Escolar Documentos

Profissional Documentos

Cultura Documentos

Valuation - Nordea

Enviado por

abeejuDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Valuation - Nordea

Enviado por

abeejuDireitos autorais:

Formatos disponíveis

1

Table of Contents

INTRODUCTION ............................................................................................................... 2 BACKGROUND ...................................................................................................................2 VALUATION METHOD .................................................................................................... 4 Dividend discount model .................................................................................................. 4 Cost of equity ................................................................................................................. 5 VALUATION .......................................................................................................................7 High growth period ........................................................................................................... 8 Stable growth period.......................................................................................................... 8 Final Valuation ..................................................................................................................9 CONCLUSION .................................................................................................................. 10

INTRODUCTION

Financial service firms encompass such organizations as banks, insurance companies, investment funds, credit unions which operate in the finance industry. The finance industry includes a range of such firms which deal mainly with management of money. Financial service firms could also be broadly categorized into four groups according to Damodaran(2002): banks, insurance companies, investment banks and investment firms. Financial service firms like other nonfinancial service firms, work for profit and have to be competitive to attain growth or to even exist. Despite these characteristics financial service firms have a lot in common with other nonfinancial service firms, there are other aspects as well which make financial service firms different from other firms. For other types of firms, valuing a firm and valuing the equity in the firm can be carried out by discounting expected cash flow prior to debt payments at the weighted average cost of capital and by discounting cash flows to equity investors at the cost of equity respectively. For financial service firms, however, estimating cash flow prior to debt payments or a weighted average cost of capital is very difficult since debt and debt payments cannot be easily identified. It is therefore a must to use alternative approach to valuing such firms. Specifically, valuing financial service firms like banks and insurance companies is problematic particularly for a couple of reasons. Damodaran has pointed two of such reasons. The first one is estimating the cash flows to financial service firms is difficult, if not impossible, because the nature of their business makes it hard to define their debt and investment. The second is the fact that they are subject to regulations makes it imperative to consider the effects of such regulations on their value as well. Therefore, in this paper alternative valuation method is used to value Nordea bank which is a financial service firm and the largest financial service group in north Europe. Key financial figures, fundamentals and multiples of the bank are first calculated and anlysed as well.

BACKGROUND

Nordea was formed in 2000 through the merger of domestic banks in Denmark, Finland, Norway and Sweden under a new name Nordea. It is now the largest financial services group in Northern Europe with a market capitalisation of approximately EUR 33bn, total assets of EUR 581bn and a core tier 1 capital ratio of 10.0%. The Nordea share is listed on the NASDAQ OMX Nordic, the stock exchanges in Stockholm (in SEK), Helsinki (EUR) and Copenhagen (DKK). It has a strong performance history compared to other European banks. Figure 1 presents this comparison using DJ STOXX European banks index. Throughout the period from 2001 to 2010, Nordeas share outperformed the index which implies that its performance was above average compared to other banks. Looking at the trend also, Nordeas over time share performance has increased on average from what it was in 2001 even though there were periods the share performance deteriorated. Especially, around 2009, during the culmination of the global financial crisis, the overall all banking industry including Nordea

was to a great extent negatively affected due to increased uncertainty. The Nordea share price appreciated afterwards somewhat on the Stockholm Stock Exchange from SEK 72 to SEK 73,15. The daily closing prices listed for the Nordea share during 2010 ranged between SEK 60,30 and SEK 76,00. During 2010, the OMX Banks Index of the Stockholm Stock Exchange appreciated by 15% and Dow Jones STOXX European banks index appreciated by 27%. Since 6 March 2000, the date of the merger between MeritaNordbanken and Unidanmark, the Nordea share has appreciated 105% and clearly outperformed the Dow Jones STOXX European banks index(-49%).

Figure 1: Nordea share performance compared to other European banks

Source: Nordea annual financial report 2010

Return on Equity (ROE)

Since the valuation of Nordea bank is undertaken using equity valuation model for reasons explained in the following sections, ROE is an important parameter and looking at the level and the trend of this multiple is thus of greater importance. In fact , the two important parameters needed for valuation under this model are the cost of equity, which will estimated later, and the return on equity. ROE measures profitability from the equity investors perspective and is determined both by the companys business choices as well as regulatory restrictions. AS presented in figure 2 , ROE of Nordea bank exhibits more or less stable trend during the period. Except for 2002, it had values more than 10% and it never went up more than 25%. The high level or ROE shows that Nordea has strong capability to generate cash internally and the stability implies that we dont need to adjust it during valuation for other periods too.

VALUATION METHOD

As was stated above, Damoran(2002) pointed out that valuing financial service firms needs different framework because of the unique role debt plays in such firms, the regulatory restrictions they operate under and the difficulty of identifying reinvestment at these firms. Therefore, he suggested two general rules to deal with these features of financial service firms. The first is to just value equity directly instead of the entire firm1. The second one is to consider measures of cashflows which dont require reinvestment needs to be estimated or to redefine reinvestment that is adaptable to a financial service firm.

Dividend discount model

Given Nordea is a financial service firm and because of the unique features of such firms, I valued its equity rather than the entire firm. However, to value its equity, free cash flow to equity2 still has to be estimated first which requires estimating the net capital expenditures or non-cash working capital. But, as already stated, estimating these two components of the free cash flow to equity of financial service firms is very difficult. As presented in figure 3, Nordea pays a large proportion of its earning as dividend and stock buybacks as it is also true for other financial service firms3. The graph shows the sum of dividend payment and stock buybacks at a given year as a proportion of net income at the same year. This ratio ranges from 20% during the financial crisis in 2008 up to 140% in 2005. This indicates that considering only dividend payments during valuation will significantly under value the present value of the stock as there are large amount of stock buybacks in different years(presented in the excel sheet). Thus the payout ratio should be modified accordingly to reflect this amount.

1

He also noted that Equity multiples such as price to earnings or price to book ratios are a much

better fit for financial service firms than value multiples such as value to EBITDA.

2

Free Cashflow to Equity = Net Income Net Capital Expenditures Change in non-cash working capital (Debt repaid New debt issued) 3 Nordea clearly stated its policy of high dividend in the 2000 annual report: Nordea shall pursue a policy of high dividends. The annual level depends on market return requirements and the amount of tier 1 capital needed for development of activities. Dividend payment shall normally exceed 40% of the net profit for the year.

Ratio

1,60 1,40 1,20 1,00 0,80 0,60 0,40 0,20 0,00 1 2 3 4 5 Ratio 6 7 8 9 10

Damodaran stated three possible reasons for this. First, the financial sector in general is more mature than other sectors like telecommunications and software and thus firms in the sector are less likely to retain much of their earnings for future growth. Second, financial service firms, especially banks and insurance companies, dont need to invest as much in capital expenditures as other firms which implies that more of these financial service firms net income is paid out as dividend. The third reason is Banks and insurance companies are better known for reliable, high dividend payments as a result of which they have long been able to attract a growing number of investors and this policy is very difficult to change. Therefore, Valuation of Nordea is undertaken in this section by using dividend payments to stock holders and stock buybacks as cash flows. This estimation gives realistic result if the given firm over time pays out its free cash flows to equity as dividend. This method is appropriate for Nordea given that it pursues a policy of high dividends and large amount of stock buybacks as explained above. Since dividend discount model is one of discount cash flow models, the value of an asset is calculated using the present value of the expected cash flows (dividend + stock buybacks) generated by that asset (the stock). But in order to find present value of any expected cash flow, the rate of return which reflects the riskiness of the asset should be known first. In this valuation since dividend payments are used for valuation, the cost of equity has to be calculated first.

Cost of equity

Investors on Nordea equity, like any other investors, require a return on their investment. The cost of the firms equity is therefore the rate of return the investors require. The required return to equity investors can also be viewed as the sum of the riskless rate and risk premium which the investors need to be compensated with for taking up market risk. That means, the risk premium depends on the firms exposure to market risk. If, for example, Nordea is very exposed to market risk in a sense that its stock returns are highly correlated to the stock market upswings, then it has to pay higher risk premium. Mathematically:

Cost of equity = Riskless rate + Beta(Risk premium)

(1)

This cost of equity has to reflect the portion of the risk in the equity that cannot be diversified away by the marginal investor in the stock. And the beta measures this risk. In other words, Beta measures the exposure of the firm to market risk and it is estimated using historical data on market prices by regressing returns on the firms stock against returns on the DJ STOXX European Banks Index. Damoran argued that though the regression beta estimate is not appropriate for non-financial firms, it could be a good estimate for large and more mature financial service firms. The following regression model is therefore used: (2) Where: is Nordeas stock return in year t, estimator for Nordeas beta. is market returns in year t and b is the

The estimation result together with the regression fit is presented below = 16,05+ 1,093*

( 4,56) (0,15)

R Square=0,87

DJ STOXX European Bank

100,00 80,00 60,00 40,00 20,00 Nordea 0 -20,00 20 40 60

-80

-60

-40

-20

-40,00

-60,00

Therefore, the beta of equity of Nordea is equal to 1,09. Then given the prevailing 5-year Treasury bond rate of 4.5% as a proxy to the riskless rate and historical risk premium of 5.5%, the cost of equity can be calculated using equation (1). Cost of equity= 4.5% + 1,09(5.5%) = 10,5%

Nordea

0,00

VALUATION

An investor buys a stock in Nordea, or any other traded firm, expecting that he will earn some amount of cash flows or dividend as long as the investor still holds the stock and that he can also sell it and earn the price. Therefore, the value of any stock can be estimated using the present value of dividends in perpetuity. Thus in this section, a general valuation of Nordea is carried out using dividend discounted cash flow model where the value of SSABs is calculated via the present value of expected future cash flows on its stocks, discounted at a rate which reflects the riskiness of the cash flows. Value per share of stock = Where: =dividend per share = Cost of equity (3)

Nordeas dividends are expected to grow for five years, from 2011-2015, at high rate which is not constant forever and the growth rate will be sustainable and constant afterwards. Thus, the valuation is carried out using two-stage dividend discount model. There are a couple of characteristics of the bank and the overall banking industry which motivated the use of two stage dividend discount model. First of all, Nordea is assumed to have a little higher growth rate during the first stage because it is now in the top quartile of its European peer group in terms of total shareholder return and it has successfully defended its position and increased market shares by virtue of its financial strength, standing in the market and service delivery during the last 10 years including the global financial crisis period. However, since Nordea wont be able to sustain this higher growth rate forever, it is assumed to grow at the rate of the economy from 2015 onwards. The prime reason for this assumption is the competitive situation in the banking industry being more and more intensified year after year as many banks were able to find new financing, sometimes with the aid of government guarantees and as global players also took a renewed interest in the Nordic region, sometime in the form of new or extended local offices. Therefore, the value of Nordeas stock is estimated using two stage dividend discount model as the sum of the present values of the dividend payments during the extraordinary growth period and the present value of the terminal price. (4)

Equation (4) presents the two-stage dividend discount model adapted for valuation of Nordeas stock according to the assumptions made above. To estimate Expected growth rate of Nordeas earnings Historical growth in earnings is used Furthermore, thecorrelation between past earnings growth and expected future growth is much higher for financial service firms than it is for other firms. Year 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

ROE Pay out ratio Growth rate Geometric mean ROE Pay out ratio Growth rate

0,13 0,43 7,50 0,13 0,42 7,36

0,07 0,76 1,80

0,12 0,48 6,39

0,15 0,40 9,15

0,18 0,21 0,40 0,40 10,50 12,28

0,18 0,41 10,68

0,15 0,10 0,20 0,43 12,04 5,85

0,11 0,44 6,09

Stock buybacks

However, as was discussed previously, Nordea has had a significant amount of stock buybacks during the period which can ultimately affect the dividend payout ratio and change the growth rate. The dividend payout ratio is modified accordingly and it became 62%. This also changes the expected growth rate to 8%. (Calculation included in the excel sheet) (footnote: In order to be able to adjust the Companys capital structure to the capital need existing at any time and to use own shares as payment in connection with acquisitions or in order to finance such acquisitions, the Board of Directors proposes to the AGM 2011 a 10% authorisation to repurchase own shares on a regulated market where the Companys shares are listed, or by means of an acquisition offer directed to all shareholders)

High growth period

Expected Grwoth Earning Per share(EPS) Payout ratio(modified) Dividend Per share(DPS) Cost of Equity Present value Sum 2011 8,00% 0,71 62% 0,44 10,50% 0,40 1,91 2012 8,00% 0,77 62% 0,48 10,50% 0,39 2013 8,00% 0,83 62% 0,52 10,50% 0,38 2014 8,00% 0,90 62% 0,56 10,50% 0,37 2015 8,00% 0,97 62% 0,60 10,50% 0,37

Stable growth period

Since the trend of ROE was more or less stable for the last 10 years we dont need to make adjustment on it. Thus, the payout ratio will not change as well. Terminal price per share= Expected earnings per share2016*Payout ratio/(Cost of Equity-g) During the stable growth period, from 2016 onwards, Nordea is assumed to grow at the rate the economy grows which is 5% and to have beta equal to 1. As a result to calculate the terminal price per share, the cost of equity should be recalculated first to reflect the change in the rate of growth of earnings.

9 Cost of equity = 4.5% + 1(5.5%) = 10%

Thus, using the new cost of equity: Terminal price per share = =EUR 12,63 Present value of terminal price = =EUR 7,67 Graphically, this two-stage growth of Nordeas equity is presented in figure 4. The stage of extraordinary growth is presented by broken lines between 2010 and 2015 and the red lines afterward represent the stable growth period.

0,90 0,80 0,70 0,60 0,50 0,40 0,30 0,20 0,10 0,00 1 2 3 4 5 6 7 8 9 DPS 10 11 12 13 14 15 16 17 18 19 20 Growth rate

Final Valuation

The present value per share for Nordea Bank is finally computed by adding the present values of the dividends during the high growth phase and the presetent value of the terminal price. PV of dividends: high growth = EUR1,91 PV of terminal price = EUR7,63

Value per share

EUR9,5

Nordeas Stock price on 31,2011 was EUR6,97 which shows that it is undervalued.

10

CONCLUSION

As a financial service firm, valuing Nordea requires using an alternative approach other than the one used to value non-financial firms. The major reasons for this are: for one thing, estimating its cash flows prior to debt payments or a weighted average cost of capital is very difficult since debt and debt payments cannot be easily identified and for the other the fact that it is, like any other financial service firms, subject to regulations makes the consideration of the effects of such regulation on the value of the firm very important.

Você também pode gostar

- Maybank Annual Report 2011Documento555 páginasMaybank Annual Report 2011rizza_jamahariAinda não há avaliações

- Deutsche Bank - DBFXDocumento1 páginaDeutsche Bank - DBFXomidreza tabrizianAinda não há avaliações

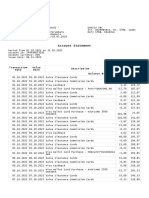

- Extras Card 1-31 OctDocumento4 páginasExtras Card 1-31 Octclonati crAinda não há avaliações

- HSBC Bank ReportDocumento16 páginasHSBC Bank ReportAhsan ButtAinda não há avaliações

- Jan 2010 DCW IssueDocumento48 páginasJan 2010 DCW IssueAdil AbrarAinda não há avaliações

- Bank Statement WPS OfficeDocumento2 páginasBank Statement WPS OfficeAdventurous FreakAinda não há avaliações

- 1.permanent Account Number (Pan)Documento13 páginas1.permanent Account Number (Pan)Ali Shaikh AbdulAinda não há avaliações

- Score and Certified BanksDocumento340 páginasScore and Certified BanksDaysiHuancaTiconaAinda não há avaliações

- International Bank Account Number (IBAN)Documento2 páginasInternational Bank Account Number (IBAN)Flaviub23Ainda não há avaliações

- Credit Card Statement-5Documento3 páginasCredit Card Statement-5ShraddhaAinda não há avaliações

- 2022 Bain Capital Credit (BCC) Application GuidanceDocumento4 páginas2022 Bain Capital Credit (BCC) Application GuidanceLilia Fatma KrichèneAinda não há avaliações

- Sohar International Bank SAOGDocumento9 páginasSohar International Bank SAOGsaleem razaAinda não há avaliações

- BilledStatements 8558 16-04-23 22.39Documento2 páginasBilledStatements 8558 16-04-23 22.39Adish BhagwatAinda não há avaliações

- Citibank'S Epay: Online Credit Card Payment. From Any BankDocumento2 páginasCitibank'S Epay: Online Credit Card Payment. From Any BankHamsa KiranAinda não há avaliações

- Credit FormDocumento2 páginasCredit Formyoeyar@gmail.comAinda não há avaliações

- Fixed DepositDocumento119 páginasFixed Depositshreeya salunkeAinda não há avaliações

- Application For Nigeria Government Treasury Bills: To: Zenith Bank PLCDocumento1 páginaApplication For Nigeria Government Treasury Bills: To: Zenith Bank PLCChidiOkoloAinda não há avaliações

- Reservation and Acquisition AgreementDocumento7 páginasReservation and Acquisition AgreementLjutko MeisterAinda não há avaliações

- Ing Vysya Bank Limited: Statement of AccountDocumento4 páginasIng Vysya Bank Limited: Statement of Accountanoop_mishra1986Ainda não há avaliações

- Pefindo Meriyanti PDFDocumento34 páginasPefindo Meriyanti PDFAnonymous ejNHnXrAinda não há avaliações

- Survey of Popularity of Credit Cards Issued by Different Banks PDFDocumento3 páginasSurvey of Popularity of Credit Cards Issued by Different Banks PDFArvindKushwaha100% (1)

- W-Tax 2306Documento11 páginasW-Tax 2306edgar gutierezAinda não há avaliações

- Credit Cards in VietnamDocumento16 páginasCredit Cards in VietnamTung LamAinda não há avaliações

- Private Debt Presentation - Edl - June 2019Documento23 páginasPrivate Debt Presentation - Edl - June 2019api-276349208Ainda não há avaliações

- CFSBB 8125121-6241.pdf - 1-7.pdf - 1-1Documento1 páginaCFSBB 8125121-6241.pdf - 1-7.pdf - 1-1ahmedkanewwiseAinda não há avaliações

- Titular Xiad en 402 Howard St. South Bend INDIANA 46617 0000 00 01 0000 07003 00 0100 VPN 100 07/17Documento2 páginasTitular Xiad en 402 Howard St. South Bend INDIANA 46617 0000 00 01 0000 07003 00 0100 VPN 100 07/17Gerson ChirinosAinda não há avaliações

- Dated: 9Th September 2002Documento10 páginasDated: 9Th September 2002michim_1Ainda não há avaliações

- DS NHDL 311213Documento29 páginasDS NHDL 311213Khiem NguyenAinda não há avaliações

- EziDebit - DDR Form - CompletePTDocumento2 páginasEziDebit - DDR Form - CompletePTAndrewNeilYoungAinda não há avaliações

- OB Report On Barclays Bank PDFDocumento22 páginasOB Report On Barclays Bank PDFUsman AhmedAinda não há avaliações

- Internship Report (Rida)Documento46 páginasInternship Report (Rida)Tania AliAinda não há avaliações

- Patria Bank S.A: Extras de Cont / Account StatementDocumento3 páginasPatria Bank S.A: Extras de Cont / Account StatementRommel FrumuseluAinda não há avaliações

- 2019 11 SNS BANK + SNS REAAL OfferDocumento5 páginas2019 11 SNS BANK + SNS REAAL OfferSouthey CapitalAinda não há avaliações

- RQCV HUBo Z4681 J EZDocumento8 páginasRQCV HUBo Z4681 J EZSACHAinda não há avaliações

- Personalizing Your Own Compliance Manual Template 3Documento20 páginasPersonalizing Your Own Compliance Manual Template 3williamhancharekAinda não há avaliações

- Methods of PaymentDocumento3 páginasMethods of PaymentEric KipkemoiAinda não há avaliações

- MasterCard JJDocumento7 páginasMasterCard JJjohnjamgochianAinda não há avaliações

- Meezan Bank AccountsDocumento17 páginasMeezan Bank AccountsHamza AkbarAinda não há avaliações

- Credit Card Statement: Personal Information. It Has Not Materiall Changed Since May 2015. For A Copy, Go ToDocumento2 páginasCredit Card Statement: Personal Information. It Has Not Materiall Changed Since May 2015. For A Copy, Go ToPavlo RiabovAinda não há avaliações

- Citi Foundation 2023 Global Challenge ApplicationDocumento17 páginasCiti Foundation 2023 Global Challenge Applicationpatalata100% (1)

- Authorization To Use and Charge Credit Card: SMC Skyway CorporationDocumento1 páginaAuthorization To Use and Charge Credit Card: SMC Skyway CorporationDarryl Coleta100% (2)

- NAB Choice Package Home LoanDocumento2 páginasNAB Choice Package Home LoanMillie JaisinghaniAinda não há avaliações

- Bank@Campus Account - ICICI Bank LTDDocumento1 páginaBank@Campus Account - ICICI Bank LTDKumar RanjanAinda não há avaliações

- Cash: Bank Reconciliations: What Is A Bank Reconciliation?Documento5 páginasCash: Bank Reconciliations: What Is A Bank Reconciliation?Jireh RiveraAinda não há avaliações

- Low Default Portfolios: A Proposal For Conservative Estimation of Default ProbabilitiesDocumento31 páginasLow Default Portfolios: A Proposal For Conservative Estimation of Default ProbabilitiesandreAinda não há avaliações

- International Bank Account Numbers: Sending and Receiving Payments To or From Europe in EurosDocumento2 páginasInternational Bank Account Numbers: Sending and Receiving Payments To or From Europe in EurosBibi LavenderAinda não há avaliações

- Sungai Kayan Plantation Company No 47 Jalan Ajibah Abol 93400 KUCHINGDocumento1 páginaSungai Kayan Plantation Company No 47 Jalan Ajibah Abol 93400 KUCHING林本Ainda não há avaliações

- Personal Data Protection PolicyDocumento17 páginasPersonal Data Protection PolicyRaja HermansyahAinda não há avaliações

- Online StatementDocumento4 páginasOnline Statementdaliesavard32Ainda não há avaliações

- GAFTA Arbitration RulesDocumento13 páginasGAFTA Arbitration Ruleskologlu9100% (1)

- KSFE Chitty 054000001548 Payment Receipt DuplicateDocumento1 páginaKSFE Chitty 054000001548 Payment Receipt DuplicateIjas AslamAinda não há avaliações

- Lol - 2019 09 06 Financial OpportunitiesDocumento3 páginasLol - 2019 09 06 Financial OpportunitiesOildeals Ng100% (1)

- USD STMT Aug To Oct 2020 For KOMDocumento3 páginasUSD STMT Aug To Oct 2020 For KOMsimple footballAinda não há avaliações

- Annexure A Application For MSME Loan Upto Rs.100 LakhDocumento6 páginasAnnexure A Application For MSME Loan Upto Rs.100 LakhChayan MajumdarAinda não há avaliações

- Post Merger Performance Analysis of Standard Chartered Bank PakistanDocumento10 páginasPost Merger Performance Analysis of Standard Chartered Bank PakistanAdnan SiddiqueAinda não há avaliações

- 0702416281102101112021Documento2 páginas0702416281102101112021balachandra123456Ainda não há avaliações

- Value Date Post Date Remitter Branch Description Cheque No. Debit AmountDocumento3 páginasValue Date Post Date Remitter Branch Description Cheque No. Debit AmountNithiyandran RajAinda não há avaliações

- Total Statement SummaryDocumento4 páginasTotal Statement SummaryIia AdvertisementsAinda não há avaliações

- QR Merchant Application FormDocumento2 páginasQR Merchant Application FormМєяяїгг ВєяиндяԁAinda não há avaliações

- Assignment Next PLCDocumento16 páginasAssignment Next PLCJames Jane50% (2)

- Aspires Aggressive Market Share: UnratedDocumento10 páginasAspires Aggressive Market Share: Unratedmbts.14014cm020Ainda não há avaliações

- Fundamentals of Investing 13th Edition Smart Test BankDocumento41 páginasFundamentals of Investing 13th Edition Smart Test Bankericduzhpfv7100% (29)

- Singur and Nandigram and The Untold Story OF Capitalised MarxismDocumento145 páginasSingur and Nandigram and The Untold Story OF Capitalised MarxismChandan BasuAinda não há avaliações

- Structured FinanceDocumento87 páginasStructured FinanceJuan Manuel FigueroaAinda não há avaliações

- TSLA Stock Quote - Tesla Motors IncDocumento2 páginasTSLA Stock Quote - Tesla Motors IncBaikaniAinda não há avaliações

- M. Com. I Advanced Accountancy Paper-I AllDocumento134 páginasM. Com. I Advanced Accountancy Paper-I Allसदानंद देशपांडेAinda não há avaliações

- FA5Documento3 páginasFA5Gray JavierAinda não há avaliações

- Warner Company Statement of Cash FlowsDocumento2 páginasWarner Company Statement of Cash FlowsKailash KumarAinda não há avaliações

- Accounting For InventoriesDocumento32 páginasAccounting For InventoriesShery HashmiAinda não há avaliações

- Free Cash Flow To Equity Discount ModelsDocumento2 páginasFree Cash Flow To Equity Discount ModelsDavid Ignacio Berastain HurtadoAinda não há avaliações

- Mrweb Finance: Whitepaper 2.0Documento18 páginasMrweb Finance: Whitepaper 2.0khalidAinda não há avaliações

- Chap 13Documento33 páginasChap 13Boo LeAinda não há avaliações

- Risk Management in ONGCDocumento9 páginasRisk Management in ONGCAdithya BangaloreAinda não há avaliações

- Oi Pulse Manual FileDocumento257 páginasOi Pulse Manual FileManish BarnwalAinda não há avaliações

- Free Online Calculators - Math, Fitness, Finance, ScienceDocumento3 páginasFree Online Calculators - Math, Fitness, Finance, SciencejAinda não há avaliações

- RECEIPT UTILITIES 20210312 Elektrik EapDocumento1 páginaRECEIPT UTILITIES 20210312 Elektrik EapTahap TeknikAinda não há avaliações

- AEV Balance Sheet: Total Current AssetsDocumento5 páginasAEV Balance Sheet: Total Current AssetsJoyce Ann Agdippa BarcelonaAinda não há avaliações

- Interest Rate Derivatives - A Beginner's Module CurriculumDocumento66 páginasInterest Rate Derivatives - A Beginner's Module CurriculumPankaj Bhasin100% (1)

- Annual Report: FPSB IndiaDocumento68 páginasAnnual Report: FPSB IndiaAnil AnveshAinda não há avaliações

- DT.22.2 FM - Midterm ExaminationDocumento35 páginasDT.22.2 FM - Midterm ExaminationJericho GeranceAinda não há avaliações

- Fractional Share FormulaDocumento1 páginaFractional Share FormulainboxnewsAinda não há avaliações

- Solutions 67Documento7 páginasSolutions 67dklus12Ainda não há avaliações

- Factors Affecting Credit Card PDFDocumento10 páginasFactors Affecting Credit Card PDFAshik Ahmed NahidAinda não há avaliações

- Five Star Training Academy: NerangDocumento1 páginaFive Star Training Academy: NeranghemssAinda não há avaliações

- Wasting AssetsDocumento4 páginasWasting AssetsjomelAinda não há avaliações

- A Project Report On Taxation in IndiaDocumento59 páginasA Project Report On Taxation in IndiaYash Bhagat100% (1)

- Cash Problem 1Documento3 páginasCash Problem 1Dawson Dela CruzAinda não há avaliações

- University of Kota - Kota: Day Date Time Subject PaperDocumento3 páginasUniversity of Kota - Kota: Day Date Time Subject PaperDinesh LalwaniAinda não há avaliações

- Research CryptocurrencyDocumento19 páginasResearch Cryptocurrencymayhem happening100% (1)

- Solved Will and Sandra Emmet Were Divorced This Year As PartDocumento1 páginaSolved Will and Sandra Emmet Were Divorced This Year As PartAnbu jaromiaAinda não há avaliações

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamAinda não há avaliações

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialAinda não há avaliações

- The Value of a Whale: On the Illusions of Green CapitalismNo EverandThe Value of a Whale: On the Illusions of Green CapitalismNota: 5 de 5 estrelas5/5 (2)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 3.5 de 5 estrelas3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNo EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthNota: 4 de 5 estrelas4/5 (20)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNo Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNNota: 4.5 de 5 estrelas4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNo EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaNota: 4.5 de 5 estrelas4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successNo EverandReady, Set, Growth hack:: A beginners guide to growth hacking successNota: 4.5 de 5 estrelas4.5/5 (93)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNota: 4.5 de 5 estrelas4.5/5 (32)

- Creating Shareholder Value: A Guide For Managers And InvestorsNo EverandCreating Shareholder Value: A Guide For Managers And InvestorsNota: 4.5 de 5 estrelas4.5/5 (8)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyNo EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyNota: 3 de 5 estrelas3/5 (1)

- Corporate Finance Formulas: A Simple IntroductionNo EverandCorporate Finance Formulas: A Simple IntroductionNota: 4 de 5 estrelas4/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNo EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingNota: 4.5 de 5 estrelas4.5/5 (17)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceNo EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceNota: 4 de 5 estrelas4/5 (1)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNo EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisNota: 5 de 5 estrelas5/5 (6)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsNo EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsNota: 4.5 de 5 estrelas4.5/5 (21)

- Product-Led Growth: How to Build a Product That Sells ItselfNo EverandProduct-Led Growth: How to Build a Product That Sells ItselfNota: 5 de 5 estrelas5/5 (1)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorAinda não há avaliações

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Financial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessNo EverandFinancial Leadership for Nonprofit Executives: Guiding Your Organization to Long-Term SuccessNota: 4 de 5 estrelas4/5 (2)

- Mind over Money: The Psychology of Money and How to Use It BetterNo EverandMind over Money: The Psychology of Money and How to Use It BetterNota: 4 de 5 estrelas4/5 (24)

- YouTube Marketing: Comprehensive Beginners Guide to Learn YouTube Marketing, Tips & Secrets to Growth Hacking Your Channel and Building Profitable Passive Income Business OnlineNo EverandYouTube Marketing: Comprehensive Beginners Guide to Learn YouTube Marketing, Tips & Secrets to Growth Hacking Your Channel and Building Profitable Passive Income Business OnlineNota: 4.5 de 5 estrelas4.5/5 (2)

- The Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressNo EverandThe Illusion of Innovation: Escape "Efficiency" and Unleash Radical ProgressAinda não há avaliações