Escolar Documentos

Profissional Documentos

Cultura Documentos

What's Next For Outsourcing

Enviado por

LeopoldobunnyDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

What's Next For Outsourcing

Enviado por

LeopoldobunnyDireitos autorais:

Formatos disponíveis

What's next for outsourcing?

Outsource Magazine

On August 29, 2012 http://www.outsourcemagazine.co.uk The global crisis and subsequent economic downturn caused significant operational and financial challenges for most US firms, and now we see a similar play-out in Europe. The next round of outsourcing is being driven out of compulsion to cut cost aggressively just to stay in business and protect margins. Years back, Harvard Business Review declared outsourcing as one of the most important management practices of the last 75 years. The current downturn is accelerating it; earlier outsourcing was merely focussed on basic functions like customer care (call centre), AP, IT help desk etc., but now it encompasses the entire organisation. So whats next? Post-crisis, more and more firms are relooking at what their core functions really are. Increasingly they are finding things that can be moved or outsourced. So, the extent and complexity level of functions outsourced is growing from call centre to sales/collections; from AP to GL accounting; from IT help desk earlier to software development now. IT was the most common outsourced function, but now others like F&A, HR, Legal are also getting outsourced. The deal size of outsourcing contracts has increased significantly over the last decade. The choice of outsourcing destinations is expanding from India and the Philippines earlier to Eastern Europe, China and South America now. So let us take a closer look at things to come and how all of this is impacting us. Deal size (F&A) After IT, F&A is the second most popular segment and is also one of the fastest growing. Companies like British Telecom, JP Morgan, HSBC are all outsourcing their F&A in a big way.

BPs F&A outsourcing was an industry first with a contract worth $20m*. By 2002, it was extended to all businesses globally valued at $1.5bn*). Services provided: GL, Retail site accounting, Inventory accounting, AP.

British Telecom outsourced their global F&A to Accenture in Czech Republic, India. Accenture provides management reporting, financial planning, GL close, budgeting/forecasting etc. (Deal value estimated at $575m/5,000 FTE*).

JP Morgan outsourced nearly $400m* of IT, F&A and back office functions to India which is part-vendor managed (Cognizant/TCS/Accenture) and part captive centre (4,000* jobs offshored, mostly IT / F&A). HSBC is a market leader; it has so far created 20 Centres of Excellence (according to hsbcglobalsourcing.com) in various emerging markets like India and the Philippines to support its global businesses and outsourced its entire shared service function (IT, HR, Finance, Procurement).

In one of the first large contracts for the UK banking industry, Lloyds TSB outsourced HR, AP, T&E, fixed asset accounting to Xansa (later acquired by French firm Steria). The Steria (ex-Xansa) contract included processing 330,000 invoices* and 144,000 T&E bills* from its offshore delivery centre. (*Source: industry estimates)

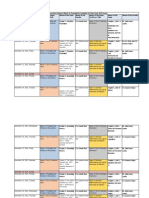

Expanding outsourcing destinations India is currently the preferred outsourcing destination due to its low wages and large English-speaking populace. Studies indicate it enjoys as much as 60 per cent market share. The Philippines with excellent English-language skills and infrastructure (but fewer skilled workers) is placed second. Other outsourcing destinations gaining ground are Poland and China. The exhibit below provides a ranking of the top outsourcing destinations.

Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Region South Asia South Asia South Asia South East Asia South Asia South Asia South Asia Western Europe South East Asia East Asia Eastern Europe East Asia South America East Asia South America

Country India India India Philippines India India India Ireland Philippines China Poland China Brazil China Argentina

City Bangalore Mumbai Delhi NCR Manila NCR Chennai Hyderabad Pune Dublin Cebu Shanghai Krakow Beijing Sao Paulo Dalian (Dairen) Buenos Aires

Status Established Established Established Established Established Established Established Established Established Established Emerging Emerging Emerging Emerging Emerging

Currently US and European cities dont appear in top outsourcing destinations (except Dublin/Krakow). But, strong political will, government incentives, and a positive economic climate will allow US and European cities to grab market share through nearshore and insourcing deals. This will happen as Tier 2 cities in Europe (like Dublin and Glasgow) and the US (like San Antonio) will come up as preferred destinations with the added benefits of being in the same timezone, excellent talent pools, competitive cost

and similar culture. More and more firms are tired of timezone differences (8+ hrs between US and India); frequent long-distance travel, higher communication costs and cultural differences causing team friction and clashes offshoring fatigue and nearshoring will avoid all these issues. So, lets understand whats being outsourced now and what is in store for the future (in the F&A domain at least). Growing complexity level Low-End (routine, simple, high-volume): Processes such as AP, T&E claims, AR, Payroll, and Settlements are low-end, simple and routine. They represent the bulk of functions outsourced with higher success rates as witnessed in several outsourcing deals since 2000s. Mid-End (slightly complex): Post-crisis, processes like GL accounting, Reporting, SOX that are somewhat complex are getting outsourced. Even in this segment slightly more complex ones like Budget, Tax are rarely outsourced but in the not-so-distant future they will get nearshored or insourced within the organisation. High-End: Highly complex & analytical functions like Planning, Board/Investor reports, Reg Report, Accounting Policy are still at their principle locations with a low probability of outsourcing. But in future these functions will get consolidated in the organisation through insourcing and organisations will create their own centres of functional excellence to manage such complex work.

Per the exhibit above, jobs attached to low-end processes (grey shaded area) are currently the bulk of stuff outsourced. Looking at the trend over the last three to four years, the complexity level of processes outsourced is rising (i.e. the grey shaded area is increasing). The future of outsourcing and offshoring Companies are realising outsourcing is one of the most potent management tools ever invented to drive efficiency. The future of outsourcing is bright and the model will continue to grow. Both governments and organisations in the western world need to work closely to identify strategies to take advantage and fight South Asian dominance. Here is some insight into the future of offshoring/outsourcing:

Excellence Hubs: Large firms will follow their peers (like HSBC) by creating Centres of Excellence but they will do this locally in Europe/Americas. They will move jobs from multiple high-cost cities to single low-cost locations, where they will establish best practices, standardise similar processes and create Excellence Hubs.

Insourcing/Nearshoring: Insourcing or nearshoring will get increasingly popular and will be the preferred choice of governments, people and firms alike. Insourcing is where work is performed by a specialised team in the firm. Nearshoring is where work is performed by another firm locally, sometimes just around the block. Both will benefit to help preserve jobs locally in the Americas and Europe.

Service Level Agreements (SLAs): In most large firms, shared services in general and F&A in particular, work without hard KPIs or service level targets is simply looked as fixed and is allocated out to frontline business. One reason offshoring has worked wonders is due to internal SLAs (for captive units) and vendor SLAs established

and followed rigorously. Similar SLAs will be the norm in future to ensure timely, high-quality, and cost-effective

delivery of tasks. Benchmarks: Outsourcing helped firms innovate, standardise and generate lower costs through benchmarks. This will be mirrored locally while establishing insourcing deals. A future focus will be to improve quality through, for example, Six Sigma programs. Best practices in one division dont benefit other teams doing similar work due to Silos, and this will change. Conclusion Outsourcing offers many benefits (cost, quality, innovation) and is now the most potent tool available to management as it drives efficiency and excellence. Organisations that outsource their non-core activities can yield up to 40-45 per cent cost reductions (Source: NASSCOM). As outsourcing continues to grow it has significant impact on labour markets. This in part explains why unemployment is at record levels even though companies are showing good turnaround and churning decent profits. Outsourcing is resulting in skill obsolescence and higher unemployment among youth, and the semi-skilled workforce. Workers associated with low-end jobs are increasingly finding their skills getting obsolete. Outsourcing will continue to be the preferred and strategic choice of firms to lower costs and improve processes. Governments, firms and workers in Europe and America need to work closely to create a favorable political, economic and incentive program to take advantage of it. (Here is a recent example: the UK has recently stated that it is not restricting outsourcing rather, the country is encouraging service providers to set up delivery centres in the UK.) Eventually, both nearshoring and offshoring will co-exist with the low to medium end of the work increasingly offshored to India and/or China and complex, highvalue processes in finance consolidation, group reporting, planning etc. nearshored in Europe and America.

About the Author Ash Bisaria is VP at Credit Suisse. http://outsourcemagazine.co.uk/whats-next-for-outsourcing/

Você também pode gostar

- Generic Strategy - CriticismDocumento15 páginasGeneric Strategy - Criticismpratyush parmar0% (1)

- CHMADocumento8 páginasCHMAAbhinandanAinda não há avaliações

- Business FailureDocumento15 páginasBusiness FailureJay Kishan100% (1)

- How To Be An Effective Leader in A Time of Crisis: MBA 6110 (070) Leading OthersDocumento6 páginasHow To Be An Effective Leader in A Time of Crisis: MBA 6110 (070) Leading OthersDat NguyenAinda não há avaliações

- Aavas FinanciersDocumento8 páginasAavas FinanciersSirish GopalanAinda não há avaliações

- Outsoucing Assignment Group 1Documento36 páginasOutsoucing Assignment Group 1ASHISH RASALAinda não há avaliações

- Introduction: Why Project Management?: © 2007 Pearson EducationDocumento18 páginasIntroduction: Why Project Management?: © 2007 Pearson EducationFarah MunawarAinda não há avaliações

- Consulting Case Study 101 - An Introduction To Frameworks - Street of WallsDocumento14 páginasConsulting Case Study 101 - An Introduction To Frameworks - Street of WallsgtrentinihAinda não há avaliações

- Data challenges and solutions in developing analytical modelsDocumento1 páginaData challenges and solutions in developing analytical modelsKritika KushwahaAinda não há avaliações

- Trade ConnectivityDocumento11 páginasTrade ConnectivityChairunnisa MappangaraAinda não há avaliações

- Assignment Unit VIIIDocumento20 páginasAssignment Unit VIIIHạnh NguyễnAinda não há avaliações

- Slide Decks CPDDocumento170 páginasSlide Decks CPDSamarth LahotiAinda não há avaliações

- Tor Esia For Ethanol Distillery Plant in Mityana DistrictDocumento42 páginasTor Esia For Ethanol Distillery Plant in Mityana Districtmubaraka kakuru0% (1)

- Professional Ethics - Course PresentationDocumento53 páginasProfessional Ethics - Course PresentationMichael MwateAinda não há avaliações

- 13.SCM - Make Vs BuyDocumento2 páginas13.SCM - Make Vs BuyWah KhaingAinda não há avaliações

- KPMG Fs Quarterly Newsletter q1 2020Documento10 páginasKPMG Fs Quarterly Newsletter q1 2020VineetAinda não há avaliações

- Business ModelDocumento13 páginasBusiness ModelJoahnna BraveAinda não há avaliações

- Bill Gates Leadership Style AnalysisDocumento4 páginasBill Gates Leadership Style Analysiskhushiyadav630% (1)

- Global Sourcing and Contract Management GuideDocumento2 páginasGlobal Sourcing and Contract Management Guidezahidul islam zahidAinda não há avaliações

- Chapter 4Documento7 páginasChapter 4yared gebrewoldAinda não há avaliações

- BUS 5116 Group 0009F Project FinalDocumento17 páginasBUS 5116 Group 0009F Project FinalazgorAinda não há avaliações

- Chapter 1 CaseDocumento3 páginasChapter 1 CaseKshitij KJ JoshiAinda não há avaliações

- The Challenge of Digital Transformation in The Automotive Industry-2020Documento180 páginasThe Challenge of Digital Transformation in The Automotive Industry-2020DoveAinda não há avaliações

- UberDocumento12 páginasUberThảo LinhAinda não há avaliações

- Singularity University 10 Year Anniversary Retrospective LR enDocumento60 páginasSingularity University 10 Year Anniversary Retrospective LR enLenin TeranAinda não há avaliações

- Marriott 2022 RFP Summary for Sheraton Saigon HotelDocumento3 páginasMarriott 2022 RFP Summary for Sheraton Saigon HotelBao MinhAinda não há avaliações

- Introduction to Consumer BehaviourDocumento29 páginasIntroduction to Consumer BehaviourSRISHTI TYAGIAinda não há avaliações

- Kansai Nerolac Annual Report 2018Documento205 páginasKansai Nerolac Annual Report 2018TejdeepAinda não há avaliações

- Maritime cabotage overviewDocumento12 páginasMaritime cabotage overviewToriqul ChowdhuryAinda não há avaliações

- Wal-Mart Struggles to Gain Foothold in Competitive Japanese Retail MarketDocumento21 páginasWal-Mart Struggles to Gain Foothold in Competitive Japanese Retail MarketNguyễn Huyền100% (1)

- Title: To Develop Marketing Strategy For The Infrastructure Storage and Security System in Effective MannerDocumento16 páginasTitle: To Develop Marketing Strategy For The Infrastructure Storage and Security System in Effective MannerTamil VelanAinda não há avaliações

- Gati Limited - at The Threshold of A Big LeapDocumento22 páginasGati Limited - at The Threshold of A Big LeapAnand DhawanAinda não há avaliações

- Detailed References WPP Master ClassDocumento7 páginasDetailed References WPP Master ClassAntónia CapelaAinda não há avaliações

- Subject: Strategic Management: ON Analysis of Ncell and NTC Telecommunication CompaniesDocumento13 páginasSubject: Strategic Management: ON Analysis of Ncell and NTC Telecommunication CompaniesKaemon BistaAinda não há avaliações

- Accenture IBS Procurement Shared ServicesDocumento12 páginasAccenture IBS Procurement Shared ServicesBob BoothAinda não há avaliações

- Tesla Inc Managment ReportDocumento39 páginasTesla Inc Managment ReportUbaid KhanAinda não há avaliações

- GolfReport v2 ENDocumento20 páginasGolfReport v2 ENEsther de la CruzAinda não há avaliações

- Talent management roadmap for SMB growth and expansionDocumento10 páginasTalent management roadmap for SMB growth and expansionElio ZerpaAinda não há avaliações

- BOSCH ReportDocumento21 páginasBOSCH ReportSubhrajit DeyAinda não há avaliações

- Digitalisation and Platform Economy - Disruption IDocumento11 páginasDigitalisation and Platform Economy - Disruption ITriptiAinda não há avaliações

- STP New - 5 - 6 - 920220722152102Documento38 páginasSTP New - 5 - 6 - 920220722152102piyush rawatAinda não há avaliações

- Business Intelligence Importance and The Role It PlaysDocumento10 páginasBusiness Intelligence Importance and The Role It PlaysGeorgiana Petrov100% (1)

- Building Organization Capable Good Strategy ExecutionDocumento46 páginasBuilding Organization Capable Good Strategy ExecutionEsmhel BrionesAinda não há avaliações

- Week 2 CH 2Documento48 páginasWeek 2 CH 2Noor TaherAinda não há avaliações

- Fin Rynki Bank Voprosov Est Oshibki - Merged-MergedDocumento73 páginasFin Rynki Bank Voprosov Est Oshibki - Merged-MergedNguyen HienAinda não há avaliações

- TL Operational Cost Strategies For Mobile Operators in EuropeDocumento15 páginasTL Operational Cost Strategies For Mobile Operators in Europeashuu_guptaAinda não há avaliações

- BSC CSIT Final Year Project Report On Sword of Warrior Game Project ReportDocumento52 páginasBSC CSIT Final Year Project Report On Sword of Warrior Game Project ReportGrey OldAinda não há avaliações

- 12 - Thesis Outline - Revenues, Expenses and Income SummaryDocumento4 páginas12 - Thesis Outline - Revenues, Expenses and Income SummaryPhuc Hoang DuongAinda não há avaliações

- BCG New Business Models For A New Global LandscapeDocumento9 páginasBCG New Business Models For A New Global LandscapefdoaguayoAinda não há avaliações

- A Case Study On Project ExecutionDocumento2 páginasA Case Study On Project ExecutionNitu Parimi100% (2)

- Swot and PestelDocumento12 páginasSwot and PestelRuchaAinda não há avaliações

- Viva EditedDocumento10 páginasViva EditedAshley Wood100% (1)

- Sayali Patil, MMS A, Roll No 44 Amazon Case QuestionsDocumento5 páginasSayali Patil, MMS A, Roll No 44 Amazon Case QuestionsSayali PatilAinda não há avaliações

- ACME Mexico City CaseDocumento6 páginasACME Mexico City Casemaulikparekh0950% (2)

- Unit 1 Business - Assignment BriefDocumento7 páginasUnit 1 Business - Assignment BriefMuhammad UMERAinda não há avaliações

- Ihrm NokiaDocumento2 páginasIhrm NokiafkkfoxAinda não há avaliações

- BCG Building Fractal Advantage in A Fragmenting World Nov 2021Documento16 páginasBCG Building Fractal Advantage in A Fragmenting World Nov 2021Varun KumarAinda não há avaliações

- Ai PDFDocumento65 páginasAi PDFKhadri MohammedAinda não há avaliações

- Offshoring & Outsourcing StrategiesDocumento12 páginasOffshoring & Outsourcing StrategiesNiket SinhaAinda não há avaliações

- The Outsourcing Revolution (Review and Analysis of Corbett's Book)No EverandThe Outsourcing Revolution (Review and Analysis of Corbett's Book)Ainda não há avaliações

- Accenture Ousourcing IntegradoDocumento1 páginaAccenture Ousourcing IntegradoLeopoldobunnyAinda não há avaliações

- Org Change ChecklistDocumento6 páginasOrg Change ChecklistLeopoldobunnyAinda não há avaliações

- 8 Useful Metrics For Evaluating Project PerformanceDocumento2 páginas8 Useful Metrics For Evaluating Project PerformanceLeopoldobunnyAinda não há avaliações

- A Drain Chambers One Ill Paper 3Documento11 páginasA Drain Chambers One Ill Paper 3LeopoldobunnyAinda não há avaliações

- Comprehensive M&A Due Diligence ChecklistDocumento30 páginasComprehensive M&A Due Diligence ChecklistSimon Tseung100% (2)

- Business Analysis - Asking The Right Questions - From Advanced Strategies 2012 EditionDocumento9 páginasBusiness Analysis - Asking The Right Questions - From Advanced Strategies 2012 EditionLeopoldobunnyAinda não há avaliações

- Chapter 4Documento19 páginasChapter 4EyadAinda não há avaliações

- Disk Electrostatic Automatic Coating System - OTSON - DM - OTS - 5000!3!0Documento16 páginasDisk Electrostatic Automatic Coating System - OTSON - DM - OTS - 5000!3!0otsontek9227Ainda não há avaliações

- Lessons Learned - Risk Management Issues in Genetic Counseling (2007)Documento151 páginasLessons Learned - Risk Management Issues in Genetic Counseling (2007)AditiAinda não há avaliações

- HDL Coder™ ReferenceDocumento487 páginasHDL Coder™ ReferenceVictor Colpo NavarreteAinda não há avaliações

- Corporate Subsidies On A Massive ScaleDocumento2 páginasCorporate Subsidies On A Massive ScaleBurchell WilsonAinda não há avaliações

- 1.9 Bernoulli's Equation: GZ V P GZ V PDocumento1 página1.9 Bernoulli's Equation: GZ V P GZ V PTruong NguyenAinda não há avaliações

- Captive Screws - Cap Head: Hex. SocketDocumento5 páginasCaptive Screws - Cap Head: Hex. SocketvikeshmAinda não há avaliações

- ICS Technical College Prospectus 2024 Edition 1Documento36 páginasICS Technical College Prospectus 2024 Edition 1samuel287kalumeAinda não há avaliações

- Iso 696 1975Documento8 páginasIso 696 1975Ganciarov MihaelaAinda não há avaliações

- UNIVERSIDAD NACIONAL DE COLOMBIA PALMIRA ENGLISH PROGRAMDocumento1 páginaUNIVERSIDAD NACIONAL DE COLOMBIA PALMIRA ENGLISH PROGRAMAlejandro PortoAinda não há avaliações

- Palo Alto Firewall VirtualizationDocumento394 páginasPalo Alto Firewall VirtualizationRyanb378Ainda não há avaliações

- More Med Surg Practice QuestionsDocumento14 páginasMore Med Surg Practice QuestionsmisscoombsAinda não há avaliações

- Chich The ChickenDocumento23 páginasChich The ChickenSil100% (4)

- The Four Principles of SustainabilityDocumento4 páginasThe Four Principles of SustainabilityNeals QuennevilleAinda não há avaliações

- Din en 912-2001Documento37 páginasDin en 912-2001Armenak BaghdasaryanAinda não há avaliações

- Year 2 - Push and Pull FPDDocumento18 páginasYear 2 - Push and Pull FPDRebecca LAinda não há avaliações

- Class 9 - Half Yearly Examination - 2023 - Portions and BlueprintDocumento16 páginasClass 9 - Half Yearly Examination - 2023 - Portions and BlueprintSUBRAMANI MANOHARANAinda não há avaliações

- Master of Advanced Nursing Practice degreeDocumento2 páginasMaster of Advanced Nursing Practice degreeAgusfian Trima PutraAinda não há avaliações

- Material Safety Data Sheet: Development Associates, IncDocumento3 páginasMaterial Safety Data Sheet: Development Associates, IncDedi MulyadiAinda não há avaliações

- Learner's Activity Sheet: English (Quarter 4 - Week 5)Documento5 páginasLearner's Activity Sheet: English (Quarter 4 - Week 5)Rufaidah AboAinda não há avaliações

- 1.an Overview On Membrane Strategies For Rare Earths Extraction and Separation - 2017Documento36 páginas1.an Overview On Membrane Strategies For Rare Earths Extraction and Separation - 2017Vasile AlexandraAinda não há avaliações

- Vijay Solvex PROJECT "Retention Strategy"Documento110 páginasVijay Solvex PROJECT "Retention Strategy"Jayesh SinghAinda não há avaliações

- Vedic Astrology OverviewDocumento1 páginaVedic Astrology Overviewhuman999100% (8)

- CFC KIDS FOR CHRIST 2020 FINAL EXAMDocumento13 páginasCFC KIDS FOR CHRIST 2020 FINAL EXAMKaisser John Pura AcuñaAinda não há avaliações

- Srimanta Shankardev: Early LifeDocumento3 páginasSrimanta Shankardev: Early LifeAnusuya BaruahAinda não há avaliações

- Chapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsDocumento10 páginasChapter 1-The Indian Contract Act, 1872, Unit 1-Nature of ContractsALANKRIT TRIPATHIAinda não há avaliações

- Health Benefits of Kidney BeansDocumento17 páginasHealth Benefits of Kidney BeansShyneAneeshAinda não há avaliações

- 68rfe IntroductionDocumento71 páginas68rfe IntroductionThePokeOne83% (6)

- Curriculum Vitae: Name: Bhupal Shrestha Address: Kamalamai Municipality-12, Sindhuli, Nepal. Email: ObjectiveDocumento1 páginaCurriculum Vitae: Name: Bhupal Shrestha Address: Kamalamai Municipality-12, Sindhuli, Nepal. Email: Objectivebhupal shresthaAinda não há avaliações

- Zombie Exodus Safe Haven GuideDocumento148 páginasZombie Exodus Safe Haven GuidejigglepopperAinda não há avaliações