Escolar Documentos

Profissional Documentos

Cultura Documentos

Nonresidential Building Construction: United States

Enviado por

Michael WarnerDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Nonresidential Building Construction: United States

Enviado por

Michael WarnerDireitos autorais:

Formatos disponíveis

Freedonia Focus Reports

US Collection

Nonresidential

Building Construction:

United States

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

February 2014

Industry Overview

Market Size and Trends | Market Segmentation

Nonresidential Building Stock and Floor Space

L

C

Resources

FU ICK

LL TO

O

R

E RD

P

O ER

R

T

Industry Structure and Leaders

Industry Composition | Additional Companies Cited

BR

O

Industry Forecasts

Market Forecasts | Building Stock and Floor Space Forecasts

CH

UR

Highlights

www.freedoniafocus.com

Nonresidential Building Construction: United States

ABOUT THIS REPORT

Scope & Method

This report forecasts US nonresidential building construction expenditures in US dollars

to 2018. Total expenditures are segmented in terms of the following markets:

commercial

office

lodging

education

healthcare

religious

industrial

transportation

other buildings such as warehouses, theaters, and fitness centers.

Construction expenditures encompass new additions and improvements to the existing

stock of nonresidential buildings, but exclude maintenance and repairs.

Nonresidential building stock in real US dollars and nonresidential building floor space

in square feet are also provided to 2018 and segmented by market:

office and commercial

institutional

industrial

transportation and other.

Nonresidential floor space is further segmented by US region as follows:

South

Midwest

West

Northeast.

To illustrate historical trends, total nonresidential building construction expenditures are

provided in an annual series from 2003 to 2013; building stock, floor space, and the

various segments are reported at five-year intervals for 2008 and 2013. Forecasts

emanate from the identification and analysis of pertinent statistical relationships and

other historical trends/events as well as their expected progression/impact over the

forecast period. Changes in quantities between reported years of a given total or

segment are typically provided in terms of five-year compound annual growth rates

(CAGRs). For the sake of brevity, forecasts are generally stated in smoothed CAGRbased descriptions to the forecast year, such as demand is projected to rise 3.2%

annually through 2017. The result of any particular year over that period, however, may

exhibit volatility and depart from a smoothed, long-term trend, as historical data typically

illustrate.

2014 by The Freedonia Group, Inc.

Nonresidential Building Construction: United States

Key macroeconomic indicators are also provided at five-year intervals with CAGRs for

the years corresponding to other reported figures. Other various topics, including

profiles of pertinent leading suppliers, are covered in this report. A full outline of report

items by page is available in the Table of Contents.

Sources

Nonresidential Building Construction: United States represents the synthesis and

analysis of data from various primary, secondary, macroeconomic, and demographic

sources including:

firms participating in the industry, and their suppliers and customers

government/public agencies

national, regional, and international non-governmental organizations

trade associations and their publications

the business and trade press

The Freedonia Group Consensus Forecasts dated December 2013

the findings of other industry studies by The Freedonia Group.

Specific sources and additional resources are listed in the Resources section of this

publication for reference and to facilitate further research.

Industry Codes

The topic of this report is related to the following industry codes:

NAICS/SCIAN 2007

North American Industry Classification System

SIC

Standard Industry Codes

236210

236220

1531

1541

Industrial Building Construction

Commercial and Institutional Building

Construction

1542

Operative Builders

General Contractors Industrial Buildings

and Warehouses

General Contractors Nonresidential

Buildings, Other than Industrial Buildings

and Warehouses

Copyright & Licensing

The full report is protected by copyright laws of the United States of America and international

treaties. The entire contents of the publication are copyrighted by The Freedonia Group, Inc.

2014 by The Freedonia Group, Inc.

ii

Nonresidential Building Construction: United States

Table of Contents

Section

Page

About This Report .......................................................................................................................................................... i

Highlights .......................................................................................................................................................................1

Industry Overview ..........................................................................................................................................................2

Market Size & Trends ...............................................................................................................................................2

Chart 1 | United States: Nonresidential Building Construction Trends, 2003-2013 .............................................2

Market Segmentation ...............................................................................................................................................3

Chart 2 | United States: Nonresidential Building Construction Expenditures by Market, 2013 ...........................3

Office & Commercial. ..........................................................................................................................................4

Commercial. ..................................................................................................................................................4

Chart 3 | United States: Office & Commercial Construction Expenditures by Market, 2013..........................5

Office. ...........................................................................................................................................................5

Lodging. ........................................................................................................................................................6

Institutional. ........................................................................................................................................................6

Education. .....................................................................................................................................................6

Chart 4 | United States: Institutional Construction Expenditures by Market, 2013 ........................................7

Healthcare.....................................................................................................................................................7

Religious. ......................................................................................................................................................8

Industrial. ............................................................................................................................................................8

Transportation.....................................................................................................................................................9

Other...................................................................................................................................................................9

Nonresidential Building Stock & Floor Space ......................................................................................................... 10

Chart 5 | United States: Nonresidential Building Stock by Market, 2013 .......................................................... 10

Chart 6 | Nonresidential Building Floor Space by Market, 2013........................................................................ 11

Chart 7 | Nonresidential Building Floor Space by Region, 2013 ....................................................................... 11

Industry Forecasts........................................................................................................................................................ 12

Market Environment ............................................................................................................................................... 12

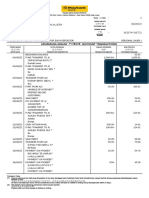

Table 1 | United States: Key Indicators for Nonresidential Building Construction (billion dollars) ..................... 12

Market Forecasts .................................................................................................................................................... 13

Table 2 | United States: Nonresidential Building Construction Expenditures (billion dollars) ............................ 13

Office & Commercial. ........................................................................................................................................ 13

Commercial. ................................................................................................................................................ 14

Office. ......................................................................................................................................................... 14

Lodging. ...................................................................................................................................................... 15

Institutional. ...................................................................................................................................................... 15

Education. ................................................................................................................................................... 15

Healthcare................................................................................................................................................... 15

Religious. .................................................................................................................................................... 16

Industrial. .......................................................................................................................................................... 16

Transportation................................................................................................................................................... 17

Other................................................................................................................................................................. 17

Building Stock & Floor Space Forecasts ................................................................................................................ 18

Table 3 | United States: Nonresidential Building Stock (billion 2009 dollars) .................................................... 18

Table 4 | United States: Nonresidential Building Floor Space (billion square feet) ........................................... 19

Industry Structure & Leaders ....................................................................................................................................... 20

Industry Composition .............................................................................................................................................. 20

Company Profile 1 | Fluor Corporation ............................................................................................................. 21

Company Profile 2 | Kiewit Corporation ............................................................................................................ 22

Company Profile 3 | HOCHTIEF (Turner Construction Company) .................................................................... 23

Additional Companies Cited ................................................................................................................................... 24

Resources .................................................................................................................................................................... 25

To return here, click on any Freedonia logo or the Table of Contents link in report footers.

PDF bookmarks are also available for navigation.

iii

2014 by The Freedonia Group, Inc.

Você também pode gostar

- Specialty Biocides: United StatesDocumento4 páginasSpecialty Biocides: United StatesMichael WarnerAinda não há avaliações

- World GraphiteDocumento4 páginasWorld GraphiteMichael WarnerAinda não há avaliações

- Salt: United StatesDocumento4 páginasSalt: United StatesMichael WarnerAinda não há avaliações

- World SaltDocumento4 páginasWorld SaltMichael WarnerAinda não há avaliações

- Aluminum Pipe: United StatesDocumento4 páginasAluminum Pipe: United StatesMichael WarnerAinda não há avaliações

- Labels: United StatesDocumento4 páginasLabels: United StatesMichael WarnerAinda não há avaliações

- World Motor Vehicle BiofuelsDocumento4 páginasWorld Motor Vehicle BiofuelsMichael WarnerAinda não há avaliações

- Polyurethane: United StatesDocumento4 páginasPolyurethane: United StatesMichael WarnerAinda não há avaliações

- Motor Vehicle Biofuels: United StatesDocumento4 páginasMotor Vehicle Biofuels: United StatesMichael WarnerAinda não há avaliações

- World Material Handling ProductsDocumento4 páginasWorld Material Handling ProductsMichael WarnerAinda não há avaliações

- World Lighting FixturesDocumento4 páginasWorld Lighting FixturesMichael WarnerAinda não há avaliações

- World BearingsDocumento4 páginasWorld BearingsMichael WarnerAinda não há avaliações

- World Medical DisposablesDocumento4 páginasWorld Medical DisposablesMichael WarnerAinda não há avaliações

- World LabelsDocumento4 páginasWorld LabelsMichael WarnerAinda não há avaliações

- Jewelry, Watches, & Clocks: United StatesDocumento4 páginasJewelry, Watches, & Clocks: United StatesMichael WarnerAinda não há avaliações

- Education: United StatesDocumento4 páginasEducation: United StatesMichael WarnerAinda não há avaliações

- Public Transport: United StatesDocumento4 páginasPublic Transport: United StatesMichael WarnerAinda não há avaliações

- Graphite: United StatesDocumento4 páginasGraphite: United StatesMichael WarnerAinda não há avaliações

- Industrial & Institutional Cleaning Chemicals: United StatesDocumento4 páginasIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerAinda não há avaliações

- World Specialty SilicasDocumento4 páginasWorld Specialty SilicasMichael WarnerAinda não há avaliações

- Ceilings: United StatesDocumento4 páginasCeilings: United StatesMichael WarnerAinda não há avaliações

- Caps & Closures: United StatesDocumento4 páginasCaps & Closures: United StatesMichael WarnerAinda não há avaliações

- Industrial & Institutional Cleaning Chemicals: United StatesDocumento4 páginasIndustrial & Institutional Cleaning Chemicals: United StatesMichael WarnerAinda não há avaliações

- Pharmaceutical Packaging: United StatesDocumento4 páginasPharmaceutical Packaging: United StatesMichael WarnerAinda não há avaliações

- Plastic Pipe: United StatesDocumento4 páginasPlastic Pipe: United StatesMichael WarnerAinda não há avaliações

- Municipal Solid Waste: United StatesDocumento4 páginasMunicipal Solid Waste: United StatesMichael WarnerAinda não há avaliações

- World HousingDocumento4 páginasWorld HousingMichael WarnerAinda não há avaliações

- Motor Vehicles: United StatesDocumento4 páginasMotor Vehicles: United StatesMichael WarnerAinda não há avaliações

- Housing: United StatesDocumento4 páginasHousing: United StatesMichael WarnerAinda não há avaliações

- World Drywall & Building PlasterDocumento4 páginasWorld Drywall & Building PlasterMichael WarnerAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- FIN338 Ch15 LPKDocumento90 páginasFIN338 Ch15 LPKjahanzebAinda não há avaliações

- Full Solution Manual For Principles of Supply Chain Management A Balanced Approach 3Rd Edition by Wisner PDF Docx Full Chapter ChapterDocumento7 páginasFull Solution Manual For Principles of Supply Chain Management A Balanced Approach 3Rd Edition by Wisner PDF Docx Full Chapter Chapteraxinitestundist98wcz100% (13)

- International Trade AssignmentDocumento7 páginasInternational Trade AssignmentHanamariam FantuAinda não há avaliações

- CERTIFIED STATEMENT OF INCOMEDocumento17 páginasCERTIFIED STATEMENT OF INCOMEArman BentainAinda não há avaliações

- Executive Chic Inc. custom uniform tailoring strategyDocumento90 páginasExecutive Chic Inc. custom uniform tailoring strategyMA MallariAinda não há avaliações

- 15 Format Man Problems and Prospects of LPG Subsidy Delivery To Consumers - 2Documento16 páginas15 Format Man Problems and Prospects of LPG Subsidy Delivery To Consumers - 2Impact JournalsAinda não há avaliações

- Topic 3 International Convergence of Financial Reporting 2022Documento17 páginasTopic 3 International Convergence of Financial Reporting 2022Nguyễn Minh ĐứcAinda não há avaliações

- Introduction to Corporate FinanceDocumento89 páginasIntroduction to Corporate FinanceBet NaroAinda não há avaliações

- Buy Refurbished Smartphones through Local Vendors with OLD is GOLDDocumento4 páginasBuy Refurbished Smartphones through Local Vendors with OLD is GOLDManish ManjhiAinda não há avaliações

- Finding and Correcting Errors on a Work SheetDocumento10 páginasFinding and Correcting Errors on a Work SheetCPAAinda não há avaliações

- Lecture 1 Introduction To Engineering Economy PDFDocumento6 páginasLecture 1 Introduction To Engineering Economy PDFRheim Vibeth DimacaliAinda não há avaliações

- Managerial Accounting The Cornerstone of Business Decision Making 7th Edition Mowen Test BankDocumento140 páginasManagerial Accounting The Cornerstone of Business Decision Making 7th Edition Mowen Test BankLauraLittlebesmp100% (16)

- Electricity Bill Sep2021Documento1 páginaElectricity Bill Sep2021Jai BajajAinda não há avaliações

- MAGNI AnnualReport2013Documento105 páginasMAGNI AnnualReport2013chinkcAinda não há avaliações

- Uttar Pradesh Budget Analysis 2019-20Documento6 páginasUttar Pradesh Budget Analysis 2019-20AdAinda não há avaliações

- 2 Marginal AnalysisDocumento25 páginas2 Marginal AnalysisShubham SrivastavaAinda não há avaliações

- 66112438X 2Documento12 páginas66112438X 2Zayd AhmedAinda não há avaliações

- Chapter 8 Student Textbook JJBDocumento24 páginasChapter 8 Student Textbook JJBapi-30995537633% (3)

- Journal and ledger assignmentsDocumento39 páginasJournal and ledger assignmentsIndu GuptaAinda não há avaliações

- MBBsavings - 162674 016721 - 2022 09 30 PDFDocumento3 páginasMBBsavings - 162674 016721 - 2022 09 30 PDFAdeela fazlinAinda não há avaliações

- Project Implementation Policy KPK 2023Documento62 páginasProject Implementation Policy KPK 2023javed AfridiAinda não há avaliações

- Ind As 16Documento41 páginasInd As 16Vidhi AgarwalAinda não há avaliações

- VC JournalDocumento24 páginasVC JournalHabeeb ChooriAinda não há avaliações

- InfosysDocumento44 páginasInfosysSubhendu GhoshAinda não há avaliações

- Introduction Lingang Fengxian ParkDocumento34 páginasIntroduction Lingang Fengxian ParkmingaiAinda não há avaliações

- WASKO - Studying PEM PDFDocumento24 páginasWASKO - Studying PEM PDFrmsoaresAinda não há avaliações

- Human Resource Management Mid-term Chapter ReviewDocumento5 páginasHuman Resource Management Mid-term Chapter ReviewChattip KorawiyothinAinda não há avaliações

- Accounting Warren 23rd Edition Solutions ManualDocumento47 páginasAccounting Warren 23rd Edition Solutions ManualKellyMorenootdnj100% (79)

- Marketing Trends 2024Documento1 páginaMarketing Trends 2024nblfuxinrqjjbtnjcs100% (1)

- Soal Ch. 15Documento6 páginasSoal Ch. 15Kyle KuroAinda não há avaliações