Escolar Documentos

Profissional Documentos

Cultura Documentos

Disbursementsnarrative 1

Enviado por

api-248687852Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Disbursementsnarrative 1

Enviado por

api-248687852Direitos autorais:

Formatos disponíveis

Disbursements eLearning Narrative

Version 3 last revised 4/4/12

CSR Curriculum

Disbursements Course

Version 3

Course Objectives

The goal of this course is to provide a 30-40 minute interactive eLearning course. Upon completion of this course, the learner will be able to: describe the key terminology associated with Surrenders, withdrawals, and Loans compare and contrast attributes of Surrenders, withdrawals, and Loans

Course Description

Provides a high-level overview of surrenders, withdrawals, and loans and includes practice scenarios that address typical policyowner/producer calls and questions.

Table of Contents

Course Objectives ......................................................................................................................................... 1 Course Description ........................................................................................................................................ 1 This sample has been truncated Module #4 Loans ........................................................................................................................................... 2 Types of Loans........................................................................................................................................... 2 Features of Cash Loans ............................................................................................................................. 4 Impacts on Accumulated Value (AV)........................................................................................................ 4 Loan Request Requirements .................................................................................................................... 4 Loan Call Scenario VP51989550 ................................................................................................................ 5 Knowledge Check Point ............................................................................................................................ 6 Closing (Course Completion)......................................................................................................................... 7

Page 1 of 7

Disbursements eLearning Narrative

Version 3 last revised 4/4/12

Module #4 Loans

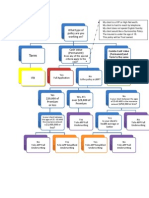

From module one you may remember that a loan allows a policyowner to borrow from the policys cash value. The loaned amount is both charged and credited interest. The loaned amount does not need to be paid back. However, if the insured dies while there is still outstanding loan debt, then the death benefit proceeds will be reduced accordingly. Availability, minimum and maximum amounts vary by product type. Refer to Rates & Values book or prospectus for specifics regarding loan provisions. For general information on loan availability by product type click the Learn More button. Learn More Term Life Loans are not allowed. Term policies do not accumulate cash value from which loans can be taken. Whole Life Loans are available only if there is cash surrender value. Minimum loan amount: $10.00 Maximum loan amount: Cash Surrender Value minus Loan Interest to the next anniversary. This calculation is available at a glance on PPT. Universal Life Loans are available based on Accumulated Value (AV). Minimum loan amount: $10.00 Maximum loan amount: Cash surrender value minus Loan Interest to next policy anniversary minus outstanding loan balance plus mortality, administrative, insurance, rider charges to the next anniversary. This calculation is available at a glance on PPT. (Equity) Indexed Universal Life Loans are available based on cash surrender value and may be continued beyond age 100. Minimum loan amount: $200.00 Maximum loan amount: Maximum loan amount available is the Accumulated Value (AV) less surrender charges and less outstanding debt. This calculation is available at a glance on PPT. Variable Universal Life Loans are available based on the Accumulated Value (AV). Minimum loan amount: Varies by product and issue state. See Rates &Values book. Maximum loan amount: 100% value of Fixed Account plus 90% value of Variable Accounts minus any surrender charge that would apply on the date the loan is taken. This calculation is available at a glance on PPT. Types of Loans With Pacific Life products there are 2 general types of Loans. Cash Loans and Premium Loans. Type Cash Loan Description Loan is available anytime after the policy is issued and sufficient cash value is available. Loan has a net cost of 2% depending on Page 2 of 7

Disbursements eLearning Narrative

Version 3 last revised 4/4/12 Automatic Premium Loan (APL) policy year. APL is a elected option that pays premiums through loans taken against the policys accumulated value (AV) to prevent the policy from terminating. APL (will continue to pay premiums with policy loans from the AV for as long as there are sufficient funds available.

During this course we will be focusing on Cash Loan type. Cash Loans Remember how we said that a life insurance loan is both charged and credited interest? There is always a cost associated with borrowing money; whether it is charged on a credit card, borrowed from a bank, or taken from a life insurance policy. This cost is the interest that is charged to the borrower. Interest Charged: Interest is charged on loan balances. If loan interest is not paid when billed, the interest capitalizes each policy anniversary and becomes part of the new loan balance. If the cash value is not sufficient to pay the loan, the policy will equity surrender (In Process) or lapse.

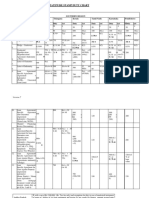

Loans taken from life insurance policies are different than other loan options because of the interest credited. Pacific Life credits the policyowner with interest. Interest Crediting: Pacific Life credits interest on balances in the loan account. Interest credited varies by product. Interest is credited daily and the amount earned is applied to the loan account value daily. The amount of interest earned increases as the accumulated value in the loan account increases. Lets see an example: Pacific Life charges 7% interest and credits 5% interest. Leaving a Net Cost of 2%. 7% Interest Charged -5% Interest Credited 2% Net Cost ABC Bank charges 7% interest and credits NOTHING in interest. Leaving a Net Cost of 7%. 7% Interest Charged -0% Interest Credited 7% Net Cost Compared to other forms of loan options available, the cost of a cash loan is far less for the policyowner. Not to mention most lenders require that you pay back whatever amount is loaned plus interest. Credit Cards Consumer Loans Home Equity Insurance Loans 10 - 29% 9 - 12% 5 - 6% 2 - 4% Net Cost Must Pay Back Pay Back Optional Page 3 of 7

Disbursements eLearning Narrative

Version 3 last revised 4/4/12 Features of Cash Loans Taxation Loans are not considered taxable income unless: The policy lapses, or is surrendered when there is an outstanding loan balance The loan is taken from a Modified Endowment Contract (MEC) policy IMPORTANT NOTE: Pacific Life will explain tax reporting process but will not offer tax advice. Customer Service Representatives should advise policyowners to consult with their tax advisors to determine the tax consequences of taking a loan. Payments Policyowner is not obligated to repay the loan Policyowner is not obligated to repay the loan interest If the policyowner chooses to make repayments at any time, they can one payment or installments Impacts on Accumulated Value (AV) The amounts loaned will miss the potential earnings provided by the investments The amounts in the loan account are not available to help pay for any policy charges Any unpaid loan amount will be subtracted from policy proceeds upon insureds death, policy maturity or surrendered If the loan amount exceeds the accumulated value, the policy will equity surrender. Equity surrender may be subject to taxation if the outstanding loan balance amount exceeds the cost basis. The amount of the outstanding loan is considered a realized disbursement - as if the borrowed amount is received at the time of surrender and used to pay off the loan

Loan Request Requirements Loan requests can be submitted in a variety of ways. Telephone request for loan - Complete request via AWD - maximum amount of $15,000 can be requested by telephone Loan Request form Letter of instructions - The letter of instructions must specifically state key information: Intent, policy Number, tax information and signature. These requests can be completed and sent by mail, fax or electronic format to Pacific Life. (Each format will be a rollover and will show examples of a loan request form, telephone request form)

Page 4 of 7

Disbursements eLearning Narrative

Version 3 last revised 4/4/12 Loan Call Scenario VP51989550 Background info: Mary ONeil has a Pacific Indexed Accumulator III life insurance policy Lets listen in on a call between Mrs. ONeil and CSR Lynn. For the purpose of this scenario, we will assume that caller has verified. Speaker Conversation Mrs. I have a life insurance policy with you guys and I want to get ONeil out $60,000.00 so that I can pay my sons school tuition. Lynn Ok Mrs. ONeil, I will be happy to assist you with your loan questions. It looks as if $60,000.00 is well under your Max loan amount. I can send you the forms necessary to start the paperwork. Mrs. Can I just request it over the phone? ONeil Learner Based on the information you just heard? How would you Question respond to Mrs. Oneal? Select the correct answer. Option Response Just one minute and I will access the Incorrect. telephone request form. The amount you are requesting is over the Correct. maximum amount of what you are allowed to request over the phone. Let me transfer you to a field financial Incorrect. coordinator who will provide you assistance Lynn The amount you are requesting is over the maximum amount of what you are allowed to request over the phone. I can send you the appropriate forms today. Mrs. Ok that sounds good. Once all the paper work gets back to ONeil you, how long do you think this is going to take before I get the check? Lynn Once we get your completed request our turnaround time is 3 to 5 business days. Mrs. Sounds great. ONeil

Additional Instruction

Show in PPT

Learner Question

What we just heard was an example of a call about a new loan request . You may also get calls after policyowner have taken loans. Lets listen to what that might sound like: For the purpose of this scenario, we will assume that caller has verified. Speaker Conversation Additional Instruction Page 5 of 7

Disbursements eLearning Narrative

Version 3 last revised 4/4/12 Speaker PO CSR PO CSR Conversation I just got a bill from Pacific Life. What is this? I am sorry for the confusion. This is your annual billed loan interest statement. Do I have to pay this? You are not required to pay the interest on your loan. However the loan interest will be applied to your loan and it will increase the amount of your loan. Oh Right, I remember now. Why do you send a bill if I dont need to pay it? We send out the bill so that you are fully informed. As long as there is a loan balance you will continue to receive a annual billed loan interest statement. Is there anything else I can help you with today? Nope. Thanks for your help. Additional Instruction

PO CSR

PO

Knowledge Check Point 1. Policyowners are able to request up to $________ by telephone. 15,000.00 Correct. - policyowners can request up to the maximum amount of $15,000 by telephone. Knowledge Check Point 2. What would the net cost of a loan that charges 6% interest and credits 4% interest? a) 10% b) .02% c) 2% d) Not enough information is provided Knowledge Check Point 3. Upon an insureds death, an unpaid loan amount will be a) forgiven b) subtracted from policy proceeds c) billed to the beneficiaries d) doubled Knowledge Check Point Select all that apply. Loans are considered taxable income if: a) The policy lapses when there is an outstanding loan balance b) The loan is taken from a Modified Endowment Contract (MEC) policy c) The policy is surrendered when there is an outstanding loan balance d) The policyowner chooses not to pay the interest Page 6 of 7

Disbursements eLearning Narrative

Version 3 last revised 4/4/12

Closing (Course Completion)

You have now completed the Disbursements course. We hope you enjoyed this eLearning and we encourage you to engage in further discussion with your team and supervisor.

Page 7 of 7

Você também pode gostar

- Premiercare - Case Studies Narrative v6Documento8 páginasPremiercare - Case Studies Narrative v6api-248687852Ainda não há avaliações

- PpcadvantagecoursesummaryDocumento1 páginaPpcadvantagecoursesummaryapi-248687852Ainda não há avaliações

- CompliancestoryboardfinalDocumento20 páginasCompliancestoryboardfinalapi-248687852Ainda não há avaliações

- Designdocumentpowerjumpstartfinal RedactedDocumento5 páginasDesigndocumentpowerjumpstartfinal Redactedapi-248687852Ainda não há avaliações

- Dealmaker StratDocumento9 páginasDealmaker Stratapi-248687852Ainda não há avaliações

- Mvpvul 10 NarrativeDocumento14 páginasMvpvul 10 Narrativeapi-248687852Ainda não há avaliações

- Disbursements: Elearning Course SummaryDocumento1 páginaDisbursements: Elearning Course Summaryapi-248687852Ainda não há avaliações

- WizardjobaidDocumento1 páginaWizardjobaidapi-248687852Ainda não há avaliações

- Disbursementsdesign Docv1Documento1 páginaDisbursementsdesign Docv1api-248687852Ainda não há avaliações

- Wizardstoryboard 1Documento1 páginaWizardstoryboard 1api-248687852Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Look Inside Study Text Acca Financial AccountingDocumento7 páginasLook Inside Study Text Acca Financial AccountingAbdirahman OmerAinda não há avaliações

- CPA REVIEW SCHOOL OF THE PHILIPPINES AUDITING PROBLEMSDocumento6 páginasCPA REVIEW SCHOOL OF THE PHILIPPINES AUDITING PROBLEMSchibbs1324Ainda não há avaliações

- TYPES OF ACCOUNTSDocumento20 páginasTYPES OF ACCOUNTSVERMA NEERAJ100% (1)

- Stamp Duty Circular-Ver 9Documento12 páginasStamp Duty Circular-Ver 9Mrigesh KejriwalAinda não há avaliações

- RBI Policy - Key Challenges For The Banking SectorDocumento4 páginasRBI Policy - Key Challenges For The Banking SectorRekha LohiaAinda não há avaliações

- Reading 23 Residual Income ValuationDocumento36 páginasReading 23 Residual Income Valuationtristan.riolsAinda não há avaliações

- Pre Qualification WorksheetDocumento1 páginaPre Qualification WorksheetVictoria BoreingAinda não há avaliações

- VINDY Income Statement and Balance SheetDocumento3 páginasVINDY Income Statement and Balance SheetPulkit SethiaAinda não há avaliações

- 1st STC BillDocumento1 página1st STC BillambidextrousindianAinda não há avaliações

- Praktikum - Cost - Jordan Junior - 1832148Documento24 páginasPraktikum - Cost - Jordan Junior - 1832148Jordan JuniorAinda não há avaliações

- Final Year Report on Jubilee Life InsuranceDocumento51 páginasFinal Year Report on Jubilee Life Insurancehafeez ahmedAinda não há avaliações

- Brochure - FDP On Financial ServicesDocumento2 páginasBrochure - FDP On Financial Servicesamitnpatel1Ainda não há avaliações

- GTAG3 Audit KontinyuDocumento37 páginasGTAG3 Audit KontinyujonisupriadiAinda não há avaliações

- Notre Dame of Salaman College IncDocumento6 páginasNotre Dame of Salaman College IncRoseLie Ma Llorca BlancaAinda não há avaliações

- Fannie Mae - 2012 Servicing GuideDocumento1.178 páginasFannie Mae - 2012 Servicing GuideudhayaisroAinda não há avaliações

- Chapter 21 Cryptocurrency Article (ACCA + IFRS Box)Documento8 páginasChapter 21 Cryptocurrency Article (ACCA + IFRS Box)Kelvin Chu JYAinda não há avaliações

- Borrower Declaration - CA & LEI RegulationDocumento2 páginasBorrower Declaration - CA & LEI RegulationSHASHI KANTAinda não há avaliações

- 2accountancy Qp-Xii (1) - 230328 - 201201Documento11 páginas2accountancy Qp-Xii (1) - 230328 - 201201jiya.mehra.2306Ainda não há avaliações

- CA New Project.pdf 1 AprilDocumento55 páginasCA New Project.pdf 1 Aprilpratikshapatil0606Ainda não há avaliações

- California Qui Tam False Claims Recording FeesDocumento18 páginasCalifornia Qui Tam False Claims Recording Feesthorne1022Ainda não há avaliações

- Nfo Process in Mutual Funds Nfo Process in Mutual Funds AT AT India Infoline India InfolineDocumento72 páginasNfo Process in Mutual Funds Nfo Process in Mutual Funds AT AT India Infoline India InfolineAmol BhawariAinda não há avaliações

- Rahul Publications Invoice NumberDocumento1 páginaRahul Publications Invoice Numberdhruvslg86Ainda não há avaliações

- Bab 23 Audit KasDocumento47 páginasBab 23 Audit KasAyakaAinda não há avaliações

- Outline 328 Special Laws (VI) 1 Of10: 2020-2021) CommercialDocumento10 páginasOutline 328 Special Laws (VI) 1 Of10: 2020-2021) CommercialQueenVictoriaAshleyPrietoAinda não há avaliações

- Top 5 Insurance Company in The PhilippinesDocumento8 páginasTop 5 Insurance Company in The PhilippinesJay Ann Belen AlbayAinda não há avaliações

- Credit InstrumentsDocumento39 páginasCredit InstrumentsRevanth Nannapaneni100% (1)

- FE&IA Question BankDocumento61 páginasFE&IA Question BankSwarnaAinda não há avaliações

- Insurance PremiumDocumento28 páginasInsurance PremiumRaghav100% (1)

- BA 540 (Homework-1)Documento6 páginasBA 540 (Homework-1)MariaAinda não há avaliações

- Company's Profile Presentation (Mauritius Commercial Bank)Documento23 páginasCompany's Profile Presentation (Mauritius Commercial Bank)ashairways100% (2)