Escolar Documentos

Profissional Documentos

Cultura Documentos

Practicepdf 1

Enviado por

mhoddiTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Practicepdf 1

Enviado por

mhoddiDireitos autorais:

Formatos disponíveis

Co n t e n t s

February/March 2007

n So Much to Choose

—page 2

n The Winners

—page 3

n 52 Weeks of Shipping Transactions

Publisher GEORGE WELTMAN

Managing Editor NORA HUVANE —page 6

n Bank Debt in 2006: Public Companies Take

Vice President / Asia Director PEDER BOGEN

Art Director / Production Manager CARI S. KOELLMER

Events Director LORRAINE PARSONS

on Dry Powder & Lenders Wander the World

—page 13

n “Junk” – The Public Debt Award

Greek Director KEVIN OATES

U.K. Director BORIS NACHAMKIN —page 26

n Restructuring Deals –

Greek Marketing Representative MIA JENSEN

Marketing Sales / Director MICHAEL MCCLEERY

Sales Director BENJAMIN PADILLA

Breathing Life into Worthy Projects

—page 31

n Out-of-the-Box Thinking or

Subscription Director ELISA BYBEE

Technical Support MICHAEL HANSON

The Structured Finance Award

President MATT MCCLEERY —page 34

Chairman JAMES R. LAWRENCE n M&A: Financial Buyers, Niche Players &

BUSINESS AND SUBSCRIPTION OFFICES

Two Special Deals

—page 38

UNITED STATES n Convertibles: The Equity Linked Award

One Stamford Landing, Suite 214, 62 Southfield Avenue —page 52

n Shipping IPOs Forge into New Territory

Stamford, CT 06902 USA

Phone: +1 203 406 0106 • Fax: +1 203 406 0110

Email: info@marinemoney.com —page 54

ASIA n Follow-ons Find a Following

140 Cecil Street, #16-00, PIL Building —page 61

n Money, Money Everywhere –

Singapore, SG-069540

Phone: +65 6222 9456 • Fax: +65 6491 5563

Email: pbogen@marinemoney.com

The Award for Private Equity

—page 65

GREECE

n The Year of the Lease (Yes, Again)

F

15 Athinaeon Street

Palio Faliro, GR-175 61, Greece

e

Phone: +30 210 9858 809 • Fax: +30 210 9842 136

—page 68 b

n Award for Innovation

Email: mia.jensen@marine-marketing.gr r

—page 80

u

UNITED KINGDOM

n Editor’s Choice: Nakilat Brings

a

3 Berkeley Square

r

London, W1X5HG UK

Phone: +44 207 629 1160 • Fax: +44 207 629 1393 Back Project Finance y

Email: seanav047@aol.com —page 84 /

n Dealmaker of the Year

M

Annual Subscription is $995 U.S. plus postage a

Payment should be made to International Marketing Strategies, Inc. —page 85

r

n Deal of the Year –

at the subscription address above.

c

While Marine Money has taken great care in the production of this publication,

no liability can be accepted for any loss incurred in any way whatsoever by any h

person who may seek to rely on the information contained herein. DP World and P&O Ports

—page 87

2

Marine Money, Inc. (International Marketing Strategies) 0

ISSN No: 1051-5496 Cover Art: 0

Reproduction in any form is strictly prohibited “Strong Seas” (2006: 1.5m x 1m) Artist: Nikos Kypraios

without written consent of the publisher.

7

www.marinemoney.com marine money 1

So Much to Choose

With apologies to all Trekkies:

“Awards the final frontier. These are the voyages of the Starship Marine Money. Its continuing mission: to explore

strange new deals, to seek out the winning capital providers, to go boldly where no sane person has gone before.”

t is a wonderful task to things. This issue is a celebra- actions, we are constantly weeks of internal debate. Invari-

I

celebrate the accomplish- tion and we make no bones amazed at the number of deals ably there are deals that in other

ments of so many and an about recognizing achievement done that we just didn’t have years would be hands down

industry so creative that each with Awards. time to cover or missed entirely. winners but this year are in

year brings yet another crop of And, this despite the fact that competitive categories. Former

deals, projects and transactions Two, it is an important compi- our Marine Money database Secretary of the US Navy John

that stretch our views of how lation of a year’s worth of trans- followed some 2,000 transac- Lehman’s acquisition of the US

business is best transacted. The actions and as such a snapshot tions, some as small as a few shipyard Atlantic Marine faced

Marine Money team follows of a moment in time that million dollars and some as competition like DP World,

the daily volume of the activity captures an industry and its much as six billion. There were OOIL, Tallink and Petro-

with a keen interest. We admire financiers in a way that is illus- deals that refinanced compa- jarl…heady stuff that not even

the tried and true, appreciate trative and when taken together nies, helped expand a business Paul Slater, the transaction’s

the real meaning of relation- with all our previous years can or just strengthened a balance advisor, could overcome with

ships, marvel at the cycles – not provide a road map useful to sheet. Others carved out new silver tongued lobbying.

just shipping’s but recently and lenders, investors and CFO’s ground. They, in fact, all

more obviously in finance – the world over. If it is true that deserve mention. For instance, We want to thank all of you

and respect the enormous one can learn from history then so many transactions competed who either prepared careful and

amount of good new thinking in a capital-intensive business, for coverage, we missed Citi- illustrative explanations of deals

and structures. We also see a where the best financing may group’s Stena Drillmax transac- or who recommended transac-

wealth of options for be found across an ocean, then tions the dollar amounts of tions for consideration. The

shipowners in financial markets this collection and review of last which were enormous. Other shipping industry benefits from

around the world, perhaps year’s deals will hopefully bring times there are new entrants the creative thinking and fierce

driven by government stimuli value to you in your year ahead. like Efibanca, which advised on competition within the finance

or more dramatically from the acquisition of Navgas by markets. But it also benefits

F fundamental shifts in the flow And finally, part of what we do Synergas. Likewise, the service from the camaraderie, commu-

e of funds. in this issue is de-construct businesses slipped below the nity and commitment of all

b some wonderfully complex radar. There was the merger of those individuals who work in

r There are three absolute truths deals. Hopefully this stimulates Atlantic Marine with Dorch- this fantastic business.

u

about this issue. One, it is true other new ideas in pursuit of ester Maritime and who knows

a

r what they say about us, at least ever more competitive and what will happen to V.Ships. Finally, congratulations to all

y sometimes – that we never saw empowering structures. Then there was the develop- our friends and colleagues for

/ a deal we did not like. The ment of a secondary market for their accomplishments. May

M simple fact is we appreciate the Each year in December we KG shares in Germany done by your bonuses be huge and your

a creativity, thought, risk and request and receive countless DSM to provide liquidity as the clients perpetually profitable.

r

hard work involved in recommendations for recogni- project lives were extended. So And thank you for all your

c

h concluding a transaction. That tion in these pages. Competi- much to cover, so little time. support throughout the year.

doesn’t mean we would put our tors actually recommend each

2 money in every deal, but we do other’s deals! While we like to The process we go through to

0 admire the men, women and think we do a great job week in select the winners is actually

0 businesses that try to build and week out chronicling trans- very detailed and takes several

7

2 Marine Money www.marinemoney.com

2006 Deal of the Year Awards

CATEGORY WINNER

Bank Debt: Nordea for Songa Shipholding

Public Debt: Jefferies, ABN Amro for Britannia Bulk

Pareto, Nordea, DnB for "Norway Inc."

Restructuring: DVB Bank, NFC Funds for TMM

Structured Finance: BNP Paribas for Vega Containervessel 2006-1 plc

M&A: Fortis, Dahlman Rose for Quintana's acquisition of Metrobulk

DnB NOR, ABG Sundal Collier for Teekay's acquisition of Petrojarl

Equity Linked: Jefferies, Bear Stearns for Hornbeck Offshore

Public Equity - IPO: Merrill Lynch, Citigroup, Dahlman Rose, Jefferies, Fortis, Nomura International for Danaos Corporation

Public Equity - Follow-on: JP Morgan, Deutsche Bank, Goldman Sachs for Horizon Lines

Private Equity: Cantor Fitzgerald, CRT Capital Group, Oppenheimer for Paragon Shipping

Leasing: Ship Finance International, AMA Capital, Argent Group, Fortis for Horizon Lines

Innovation: Lloyd Fonds, Oppenheim Pramerica for Open Waters

Editor's Choice SMBC, CSFB, Lehman Brothers, Barclays Capital, BNP Paribas, DnB NOR, Gulf International Bank,

KEIC, KEXIM for Nakilat Inc.

Dealmaker of the Year: Axel Eitzen

Deal of the Year: Deutsche Bank, Citigroup for DP World deals

2005 Deal of the Year Awards

CATEGORY WINNER

Bank Debt: Nordea and DnB NOR for Euronav

Public Debt: Deutsche Bank for Berlian Laju Tankers

Public Equity: Citigroup and Merrill Lynch & Co. for Seaspan in New York F

HSBC, UBS Investment Bank, and JPMorgan for China COSCO Holdings Company Limited in Hong Kong e

Carnegie and UBS Investment Bank for Bergesen Worldwide Gas in Oslo b

r

Private Equity: Jefferies Capital Partners for Pacific Basin u

Fortis Securities LLC for representing Maas Capital Investments in Diana Shipping a

M&A: Citigroup, Goldman Sachs and JP Morgan for AP Moller-Maersk's acquisition of Royal P&O Nedlloyd r

y

DVB for National Shipping Company of Saudia Arabia for Acquisition of 30% of Petredec /

Leasing: KGAL and V. Ships for IMC M

Dealmaker of the Year: Morten Arntzen a

r

Editor's Choice: DnB NOR Markets and Enskilda for Aker American Shipping ASA c

Greatest Contribution to Jeremy Kramer at Neuberger Berman h

Ship Finance: John Sinders at Jefferies & Company

2

0

0

7

www.marinemoney.com Marine Money 3

2004 Deal of the Year Awards

CATEGORY WINNER

Bank Debt: Citigroup / KEXIM for Maran Gas

DnB NOR for Nordic American Tankers

Nordea Bank for General Maritime

Public Debt: Jefferies & Co. / Fortis Securities for Trailer Bridge

Restructuring: Miller Buckfire Ying & Co. for Stolt Nielsen S.A.

Public Equity: JP Morgan / ABN Amro for P&O Nedlloyd

Cantor Fitzgerald / DZ Financial Markets / HARRISdirect / Hibernia Southcoast for Top Tankers

Private Equity: Goldman Sachs & Co. for Carlyle Group

M&A: American Marine Advisors for Attransco

Leasing: DVB / Pareto for Stelmar K/S

Equity Linked: Jefferies & Co. for OMI Corp. convertible

Dealmaker of the Year: Stelios Haji-Ioannou

Editor's Choice: Jefferies & Co. / Citigroup for Ship Finance International

2003 Deal of the Year Awards

CATEGORY WINNER

Bank Debt: Nordea / JP Morgan for General Maritime

Fortis / Export-Import Bank of Korea for Seaspan Container Lines

Public Debt: Jefferies / Citigroup for Frontline

Restructuring: American Marine Advisors for Cruiseinvest

Public Equity: JP Morgan for Star Cruise Lines

Private Equity: DnB Markets for Aequitas Holdings

M&A: JP Morgan / Citigroup for Neptune Orient Lines / MISC

Leasing: Citigroup for Golar LNG

New Entrant of the Year: Export-Import Bank of Korea

F Dealmaker of the Year: Tor Olav Trøim

e Editor's Choice: BTM Financial Services, Inc., Vereins-und Westbank AG and HSH Nordbank AG for First Ship Lease Mezzanine

b

r

u

a 2002 Deal of the Year Awards

r

y

CATEGORY WINNER

/

M Bank Debt: Citigroup / KDB / KEB for Wallenius / HMM

a Public Debt: Citigroup for CP Ships

r

Restructuring: American Marine Advisors for Enterprises & American Classic Voyages

c

h Public Equity: JP Morgan / Jefferies / Sunrise / Alpha for Tsakos Energy Navigation

Private Equity: Fortis / Royal Bank of Canada for Seabulk

2

M&A: DnB Markets / JP Morgan for Teekay / Navion

0

0 Leasing: Royal Bank of Scotland for BP

7 Editor's Choice: NIB for Latitutde Synthetic Securitization

4 Marine Money www.marinemoney.com

"SSY Capital advertised here in the hard copy this month and

reached the most influential readers of our industry, why don't you? Interested?

Please contact info@marinemoney.com, for more information!"

52 Weeks of Shipping Transactions

WEEK ENDING DEALS

Week 1 January 6 • General Maritime buys out Oaktree’s stake at $37 per share, amounting to $154 million

• Fredriksen’s SeaDrill bids for Smedvig shares, continues consolidation in rig market

• Electra sells Inchcape Shipping Services to Istithmar for 7x earnings at $285 million

Week 2 January 12 • Nordea and DnB NOR top Dealogic league tables as syndicated shipping lend tops $60 billion

• PSA, DP World bid for P&O’s prized terminal properties

• TEN takes two four vessels from Tsakos family interests for $219 million

• DryShips announces standard $0.20 dividend following rumors the company would fall short

• Dahlman Rose downgrades the tanker sector

• Citigroup downgrades Eagle Bulk, shares plummet 10%

• AP Moller-Maersk, COSCO Pacific and Hutchison take stakes in new Shanghai Port Yangshan Phase II

Week 3 January 19 • Berlian Laju Tankers announces intent to seek a dual listing in either New York or Singapore

• Bank of Scotland raises $405 million in debt for Prime Marine, $166.5 million for Viken LR2

• Markets quiet, analysts cast lots on the year to come

Week 4 January 26 • BNP Paribas develops securitized structure for CMA-CGM with XL Capital Assurance

• Hanjin Shipping announces $206 million loan raised through various South Korean domestic financial institutions

• China Shipping Development signs $52 million loan with Citibank, HSH Nordbank and DnB

• Richard Hext to take helm at Pacific Basin as Mark Harris announces intention to step down

• SeaDrill places $750 million in an issue managed by Carnegie and Pareto

• Arlington Tankers declares $0.53 dividend

• Dahlman Rose downgrades dry sector, Bank of America sees value in the tanker sector

Week 5 February 2 • Fredriksen picks up GenMar OBOs, GenMar picks up $256.5 million

• ABG Sundal Collier initiates coverage of Golden Ocean with a Buy saying “The World is Not Going to Hell Just

Yet…”

Week 6 February 9 • Rand shareholders prepare to vote on $57.3 million acquisition of Lower Lakes Towing and Grand River Navigation

• 2nd Odfjell Invest company acquires high spec rig for $628 million with funding from DnB NOR and 10x over-

subscribed equity issue

• Odfjell Chemical Tankers prepares NOK600 million 5-yr bond issue to be priced at 3-mo NIBOR + 80

• SMBC closes first Japanese and club deal for Cido Shipping Group

• DP World moves closer to P&O as PSA fails to challenge its 520p/share bid

Week 7 February 16 • CMA-CGM closes $800 million securitization with BNP

• Natexis leads E500 million 5-year syndication with SG and Barclays for CMA-CGM priced at L+90

F

• Industrial Shipping Enterprises formed

e

b • Citigroup and Nordea agree to provide $1.5 billion 7-yr unsecured facility to OSG

r • Bank of Scotland and Nordea commit to new $360 million 5-yr facility for Aries Maritime

u • Mitsui & Co signs $33.5 million deal with West Asia Marine

a • Navantia SL completes 6.5-yr E259 million bonding facility with Lloyds TSB Bank

r • 19.8% stake in FESCO finally sold to Sergei Generalov’s Industrial Investors for $139 million

y • Seacor commences consent solicitation for Seabulk bonds

/

Week 8 February 23 • Nordea and Bank of Scotland launch syndication of Aries loan, with anticipated pricing of L+100-150

M

a • Fortis Securities closes $150 million 3-yr Bronco deal at L+200-300

r • Marine Money opens its Singapore office

c Week 9 March 2 • TEN acquires 9 product tankers from Western Petroleum for $530 million

h • Seaspan contracts for 4 newbuildings, puts them on 12-yr charters to CSCL

• Quintana initiates dividend policy, setting yield at 9.5%

2

• Stolt-Nielsen announces the purchase of 100,000 of its common shares in ongoing share repurchase program

0

• Nordic American Tanker Shipping acquires suezmax tanker, new share issue with Bear Stearns, UBS, DnB NOR

0

7 • Jefferies, Bank of America bullish on tanker sector

6 Marine Money www.marinemoney.com

"Bourbon advertised here in the hard copy this month and

reached the most influential readers of our industry, why don't you? Interested?

Please contact info@marinemoney.com, for more information!"

52 Weeks of Shipping Transactions, continued

WEEK ENDING DEALS

Week 10 March 9 • NFC, BTM bank $57 million TMM buy-out of Seacor interest in Marmex

• UAE decides to divest US-based P&O interests “primarily to salvage the relationship between the UAE and the US”

• Hornbeck Offshore Services announces exchange offer for outstanding aggregate principled 6.125% notes

• Rand Acquisition Corp consummates takeover of Great Lakes Towing and Grand River Navigation

• Seadrill announces intention to make mandatory offer for outstanding shares in Smedvig

• Stolt-Nielsen divests and Fredriksen consolidates in sea farm sector as Stolt and Nutreco sell Marine Harvest to

Geveran Trading for $1.4 billion

Week 11 March 16 • Top Tankers sells 13 vessels for $550 million with 5-7 year leases back in deals arranged by Pareto and Fortis

• KOMARF takes 4 of Top’s vessels in its first non-domestic lease financing

• OMI shakes up fleet, strengthens balance sheet

• Deep Sea Supply purchases 22 supply ship newbuildings from Fredriksen interests for a total consideration of $394

million

• First Securities, Pareto Securities and Fortis Bank lead $165 million placement, Fortis provides $225 million in debt

to fund Deep Sea acquisition

• Deutsche Bank hired to advise on DP World sale of P&O US assets

• Grindrod expands logistical capabilities with acquisition of interests in Auto Carrier Transport and Grindrod

Perishable Cargo Agents

• GATX expected to buy Oglebay Norton Fleet

Week 12 March 23 • Ship Finance buys 5 containership newbuildings and puts them away on 12-year bareboat charters to Horizon Lines

• DryShips dividend discrepancy happily resolved through HSH with $530 million refinancing

• CMA Shipping 2006 draws two thousand to Connecticut

Week 13 March 30 • Georgios Kassiotis’ Omega Navigation Enterprises prepares for $220 million IPO with Jefferies and JP Morgan in

the US and UOB Asia in Singapore

• HSH extends $295 million secured facility to Omega at L+100-120

• Ultrapetrol files IPO registration statement for $175 million with Credit Suisse and UBS

Week 14 April 6 • Marine Money launches its Asia Edition

• Omega Navigation prices first shipping IPO of year at $17 per share

• Goldenport lists in London with HSBC at 4x EBITDA, 1.2x NAV

• Menendez family’s Ultrapetrol files F-1 for NY IPO to raise $175 million

• Carnegie, Pareto and SEB Enskilda take SeaDrill to market to sell $540 million in shares

Week 15 April 13 • Caledonia Investments and Anthony Hardy sell Wallem holdings to Tom Steckmest and Nigel Hill under advisory

of HSH Gudme, valuing the company at $78 million

F

Week 16 April 20 • Top Tankers files registration statement to sell up to $17 million in shares not long after paying out $210 million in

e

b cash dividends

r • Jefferies inks joint venture agreement with Ness Risan

u • Dalian Port raises $275 million in IPO with UBS and BNP Paribas Peregrine reportedly hundreds of times over-

a subscribed

r • State Bank of India, KfW finance VLCC order for Shipping Corp of India

y

• Patrick Corp board recommends acceptance of revised bid from Toll Holdings valuing the company at around $4.2

/

billion

M

a Week 17 April 27 • 50th anniversary of the debut of Malcolm P. McLean’s “radical” idea

r • Interpool sells a large portion of its operating lease portfolio of containers for $515 million to investors in Switzerland

c Week 18 May 4 • Heidenreich Marine is on the market under the advisory of Lazard

h Week 19 May 11 • Quintana prepares to acquire Metrobulk for $735 million

• BW Gas agrees to acquire and leaseback Yara’s ammonia fleet for $347 million under advisory of DnB NOR, ABG

2

Sundall Collier

0

0

7

8 Marine Money www.marinemoney.com

52 Weeks of Shipping Transactions, continued

WEEK ENDING DEALS

Week 19 (continued) • AMA advises CECO on acquisition of Fouquet Sacop; speculation about chemical spin-off abounds

• Bourbon Offshore orders 56 platform supply vessels and 12 harbor tugs for over $880 million

Week 20 May 18 • Quintana acquires Metrobulk, supported by Dahlman Rose raising $191 million through PIPE offering and Fortis

providing $735 in debt

• Tianjin Port IPO 1,700x oversubscribed in Hong Kong

• Pacific Shipping Trust prepares for first Singapore shipping trust IPO with DBS, ABN Amro and DnB NOR

Week 21 May 25 • Ultrapetrol prepares to take IPO on the road

• PIL Closes Singapore’s First Shipping Trust IPO, raising $100 million

Week 22 June 1 • Diana files for follow-on offering with Bear Stearns and Wachovia looking to raise $77 million

• TEN files shelf registration to raise up to $300 million plus to allow up to $194 million in sales by selling share-

holder

• Castle Harlan interests file to sell off $75 million in Horizon stock with Deutsche Bank and JP Morgan

Week 23 June 8 • Oglebay Norton sells 6 of remaining 9 self-unloading “lakers” to GATX subsidiary American Steamship Company

for $120 million cash

• Ultrapetrol postpones IPO

• Genco increases credit facility with Nordea, DnB NOR and Citigroup to $550 million

• Oslo bond market sizzles, with $2.5 billion raised in first 5 months of year

• Analysts call bottom of bulk market

Week 24 June 15 • Teekay announces plan to spin off shuttle tanker and FSO business into MLP Teekay Offshore Partners

• Diana prices second follow-on offering right around NAV

• Horizon Lines secondary offering 2x oversubscribed

• Heerema Group and Wilh. Wilhelmsen appoint Deutsche Bank to advise on spin-off of heavy lift company

Dockwise Transport

• Tallink takes Silja Lines from Sea Containers for $594 million with Citigroup and Societe General advising

• First Ship Lease secures $90 million 12-yr sale leaseback with Berlian Laju Tankers

• Nordea receives mandate for $670 million Awilco Offshore refinance

• Natexis and Goldman awarded mandate for PT Apexindo $120 million financing

• Morgan Stanley awarded mandate for PSA $1 billion bond

• BW Gas prepares for issue of 3 bond loans with Nordea and Pareto to raise $193 million

• Belships announces issue of 5-yr NOK 200 million bond with Nordea

Week 25 June 22 • Morgan Stanley Capital Group announced as buyers of Heidenreich Marine for $200-$250 million with Lazard

advising

F

• HVB wins mandate to advise Croatian government on shipyard restructuring and privatization

e

Week 26 June 29 • Eagle celebrates first anniversary of IPO with acquisition of 3 supramaxes, issue of $33 million PIPE with UBS b

• ICON Capital reemerges with 2 4-vessel deals r

• After payment of hefty dividend, Top Tankers raises $19.5 million through at-the-market share offerings with Cantor u

Fitzgerald a

• NFC in $30 million sale leaseback with Golden Ocean Group r

y

• Fortis acquires Cinergy Market & Trading and Cinergy Canada from Duke Energy for Euro 330 million

/

• Singapore releases details of maritime finance incentive scheme

M

Week 27 July 6 • Golden Ocean takes one newbuilding order, one vessel on charter from NFC, one vessel on charter from Ship a

Finance r

• SeaDrill sells jack-up rig to Ship Finance for $210 million and takes back on 15-yr lease c

• BW Offshore signs $600 million credit facility with DnB NOR h

• BW Gas completes NOK 700 million bond issue with Nordea and Pareto

2

• Saverys-controlled Delphis takes TeamLines from Finnlines Group for $51 million

0

Week 28 July 13 • Morgan Stanley commits to taking 11 MR product on 3-5 year charters

0

7

www.marinemoney.com Marine Money 9

52 Weeks of Shipping Transactions, continued

WEEK ENDING DEALS

Week 29 July 20 • US Shipping announces financing plan to fund construction of 9 Jones Act product carriers at NASSCO and 4 ATBs

• DP World bidding progresses

• CSAV mandates BNP Paribas to lead $300 million revolver

• Navigazione Montanari mandates BNP Paribas, MCC, ING to arrange $450 million loan

• HSH Nordbank lends $170 million to Fesco

• NFC closes $181 million Ezra deal

• J.F. Lehman to take Atlantic Marine for $172 million with debt financing from BNP Paribas, CIBC

Week 30 July 27 • Rumors surface of Bodouroglou planning London-based SPAC

• Gulf Navigation moves forward with $248 million Dubai IPO led by Shuaa Capital

• Secunda International renews IPO efforts with Genuity Capital Markets to lead the deal

• Fortis closes oversubscribed $735 million credit facility for Quintana

Week 31 August 3 • TBS revitalizes capital structure with $140 million Bank of America-led refinancing at L+225

• Terrapin-sponsored SPAC Aldabra sets sights on Madison Dearborn-controlled Great Lakes Dredge & Dock

• Wellington Management leads $13 million equity placement for Rand Logistics to fund chartering in of 3 self-

unloading vessels from Wisconsin & Michigan Steamship Co

• Golden Ocean takes over Clipper’s bareboat agreement on 5 panamax bulkers for $38 million

• First Ship Lease expands equity capital by $55 million

• US Shipping closes downsized bond deal to raise $100 million at 13% with Lehman Brothers and CIBC World

Markets

Week 32 August 10 • Marpetrol sold to Sovcomflot and Novoship

• Bjorn Aaserod and Cambridge Partners in market for product tanker project investors

• US Shipping pushes forward with USS Product Carriers project, with private equity placement led by Zimmer Lucas

Partners and Alerian Capital Management, downsized bond issue managed by CIBC World Markets and Lehman

Brothers, increase in existing credit facility

• Rumors that Fredriksen and Georgiopoulos near $40/share agreement for sale of General Maritime

• JF Lehman closes acquisition of Atlantic Marine

Week 33 August 17 • Nordea, DnB and Fortis are in the market with $940 million loan for Teekay Offshore Partners

• Nordea syndicating $475 million deal for Ray Shipping

• Horizon Lines files with Deutsche Bank and JP Morgan for further sell down of Castle Harlan stake

• Sohmen interests take Frontline stake in General Maritime for circa $150 million

• Essar restructures its business in shipping, terminals and logistics

Week 34 August 24 • Camillo Eitzen announces $1,280 million acquisition of Blystad-controlled Songa with Carnegie, Pareto and Nordea

F

advising

e

b Week 35 August 31 • SHUAA Capital leads Gulf Navigation in Dubai’s first shipping IPO with National Bank of Abu Dhabi and Emirates

r Bank

u • Teekay and Prosafe court Petrojarl

a • Eagle Bulk files $300 million shelf registration

r • Aldabra shareholders prepare to vote on Great Lakes acquisition

y

Week 36 September 7 • Seaspan files $300 million shelf registration

/

• Nordic American Tanker Shipping expands credit facility with DnB NOR to $500 million

M

a • Ship Finance looks to increase its $1,200 million credit facility with DnB, Fortis, Nordea and Calyon

r • Cargill acquires stake in dry bulk vessel vetter RightShip

c • Chandran-led Chemoil prepares to take the asset-light IPO in Singapore

h • Castle Harlan continues to sell off Horizon as JP Morgan prepares to price secondary

• Healy & Baillie merges with Blank Rome

2

Week 37 September 14 • Eagle sponsor Kelso and Horizon sponsor Castle Harlan both price secondary offerings at full valuations

0

• Pacific Basin uses Danish K/S market to expand controlled fleet

0

7

10 Marine Money www.marinemoney.com

52 Weeks of Shipping Transactions, continued

WEEK ENDING DEALS

Week 38 September 21 • John Coustas-led Danaos Corporation files prospectus for IPO to raise up to $226 million with Merrill Lynch and

Citigroup running the deal

• DnB NOR completes first PRC flag bilateral loan as a foreign lender, with $38.4 million 8-yr loan to Shanghai Times

Shipping

• Fortis Bank provides $62 million in newbuilding finance to Diana

• Teekay bids for Petrojarl at $804 million

• AET in $168 million sale leaseback to ABG Sundal KS

• Aker Philadelphia launches first in series of Jones Act newbuildings for OSG

Week 39 September 28 • OSG announces acquisition of Maritrans for $455 million to be advised by UBS, Merrill Lynch

• Chiquita Brands International hires Fortis to explore strategic alternatives for Great White Fleet

• Nordic American Tanker files for to raise up to $170 million with follow-on offering

• FreeSeas announces intent to raise up to $22 million with convertible issue

• First Ship Lease gets “Approved Shipping Investment Enterprise” status in Singapore

Week 40 October 5 • Danaos prices IPO at $21 per share, the midpoint of the targeted range

• Secunda files updated prospectus with Canadian securities regulators, targets October IPO

• Ultrapetrol files updated registration statement with UBS and Bear Stearns, increasing maximum offering size to

$215 million

• Aegean Marine returns, garners support from Peter Georgiopoulos

• China Cosco Holdings announces plans to raise circa $970 million with issue of 1.5 billion shares on Shanghai

exchange

• Teekay LNG files $400 million shelf registration

• Euroseas announces 3 for 1 reverse stock split, potential share issue

• Ship Finance upsizes credit facility

• Captain Charles Vandeperre sells 50% stake in Univan Shipmanagement to Clipper Group

• Simpson, Spence & Young launches capital arm

• Diana alters target capital structure to incorporate $150 million of semi-permanent debt

Week 41 October 12 • Seaspan acquires 4 vessels from Maersk for $160 million and puts them on 5-yr time charters back

• Dr. Peters emerges as HMM buyer

• Global Oceanic wins support of investors, hires Jefferies for AIM rights offering

• Grimaldi tenders for Finnlines valuing company at $814 million, around 8.7x 2005 EBITDA

• NAT raises $184 million with follow-on offering led by Bear Stearns and Morgan Stanley

Week 42 October 9 • Ultrapetrol prices IPO at $11 per share

F

• Naftotrade and advisor Eurofin cement $60 million NFC deal e

• Sea Containers files for Chapter 11 bankruptcy protection b

Week 43 October 26 • Berlian Laju Tankers prices Singapore offering with Deutsche Bank and UBS to raise $117 million r

• Seaspan files for $250 million follow-on offering to be led by Citigroup and Merrill Lynch u

Week 44 November 2 • KS organized by RS Platou and controlled by NFC sells PSV newbuilding contracts and options to KG controlled a

by HCI, Peter Dohle and Basil Papachristidis

r

y

• Allocean sells two vessels to Pareto with 5-yr bareboat back

/

• Eitzen Chemical issues two-tranche bond with Pareto and Nordea to raise circa $100 million at 350 basis points over M

floating, completes equity placement with Carnegie and Pareto to raise $300 million and looks to place $20 million a

in additional equity r

• Global Oceanic Carriers closes its AIM rights offering with Jefferies to raise _13 million c

• HVB bank commits to 5-yr amortizing term loan of up to $45 million, AB Bank commits to senior secured syndi- h

cated term loan of up to $16.5 million to finance GO Carriers

2

• Varun Shipping completes $51 million preferred placement of 3% shareholding to Caledonia Investments, Sofina

0

NA, SG, ICGQ, and IL&FS Trust C 0

7

www.marinemoney.com Marine Money 11

52 Weeks of Shipping Transactions, continued

WEEK ENDING DEALS

Week 44 (continued) • Essar Shipping & Logistics raises $200 million in 10-yr syndicated loan led by NIBC Bank and priced at L+20 plus

$350 million in high yield offering led by Jefferies and NIBC

• Great Eastern to inject around $55 million into recently demerged offshore shipping subsidiary Greatship

Week 45 November 9 • Hornbeck Offshore issues convertible notes with Jefferies and Bear Stearns to raise $220 million initially bearing

interest at a fixed rate of 1.625%

• Jefferies and ABN Amro lead Britannia Bulk in $185 million bond issue

• Kristian Gerhard Jebsen Skipsrederi expands cement carrier fleet with $240 million acquisition of Belden advised by

DVB

• Pacific Basin announces plans for $157 million equity placement led by Goldman Sachs

• Fortis, KBC Securities raise Euro 75 million for Exmar in private placement

• Canada announces elimination of tax advantages for income trusts, market value of Toronto stock exchange falls

C$20 billion

Week 46 November 16 • Broker ACM Shipping prepares to list on London AIM with Noble & Company

• Oceania Cruises bank facility and private placement complete AMA Cruiseinvest effort

• Kelso and Castle Harlan affiliates continues to sell down their respective stakes in Eagle Bulk and Horizon Lines

• HSH and König & Cie take new ship investment vehicle Marenave Schiffahrts public

• China Shipping Development plans $250 million convertible to fund 42 vessel acquisition

• Green Reefers takes 20 vessels from Seatrade, Eidesvik and Odfjell interests

• MC Shipping in $52 million ale leaseback with MPC Capital KG fund

Week 47 November 23 • Carnival Corp hires Merrill Lynch, RBS, UBS for circa $958 million euro bond offering to mitigate foreign exchange

risk in shipbuilding contracts

• Vinashin hires Habubank for 9.6% $19 million bond offering

• Siam Commercial Bank and Deutsche Bank prepare for three-tranche Thorsen Thai notes issue

• HSH Nordbank leads $434 million 15-yr financing for Sovcomflot along with ING and Norddeutsche Landesbank

Girozentrale

Week 48 November 30 • Chemoil successfully closes $101 million bunkering IPO in Singapore with JP Morgan, UBS and UOB Asia Limited

• Aegean Marine Petroleum sets price range for New York bunkering IPO

• DnB NOR in record $293 million KS deal with Westfal-Larsen

• AP Moller-Maersk in $127 million sale leaseback with Danaos

• Navios announces plans for $300 million bond issue

• B+H completes private placement of bond loan with Pareto and Nordea to raise $60 million

• Fortis launches $775 million facility for Aker American Shipping

F

• OOIL sells four terminals to Ontario Teachers’ Pension Plan for $2,350 million with help of UBS

e

Week 49 December 7 • Aegean Marine prices Bear Stearns-led IPO at top of range or 25-30x earnings to raise $175 million

b

r • Teekay Offshore MLP files for IPO with Citigroup and Merrill Lynch

u • Bodouroglou’s Paragon Shipping raises $100 million in 144A US private equity issue led by Cantor Fitzgerald

a • HSH Nordbank provides $90.75 million credit facility to Paragon

r • Sevan Marine raises $140 million in bond issue with Pareto

y • Odfjell issues notes with DBS Bank in Singapore to raise SGD 160 million

/

• GulfMark Offshore raises $77.8 million in follow-on offering led by Jefferies

M

a • Tufton Oceanic closes $114 million in sale leasebacks with Geden Lines, Marsol

r Week 50 December 14 • Teekay Offshore Partners prices IPO at $21, raising $147 million

c • Navios Maritime issues $300 millions of 9.5% senior notes due 2014 with Merrill Lynch, JP Morgan, Banc of

h America and S. Goldman Advisors

• Deutsche Bank successfully sells DP World’s US ports to AIG with Lehman advising for 20-25x EBITDA

2 • Larsen & Tubro set up infrastructure finance company

0

Week 51 December 21 • GECAS sale of 41 aircraft portfolio to Genesis has greater implications for shipping

0

7 Week 52 December 28 • Time to start the next year…

12 Marine Money www.marinemoney.com

Bank Debt in 2006:

Public Companies Take on Dry Powder

& Lenders Wander the World

If the international ship from $60 billion in 2005 to the evolution of certain ship- dry cargo rates and the vintage

I

finance business is a body, $70 billion in 2006. This ping companies into quasi- vessel values, analysts at invest-

comprising complex system of increase was thanks to high operating lease providers such ment bank Dahlman Rose

vital organs, then commercial asset prices, which can be seen as Seaspan and Danaos while telegraphed to the market in a

bank debt is its heart – and as in figure 1. Another reason, we other shipping companies like research note that they believed

you can see from looking just think, for the increased deal Ship Finance have evolved into DryShips had either blown

about every single transaction volume is simply that there are a financing vehicle providing covenants in its loan agreement,

highlighted in this special issue more public companies than capital to other shipowners in or was close to doing so.

of Marine Money - nothing ever before and these compa- the form of bareboat leases. At

functions without it. nies are legally bound to file the same time, other owners This set off a flurry of debate in

details of their financing with like Frontline, Pacific Basin and both shipping and Wall Street

Whether you are talking about Securities and Exchange Top Tankers have been taking about whether this was the

XL Capital’s $1 billion invest- Commission, which means ships in on charters and beginning of the end of the

ment grade credit wrap for they get included in the figures sale/leasebacks rather than golden era, especially for yield

CMA-CGM, Top Tankers compiled by data processors financing them on balance oriented dry bulk companies

sale/leaseback in Korea, Odfjell like Dealogic. sheet to maximize returns on that might have their banks put

bonds in Norway, Quintana’s capital, unlock cash for divi- the kibosh on their dividends

acquisition of Metrobulk or the Loan pricing was stable, thanks dends and minimize residual and then have investors put the

dozens and dozens of public to a balance between the supply value risk. A result of all this is kibosh on their yield driven

and private equity deals living of and demand for capital, that certain loan facilities, like valuations.

and breathing in New York coupled with the fact that loan the $1 billion plus that Ship

these days, the reality is that the spreads simply could not go Finance borrowed this year was Around the same time, a

financial returns needed to much lower. Most importantly, in fact used to finance a host of number of dry cargo deals that

create virtually every capital the shipping market was the other shipowners. Here is a had been concluded at the top

structure in the global shipping star of the show for the third look at some specific transac- of the market with aggressive

industry are nourished by straight year - making just tion highlights from amortization had to have their

leverage - and that leverage about every deal, except those throughout the year. amortization profiles extended F

comes from the bank debt done at the top tick of the to make the cashflows work. e

market. market, look like genius. Much Ado DryShips vigorously denied b

About Dahlman’s assertion and came r

u

And so long as transaction BNP jumped up the standings Nothing…Yet to market with a $530 million

a

activity is increasing in size and in 2006 and DnB and Nordea “It’s over,” a very well known refinancing with HSH just few r

complexity, as it has been for continued their high-spirited dry cargo owner said to me in weeks later. The bulk market y

years, we think that the market competition for the top spot the early part of 2006. recovered, and then soared to /

for bank debt will become even among loan syndicators, while Although the sun was shining all time highs, and talk of M

more vibrant. HSH continues to be an on our industry for most the blown covenants vanished. a

r

omnipresent Big Brother on year, the first quarter saw a few

c

Not surprisingly, the year 2006 deals in every corner of the dark clouds pass by and serve as Banks Wander h

was another great one for the world. a reminder of how it feels when the World in

business of commercial ship things aren’t so buoyant. Search of Deals 2

lending. According to Dealogic, Another interesting trend that The year 2006 saw interna- 0

syndicated loan volume was up continued through 2006 was In March, after a steep drop in tional banks pack up their bags, 0

7

www.marinemoney.com Marine Money 13

pick their spots around the signing a loan agreement with transporting coal on behalf of lucrative deals, 2006 was the

world and then hire lots of local the Chinese company Shanghai the beneficial owner of year when the international

lawyers to help them under- Times Shipping for a $38.4 Shanghai Times, who provide lending community got a few

stand rights and remedies. million bilateral term loan of 8 10% of the electrical power to signs that it may be close to a

More than any other year that years. The bilateral is the first of China’s 1.3 billion citizens. breakthrough in Japan – and

we can recall (at least since the its kind being offered by a Wikborg Rein & Co, Shanghai Sumitomo Bank is in perfect

Asian Crisis in 1997), commer- foreign lender towards a Branch was legal counsel on the position to facilitate that break-

cial shipping bankers have been People’s Republic of China transaction so those interested through.

aggressively moving into (PRC) flag mortgage, which in doing financings in that

emerging markets that they feel until then had been viewed as market are well advised to call Although Japanese shipping

they understand. This is partly too high risk by foreign lenders. our friends at Wikborg Rein. companies have long had their

a function of the fact that banks appetite for capital satiated by

are looking for ways to leverage This was an ideal first transac- Royal Bank of Scotland also LIBOR minus debt from

their expertise and comfort tion in that it involved solid entered the PRC flag market Japanese banks and shipyard-

with the assets into higher players, quality vessels and when they, together with Bank related trading companies, it

yields, and partly because banks industrial employment the of China, closed a club deal for now appears that the state of

seem to be functioning so well demand for which is unlikely to 3 PRC flag vessels in the second that economy, the truly enor-

that bankers have the time to diminish. Specifically, proceeds quarter of 2006. mous newbuilding orders

devote to the harder deals. of the deal financed Shanghai undertaken by the large

Times purchase of one Japan (Finally) Japanese companies, and the

Hardly a week went by in 2006 panamax and one handymax Opens Up growing trend by Shikoku

that we did not see deals of this from Danaos Shipping, both After many years of making owners to provide long term

nature, and here are a few built in 1994 in Japan. As for sales calls that resulted in more bareboat financing to compa-

selected examples. employment, the bulkers are embarrassing karaoke than nies outside Japan have

Royal Bank of Scotland and

DnB Finance PRC Flag Vessels

Some Horses Change Position in 2006

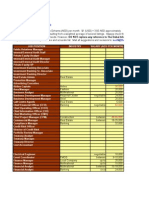

After many years of talking Top 20 Bookrunner Table - Syndicated Shipping Loans – Full Year 2006

about it, 2006 saw interna- Rank Bookrunner Amt ($m) No. % share

tional banks make a confident 1 DnB NOR Bank ASA 13,691 68 20.6

move onto Mainland China. 2 Nordea Bank AB 13,334 54 20.1

Although much of the business 3 BNP Paribas 5,306 22 8.0

was still conducted with the big 4 Citigroup 4,682 15 7.1

and state owned companies that 5 ING 3,622 15 5.5

F have long had access to interna- 6 Fortis 2,951 16 4.5

e tional coffers, such as the $52 7 Sumitomo Mitsui Banking Corp 2,715 19 4.1

b million deal that China Ship- 8 Calyon 2,689 5 4.1

r ping Development did with

u 9 SG CIB 2,386 15 3.6

Citibank, HSH Nordbank and 10 HSH Nordbank 1,995 6 3.0

a

r DnB, we saw some smaller 11 Mitsubishi UFJ Financial Group 1,166 11 1.8

y companies access bank funds as 12 Mizuho 960 17 1.5

/ well this year. 13 Korea Development Bank - KDB 907 6 1.4

M

14 Gulf International Bank BSC 762 2 1.2

a The most celebrated (literally)

r 15 Lloyds TSB 654 3 1.0

example of this occurred with 16 Barclays Capital 654 1 1.0

c

h great fanfare in September 17 RBS 651 3 1.0

when DnB completed its first 18 NATIXIS SA 603 1 0.9

2 PRC flag bilateral loan as a 19 Bank of America 565 3 0.9

0 foreign lender. That deal 20 HSBC 493 3 0.7

0 involved the Norwegian bank

7 Total 76,380 286 100.0

Source: Dealogic

14 Marine Money www.marinemoney.com

combined to pique the interest as the 4th largest owners of financed one vessel, the other international syndicated loan.

of Japanese owners in interna- these vehicles. The vessels will was financed by KfW, Citi-

tional sources of capital. go on charter to NYK and Cido group and Nordea. This is the Asia &

Shipping Group. The other largest amount ever raised at Latin America

One example of the emerging lenders involved in the senior one time by the Shipping Corp Natexis went from participant

phenomena came when part are Allied Irish Banks, The of India, the two largest VLCCs to arranger when it, along with

Sumitomo Mitsui Banking Bank of Fukuoka, Ltd., ever ordered under the India Goldman Sachs, was awarded a

Corporation’s head of shipping Commerzbank AG, Crédit registry, and it is evidence of a mandate from drilling rig

Stanislas Roger closed a $240 Industriel et Commercial, growing relationship between company PT Apexindo for a

million syndicated club deal for Kansai Urban Banking Corpo- SCI and international ship $120 million financing in

Cido Shipping Group. ration, Natexis, and The finance community. Indonesia. The ten year

According to our records, this is Norinchukin Bank – a nice mix financing, the first of its kind in

the first ever shipping deal of banks that we could easily In November, Essar Shipping Indonesia, was used for the

where a Japanese bank has acted imagine coming together on & Logistics raised $200 million construction of a jack-up rig to

with the role as sole mandated future deals. in the international banking be delivered early 2007 from

arranger and facility agent for a market in the form of a 10-year PPL in Singapore at a total

club deal with Japanese and India Embraces syndicated loan with the help of price of $145 million. Interest-

foreign banks. The proceeds of the Dollars mandated lead arranger and ingly, Sea Drill owns 30% of

the 10-year loan were used to There were plenty of other facility agent NIBC Bank, who PT Apexindo, which shows that

fund for Cido’s 6 PCC global firsts in 2006. In May, took in DnB NOR, DVB and consolidation is also a catalyst

newbuildings to be delivered government-controlled Ship- Bank of Scotland as arrangers for internationalization of ship

from Shin Kurushima Dock- ping Corp of India signed and Nordea as lead arranger. finance.

yard between 2006 and 2009. financing for two 319,000 The facility, priced at L+120,

Each vessel will have a capacity DWT VLCC newbuildings for goes towards the company’s No conversation about

of 6,400 RT and brings Cido’s a total of $206 million. $300 million ship acquisition emerging markets is complete

PCC fleet to 44 putting them Although State Bank of India program and is Essar’s first with a stop in Latin America,

that resource rich part of the

Top 20 Mandated Arranger Table - Syndicated Shipping Loans – Full Year 2006 world known for the age of its

Rank Mandated Arranger Amt ($m) No. %share fleet and the challenge of some

1 DnB NOR Bank ASA 12,521 87 16.4 of its flags. In May, Chile’s

2 Nordea Bank AB 11,714 78 15.3 CSAV mandated BNP Paribas

3 BNP Paribas 4,638 32 6.1 as sole MLA, bookrunner and

4 Citigroup 4,391 27 5.8 facility agent to lead a $300

5 Fortis 3,875 24 5.1 million revolver with proceeds

6 HSH Nordbank 3,610 23 4.7 to be used to fund future vessel F

7 Calyon 3,477 11 4.6 acquisitions. DVB, Natexis and e

BTM have also been active in b

8 SG CIB 3,460 27 4.5

Mexico with deals for TMM. r

9 Sumitomo Mitsui Banking Corp 3,214 29 4.2 u

10 ING 2,973 24 3.9 Meanwhile, HSH Nordbank

a

11 HSBC 1,733 15 2.3 has made a move into the r

12 Mitsubishi UFJ Financial Group 1,418 19 1.9 Russian market for shipping y

13 Mizuho 1,205 24 1.6 lending with a $170 million /

facility for Russian liner M

14 Korea Development Bank - KDB 935 6 1.2

company Fesco. a

15 DZ Bank AG 915 8 1.2 r

16 RBS 889 7 1.2 c

17 Deutsche Bank AG 780 8 1.0 Public h

18 Lloyds TSB 598 5 0.8 Companies

19 Goldman Sachs 583 2 0.8 Reload 2

It is difficult for any of us to 0

20 Commerzbank Group 556 5 0.73

fully comprehend the impact 0

Total 76,380 286 100 7

www.marinemoney.com Marine Money 15

that having so many public case this involved the recycling market previously only seen by won’t need debt!”

companies will have on the and topping off of existing those doing the deals.

global shipping industry, but it loans. In addition to the sheer That didn’t last long. In fact, as

is very clear in the bank market. volume of deals, the public Commercial we stated above, we believe

companies, and their require- Banks Find increased capital market trans-

One result of this increased ment to file their loan agree- Ways to Add action volume stimulates

transparency of having more ments, has opened wide a More Value demand for bank debt, not

public companies is that loan window into the previously A few years ago, when shipping competes with it. In May of

pricing and covenants have private world of commercial companies began their steady 2006, Diana Shipping, which

become much more efficient ship lending. Of course, when march up Wall Street, there initially proclaimed it would

than they were in the past. companies go public the juicy were, as always, a lot of gossip never use leverage for anything

details of their personal guaran- chattering in the ship finance more than a bridge between

As you can see from the Marine tees and other assets involved in market. One refrain was that buying a ship and concluding a

Money deal table that accom- cross collateralization melt “equity markets are going to follow on stock offering, made

panies this article, public away, but nevertheless public reduce the demand for bank the following formal announce-

companies were voracious company loan filings have debt, especially because compa- ment, “…it is in the best

consumers of capital commit- exposed the inner workings of nies like Diana Shipping will interest of its shareholders to

ments in 2006, though in many the commercial ship finance not even have any debt! They target a capital structure incor-

Noteworthy 2006 Events in Commercial Banking

3 Dry Ships covenants "almost blown", issue blows over quickly

3 Dnb completes bilateral loan in PRC flag for Shanghai Times

3 BNP jumps up the league tables, active in every corner of the planet

3 Diana Shipping changes policy to include permanent bank debt

3 Sumitomo closes first Japanese/Foreign Club Deal - for Cido

3 Monaline Insurance company XL Capital wraps CMA-CGM credit

3 Healthy demand and good valuations in follow-on offering market take pressure off banks

3 Fredriksen, Troim, Bylstad, DnB swap personnel, dig into the offshore market

3 Despite high leverage, Lehman gets Nakilat Aa3/A+ rating on the back of Qatar contracts

3 Robust demand in KS, KG, Korean and other leasing markets create demand for bank debt

3 Bond market deleverages Navios' balance sheet, in favor of HSH

3 Fortis Bank continues to integrate commercial and investment banking with Metrobulk

3 Regional shipping companies outstrip local capital and mandate more foreign banks

F 3 Natexis goes from participant to arranger

e 3 TBS Shipping graduates from finance companies into bank market, chops cost of funds in half

b 3 Some shipping companies evolve into finance providers

3

r

Others evolve into non-vessel owning trading companies

3

u

a Loan volumes jump on high asset prices, consolidation, more reporting

r 3 Loan volumes enhaced by non-traditional shipping assets like LNG and Rigs

y 3 Dividend paying companies turn to bank debt market to boost yields

/ 3 French banks seen wandering the world with deals in South America and Asia

M 3 Trading companies begin to see that by owning tonnage that they control physical commodities

3

a

$1 billion deals being pushed out of the top 10

3

r

c International banking tiptoeing into mainland China, South America, Mexico, FSU

h 3 Prosperity continues in Norway's transaction community

3 Strong freight markets have all but those who paid highest prices feeling good

2 3 Loan pricing stabilizes, with no room to go down further with credit enhancement

0 3 Credit hogs tk, etc out of market in 06

3

0

Public companies reload revolves, for public relations and increased buying power

3

7

Indian and Italian shipping companies increasingly active in global capital markets

16 Marine Money www.marinemoney.com

"LISCR advertised here in the hard copy this month and

reached the most influential readers of our industry, why don't you? Interested?

Please contact info@marinemoney.com, for more information!"

porating $150 million of semi- Yeah, as long as the market Nordea extended Aries $360 nical default.

permanent debt to support the remain firm. million in credit with CEO

company’s long-term growth Mons Bolin saying, “With a In March, the name HSH again

plans.” And Diana wasn’t alone. As you $75 million undrawn commit- surfaced in an US IPO

can see from our own league ment, Aries is in a strong posi- prospectus as the money behind

So why did they change their tables, the availability of tion to pursue future growth soon to be public Omega Navi-

strategy? It is simple – because a standby bank debt became a opportunities.” Aries immedi- gation’s $295 million senior

good deal is almost always made prime public relations message ately snapped up two panamax secured credit facility. About

better with a slug of bank debt. for just about all of the freshly tankers from Stena for $56 $145 million of the term loan

Scott Burk, analyst at Bear minted public companies, million each. HSH and Bank of portion and a $63 million draw

Stearns pretty much sums up the looking for ways to articulate to Scotland gave DryShips the down on the revolving credit

beauty of bank debt; “The new investors that they are able to ultimate in investor relations facility will fund repayment of

policy results in higher divi- grow, even if they chose not to services when granting George the company’s old facility and a

dends because the company now in a market with high asset $530 million with about 30% substantial portion of the iden-

won’t need to use equity to pay prices. of the amortization, which we tified fleet - and leave Omega

for its recent $91 million cape- figure equated to a 10-year with some liquidity if it chooses

size acquisition. We think this is Citigroup, Nordea, DnB and profile on assets already 10 to exercise any of its purchase

positive for the stock as it HSBC put together a $1.5 years old. It immediately options on the panamax

increases its dividends, improves billion unsecured, floating rate soothed any investor worried tankers. As always, bank debt

its equity gearing and lowers its credit facility for OSG priced at about Dahlman Rose’s claim provided the grease that made

cost of capital.” L+80, Bank of Scotland and that the company was in tech- Omega’s sensitive economics

Top 10 Largest Syndicated Loans in 2006

Credit Date Borrower Deal Value ($m) Deal Nationality Mandated Arranger Parent Bookrunner Parent

14-Dec-06 Qatar Gas Transport Co Ltd - 2,615 Qatar Barclays Capital, BNP Paribas, DnB NOR Bank Barclays Capital, BNP Paribas,

Nakilat ASA, Gulf International Bank BSC, Arab Banking DnB NOR Bank ASA, Gulf

Corp - BSC, Calyon, Citigroup, Credit Suisse, International Bank BSC

Dexia Group, Fortis, Goldman Sachs & Co,

HSBC, JP Morgan, Lehman Brothers, Mizuho

Financial Group Inc, Morgan Stanley,

9-Feb-06 Overseas Shipholding 1,800 United States Citigroup, DnB NOR Bank ASA, HSBC, Citigroup, Nordea Bank AB

Group Inc Nordea Bank AB

22-Sep-06 F3 ONE Ltd & F3 Two Ltd 1,687 United States BNP Paribas, SG Corporate & Investment

Banking, Calyon, HSBC

F

9-Jun-06 Euronav SA/NV 1,645 Belgium Nordea Bank AB, DnB NOR Bank ASA Nordea Bank AB

e

b 26-Jan-06 J5 Nakilat Ltd 1,632 Qatar Mitsubishi UFJ Financial Group Inc, DnB NOR Mitsubishi UFJ Financial

Bank ASA, SG Corporate & Investment Banking, Group Inc, DnB NOR Bank

r Sumitomo Mitsui Banking Corp ASA, SG Corporate &

u Investment Banking

a

11-Sep-06 Mediterranean Shipping Co 1,473 Greece Calyon Calyon

r

18-Sep-06 Ship Finance International Ltd 1,131 Norway Calyon, DnB NOR Bank ASA, Fortis, DnB NOR Bank ASA,

y Nordea Bank AB Nordea Bank AB

/

M 20-Nov-06 J.O.Q Shipping SA, J.O.R 954 South Korea Export-Import Bank of Korea - KEXIM, BNP BNP Paribas, DnB NOR Bank

Shipping SA, J.O.S Shipping Paribas, ING, DnB NOR Bank ASA, Industrial & ASA, ING

a

SA, J.O.T Shipping SA, Commercial Bank of China - ICBC, Lloyds TSB

r J.O.U Shipping SA Group plc, Sumitomo Mitsui Banking Corp, DBS

c Bank Ltd, Woori Finance Holdings Co Ltd,

h Mizuho Financial Group Inc

7-Nov-06 Royal Caribbean Cruises Ltd 953 United States Citigroup, Goldman Sachs & Co Citigroup, Goldman

2 Sachs & Co

0

2-Oct-06 Teekay Offshore Partners LP 940.000 Bahamas DnB NOR Bank ASA, Fortis, Nordea Bank AB DnB NOR Bank ASA, Fortis,

0 Nordea Bank AB

7

Source: Dealogic

18 Marine Money www.marinemoney.com

work. Pricing on the loan was Shortly after Diana made its

LIBOR + 100 if the company announcement, Genco Ship-

keeps its debt to capitalization ping & Trading announced its

at less than 0.55 to 1.0, and agreement to increase its credit

LIBOR + 120 otherwise. Repli- facility with Nordea, DnB

cating bond like features, the NOR and Citigroup from $450

term loan requires semi-annual million to $550 million.

payments of a paltry $1.5 Genco, which was appreciative

million until the facility enough to not make any

matures in five years, at which changes to the participants or

point $131.5 million is due. terms of the facility, agreed to

pay LIBOR + 95 to LIBOR +

The cornerstone of the finan- 100 basis points for the 10 year

cial structure needed to make deal. The new deal left Genco

Quintana’s $735 million acqui- with undrawn commitments of

sition of the Metrobulk fleet $419 million, which was a clear

work was the $735 million signal to investors that they

secured revolving credit facility could still grow without dilu-

provided by the advisor, Fortis tion. And this phenomenon is

Bank. The facility, which has a not limited to America. In May,

term of 8.25 years, will also the debt component of the "Anglo-Eastern advertised here in the hard

repay debt drawn down out of Pacific Shipping Trust which

Quintana’s current $250 did an IPO in Singapore was copy this month and

million facility with Citigroup provided through amortizing

and Bank of Scotland. Secured loan facilities from DBS Bank, reached the most influential readers of our

by vessels, the majority of DnB NOR, HSH Nordbank

which are on charter to invest- and OCBC totaling $155 industry, why don't you? Interested?

ment-grade Bunge, the facility million. The DBS, HSH, and

is priced at only 85 basis points OCBC loans all have 12-year Please contact info@marinemoney.com, for

over LIBOR until the end of terms, while the DnB loan is to

2010, at which point the have a term of 10 years. more information!"

margin will increase to 110

basis points. A bullet repay- And the deals kept on coming.

ment of $294 million is due on On May 19, 2006, Seaspan

final maturity date. Here is an Corporation entered into a 10 F

example of the privy look that to 13-year (based on the e

the world gets at loan agree- delivery dates of certain vessels), b

ments, like the one Quintana senior secured, $365 million r

u

entered into the acquire revolving credit facility with

a

Metrostar. The degree if detail DnB Nor, Credit Suisse and r

that was disclosed at the time of Fortis Capital Corp. as y

the loan closing, discussed Mandated Lead Arrangers, /

further in our M&A article in DNB Nor Bank ASA as Sole M

which Fortis receives an award Book runner, Administrative a

r

for its work on this transaction, Agent and Security Agent,

c

is an excellent example of the Landesbank Hessen-Thuringen h

private look the world gets at as Documentation Agent and

public company loan agree- various participating banks 2

ments due to disclosure require- including: Bayerische Hypo- 0

ments and concerns. Und Vereinsbank, Deutsche 0

7

www.marinemoney.com Marine Money 19

Bank AG in Hamburg, Credit dry powder to acquire addi- tions. Royal Bank of Scotland, should apply with the National

Industriel et Commercial and tional tonnage. But unlike which led the Eagle facility, Association of Securities

Deutsche Schiffsbank. Indebt- Genco and Seaspan, Eagle also created a similar one for Diana, Dealers to become a registered

edness under the revolving tapped the equity markets which also amended their Broker/Dealer, thus allowing

credit facility bears interest at a through a PIPE to help fund facility to provide cash avail- them to collect underwriting

rate equal to LIBOR + 85 basis their latest acquisitions. It is ability for expansion and to fees from public debt and

points until approximately July also interesting to note that lower overall finance costs. equity deals. The logic was that

31, 2013, for the first tranche, Eagle’s facility is strikingly since many of the commercial

and LIBOR + 92.5 basis points similar to the high yield bond To B/D or banks basically controlled the

thereafter. structures so alluring in the late Not to B/D client relationships, why should

90s – no principle repayment Another frequent topic of they simply let the investment

Eagle Bulk Shipping also obligations during the loan’s discussion amongst commercial banks skim the cream of non-

increased its credit facility, six-year tenor. So similar, but banks at the beginning of ship- risk placement fees, which run

lowering their overall cost of blessedly cheaper in terms of ping’s bull run for securities into the millions of dollars.

capital while also attaining the both costs and filing obliga- issuance was whether they Some leading banks did, like

Nordea Largest 2006 Debt Deals

Customer Currency Global Facility Tenor Signing Nationality

Amount Type (In Months) Date

Nakilat Inc USD 2,225,000,000 T/L 228 12/14/06 Qatar

Overseas Shipholding Group USD 1,800,000,000 R/C 84 5/10/06 United States

Euronav NV USD 1,650,000,000 R/C 84 6/9/06 Belgium

Seadrill Limited USD 1,200,000,000 T/l 24 6/23/06 Bermuda

Eastwind USD 80,000,000 TL+RC 1/30/06 United States

Ship Finance International Ltd. USD 1,131,439,219 T/L 53 9/18/06 Norway

SeaDrill Limited NOK 7,410,631,696 Guarantee 2.5 2/17/06 Bermuda

Teekay Offshore Operating L.P. USD 940,000,000 R/C 96 10/11/06 Bahamas

Bonny Gas Transport Limited USD 680,000,000 T/L 144 9/29/06 Nigeria

Awilco Offshore ASA USD 670,000,000 T/L & R/C 40 9/11/06 Norway

Teekay Shipping Corp. USD 650,000,000 R/C 78 9/29/06 Canada

NCL Corporation Ltd USD 610,000,000 R/C 60 12/22/06 United States

SeaDrill Tender Rigs Ltd. USD 585,000,000 R/C 72 7/7/06 Bermuda

Genco Shipping & Trading Limited USD 550,000,000 R/C 108 7/10/06 United States

F Victoria Marine, Inc. USD 537,000,000 T/L 115 10/25/06 Virgin Islands (British)

e Hurtigruten Group ASA NOK 3,300,000,000 R/C 84 9/22/06 Norway

b Songa Shipholding Pte Ltd. USD 510,000,000 T/L & R/C 96 7/13/06 Singapore

r

Ray Car Carriers Ltd. USD 475,000,000 T/L 120 10/13/06 Israel

u

a Prosafe ASA USD 450,000,000 R/C 84 7/6/06 Norway

r Silja Oy Ab EUR 350,000,000 T/L 90 6/11/06 Finland

y Masterbulk Pte Ltd USD 418,000,000 T/L 96 8/30/06 Singapore

/ MSC Mediterranean Shipping Co. USD 410,000,000 T/L 144 8/1206 Switzerland

M Songa Offshore ASA USD 400,000,000 R/C 30 9/27/06 Norway

a

Sea Containers / Silja EUR 306,000,000 T/L $ R/C 60 6/15/06 United Kingdom

r

c Aries Maritime Transport Ltd. USD 360,000,000 R/C 60 4/3/06 Greece

h Seacor Holdings Inc. USD 300,000,000 R/C 84 11/3/06 United States

Color Group ASA NOK 1,626,000,000 R/C 96 6/12/06 Norway

2 Concordia Maritime AB USD 250,000,000 RCF 96 6/19/06 Sweden

0 First Olsen Cruise Lines GBP 122,000,000 T/L 110 8/29/06 Norway

0

Clipper Fourth Ltd. USD 230,000,000 T/L & R/C 120 3/23/06 Bahamas

7

Source: Nordea

20 Marine Money www.marinemoney.com

Fortis, DnB and DVB, and without any of the risk was Like many complex deals, the that helped the transaction get

some leading banks didn’t, like wrong. What time and data financing in question involves a done and Nordea even provided

HSH Nordbank, Nordea and have shown is that there are few few steps. In July, Nordea lead a $75 million bridge loan and

Royal Bank of Scotland. business activities that have as arranged a $510 million credit provided all of the FX services

little risk as lending reasonable facility for Songa Shipholding. required.

What has borne out since then, amounts of money against rela- This facility consolidated all of

and was especially clear in tively modern assets controlled the indebtedness for the Conclusion

2006, is that underwriting by experienced operators. company while providing long- Those companies that have the

securities deals is not as easy as term financing for its signifi- healthiest relationships with the

it looks, especially in a market The Winners cant newbuilding program. The commercial banking commu-

that is anything less than a Nordea for Songa Shipholding transaction was also intended to nity are by definition the same

feeding frenzy. Instead, some of Behind every great shipping streamline Songa’s capital struc- companies that have access to

those banks that chose not to dealmaker, there is a financial ture ahead of being acquired the broadest and cheapest

pursue the coveted “B/D” institution – and usually a and was assumed as part of the capital in the world – and this is

license as it is called in Wall bunch of them. In the case of acquisition. an important thing when you

Street parlance, perhaps antici- Axel Eitzen, our dealmaker of consider that the cost of capital

pating that the risk was in fact the year, his efforts to grow the Then, in October, Nordea was is single largest daily expense

greater than the opportunity world’s largest product tanker sole lead arranger, sole for most ships. The converse is

cost. Banks like Nordea, have company almost overnight have bookrunner and agent for the also true – those companies that

found plenty of other ways to been aided by no fewer than 25 $265 million, 7-year facility for whatever reason do not have

give value to their customers, financial institutions, ranging that allowed Eitzen Chemical access to the bank market have

and one of such deals has put from American Marine Advi- ASA to acquire Songa to work a lot hard to achieve

Nordea in the winner’s circle for sors to Carnegie. And while Shipholding AS for $1.28 fewer and more costly financing

the third straight year in the there have been many parties billion. What is interesting to alternatives. But buttressed by

category of bank debt. What who have helped Axel turn his note is that Nordea actually years of strong earnings and

will be clear for close readers of vision into a reality, the work of represented Arne Blystad in the basically no defaults, the good

Marine Money, is that anyone Nordea stands out as extraordi- sale of Songa, but also served as news is banks continue to be

who thought investment nary for a “traditional” Joint Lead Manager for the $25 hungry.

banking carries all the return commercial bank. million unsecured bond deal

DnB NOR Selected 2006 Financings

Borrower/Group Nationality Amount Currency Facility type Deal date Maturity date

Qatar Gas Transport Co Ltd - Nakilat Qatar 2,615 USD Term Loan / Export Credit 14-Dec-06 12/14/25

J5 Nakilat Ltd Qatar 1,632 USD Term Loan 26-Jan-06 26-Jan-21

F

Hanjin Group South Korea 954 USD Term Loan 20-Nov-06 20-Nov-18

e

Teekay Offshore Partners LP Bahamas 940 USD Revolving Credit 2-Oct-06 2-Oct-13

b

Eastern Drilling ASA Norway 800 USD Revolving Credit/Trem Loan 6-Dec-06 6-Dec-09

r

Aker Drilling ASA Norway 775 USD Term Loan/Revolving Credit 19-Jan-06 19-Jan-09

u

Star Cruises Ltd Hong Kong 750 USD Term Loan/Revolving Credit 18-Dec-06 18-Dec-14

a

NCL Corp Ltd United States 610 USD Term Loan 22-Dec-06 22-Dec-11

r

Bergesen Worldwide Offshore Ltd Norway 600 USD Revolving Credit 5-Jul-06 5-Jul-12

y

Universal Terminals Singapore 539 SGD Term Loan 7-Jul-06 7-Jul-16

/

Nordic American Tanker Shipping Ltd Bermuda 500 USD Revolving Credit 21-Sep-06 21-Sep-10

M

Carnival plc United States 461 USD Term Loan 19-Sep-06 19-Sep-20

a

Acergy Treasury Ltd United Kingdom 400 USD Revolving Credit 10-Aug-06 1-Aug-11

r

Odfjell Invest Ltd Norway 388 USD Term Loan 4-May-06 4-May-11

c

Grieg Shipping Norway 370 USD Term Loan 8-Nov-06 8-Nov-16

h

Seaspan Corp Hong Kong 365 USD Revolving Credit 11-May-06 31-Aug-19

Cido Tanker Holding Co Japan 324 USD Term Loan 24-Jul-06 24-Jul-16

2

Seacor United States 300 USD Revolving Credit 31-Oct-06 31-Oct-13

0

Exmar NV Belgium 280 USD Term Loan 4-May-06 4-May-18

0

Westfal-Larsen Chemical Carriers I KS Norway 233 USD Term Loan 18-Dec-06 18-Mar-15

7

Source: DnB NOR

www.marinemoney.com Marine Money 21

Selected Bank Debt Deals 2006

Borrower Lender Amount ($mm) Purpose Month

Thoresen Thai Societe General $50-$60 Funding for 2 x handmax newbuildings Dec-06

Navibulgar Nord Bank $70 Funding for newbuilding program Dec-06

Precious Shipping DnB NOR $250 1-yr extension of existing but as-yet unused credit facility Nov-06

Aker American Shipping Fortis Capital $775 Senior secured credit facility to fund acquisition of 10 Jones Nov-06

Act product tanker under construction on BB to OSG

Westfal-Larsen KS DnB NOR Bank $240 8 year first priority mortgage at L+75 Nov-06

Nakilat Korea Export Insurance Co $225 Funding for 16-ship LNG newbuilding program Nov-06

Nakilat KEXIM $500 Funding for 16-ship LNG newbuilding program Nov-06

Diana Shipping RBS $200 Offer letter for 364-day facility to become available upon Nov-06

full utilization of existing revolving facility

Sovcomflot HSH Nordbank as lead arranger, $434 15-yr loan to finance 3 x ice-class shuttle tankers + Nov-06

ING Bank advisor, Norddeutsche 3 x product carriers

Landesbank Girozentrale as

co-lender

Oceania Cruises UBS, Lehman Brothers $400 $300m 6-yr term loan, $75m 7-yr loan, Nov-06

$25m 5-yr revolver

Bonny Gas Transport BNP Paribas $680 Refinancing for 13 x LNG carriers on charter to Oct-06

Nigeria LNG

Nanjing Tanker Corporation ICBC, Agricultural Bank of $1,850 Funding for 4x VLCCs & 18x product tanker newbuilds Oct-06

China, Bank of Communications, delivered by Bohai Shipbuilding

China Construction Bank

Nanjing Tanker Corporation Credit Agricole Indosuez $180 Funding for 2x VLCC newbuildings at Jiangnan Changxing Oct-06

Pakistan National ABN Amro $135 Funding for 2 x aframax tankers, 1 x panamax bulker Oct-06

Shipping Corporation

Global Oceanic Carriers AB Bank $17 10-yr senior secured syndicated term loan at a benchmark Oct-06

rate + 120 bp to finance 1 x dry bulk carrier

Global Oceanic Carriers HVB $45 5-yr committed amortizing term loan at a benchmark rate + Oct-06

160 bps to finance 1 x dry bulk carrier

Sovcomflot / NYK / Societe General $400 Limited recourse facility of 2 x LNG carriers on long Sep-06

Samudera term charter to Tangguh LNG

Szczecin shipyard Agencja Rozwoju Przemyslu $81 Loans from Polish industrial-development agency Sep-06

F done along with consortium of private banks

e Ship Finance International DnB NOR, Fortis, Nordea, $220 Increase to existing facility; pricing at L+70; original had Sep-06

b Calyon 6-year term

r

Star Cruises BNP Paribas, Calyon, HSBC, $1,700 Financing for two by 4,200 passenger newbuildings Sep-06

u

a Societe General

r Nel Lines First Business Bank as lender, EUR 21 7-year loan to refinance existing disputed loan agreement Sep-06

y XRTC as advisor

/ Shanghai Time DnB NOR $38 8-yr mortgage financing for Chinese-flag panamax & Sep-06

M handymax

a

Diana Shipping Fortis $62 Construction financing for 2 x capesize bulkers from Sep-06

r

c Shanghai Waigaoqiao Shipbuilding w/ 2010 delivery

h Eitzen Chemical Nordea Circa $150 Financing for Songa acquisition Sep-06

Regional Container Lines DnB NOR $40 10-yr financing for 2 x 1,108 teu containership newbuildings Sep-06

2 KGs managed by HSH Nordbank, $86 Construction financing for 3 x 73,400 dwt product Sep-06

0 Hellespont Hammonia Exim Bank of China tankers bound for KGs

0

Energy Spring LNG Carrier Gulf International Bank $136 Refinancing for MOL/Oman Shipping Co JV funding Sep-06

7

purchase of 1 x LNG carrier with 16-year term

22 Marine Money www.marinemoney.com

Selected Bank Debt Deals 2006 continued

Borrower Lender Amount ($mm) Purpose Month

Nordic American DnB NOR $200 Increase in existing facility to $500m; terms to Sep-06

Tanker Shipping remain unchanged

Bluewater ING $850 Refinancing on$600m in leases with Lloyds TSB for Aug-06

fleet of 4 FPSOs

Grupo TMM Deutsche Bank $200 Securitization to refinance existing debt and provide Aug-06

capital for future projects

B+H Ocean Carriers Nordea, DVB, HSH Nordbank, $202 Refinancing and funding for future acquisitoins Aug-06

Bank of Scotland

Essar Shipping De Nationale Invester-ingsbank $200 Funding for acquisitions in 10-yr facility at L+120 Aug-06

Ray Shipping Nordea $475 Aug-06

Teekay Offshore Partners Nordea, DnB, Fortis $940 Planned facility for Teekay's offshore spin-off Aug-06

China Shipping ICBC Bank as lead arranger, $186 10-yr yuan-denominted financing for 4 x Aug-06

Container Lines Agricultural Bank, China containership newbuildings

Merchant Bank, Shenzhen

Development

US Shipping Lehman Brothers, $350 Amendment to existing facility; upsized from Aug-06