Escolar Documentos

Profissional Documentos

Cultura Documentos

Contactless Payments Benefits

Enviado por

anjitachinkiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Contactless Payments Benefits

Enviado por

anjitachinkiDireitos autorais:

Formatos disponíveis

Benefits of Accepting Contactless Payments

You probably dont give much thought to your businesss credit card terminalsbut maybe you should. Millions of consumers are now equipped with contactless-enabled debit cards, credit cards and other contactless payment devices, and adoption is likely to grow rapidly with the emergence of mobile phone-based NFC (near-field communication) payments. At retailers outfitted with contactless readers at the point of sale, customers simply wave or tap their card or other payment device to pay for their purchases. The benefits to both consumers and retailers are significant.

2011 First Data Corporation. All trademarks, service marks and trade names referenced in this material are the property of their respective owners.

Benefits of Accepting Contactless Payments

Consumers benefit in several ways from being able to use contactless payments:

g Convenience and Ease of Use Instead of swiping a card, customers simply wave their card in the proximity of the reader. Its no surprise that when surveyed, 85 percent of contactless payment users said they would recommend the technology to friends and family1. g Safety and Security Contactless payments are processed through the same networks as other transactions. The chip technology utilized by contactless payments provides protection through encryption and dynamic data technologies, and can actually be safer and more secure than other forms of payment. Additionally, there is less chance that the card will be lost or forgotten during the course of the transaction, since it never leaves the customers hand. This also reduces the opportunity for a dishonest employee to steal the cards magnetic-stripe data through skimming, the practice of fraudulently procuring card data with a hand-held electronic device. g Flexibility of Alternate Form Factors Contactless payment technology doesnt have to be delivered on conventional plastic cards. Contactless technology is increasingly available to consumers in other forms, such as mini-cards, stickers, key fobs and even mobile wallets that turn contactless-enabled phones into payment devicesreducing the need to carry a physical wallet at all.

Retailers benefit, too:

g Operational Efficiency Industry research has shown that contactless transactions are faster than both cash and conventional card transactions averaging 12.5 seconds, compared to 26.7 seconds for conventional card transactions and 33.7 seconds for cash transactions2. This reduced transaction time can result in shorter queues, increased revenue and better customer satisfaction. Because of the increased throughput at each point-of-sale, fewer personnel may be needed during peak times. g Competitive Differentiation Studies have also revealed that consumers with contactless payment devices use them often and exhibit greater loyalty to retailers that accept them. According to MasterCard, contactless cardholders make purchases with 26 percent greater frequency than regular cardholders. Further, the overall usage for contactless account holders increases by 24 percent3. Retailers that accept contactless payments are especially well-positioned to benefit from the emergence of mobile phonebased payments, which are predicted to be an especially popular payment choice among young and affluent consumers. g Technology Integration Opportunities The ability to accept mobile phone-based contactless payments opens up a multitude of marketing opportunities by improving integration with existing loyalty programmes, as well as enhancing the opportunity to utilise personalised mobile couponing and location-based marketing to target consumers inside or nearby a retail location. To find out how to begin accepting contactless payments, contact your sales representative or visit firstdata.com.

Hernandez, W. (2011). U.K. Consumers Like Contactless Payments, But Seek Merchant Acceptance. Retrieved from http://www.americanbanker.com/issues/176_172/surveycontactless-payments-united-kingdom-1041876-1.html 2 Dennison, P. (2011). Contactless Payments Merchant Accounts. Retrieved from http://www.articletrader.com/ computers/software/contactless-payments-merchant-accounts.html 3 Nichols, D. (2011). Why NFC may be the second-best contactless payment solution. Retrieved from http:/ /www.hidglobal.com/main/blog/2011/01/why-nfc-may-be-the-second-best-contactless-payment-solution.html

1

The Global Leader in Electronic Commerce

Around the world every day, First Data makes payment transactions secure, fast and easy for merchants, financial institutions and their customers. We leverage our unparalleled product portfolio and expertise to deliver processing solutions that drive customer revenue and profitability. Whether the payment is by debit or credit, gift card, check or mobile phone, online or at the point of sale, First Data helps you maximize value for your business.

firstdata.com

2011 First Data Corporation. All rights reserved.

Você também pode gostar

- Submitted To Submitted byDocumento20 páginasSubmitted To Submitted bypreetgodan100% (2)

- Mobile Payment Systems SeminarDocumento26 páginasMobile Payment Systems Seminarkrishnaganth kichaaAinda não há avaliações

- Cloud Contact Center A Complete Guide - 2021 EditionNo EverandCloud Contact Center A Complete Guide - 2021 EditionAinda não há avaliações

- Digital Payment BookDocumento132 páginasDigital Payment BookGovind0% (1)

- Overview of Mobile Payments WhitepaperDocumento14 páginasOverview of Mobile Payments WhitepapertderuvoAinda não há avaliações

- Chapter2 Disruption and Disintermediation in Financial Products and ServicesDocumento33 páginasChapter2 Disruption and Disintermediation in Financial Products and ServicesAllen Uhomist AuAinda não há avaliações

- A Study On E-Wallet Payment Using QR Code Technology Towards Grocery System As An ExampleDocumento33 páginasA Study On E-Wallet Payment Using QR Code Technology Towards Grocery System As An ExampleAnand ThamilarasuAinda não há avaliações

- Pink GurlzDocumento423 páginasPink Gurlzmygurlz1991Ainda não há avaliações

- Best Practices Securing EcommerceDocumento64 páginasBest Practices Securing Ecommercejunior_00Ainda não há avaliações

- Near Field Communication (NFC)Documento17 páginasNear Field Communication (NFC)Saurabh KesarwaniAinda não há avaliações

- Adyen and Fintech - Driving Change in The Financial Services IndustryDocumento4 páginasAdyen and Fintech - Driving Change in The Financial Services Industry030239230171Ainda não há avaliações

- Forever YoungDocumento3 páginasForever YoungMeluAinda não há avaliações

- Mifos X Data Sheet July2015Documento4 páginasMifos X Data Sheet July2015konverg101Ainda não há avaliações

- Atm Switch RFPDocumento77 páginasAtm Switch RFPRishi SrivastavaAinda não há avaliações

- Service Brochure PDFDocumento10 páginasService Brochure PDFN MariappanAinda não há avaliações

- RBICircular On Cyber SecurityDocumento13 páginasRBICircular On Cyber SecurityPravin BandaleAinda não há avaliações

- CybersourceDocumento94 páginasCybersourceFenck FencksAinda não há avaliações

- Kiosk ManualDocumento39 páginasKiosk Manualezlink5Ainda não há avaliações

- Shared e Bike and EScooter Final Pilot ReportDocumento28 páginasShared e Bike and EScooter Final Pilot Report01fe19bme079Ainda não há avaliações

- Mobile Banking PolicyDocumento12 páginasMobile Banking PolicySuraj GCAinda não há avaliações

- Questions Regarding This Proposal Should Be Directed To:: Ffice of The Rizona Ttorney EneralDocumento5 páginasQuestions Regarding This Proposal Should Be Directed To:: Ffice of The Rizona Ttorney EneralBrian KnightAinda não há avaliações

- Mobilink-Network Partial List of PartnersDocumento5 páginasMobilink-Network Partial List of PartnersEksdiAinda não há avaliações

- Case Study eKYC Solution New PDFDocumento2 páginasCase Study eKYC Solution New PDFykbharti101Ainda não há avaliações

- Proposal For Remittance....Documento18 páginasProposal For Remittance....Simon ShresthaAinda não há avaliações

- Payment Express Eftpos Getting Started GuideDocumento11 páginasPayment Express Eftpos Getting Started GuidenguyenbxAinda não há avaliações

- Sample Report II - Card System Forensic Audit ReportDocumento24 páginasSample Report II - Card System Forensic Audit ReportArif AhmedAinda não há avaliações

- Paypal Case WriteupDocumento3 páginasPaypal Case WriteupAaras VasaAinda não há avaliações

- Mobile WalletDocumento2 páginasMobile WalletHimanshu KoliAinda não há avaliações

- FASTAGDocumento20 páginasFASTAGSankaramurthy C0% (1)

- TechTrex Company & SecurePro Introduction V16Documento27 páginasTechTrex Company & SecurePro Introduction V16kab4kjdAinda não há avaliações

- Whitepaper - 10 Top Drivers To Launch A Mobile Wallet - SoftwaregroupDocumento14 páginasWhitepaper - 10 Top Drivers To Launch A Mobile Wallet - SoftwaregroupAba JifarAinda não há avaliações

- Seminar AtmDocumento16 páginasSeminar AtmJasmeet SandhuAinda não há avaliações

- 4 A Guide To Payment Gateways PDFDocumento3 páginas4 A Guide To Payment Gateways PDFMishel Carrion lopezAinda não há avaliações

- Pci Dss Faqs: We Suggest That You Contact Your AcquirerDocumento9 páginasPci Dss Faqs: We Suggest That You Contact Your Acquirerchaouch.najehAinda não há avaliações

- Mobile Payment L Six IssuesDocumento17 páginasMobile Payment L Six IssuesiAditya100% (4)

- Card Acceptance Guidelines Visa Merchants PDFDocumento81 páginasCard Acceptance Guidelines Visa Merchants PDFsanpikAinda não há avaliações

- SSI eIDAS Legal Report Final 0Documento150 páginasSSI eIDAS Legal Report Final 0yomamaAinda não há avaliações

- CA Focused AttachmentsDocumento8 páginasCA Focused AttachmentssatishAinda não há avaliações

- Near Field Communication Based College CanteenDocumento5 páginasNear Field Communication Based College CanteenJunaid M FaisalAinda não há avaliações

- Harnessing Technology Creating A Less Cash Society: Connect With UsDocumento32 páginasHarnessing Technology Creating A Less Cash Society: Connect With UsPunyabrata Ghatak100% (1)

- Core Banking Software: Providing A Platform To Speed Time To ValueDocumento4 páginasCore Banking Software: Providing A Platform To Speed Time To ValueIBMBankingAinda não há avaliações

- Middle East/Africa: Purchase Volume 2015 vs. 2014Documento11 páginasMiddle East/Africa: Purchase Volume 2015 vs. 2014Charan TejaAinda não há avaliações

- NFC SynopsisDocumento6 páginasNFC SynopsisYash SinglaAinda não há avaliações

- Card Payment Security Using RSADocumento23 páginasCard Payment Security Using RSAKaataRanjithkumar100% (1)

- GTAG 21 Auditing ApplicationsDocumento36 páginasGTAG 21 Auditing ApplicationsFarid AbdelkaderAinda não há avaliações

- Security and Web Application MonitoringDocumento58 páginasSecurity and Web Application MonitoringTomBikoAinda não há avaliações

- Approval Procedure of PSO PSP Pso - PSP - 03022019Documento7 páginasApproval Procedure of PSO PSP Pso - PSP - 03022019Shaq JordanAinda não há avaliações

- Company Profile - 1kosmosDocumento5 páginasCompany Profile - 1kosmosPankajkumar JoshiAinda não há avaliações

- E WalletDocumento15 páginasE WalletManoj Kumar Paras100% (1)

- Cyber Security Control For UCBDocumento12 páginasCyber Security Control For UCBAdesh NaharAinda não há avaliações

- Digital WalletDocumento19 páginasDigital WalletJoselin ReañoAinda não há avaliações

- Online Gateway Product Research 1.1Documento15 páginasOnline Gateway Product Research 1.1EzmeyAinda não há avaliações

- Merchant Presentation v5.0 (QR)Documento21 páginasMerchant Presentation v5.0 (QR)أغيلا جيليان100% (2)

- Cybersource APIDocumento6 páginasCybersource APIMadhur Aggarwal100% (1)

- Mobile PaymentsDocumento36 páginasMobile Paymentsadnan67Ainda não há avaliações

- User Manual: (BSNL - PM - UM - 01 - Preventive - Maintenance - V2.0Documento71 páginasUser Manual: (BSNL - PM - UM - 01 - Preventive - Maintenance - V2.0anjitachinkiAinda não há avaliações

- Refurbishment Process in Plant MaintenanceDocumento8 páginasRefurbishment Process in Plant Maintenanceanjitachinki50% (2)

- Precot Mills LTDDocumento9 páginasPrecot Mills LTDanjitachinkiAinda não há avaliações

- Business Ethics QuestionsDocumento2 páginasBusiness Ethics Questionsanjitachinki100% (1)

- LOM Parameter LengthDocumento1 páginaLOM Parameter LengthanjitachinkiAinda não há avaliações

- System Name: Functional SpecificationDocumento8 páginasSystem Name: Functional SpecificationanjitachinkiAinda não há avaliações

- SAD PM MasterdataDocumento19 páginasSAD PM MasterdataanjitachinkiAinda não há avaliações

- Sap MRPDocumento30 páginasSap MRPanjitachinki100% (4)

- TPLM30 IG Col33Documento17 páginasTPLM30 IG Col33ahmedwwwAinda não há avaliações

- Sap PPDocumento19 páginasSap PPJegathu Singh100% (2)

- SFCDocumento96 páginasSFCanjitachinkiAinda não há avaliações

- Steps in Implementation of SAP PPDocumento12 páginasSteps in Implementation of SAP PPVelavan Arumugam100% (1)

- Module: PP (Production Planning)Documento155 páginasModule: PP (Production Planning)Suryanarayana TataAinda não há avaliações

- Sap Workcenter-Resource ViewsDocumento20 páginasSap Workcenter-Resource ViewsanjitachinkiAinda não há avaliações

- Learn Sap MRP in 11 StepsDocumento17 páginasLearn Sap MRP in 11 Stepsanjitachinki100% (2)

- Sap Batch ManagementDocumento66 páginasSap Batch ManagementanjitachinkiAinda não há avaliações

- PP Material Master ViewsDocumento26 páginasPP Material Master ViewsanjitachinkiAinda não há avaliações

- Master Recipes in Sap PppiDocumento11 páginasMaster Recipes in Sap PppianjitachinkiAinda não há avaliações

- SAP MRP Strategy Made Easy PDFDocumento172 páginasSAP MRP Strategy Made Easy PDFraky0369100% (4)

- Routing SDocumento24 páginasRouting SanjitachinkiAinda não há avaliações

- Fixed Plug-In Motor A2Fe: Series 6Documento24 páginasFixed Plug-In Motor A2Fe: Series 6Michail ArmitageAinda não há avaliações

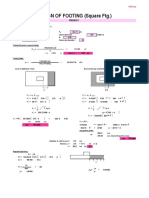

- Design of Footing (Square FTG.) : M Say, L 3.75Documento2 páginasDesign of Footing (Square FTG.) : M Say, L 3.75victoriaAinda não há avaliações

- Instructions For Comprehensive Exams NovemberDocumento2 páginasInstructions For Comprehensive Exams Novembermanoj reddyAinda não há avaliações

- Slope Stability Analysis Using FlacDocumento17 páginasSlope Stability Analysis Using FlacSudarshan Barole100% (1)

- Bangalore University: Regulations, Scheme and SyllabusDocumento40 páginasBangalore University: Regulations, Scheme and SyllabusYashaswiniPrashanthAinda não há avaliações

- DoctorTecar Brochure MECTRONIC2016 EngDocumento16 páginasDoctorTecar Brochure MECTRONIC2016 EngSergio OlivaAinda não há avaliações

- Addendum No.1: Indianapolis Metropolitan Airport T-Hangar Taxilane Rehabilitation IAA Project No. M-12-032Documento22 páginasAddendum No.1: Indianapolis Metropolitan Airport T-Hangar Taxilane Rehabilitation IAA Project No. M-12-032stretch317Ainda não há avaliações

- Forod 2bac en s2 6 PDFDocumento4 páginasForod 2bac en s2 6 PDFwwe foreverAinda não há avaliações

- 10.isca RJCS 2015 106Documento5 páginas10.isca RJCS 2015 106Touhid IslamAinda não há avaliações

- RH S65A SSVR Users ManualDocumento11 páginasRH S65A SSVR Users ManualMohd Fauzi YusohAinda não há avaliações

- About FW TaylorDocumento9 páginasAbout FW TaylorGayaz SkAinda não há avaliações

- CSP Study Course 2 Willard StephensonDocumento137 páginasCSP Study Course 2 Willard Stephensonsamer alrawashdehAinda não há avaliações

- Standard C4C End User GuideDocumento259 páginasStandard C4C End User GuideKanali PaariAinda não há avaliações

- Sworn Statement of Assets, Liabilities and Net WorthDocumento2 páginasSworn Statement of Assets, Liabilities and Net WorthFaidah Palawan AlawiAinda não há avaliações

- Bank Soal LettersDocumento17 páginasBank Soal Lettersderoo_wahidahAinda não há avaliações

- General Director AdDocumento1 páginaGeneral Director Adapi-690640369Ainda não há avaliações

- Forecasting and Demand Management PDFDocumento39 páginasForecasting and Demand Management PDFKazi Ajwad AhmedAinda não há avaliações

- Hey Can I Try ThatDocumento20 páginasHey Can I Try Thatapi-273078602Ainda não há avaliações

- Outline - Essay and Argumentative EssayDocumento2 páginasOutline - Essay and Argumentative EssayGabbo GómezAinda não há avaliações

- Artificial Intelligence and Parametric Construction Cost Estimate Modeling State-of-The-Art ReviewDocumento31 páginasArtificial Intelligence and Parametric Construction Cost Estimate Modeling State-of-The-Art ReviewmrvictormrrrAinda não há avaliações

- Study On Color Fastness To Rubbing by Crock MeterDocumento4 páginasStudy On Color Fastness To Rubbing by Crock Metertushar100% (5)

- Feed Water Heater ValvesDocumento4 páginasFeed Water Heater ValvesMukesh AggarwalAinda não há avaliações

- Copyright IP Law Infringment of CopyrightDocumento45 páginasCopyright IP Law Infringment of Copyrightshree2485Ainda não há avaliações

- Taiwan Petroleum Facilities (1945)Documento85 páginasTaiwan Petroleum Facilities (1945)CAP History LibraryAinda não há avaliações

- Defensive Driving TrainingDocumento19 páginasDefensive Driving TrainingSheri DiĺlAinda não há avaliações

- FLIPKART MayankDocumento65 páginasFLIPKART MayankNeeraj DwivediAinda não há avaliações

- Manufacturer MumbaiDocumento336 páginasManufacturer MumbaiNafa NuksanAinda não há avaliações

- The Consulting Services For PreparationDocumento50 páginasThe Consulting Services For PreparationJay PanitanAinda não há avaliações

- Compound Wall Design (1) - Layout1Documento1 páginaCompound Wall Design (1) - Layout1SandeepAinda não há avaliações

- Example of Praxis TicketDocumento3 páginasExample of Praxis TicketEmily LescatreAinda não há avaliações