Escolar Documentos

Profissional Documentos

Cultura Documentos

M&a Deal Evaluation

Enviado por

Vikram Pratap Singh0 notas0% acharam este documento útil (0 voto)

52 visualizações11 páginasaaa

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoaaa

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

52 visualizações11 páginasM&a Deal Evaluation

Enviado por

Vikram Pratap Singhaaa

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 11

1 M&A Deal Evaluation: Challenging Metrics Myths

M&A Deal Evaluation:

Challenging

Metrics Myths

In the world of mergers and acquisitions, emphasis

is often placed on evaluation metrics that look as if they

tell the story, but they can be misleading.

2 M&A Deal Evaluation: Challenging Metrics Myths

The presentation was over. The CEO of a global business-services group had been part of a due

diligence process to advise on whether or not to proceed with a major European acquisition.

Our job was to help the CEO and the board answer some important questions: Was the target

company a good fit? How did synergies stack up against the risks? Did the target companys

sector show potential for growth?

Our findings were less than encouraging. They suggested limited growth going forward, and

even though the potential for synergies was good, the risks were significant, and there were

doubts about the companys ability to deliver those synergies.

As we walked out of the meeting, the CEO was digesting all that he had just heard and contem-

plating the boards likely reaction to our findings. Then he spoke: Well, theres one thing we can

say about this acquisitionits highly earnings accretive.

An argument to support the myth

that EPS accretion equates to value

creation is that some people believe

it doesa misperception that

is then priced into the stock.

What does that mean? Does the fact that a deal is accretive necessarily mean that its a good

move? Conversely, are deals that dilute earnings per share (EPS) necessarily bad moves?

Should we even use EPS as a measure by which to evaluate an M&A transaction?

In this paper, we discuss findings from our research into the metrics and analyses most frequently

used to evaluate proposed mergers and acquisitions. The research introduced a surprising

insight: The impact on EPS is by far the most emphasized metric used to evaluate proposed

M&A transactions between public companies.

With this in mind, we look at two common and related myths surrounding EPS and demonstrate

why these are at best unhelpful and at worst potentially misleading. We also examine what

business leaders and market analysts should focus on instead. As always, our advice is pragmatic:

Stick to the business fundamentals.

How Do They Get It So Wrong?

It is widely recognized that a significant percentage of M&A transactions fail to deliver value

to shareholders. What goes wrong? How is it that acquisitions on average seem to create

negligible returns? It can be tempting to blame poor merger integration for the meager returns,

and certainly the execution of an integration can have a major impact on whether or not

a transaction is regarded as successful. However, it may also be useful to consider if the deal

was worth doing in the first place. Maybe some transactions should never have happened.

With this in mind, A.T. Kearney joined forces with the UKs Investor Relations Society (IR Society)

to understand exactly which metrics and analyses get the most emphasis in evaluating proposed

3 M&A Deal Evaluation: Challenging Metrics Myths

M&A transactions. Maybe the solution to the question of what goes wrong lies in the tools used

to filter (and one would hope eliminate) value-destroying transactions from those that create value.

Investor Relations professionals were surveyed to gauge the views of key stakeholders

company executives, sell-side analysts, and investorson 10 frequently used metrics and

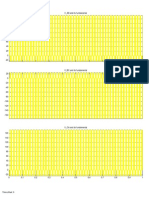

analyses (see sidebar: M&A MetricsWhy the Diference in Emphasis? on page 4). We found

that EPS analysis is used most, and by a wide margin: 75 percent of respondents ranked it in the

strong emphasis category, fully 26 points ahead of enterprise value/EBITDA, the number two

rated metric (see figure 1).

All stakeholders

respondents

EPS

accretion/

dilution

%

%

%

% %

%

Enterprise

value/

EBITDA

Price

earnings

ratio (P/E)

Debt ratio

analyses

DCF

valuation

Price/book

value

Cultural fit

assessment

Cost of

capital

analysis

Core

capabilities

assessment

Enterprise

value/

revenues

Note: Stakeholders include company executives, sell-side analysts, and investors; EPS is earnings-per-share; DCF is discounted cash low.

Source: A.T. Kearney and Investor Relations Society,

Figure

EPS accretion/dilution analysis is given the most emphasis in evaluating proposed

M&A transactions

2%

2% 2% 2%

2%

22%

6%

8%

16%

A1%

%

2%

6%

A%

2C%

A%

2%

27%

A7%

22%

8%

7%

2%

22%

%

16%

22%

%

2C%

A%

A%

%

A%

7%

Strohg enphasis Sone enphasis No enphasis Doht khow

What Exactly Is EPS Accretion and EPS Dilution?

Before we go any further, lets define what we mean by EPS accretion and EPS dilution.

A companys EPSagain, earnings per shareis simply the total profit allocated to each

outstanding share.

EPS growth can be achieved either organically or inorganically through M&A activity, and few

would argue that organic EPS growth is anything other than a positive indicator. EPS growth

delivered through M&A activity, that is, EPS accretion, is fundamentally diferent. Yet there

4 M&A Deal Evaluation: Challenging Metrics Myths

are some commonly held beliefsor, more accurately, mythsto suggest this distinction is not

fully understood by many experienced investment professionals, including some company

executives (see sidebar: The Lingering Myth of EPS Accretion on page 8).

1

Two myths are widely believed:

EPS accretive transactions create value.

EPS dilutive transactions destroy value.

As we will see, neither of these preconceptions stands up to scrutiny. Why then do so many

executives and others persist in using EPS analysis to evaluate M&A transactions?

1

Not all M&A transactions grow EPS. Some transactions reduce EPS, resulting in EPS dilution.

Conpahy

executives

Sell-side

ahalysts

hvestors

Source: A.T. Kearhey ahd hvestor Relatiohs Society, 2C1

Figure

How much emphasis is given to EPS accretion or dilution analysis in evaluating

proposed M&A transactions?

A1%

88%

18%

76%

%

Strohg enphasis

Sone enphasis

No enphasis

Doht khow

6% 6%

6%

M&A Metrics: Why the Diference in Emphasis?

To learn how diferent stake-

holder groups view earnings-

per-share (EPS) analysis as a

metric for evaluating mergers

and acquisitions, members of the

UK-based Investor Relations

Society were surveyed regarding

the emphasis that key stake-

holders (company executives,

sell-side analysts, and investors)

give to 10 frequently used

metrics and analyses. All stake-

holders have skin in the game

but, as it turns out, significantly

diferent perspectives on the

extent to which they emphasize

EPS analysis. The biggest

contrast was among those

who strongly emphasize EPS

company executives (59 percent)

and investors (88 percent).

Sell-side analysts were in the

middle at 76 percent (see figure).

Perhaps these results are not so

surprising. Company executives

are likely to take a more all-

encompassing, or perhaps more

strategic, view of a mergers

impact. But should that be the

case? Shouldnt all parties be

striving for the same objective

assessment of a deals benefits

and the extent to which it will

strengthen competitive position

and ultimately, generate share-

holder value through increased

cash flow?

This raises an interesting

question: Which group is more

correct? Our answer is that while

company executives place

significantly less emphasis on

EPS analysis, all three groups pay

far more attention to the metric

than it merits.

5 M&A Deal Evaluation: Challenging Metrics Myths

The answer comes down to views about valuation. A companys stock is frequently valued on

the basis of its EPS by applying a price-to-earnings (P/E) ratio. Based on the assumption that

an acquiring companys P/E ratio will stay the same after an acquisition, if earnings per share

increase, then the companys overall value will increase, ostensibly as a result of the deal.

Whats the Catch?

But, theres a catch. To understand it you need to consider the fundamentals of why one

company has a higher P/E ratio than another in the first place. It is because the market believes

the earnings of the company with the higher P/E ratiocall it Company Awill rise faster than

those of the company with a lower P/E ratio (Company B).

2

Now suppose Company A buys

Company B, using its stock as the acquisition currency. As a result of the purchase the EPS of

the combined company will be higher than that of Company A had it not made the acquisition

thus the transaction is EPS accretive for Company A.

They call it the bootstrap game.

If companies can fool investors by buying

a company with lower P/E rated stocks,

then why not continue to do so?

But being EPS accretive comes with a downsideand thats the catch. The newly combined

company will also have a lower earnings growth rate than Company A would have had as a

standalone company. So while the EPS of the post-acquisition company will be higher than

that of the pre-acquisition Company A, its P/E ratio will be lower due to its acquisition of the

lower-P/E rated Company B.

In fact, the reduction in the P/E ratio, all other things being equal, will exactly counterbalance

the impact of the higher EPS. The result is that the valuation of the newly combined company

will reflect the blended higher EPS and lower P/E ratio of the two original companies. In other

words, no value is created.

A key reason for doing an M&A deal is, of course, the synergies that can result. By increasing

the new entitys combined earnings, synergies can add enough value to make the combined

company worth more than the two individual companies were before the merger. It is important

to note that the increased value results from the synergies created, not from the deal being EPS

accretive or dilutive. It is quite possible that highly dilutive deals ofer the greatest opportunities

for delivering synergies.

An argument sometimes put forward to support the myth that EPS accretion equates to value

creation is that people believe it does. This becomes reality as the misperception is priced

into the stock.

2

Alternatively, it believes that earnings are more sustainable than the earnings in the lower-rated company. This paper adheres

to the idea that earnings will grow faster in the company with the higher P/E ratio. In reality, the two ideas relate to the same thing

the strength of the earnings stream a company generates.

6 M&A Deal Evaluation: Challenging Metrics Myths

Richard A. Brealey and Stewart C. Myers write about this idea in their seminal textbook, Principles

of Corporate Finance. They call it the bootstrap game. If companies can fool investors by buying

a company with lower P/E rated stocks, then why not continue to do so? The flaw in the bootstrap

game is the need to keep the market fooled, hoping it doesnt notice that the acquiring companys

earnings growth potential is becoming progressively more diluted.

The inevitable result of pursuing such a strategy to its logical conclusion by continuing to acquire

lower P/E rated companies is clear: In the same way a Ponzi scheme must eventually fail due

to the lack of underlying value creation, the P/E multiple of the acquiring company must fall

as it becomes increasingly evident to the market that no value is created.

Whats the Alternative for Evaluating Proposed Mergers?

Our advice for evaluating a proposed merger is characteristically pragmatic: Stick to the funda-

mentals. M&A can deliver significant competitive advantage and value to shareholders, but the

criteria by which to assess just how much must answer fundamental business questions:

Is the proposed merger strategically logical?

Will it deliver cost, revenue, or other financial synergies?

Will it build management or other capabilities?

Is the combined company capable of delivering the synergies?

A thorough, fact-based due diligence is the best way to answer these questions (see figure 2).

To understand the business

fundamentals of a proposed deal

Activities

and

analysis

Source: A.T. Kearney analysis

Figure

Transaction due diligence overview

Strategic

options

Commercial

due diligence

Operational

due diligence

Financial

due diligence

Legal

due diligence

Market dynamics

High-level trends

Business portfolio

analysis

Target identifi-

cation

Market and

customer

attractiveness

and dynamics

Industry structure

and dynamics

Competitive

position

Distribution

channel dynamics

Top-line oppor-

tunities

Business plan review

Risks and oppor-

tunities

Cost structures

and drivers

Operational

improvement

potential

Cost synergies

assessment

Integration

capabilities

Risks and oppor-

tunities

Review financial

statements and

management

accounts

Basis for future

business plans

Valuation

Deal financing

Target liabilities

and potential risks

Competition

authority

implications

Transaction

mechanics,

execution, and

closing

Typical

parties

involved

Senior managers

(CEO, board)

Strategic advisors

(consultants,

bankers)

Senior management

(CEO, strategy director, business

development director)

Consultants

CFO

Accountants

Input from

commercial and

operational due

diligence

Company general

counsel

Legal advisors

Fact-based

assessment

of value

creation

potential

7 M&A Deal Evaluation: Challenging Metrics Myths

Typical opportunity areas Typical synergy value

Source: A.T. Kearney Merger Integration Framework

Figure

Merger synergies originate from three value creation areas

Top-line growth,

commercial

optimization

Operations

productivity

improvement

Asset and capital

investment

rationalization

Cross selling

Product development and innovation

Brand portfolio optimization

Price realization and service ofer

Combined innovation pipeline

Leverage sales capabilities

(Negative synergies: customer retention)

Capital investment rationalization

Working capital reduction

Sale of rationalised assets

Operations and supply chain

Manufacturing footprint

Warehouse and logistics footprint

Procurement

Price leveling

Volume consolidation

Strategic sourcing

Procurement transformation

SG&A

Ofice consolidation

Finance, HR, IT consolidation

Sales and marketing cost reduction

Leverage capabilities and best practice

Net -%

of combined

sales year one

-%

of combined

cost base

-%

excluding

asset sales

Merger

synergies

Accretion or dilution is a fact of

doing deals, but is not a measure

of potential value creation.

For that, you need to examine

the deals business fundamentals.

Of course, there is also a role for using many of the M&A metrics and analyses described in

figure 1 as part of an overall assessment. These can play a complementary role in developing

a full perspective on a transaction. Used in isolation, however, and without a clear understanding

of their limitations, they have a tendency to give a very limited view of the real potential for

value creation.

Ultimately, any value an M&A transaction creates must translate into future cash flow, resulting

from synergies in three value-creation areas: topline growth, operations productivity, and asset

and capital investment rationalizations (see figure 3).

3

3

The synergies ultimately delivered in a merger are influenced by a number of factors, including the transactions strategic goals

and the proportion of total spend that is addressable for synergy purposes.

8 M&A Deal Evaluation: Challenging Metrics Myths

And then theres the crucial question of how much to pay for a deal and who will realize the

value it creates. If the net present value (NPV) of future synergies is paid to the selling share-

holders in an acquisition price premium, even the most synergistic of mergers can result in

value destruction for the acquirers shareholders.

5

Always consider who will be the winners

in an M&A transactionthe final outcome is rarely the same for all parties.

EPS Myths Revisited

The moral of the story is this: Too often, too much emphasis is placed on whether a deal is EPS

accretive or dilutive. These are time-honored metrics that appear sensible but in reality do not

answer the most important question: Should we do the deal? Lets review the two commonly

held myths and why they dont work as M&A evaluation measures.

EPS-accretive transactions create value. Not necessarily. Accretion is a relative measure that

simply shows the company being acquired has a lower P/E rated stock.

EPS-dilutive transactions are value destroying. Again, not necessarily. In fact, EPS-dilutive

transactions can increase value when the target company has good growth potential and the

strategic logic for the deal is strong.

The fact is that EPS analysis is not a useful tool for evaluating the merits of proposed M&A

transactions. Accretion or dilution is a fact of doing deals but is not a measure of potential value

creation. For that, you need to examine the deals business fundamentals.

Our research reveals one more insight: how the emphasis given to the diferent metrics and

analyses has changed over the past decade. Two measures, core capabilities and cultural fit,

The Lingering Myth of EPS Accretion

In an examination of 30 acquisi-

tions performed and announced

by publicly owned companies,

68 percent referred to the

mergers potential impact on

EPS.

4

The prominence given to

this metric at the announcement

reinforces the lingering belief that

EPS is a proxy for value creation.

The EPS accretion myth has

lingered for a long time. Heres

why. At first glance, EPS accre-

tion appears to be a simple, and

therefore appealing, way to

determine or communicate

whether or not a transaction will

create value. In fact, it is logically

and mathematically flawed.

Large mergers and acquisitions

almost always involve the high

drama of risk and reward for the

parties involved. M&A can

makeor breakan executives

reputation or career, and

multimillion-dollar fees and

bonuses can be won or lost.

Given all that, no wonder every

possible argument supporting

M&A deals is applied by those

trying to make them happen.

This is precisely why analysts and

other stakeholders need accurate

evaluation tools: to make sure all

the arguments for making the deal

hold water. Despite the frequency

with which EPS accretion is

alluded to or used to bolster

arguments for the deal, the metric

doesnt stand up to scrutiny.

4

Companies were randomly selected from a group of transactions in which the acquiring company was U.S.- or UK-based and the

transaction satisfied a set of criteria, including deal value of more than $1 billion and 100 percent of the target was acquired.

The examination included a review of press releases and transcripts of press conferences where the acquirer announced the deal.

5

The acquisition price premium is typically 20 to 30 percent over the pre-announcement trading price, although this premium

is perceived to have fallen in recent years.

9 M&A Deal Evaluation: Challenging Metrics Myths

the most qualitative among the 10 examined, are among the top measures that have become

more important in the past decade (see figure 4). This suggests stakeholders are becoming

increasingly aware of the conditions necessary for merged organizations to deliver sustained

value after the deal has closed and the merger integration process begins.

Quick and Easy Shortcuts Can Be Misleading

This is not to say a proposed transactions impact on EPS isnt important. It is something that

needs to be understood and communicated to investors. The fact remains, however, that doing

an EPS-accretive deal is easysimply buy a company with a lower P/E-rated stock than your

own. So the next time someone says or implies that an M&A deal is a good one because it is EPS

accretive, ask why the market gave the target companys stock a lower rating in the first place.

To truly understand whether a proposed acquisition will create value requires evaluating the

strategic rationale for making the deal, and if it will deliver enough synergies to create value.

As with many things in life, quick and easy answers can be misleading.

Core

capabilities

assessment

%

% % % % %

Cultural fit

assessment

Enterprise

value/

EBITDA

Cost of

capital

analysis

Debt ratio

analyses

EPS

accretion/

dilution

DCF

valuation

Price

earnings

ratio (P/E)

Enterprise

value/

revenues

Price/book

value

Notes: EPS is earnings-per-share; DCF is discounted cash low. Figures may not resolve due to rounding.

Source: A.T. Kearney and Investor Relations Society,

Figure

How has the relative importance of each metric and analysis changed over the past years?

2%

1%

1%

2%

1%

1%

1%

AA% AA%

2%

1%

1%

8%

1%

1%

6%

6%

1%

6%

1% 1%

C%

2% 2%

6%

6%

8%

AA%

8%

AA%

C%

More inportaht hchahged Less inportaht Doht khow

+ + + + + + + - - -

Net change in perceived importance

percentage points

10 M&A Deal Evaluation: Challenging Metrics Myths

Authors

Philip Dunne, partner, London

philip.dunne@atkearney.com

Angus Hodgson, principal, London

angus.hodgson@atkearney.com

The authors wish to thank their colleagues Oliver Lawson and Olga Wittig and the Investor Relations Society for their

support in the preparation of this paper. The IR Society is the professional body for those involved in investor relations

and the focal point for investor relations in the United Kingdom. For more information, visit www.irs.org.uk.

A.T. Kearney is a global team of forward-thinking partners that delivers immediate

impact and growing advantage for its clients. We are passionate problem solvers

who excel in collaborating across borders to co-create and realize elegantly simple,

practical, and sustainable results. Since 1926, we have been trusted advisors on the

most mission-critical issues to the worlds leading organizations across all major

industries and service sectors. A.T. Kearney has 59 ofices located in major business

centers across 39 countries.

Americas

Europe

Asia Pacific

Middle East

and Africa

Atlanta

Calgary

Chicago

Dallas

Detroit

Houston

Mexico City

New York

San Francisco

So Paulo

Toronto

Washington, D.C.

Bangkok

Beijing

Hong Kong

Jakarta

Kuala Lumpur

Melbourne

Mumbai

New Delhi

Seoul

Shanghai

Singapore

Sydney

Tokyo

Amsterdam

Berlin

Brussels

Bucharest

Budapest

Copenhagen

Dsseldorf

Frankfurt

Helsinki

Istanbul

Kiev

Lisbon

Ljubljana

London

Madrid

Milan

Moscow

Munich

Oslo

Paris

Prague

Rome

Stockholm

Stuttgart

Vienna

Warsaw

Zurich

Abu Dhabi

Dubai

Johannesburg

Manama

Riyadh

A.T. Kearney Korea LLC is a separate and

independent legal entity operating under

the A.T. Kearney name in Korea.

2013, A.T. Kearney, Inc. All rights reserved.

The signature of our namesake and founder, Andrew Thomas Kearney, on the cover of this

document represents our pledge to live the values he instilled in our firm and uphold his

commitment to ensuring essential rightness in all that we do.

For more information, permission to reprint or translate this work, and all other correspondence,

please email: insight@atkearney.com.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Franchise Rule Compliance Guide - FTC - GovDocumento154 páginasFranchise Rule Compliance Guide - FTC - GovFranchise InformationAinda não há avaliações

- IC Automotive Work Order Template 8963Documento5 páginasIC Automotive Work Order Template 8963JeanetteAinda não há avaliações

- Category Wise Spend AnalysisDocumento13 páginasCategory Wise Spend AnalysisVikram Pratap Singh100% (1)

- Infosys Spend AnalysisDocumento10 páginasInfosys Spend AnalysisVikram Pratap SinghAinda não há avaliações

- SACCO Budgeting and Business Planning ManualDocumento54 páginasSACCO Budgeting and Business Planning ManualFred IlomoAinda não há avaliações

- NIL Case Outline DigestDocumento44 páginasNIL Case Outline DigestCid Benedict PabalanAinda não há avaliações

- BCBS 239 Compliance: A Comprehensive ApproachDocumento7 páginasBCBS 239 Compliance: A Comprehensive ApproachCognizantAinda não há avaliações

- Nivea Is Widely Known Especially in Skin Care and Beauty ProductsDocumento3 páginasNivea Is Widely Known Especially in Skin Care and Beauty ProductsMyra AbbasiAinda não há avaliações

- Belief' Which Is The Golden Mantra. It Is Self-Belief Which Will Help Him Go Miles Was The Final TakeawayDocumento1 páginaBelief' Which Is The Golden Mantra. It Is Self-Belief Which Will Help Him Go Miles Was The Final TakeawayVikram Pratap SinghAinda não há avaliações

- BarillaDocumento7 páginasBarillaspchua18100% (1)

- College Application RequirementsDocumento2 páginasCollege Application RequirementsVikram Pratap SinghAinda não há avaliações

- Yeild Management AssignmentDocumento12 páginasYeild Management AssignmentVikram Pratap SinghAinda não há avaliações

- A1 SCM PGP13 078Documento1 páginaA1 SCM PGP13 078Vikram Pratap SinghAinda não há avaliações

- Regression analysis of sales dataDocumento12 páginasRegression analysis of sales dataVikram Pratap SinghAinda não há avaliações

- Coke-Vikram RohithDocumento15 páginasCoke-Vikram RohithVikram Pratap SinghAinda não há avaliações

- BPRDocumento2 páginasBPRVikram Pratap SinghAinda não há avaliações

- Rick Frazier: The Coca-Cola Company - People, Planet, Profit: Driving Measurements For SuccessDocumento27 páginasRick Frazier: The Coca-Cola Company - People, Planet, Profit: Driving Measurements For SuccessVikram Pratap SinghAinda não há avaliações

- BMC Brochure WebDocumento4 páginasBMC Brochure WebVikram Pratap SinghAinda não há avaliações

- Coke-Vikram RohithDocumento15 páginasCoke-Vikram RohithVikram Pratap SinghAinda não há avaliações

- Coca-Cola's People, Planet, Profit Sustainability GoalsDocumento27 páginasCoca-Cola's People, Planet, Profit Sustainability GoalsVikram Pratap SinghAinda não há avaliações

- Publication-Quarter IVDocumento18 páginasPublication-Quarter IVVikram Pratap SinghAinda não há avaliações

- Operations Strategy PaperDocumento24 páginasOperations Strategy PaperscribddmiAinda não há avaliações

- Raghuram RajanDocumento1 páginaRaghuram RajanVikram Pratap SinghAinda não há avaliações

- How To Control Over Speeding: Juie Gosalia Mansi Chawla Vikram Pratap Singh Vivekanand SaripalliDocumento2 páginasHow To Control Over Speeding: Juie Gosalia Mansi Chawla Vikram Pratap Singh Vivekanand SaripalliVikram Pratap SinghAinda não há avaliações

- SyrupDocumento1 páginaSyrupVikram Pratap SinghAinda não há avaliações

- Is Kraft Killing The Goose That Lays The Golden Eggs - Opinion - Marketing WeekDocumento2 páginasIs Kraft Killing The Goose That Lays The Golden Eggs - Opinion - Marketing WeekVikram Pratap SinghAinda não há avaliações

- Case Study - RLEKDocumento13 páginasCase Study - RLEKVikram Pratap SinghAinda não há avaliações

- MATLABDocumento1 páginaMATLABVikram Pratap SinghAinda não há avaliações

- Minor - DVDocumento4 páginasMinor - DVVikram Pratap SinghAinda não há avaliações

- Tanuj CVDocumento2 páginasTanuj CVVikram Pratap SinghAinda não há avaliações

- 00553466Documento11 páginas00553466Vikram Pratap SinghAinda não há avaliações

- Batik Fabric Manila Philippines Starting US 199 PDFDocumento3 páginasBatik Fabric Manila Philippines Starting US 199 PDFAjeng Sito LarasatiAinda não há avaliações

- Comparative Balance Sheets for Pin and San MergerDocumento12 páginasComparative Balance Sheets for Pin and San MergerFuri Fatwa DiniAinda não há avaliações

- Act Companies 1965 s167Documento1 páginaAct Companies 1965 s167Masni MaidinAinda não há avaliações

- Price Comparisson - Bored Piling JCDC, Rev.02Documento2 páginasPrice Comparisson - Bored Piling JCDC, Rev.02Zain AbidiAinda não há avaliações

- Final (BDSM) SimulationDocumento28 páginasFinal (BDSM) SimulationusmanAinda não há avaliações

- Flavia CymbalistaDocumento3 páginasFlavia Cymbalistadodona7772494Ainda não há avaliações

- Challan Form PDFDocumento2 páginasChallan Form PDFaccountsmcc islamabadAinda não há avaliações

- F.W.TAYLOR Father of scientific managementDocumento7 páginasF.W.TAYLOR Father of scientific managementTasni TasneemAinda não há avaliações

- 0 - 265454387 The Bank of Punjab Internship ReportDocumento51 páginas0 - 265454387 The Bank of Punjab Internship Reportفیضان علیAinda não há avaliações

- CV of Faysal AhamedDocumento2 páginasCV of Faysal AhamedSyed ComputerAinda não há avaliações

- US Economics Digest: The 2014 FOMC: A New Cast of CharactersDocumento10 páginasUS Economics Digest: The 2014 FOMC: A New Cast of CharactersGlenn ViklundAinda não há avaliações

- Achieving Strategic Fit Across the Entire Supply ChainDocumento28 páginasAchieving Strategic Fit Across the Entire Supply ChainJoann TeyAinda não há avaliações

- Ratio Analysis Explained: Key Financial Ratios for Business PerformanceDocumento3 páginasRatio Analysis Explained: Key Financial Ratios for Business PerformanceNatalieAinda não há avaliações

- BBA Syllabus - 1Documento39 páginasBBA Syllabus - 1Gaurav SaurabhAinda não há avaliações

- Enterprise System Engineering: Course Code: SWE - 304Documento8 páginasEnterprise System Engineering: Course Code: SWE - 304syed hasnainAinda não há avaliações

- Asset Quality, Credit Delivery and Management FinalDocumento21 páginasAsset Quality, Credit Delivery and Management FinalDebanjan DasAinda não há avaliações

- SBR Res QcaDocumento3 páginasSBR Res QcaAlejandro ZagalAinda não há avaliações

- Assessment Information Plan WorkshopDocumento4 páginasAssessment Information Plan WorkshopLubeth CabatuAinda não há avaliações

- 01 - IntroductionDocumento19 páginas01 - IntroductionchamindaAinda não há avaliações

- Chapter07 - AnswerDocumento18 páginasChapter07 - AnswerkdsfeslAinda não há avaliações

- Ch04 Consolidation TechniquesDocumento54 páginasCh04 Consolidation TechniquesRizqita Putri Ramadhani0% (1)

- Case StudyDocumento7 páginasCase StudynarenderAinda não há avaliações

- 1019989-Industrial Trainee-Publishing and Product License SupportDocumento2 páginas1019989-Industrial Trainee-Publishing and Product License SupportSravan KumarAinda não há avaliações

- Aud589 (Pya 2019 Dec)Documento7 páginasAud589 (Pya 2019 Dec)amirah zahidahAinda não há avaliações