Escolar Documentos

Profissional Documentos

Cultura Documentos

Substitute Form W-9 Request For Taxpayer Identification Number and Certification

Enviado por

Tabitha HowardDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Substitute Form W-9 Request For Taxpayer Identification Number and Certification

Enviado por

Tabitha HowardDireitos autorais:

Formatos disponíveis

Federal Deposit Insurance Corporation

Division of Finance

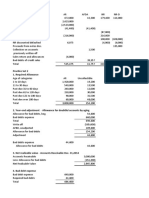

Substitute Form W-9 REQUEST FOR TAXPAYER IDENTIFICATION NUMBER AND CERTIFICATION

PRI ACY ACT STATEMENT Section 6109 of the Internal Revenue Code requires you to give your correct Ta payer Identification !u"#er $TI!% to persons &ho "ust file infor"ation returns &ith the IRS to report interest' dividends' and certain other inco"e paid to you' "ortgage interest you paid' the acquisition or a#andon"ent of secured property' cancellation of de#t' or contri#utions you "ade to an IR() The IRS &ill use the nu"#ers for identification purposes and to help verify the accuracy of your ta return) The IRS "ay also provide this infor"ation to the Depart"ent of *ustice for civil and cri"inal litigation and to cities' states' and the District of Colu"#ia to carry out their ta la&s) +ou "ust provide your TI! &hether or not you are required to file a ta return) ,ayers "ust generally &ithhold -0. of ta a#le interest' dividend' and certain other pay"ents to a payee &ho does not give a TI! to a payer) Certain penalties "ay also apply)

!a"e /usiness !a"e (ddress (Number, Street, Apt. or Suite No.) City' State' and 3I, Code

0 e"pt Fro" /ac1up 2ithholding

4ist (ccount !u"#er$s% $5ptional%

SECTION I ! TAXPAYER ID NUMBER" PAYEE TYPE" AND BUSINESS OWNERS#IP TYPE TAXPAYER ID NUMBER E$ter %our T&'(&%er I)e$ti*i+&tio$ Number ,TIN- i$ t.e &((ro(ri&te bo'/ For i$)i0i)u&1s" t.is is %our So+i&1 Se+urit% Number ,SSN-/ For ot.er e$tities" it is %our Em(1o%er I)e$ti*i+&tio$ Number ,EIN-/ 0"ployer Identification !u"#er $0I!% Social Security !u"#er $SS!% PAYEE TYPE Individual Federal 7overn"ent (gency State' 4ocal 7overn"ent (gency 4a& Fir" or ,ractice 4egal Service ,rovider Foreign8!on6resident (Provide the appropriate Form W- ) 5ther (Please explain) 6 6 OR 6

(Please check one box in each column) BUSINESS OWNERS#IP TYPE Sole ,roprietorship ,artnership Corporation 7overn"ent (gency Trust Ta 0 e"pt8!on6,rofit 5ther (Please explain)

CERTIFICATION INSTRUCTIONS 6 +ou "ust cross out ite" 9' #elo& if you have #een notified #y the IRS that you are currently su#:ect to #ac1up &ithholding #ecause of underreporting of interest or dividends on your ta return) For real estate transactions' ite" 9 does not apply) For "ortgage interest paid' the acquisition or a#andon"ent of secured property' cancellation of de#t' contri#utions to an individual retire"ent account $IR(%' and generally' pay"ents other than interest and dividends' you are not required to sign the Certification' #ut you "ust provide your correct TI!) SECTION II - CERTIFICATION ;nder penalties of per:ury' I certify that< 1) The nu"#er sho&n on this for" is "y correct ta payer identification nu"#er $or I a" &aiting for a nu"#er to #e issued to "e%' &$) 9) I a" not su#:ect to #ac1up &ithholding #ecause< $a% I a" e e"pt fro" #ac1up &ithholding' or $#% I have not #een notified #y the IRS that I a" su#:ect to #ac1up &ithholding as a result of failure to report all interest and dividends' or $c% the IRS has notified "e that I a" no longer su#:ect to #ac1up &ithholding' &$) -) I a" a ;)S) person $including a ;)S) resident alien%) T.e I$ter$&1 Re0e$ue Ser0i+e )oes $ot re2uire %our +o$se$t to &$% (ro0isio$ o* t.is )o+ume$t ot.er t.&$ t.e +erti*i+&tio$s re2uire) to &0oi) b&+3u( 4it..o1)i$5) Signature of ;)S) ,erson Date !a"e(Please print) Title Telephone !u"#er Fa !u"#er $% 6 $% 6

FDIC =>-1810 $1060-%

Você também pode gostar

- Newmass w9Documento4 páginasNewmass w9Tabitha HowardAinda não há avaliações

- W-9 ElectronicDocumento5 páginasW-9 ElectronicTabitha HowardAinda não há avaliações

- Collection Agency Removal LetterDocumento4 páginasCollection Agency Removal LetterKNOWLEDGE SOURCEAinda não há avaliações

- Read The Instructions On The Reverse Side Before Completing This FormDocumento2 páginasRead The Instructions On The Reverse Side Before Completing This FormTabitha HowardAinda não há avaliações

- Personal Financial Statement: Personal Data On Your SpouseDocumento3 páginasPersonal Financial Statement: Personal Data On Your Spousenomi_425Ainda não há avaliações

- Legal Forms Reviewer.Documento18 páginasLegal Forms Reviewer.Jerry Kho100% (1)

- Getting A Cusip NumberDocumento2 páginasGetting A Cusip Numberjoerocketman94% (87)

- You're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowDocumento6 páginasYou're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowJosin JoseAinda não há avaliações

- Irrevocable Payment Order Via Atm CardDocumento2 páginasIrrevocable Payment Order Via Atm CardNasir Naveed0% (1)

- Tax Related Issues FromDocumento8 páginasTax Related Issues FromVemula Venkata PavankumarAinda não há avaliações

- APPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesDocumento4 páginasAPPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesKevin JacobAinda não há avaliações

- LG FFDocumento1 páginaLG FFfeem743Ainda não há avaliações

- Common-Law Trust Fraud Defined Public Notice Public RecordDocumento2 páginasCommon-Law Trust Fraud Defined Public Notice Public Recordin1or100% (2)

- Income Tax - Forms - CopDocumento3 páginasIncome Tax - Forms - CopNeil CruzAinda não há avaliações

- 2 (1) - Form 102 - PrintDocumento4 páginas2 (1) - Form 102 - PrintPraveen SehgalAinda não há avaliações

- Income Tax (File - 1)Documento5 páginasIncome Tax (File - 1)Nazim KhanAinda não há avaliações

- Common-Law Trust Tax Exempt Foreign Status Public Notice Public RecordDocumento3 páginasCommon-Law Trust Tax Exempt Foreign Status Public Notice Public Recordin1or100% (9)

- Mortgage Foreclosure RecoupmentDocumento28 páginasMortgage Foreclosure Recoupmentjvo197077% (13)

- Add To P. 44-46: Am+dg Taxation Two AddendumDocumento11 páginasAdd To P. 44-46: Am+dg Taxation Two AddendumEins BalagtasAinda não há avaliações

- How To Save Tax For FY 2014-15 and Financial Planning?Documento44 páginasHow To Save Tax For FY 2014-15 and Financial Planning?NishimaAinda não há avaliações

- CH 02Documento16 páginasCH 02Yomna AttiaAinda não há avaliações

- Loan AppDocumento1 páginaLoan Appapi-263540012Ainda não há avaliações

- BDM1 Birth Applic FormDocumento5 páginasBDM1 Birth Applic FormMichael Rogers100% (1)

- Intro To Federal Income Taxation - Law School Exam OutlineDocumento65 páginasIntro To Federal Income Taxation - Law School Exam OutlineLaura GoldsmithAinda não há avaliações

- Legal Potential Power LettersDocumento28 páginasLegal Potential Power LettersKNOWLEDGE SOURCEAinda não há avaliações

- Form 15 AaDocumento3 páginasForm 15 AaTrans TradesAinda não há avaliações

- Affidavit of OwnershipDocumento2 páginasAffidavit of OwnershipJacomo CuniitAinda não há avaliações

- Shinola 101-2 JCC-1Documento93 páginasShinola 101-2 JCC-1cfr2hellAinda não há avaliações

- State of Florida: Substitute Form W-9Documento2 páginasState of Florida: Substitute Form W-9Tabitha HowardAinda não há avaliações

- Domondon NotesDocumento15 páginasDomondon NotesShiela ValdezAinda não há avaliações

- Consti 103 Cases Digest 1Documento10 páginasConsti 103 Cases Digest 1Mark Joseph Delima100% (1)

- Chase 1099int 2013Documento2 páginasChase 1099int 2013Srikala Venkatesan100% (1)

- Legal Credit Repair-1Documento9 páginasLegal Credit Repair-1MsDiamondTraxx100% (1)

- W9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFDocumento1 páginaW9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFAnonymous 6ZE5pGAinda não há avaliações

- Cease and DesistDocumento6 páginasCease and DesistKNOWLEDGE SOURCE100% (2)

- BpiDocumento35 páginasBpiChing CamposagradoAinda não há avaliações

- Transcript Jean KeatingDocumento14 páginasTranscript Jean Keatingjoerocketman98% (64)

- 2014 03 01 CPNI CertificateDocumento2 páginas2014 03 01 CPNI CertificateFederal Communications Commission (FCC)Ainda não há avaliações

- Motion For Demand of Verified Complaint in IllinoisDocumento7 páginasMotion For Demand of Verified Complaint in IllinoisMarc MkKoy100% (7)

- RAO - Application FormDocumento8 páginasRAO - Application Formgirlygirl10Ainda não há avaliações

- My Part Tax FinalDocumento5 páginasMy Part Tax FinaljonilawAinda não há avaliações

- National Minorities Development & Finance Corporaiton: NMDFCDocumento9 páginasNational Minorities Development & Finance Corporaiton: NMDFCMunish KharbAinda não há avaliações

- Know More About Income TaxDocumento5 páginasKnow More About Income TaxcanarayananAinda não há avaliações

- IRS A Private For Profit "Foreign Corporation" Find Attached IRS Certificate of Incorporation Plus List of Private For Profit "Foreign Corporations'' Public Notice/Public RecordDocumento10 páginasIRS A Private For Profit "Foreign Corporation" Find Attached IRS Certificate of Incorporation Plus List of Private For Profit "Foreign Corporations'' Public Notice/Public Recordin1or100% (3)

- Your Remedy Starts With The IRS FORM W-9 To CourtDocumento6 páginasYour Remedy Starts With The IRS FORM W-9 To CourtPatrick Long100% (11)

- SET O Form 04-14Documento87 páginasSET O Form 04-14nischal009Ainda não há avaliações

- Order in The Matter of Greentouch Projects Ltd.Documento15 páginasOrder in The Matter of Greentouch Projects Ltd.Shyam Sunder0% (1)

- China: BIR Case Against Manny PacquiaoDocumento5 páginasChina: BIR Case Against Manny PacquiaoAyenGaileAinda não há avaliações

- FF.,T (LT: Ldentification CertificationDocumento1 páginaFF.,T (LT: Ldentification CertificationÉzsaiás JiménezAinda não há avaliações

- Form& ApplicationDocumento1 páginaForm& ApplicationMadhurama SethiAinda não há avaliações

- Bank Temples CourthousesDocumento16 páginasBank Temples CourthousesPatrick BrookingAinda não há avaliações

- W-9 FormDocumento2 páginasW-9 FormTrish HitAinda não há avaliações

- Travelasyoulike VR 001 08 Oct 13Documento4 páginasTravelasyoulike VR 001 08 Oct 13nagammaiAinda não há avaliações

- Sample MotionsDocumento42 páginasSample MotionsKNOWLEDGE SOURCE33% (3)

- Form No. 15G: Area Code AO Type Range Code Ao NoDocumento2 páginasForm No. 15G: Area Code AO Type Range Code Ao NoRanjan ManoAinda não há avaliações

- Unabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2No EverandUnabridged Articles of the Ike Jackson Report :the Future of Hip Hop Business 2020-2050: Unabridged articles of the Ike Jackson Report :The Future of Hip Hop Business 2020-2050, #2Ainda não há avaliações

- Corporate Fraud and Internal Control: A Framework for PreventionNo EverandCorporate Fraud and Internal Control: A Framework for PreventionAinda não há avaliações

- 37 Ways To Protect Yourself From Identity Theft and What to Do if You Are a VictimNo Everand37 Ways To Protect Yourself From Identity Theft and What to Do if You Are a VictimAinda não há avaliações

- LEAF-Simply Sustainable Soils 2016Documento36 páginasLEAF-Simply Sustainable Soils 2016Tabitha HowardAinda não há avaliações

- Future With Be Going To - Quiz 1 - Schoology3Documento2 páginasFuture With Be Going To - Quiz 1 - Schoology3Tabitha HowardAinda não há avaliações

- Will vs. Be Going To Quiz 5: Prev NextDocumento3 páginasWill vs. Be Going To Quiz 5: Prev NextTabitha HowardAinda não há avaliações

- Like Vs Would Like Exercise - GrammarBankDocumento2 páginasLike Vs Would Like Exercise - GrammarBankTabitha HowardAinda não há avaliações

- Will vs. Be Going To Quiz 5: Prev NextDocumento3 páginasWill vs. Be Going To Quiz 5: Prev NextHenry VillegasAinda não há avaliações

- Future With Be Going To - Quiz 1 - Schoology2Documento2 páginasFuture With Be Going To - Quiz 1 - Schoology2Tabitha HowardAinda não há avaliações

- Vidas L. Monocytogenes Xpress (LMX) Ultra Performance SummaryDocumento11 páginasVidas L. Monocytogenes Xpress (LMX) Ultra Performance SummaryTabitha HowardAinda não há avaliações

- Future With Be Going To - Quiz 1 - SchoologyDocumento2 páginasFuture With Be Going To - Quiz 1 - SchoologyTabitha HowardAinda não há avaliações

- Https Videos MMM EnglhisDocumento2 páginasHttps Videos MMM EnglhisTabitha HowardAinda não há avaliações

- Present Continuous Tense - Quiz 2 - SchoologyDocumento2 páginasPresent Continuous Tense - Quiz 2 - SchoologyTabitha HowardAinda não há avaliações

- EdadDocumento1 páginaEdadTabitha HowardAinda não há avaliações

- Rice Farming Education and TechnologyDocumento1 páginaRice Farming Education and TechnologyTabitha HowardAinda não há avaliações

- Evaporimetrothe LeafletDocumento3 páginasEvaporimetrothe LeafletTabitha HowardAinda não há avaliações

- PornerDocumento2 páginasPornerTabitha HowardAinda não há avaliações

- Mass Transfer OperationsDocumento2 páginasMass Transfer OperationsTabitha HowardAinda não há avaliações

- English Exercises - The Present Continuous Tense2Documento2 páginasEnglish Exercises - The Present Continuous Tense2Tabitha HowardAinda não há avaliações

- Terms Definitions: Keyboard ShortcutsDocumento10 páginasTerms Definitions: Keyboard ShortcutsTabitha HowardAinda não há avaliações

- Browse Similar Products: ACQ Series Ampoule Ultrasonic Washing MachineDocumento2 páginasBrowse Similar Products: ACQ Series Ampoule Ultrasonic Washing MachineTabitha HowardAinda não há avaliações

- Crack ChecadDocumento1 páginaCrack ChecadTabitha HowardAinda não há avaliações

- Every Day Activities - Verbs: Flashcards Learn Speller TestDocumento15 páginasEvery Day Activities - Verbs: Flashcards Learn Speller TestTabitha HowardAinda não há avaliações

- Publication 20150617182349867Documento2 páginasPublication 20150617182349867Tabitha HowardAinda não há avaliações

- E & Thiele Graphical Method: NormalDocumento1 páginaE & Thiele Graphical Method: NormalTabitha HowardAinda não há avaliações

- Pinturas Tremen JDocumento2 páginasPinturas Tremen JTabitha HowardAinda não há avaliações

- Argcis 10.3Documento1 páginaArgcis 10.3Tabitha HowardAinda não há avaliações

- Natamicina PDFDocumento2 páginasNatamicina PDFTabitha HowardAinda não há avaliações

- Custom Key InfoDocumento3 páginasCustom Key InfoEdmund Earl Timothy Hular Burdeos IIIAinda não há avaliações

- Custom Key InfoDocumento3 páginasCustom Key InfoEdmund Earl Timothy Hular Burdeos IIIAinda não há avaliações

- 11Documento1 página11Tabitha HowardAinda não há avaliações

- REVITDocumento2 páginasREVITTabitha HowardAinda não há avaliações

- General Purpose Loan - FillableDocumento2 páginasGeneral Purpose Loan - Fillablenemo_nadalAinda não há avaliações

- AccountingDocumento5 páginasAccountingMaitet CarandangAinda não há avaliações

- Research Report Pidilite Industries LTDDocumento7 páginasResearch Report Pidilite Industries LTDAnirudh PatilAinda não há avaliações

- Practice Set 1Documento6 páginasPractice Set 1moreAinda não há avaliações

- Assignment FA2 May 2012 QuestionDocumento4 páginasAssignment FA2 May 2012 Questionsharvin_94Ainda não há avaliações

- Comparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexDocumento21 páginasComparative Analysis of Index of 3 Industries (Publicly Listed Companies) With DSEX IndexPlato KhisaAinda não há avaliações

- R.A. 9147 Wildlife Resources Conservation and Protection ActDocumento17 páginasR.A. 9147 Wildlife Resources Conservation and Protection ActDennis S. SiyhianAinda não há avaliações

- The Rule in Clayton's Case Revisited.Documento20 páginasThe Rule in Clayton's Case Revisited.Adam Channing100% (2)

- Ch13 Case Novo IndustriesDocumento11 páginasCh13 Case Novo IndustriesAlfaRahmatMaulana100% (4)

- Doing Business in UAEDocumento16 páginasDoing Business in UAEHani SaadeAinda não há avaliações

- Toppamono Cap.2Documento24 páginasToppamono Cap.2rhidalgo0% (1)

- Call For Expression of Interest Ip Selection Co Financing Initiative Migration Governance 0Documento27 páginasCall For Expression of Interest Ip Selection Co Financing Initiative Migration Governance 0lightnorth96Ainda não há avaliações

- 28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteDocumento4 páginas28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteMatías PierottiAinda não há avaliações

- Brand ExtensionDocumento6 páginasBrand Extensionmukhtal8909Ainda não há avaliações

- Public Private Partnership Booklet - enDocumento28 páginasPublic Private Partnership Booklet - enJoeAinda não há avaliações

- Founders Equity AgreementDocumento2 páginasFounders Equity AgreementrobogineerAinda não há avaliações

- Canning The Eastern Question PDFDocumento285 páginasCanning The Eastern Question PDFhamza.firatAinda não há avaliações

- Ae1 RFP PDFDocumento117 páginasAe1 RFP PDFAnonymous eKt1FCDAinda não há avaliações

- Q 1Documento4 páginasQ 1sam heisenbergAinda não há avaliações

- EurobondDocumento11 páginasEurobondMahirAinda não há avaliações

- Nyu Real EstateDocumento9 páginasNyu Real EstateRaghuAinda não há avaliações

- Republic Vs CaguioaDocumento6 páginasRepublic Vs CaguioaKim Lorenzo CalatravaAinda não há avaliações

- First Data Annual Report 2008Documento417 páginasFirst Data Annual Report 2008SteveMastersAinda não há avaliações

- Compliances For Small Company - Series - 40Documento11 páginasCompliances For Small Company - Series - 40Divesh GoyalAinda não há avaliações

- IFRNPO FullReport FinalDocumento140 páginasIFRNPO FullReport FinalRatnawatyAinda não há avaliações

- RakibulDocumento20 páginasRakibulMeltrice RichardsonAinda não há avaliações

- Unilever Annual Report and Accounts 2016 Tcm244 498880 enDocumento192 páginasUnilever Annual Report and Accounts 2016 Tcm244 498880 enromAinda não há avaliações

- Rajiv Gandhi Equity Savings Scheme (80-CCG)Documento9 páginasRajiv Gandhi Equity Savings Scheme (80-CCG)shaannivasAinda não há avaliações

- Loan Life CycleDocumento7 páginasLoan Life CyclePushpraj Singh Baghel100% (1)

- Simple, Compound Interest and Annuity Problems For Special ClassDocumento2 páginasSimple, Compound Interest and Annuity Problems For Special ClassPaolo PerezAinda não há avaliações