Escolar Documentos

Profissional Documentos

Cultura Documentos

Shree Rama Multi-Tech Ltd1 140114

Enviado por

Chaitanya JagarlapudiDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Shree Rama Multi-Tech Ltd1 140114

Enviado por

Chaitanya JagarlapudiDireitos autorais:

Formatos disponíveis

CORRIGENDUM TO THE PUBLIC ANNOUNCEMENT TO THE EQUITY SHAREHOLDERS OF

SHREE RAMA MULTI-TECH LIMITED

(Registered Office: 603, Shikhar Shreemali Society, Near Vadilal House, Mithakhali, Navrangpura, Ahmedabad 380 009; Tel. No.: 079 2656 9855; 2656 9455; Fax No.: 079 2656 2667)

This Corrigendum to the Public Announcement (Corrigendum) is being issued by PL Capital Markets Pvt. Ltd. (PLCM or Manager to the Offer), for and on behalf of Nirma Industries Private Ltd. (NIPL) and Nirma Chemical Works Private Ltd. (NCWPL) (hereinafter jointly referred as Acquirers) to the equity shareholders of Shree Rama Multi-Tech Ltd. (SRMTL or Target Company) pursuant to and in compliance with Regulations 10 and 12 of the Securities and Exchange Board of India (Substantial Acquisition of Shares & Takeovers) Regulations, 1997 & subsequent amendments thereto ( Regulations).This Corrigendum should be read in continuation of and in conjunction with the PA made in accordance with Regulation 15(1) of the Regulations in the same newspapers on 26th July, 2005 and the Letter of Offer dated 9th January, 2014 which has been dispatched to the Shareholders of SRMTL on 11th January, 2014. Capitalized terms used but not defined in this Corrigendum shall, except to the extent modified hereunder, have the same meanings as assigned to such terms in the PA and/or the Letter of Offer. The Shareholders are requested to note the following significant developments / information related to the Offer following the date of the PA until the date of this Corrigendum: a. The PA for the captioned Offer in terms of Regulation 15 of the Regulations was made by LKP Shares and Securities Ltd. being the then manager to the Offer, on behalf of the Acquirers. Subsequently, the Acquirers discovered fraudulent embezzlement of funds in SRMTL and requested SEBI to allow them to withdraw the Offer, which was rejected by SEBI vide its letter dated April 30, 2007. The Acquirers filed an appeal before the Honble Securities Appellate Tribunal (SAT) under Section 15T of the SEBI Act. The Honble SAT vide its order dated 5th June, 2008 rejected the appeal of the Acquirers. In response to said order of the SAT, the Acquirers made an appeal to the Honble Supreme Court of India. The Honble Supreme Court of India vide order dated 9th May, 2013 dismissed the appeal of the Acquirers and upheld the decision of SEBI and SAT whereby the Acquirers were denied the right to withdraw the Offer. Accordingly, in terms of the order of the Supreme Court of India, the Acquirers are now completing the Offer made vide the PA. The Regulations have since been replaced by the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations 2011 (New Regulations). However, since the PA of the Offer was made prior to the New Regulations coming into force, the Offer has been made in accordance with the provisions of the Regulations. For the purpose of completing the Offer, the Acquirers have decided to appoint PLCM, as the Manager to the Offer in place of LKP Shares and Securities Ltd. Accordingly, the Acquirers, LKP Securities Ltd. (the merged entity after LKP Shares and Securities Ltd. was merged into LKP Securities Ltd.) and PLCM have executed a letter on June 8, 2013 whereby it has been agreed by all parties that the engagement of LKP Securities Ltd. as manager to the Offer is substituted by PLCM. The Acquirers vide letter dated June 10, 2013 have appointed PLCM, as the Merchant Banker to the Offer, in terms of Regulation 13 of the Regulations. Similarly there has been a change in the Registrar to the Offer. Earlier, Intime Spectrum Registry Ltd. (now called Link Intime India Private Ltd.) was appointed by the Acquirers as the registrar to the Offer. Subsequently, the Acquirers have decided to appoint Karvy Computershare Pvt. Ltd as the Registrar to the Offer. A confirmatory letter dated June 14, 2013 was executed between the Acquirers, Link Intime India Private Ltd. and Karvy Computershare Pvt. Ltd. whereby, the engagement of Link Intime India Private Ltd. as the registrar to the Offer was terminated and Karvy Computershare Pvt Ltd was appointed as the Registrar to the Offer. Nirma Industries Ltd. was converted into private limited company and a fresh certificate of incorporation was issued on 20th February, 2009 and its name changed to Nirma Industries Pvt. Ltd. Nirma Chemical Works Ltd. was converted into private limited company and a fresh certificate of incorporation was issued on 25th February, 2009 and its name changed to Nirma Chemical Works Pvt. Ltd. A revised Draft Letter of Offer (DLOF) in respect of the Offer has been filed by PLCM with SEBI, Mumbai on August 1, 2013 in terms of the Regulations. SEBI has issued its final comments on the DLOF vide its letter bearing number CFD/DCR/SKS/138/2014 dated January 2, 2014. The Original Shareholders will be entitled to receive Applicable Interest. The relevant definitions are as under: Original Shareholders: Those registered Shareholders (excluding the Acquirers, Issuer Companies and Pledger Sellers) who were holding Share(s) as on Trigger Date i.e. 22nd July, 2005 and continue to hold the same Share(s) till the date of offering those Share(s) in this Offer Applicable Interest: Rs.14.31 per Share payable to Original Shareholders as defined above towards the delay in the payment of Offer Price i.e. from 14th June, 2006 till 19th February, 2014 being the assumed last date of payment at a simple interest rate of 10% per annum (the interest amount is subject to change depending upon the actual date of payment). (For further details please refer para 5.3 of the Letter of Offer.) Other Financial Data for the period from Dividend Earning per share (face value of Rs. 10) Return on networth Book value per share (face value of Rs. 10) Unit (%) (Rs.) (%) (Rs.) 1st April, 2013 to 30th November, 2013 Nil 95.60 2.66 3,599.32 Profit & Loss Statement Total Income Total Expenditure Profit/(Loss) After Tax Balance Sheet Statement SOURCES OF FUNDS Issued, Subscribed & Paid up Equity Share capital Add: Forfeited Shares 15% Cumulative Redeemable Preference Shares (Rs. in Lacs) Particulars Total Income Profit After Tax Networth Other Financial Data for years ended 31st March Dividend Earning per share (face value of Rs. 10) Return on networth Book value per share (face value of Rs. 10) Unit (%) (Rs.) (%) (Rs.) 2013 (Audited) 11,086.64 7,374.26 70,074.43 2013 (Audited) Nil 368.71 10.52 3,503.72 2012 (Audited) 4,901.53 1,699.71 62,700.17 2012 (Audited) Nil 84.99 2.71 3,135.00 2011 (Audited) 1,499.95 (2,186.03) 2010 (Audited) 5639.30 1884.04 Total paid-up capital Reserves and Surplus (excluding revaluation reserve) Networth 24. The para no. 4.6 of the PA stands revised as under: As on date of this Corrigendum, SRMTL has no outstanding instrument in the nature of fully convertible debentures/ partly convertible debentures, etc. convertible into the Shares on any later date. There has been no merger / de-merger or spin-off of SRMTL s business operations during the past 3 years. 25. The para no. 4.8 of the PA stands revised as under: The Board of Directors of SRMTL has approved a composite scheme of compromise and arrangement at its meeting held on 15th March, 2008 (Scheme) with its lenders and the Shareholders. The Scheme is subject to the approval of the Gujarat High Court which is currently pending. The existing paid up share capital of SRMTL is proposed to be reduced by 90% to Rs. 3.71 Crores by consolidating Shares from face value of Rs. 5 each to Rs. 10 each and then cancelling 90% of the face value of each equity share. The Acquirers shall infuse Rs. 21 Crores in SRMTL by way of additional equity within 30 days from the date on which the Scheme is approved by the Gujarat High Cour t. However, since the Scheme is yet to be approved by the Gujarat High Court and a considerable time has lapsed, the Target Company has offered One Time Settlement (OTS) to some of its lenders. Under the OTS scheme for settlement of long outstanding debts, SRMTL has paid a total amount of about Rs. 77.98 Crore to its various lenders upto 31st March, 2013. After such payment, the total principal amount of outstanding debt in the books of SRMTL as of 31st March, 2013 stands at about Rs. 102.58 Crore. SRMTL has also approached the Board for Industrial and Financial Reconstruction (BIFR) in September 2005 and again in August 2006 seeking a reference for being declared as a sick company. However, the reference was rejected by BIFR vide order dated 20th December, 2006. An appeal against the said order of BIFR being Appeal No. 61 of 2007 dated 25th January, 2007 has been filed which has been decided in favour of the Target Company vide order dated 4th December, 2007 of Appellate Authority for Industrial and Financial Reconstruction (AAIFR) and the matter was remanded back to the BIFR. SRMTL has learnt of the summary of proceedings of a meeting of the BIFR held on October 1, 2013. As per this summary of proceedings, the BIFR has concluded as follows: Having considered the material on record and the submissions made before the BIFR, the BIFR declared the Target Company M/s . Shree Rama Multitech Ltd. (Ca s e No. 69/ 2006) as sick u / s 3(1)(o) of SICA and appointed IDBI as the Operating Agency (OA) u / s 17(3) of the Act to prepare a rehabilitation scheme for the company. The BIFR further issued the following directions: i) ii) The company shall prepare a fully tied up draft rehabilitation scheme (DRS) within six weeks and submit the same to OA, with a copy to the Board. The OA shall examine the DRS prepared by the company within further six weeks time and hold a joint meeting of all the stakeholders to consider the companys DRS and submit a report with a fully tied up DRS, if it emerges The company shall not dispose of any of its assets as per provisions of Section 22 of SICA without prior approval of the Board. The BIFR fixed the next date of hearing 17 December 2013. The hearing fixed for 17. 12. 2013 will be cancelled, if the BIFR is able to circulate a fully tied up DRS before the said date. 3,173.40 2.63 666.67 3,842.70 (6,577.05) (2,734.35) (Rupees in lacs) 5,183.74 4,446.07 (286.13)

The above mentioned financial statement is certified by the Auditor, M/s. Hemanshu Shah & Co., Chartered Accountants vide certificate dated 6th January, 2014. 15. The para no. 3.5 of the PA contained financials of NCWPL which stands updated as under: Brief financial details of NCWPL are as under:

61,000.46 63,182.72 2011 (Audited) Nil (109.30) (3.58) 3,050.02 2010 (Audited) Nil 94.20 2.98 3,159.13

b.

c.

The above mentioned financial details are extracted from the certificate issued by the Auditor, M/s. Hemanshu Shah & Co., Chartered Accountants vide certificates dated 5th July, 2013 and 6th January, 2014 16. The para no. 3.6 of the PA stands revised as under: NIPL has its registered office at Nirma House, Ashram Road, Ahmedabad - 380 009; Tel. No.: 079 6512 6505; Fax No.: 079 - 2754 6605. NIPL was incorporated on 31st December, 1979 as Nirma Chemical Works Pvt. Ltd. Its name was changed to Nirma Industries Limited vide fresh Certificate of Incorporation dated 23rd September, 1994. It was converted into private limited company and a fresh certificate of incorporation was issued on 20th February, 2009. NIPL s present business is to utilize surplus funds for making investments and to trade in securities. It is not an NBFC. 17. The following information is added in para no. 3.7 of the PA to provide recent information as on the date of the Letter of Offer: The shareholding pattern of NIPL is follows: Sr. No. A. 1. 2. 3. 4. 5. 6. 7. B. C. Name of the shareholder Promoters/Promoter Group Shri Karsanbhai K Patel (Holding as member on behalf of Rakesh Associate) Shri Karsanbhai K Patel (Holding as member on behalf of Haresh Associate) Smt. Shantaben K Patel (Holdings as member on behalf of Haresh Associate) Shri Hirenbhai K Patel Shri Rakeshbhai K Patel Smt. Keyuriben R Patel Smt. Rajalben H Patel FII/ Mutual-Funds/ FIs/Banks Public Total 91,810 91,700 10 9,540 6,920 10 10 Nil Nil 2,00,000 45.905 45.85 0.005 4.77 3.460 0.005 0.005 0.00 0.00 100.00 No. of shares held (face value = Rs. 100) %

d.

e. f. g.

h.

iii) iv) v)

i.

Applicable Interest paid to Original Shareholders of SRMTL will be reduced from the net interest received by NIPL on the fixed deposits kept with Bank of Baroda to meet its obligation towards maintaining an escrow account If there is any surplus of net interest received on such fixed deposits over the Applicable Interest paid to Original Shareholders of SRMTL, such surplus will be transferred to the SEBI Investor Protection and Education Fund. If the amount of interest payable is greater than the amount of net interest received by NIPL on the fixed deposits kept with Bank of Baroda to meet its obligation towards maintaining an escrow account the additional amount will be paid by the Acquirers and no amount will be transferred to the SEBI Investor Protection and Education Fund.

At the hearing held on 17th December 2013, the representative of IDBI (OA) stated that SRMTL has not submitted the Rehabilitation Proposal to OA for examination. The BIFR directed SRMTL to submit the Rehabilitation Proposal to the OA within a period of two weeks. The OA has been further directed to examine the DRS, to hold a joint meeting of all concerned and submit a fully tied up DRS of SRMTL to BIFR within a period of further four weeks. Accordingly, the BIFR has fixed the next date of hearing on 26th February, 2014 26. The para no. 4.9 of the PA stands revised as under: As per information provided by SRMTL and by NIPL being a major Shareholder, they have duly complied with the provisions of Chapter II of the Regulations from time to time except i) there has been delay in filing information under Regulation 8(3) for the financial years ended 31st March, 2000 (194 days), 31st March 2002 (182 days), and 31st March 2003 (171 days) by SRMTL; ii) SRMTL has not complied with the provisions of Regulation 8(3) as on date of this Corrigendum for the financial year ended 31st March, 2011 for which the due date was 30th April, 2011; iii). NIPL has not made the disclosure under Regulation 7(1) in September 2004 when it acquired 11,80,000 Shares; iv) The erstwhile Promoters have delayed filing information u/r 8(2) of the Regulations for 1999-2000 (172 days); 2000-01 (173 days), 2001-02 (166 days) and 2002-03 (258 days). Information u/r 8(2) of the Regulations were filed in time for the year 2004-05 while no information was filed for the years 2003-04; 2005-06; 2006-07. Relevant information from Pledger Sellers is not available; v). SEBI may take appropriate action with regards to the non-filing of disclosures or delay in filing of disclosures as mentioned above. 27. In para no. 5.1 of the PA the words without change in control or management, thereby attracting the provisions of Regulation 10 of the Regulations should be read as .. with change in control or management, thereby attracting the provisions of Regulations 10 and 12 of the Regulations. 28. The para no. 5.3 of the PA stands revised as under: This Offer to the shareholders of SRMTL is in order to comply with the provisions of Regulation 10 and Regulation 12 and other applicable provisions of the Regulations on account of a substantial acquisition of Shares with change in control or management. 29. The para no. 6.1 of the PA stands revised as under: The acceptance of Shares of non-resident Shareholders who validly tender their Shares under this Offer shall be subject to the receipt of approval from the RBI, if such non-resident Shareholders are bound by the terms of the RBI approval granted to them to not transfer the Shares without prior RBI approval. 30. The para 6.2 of the PA stands revised as under: To the best of knowledge and belief of the Acquirers, as of the date of the Letter of Offer, there are no further statutory approvals required to implement the Offer. However, in case of any regulatory or statutory approval being required at a later date before the Offer Closing Date, the Offer shall be subject to all such approvals and the Acquirers shall make the necessary applications for such approval. To the best of knowledge and belief of the Acquirers, no consents are required by the Acquirers from any financial institution or banks for the Offer. 31. The para no. 7.3 of the PA stands revised as under: The maximum amount of funds required to make payment of consideration of the Offer Price and the Applicable Interest (payable only to Original Shareholders as defined in para 5.3.3 of the Letter of Offer) for the Shares tendered in the Offer (assuming full acceptances) would be Rs. 41,77,46,409 (Rupees Forty One Crore Seventy Seven Lac Forty Six Thousand Four Hundred and Nine Only), assuming all Shares are tendered by the Original Shareholders. In accordance with Regulation 28(1) of the Regulations, the Acquirers, by way of security for performance of their obligations under the Regulations, have created an escrow account in the form of fixed deposits with Bank of Baroda, Gandhi Road branch, P .B. No. 101, Fuvara, Gandhi Road, Ahmedabad 380 001 (Tel. No. 079 2539 1873-74-75; Fax No. 079 2538 0065) for a sum aggregating to Rs. 10,49,21,118 (Rs. Ten Crore Forty Nine Lac Twenty One Thousand One Hundred and Eighteen Only) being over 25% of the total consideration payable in terms of the Offer (assuming full acceptance by the shareholders) for 1,26,93,601 Shares at a price of Rs. 18.60 per Share and Applicable Interest (i.e. Rs. 14.31 per Share to Original Shareholders). A lien has been marked in favour of PL Capital Markets Private Limited i.e. Manager to the Offer on the amount lying in the escrow account in the form of fixed deposits as confirmed by letter dated 6th January 2014 issued by Bank of Baroda, Ahmedabad. The Acquirers have empowered the Manager to the Offer to realise the value of the escrow account in terms of Regulation 28(5) of the Regulations. 32. In para no. 8.2 of the PA the Specified Date stands revised to 2nd August, 2013 (Specified Date). 33. The para no. 8.3 of the PA stands revised as under: All the shareholders registered or unregistered, (except the Acquirers, Pledger Sellers and Issuer Companies) who own Shares anytime before the Closure of the Offer are eligible to participate in the Offer. 34. In para no. 8.4 of the PA the name of the Registrar to the Offer stands amended to Karvy Computershare Pvt. Ltd. 35. In para no. 8.5 of the PA the details of the Special Depository Escrow Account stand revised as under: DP Name DP ID No. Client ID No. Account Name Depository ISIN : : : : : : Karvy Stock Broking Ltd. IN300394 18638948 SRMTL - OPEN OFFER SPECIAL DEPOSITORY ESCROW ACCOUNT National Securities Depository Ltd. INE879A01019

18. The para no. 3.9 of the PA contained financials of NIPL which stands updated as under so as to provide recent information: Cer tified limited review financial data (unaudited) for NIPL, not older than 6 months as of the date of this Corrigendum to PA is summarised below: (Rupees in Lacs) Particulars Total Income Profit After Tax Networth Other Financial Data for the period from Dividend Earning per share (face value of Rs. 100) Return on networth* Book value per share (face value Rs. 100) Unit (%) (Rs.) (%) (Rs.) 1st April, 2013 to 30th November, 2013 414.43 78.07 2,603.43 1st April, 2013 to 30th November, 2013 Nil 39.04 4.06 1,301.71

Consequent to the above mentioned developments related to the Offer following the date of the PA and also due to the passage of time until the date of this Corrigendum, the shareholders of SRMTL are requested to note the following modifications/ updation to the information provided in the PA published on 26th July 2005: 1. 2. 3. In the PA, wherever the reference of Nirma Industries Ltd. and NIL is appearing, it stands revised as Nirma Industries Pvt. Ltd. and NIPL respectively. In the PA, wherever the reference of Nirma Chemical Works Ltd. and NCWL is appearing, it stands revised as Nirma Chemical Works Pvt. Ltd. and NCWPL respectively. The para no. 1.2 of the PA stands revised as under: NIPL held 1264 Premium Notes while NCWPL held 3630 Premium Notes as on the date of the PA. Presently, the Acquirers do not hold any Premium Notes. 4. 5. The para no. 2.1 of the PA stands revised as under: The Acquirers are making the Offer in terms of Regulations 10 and 12 of the Regulations. The para no. 2.2 of the PA stands revised as under: The Offer is being made in terms of Regulations 10 and 12 of the Regulations to all the shareholders of the Target Company (except Acquirers, Issuer Companies and Pledger Sellers) to acquire upto 1,26,93,601 Shares, representing 20% of the issued, subscribed and paid up capital i.e. voting capital as of 15 days from the Offer Closing Date at a price of Rs. 18.60 per Share paid in cash, in terms of Regulation 20 of the Regulations. Over and above Rs. 18.60 per Share, the Original Shareholders would also be entitled to receive Rs. 14.31 per Share towards Applicable Interest in terms of the Regulations. 6. The para no. 2.3 of the PA stands revised as under: SRMTLs issued, subscribed and paid-up capital as on January 8, 2014 comprises of 6,34,68,005 equity shares of face value of Rs. 5 each fully paid up, aggregating to Rs. 31,73,40,025 and hence the minimum number of Shares for which this Offer is made is computed on the current enhanced equity capital of the Target Company. 7. The para no. 2.4 of the PA stands revised as under: The Offer is not subject to any minimum level of acceptance. The Acquirers will acquire all the Shares, that are validly tendered and accepted in terms of this Offer, upto 1,26,93,601 Shares. 8. The para no. 2.6 of the PA stands revised as under: NCWPL was holding 18,11,419 Shares as on the date of triggering the Offer. NCWPL sold all these 18,11,419 Shares in open market after the PA. NIPL was holding 11,80,000 Shares as on date of triggering the Offer. NIPL sold all these 11,80,000 Shares in open market after the PA. Consequent to invocation of pledge, which triggered the Offer, 1,42,88,700 Shares were transferred to the demat account of NIPL in July 2005. NIPL transferred 1,10,83,817 Shares on 26th June, 2013 through an off market transfer to the demat account of NCWPL without any consideration. Current shareholding of NIPL in SRMTL is 32,04,883 Shares and of NCWPL in SRMTL is 1,10,83,817 Shares i.e. the Acquirers holding in SRMTL is 1,42,88,700 Shares, representing 22.51% of the existing issued, subscribed and paid up and voting capital of Target Company. 9. The para no. 2.8 of the PA stands revised as under: The Shares are listed on the BSE Ltd. (BSE) and National Stock Exchange of India Ltd. (NSE). The Shares are frequently traded on the BSE and the NSE, within the meaning of Explanation (i) to Regulation 20(5) of the Regulations (Source: www.bseindia.com, www.nseindia.com). The equity shares of SRMTL have been delisted from Ahmedabad Stock Exchange with effect from June 15, 2007. 10. The following line is added at the end of para no. 2.11: The Equity Shares of SRMTL have been delisted from Ahmedabad Stock Exchange with effect from June 15, 2007. 11. The para no. 2.13 of the PA stands revised as under: PL Capital Markets Private Limited, the Manager to the Offer, does not hold any equity shares in SRMTL. They declare and undertake that they shall not deal in the shares of SRMTL during the period commencing from the date of their appointment as Manager to the Offer till the expiry of 15 days from the date of closure of the Offer 12. In the para no. 3.1 of the PA, Tel: 079-2754 6565 stands revised as Tel: 079-6512 6505. 13. The following information is added in para no. 3.2 of the PA to provide recent information as on the date of the Letter of Offer: The shareholding pattern of NCWPL as on the date of the Letter of Offer is: Sr. No. A. 1. 2. 3. 4. 5. 6. 7. 8. B. C. Name of the Shareholder Promoters/ Promoter Group Shri Ambubhai M. Patel (Holding as Trustee on behalf of S. K. Patel Family Trust) Smt. Shantaben K. Patel Shri Hirenbhai K. Patel Shri Rakeshbhai K. Patel Shri Ambubhai M. Patel (Holding as Trustee on behalf of Khodidas Vandas Patel Discretionary Trust) Nirma Credit and Capital Pvt. Limited Smt. Rajalben H. Patel Smt. Keyuriben R. Patel FII/ Mutual-Funds/ FIs/Banks Public Total 19,40,000 10,000 8,000 8,000 10,000 20,000 2,000 2,000 Nil Nil 20,00,000 97.00 0.50 0.40 0.40 0.50 1.00 0.10 0.10 0.00 0.00 100.00 No. of shares held %

*calculated excluding the capital reserve amounting to Rs. 678.59 lacs. The above mentioned financial statements are certified by the Auditors, M/s. Rajendra D. Shah & Co., Chartered Accountants vide certificate dated 6th January, 2014. 19. The para no. 3.10 of the PA contained financials of NIPL which stands updated as under so as to provide recent information: Brief financial details of NIPL are as under: (Rupees in Lacs) Particulars Total Income Profit After Tax Networth Other Financial Data for years ended 31st March Dividend Earning per share (face value of Rs. 100) Return on networth Book value per share (face value of Rs. 100) Unit % Rs. % Rs. 2013 Audited 2,067.01 1,094.48 2,525.36 2013 Audited Nil 547.24 59.26 1,262.68 2012 Audited 112.66 (1,77.18) 1,430.88 2012 Audited Nil (88.59) (23.55) 715.44 2011 Audited 667.74 (1,083.11) 1,608.06 2011 Audited Nil (541.55) (116.53) 804.03 2010 Audited 1,577.74 599.58 2,691.16 2010 Audited Nil 2,997.92 29.79 13,455.81

The above mentioned financial par ticulars are extracted from the certificate as certified by the Auditor M/s. Rajendra D. Shah & Co., Chartered Accountants vide its certificates dated 5th July, 2013 and 6th January, 2014. 20. The address of SRMTL given in para no. 4.1 of the PA stands revised as under: Its registered office is at 603, Shikhar Shreemali Society, Near Vadilal House, Mithakhali, Navrangpura, Ahmedabad 380 009; Tel. No.: 079 2656 9855; 2656 9455; Fax No.: 079 2656 2667; email: cslegal@srmtl.com. 21. In para no. 4.2 of the PA it was stated that SRMTL had one manufacturing plant in Pondicherry in South India. This is now updated to read SRMTL had plant at Pondicherry but the machineries are shifted to Ambaliyara. Now, therefore only the land and factory shed remained which was rented and now stands vacated by the tenant. 22. The para no. 4.3 of the PA stands revised as under: The Shares were also listed on ASE, which have been delisted with effect from 15th June, 2007. The Shares are listed on BSE and NSE except for 45,55,555 Shares allotted on 28th July, 2007. As per the information provided by SRMTL, SRMTL had made the applications to BSE and NSE for listing of 45,55,555 Shares but SRMTL has not received any communication from BSE and NSE in this matter. 23. The following information is added in the para no. 4.4 of the PA: The brief financial detail of SRMTL is as under: (Rupees in lacs) Profit & Loss Statement for the Financial Year ended at 31st March, Total Income Total Expenditure Profit/(Loss) After Tax Balance Sheet Statement as at 31st March, SOURCES OF FUNDS Issued, Subscribed & Paid up Equity Share capital Add: Forfeited Shares 15% Cumulative Redeemable Preference Shares Total paid-up capital Reserves and Surplus (excluding revaluation reserve) Networth Miscellaneous Expenditure not written off Other Financial Data Dividend (%) Earnings Per Share (Rs) Return on Networth (%)* Book Value Per Share (Rs) * Not Meaningful as networth is negative in all years. The unaudited financials for SRMTL for six months ended and as at 30th September, 2013 as certified by SRMTL vide its certificate dated 4th January, 2014, is summarized below: 3,173.40 2.63 666.67 3,842.70 (6,290.92) (2,448.22) 2013 Audited 0.00 (3.14) NA (3.86) 3,173.40 2.63 666.67 3,842.70 (16,819.65) (12,976.95) 2012 Audited 0.00 0.06 NA (20.45) 3,173.40 2.63 666.67 3,842.70 (22,602.92) (18,760.22) 2011 Audited 0.00 2.96 NA (29.56) 2013 Audited 8,860.60 8,843.16 (1,993.06) 2013 Audited 2012 Audited 7,551.17 7,311.50 39.22 2012 Audited 2011 Audited 10,336.69 8,227.11 1,880.71 (Rupees in lacs) 2011 Audited

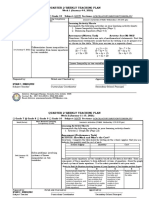

36. The para no. 8.6 of the PA stands revised as under: All owners of Shares, registered or unregistered, who qualify and wish to avail this Offer should arrange to send their Shares along with Form of Acceptance cum Acknowledgement and other relevant documents (as set out in para no. 7.6 of the Letter of Offer) to the Registrar to the Offer on all working days i.e. from Monday to Friday (except Public Holidays) between 10.00 a.m. and 5.00 p.m. on or before the Offer Closing Date at: Name and Address of the Collection Centre Mumbai: Karvy Computershare Pvt Ltd., 24-B, Rajabahudur Mansion, Gr Floor, 6 Ambalal Doshi Marg, Behind BSE Ltd, Fort, Mumbai 400001 New Delhi: Karvy Computershare Pvt Ltd. 305, New Delhi House, 27, Barakhamba Road, Connaught Place, New Delhi - 110 001 Contact Person Ms. Nutan Shirke Mode of Delivery Hand Delivery Tel. No. / Fax. No. Tel: 022 6623 5454 Fax: 022 6633 1135 Tel: 011 4368 1700/ 1798 Fax: 011 4103 6370 Tel: 079 6515 0009 Email Id ircfort@ karvy.com nutan.shirke@ karvy.com rakeshj@ karvy.com jmathew@ karvy.com ahmedabad@ karvy.com robert.joeboy@ karvy.com sujitkundu@ karvy.com nilkanta@ karvy.com einward.ris@ karvy.com

Mr. Rakesh Kr Jamwal/ Vinod Singh Negi

Hand Delivery

Ahmedabad: Karvy Computershare Pvt Ltd., Mr. Aditya Gupta/ 201-203, Shail, Opp. Madhusudhan House, Robert Joeboy/ Behind Girish Cold Drinks, Off C G Road, Ms. Jagruthi Ahmedabad - 380 006 Kolkata: Karvy Computershare Pvt Ltd., 49, Jatin Das Road, Nr.Deshpriya Park, Kolkatta - 700 029 Mr. Sujit Kundu/ Mr. Debnath

Hand Delivery

14. The para no. 3.4 of the PA contained financials of NCWPL which stands updated as under: Certified limited review financial data (unaudited) for NCWPL not older than 6 months as of the date of this Corrigendum to PA are summarised below: (Rupees in Lacs) Particulars Total Income Profit After Tax Networth 1st April, 2013 to 30th November, 2013 2,906.17 1,912.00 71,986.43

Hand Delivery

Tel: 033 6619 2844 Fax: 033 2464 4866 Tel: 040 4465 5000 Fax: 040 2343 1551

Hyderabad: Karvy Computershare Pvt Ltd., M. Muralikrishna Plot No. 17 to 24, Vithalrao Nagar, Hi-Tech City Road, Madhapur, Hyderabad - 500 081

Hand Delivery or Registered Post

The Form of Acceptance cum Acknowledgement and other relevant documents should not be sent to the Acquirers, SRMTL, Issuer Companies or the Manager to the Offer.

Size: 32.9 x 50 cm

37. The para no. 8.12 of the PA stands revised as under: If the aggregate of the valid responses to the Offer exceeds 1,26,93,601 Shares, then the Acquirers shall accept the valid Shares tendered on a proportionate basis in accordance with Regulation 21(6) of the Regulations. The trading lot of Shares is 1. 38. The para no. 8.15 of the PA stands revised as under: A schedule of some of the key events in respect of the Offer is given below: Activity Public Announcement (PA) Date Specified Date (for the purpose of determining the names of shareholders to whom the Letter of Offer (LOF) will be sent) Last date for a competitive bid Date by which LOF will be despatched to shareholders Original Day and Date Tuesday, 26th July, 2005 Wednesday, 27th July, 2005 Tuesday, 16th August, 2005 Tuesday, 6th September, 2005 Revised Day and Date Tuesday, 26th July, 2005 Friday, 2nd August, 2013 Tuesday, 16th August, 2005 Monday, 13th January, 2014

Offer Opening Date Last date for revising the offer price /number of shares Last date for withdrawal of acceptance by the shareholders Offer Closing Date Date by which the acceptance/ rejection would be intimated and the corresponding payment for the acquired shares and /or the share certificate for the rejected shares will be dispatched.

Thursday, 15th September, 2005 Thursday, 22nd September, 2005 Wednesday, 28th September, 2005 Tuesday, 4th October, 2005 Wednesday, 19th October, 2005

Thursday, 16th January, 2014 Thursday, 23rd January, 2014 Thursday, 30th January, 2014 Tuesday, 4th February, 2014 Wednesday, 19th February, 2014

40. The para no. 9.3 of the PA stands revised as under: Pursuant to Regulation 13 of the Regulations, the Acquirers have appointed PL Capital Markets Pvt. Ltd. as Manager to the Offer. 41. In the para no. 9.4 of the PA, on or before 28th September, 2005 stands revised as on or before 30th January, 2014 42. In the para no. 9.6 of the PA, not later than 22nd September, 2005, stands revised as not later than 23rd January, 2014. 43. In the para no. 9.11 of the PA, from the Offer opening date i.e. 15th September, 2005 stands revised as from the Offer opening date i.e.16th January, 2014. All other terms and conditions of the Offer remain unchanged. The Acquirers and its respective Directors, accept full responsibility for the information contain in this Corrigendum and its obligations under the Regulations. This Corrigendum announcement would also be available on the SEBIs website (www.sebi.gov.in). Issued by Manager to the Offer for and on behalf of the Acquirers

C O N C E P T

*Specified Date is only for the purpose of determining the names of the shareholders as on such date to whom the Letter of Offer would be sent. All owners (registered or unregistered) of Shares (except the Acquirers, Pledger Sellers and Issuer Companies) are eligible to participate in the Offer anytime before the Closure of the Offer. 39. The para no. 8.16 of the PA stands deleted on account of the Acquirer being allowed under applicable law to acquire Equity Shares held by non-resident shareholders who have tendered their Equity Shares in this Offer without obtaining any prior approval from the RBI.

PL CAPITAL MARKETS PVT. LTD. 3rd Floor, Sadhana House, 570, P .B.Marg, Worli, Mumbai 400 018 Tel:+91 - 22 - 6632 2222; Fax:+91-22 -6632 2229; Website: www.plindia.com; Email: openoffersrmtl@plindia.com; Contact person: Mr. Bhavin Shah/ Mr. Ajesh Dalal; SEBI Registration No.: INM000011237 Place : Mumbai Date : January 13, 2014

Você também pode gostar

- 100 IdeasDocumento21 páginas100 IdeasNo ID100% (1)

- Instruction Manual Twin Lobe CompressorDocumento10 páginasInstruction Manual Twin Lobe Compressorvsaagar100% (1)

- Differential Calculus ExamDocumento6 páginasDifferential Calculus ExamCaro Kan LopezAinda não há avaliações

- Best of The Photo DetectiveDocumento55 páginasBest of The Photo DetectiveSazeed Hossain100% (3)

- Acute Leukemia The Scientist's Perspective and ChallengeDocumento438 páginasAcute Leukemia The Scientist's Perspective and ChallengemedskyqqAinda não há avaliações

- Interim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedDocumento16 páginasInterim Order Cum Show Cause Notice in The Matter of Bhabiswajyoti Infrastructure India LimitedShyam SunderAinda não há avaliações

- Order in The Matter of Mudra Lifestyle LimitedDocumento5 páginasOrder in The Matter of Mudra Lifestyle LimitedShyam SunderAinda não há avaliações

- Order in The Matter of Steelco Gujarat LimitedDocumento4 páginasOrder in The Matter of Steelco Gujarat LimitedShyam SunderAinda não há avaliações

- Interim Order in The Matter of Suvidha Land Developers India LimitedDocumento15 páginasInterim Order in The Matter of Suvidha Land Developers India LimitedShyam SunderAinda não há avaliações

- Sebi Order AmritDocumento13 páginasSebi Order AmritStephen GreenAinda não há avaliações

- Interim Order in The Matter of Amazan Agro Products LimitedDocumento14 páginasInterim Order in The Matter of Amazan Agro Products LimitedShyam SunderAinda não há avaliações

- Sahara JudgmentDocumento270 páginasSahara JudgmentFirstpostAinda não há avaliações

- Model Financial Corpn. Ltd.Documento13 páginasModel Financial Corpn. Ltd.srk1606Ainda não há avaliações

- Adjudication Order in Respect of Rajasthan Polyvin Tubes LTDDocumento6 páginasAdjudication Order in Respect of Rajasthan Polyvin Tubes LTDShyam SunderAinda não há avaliações

- Interim Order - Goldmine Agro LimitedDocumento15 páginasInterim Order - Goldmine Agro LimitedShyam SunderAinda não há avaliações

- Interim Order in Respect of Ambitious Diversified Projects Management LimitedDocumento15 páginasInterim Order in Respect of Ambitious Diversified Projects Management LimitedShyam SunderAinda não há avaliações

- Interim Order in The Matter of Morningstar Ventures Ltd.Documento13 páginasInterim Order in The Matter of Morningstar Ventures Ltd.Shyam SunderAinda não há avaliações

- Interim Order Was Passed Without Prejudice To The Right of SEBI To Take Any Other ActionDocumento3 páginasInterim Order Was Passed Without Prejudice To The Right of SEBI To Take Any Other ActionKnowledge GuruAinda não há avaliações

- 1 Stakeholder Meeting Explanatory Notes SRS LimitedDocumento4 páginas1 Stakeholder Meeting Explanatory Notes SRS LimitedManoj100% (1)

- Mohit Agro Gujarat AmbujaDocumento20 páginasMohit Agro Gujarat AmbujaMuskan KhatriAinda não há avaliações

- Updates On Buy Back Offer (Company Update)Documento52 páginasUpdates On Buy Back Offer (Company Update)Shyam SunderAinda não há avaliações

- CA9813 Sahara CombinedDocumento263 páginasCA9813 Sahara CombinedmailtoashishAinda não há avaliações

- Order in The Matter of M/s Sunshine Global Agro LimitedDocumento16 páginasOrder in The Matter of M/s Sunshine Global Agro LimitedShyam SunderAinda não há avaliações

- Nirma JudgementDocumento17 páginasNirma JudgementAwantika YashAinda não há avaliações

- Registered Office: Door No 4-56, Survey No.62/1/A & 67, Tech Mahindra Road, Bahadurpally, QutbullapurDocumento33 páginasRegistered Office: Door No 4-56, Survey No.62/1/A & 67, Tech Mahindra Road, Bahadurpally, Qutbullapurmealokranjan9937Ainda não há avaliações

- Suchitra Kanuparthi, Member (J) and Chandra Bhan Singh, Member (T)Documento17 páginasSuchitra Kanuparthi, Member (J) and Chandra Bhan Singh, Member (T)himeesha dhiliwalAinda não há avaliações

- Order in The Matter of Prism Infracon LimitedDocumento15 páginasOrder in The Matter of Prism Infracon LimitedShyam SunderAinda não há avaliações

- Order Against Infinity Realcon LimitedDocumento18 páginasOrder Against Infinity Realcon LimitedShyam SunderAinda não há avaliações

- Interim Order in The Matter of United Cosmetics Manufacturing (I) Ltd. and Its DirectorsDocumento15 páginasInterim Order in The Matter of United Cosmetics Manufacturing (I) Ltd. and Its DirectorsShyam SunderAinda não há avaliações

- Interim Order Cum Show Cause Notice in The Matter of DGR Farms & Leisures Ltd.Documento15 páginasInterim Order Cum Show Cause Notice in The Matter of DGR Farms & Leisures Ltd.Shyam SunderAinda não há avaliações

- Takeover Panorama April 2013: A Monthly Newsletter On Takeover MattersDocumento22 páginasTakeover Panorama April 2013: A Monthly Newsletter On Takeover MattersCorporate ProfessionalsAinda não há avaliações

- The Chairman, Sebi Vs Shriram Mutual Fund & AnrDocumento13 páginasThe Chairman, Sebi Vs Shriram Mutual Fund & AnrShrom SethiAinda não há avaliações

- Order in The Matter of Maitreya Plotters and Structures Private LimitedDocumento15 páginasOrder in The Matter of Maitreya Plotters and Structures Private LimitedShyam SunderAinda não há avaliações

- Camlin Post Open Offer Status Oct2011Documento1 páginaCamlin Post Open Offer Status Oct2011pareshsharmaAinda não há avaliações

- Adjudication Order in The Matter of Sai Prasad Properties Limited and Sai Prasad Foods LimitedDocumento18 páginasAdjudication Order in The Matter of Sai Prasad Properties Limited and Sai Prasad Foods LimitedShyam SunderAinda não há avaliações

- Adjudication Order in Respect of Waverley Investments Ltd.Documento8 páginasAdjudication Order in Respect of Waverley Investments Ltd.Shyam SunderAinda não há avaliações

- Adjudication Order in The Matter of Anil Monga and OthersDocumento12 páginasAdjudication Order in The Matter of Anil Monga and OthersShyam SunderAinda não há avaliações

- 10 25 Full Company Update 20230227Documento16 páginas10 25 Full Company Update 20230227Contra Value BetsAinda não há avaliações

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento9 páginasStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderAinda não há avaliações

- Notice To Share HoldersDocumento39 páginasNotice To Share HoldersGaurav Shah0% (1)

- Mr. Lagadapati Ramesh Vs Mrs. Ramanathan Bhuvaneshwari NCLAT DelhiDocumento41 páginasMr. Lagadapati Ramesh Vs Mrs. Ramanathan Bhuvaneshwari NCLAT DelhiAyantika MondalAinda não há avaliações

- Settlement Order Against Brady & Morris Engineering Company LTD and 5 OthersDocumento4 páginasSettlement Order Against Brady & Morris Engineering Company LTD and 5 OthersShyam SunderAinda não há avaliações

- Balrampur Chini Q4FY20Documento21 páginasBalrampur Chini Q4FY20premAinda não há avaliações

- Ritesh MergedDocumento4 páginasRitesh MergedShivam TiwaryAinda não há avaliações

- Post Buy Back Offer (Company Update)Documento2 páginasPost Buy Back Offer (Company Update)Shyam SunderAinda não há avaliações

- In The Matter of Hemant Kothari and OthersDocumento5 páginasIn The Matter of Hemant Kothari and OthersShyam SunderAinda não há avaliações

- RrgreenhandslofDocumento28 páginasRrgreenhandslofRajesh SivajiAinda não há avaliações

- DCIT Vs Nirshilp Securities Pvt. Ltd. ITAT MumbaiDocumento63 páginasDCIT Vs Nirshilp Securities Pvt. Ltd. ITAT MumbaiCA Prakash Chandra BhandariAinda não há avaliações

- Settlement Order in Respect of M/s Kidderpore Holdings Limited in The Matter of M/s Kidderpore Holdings LimitedDocumento3 páginasSettlement Order in Respect of M/s Kidderpore Holdings Limited in The Matter of M/s Kidderpore Holdings LimitedShyam SunderAinda não há avaliações

- Court Order or NCLT or CLB or Order by Any Other Competent Authority.-29032018Documento5 páginasCourt Order or NCLT or CLB or Order by Any Other Competent Authority.-29032018Vritika Jain100% (1)

- Adjudication Order Dated May 05, 2015 With Respect To The Promoters of Austral Coke and Projects LimitedDocumento17 páginasAdjudication Order Dated May 05, 2015 With Respect To The Promoters of Austral Coke and Projects LimitedShyam SunderAinda não há avaliações

- Ratnabali Capitals Markets LTDDocumento6 páginasRatnabali Capitals Markets LTDShubh DixitAinda não há avaliações

- Judgment - Supreme Court Upholds Creditors Committee Sovereignty Under The IBCDocumento102 páginasJudgment - Supreme Court Upholds Creditors Committee Sovereignty Under The IBCbipulAinda não há avaliações

- Interim Order in The Matter of Everlight Realcon Infrastructure LimitedDocumento13 páginasInterim Order in The Matter of Everlight Realcon Infrastructure LimitedShyam SunderAinda não há avaliações

- Adjudication Order in The Matter of Varun Shipping Company LimitedDocumento8 páginasAdjudication Order in The Matter of Varun Shipping Company LimitedShyam SunderAinda não há avaliações

- In The High Court of Delhi at New DelhiDocumento10 páginasIn The High Court of Delhi at New DelhiSudhir KumarAinda não há avaliações

- Securities and Exchange Board of India Vs Ajay Agas100136COM124163Documento8 páginasSecurities and Exchange Board of India Vs Ajay Agas100136COM124163Shreya SinghAinda não há avaliações

- (2010) 128 TTJ 0596 The AP Paper Mills LTDDocumento17 páginas(2010) 128 TTJ 0596 The AP Paper Mills LTDSubramanyam SettyAinda não há avaliações

- BSE Limited National Stock Exchange of India LimitedDocumento29 páginasBSE Limited National Stock Exchange of India LimitedVivek AnandAinda não há avaliações

- JK Jute Mills BIFR CaseDocumento44 páginasJK Jute Mills BIFR CaseHemanth RaoAinda não há avaliações

- Journals of Regulatory Frame Work in Malawi: Book 1No EverandJournals of Regulatory Frame Work in Malawi: Book 1Ainda não há avaliações

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersAinda não há avaliações

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionAinda não há avaliações

- What You Must Know About Incorporate a Company in IndiaNo EverandWhat You Must Know About Incorporate a Company in IndiaAinda não há avaliações

- Editorial PDFDocumento1 páginaEditorial PDFChaitanya JagarlapudiAinda não há avaliações

- IDirect GSKConsumer ICDocumento26 páginasIDirect GSKConsumer ICChaitanya JagarlapudiAinda não há avaliações

- Quarterly Update - June 2021Documento5 páginasQuarterly Update - June 2021Chaitanya Jagarlapudi100% (1)

- Quarterly Report - September 2021Documento6 páginasQuarterly Report - September 2021Chaitanya JagarlapudiAinda não há avaliações

- Bernstein Journal Summer08Documento39 páginasBernstein Journal Summer08Chaitanya JagarlapudiAinda não há avaliações

- Gabriel q4 Fy 2018 19Documento5 páginasGabriel q4 Fy 2018 19Chaitanya JagarlapudiAinda não há avaliações

- Intellect Technology Day Presentations June 2021Documento176 páginasIntellect Technology Day Presentations June 2021Chaitanya JagarlapudiAinda não há avaliações

- Intellect Technology Day Presentations June 2021Documento176 páginasIntellect Technology Day Presentations June 2021Chaitanya JagarlapudiAinda não há avaliações

- IRDA English Final Printing - FinalDocumento202 páginasIRDA English Final Printing - FinalAbhishek NayakAinda não há avaliações

- Thomas Russo: Global Value Investing - Richard Ivey School of Business, 2013Documento34 páginasThomas Russo: Global Value Investing - Richard Ivey School of Business, 2013Hedge Fund ConversationsAinda não há avaliações

- Virgo 2016 Second-Half Report (FINAL)Documento18 páginasVirgo 2016 Second-Half Report (FINAL)Chaitanya JagarlapudiAinda não há avaliações

- Investor Letter 2014Documento4 páginasInvestor Letter 2014Chaitanya JagarlapudiAinda não há avaliações

- (Kotak) BFSI, June 2, 2015 - Quarterly Review 4QFY15Documento30 páginas(Kotak) BFSI, June 2, 2015 - Quarterly Review 4QFY15Chaitanya JagarlapudiAinda não há avaliações

- DAWisdomGreatInvestors 1213Documento14 páginasDAWisdomGreatInvestors 1213Chaitanya JagarlapudiAinda não há avaliações

- Buffett PaperDocumento46 páginasBuffett PaperChaitanya JagarlapudiAinda não há avaliações

- 1-TMG Student Mannual-Introduction To The CompetitionDocumento78 páginas1-TMG Student Mannual-Introduction To The CompetitionChaitanya JagarlapudiAinda não há avaliações

- CustomerPresentation Version 1.0Documento16 páginasCustomerPresentation Version 1.0Chaitanya JagarlapudiAinda não há avaliações

- Macro Capex Trends - Oct12Documento8 páginasMacro Capex Trends - Oct12Chaitanya JagarlapudiAinda não há avaliações

- Opening Remarks q3 2015Documento19 páginasOpening Remarks q3 2015Chaitanya JagarlapudiAinda não há avaliações

- IIFL - India - Strategy 2015 - Earnings Bouncing Back - 20141217 - 15!18!23Documento41 páginasIIFL - India - Strategy 2015 - Earnings Bouncing Back - 20141217 - 15!18!23Chaitanya JagarlapudiAinda não há avaliações

- Bajaj Corp - VN - 4 Sept 2013Documento4 páginasBajaj Corp - VN - 4 Sept 2013Chaitanya JagarlapudiAinda não há avaliações

- Shree Rama Multi-Tech Ltd1 140114Documento2 páginasShree Rama Multi-Tech Ltd1 140114Chaitanya JagarlapudiAinda não há avaliações

- Annual Report 13 14Documento180 páginasAnnual Report 13 14Chaitanya JagarlapudiAinda não há avaliações

- 05aug2014 India DailyDocumento73 páginas05aug2014 India DailyChaitanya JagarlapudiAinda não há avaliações

- Annual Report 2001Documento35 páginasAnnual Report 2001Chaitanya JagarlapudiAinda não há avaliações

- Some Thoughts On Becoming An Independent Fund ManagerDocumento4 páginasSome Thoughts On Becoming An Independent Fund ManagerChaitanya JagarlapudiAinda não há avaliações

- (Kotak) ICICI Bank, January 31, 2013Documento14 páginas(Kotak) ICICI Bank, January 31, 2013Chaitanya JagarlapudiAinda não há avaliações

- Ipca BUY (Safe and Sound) 20140128Documento8 páginasIpca BUY (Safe and Sound) 20140128Chaitanya JagarlapudiAinda não há avaliações

- NSE Stock Names On Yahoo FinanceDocumento18 páginasNSE Stock Names On Yahoo FinanceGuru PrasadAinda não há avaliações

- ProcessingobservationsDec27 PDocumento1 páginaProcessingobservationsDec27 PChaitanya JagarlapudiAinda não há avaliações

- Fh84fr6ht GBR EngDocumento6 páginasFh84fr6ht GBR EngEsmir ŠkreboAinda não há avaliações

- Singer 900 Series Service ManualDocumento188 páginasSinger 900 Series Service ManualGinny RossAinda não há avaliações

- Firing OrderDocumento5 páginasFiring OrderCurtler PaquibotAinda não há avaliações

- Andromeda: Druid 3 Warborn06Documento5 páginasAndromeda: Druid 3 Warborn06AlanAinda não há avaliações

- Army Watercraft SafetyDocumento251 páginasArmy Watercraft SafetyPlainNormalGuy2Ainda não há avaliações

- March 2023 (v2) INDocumento8 páginasMarch 2023 (v2) INmarwahamedabdallahAinda não há avaliações

- Microbial Diseases of The Different Organ System and Epidem.Documento36 páginasMicrobial Diseases of The Different Organ System and Epidem.Ysabelle GutierrezAinda não há avaliações

- Teaching Plan - Math 8 Week 1-8 PDFDocumento8 páginasTeaching Plan - Math 8 Week 1-8 PDFRYAN C. ENRIQUEZAinda não há avaliações

- Automated Facilities Layout Past Present and FutureDocumento19 páginasAutomated Facilities Layout Past Present and FutureJose Luis Diaz BetancourtAinda não há avaliações

- 12 Constructor and DistructorDocumento15 páginas12 Constructor and DistructorJatin BhasinAinda não há avaliações

- Johari WindowDocumento7 páginasJohari WindowSarthak Priyank VermaAinda não há avaliações

- Ladies Code I'm Fine Thank YouDocumento2 páginasLadies Code I'm Fine Thank YoubobbybiswaggerAinda não há avaliações

- Sungbo's Eredo, Southern Nigeria: Nyame Akuma NoDocumento7 páginasSungbo's Eredo, Southern Nigeria: Nyame Akuma NosalatudeAinda não há avaliações

- Overview of Incorporation in CambodiaDocumento3 páginasOverview of Incorporation in CambodiaDavid MAinda não há avaliações

- Corporate Valuation WhartonDocumento6 páginasCorporate Valuation Whartonebrahimnejad64Ainda não há avaliações

- A Vision System For Surface Roughness Characterization Using The Gray Level Co-Occurrence MatrixDocumento12 páginasA Vision System For Surface Roughness Characterization Using The Gray Level Co-Occurrence MatrixPraveen KumarAinda não há avaliações

- I. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Documento5 páginasI. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Shelton Lyndon CemanesAinda não há avaliações

- A Project Report On "A Comparative Study Between Hero Honda Splendor+ and Its Competitors To Increase The Market Share in MUDHOL RegionDocumento70 páginasA Project Report On "A Comparative Study Between Hero Honda Splendor+ and Its Competitors To Increase The Market Share in MUDHOL RegionBabasab Patil (Karrisatte)Ainda não há avaliações

- EC105Documento14 páginasEC105api-3853441Ainda não há avaliações

- 30 de Thi Hoc Ky 2 Mon Tieng Anh Lop 9 Co Dap An 2023Documento64 páginas30 de Thi Hoc Ky 2 Mon Tieng Anh Lop 9 Co Dap An 2023Trần MaiAinda não há avaliações

- Florida Gov. Ron DeSantis Provides Update As Hurricane Ian Prompts EvDocumento1 páginaFlorida Gov. Ron DeSantis Provides Update As Hurricane Ian Prompts Evedwinbramosmac.comAinda não há avaliações

- Amsterdam Pipe Museum - Snuff WorldwideDocumento1 páginaAmsterdam Pipe Museum - Snuff Worldwideevon1Ainda não há avaliações

- PBPO008E FrontmatterDocumento13 páginasPBPO008E FrontmatterParameswararao Billa67% (3)

- Javascript NotesDocumento5 páginasJavascript NotesRajashekar PrasadAinda não há avaliações

- Gifted Black Females Attending Predominantly White Schools Compressed 1 CompressedDocumento488 páginasGifted Black Females Attending Predominantly White Schools Compressed 1 Compressedapi-718408484Ainda não há avaliações