Escolar Documentos

Profissional Documentos

Cultura Documentos

BSP Circular 170

Enviado por

RJ SakuragiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BSP Circular 170

Enviado por

RJ SakuragiDireitos autorais:

Formatos disponíveis

BSP CIRCULAR NO. 170 Series of 1998 (08/05/98) Pursuant to Monetary Board Resolution Nos.

832 and 1098 dated June 10, 1998 and August 5, 1998, respectively, the following clarifications and illustrations are hereby issued relative to Section 26 of Republic Act No. 7653: 1. All banks and their directors, officers or stockholders shall continue to comply with Section 26 of Republic Act No. 7653, which provides, thus: "SECTION 26. Bank Deposits and Investments. Any director, officer or stockholder who, together with his related interest, contracts a loan or any form of financial accommodation from: (1) his bank; or (2) from a bank (a) which is subsidiary of a bank holding company of which both his bank and lending bank are subsidiaries or (b) in which a controlling proportion of the shares is owned by the same interest that owns a controlling proportion of the shares of his bank, in excess of five percent (5%) of the capital and surplus of the bank, or in the maximum amount permitted by law, whichever is lower, shall be required by the lending bank to waive the secrecy of his deposits of whatever nature in all banks in the Philippines. Any information obtained from an examination of his deposits shall be held strictly confidential and may be used by the examiners only in connection with their supervisory and examination responsibility or by the Bangko Sentral in an appropriate legal action it has initiated involving the deposit account." 2. The following elements must concur for abovequoted Section 26, Republic Act No. 7653 to apply: a. b. c. The borrower is a director, officer or any stockholder of a bank; He contracts a loan or any form of financial accommodation; The loan or financial accommodation is from (1) his bank or (2) a bank that is a subsidiary of a bank holding company of which both his bank and the lending bank are subsidiaries, or (3) a bank in which a controlling proportion of the shares is owned by the same interest that owns a controlling proportion of the shares of his bank; and The loan or financial accommodation of the director, officer or stockholder, singly or with that of his related interest, is in excess of 5% of the capital and surplus of the lending bank or in the maximum amount permitted by law, whichever is lower.

owning two percent (2%) of more of the subscribed capital stock of the bank. 4. For purposes of Section 26 of Republic Act No. 7653, the term "related interest" shall include the following: 1. Spouse or relative within the first degree of consanguinity or affinity, or relative by legal adoption, of a director, officer or stockholder of the bank; Partnership of which a director, officer, or stockholder or his spouse or relative within the first degree of consanguinity or affinity, or relative by legal adoption, is a general partner; Co-owner with the director, officer, stockholder or his spouse or relative within the first degree of consanguinity or affinity, or relative by legal adoption, of the property or interest or right mortgaged, pledged or assigned to secure the loans or credit accommodations, except when the mortgage, pledge or assignment covers only said co-owner's undivided interest; Corporation, association, or firm of which a director or officer of the bank, or his spouse is also director or officer of such corporation, association or firm, except (a) where the securities of such corporation, association of firm are listed and traded in the big board or commercial and industrial board of domestic stock exchanges and less than fifty percent (50%) of the voting stock thereof is owned by any one person or by persons related to each other within the third degree of consanguinity or affinity; or (b) where the director, officer or stockholder of the lending bank sits as a representative of the bank in the board of directors of such corporation: Provided, That the bank representative shall not have any equity interest in the borrower corporation except for the minimum shares required by law, rules and regulations, or by the by-laws of the corporation: Provided, further, That the borrowing corporation under (a) or (b) is not among those mentioned in items (5) and (6) hereof. Corporation, association or firm of which any or a group of directors, officers, stockholders of the lending bank and/or their spouses or relatives within the first degree of consanguinity or affinity, or relative by legal adoption, hold/own more than twenty percent (20%) of the subscribed capital of such corporation, or of the equity of such association or firm; Corporation, association or firm wholly or majority-owned or controlled by any related entity or a group of related entities mentioned in items (2), (4) and (5) hereof.

2.

3.

4.

5.

d.

3. In paragraph 2(a) above, the director, officer or any stockholder should himself be the borrower or recipient of the loan or financial accommodation. Thus, if the borrower is the related interest but not the director, officer or stockholder himself, the director, officer or stockholder is not required to waive the secrecy of his bank deposits. The function of the phrase "who, together with his related interest" in abovequoted Section 26 is to determine whether the loan(s) or financial accommodation(s) exceeds the aggregate ceiling prescribed therein. Moreover, the term "stockholder" means one as defined in Section 83 of Republic Act No. 337, as amended, and its implementing rules in Part III of the Manual of Regulations for Banks and Other Financial Intermediaries,

6.

5. In paragraph 2(b), the terms "loan" or "financial accommodation" shall refer to transactions which involve the grant, renewal or extension or increase of any loan, discount, credit or advance in any form whatsoever, including the transactions considered as such in Part III of the Manual of Regulations for Banks and Other Financial Intermediaries. 6. The following are illustrations of paragraphs 2(c)(2) and 2(c)(3) above: Paragraph 2(c)(2) Thus, if Mr. A, who is a director of Z Bank borrows from Y Bank, he should

1 | BSP Circular 170

waive the secrecy of deposits of whatever nature in all banks in the Philippines since both Y Bank and Z Bank are subsidiaries of X Holding Company. Paragraph 2(c)(3) For purposes of this paragraph, "controlling interest" means ownership of more than 50% of the voting stock or subscribed capital stock of the bank. In the illustration above, the controlling shares in both banks belong to the "same interest", Owner A. The term "same interest" as used herein shall refer to any of the following: a. b. c. The same natural person; The same corporation, partnership or entity; The same family group, i.e., persons related to each other within the third degree of consanguinity or affinity, including any corporation majority or all of the equity of which is owned by such family group; or The same business group, i.e., a group of persons whose stockholdings altogether constitute a majority or control in one or more enterprises.

d.

Thus, if Mr. B., who is a director of Bank Z, borrows from Bank Y, Mr. B should waive the secrecy of his deposits of whatever nature in all banks in the Philippines since the controlling shares in both banks belong to the "same interest". 7. In paragraph 2(d) above, the phrase "maximum amount permitted by law" refers to the limit on loans that may be extended to a director, officer or stockholder under Section 83 of R.A. No. 337, as amended. 8. Violations of Section 26 of Republic Act No. 7653 committed after date of issuance of this Circular, or those committed in connection with loans or financial accommodations granted on or after July 3, 1993 (date of effectivity of Republic Act No. 7653) and which are still outstanding on the date of this Circular, will subject the offender to the sanctions provided under Section 37 of Republic Act No. 7653.

For the Monetary Board: GABRIEL C. SINGSON Governor

2 | BSP Circular 170

Você também pode gostar

- Application For Issuance of Good Moral Character (Ibp Rizal)Documento1 páginaApplication For Issuance of Good Moral Character (Ibp Rizal)kg_batac93Ainda não há avaliações

- IBP Iloilo Chapter Lifetime Request CertificationDocumento1 páginaIBP Iloilo Chapter Lifetime Request CertificationHector Jamandre DiazAinda não há avaliações

- G.R. No. 179448 - People vs TanenggeeDocumento13 páginasG.R. No. 179448 - People vs TanenggeelyrrehcAinda não há avaliações

- Digested Nego CasesDocumento9 páginasDigested Nego CasesBonna De RuedaAinda não há avaliações

- Edited Petition-for-MandamusDocumento4 páginasEdited Petition-for-MandamusStephany PolinarAinda não há avaliações

- Midterm Exams - NegoDocumento3 páginasMidterm Exams - NegoMichael Arthur SantiagoAinda não há avaliações

- Commercial Law Pre-Week Discussions by Atty. Ella EscalanteDocumento28 páginasCommercial Law Pre-Week Discussions by Atty. Ella Escalantejanica246Ainda não há avaliações

- Petition For Annulment AnswerDocumento4 páginasPetition For Annulment AnswerCarmelito Dante ClabisellasAinda não há avaliações

- Warsaw ConventionDocumento6 páginasWarsaw ConventionPaula CaubalejoAinda não há avaliações

- Municipal Court Interpleader CaseDocumento3 páginasMunicipal Court Interpleader CaseStephen Jorge Abellana EsparagozaAinda não há avaliações

- Office of The City ProsecutorDocumento3 páginasOffice of The City ProsecutorMalen Roque SaludesAinda não há avaliações

- Fria JurisprudenceDocumento8 páginasFria JurisprudenceStephanie Lopez100% (1)

- BP 22Documento3 páginasBP 22Cayen Cervancia CabiguenAinda não há avaliações

- Sylt Academy Sues Student for Unpaid TuitionDocumento8 páginasSylt Academy Sues Student for Unpaid TuitionmarjAinda não há avaliações

- 4 Bill of ParticularsDocumento2 páginas4 Bill of ParticularsKetaks MooAinda não há avaliações

- Metropolitan Trial Court Branch - : PlaintiffDocumento5 páginasMetropolitan Trial Court Branch - : PlaintiffJaniceAinda não há avaliações

- Metropolitan Bank & Trust Company, Petitioner, V. G & P Builders, Incorporated, Spouses Elpidio and Rose Violet Paras, Spouses Jesus and Ma. Consuelo Paras and Victoria Paras, Respondents.Documento4 páginasMetropolitan Bank & Trust Company, Petitioner, V. G & P Builders, Incorporated, Spouses Elpidio and Rose Violet Paras, Spouses Jesus and Ma. Consuelo Paras and Victoria Paras, Respondents.Daryst HuertasAinda não há avaliações

- Motion to Avail of Plea Bargaining in Drug CaseDocumento2 páginasMotion to Avail of Plea Bargaining in Drug CaseAtty Arvin LlegoAinda não há avaliações

- STRUCTURAL RUBBER CO. v. PARK RUBBER CO.Documento6 páginasSTRUCTURAL RUBBER CO. v. PARK RUBBER CO.Maree Erika Chrizette Opu-anAinda não há avaliações

- Cases 3 - Extinction or Survival of Civil Liability Ex-DelictoDocumento3 páginasCases 3 - Extinction or Survival of Civil Liability Ex-DelictoAllana NacinoAinda não há avaliações

- G.R. No. 203754Documento2 páginasG.R. No. 203754JushiAinda não há avaliações

- Affidavit of Merit SampleDocumento2 páginasAffidavit of Merit SampleDyan Corpuz-SurescaAinda não há avaliações

- Laguna Tayabas Bus Co V The Public Service CommissionDocumento1 páginaLaguna Tayabas Bus Co V The Public Service CommissionAnonymous byhgZIAinda não há avaliações

- CD - 35 G.R. No. 182307 - BELINA CANCIO AND JEREMY PAMPOLINA, PETITIONERS, VS. PERFORMANCE FOREIGN EXCHANGE CORPORATION, RESPONDENT - DECISION - Supreme Court E-LibraryDocumento2 páginasCD - 35 G.R. No. 182307 - BELINA CANCIO AND JEREMY PAMPOLINA, PETITIONERS, VS. PERFORMANCE FOREIGN EXCHANGE CORPORATION, RESPONDENT - DECISION - Supreme Court E-LibraryRuben100% (1)

- Sample RESOLUTIONDocumento4 páginasSample RESOLUTIONDesiree Jane Espa TubaonAinda não há avaliações

- Motion For Leave To InterveneDocumento32 páginasMotion For Leave To InterveneBonnie BoldenAinda não há avaliações

- Fabre Vs CaDocumento26 páginasFabre Vs CaSonnyAinda não há avaliações

- 3 Complaint-With-Application-For-ReceivershipDocumento4 páginas3 Complaint-With-Application-For-ReceivershipIanLightPajaroAinda não há avaliações

- Alis WritDocumento3 páginasAlis WritYulo Vincent PanuncioAinda não há avaliações

- Sample Information SlanderDocumento2 páginasSample Information SlanderAshleyAinda não há avaliações

- Ian Alba ComplaintDocumento5 páginasIan Alba ComplaintIsidore Tarol III100% (2)

- Banking - Bar QuestionsDocumento11 páginasBanking - Bar QuestionsGenelle Mae MadrigalAinda não há avaliações

- Motion for new trial after default judgmentDocumento1 páginaMotion for new trial after default judgmentTahani Awar GurarAinda não há avaliações

- Affidavit for Preliminary Attachment PhilippinesDocumento1 páginaAffidavit for Preliminary Attachment PhilippinesRached Piamonte Rondina100% (1)

- Salient Features of Philippine Competition ActDocumento17 páginasSalient Features of Philippine Competition ActmayAinda não há avaliações

- Collection Complaint Against DebtorDocumento4 páginasCollection Complaint Against DebtorMatthew Witt100% (2)

- Gabionza v. CADocumento17 páginasGabionza v. CADelmar Jess TuquibAinda não há avaliações

- For GericahDocumento22 páginasFor GericahTauniño Jillandro Gamallo NeriAinda não há avaliações

- Case Digest - As 3Documento21 páginasCase Digest - As 3Mar Darby Parayday100% (2)

- R.A. 9262 Sec. 5a Reiland R. AngelesDocumento2 páginasR.A. 9262 Sec. 5a Reiland R. AngelesDustin NitroAinda não há avaliações

- 2016 Bar QuestionsDocumento12 páginas2016 Bar QuestionsAnonymous 2UPF2xAinda não há avaliações

- Trust Receipt SampleDocumento2 páginasTrust Receipt SampleCecil MaquirangAinda não há avaliações

- InformationDocumento2 páginasInformationJoan PabloAinda não há avaliações

- Doj Opinion 18Documento2 páginasDoj Opinion 18Jennifer BergAinda não há avaliações

- Disbarment Complaint Page OneDocumento1 páginaDisbarment Complaint Page OneManuel MejoradaAinda não há avaliações

- Abdulrahman V OmbudsmanDocumento3 páginasAbdulrahman V OmbudsmanrheyneAinda não há avaliações

- Quiz No. 2 – Trust Receipts Law (PD 115Documento5 páginasQuiz No. 2 – Trust Receipts Law (PD 115Your Public ProfileAinda não há avaliações

- Ejercito v. Sandiganbayan DigestDocumento1 páginaEjercito v. Sandiganbayan DigestDianna Louise Dela GuerraAinda não há avaliações

- Tax Q&ADocumento4 páginasTax Q&AOnat PAinda não há avaliações

- PDIC Vs Philippine Countryside Rural BankDocumento2 páginasPDIC Vs Philippine Countryside Rural BankLiliaAzcarraga100% (1)

- Damnum Absque Injuria DoctrineDocumento2 páginasDamnum Absque Injuria Doctrineaj salazarAinda não há avaliações

- InterpleaderDocumento3 páginasInterpleaderAron Menguito100% (1)

- TRDocumento21 páginasTRanailabuca100% (1)

- Sales and Lease CasesDocumento21 páginasSales and Lease CasesApril Tuanda100% (1)

- Notice of CallDocumento1 páginaNotice of CallCharmila SiplonAinda não há avaliações

- Circular 423 DOSRIDocumento11 páginasCircular 423 DOSRIDaryl G. LiangcoAinda não há avaliações

- c914 - 2016 Updates On DOSRI Rule PDFDocumento19 páginasc914 - 2016 Updates On DOSRI Rule PDFJoey SulteAinda não há avaliações

- BSP Policy StatementsDocumento8 páginasBSP Policy StatementsMark TeaAinda não há avaliações

- Inclusion To SBL To Dosri NotesDocumento2 páginasInclusion To SBL To Dosri NotesRon VirayAinda não há avaliações

- Section X336Documento7 páginasSection X336mjpjoreAinda não há avaliações

- Investigation Data FormDocumento1 páginaInvestigation Data FormCrisz Gogo100% (4)

- 2000 BAR EXAMINATION IN MERCANTILE LAW QUESTIONS AND ANSWERSDocumento16 páginas2000 BAR EXAMINATION IN MERCANTILE LAW QUESTIONS AND ANSWERSsirenangblue100% (4)

- Eagle Star Vs Chia YuDocumento2 páginasEagle Star Vs Chia YuRJ SakuragiAinda não há avaliações

- List of Requirements To Take Bar ExamDocumento1 páginaList of Requirements To Take Bar ExamRJ SakuragiAinda não há avaliações

- Investigation Data FormDocumento1 páginaInvestigation Data FormCrisz Gogo100% (4)

- Guy family feud over shares ownershipDocumento2 páginasGuy family feud over shares ownershipRJ SakuragiAinda não há avaliações

- LawsDocumento3 páginasLawsRJ SakuragiAinda não há avaliações

- Petition To Take The BarDocumento2 páginasPetition To Take The BarRJ SakuragiAinda não há avaliações

- SALES CASE DIGEST HIGHLIGHTS KEY POINTS ON SALE OF LAND AND TENANCY RIGHTSDocumento13 páginasSALES CASE DIGEST HIGHLIGHTS KEY POINTS ON SALE OF LAND AND TENANCY RIGHTSRJ SakuragiAinda não há avaliações

- Case Digested byDocumento2 páginasCase Digested byRJ SakuragiAinda não há avaliações

- 2010 Bar QuestionsDocumento2 páginas2010 Bar QuestionsPrecy Delfin Villa-AgustinAinda não há avaliações

- The Tau Mu HistoryDocumento1 páginaThe Tau Mu HistoryRJ SakuragiAinda não há avaliações

- Customer Name Company MobileDocumento58 páginasCustomer Name Company Mobilefarhana farhana100% (2)

- Audit of Shareholders EquityDocumento6 páginasAudit of Shareholders EquityMark Lord Morales Bumagat71% (7)

- DangCem Peers ComparisonDocumento15 páginasDangCem Peers ComparisonDavid HundeyinAinda não há avaliações

- Rick Berg's 2011 Personal Financial Disclosure FormDocumento44 páginasRick Berg's 2011 Personal Financial Disclosure FormNorthDakotaWayAinda não há avaliações

- WACCDocumento3 páginasWACCsalsabilawidyaAinda não há avaliações

- Anti-Dilution Calculation (English Version)Documento12 páginasAnti-Dilution Calculation (English Version)api-3764496100% (3)

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Large 200 Index ComponentsDocumento401 páginasFundamental Equity Analysis & Analyst Recommendations - STOXX Large 200 Index ComponentsQ.M.S Advisors LLCAinda não há avaliações

- Sime Darby AR2010Documento247 páginasSime Darby AR2010Hamid NajiAinda não há avaliações

- The Asia-Pacific Agency Directory 2013-2014Documento212 páginasThe Asia-Pacific Agency Directory 2013-2014Frank Hayes100% (2)

- BCG - Upstream M-ADocumento18 páginasBCG - Upstream M-AThu NaAinda não há avaliações

- Mayora Indah TBKDocumento95 páginasMayora Indah TBKMegaAinda não há avaliações

- Blackstone S Acquisition of R Systems 1703655912Documento47 páginasBlackstone S Acquisition of R Systems 1703655912bzhqdyr9hbAinda não há avaliações

- CONSEQUENCES (Effects) OF SEPARATE LEGAL PERSONALITYDocumento16 páginasCONSEQUENCES (Effects) OF SEPARATE LEGAL PERSONALITYFrst-Ngwazi Prince Christopher Manda75% (4)

- Annual Report 2020 PT Rajawal NusindoDocumento476 páginasAnnual Report 2020 PT Rajawal NusindoNugiAinda não há avaliações

- Advanced Part 2 Solman MillanDocumento320 páginasAdvanced Part 2 Solman Millanlily janeAinda não há avaliações

- A Strategic Analysis of Woolworths PLCDocumento22 páginasA Strategic Analysis of Woolworths PLCviswas_rsAinda não há avaliações

- Business Organisation: BBA I SemDocumento49 páginasBusiness Organisation: BBA I SemAnchal LuthraAinda não há avaliações

- Corporate Finance FundamentalsDocumento36 páginasCorporate Finance FundamentalsRachmawati 123Ainda não há avaliações

- Seminar Part List London FinalDocumento17 páginasSeminar Part List London FinalBhavesh BhanushaliAinda não há avaliações

- Kasus: Ligand PharmaceuticalsDocumento7 páginasKasus: Ligand PharmaceuticalsMichelle Gabriella MarcAinda não há avaliações

- Consolidated Financial Statements WorksheetDocumento53 páginasConsolidated Financial Statements WorksheetSowmeia Vasudevan100% (2)

- Illustrative Examples 9Documento3 páginasIllustrative Examples 9Banjo A. ReyesAinda não há avaliações

- 1.2.2 - For-Profit Types of BusinessesDocumento35 páginas1.2.2 - For-Profit Types of BusinessesKenny HsuAinda não há avaliações

- Jose Polit-Stock Analysis AssignmentDocumento8 páginasJose Polit-Stock Analysis Assignmentapi-644866295Ainda não há avaliações

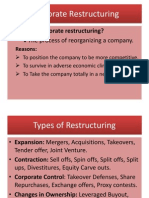

- Corporate RestructuringDocumento27 páginasCorporate RestructuringAkash Bafna100% (1)

- Shareholders' PresentationDocumento29 páginasShareholders' PresentationBernard Tagoe100% (1)

- 2236, Business EnvironmentDocumento31 páginas2236, Business EnvironmentNidhi PrakritiAinda não há avaliações

- Classification of CompanyDocumento20 páginasClassification of CompanygautamAinda não há avaliações

- Private Equity Investment Banking Hedge Funds Venture CapitalDocumento26 páginasPrivate Equity Investment Banking Hedge Funds Venture Capitalpankaj_xaviersAinda não há avaliações

- Citigroup Open Bank Assistance Unredacted FDIC Minutes From 23 Nov 2008 (Lawsuit #2)Documento16 páginasCitigroup Open Bank Assistance Unredacted FDIC Minutes From 23 Nov 2008 (Lawsuit #2)Vern McKinleyAinda não há avaliações