Escolar Documentos

Profissional Documentos

Cultura Documentos

Are JV The Right Hendrik H Van Delden

Enviado por

Somnath TalukdarTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Are JV The Right Hendrik H Van Delden

Enviado por

Somnath TalukdarDireitos autorais:

Formatos disponíveis

Technical Textiles

Techtextil India Symposium Are Joint Ventures or Strategic Tie-Ups the Right Recipe for the Indian Technical Textiles Industry?

Knowledge Partner

Gherzi van Delden GmbH, Germany

www.gherzi.com

th and Techtextile India Symposium : 30 31 October 2012 Mumbai October 30 31st , 2012

th st

Page 1

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

In 2012 the Indian Techtex industry is estimated by Gherzi at about 1/10 of the Techtex industry in China Indian Techtex Industry Chinese Techtex Industry

6363560 Rs cr.

116 bn USD

58000 Rs cr.

11 bn USD

Source: Gherzi research and estimates Techtextile India Symposium : 30th 31st October 2012

Page 2

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

The Indian Techtex market today is mainly focusing on Packtech, Clothtech and Hometech. Higher value added applications like Indutech or Medtech still have to be expanded, coming from a smaller base World Techtex Market Structure Indian Techtex Market Structure (2010)

5%

7%

7%

33 %

39 %

81 %

13 %

15 %

Agrotech, Buildtech, Geotech, Indutech, Mobiletech, Oekotech, Protech, Sporttech

Packtech

Clothtech

Hometech

Source: Gherzi research Techtextile India Symposium : 30th 31st October 2012

Page 3

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

India: Attractiveness

(1)

Indian TechTex has recently seen major indigenous capacity investments without support by a western tie-up or JV partner. Examples include:

Gini Filaments into spunlace nonwovens Ahlstrom Gujarat into SMS nonwovens for gowns and drapes SRF into High Tenacity PET yarns and downstream PVC lamination (signage) and PVC coating (tarpaulins) Welspun into spunlace nonwovens Arvind into glass fabrics and wide width technical wovens Neocorp into wide width tape wovens Techfab into geogrid and woven geotextile manufacturing etc.

Techtextile India Symposium : 30th 31st October 2012

Page 4

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

India: Attractiveness

(2)

These investments demonstrate that India has reached the stage to become a major player in Technical Textiles outside of the traditional Packtech segment

For the local market which seems finally to take off For the international market which shows an increasing acceptance for India made products

After many years of focus chiefly on China, major foreign TechTex producers and converters have discovered India as the next growth market. Segments which should be the main focus of foreign interest include in Gherzi`s view:

Composites (wind energy, Mobiletech) Automotive textiles (nonwovens and moulded parts, headliner, airbag, seat fabrics) Hygiene (baby diapers, womens hygiene) Defence textiles Specialty Geotextiles (like shore reinforcement) State of the art crop protections / crop transport (Agrotech) Contract home textiles for modern large scale offices in the Software, IT and BOP sector

Techtextile India Symposium : 30th 31st October 2012

Page 5

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

India: Attractiveness

(3)

The advantage of Indian firms being a late entrant into the Techtex domain (compared to China) is, that companies can directly invest into state of the art technology. However,

Factories must be conceived as flexible as possible (a maximum number of segments to be served from one manufacturing line) Exportability of the product range constitutes an important asset to quickly fill a new, highly productive facility

Techtextile India Symposium : 30th 31st October 2012

Page 6

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Foreign investors in Indian Techtex have partially opted for a 100 % foreign owned local set-up

Recent Techtex FDIs in India

Saertex India (D): Glass multiaxial fabrics (composites) Ahlstrom (USA): Nonwovens and specialty papers (Medtech) Freudenberg Nonwovens India (USA): Interlining and Industrial Nonwovens

Autoliv India (D): Seat belts and Airbag Bond Safety belts (Sicherheitsgurte) (D): Seat belts Johnson and Johnson (USA): Hygiene, Medtech KOB Medical Textiles (D): Elastic Bandages (Medtech)

Lear Corporation (USA): Tier 1 for Automotive

Autoneum (CH): Tier 1 for Automotive Brinton carpets (UK) Skaps (USA): Geotextiles Meccaferri (I): Geotextiles TB Kawashima Automotive (Textile) India Pvt. Ltd (recently announced) (J): Automotive

Source: Press Info

Techtextile India Symposium : 30th 31st October 2012

Page 7

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Foreign investors in Indian Techtex have partially opted for a 100 % foreign owned local set-up (ctd)

Recent Techtex FDIs in India

Procter and Gamble (USA):Hygiene Karl Otto Braun (D): Cotton gauze and wound dressing (Medtech) MEP Olbo (D): Mechanical rubber good reinforcements (Indutech) Madura-Coats (UK): Sewing thread (Clothtech) Lindstrom (SF): Laundry rental (Protech) BWF (D): Filter bags for hot gas filtration (Indutech) Andrews (UK): Filter bags for hot gas filtration (Indutech) Unicharm India (J): Hygiene

Kimberly Clark (USA): Hygiene

3 M India (USA): Industrial and Medtech LANEX (Seile and Gurte) (CZ): Ropes and belts TAKATA (J): Seat belts and Airbag Schoeller India (CH): Functional textiles Wilhelm India (D): Laminated fabric for shoe industry

Source: Press info

Techtextile India Symposium : 30th 31st October 2012

Page 8

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

and partially opted for a tie-up with a qualified Indian counterpart

Key foreign JVs / Tie-Ups in India Technical Textile Field

Supreme NW / Textilgruppe Hof (D): Nonwoven interlining (Clothtech) KE - Burgmann Fibre India (D): Synthetic yarns (Indutech) Indo Danish (Past JV mit KE Burgmann fibre) Harley Nirafon India and Keld Ellemtoft (for Filters) Finland Aunde (D) Faze 3: Automotive seat fabrics Supreme Treves nonwovens (F): Automotive interior (Mobiltech) Treves Banswara Pvt Ltd (F): Automotive internal furnishing (Mobiltech) Kineco, Kaman Corporation (USA): Composites Strata Geosystems India Pvt. Ltd, (USA): Geotextiles Hindoostan and TOHO (J): Carbon / Aramid composites Tata and Johnson Control, (USA): Automotive Tier 1 ATM and Colan (AUS): Glass Fabrics (Composites) TRW (D) / Rane: Automotive Seat Belt KSS(USA) / Abhishek Auto Ind. Ltd.: Automotive Seat Belt, Airbag

Source: Press info

Techtextile India Symposium : 30th 31st October 2012

Page 9

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

and partially opted for a tie-up with a qualified Indian counterpart (ctd)

Key foreign JVs / Tie-Ups in India Technical Textile Field

H & V (USA), Nath group: HVAC filtration and battery separator (Indutech) Arvind, P.D. Group (D): Glass fabrics (Composites) Kusumgar Corporates, Saati (Italy): Protech DSM (CH), Kemrock: Specialty composite resins Loyal Textiles & M/s. Gruppo P&P Loyal SpA and Schaefer Loyal (I) and (D): Workwear Lenzing (CH) Modi Fibres India Pvt. Ltd. - Fibres

Arvind - Du Pont (USA): Aramide fabrics (Protech) Arvind - Rhodia (F): Cotton FR Proban (Protech) Vardhman - A&E (USA): Sewing thread (Clothtech)

Source: Press info

Techtextile India Symposium : 30th 31st October 2012

Page 10

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

In some cases Indian firms have ventured abroad to acquire know-how and market access through M & A

M&A

S. Kumars Ltd (takeover of Klopmann) Italy

Neo Corp International Ltd (takeover of Europlast) UK Binani Group / Goa glass fibre (3 B takeover) Belgium

SRF Belting division (takeover of Industex) S. Africa Alok Protech & Workwear division (takeover of Mileta) Czech Republic

Source: Press info

Techtextile India Symposium : 30th 31st October 2012

Page 11

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

The right approach Entering into new Techtex market segments requires

a) Know-how b) Investment in a manufacturing technology suitable for product certification to international norms and c) Customer access (locally and abroad)

A tie-up with a foreign partner can but most not always and in every case supply answers to the missing market entry skills described above

Techtextile India Symposium : 30th 31st October 2012

Page 12

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Acquisition of market entry skills: Four different cases

Targeted Market Indian Producer

Developed Indian market Packtech, Hometech Clothtech Market less developed in India All other Techtex segments

Small to Medium Enterprise

Stand alone or licensing / distribution agreement

Tie-up or Joint Venture for local market development

Larger enterprise

Stand alone approach or M & A

Tie-up or Joint Venture for local market and global exports

Source: Gherzi research Techtextile India Symposium : 30th 31st October 2012

Page 13

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Case 1

Small to medium enterprise: Packtech / Hometech / Clothtech market focus

Issues to deal with:

Why only licensing or distribution agreement required? Large Indian market allows for scale without foreign partner Penetration of higher end segments (FDA approved, pharma, ) requires skills best supplied, however, through a tie-up

Potential interest for foreign partner in tie-up with Indian firm?

Large size of Indian market Quick market entry through tie-up

Scalability?

Limited, as foreign partners will try to limit JV scope to India

Source: Gherzi research Techtextile India Symposium : 30th 31st October 2012

Page 14

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Case 2

Large enterprise: Packtech / Hometech / Clothtech market

Issues to deal with:

Why stand alone approach? Combination of larger Indian firm plus large domestic market allows for trading-up into higher end markets without foreign partner support Scalability? Yes going global might best be achieved through M & A (acquisition of foreign distributors or smaller producers)

Source: Gherzi research Techtextile India Symposium : 30th 31st October 2012

Page 15

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Case 3

Small to medium enterprise: All other segments

Issues to deal with:

Why tie-up for local market? Development of a foothold in emerging Indian market requires product and technology know-how often not available to Indian Techtex producers Interest for foreign partner? Small, but rapidly developing Indian market Scalability?

Limited, as foreign partners will try to limit JV scope to India

Source: Gherzi research Techtextile India Symposium : 30th 31st October 2012

Page 16

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Case 4

Large enterprise: Tie-up for local market and global exports

Issues to deal with:

Why tie-up for local market and global exports ? Investment in high performance western manufacturing technology requires global sales to fill the plant Interest for foreign partner?

Small, but developing Indian market Low cost base for global exports

Scalability?

Yes, if world market can be targeted

Source: Gherzi research Techtextile India Symposium : 30th 31st October 2012

Page 17

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Route to success (1)

Set the goals:

Long list of suitable partners:

Investment Memorandum:

Initial approach:

Which product / market segment Prio 1: Attractiveness of a tie-up for foreign partner Type of transaction: Off-take Strategic alliance or licensing JV Optimum fit optimum size Prio 2: Suited but less optimal

Presentation of the Indian market and Indian partner profile

1st contact NDA

Attractiveness of the transaction IM sent for the foreign partner 1st meeting Ideal transaction structure

Techtextile India Symposium : 30th 31st October 2012

Page 18

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Route to success (2)

Initial Approch

Short list:

LOI / MOU:

Pre-Contract:

Limited number (1 3) of tie-up partners for further negotiations

Agreement on transaction subject to

Joint business plan Detailed transaction structure Due diligence

Techtextile India Symposium : 30th 31st October 2012

Page 19

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Route to success (3)

Legal and tax:

Closure

Certifications Licenses Legal contracts

Techtextile India Symposium : 30th 31st October 2012

Page 20

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Success factors In Gherzis experience the following criteria are important to successfully close a transaction Show the attractiveness of the project for the foreign partner Identify the right partner and approach the right person on a personal level

Build trust in a series of successive meetings

Respect need of western partner to protect his IP

Involvement of an experienced consultant often helps to achieve these aims

Techtextile India Symposium : 30th 31st October 2012

Page 21

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Conclusion (1) Not always is a tie-up required to build up a successful business in Technical Textiles. A number of Indian firms have followed a stand alone approach Typically, foreign partners are mainly interested in the Indian market. The market is, however, still small outside of the Packtech Hometech Clothtech segments

Techtextile India Symposium : 30th 31st October 2012

Page 22

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Conclusion (2) A thorough analysis of the right partner to be approached helps to avoid disappointment lateron in the process

A clearly defined product / market focus and set of goals accompanied by a professionally worked out investment memorandum helps to attract the interest of a foreign partner

It is important to a) build trust between the parties in the series of negotiations and b) agree on a joint business plan in order to close the transaction in a manner satisfying both the Indian as well as the foreign party

Techtextile India Symposium : 30th 31st October 2012

Page 23

Are Joint Ventures or Strategic Tie-Ups the right recipe for the Indian Technical Textile Industry?

Thank you very much

Any questions?

Techtextile India Symposium : 30th 31st October 2012

Page 24

Você também pode gostar

- Study On Contribution of Technical Textile Industry in Indian EconomyDocumento13 páginasStudy On Contribution of Technical Textile Industry in Indian EconomytanishqAinda não há avaliações

- Q: What Is Technical Textiles?Documento7 páginasQ: What Is Technical Textiles?SantoshAinda não há avaliações

- INVESTOR GUIDE Technotex 2013 PDFDocumento200 páginasINVESTOR GUIDE Technotex 2013 PDFmukesh0887Ainda não há avaliações

- Financial Analysis of Indian Hometech Industry in Tenth and Eleventh Five Year PlanDocumento10 páginasFinancial Analysis of Indian Hometech Industry in Tenth and Eleventh Five Year PlanTJPRC PublicationsAinda não há avaliações

- Chapter 8Documento16 páginasChapter 8sanjay chandwaniAinda não há avaliações

- Non Woven Filter Market in IndiaDocumento11 páginasNon Woven Filter Market in Indiakalyani dynamicsAinda não há avaliações

- Automoble TrajectoriesDocumento54 páginasAutomoble TrajectoriesMr. Faisal ShameemAinda não há avaliações

- Technotex 2023 BrochureDocumento6 páginasTechnotex 2023 BrochureHemant YadavAinda não há avaliações

- International ConferenceDocumento2 páginasInternational ConferenceakpradhanAinda não há avaliações

- Project Technical TextilesDocumento22 páginasProject Technical Textilesvijayabaskar777Ainda não há avaliações

- 1 Technotex 2016 Knowledge Paper PDFDocumento44 páginas1 Technotex 2016 Knowledge Paper PDFArvind GuptaAinda não há avaliações

- Navdeep Singh SodhiDocumento35 páginasNavdeep Singh SodhiAditi ChauhanAinda não há avaliações

- Final Brochure ITC 2012Documento4 páginasFinal Brochure ITC 2012Shanmugam SubramanyanAinda não há avaliações

- Industry Giants To Present at Techtextil IndiaDocumento4 páginasIndustry Giants To Present at Techtextil Indiakalyani dynamicsAinda não há avaliações

- Introduction TechnotexDocumento16 páginasIntroduction Technotexaagrawal3Ainda não há avaliações

- Technical Textile Report by Invest IndiaDocumento49 páginasTechnical Textile Report by Invest IndiaGunjan KumarAinda não há avaliações

- 06 Chapter2Documento41 páginas06 Chapter2Surya MAinda não há avaliações

- Research and Development in Textiles and Its Importance in Present ScenarioDocumento5 páginasResearch and Development in Textiles and Its Importance in Present ScenarioTowhid Ul IslamAinda não há avaliações

- WWW - Drdo.gov - in Drdo English IITM Industry CompendiumDocumento578 páginasWWW - Drdo.gov - in Drdo English IITM Industry CompendiumGirish AgnihotriAinda não há avaliações

- Indian Technology Congress BrochureDocumento4 páginasIndian Technology Congress BrochureShanmugam SubramanyanAinda não há avaliações

- CRISIL Research Cust Bulletin Jan12Documento20 páginasCRISIL Research Cust Bulletin Jan12cse10vishalAinda não há avaliações

- Technical TextilesDocumento2 páginasTechnical TextilesAbrar Ahmed Apu50% (2)

- Technical Textiles GeneralDocumento43 páginasTechnical Textiles GeneralRachit ModiAinda não há avaliações

- DRDO Guidelines For ToT PDFDocumento100 páginasDRDO Guidelines For ToT PDFRamnivas KumarAinda não há avaliações

- A Project SynopsisDocumento11 páginasA Project SynopsisAnurag SinghAinda não há avaliações

- 08 Chapter 2Documento11 páginas08 Chapter 2Ridhosh VkAinda não há avaliações

- Automotive Textiles - Trends in IndiaDocumento8 páginasAutomotive Textiles - Trends in IndiaNimish MahajanAinda não há avaliações

- Textile Machinery EquipmentDocumento4 páginasTextile Machinery EquipmentgirishrajsAinda não há avaliações

- Techtex Interview - Anand Singh Jan 11Documento47 páginasTechtex Interview - Anand Singh Jan 11zocilghfmpxubrmxhnAinda não há avaliações

- Scope of Technical TextilesDocumento2 páginasScope of Technical Textiles09m008_159913639Ainda não há avaliações

- IpitexDocumento2 páginasIpitexfaridatul lutfiAinda não há avaliações

- Support To Indian Industry - 1Documento2 páginasSupport To Indian Industry - 1packwell paper tubeAinda não há avaliações

- Note On Technical Textiles: Scheme For Growth and Development of Technical Textiles (SGDTT) Was LaunchedDocumento4 páginasNote On Technical Textiles: Scheme For Growth and Development of Technical Textiles (SGDTT) Was LaunchedAniket MahajanAinda não há avaliações

- Technical Textiles NotesDocumento30 páginasTechnical Textiles NotesGany HarwalAinda não há avaliações

- AYM Syntex LTDDocumento12 páginasAYM Syntex LTDsanjay chandwaniAinda não há avaliações

- Textile Sector Needs A Vision and MissionDocumento3 páginasTextile Sector Needs A Vision and MissionRam RanaAinda não há avaliações

- ThandaraiDocumento3 páginasThandaraisanthosh.smtsAinda não há avaliações

- Working Paper 33Documento30 páginasWorking Paper 33vimalpatel63Ainda não há avaliações

- Need of Adoptive Textile Research Centre Needed in IndiaDocumento4 páginasNeed of Adoptive Textile Research Centre Needed in IndiaMerugu RachanaAinda não há avaliações

- NTTM Newsletter - January 2023 - 090223Documento12 páginasNTTM Newsletter - January 2023 - 090223Sourav MukherjeeAinda não há avaliações

- Self Reliance in Military Aviation FinalDocumento11 páginasSelf Reliance in Military Aviation FinalShallu NandwaniAinda não há avaliações

- Indian Scenario of Engineering Services Outsourcing (ESO) BusinessDocumento21 páginasIndian Scenario of Engineering Services Outsourcing (ESO) BusinessSanjay BaidAinda não há avaliações

- Drdo Industry CompendiumDocumento578 páginasDrdo Industry CompendiumthamaraikannanAinda não há avaliações

- Employment, Technology and Value Chain: A Case of Indian Leather IndustryDocumento24 páginasEmployment, Technology and Value Chain: A Case of Indian Leather IndustryKrishna KumarAinda não há avaliações

- Technical Textiles in India - Current and Future Market Scenario, ICTN 2010, IIT DelhiDocumento19 páginasTechnical Textiles in India - Current and Future Market Scenario, ICTN 2010, IIT DelhiKumar ManoharanAinda não há avaliações

- Transaction Costs, Technology Transfer, and In-House R&DDocumento7 páginasTransaction Costs, Technology Transfer, and In-House R&DRupak Kumar JhaAinda não há avaliações

- Industry4.0 AbhinavSrivastavaDocumento4 páginasIndustry4.0 AbhinavSrivastavaAbhinav SrivastavaAinda não há avaliações

- Research Papers On DTH IndustryDocumento6 páginasResearch Papers On DTH Industrygz8qarxz100% (1)

- MTICDocumento5 páginasMTICSonali TanejaAinda não há avaliações

- 1 s2.0 S221478532200462X MainDocumento8 páginas1 s2.0 S221478532200462X MainCristian Heidelberg Valencia PayanAinda não há avaliações

- Drdo PDFDocumento578 páginasDrdo PDFAbhishek GoelAinda não há avaliações

- Management Perspective On Low Productivity and Related Causative Factors: A Study On Indian Apparel Manufacturing IndustryDocumento12 páginasManagement Perspective On Low Productivity and Related Causative Factors: A Study On Indian Apparel Manufacturing IndustryAbdur Rauf KhanAinda não há avaliações

- Investor Guide - Technotex 2013 PDFDocumento178 páginasInvestor Guide - Technotex 2013 PDFHodAinda não há avaliações

- EficienciaDocumento11 páginasEficienciaEricka Daniela chinchayAinda não há avaliações

- Be - Awale WorddocDocumento11 páginasBe - Awale WorddocArchana PandurangiAinda não há avaliações

- Granules For Bio-Degradable BagsDocumento3 páginasGranules For Bio-Degradable Bagspmf engineering limitedAinda não há avaliações

- Hi-Tech Magazine Mar 2022 - How To Start Manufacturing Industry - Project Consultancy ServicesDocumento42 páginasHi-Tech Magazine Mar 2022 - How To Start Manufacturing Industry - Project Consultancy ServicesSachin SharmaAinda não há avaliações

- Wearable Technology Trends: Marketing Hype or True Customer Value?No EverandWearable Technology Trends: Marketing Hype or True Customer Value?Ainda não há avaliações

- How Indian Alt-Meat Startups Are Changing The Way We Perceive Food - The Economic TimesDocumento7 páginasHow Indian Alt-Meat Startups Are Changing The Way We Perceive Food - The Economic TimesSomnath TalukdarAinda não há avaliações

- Toy DatabaseDocumento3 páginasToy DatabaseSomnath TalukdarAinda não há avaliações

- Office Space: No Improvement in Vacancy As Demand Slows: India PropertyDocumento9 páginasOffice Space: No Improvement in Vacancy As Demand Slows: India PropertySomnath TalukdarAinda não há avaliações

- NCEUS - Working Paper 1 - Measures of Labour Force Participation and UtilizationDocumento23 páginasNCEUS - Working Paper 1 - Measures of Labour Force Participation and UtilizationSomnath TalukdarAinda não há avaliações

- Measures of Indicator 1Documento2 páginasMeasures of Indicator 1ROMMEL BALAN CELSOAinda não há avaliações

- Swenson 1 Dan Swenson Printing Press: Part One (Timeline)Documento6 páginasSwenson 1 Dan Swenson Printing Press: Part One (Timeline)Dan SwensonAinda não há avaliações

- Kowalkowskietal 2023 Digital Service Innovationin B2 BDocumento48 páginasKowalkowskietal 2023 Digital Service Innovationin B2 BAdolf DasslerAinda não há avaliações

- Piaggio MP3 300 Ibrido LT MY 2010 (En)Documento412 páginasPiaggio MP3 300 Ibrido LT MY 2010 (En)Manualles100% (3)

- Make Yeast StarterDocumento2 páginasMake Yeast StarterAlexandraAinda não há avaliações

- William Ury Power of A Positive No Bantam - 2007Documento227 páginasWilliam Ury Power of A Positive No Bantam - 2007Tam Jeopardy100% (1)

- Swot Matrix Strengths WeaknessesDocumento6 páginasSwot Matrix Strengths Weaknessestaehyung trash100% (1)

- Hemax-530 PDFDocumento2 páginasHemax-530 PDFNice BennyAinda não há avaliações

- Scan WV1DB12H4B8018760 20210927 1800Documento6 páginasScan WV1DB12H4B8018760 20210927 1800Sergio AlvarezAinda não há avaliações

- Sensor de Temperatura e Umidade CarelDocumento1 páginaSensor de Temperatura e Umidade CarelMayconLimaAinda não há avaliações

- Libherr CraneDocumento157 páginasLibherr Craneali67% (3)

- College of Engineering Cagayan State UniversityDocumento16 páginasCollege of Engineering Cagayan State UniversityErika Antonio GutierrezAinda não há avaliações

- GE Uno Downlight Backlit BLDocumento2 páginasGE Uno Downlight Backlit BLChen KengloonAinda não há avaliações

- Application Letter For Promotion T2 T3Documento24 páginasApplication Letter For Promotion T2 T3FGacadSabadoAinda não há avaliações

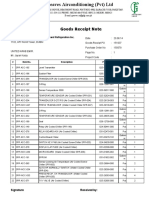

- Goods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateDocumento4 páginasGoods Receipt Note: Johnson Controls Air Conditioning and Refrigeration Inc. (YORK) DateSaad PathanAinda não há avaliações

- Noth PicturesDocumento17 páginasNoth PicturesJana AssaAinda não há avaliações

- HP Scanjet Pro 2500 F1 Flatbed Scanner: Boost Productivity With Fast, Versatile ScanningDocumento2 páginasHP Scanjet Pro 2500 F1 Flatbed Scanner: Boost Productivity With Fast, Versatile ScanningParesh BabariaAinda não há avaliações

- DLL Drafting 7Documento4 páginasDLL Drafting 7Ram Dacz100% (3)

- OB Case Study Care by Volvo UK 2020Documento1 páginaOB Case Study Care by Volvo UK 2020Anima AgarwalAinda não há avaliações

- Waste Foundry Sand and Its Leachate CharDocumento10 páginasWaste Foundry Sand and Its Leachate CharJanak RaazzAinda não há avaliações

- Chemical Engineering & Processing: Process Intensi Fication: ArticleinfoDocumento9 páginasChemical Engineering & Processing: Process Intensi Fication: Articleinfomiza adlinAinda não há avaliações

- UntitledDocumento5 páginasUntitledapril montejoAinda não há avaliações

- Ib Psychology - Perfect Saq Examination Answers PDFDocumento2 páginasIb Psychology - Perfect Saq Examination Answers PDFzeelaf siraj0% (2)

- Kat-A 4102 Rotovalve Edition3!12!02-2013 enDocumento4 páginasKat-A 4102 Rotovalve Edition3!12!02-2013 enWalter PiracocaAinda não há avaliações

- National Pension System (NPS) - Subscriber Registration FormDocumento3 páginasNational Pension System (NPS) - Subscriber Registration FormPratikJagtapAinda não há avaliações

- Empowerment Technology Lesson 4 PDFDocumento18 páginasEmpowerment Technology Lesson 4 PDFqueenless eightyoneAinda não há avaliações

- Centrifugal Pumps: Turbo Machines Amit Pathania Roll No:09309 Mechanical EngineeringDocumento4 páginasCentrifugal Pumps: Turbo Machines Amit Pathania Roll No:09309 Mechanical EngineeringAmit PathaniaAinda não há avaliações

- KARAKTERISTIK GEOTERMAL SUMUR EKSPLORASI AT-1, LAPANGAN PANAS BUMI ATADEI, KABUPATEN LEMBATA NTT. Kastiman Sitorus Dan Arif Munandar SUBDIT PANAS BUMIDocumento7 páginasKARAKTERISTIK GEOTERMAL SUMUR EKSPLORASI AT-1, LAPANGAN PANAS BUMI ATADEI, KABUPATEN LEMBATA NTT. Kastiman Sitorus Dan Arif Munandar SUBDIT PANAS BUMIItTo MakinoAinda não há avaliações

- CUIT 201 Assignment3 March2023Documento2 páginasCUIT 201 Assignment3 March2023crybert zinyamaAinda não há avaliações

- Lecture 5Documento20 páginasLecture 5Paylaşım KanalıAinda não há avaliações