note

2,591,760

2,025,018

1,407,270

733,924

-0-

Chapter 2 - Non-Current Liabilities

(c)

04/01/09

12/31/09

03/31/10

Equipment

Discount on Notes Payable

Notes Payable

2,591,760

608,240

3,200,000

Interest Expense (233,258 x 9/12)

Discount on Notes Payable

174,944

Notes Payable

Interest Expense

Cash

800,000

58,314

174,944

800,000

58,314

Discount on Notes Payable (233,258-174,944)

12/31/10

03/31/11

Interest Expense (182,252 x 9/12)

Discount on Notes Payable

136,689

Notes Payable

Interest Expense

Cash

800,000

45,463

136,689

800,000

45,563

Discount on Notes Payable (182,252-136,689)

12/31/11

03/31/12

Interest Expense (126,654 x 9/12)

Discount on Notes Payable

94,991

94,991

Notes Payable

Interest Expense

Cash

800,000

31,663

800,000

31,663

Discount on Notes Payable (126,654-94,991)

12/31/12

03/31/13

Interest Expense (66,076 x 9/12)

Discount on Notes Payable

49,557

49,557

Notes Payable

Interest Expense

Cash

800,000

16,519

800,000

16,519

Discount on Notes Payable (66,076-49,557)

2-16.

(Burgees Food Corporation)

(a)

Principal Payment

Date

04/01/09

03/31/10

03/31/11

03/31/12

03/31/13

Annual Payment

Interest

800,000

800,000

800,000

800,000

233,258

182,252

126,654

66,053

*Adjusted

(b)

04/01/09

Equipment

Notes Payable

12/31/09

04/01/10

566,742

617,748

673,346

733,947*

Carrying Value

2,591,760

2,025,018

1,407,270

733,924

-0-

2,591,760

2,591,760

Interest Expense (233,258 x 9/12)

Interest Payable

174,944

Interest Payable

Interest Expense (233,258 174,944)

Notes Payable

174,944

58,314

566,748

18

174,944

Chapter 2 - Non-Current Liabilities

Cash

12/31/10

04/01/11

12/31/11

04/01/12

12/31/12

04/01/13

(c)

800,000

Interest Expense (182,252 x 9/12)

Interest Payable

136,689

Interest Payable

Interest Expense (182,252 136,689)

Notes Payable

Cash

136,689

45,563

617,748

Interest Expense (126,654 x 9/12)

Interest Payable

Interest Payable

Interest Expense (126,654 94,991)

Notes Payable

Cash

Interest Expense (66,053 x 9/12)

Interest Payable

Interest Payable

Interest Expense (66,053 49,540)

Notes Payable

Cash

136,689

800,000

94,991

94,991

94,991

31,663

673,346

800,000

49,540

49,540

49,540

16,513

733,947

800,000

Current portion at December 31, 2010

Notes Payable

Interest Payable

617,748

136,689

Noncurrent portion at December 31, 2010

Notes Payable

1,407,270

2-17.

(a)

(b)

(c)

(South Company

Notes Payable

Interest Payable

Cost of Sales

Inventory of Machine Parts

Sales

Gain on Debt Restructuring

(Jay Company)

Bonds Payable

Interest Payable

Ordinary Share

Share Premium

900,000

90,000

650,000

650,000

800,000

190,000

10,000,000

900,000

7,500,000

3,400,000

(Capshell Company)

Notes Payable

Interest Payable

Restructured Notes Payable

Gain on Debt Restructuring

Present value of future payments

8,000,000 x 0.7972

= 6,377,600

8,000,000 x 8% x 1.6901 = 1,081,664

Total

7,459,264

Carrying value of liability

11,200,000

Gain on debt restructuring

3,740,736

19

10,000,000

1,200,000

7,459,264

3,740,736

Chapter 2 - Non-Current Liabilities

Alternatively, the entry may be recorded as:

Notes Payable

Interest Payable

Discount on Restructured Notes Payable

Restructured Notes Payable

Gain on Debt Restructuring

(d)

(Solid Company)

Notes Payable

Interest Payable

Restructured Notes Payable

Gain on Debt Restructuring

10,000,000

1,200,000

540,736

8,000,000

3,740,736

3,000,000

330,000

3,111,024

218,976

Present value of future payments

3,000,000 x 0.5935

= 1,780,500

3,000,000 x 12% x 3.6959 = 1,330,524

Total

3,111,024

Carrying value of liability

3,330,000

Gain on debt restructuring

218,976

Alternatively, the entry may be recorded as:

Notes Payable

Interest Payable

3,000,000

330,000

Premium on Restructured Notes Payable

Restructured Notes Payable

Gain on Debt Restructuring

MULTIPLE CHOICE QUESTIONS

Theory

MC1

MC2

MC3

MC4

MC5

MC6

MC7

MC8

MC9

MC10

D

D

D

C

D

D

D

C

D

C

MC11

MC12

MC13

MC14

MC15

MC16

MC17

MC18

MC19

MC20

C

B

B

D

A

A

D

B

A

C

Problems

MC21

MC22

MC23

MC24

MC25

MC26

MC27

MC28

D

B

A

B

B

C

A

D

MC29

MC30

MC31

MC32

MC33

D

C

A

A

B

MC34

(1,000,000 x 0.38554) + (80,000 x 6.14457) = 877,106

(1,000 x 0.31) + (40 x 11.47) = 768.80

(2,000,000 x 97%) + (2,000,000 x 10% x 3/12) = 1,990,000

(2,000 X 1,040) - 2,000,000 = 80,000

(4,000,000 x 97%) + (4,000,000 x 12% x 3/12) = 4,000,000

1,070,000 - (96% x 1,000,000) = 110,000

1,000,000 x 12% x 1/12 = 10,000

1,000,000 - 30,000 + 50,000 = 1,020,000;

1,020,000 - (40,000 x 20) - 10,000 = 210,000

Using the book value method, no gain or loss is recorded upon conversion

1,032,880 x 10% x 6/12 = 51,644

1,032,880 - {(1,000,000 x 6%) - 51,644}= 1,024,524

1,878,000 - {(10% x 1,878,000) -(2,000,000 x 9%) = 1,885,800

10,000,000 1,145,000 = 8,855,000;

(8,855,000 x 6%) - (10,000,000 x 5%) = 31,300

5,680,000 x 8% x 6/12 = 227,200

20

111,024

3,000,000

218,976

Chapter 2 - Non-Current Liabilities

MC35

MC36

MC37

C

D

MC38

MC39

B

D

MC40

MC41

MC42

B

C

MC43

MC44

(2,100,000 x 6%) (2,000,000 x 7%) = 14,000; 2,100,000 14,000 = 2,086,000 BCV;

BCV of P2,086,000 face value of P2,000,000 = P86,000 premium

1,032,880 x 10% = 103,288

1,902,800 x 10% = 190,280 effective interest; 190,280 effective interest nominal interest of

160,000=30,280 discount amortization; carrying value = 1,902,800 + 30,280 principal

payment of 400,000 = 1,533,080

2,400,000 X 12% = 288,000

2,400,000 1,000,000 + 288,000 = 1,688,000

1,688,000 X 12% = 202,560; 1,000,000 202,560 = 797,440

3,000,000 2,400,000 = 600,000; 600,000 288,000 = 312,000

4,500,000 3,000,000 = 1,500,000

6,000,000 + 600,000 = 6,600,000

(6000,000 x 0.6209) +(6000,000 x 8% x 3.7908) = 5,544,984

6,600,000 5,544,984= 1,055,016

6,600,000 [(5,000,000 x .6209) +(5,000,000 x .12 x 3.7908)] =1,221,020

8,000,000 + 640,000 = 8,640,000

(6,000,000 x 0.8573) + (6,000,000 x 10% x 1.7833) = 6,213,780

8,640,000 6,213,780 = 2,426,220

21

Você também pode gostar

- Accounting For Income TaxDocumento31 páginasAccounting For Income TaxJames Ryan AlzonaAinda não há avaliações

- ACC 106 Final ExaminationDocumento5 páginasACC 106 Final ExaminationJezz Culang0% (1)

- Quiz Week 8 Akm 2Documento6 páginasQuiz Week 8 Akm 2Tiara Eva TresnaAinda não há avaliações

- Ae 211 Solutions-PrelimDocumento10 páginasAe 211 Solutions-PrelimNhel AlvaroAinda não há avaliações

- Chapter 10Documento8 páginasChapter 10Coursehero PremiumAinda não há avaliações

- Economic Development Midterm ExaminationDocumento4 páginasEconomic Development Midterm ExaminationHannagay BatallonesAinda não há avaliações

- Multiple Choice Questions 1 A Method That Excludes Residual Value FromDocumento1 páginaMultiple Choice Questions 1 A Method That Excludes Residual Value FromHassan JanAinda não há avaliações

- CPA Dreams Test BankDocumento6 páginasCPA Dreams Test BankMayla MasxcxlAinda não há avaliações

- Ia2 Ka & SolDocumento31 páginasIa2 Ka & SolCarlah Jeane BasinaAinda não há avaliações

- IA2 06 - Handout - 1 PDFDocumento5 páginasIA2 06 - Handout - 1 PDFMelchie RepospoloAinda não há avaliações

- Earnings Per ShareDocumento3 páginasEarnings Per ShareYeshua DeluxiusAinda não há avaliações

- Discussion 2 CHAPDocumento4 páginasDiscussion 2 CHAPHannah LegaspiAinda não há avaliações

- Chapter 34Documento17 páginasChapter 34Mike SerafinoAinda não há avaliações

- Depn CompDocumento3 páginasDepn CompCassandra Dianne Ferolino MacadoAinda não há avaliações

- AsdasdDocumento3 páginasAsdasdMark Domingo MendozaAinda não há avaliações

- Bond Valuation Exam 1Documento2 páginasBond Valuation Exam 1Ronah Abigail BejocAinda não há avaliações

- 11 - Equity SecuritiesDocumento2 páginas11 - Equity Securitiesralphalonzo0% (1)

- JM IncDocumento3 páginasJM IncJomar VillenaAinda não há avaliações

- Summary Notes - Correction of Errors, Cash and AccrualDocumento1 páginaSummary Notes - Correction of Errors, Cash and AccrualShin MelodyAinda não há avaliações

- This Study Resource Was: Intermediate Accounting 3 (Interim)Documento2 páginasThis Study Resource Was: Intermediate Accounting 3 (Interim)Nah HamzaAinda não há avaliações

- Answers - V2Chapter 6 2012Documento6 páginasAnswers - V2Chapter 6 2012Rhei BarbaAinda não há avaliações

- Fin Mar 2.1 Determinants of Int RatesDocumento3 páginasFin Mar 2.1 Determinants of Int RatesMadelyn EspirituAinda não há avaliações

- Quiz 1 Finals BSA2102 With SolutionDocumento6 páginasQuiz 1 Finals BSA2102 With SolutionJohn ryan Del RosarioAinda não há avaliações

- Module 1 Notes and Loans ReceivableDocumento21 páginasModule 1 Notes and Loans ReceivableEryn GabrielleAinda não há avaliações

- Bonds Payable Issued at A PremiumDocumento6 páginasBonds Payable Issued at A PremiumCris Ann Marie ESPAnOLAAinda não há avaliações

- Chapter 6 - Notes ReceivableDocumento5 páginasChapter 6 - Notes ReceivableTurks100% (1)

- Albert I. Rivera, CPA, MBA, CRA 1Documento6 páginasAlbert I. Rivera, CPA, MBA, CRA 1Reina EvangelistaAinda não há avaliações

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Documento18 páginasShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)nmdl123Ainda não há avaliações

- Far - QuizDocumento3 páginasFar - QuizRitchel CasileAinda não há avaliações

- Review Exercise ADocumento5 páginasReview Exercise AFitz Gerald BalbaAinda não há avaliações

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Documento7 páginasPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)rain06021992Ainda não há avaliações

- Orca Share Media1577676507201Documento4 páginasOrca Share Media1577676507201Jayr BVAinda não há avaliações

- Acctg201 IntroductionDocumento10 páginasAcctg201 Introductionaaron manacapAinda não há avaliações

- BUS-TAX M1Exer2Documento1 páginaBUS-TAX M1Exer2joint accountAinda não há avaliações

- 1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Documento10 páginas1 ULO 1 To 3 Week 1 To 3 SHE Activities (AK)Margaux Phoenix KimilatAinda não há avaliações

- Seatwork Module 10Documento3 páginasSeatwork Module 10Marjorie PalmaAinda não há avaliações

- Cash and Cash EquivalentsDocumento3 páginasCash and Cash EquivalentsEuniceChungAinda não há avaliações

- Chapter 1 LiabilitiesDocumento4 páginasChapter 1 LiabilitiesA cAinda não há avaliações

- Intermediate Accounting Unit4 - Topic2Documento12 páginasIntermediate Accounting Unit4 - Topic2Lea Polinar100% (1)

- MSC-Audited FS With Notes - 2014 - CaseDocumento12 páginasMSC-Audited FS With Notes - 2014 - CaseMikaela SalvadorAinda não há avaliações

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocumento5 páginasSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotAinda não há avaliações

- Finals Part 1 Answers May 2019Documento5 páginasFinals Part 1 Answers May 2019edwin_dauzAinda não há avaliações

- Cost Concept, Terminologies and BehaviorDocumento8 páginasCost Concept, Terminologies and BehaviorANDREA NICOLE DE LEONAinda não há avaliações

- Cash and Cash Equivalents QuizDocumento2 páginasCash and Cash Equivalents QuizMarkJoven Bergantin100% (1)

- 1.1.2. Hoba - General TransactionsDocumento26 páginas1.1.2. Hoba - General TransactionsJane DizonAinda não há avaliações

- This Study Resource WasDocumento4 páginasThis Study Resource WasMarcus MonocayAinda não há avaliações

- BLTDocumento4 páginasBLTJaylord PidoAinda não há avaliações

- Unmodified ReportDocumento2 páginasUnmodified ReportErica CaliuagAinda não há avaliações

- Process Costing: Assign Cost To Outputs in ManufacturingDocumento7 páginasProcess Costing: Assign Cost To Outputs in ManufacturingJoanne TolentinoAinda não há avaliações

- Quiz Chapter+3 Bonds+PayableDocumento3 páginasQuiz Chapter+3 Bonds+PayableRena Jocelle NalzaroAinda não há avaliações

- ProblemDocumento26 páginasProblemMengyao LiAinda não há avaliações

- Kunci Jawaban Intermediate AccountingDocumento41 páginasKunci Jawaban Intermediate AccountingbelindaAinda não há avaliações

- Diagnostic Exercises2Documento32 páginasDiagnostic Exercises2HanaAinda não há avaliações

- Module 1 ExamDocumento4 páginasModule 1 ExamTabatha Cyphers100% (2)

- EXERCISES On EARNINGS PER SHAREDocumento4 páginasEXERCISES On EARNINGS PER SHAREChristine AltamarinoAinda não há avaliações

- 2014 Volume 2 CH 2 AnswersDocumento15 páginas2014 Volume 2 CH 2 AnswersJames Louis B. AntonioAinda não há avaliações

- 2Documento15 páginas2Charo Santos LeyvaAinda não há avaliações

- Answers - Chapter 2 Vol 2 RvsedDocumento13 páginasAnswers - Chapter 2 Vol 2 Rvsedjamflox100% (3)

- 9706 s10 Ms 43Documento6 páginas9706 s10 Ms 43cherylllimclAinda não há avaliações

- Abc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesDocumento24 páginasAbc Limited: Balance Sheet As at September 30, 2012 Amount in RupeesSharbani ChowdhuryAinda não há avaliações

- P033 Project SelectionDocumento9 páginasP033 Project SelectionMisha RanaAinda não há avaliações

- National Stock ExchangeDocumento1 páginaNational Stock ExchangeSachin YadavAinda não há avaliações

- Interest Rate Risk Management PDFDocumento2 páginasInterest Rate Risk Management PDFHARSHALRAVALAinda não há avaliações

- Pupun01206130000493015 2023Documento2 páginasPupun01206130000493015 2023abhishekkumarasr847687Ainda não há avaliações

- Finlatics Sector Project - 1Documento2 páginasFinlatics Sector Project - 1Aditya ChitaliyaAinda não há avaliações

- Comparison Report On HIL, Everest and Visaka IndustriesDocumento4 páginasComparison Report On HIL, Everest and Visaka IndustriesHItesh priyhianiAinda não há avaliações

- FAFDocumento8 páginasFAFShaminiAinda não há avaliações

- Test Paper-2 Master Question PGBPDocumento3 páginasTest Paper-2 Master Question PGBPyeidaindschemeAinda não há avaliações

- Concepts Statement 5 - As AmendedDocumento18 páginasConcepts Statement 5 - As AmendedDian AngeleneAinda não há avaliações

- Lazy Portfolios: Core and SatelliteDocumento2 páginasLazy Portfolios: Core and Satellitesan291076Ainda não há avaliações

- BFN202 Seminar Questions SET1Documento3 páginasBFN202 Seminar Questions SET1baba cacaAinda não há avaliações

- GR+XII +Chapter++Test +National+IncomeDocumento7 páginasGR+XII +Chapter++Test +National+IncomeAkshatAinda não há avaliações

- Introduction To Islamic BankingDocumento3 páginasIntroduction To Islamic BankingEhsan QadirAinda não há avaliações

- CH 10Documento78 páginasCH 10Natalicio da AssuncaoAinda não há avaliações

- Palchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)Documento19 páginasPalchoki Building Material 2076/77 Trial Balance: 17-Jul-2019 To 14-Nov-2019 (2076-04-01 To 2076-07-28)SworajAinda não há avaliações

- Receiving Payments and Making DepositsDocumento28 páginasReceiving Payments and Making DepositsElla MaeAinda não há avaliações

- Tax Invoice: Madimack Pty LTD 19 Tarra Cres Dee Why NSW 2099Documento1 páginaTax Invoice: Madimack Pty LTD 19 Tarra Cres Dee Why NSW 2099Mildred PagsAinda não há avaliações

- Financial LiteracyDocumento7 páginasFinancial LiteracyRochelle Ann Galvez Gabaldon100% (1)

- ProductNote Micro MarvelDocumento3 páginasProductNote Micro MarvelthilaksafaryAinda não há avaliações

- 112380-237973 20190331 PDFDocumento5 páginas112380-237973 20190331 PDFKutty KausyAinda não há avaliações

- Baba2 Fin MidtermDocumento8 páginasBaba2 Fin MidtermYu BabylanAinda não há avaliações

- Print ChallanDocumento1 páginaPrint ChallanSameer AsifAinda não há avaliações

- Kicki Andersson PGLDocumento15 páginasKicki Andersson PGLKicki AnderssonAinda não há avaliações

- (Nikolay TSD) LCBB4001 Accounting Fundamentals-A1Documento24 páginas(Nikolay TSD) LCBB4001 Accounting Fundamentals-A1munnaAinda não há avaliações

- (Kotak) Vedanta, October 02, 2023Documento9 páginas(Kotak) Vedanta, October 02, 2023PrakashAinda não há avaliações

- PBB Short NotesDocumento47 páginasPBB Short Notesstudy studyAinda não há avaliações

- Solution To Ch02 P14 Build A ModelDocumento4 páginasSolution To Ch02 P14 Build A Modeljcurt8283% (6)

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento2 páginasDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceamarjeetsinghas977Ainda não há avaliações

- MODULE 4 More ProblemsDocumento5 páginasMODULE 4 More ProblemsJohn Lery YumolAinda não há avaliações

- Capital StructureDocumento37 páginasCapital StructureIdd Mic-dadyAinda não há avaliações