Escolar Documentos

Profissional Documentos

Cultura Documentos

DTF 950

Enviado por

vikas_ojha54706Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

DTF 950

Enviado por

vikas_ojha54706Direitos autorais:

Formatos disponíveis

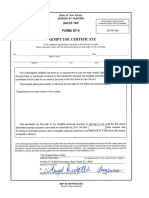

New York State Department of Taxation and Finance

Certicate Of Sales Tax Exemption for Diplomatic Missions And Personnel

Single Purchase Certicate

Type or print Name of cardholder Mission of Name of vendor Tax exemption number Date of expiration Total amount of purchase $

DTF-950

(9/11)

I hereby certify that I have been issued a mission tax exemption or personal tax exemption card authorized by the United States Department of State or the American Institute in Taiwan. I am authorized to make purchases exempt from state and local sales and use taxes subject to any restriction(s) listed on the card. I have been issued the following exemption card (mark an X in the appropriate box): Buffalo image card exempt from sales tax on ofcial mission purchases, except for the following restrictions (List the restrictions that appear on the bottom of your card.) : Owl image card exempt from sales tax on all ofcial mission purchases Deer image card exempt from sales tax on personal purchases, except for the following restrictions (List the restrictions that appear on the bottom of your card.) : Eagle image card exempt from sales tax on all personal purchases American Institute in Taiwan (AIT) card

This form may not be used to make purchases of motor fuel or diesel motor fuel exempt from tax other than non-highway diesel motor fuel.

Signature Note: This form must be signed in the presence of the vendor. Date of purchase

Instructions

Note: Exemption cards containing colored stripes have been replaced by cards containing animal images. Vendors may no longer accept cards containing colored stripes.

other transactions, including sales of non-highway diesel motor fuel, get a separate single purchase certicate for each sale. Record the date and the name, address, and tax exempt number of the purchaser on the purchase invoice. Have the purchaser sign and date the certicate and invoice at the time of sale. Verify the accuracy of the information on the certicate. Accept the certicate only if: the certificate is complete and accurate, the amount of purchase (in total) exceeds the minimum level shown,* the exemption card has not expired, the purchaser is the person in the picture (for eagle, deer, or AIT cards), and the purchaser is also the payer of record.** * Minimum levels do not apply to purchases of utilities covered under

Tax Law section 1105(b). ** The purchaser cannot use cash or a personal credit card or check when making purchases for a mission.

Diplomatic missions and personnel Enter the information exactly as it appears on the mission or personal tax exemption card authorized by the U.S. Department of State or American Institute in Taiwan. Also, enter the vendors name and amount of purchase. Next, mark an X in the appropriate box indicating the animal image and exemption limitations shown on your card. If you marked the buffalo or deer image card box, enter the limitations shown on the card in the space provided above. Sign and date this certicate and the purchase invoice in the presence of the vendor at the time of purchase. Present your exemption card for verication. For all transactions other than purchases of utilities, give the vendor a separate exemption certicate each time you make a purchase (including the purchase of non-highway diesel motor fuel). For purchases of utilities, give only one certicate to each utility vendor. You may not use a mission tax exemption card (buffalo or owl image) to make personal purchases exempt from tax. Vendor If you provide utility services, you need only one exemption certicate from the purchaser to cover all sales to that person. For

You must retain each certicate for at least three years after the due date of the return to which it relates, or the date the return is led, if later, and maintain a method of associating the certicate on le with the sale made. Substantial civil or criminal penalties, or both, will result from misuse of this form.

Você também pode gostar

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesAinda não há avaliações

- Certificate of Indian Exemption For Certain Property or Services Delivered On A ReservationDocumento2 páginasCertificate of Indian Exemption For Certain Property or Services Delivered On A Reservationvikas_ojha54706Ainda não há avaliações

- Everthing You Need To Know To Start An Auto DealershipNo EverandEverthing You Need To Know To Start An Auto DealershipNota: 5 de 5 estrelas5/5 (1)

- WV TEC InstructionsDocumento4 páginasWV TEC InstructionsnareshkumharAinda não há avaliações

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsAinda não há avaliações

- E595E Tax Exempt FormDocumento4 páginasE595E Tax Exempt FormstockfaceAinda não há avaliações

- 1040 Exam Prep Module X: Small Business Income and ExpensesNo Everand1040 Exam Prep Module X: Small Business Income and ExpensesAinda não há avaliações

- Affidavit of Exempt Sale StandardDocumento2 páginasAffidavit of Exempt Sale StandardAnna AtienzaAinda não há avaliações

- Resale CertificateDocumento2 páginasResale CertificateRobertaVasconcelosAinda não há avaliações

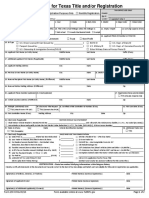

- TX Tax Exempt FormDocumento1 páginaTX Tax Exempt FormDemo CreditManagerAinda não há avaliações

- St120 Fill inDocumento2 páginasSt120 Fill inUber NewAinda não há avaliações

- Outside Resale Certificate-OhioDocumento8 páginasOutside Resale Certificate-OhioS S AliAinda não há avaliações

- Resale Certificate: Purchaser InformationDocumento2 páginasResale Certificate: Purchaser InformationGlendaAinda não há avaliações

- New York State Resale Certificate GuideDocumento2 páginasNew York State Resale Certificate Guidem4r4nzn0Ainda não há avaliações

- Affidavit of Non LiabilityDocumento3 páginasAffidavit of Non LiabilityJAMES DOUGLAS JRAinda não há avaliações

- Texas Sales and Use Tax DocumentsDocumento2 páginasTexas Sales and Use Tax Documentsvanderbrley100% (1)

- 130 U 3Documento2 páginas130 U 3Juan Escobar JuncalAinda não há avaliações

- Texas school district tax exemptionDocumento1 páginaTexas school district tax exemptionjuan camaneyAinda não há avaliações

- Transfer/Tax Form GuideDocumento2 páginasTransfer/Tax Form GuideKarma Pema DorjeAinda não há avaliações

- Used Car Sale Agreement 001Documento2 páginasUsed Car Sale Agreement 001heads81Ainda não há avaliações

- Vehicle Registration in AustraliaDocumento8 páginasVehicle Registration in AustraliaInarAinda não há avaliações

- COMMON TRANSACTION SLIPDocumento1 páginaCOMMON TRANSACTION SLIParwa_mukadam03Ainda não há avaliações

- Automobile Bill of Sale - AS ISDocumento9 páginasAutomobile Bill of Sale - AS ISFindLegalFormsAinda não há avaliações

- Resale CertificateDocumento1 páginaResale CertificateplayerwheelAinda não há avaliações

- UntitledDocumento11 páginasUntitledapi-61200414Ainda não há avaliações

- VRPIN02687DealerAppForTransferOfRego 0712 WebDocumento1 páginaVRPIN02687DealerAppForTransferOfRego 0712 WebChaitanya DevAinda não há avaliações

- Analyzing ecommerce tools and understanding resale permitsDocumento5 páginasAnalyzing ecommerce tools and understanding resale permitsfayyaz haydariAinda não há avaliações

- Illinois Common Sales Tax ExemptionsDocumento4 páginasIllinois Common Sales Tax ExemptionsFashion Revolution IncAinda não há avaliações

- Texas Sales and Use Tax Exemption CertificationDocumento2 páginasTexas Sales and Use Tax Exemption CertificationluherservicesAinda não há avaliações

- Affidavit of Ownership PacketDocumento8 páginasAffidavit of Ownership PacketJeremy WebbAinda não há avaliações

- Formvrtvpd1 PDFDocumento1 páginaFormvrtvpd1 PDFnirav16Ainda não há avaliações

- Vic Roads Transfer FormDocumento4 páginasVic Roads Transfer Formjikolji0% (1)

- Form ST-105: Indiana Department of RevenueDocumento2 páginasForm ST-105: Indiana Department of RevenueRenn DallahAinda não há avaliações

- BLTST119ExOr NY PDFDocumento1 páginaBLTST119ExOr NY PDFmoresubscriptionsAinda não há avaliações

- NC - Certificate of ResaleDocumento2 páginasNC - Certificate of ResaleChr FedAinda não há avaliações

- Tax Exempt Formsst4 and Sub st5 Sep 2012Documento4 páginasTax Exempt Formsst4 and Sub st5 Sep 2012api-330859141Ainda não há avaliações

- Tax Exempt FormsDocumento2 páginasTax Exempt Formsapi-251018730Ainda não há avaliações

- Application For Transfer of RegistrationDocumento6 páginasApplication For Transfer of RegistrationAnand KumarAinda não há avaliações

- Texas Resale CertificateDocumento2 páginasTexas Resale CertificatevandarsAinda não há avaliações

- Pa Rev 1220asDocumento2 páginasPa Rev 1220asVikram rajputAinda não há avaliações

- This Form May Be Photocopied - Void Unless Complete Information Is SuppliedDocumento2 páginasThis Form May Be Photocopied - Void Unless Complete Information Is SuppliedCristian De la cruz cantilloAinda não há avaliações

- XebisDocumento4 páginasXebis909214umarbashaAinda não há avaliações

- Sales and Use Tax Resale CertificateDocumento2 páginasSales and Use Tax Resale CertificatejesbmnAinda não há avaliações

- AZ Resale License Form 5000ADocumento1 páginaAZ Resale License Form 5000AZeal CoAinda não há avaliações

- Reg 343Documento2 páginasReg 343Joe BidenAinda não há avaliações

- Texas-Resale-Certificate Wasi LLCDocumento2 páginasTexas-Resale-Certificate Wasi LLCSyed TouseefAinda não há avaliações

- Alberta Bill of SaleDocumento2 páginasAlberta Bill of Saleapi-200845891Ainda não há avaliações

- Statutory Forms For Transfer of StocksDocumento2 páginasStatutory Forms For Transfer of Stockssaumil55Ainda não há avaliações

- Contract CaravanDocumento2 páginasContract CaravanKovacsAinda não há avaliações

- Auto Contract Eng ALTUDocumento2 páginasAuto Contract Eng ALTUVeronicaAinda não há avaliações

- IA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxDocumento2 páginasIA 843 Claim For Refund: Sales, Use, Excise, and Local Option TaxbolinagAinda não há avaliações

- DTF 802Documento2 páginasDTF 802Peter R MantiaAinda não há avaliações

- Illinois Department of Revenue ST-556 Sales Tax Return InstructionsDocumento3 páginasIllinois Department of Revenue ST-556 Sales Tax Return InstructionsLEAHAinda não há avaliações

- NY DMV Checklist for 2002 Mercedes CL500 RegistrationDocumento2 páginasNY DMV Checklist for 2002 Mercedes CL500 Registrationvenom4u31Ainda não há avaliações

- Resale Certificate: Form St-3Documento2 páginasResale Certificate: Form St-3jesbmnAinda não há avaliações

- MV Bill of Sale Form Form T7 0Documento1 páginaMV Bill of Sale Form Form T7 0Matrix31415Ainda não há avaliações

- Abandoned Property Bill of Sale FormDocumento2 páginasAbandoned Property Bill of Sale FormJesse GibsonAinda não há avaliações

- Purchase ReceiptDocumento3 páginasPurchase ReceiptZubair MohammedAinda não há avaliações

- Reseller CertificateDocumento2 páginasReseller CertificateKatherine KilcullenAinda não há avaliações

- Affidavit For Purchase of Motor Vehicles 0318Documento1 páginaAffidavit For Purchase of Motor Vehicles 0318Virnic FarmAinda não há avaliações

- Dtf275 Fill inDocumento1 páginaDtf275 Fill invikas_ojha54706Ainda não há avaliações

- Abr 2012 3 4 1712 1718Documento7 páginasAbr 2012 3 4 1712 1718vikas_ojha54706Ainda não há avaliações

- Little Champs PMS: An Investment Strategy For Indian Small Caps From Marcellus Investment ManagersDocumento18 páginasLittle Champs PMS: An Investment Strategy For Indian Small Caps From Marcellus Investment Managerssubham mohantyAinda não há avaliações

- q3 13 Efh Inv Call Deck FinalDocumento26 páginasq3 13 Efh Inv Call Deck Finalvikas_ojha54706Ainda não há avaliações

- MBN003 MitsubishiMarineGasEngineRangeDocumento2 páginasMBN003 MitsubishiMarineGasEngineRangevikas_ojha54706Ainda não há avaliações

- SDT Connector Quick StartDocumento4 páginasSDT Connector Quick Startvikas_ojha54706Ainda não há avaliações

- Statement of Financial Condition and Other InformationDocumento8 páginasStatement of Financial Condition and Other Informationvikas_ojha54706Ainda não há avaliações

- Business Tax Account Update: Step 1Documento2 páginasBusiness Tax Account Update: Step 1vikas_ojha54706Ainda não há avaliações

- Summary of Dev DiscourseDocumento5 páginasSummary of Dev Discoursevikas_ojha54706Ainda não há avaliações

- SDT Connector Quick StartDocumento4 páginasSDT Connector Quick Startvikas_ojha54706Ainda não há avaliações

- 2205GB Complete PitDocumento2 páginas2205GB Complete Pitvikas_ojha54706Ainda não há avaliações

- 1717949Documento2 páginas1717949vikas_ojha54706Ainda não há avaliações

- 386609004Documento24 páginas386609004vikas_ojha54706Ainda não há avaliações

- S16R - S16R MPTK PDFDocumento1 páginaS16R - S16R MPTK PDFvikas_ojha54706Ainda não há avaliações

- EnzzDocumento7 páginasEnzzshine141Ainda não há avaliações

- MPTK Source Installation With Win32Documento13 páginasMPTK Source Installation With Win32vikas_ojha54706Ainda não há avaliações

- S12A2MPTKDocumento3 páginasS12A2MPTKvikas_ojha5470650% (2)

- Landia MPTK-I MediumDocumento2 páginasLandia MPTK-I Mediumvikas_ojha54706Ainda não há avaliações

- IMO S6A3-MPTK engine specification sheetDocumento3 páginasIMO S6A3-MPTK engine specification sheetvikas_ojha54706100% (6)

- Abr 2012 3 4 1712 1718Documento7 páginasAbr 2012 3 4 1712 1718vikas_ojha54706Ainda não há avaliações

- Landia MPTK-I MediumDocumento2 páginasLandia MPTK-I Mediumvikas_ojha54706Ainda não há avaliações

- S6R2MPTKDocumento3 páginasS6R2MPTKvikas_ojha54706100% (4)

- S12A2MPTKDocumento3 páginasS12A2MPTKvikas_ojha5470650% (2)

- Ts KLM-KLP DKLM-DKLP EngDocumento5 páginasTs KLM-KLP DKLM-DKLP Engvikas_ojha54706Ainda não há avaliações

- 5sushruta KalpaDocumento41 páginas5sushruta KalpaYogesh ChavanAinda não há avaliações

- SRI June 2009 EngDocumento40 páginasSRI June 2009 Engvikas_ojha54706Ainda não há avaliações

- KLP User DDocumento84 páginasKLP User Dvikas_ojha54706Ainda não há avaliações

- KLP User DDocumento84 páginasKLP User Dvikas_ojha54706Ainda não há avaliações

- Application For Interim InjunctionDocumento2 páginasApplication For Interim InjunctionBusiness Law Group CUSBAinda não há avaliações

- Guaranty Agreement For Corporate Guarantor Dcma Form 1620Documento2 páginasGuaranty Agreement For Corporate Guarantor Dcma Form 1620Tira MagdAinda não há avaliações

- Pelaez vs. Auditor GeneralDocumento2 páginasPelaez vs. Auditor GeneralPia SarconAinda não há avaliações

- Arya Samaj Mandir Provides Inter - Religion Marriage Registration and Cerificate SupportDocumento2 páginasArya Samaj Mandir Provides Inter - Religion Marriage Registration and Cerificate SupportaryasamajmandirmarriageAinda não há avaliações

- Eugenio To InokDocumento25 páginasEugenio To InokHuehuehueAinda não há avaliações

- Gonzales III V Office of The President Case DigestDocumento3 páginasGonzales III V Office of The President Case DigestRe doAinda não há avaliações

- Koil - Olugu Account of Srirangam DisputesDocumento3 páginasKoil - Olugu Account of Srirangam DisputesramanujamuniAinda não há avaliações

- Legalization of Divorce in The PhilippinesDocumento3 páginasLegalization of Divorce in The PhilippinesGede RuizAinda não há avaliações

- Civil Procedure I Outline Explains Basic Principles and Rules of PleadingDocumento31 páginasCivil Procedure I Outline Explains Basic Principles and Rules of PleadingAshley DanielleAinda não há avaliações

- United States v. Alberto Valenzuela-Cueves, 4th Cir. (2013)Documento3 páginasUnited States v. Alberto Valenzuela-Cueves, 4th Cir. (2013)Scribd Government DocsAinda não há avaliações

- Dang Vang v. Vang Xiong X. Toyed, 944 F. 2d 476 - Court of Appeals, 9th Circuit 1991Documento7 páginasDang Vang v. Vang Xiong X. Toyed, 944 F. 2d 476 - Court of Appeals, 9th Circuit 1991bbcourtAinda não há avaliações

- Gonzales v. CADocumento2 páginasGonzales v. CAAnjAinda não há avaliações

- Student Members ListDocumento2 páginasStudent Members Listjai kalaAinda não há avaliações

- Calon ArangDocumento8 páginasCalon ArangDian Natalia SutantoAinda não há avaliações

- Subah Aur Sham Ke AzkarDocumento26 páginasSubah Aur Sham Ke AzkarAbdul Haque Shaikh0% (1)

- Sardar Vallabhbhai Patel World Tallest Statue ComingDocumento3 páginasSardar Vallabhbhai Patel World Tallest Statue ComingKunal GroverAinda não há avaliações

- BM Distress OperationDocumento1 páginaBM Distress OperationJon CornishAinda não há avaliações

- Francisco de Liano, Alberto Villa-Abrille JR and San Miguel Corporation Vs CA and Benjamin Tango GR No. 142316, 22 November 2001 FactsDocumento2 páginasFrancisco de Liano, Alberto Villa-Abrille JR and San Miguel Corporation Vs CA and Benjamin Tango GR No. 142316, 22 November 2001 FactscrisAinda não há avaliações

- FGM in Egypt, Sudan and IndiaDocumento18 páginasFGM in Egypt, Sudan and IndiaMaya El AzharyAinda não há avaliações

- Ethics LawDocumento8 páginasEthics LawDeyowin BalugaAinda não há avaliações

- J Butler - Revisiting Bodies and PleasuresDocumento10 páginasJ Butler - Revisiting Bodies and PleasuresDiego Madias100% (1)

- MSc Zoology Merit List Fall 2019Documento17 páginasMSc Zoology Merit List Fall 2019FarzanaAinda não há avaliações

- Letter of Appointment (HKDocumento4 páginasLetter of Appointment (HKSikkandhar JabbarAinda não há avaliações

- Rule 14 Cathay Metal Corporation vs. Laguna West Multi-Purpose Cooperative, Inc. G.R. No. 172204. July 2, 2014Documento16 páginasRule 14 Cathay Metal Corporation vs. Laguna West Multi-Purpose Cooperative, Inc. G.R. No. 172204. July 2, 2014Shailah Leilene Arce BrionesAinda não há avaliações

- Vanguard Index Chart 2009Documento5 páginasVanguard Index Chart 2009Anthony LeAinda não há avaliações

- Future Tenses WorkshopDocumento6 páginasFuture Tenses WorkshopJader loboAinda não há avaliações

- Air IndiaDocumento6 páginasAir IndiaANKITA M SHARMAAinda não há avaliações

- Bmt5121 Corporate Goverance and Ethics Digital Assignment 3Documento17 páginasBmt5121 Corporate Goverance and Ethics Digital Assignment 3Barani Kumar NAinda não há avaliações

- The Lost Land Chapter 2, A Lord of The Rings Fanfic - FanFictionDocumento1 páginaThe Lost Land Chapter 2, A Lord of The Rings Fanfic - FanFictionErszebethAinda não há avaliações

- SEERAH OF MUHAMMAD J BOOK 6: KEY EVENTS OF THE PROPHET'S LIFEDocumento80 páginasSEERAH OF MUHAMMAD J BOOK 6: KEY EVENTS OF THE PROPHET'S LIFEHeal ThyoldwaydsAinda não há avaliações

- How to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingNo EverandHow to Keep House While Drowning: A Gentle Approach to Cleaning and OrganizingNota: 4.5 de 5 estrelas4.5/5 (842)

- Decluttering at the Speed of Life: Winning Your Never-Ending Battle with StuffNo EverandDecluttering at the Speed of Life: Winning Your Never-Ending Battle with StuffNota: 4.5 de 5 estrelas4.5/5 (578)

- The Martha Manual: How to Do (Almost) EverythingNo EverandThe Martha Manual: How to Do (Almost) EverythingNota: 4 de 5 estrelas4/5 (11)

- The Buy Nothing, Get Everything Plan: Discover the Joy of Spending Less, Sharing More, and Living GenerouslyNo EverandThe Buy Nothing, Get Everything Plan: Discover the Joy of Spending Less, Sharing More, and Living GenerouslyNota: 4 de 5 estrelas4/5 (40)

- Simply Clean: The Proven Method for Keeping Your Home Organized, Clean, and Beautiful in Just 10 Minutes a DayNo EverandSimply Clean: The Proven Method for Keeping Your Home Organized, Clean, and Beautiful in Just 10 Minutes a DayNota: 4 de 5 estrelas4/5 (87)

- Tortoise and Hare Decluttering: The Whats, Whys, and Hows of Every Angle of DeclutteringNo EverandTortoise and Hare Decluttering: The Whats, Whys, and Hows of Every Angle of DeclutteringNota: 4.5 de 5 estrelas4.5/5 (51)

- The Joy of Less: A Minimalist Guide to Declutter, Organize, and SimplifyNo EverandThe Joy of Less: A Minimalist Guide to Declutter, Organize, and SimplifyNota: 4 de 5 estrelas4/5 (275)

- Survival Mom: How to Prepare Your Family for Everyday Disasters and Worst-Case ScenariosNo EverandSurvival Mom: How to Prepare Your Family for Everyday Disasters and Worst-Case ScenariosNota: 3.5 de 5 estrelas3.5/5 (8)

- The Gentle Art of Swedish Death Cleaning: How to Free Yourself and Your Family from a Lifetime of ClutterNo EverandThe Gentle Art of Swedish Death Cleaning: How to Free Yourself and Your Family from a Lifetime of ClutterNota: 4 de 5 estrelas4/5 (466)

- Simplified Organization: Learn to Love What Must Be DoneNo EverandSimplified Organization: Learn to Love What Must Be DoneAinda não há avaliações

- Success at Home with ADHD.: Practical Organization Strategies to Make Your Life Easier.No EverandSuccess at Home with ADHD.: Practical Organization Strategies to Make Your Life Easier.Nota: 4 de 5 estrelas4/5 (17)

- Martha Stewart's Organizing: The Manual for Bringing Order to Your Life, Home & RoutinesNo EverandMartha Stewart's Organizing: The Manual for Bringing Order to Your Life, Home & RoutinesNota: 4 de 5 estrelas4/5 (11)

- The Art of Happy Moving: How to Declutter, Pack, and Start Over While Maintaining Your Sanity and Finding HappinessNo EverandThe Art of Happy Moving: How to Declutter, Pack, and Start Over While Maintaining Your Sanity and Finding HappinessNota: 3.5 de 5 estrelas3.5/5 (9)

- Martha Stewart's Very Good Things: Clever Tips & Genius Ideas for an Easier, More Enjoyable LifeNo EverandMartha Stewart's Very Good Things: Clever Tips & Genius Ideas for an Easier, More Enjoyable LifeAinda não há avaliações

- The Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and OrganizingNo EverandThe Life-Changing Magic of Tidying Up: The Japanese Art of Decluttering and OrganizingNota: 4 de 5 estrelas4/5 (2993)

- Dwelling: Simple Ways to Nourish Your Home, Body, and SoulNo EverandDwelling: Simple Ways to Nourish Your Home, Body, and SoulNota: 4.5 de 5 estrelas4.5/5 (9)

- Let It Go: Downsizing Your Way to a Richer, Happier LifeNo EverandLet It Go: Downsizing Your Way to a Richer, Happier LifeNota: 4.5 de 5 estrelas4.5/5 (67)

- The Everything Organize Your Home Book: Eliminate clutter, set up your home office, and utilize space in your homeNo EverandThe Everything Organize Your Home Book: Eliminate clutter, set up your home office, and utilize space in your homeNota: 3 de 5 estrelas3/5 (1)

- Nobody Wants Your Sh*t: The Art of Decluttering Before You DieNo EverandNobody Wants Your Sh*t: The Art of Decluttering Before You DieNota: 4.5 de 5 estrelas4.5/5 (21)

- Declutter Like a Mother: A Guilt-Free, No-Stress Way to Transform Your Home and Your LifeNo EverandDeclutter Like a Mother: A Guilt-Free, No-Stress Way to Transform Your Home and Your LifeNota: 4.5 de 5 estrelas4.5/5 (164)

- Super Attractor Manifestation Meditations work your magic: limitless luck happiness joy abundance, activate your grid, quantum physics, instant result, miracles life changing, ultra serotoninNo EverandSuper Attractor Manifestation Meditations work your magic: limitless luck happiness joy abundance, activate your grid, quantum physics, instant result, miracles life changing, ultra serotoninNota: 2 de 5 estrelas2/5 (1)

- Plan and Organize Your Life: Achieve Your Goals by Creating Intentional Habits and Routines for SuccessNo EverandPlan and Organize Your Life: Achieve Your Goals by Creating Intentional Habits and Routines for SuccessNota: 5 de 5 estrelas5/5 (19)

- The Homesteader's Handbook: Mastering Self-Sufficiency on Any PropertyNo EverandThe Homesteader's Handbook: Mastering Self-Sufficiency on Any PropertyAinda não há avaliações

- Identity Clutter: The Whats, Whys, and Hows of Every Angle of DeclutteringNo EverandIdentity Clutter: The Whats, Whys, and Hows of Every Angle of DeclutteringNota: 5 de 5 estrelas5/5 (44)

- Mini Farming: Self-Sufficiency on 1/4 AcreNo EverandMini Farming: Self-Sufficiency on 1/4 AcreNota: 4.5 de 5 estrelas4.5/5 (6)

- M.O.M. Master Organizer of Mayhem: Simple Solutions to Organize Chaos and Bring More Joy into Your HomeNo EverandM.O.M. Master Organizer of Mayhem: Simple Solutions to Organize Chaos and Bring More Joy into Your HomeNota: 4.5 de 5 estrelas4.5/5 (25)