Escolar Documentos

Profissional Documentos

Cultura Documentos

Senate Bill 461, Creating The Future Fund

Enviado por

West Virginia SenateTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Senate Bill 461, Creating The Future Fund

Enviado por

West Virginia SenateDireitos autorais:

Formatos disponíveis

1 2 3 4 5 6 7 8 9 10 11 12 13

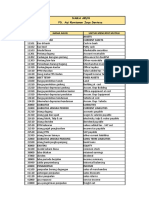

Senate Bill No. 461 (By Senator Kessler (Mr. President), Williams, Tucker, Plymale, Stollings, Snyder, Cookman, Palumbo, Fitzsimmons, Beach, Yost, Miller, D. Hall, Jenkins, McCabe, Wells, Edgell, Barnes, Blair, Boley, Cann, Chafin, Kirkendoll, Laird, Nohe, Prezioso, Sypolt, Unger, Walters, Green and M. Hall) ____________ [Introduced January 31, 2014; referred to the Committee on Economic Development; and then to the Committee on Finance.] ____________

14 A BILL to amend the Code of West Virginia, 1931, as amended, by 15 16 17 18 19 20 21 22 23 24 adding thereto a new section, designated 11-13A-5b, relating to the use of oil and natural gas severance tax revenues; setting a baseline of oil and natural gas severance tax revenue collections; creating the West Virginia Future Fund; providing for the distribution of funds collected in excess of that baseline; providing for initial funding of the West Virginia Future Fund to consist of twenty-five percent of excess proceeds from oil and natural gas severance taxes; expressing legislative intent not to encumber, spend, promise or otherwise use any interest from the West Virginia Future

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Fund for a term of six years following the creation of the West Virginia Future Fund; expressing legislative intent that the principal of the West Virginia Future Fund be inviolable and not be encumbered, spent, promised or otherwise disturbed; requiring development moneys to be expended solely for economic and

projects,

infrastructure

projects

supplementing and increasing state salaries for teachers as stated in section two, article four, chapter eighteen-a of this code; providing definitions; providing restrictions on the expenditure of moneys; providing duties of State Tax Commissioner; requiring report of expenditures to Joint

Committee on Government and Finance; providing audits of distributed funds when authorized by the Joint Committee on Government and Finance; and authorizing legislative and

emergency rules.

16 Be it enacted by the Legislature of West Virginia: 17 That the Code of West Virginia, 1931, as amended, be amended

18 by adding thereto a new section, designated 11-13A-5b, to read as 19 follows: 20 ARTICLE 13A. 21 11-13A-5b. 22 23 24 SEVERANCE AND BUSINESS PRIVILEGE TAX ACT. Setting a baseline of severance tax revenue for purposes of future tax severance allocation; Creation of West intent; Virginia Future Fund; of

legislative

permissible

uses

1 2 3

distributed revenues; duties of State Treasurer and State Tax Commissioner; audits; rulemaking. (a) For fiscal years beginning July 1, 2014, a baseline for

4 collections of severance tax on the privilege of producing oil and 5 natural gas levied by section three-a of this article that are 6 deposited in the General Revenue Fund as provided in section five-a 7 of this article, is established at $175 million. 8 (b) There is created in the State Treasury a special revenue

9 account, designated the "West Virginia Future Fund," which is an 10 interest-bearing account and may be invested by the West Virginia 11 Investment Management Board in the manner permitted by the

12 provisions of article six, chapter twelve of this code, with the 13 interest income a proper credit to the fund. Notwithstanding any

14 provision of this code to the contrary, twenty-five percent of the 15 excess proceeds, above the baseline set by subsection (a) of this 16 section, received on and after the effective date of this section 17 as state revenue pursuant to the provisions of section three-a, 18 article thirteen-a, chapter eleven of this code shall be deposited 19 in this fund. 20 designation The Legislature may, by general appropriation or by of other funding sources, deposit into the fund

21 additional moneys as it considers appropriate. 22 (c) The Legislature declares its intention to use the fund as

23 a means of conserving a portion of the states revenue derived from 24 the increased revenue proceeds received by the state as a result of

1 any new oil and natural gas production as well as other funding 2 sources as the Legislature may designate in order to meet future 3 needs. The Legislature further declares its intention that the

4 fund shall maintain inviolability of principal while maximizing 5 total return and that only interest income be used for the purposes 6 enumerated in this section. No interest income of the Future Fund

7 may be used for a term of six years following the effective date 8 except for the purposes enumerated in this section. 9 10 (d) For purposes of this section: (1) Economic development project means a project in the

11 state which is likely to foster economic growth and development in 12 the area in which the project is developed for commercial,

13 industrial, community improvement or preservation or other proper 14 purposes. 15 (2) Infrastructure project means a project in the state

16 which is likely to foster infrastructure improvements including, 17 but not limited to, post-mining land use, water or wastewater 18 facilities or a part thereof, storm water systems, steam, gas, 19 telephone and telecommunications, broadband development, electric 20 lines and installations, roads, bridges, railroad spurs, drainage 21 and flood control facilities, industrial park development or

22 buildings that promote job creation and retention.

Você também pode gostar

- Kessler Calls For Day of ActionDocumento1 páginaKessler Calls For Day of ActionWest Virginia SenateAinda não há avaliações

- Tobacco Tax Increase IntroducedDocumento1 páginaTobacco Tax Increase IntroducedWest Virginia SenateAinda não há avaliações

- Kessler Calls For Day of ActionDocumento1 páginaKessler Calls For Day of ActionWest Virginia SenateAinda não há avaliações

- MEDIA ADVISORY: SCORE MeetingDocumento1 páginaMEDIA ADVISORY: SCORE MeetingWest Virginia SenateAinda não há avaliações

- Media AdvisoryDocumento2 páginasMedia AdvisoryWest Virginia SenateAinda não há avaliações

- Tourism Funding Bill IntroducedDocumento2 páginasTourism Funding Bill IntroducedWest Virginia SenateAinda não há avaliações

- Kessler Says It's Time For EHNDADocumento1 páginaKessler Says It's Time For EHNDAWest Virginia SenateAinda não há avaliações

- SB209 PresentationDocumento1 páginaSB209 PresentationWest Virginia SenateAinda não há avaliações

- Statement On The Loss of Shelley Riley MooreDocumento1 páginaStatement On The Loss of Shelley Riley MooreWest Virginia SenateAinda não há avaliações

- Kessler Names Juvenile Justice Task Force MembersDocumento2 páginasKessler Names Juvenile Justice Task Force MembersWest Virginia SenateAinda não há avaliações

- W.Va. Prison Launches Moral Rehabilitation College Degree ProgramDocumento2 páginasW.Va. Prison Launches Moral Rehabilitation College Degree ProgramWest Virginia SenateAinda não há avaliações

- Unger Wants Conditions of Dangerous Jefferson County Road Immediately AddressedDocumento1 páginaUnger Wants Conditions of Dangerous Jefferson County Road Immediately AddressedWest Virginia SenateAinda não há avaliações

- Senator Green Statement On Bud/Alpoca SituationDocumento1 páginaSenator Green Statement On Bud/Alpoca SituationWest Virginia SenateAinda não há avaliações

- Kessler Pleased With Signing of SB 373Documento1 páginaKessler Pleased With Signing of SB 373West Virginia SenateAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Schedule B SAG-AFTRA Interactive Media Agreement Wage Table: Off-Camera PerformersDocumento2 páginasSchedule B SAG-AFTRA Interactive Media Agreement Wage Table: Off-Camera PerformersChristian MopsAinda não há avaliações

- CDP Chakghat EnglishDocumento354 páginasCDP Chakghat EnglishCity Development Plan Madhya PradeshAinda não há avaliações

- Appaloosa County Day Care Center Inc PDFDocumento5 páginasAppaloosa County Day Care Center Inc PDFbashaeAinda não há avaliações

- Profitability and Risk Analysis For WalmartDocumento8 páginasProfitability and Risk Analysis For WalmartMike rossAinda não há avaliações

- Commercial PropertyDocumento14 páginasCommercial PropertyMITHILESHBHARATIAinda não há avaliações

- Unilag Tax Taxation of Non-Residents in Nigeria-Firs Cir 9302Documento17 páginasUnilag Tax Taxation of Non-Residents in Nigeria-Firs Cir 9302IfemideAinda não há avaliações

- Solución de Problemas Planteados PresupuestosDocumento13 páginasSolución de Problemas Planteados PresupuestosAndre AliagaAinda não há avaliações

- Acquisition of Consolidated Rail CorporationDocumento12 páginasAcquisition of Consolidated Rail CorporationEdithAinda não há avaliações

- Barangay Budget ExecutionDocumento6 páginasBarangay Budget Executionlinden_07100% (1)

- Kuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerDocumento4 páginasKuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerBastian Nugraha SiraitAinda não há avaliações

- 14 - Asset Acquisitions Case 2 - Equipment PurchaseDocumento3 páginas14 - Asset Acquisitions Case 2 - Equipment PurchaseQuan Qa0% (1)

- Literature ReviewDocumento8 páginasLiterature Reviewjopi60Ainda não há avaliações

- Plant Design Costing RevisionDocumento78 páginasPlant Design Costing RevisionLei YinAinda não há avaliações

- Worksheet TabaranzaDocumento6 páginasWorksheet Tabaranzakianna doctoraAinda não há avaliações

- Prepare Financial Statements From Trial Balance in ExcelDocumento5 páginasPrepare Financial Statements From Trial Balance in ExcelShania FordeAinda não há avaliações

- Generally Accepted Accounting Principles Refer To TheDocumento55 páginasGenerally Accepted Accounting Principles Refer To TheVimala Selvaraj VimalaAinda não há avaliações

- CPWA Code MCQDocumento43 páginasCPWA Code MCQSamrat Mukherjee100% (3)

- Ftxmys 2011 Dec QDocumento12 páginasFtxmys 2011 Dec Qaqmal16Ainda não há avaliações

- Summary of DTDocumento19 páginasSummary of DTin_indiaAinda não há avaliações

- Lanjutan KOMPUTER AKUTANSIDocumento26 páginasLanjutan KOMPUTER AKUTANSIRedho AzmiAinda não há avaliações

- Lease - EssayDocumento11 páginasLease - EssayhomerikoAinda não há avaliações

- ACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I The Accounting EquationDocumento11 páginasACCT 1A&B: Fundamentals of Accounting BCSV Fundamentals of Accounting Part I The Accounting EquationAyana Mae BaetiongAinda não há avaliações

- Skoda Auto Volkswagen India Private Limited: Detailed ReportDocumento13 páginasSkoda Auto Volkswagen India Private Limited: Detailed Reportb0gm3n0tAinda não há avaliações

- Data Center College of The PhilippinesDocumento1 páginaData Center College of The PhilippinesCjhay MarcosAinda não há avaliações

- Operating and Financial Budgeting FinalDocumento10 páginasOperating and Financial Budgeting FinalKharen SantosAinda não há avaliações

- AFAR - Part 1Documento18 páginasAFAR - Part 1Myrna LaquitanAinda não há avaliações

- Module II - Analyzing Business TransactionsDocumento4 páginasModule II - Analyzing Business TransactionsIj IlardeAinda não há avaliações

- Book 110Documento10 páginasBook 110Maria Dana BrillantesAinda não há avaliações

- Pertemuan 3Documento31 páginasPertemuan 3Ari Budi SantosoAinda não há avaliações

- Analyze The Effects of The Transactions On The Accounting Equation.eDocumento4 páginasAnalyze The Effects of The Transactions On The Accounting Equation.eShesharam ChouhanAinda não há avaliações