Escolar Documentos

Profissional Documentos

Cultura Documentos

Kruti MAP Assgn

Enviado por

Kruti VadodariaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Kruti MAP Assgn

Enviado por

Kruti VadodariaDireitos autorais:

Formatos disponíveis

MARKETING APPLICATIONS AND PRACTICES A Report on FMCG Sector (Fruit Juice Industry)

SUBMITTED BY: Kruti Vadodaria MMS B- 110

1) Company- Coco-Cola Product category- Fruit Drink (Maaza)

2) Portfolio-Beverages

3) Mangola, Slice, Tropicana, Frooti, Real, Appy Fizz, Nimbu Fresh etc.

4) The Beverage market is estimated to be worth approx. Rs. 13,000 crore and the Fruit Drink industry amounts to approx. Rs.3500 crore

5) The various categories falling under the umbrella of Beverages are: Mineral Water Soft Drink Fruit Drinks Hot Drinks-Tea/Coffee Energy Drinks Dairy Product Drinks-Buttermilk, Lassi Health Drinks-GluconD, Bournvita etc. Alchoholic Drinks

6) The product category of Fruit Drinks can be classified into three segments: Fruit Juice 100% pulp (Maaza, Frooti, Slice)-Economy Nectar 25% to 50% added sugar (Real-Fruit Power, Tropicana-Mixed Fruit Juice)Premium 100% juice (Tropicana Pure Premium-No pulp, Real-Active Fibre)-Super Premium

7) The industry of Fruit Drinks has grown at a growth rate of 30% per annum over the last 5 years. The overall Beverage market has the potential to grow at 18% per annum.

8) The market leader in the Indian Fruit Drink industry is Dabur with a market share of 52% courtesy its two major brands- (Real-Fruit Power, Real Active).

9) RECENT TRENDS IN THE INDUSTRY In recent years, Indians have displayed a marked preference for juices over carbonated drinks. This can be partly attributed to a negative publicity campaign against soft drink manufacturers regarding the ingredients found in their products. While non-packaged fruit juices are already popular in India, it is the packaged fruit juice segment that has witnessed tremendous growth of late. People consider packaged fruit juices to be more hygienic than non-packaged ones as the former are available in sealed packs. While it is a fact that packaged fruit juices are costlier than non-packaged ones, this is unlikely to pose a major challenge for the juice manufacturers, given that the disposable income in the hands of Indian consumers has almost doubled since 1985. Some of the major challenges faced by juice manufacturers in India include the reluctant attitude displayed by local farmers towards fruit farming, current volatility in prices of fruits and the lack of storage facilities for fruit-products. The emerging concept of juice bars and the recent trend of health awareness among the population have together contributed towards making the consumption of juices much more popular than before in India. Every company is trying to introduce new and unique flavours in the market and they are also working on different strategies to make their products more popular. A number of companies are trying to capture the untapped segment of the market aimed at children. The rural market in India has huge growth potential in this regard. With the availability of a wide range of options, Indian consumers have become much more brand conscious these days. Consequently, the domestic juice market has also witnessed the emergence of a number of branded players. Private label juice brands are also expected to grab a larger share of the market, with the government announcing FDI in multi-brand retail. Current trends suggest that the domestic players are competing well with the multinational companies. Entry of smaller brands is also a very good sign for the overall juice market in India.

10) Penetration Level of the fruit juice industry in the rural area is as high as 85% and that for urban area is around 99%. Thus the penetration is around 99% for overall India.

11) INNOVATIONS IN THE FRUIT JUICE INDUSTRY BY COCA-COLA Maaza, Indias biggest and most favorite juice drink brand, today unveiled an innovative communication initiative for 2009 aptly called Aam ki Pyaas (i.e. Thirst for Mangoes). The new communication program has been designed to position Maaza as the best and the only way to quench the thirst of Mango lovers who have an ultimate desire to have Mango, anywhere and anytime, best captured by the tagline, Maaza Lao Aam ki Pyaas Bujhao (i.e. Quench your thirst for Mangoes by Maaza). In-addition, the company has also has Minute Maid Pulpy Orange, a naturally refreshing juice drink, offering an unmatched taste experience due to the presence of natural Orange Pulp. With a larger juice drink portfolio and by launching a fresh communication for Maaza, Coca-Cola in India is all set to extend its leadership in the juice drink segment.

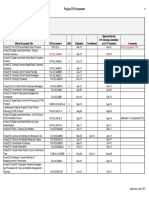

12) Organized 13) Supermarket (Convenience Stores)- Reliance Fresh- Mira Road 14) 1 15) Yes 16) Fruit Juice brands Maaza, Mangola, Slice, Tropicana, Frooti, Real-Fruit Power, Tropicana-Mixed Fruit Juice, Real-Active Fibre 17) Around 70-80 Maaza bottles of 1.2l and about 40-50 bottles of 600ml are held at Reliance Fresh-Mira Road outlet 18) Rank 1-Maaza Rank 2- Slice Rank-3- Mangola 19) Same as 16

20) PRICE OFFERS Save Rs.18/- on purchase of Maaza. Buy a Maaza (1.2l) worth Rs.58/-onwards Get at Rs.40/- onwards. Save Rs.20/- on purchase of Slice 1.2ltr Buy a Slice (1.2l) worth Rs.53/-onwards at Rs.33/- onwards. Hurry! Grab it today. Though the price of Maaza was higher as compared to Slice it has a good market demand because of the taste, quality and brand value 21) NA

22) NA 23) MARKET LEADERS IN DIFFERENT CATEGORIES OF BEVERAGE INDUSTRIES Mineral Water Bisleri with 60% market share Soft Drink Coca-Cola-Thums-up with 60.5% market share Fruit Drinks Dabur-Real with 52% market share Energy Drinks- Red bull with 95% market Share Dairy(Probiotic) Drinks - Amul-Masti with 70% market share Health Drinks- GlaxoSmithKline-Horlicks with 51% market share Alcoholic Drinks - United spirits with about 60 % of market share

24) COMPETITIVE ANALYSIS Mangoes are a summer obsession and mango drinks their chilled, refreshing, pulpy substitute. To cash in on the scorching, sultry summers, beverage majors PepsiCo and CocaCola have launched new campaigns for their non-fizzy mango drinks, Slice and Maaza. While Slice has unveiled a new campaign in the popular Aamsutra series to welcome the summer season, Maaza has come up with a new positioning tactic with the its Har Mausam Aam campaign as a year round option, irrespective of the season. Summer pull Vs all season treat

The latest brand campaign for Maaza has positioned the mango drink as an all season brand, which is available throughout the year, irrespective of the time of the year. This new communication strategy is a marked departure from their advertising strategy since the past few years when Maaza was positioned as the ideal substitute for mango. While Maaza is reinforcing the year round availability positioning, Slice from PepsiCo is focusing on the season of mangoes summers, for its new campaign. Thus, PepsiCo has continued the Aamsutra brand proposition with a new campaign for Mango Slice, Ab Ras Barsega and made its approach more season-centric. Fruit of the matter

Moreover, there seems to be a slight differentiation in terms of their target audience. Maaza initially targeted children and young adults but its recent marketing campaigns seem to focus more on the youth. Slice, on the other hand with its playful and sensuous advertisements would cater more to a slightly mature audience as opposed to a younger segment. One of the major differences between the two therefore remains its current positioning and marketing campaigns. Slice has witnessed a boost in sales after signing Bollywood celebrity, Katrina Kaif to endorse the brand and their Aamsutra campaigns have been successful in striking a chord with the audience. Maaza, on the other hand does not have a brand ambassador and it relies heavily on its advertising initiatives.

25) RECENT STRATEGIES BY COMPANY Coca-Cola in India, as part of its continuous endeavor to bring new and enriching experiences to its consumers, today announced the launch of a slew of new innovative offerings. Launched exclusively for Mumbaikars, Frosted bottles of Coca-Cola, Diet Coke and Sprite have been made available for the first time in the country.

To add further excitement, Indias largest beverage company also extended the Schweppes range of its international brand portfolio. In-addition, Coca-Cola would also make available, Minute Maid, its premium juices in flavours like orange, tomato, strawberry and multi vitamin. All these new innovations have been made available in over 45 select locations across Mumbai city - includes cafs, high end restaurants and 5 star hotels. The innovative, premium frosted bottles of Coca-Cola, Diet Coke and Sprite are priced at Rs. 35 per 250 ml bottle. The Schweppes brand portfolio of Coca-Cola launched in India includes premium water, tonic water and soda water. The Schweppes range has been priced at Rs 30, Rs 30 and Rs 20 respectively. Coca-Colas premium range of juices, Minute Maid, made available to Mumbaikars includes flavours like orange, tomato, strawberry and multivitamin, all in 200 ml bottles, priced at Rs. 50. Coca-Cola India refreshes millions of consumers throughout the country with an exciting range of beverages including Coca-Cola, Diet Coke, Thums Up, Fanta, Limca, Sprite, Maaza, Georgia, Georgia Gold, Kinley and Kinley Club Soda through a network of more than one million outlets. The company has invested more than US$ 1 billion in its Indian operations, emerging as one of the country's top international investors and employs approximately 6,000 people in India. After successfully delighting consumers with the refreshing taste of Minute Maid Pulpy Orange & Minute Maid Nimbu Fresh, Coca-Cola India today announced the launch of its Minute Maid 100% juice range in India. The launch further strengthens Coca-Cola India's diverse product portfolio, comprising of home grown and globally available sparkling and still products.

Você também pode gostar

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- 04 SAMSS 005 Check ValvesDocumento9 páginas04 SAMSS 005 Check ValvesShino UlahannanAinda não há avaliações

- 39ED3050CT - RT49S - AP Service ManualDocumento31 páginas39ED3050CT - RT49S - AP Service Manualبوند بوند100% (1)

- Astm 2017-F2059Documento5 páginasAstm 2017-F2059laythAinda não há avaliações

- Brief Summary of Catalytic ConverterDocumento23 páginasBrief Summary of Catalytic ConverterjoelAinda não há avaliações

- Manufacuring EngineeringDocumento3 páginasManufacuring Engineeringapi-79207659Ainda não há avaliações

- Analysis of LaminatedDocumento31 páginasAnalysis of LaminatedKaustubh JadhavAinda não há avaliações

- Updating - MTO I - Unit 2 ProblemsDocumento3 páginasUpdating - MTO I - Unit 2 ProblemsmaheshAinda não há avaliações

- Angewandte: ChemieDocumento13 páginasAngewandte: ChemiemilicaAinda não há avaliações

- ReviewerDocumento3 páginasReviewerKristine SantominAinda não há avaliações

- Abdominal Examination OSCE GuideDocumento30 páginasAbdominal Examination OSCE Guideزياد سعيدAinda não há avaliações

- Solid Modeling Techniques: Constructive Solid Geometry (CSG)Documento22 páginasSolid Modeling Techniques: Constructive Solid Geometry (CSG)amolAinda não há avaliações

- Chemical Bonds WorksheetDocumento2 páginasChemical Bonds WorksheetJewel Mae MercadoAinda não há avaliações

- FAJASDocumento891 páginasFAJASCecilia GilAinda não há avaliações

- Approved Project 25 StandardsDocumento5 páginasApproved Project 25 StandardsepidavriosAinda não há avaliações

- Conformational Analysis: Carey & Sundberg: Part A Chapter 3Documento53 páginasConformational Analysis: Carey & Sundberg: Part A Chapter 3Dr-Dinesh Kumar100% (1)

- SPM 1449 2006 Mathematics p2 BerjawapanDocumento18 páginasSPM 1449 2006 Mathematics p2 Berjawapanpss smk selandar71% (7)

- LPG GasDocumento39 páginasLPG Gasv prasanthAinda não há avaliações

- A Textual Introduction To Acarya Vasuvan PDFDocumento3 páginasA Textual Introduction To Acarya Vasuvan PDFJim LeeAinda não há avaliações

- HMT RM65 Radial DrillDocumento2 páginasHMT RM65 Radial Drillsomnath213Ainda não há avaliações

- Exp6.Single Phase Bridge Inverter Using PWMDocumento6 páginasExp6.Single Phase Bridge Inverter Using PWMAbdullah MohammedAinda não há avaliações

- MiscanthusDocumento27 páginasMiscanthusJacob GuerraAinda não há avaliações

- Guidelines For The Management of Brain InjuryDocumento26 páginasGuidelines For The Management of Brain InjuryfathaAinda não há avaliações

- Aircraft Design Course PhillStocking 4.2Documento48 páginasAircraft Design Course PhillStocking 4.2ugurugur1982Ainda não há avaliações

- American University of BeirutDocumento21 páginasAmerican University of BeirutWomens Program AssosciationAinda não há avaliações

- Pythagorean Theorem WorksheetDocumento11 páginasPythagorean Theorem WorksheetJames ChanAinda não há avaliações

- Zincanode 304 pc142Documento3 páginasZincanode 304 pc142kushar_geoAinda não há avaliações

- Full Download Short Term Financial Management 3rd Edition Maness Test BankDocumento35 páginasFull Download Short Term Financial Management 3rd Edition Maness Test Bankcimanfavoriw100% (31)

- MioPocket ReadmeDocumento30 páginasMioPocket Readmelion78Ainda não há avaliações

- Unit 2 - Presentations (Image, Impact and Making An Impression) 2Documento25 páginasUnit 2 - Presentations (Image, Impact and Making An Impression) 2LK Chiarra Panaligan100% (1)

- BECO UACE Chem2Documento6 páginasBECO UACE Chem2EMMANUEL BIRUNGIAinda não há avaliações