Escolar Documentos

Profissional Documentos

Cultura Documentos

HES Intermediate Acctg Syllabus Spring 2014 Revised

Enviado por

Rahib JaskaniTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

HES Intermediate Acctg Syllabus Spring 2014 Revised

Enviado por

Rahib JaskaniDireitos autorais:

Formatos disponíveis

MGMT E-1100 (23893) Intermediate Accounting Number of credit hours: 4 Spring 2014 Professor Vijay Sampath Section Meeting

Time: Wednesday, 7:40 pm 9:40 pm Telephone: (646) 479-7517 Web Conference Email: vsampath@fas.harvard.edu Prerequisites: MGMT E-1000 with grades of C or better TA: Professor Jamal Ahmad Email: jahmad003@gmail.com Course Objectives This course builds on the fundamentals of financial accounting and reporting that you learned in the introductory Financial Accounting course (MGMT E-1000). By the end of the course you should have a good understanding of the (a) preparation and interpretation of an entitys financial statements in accordance with generally accepted accounting principles, (b) accounting for complex business transactions, and (c) techniques to evaluate firm performance. Topics include income statement, individual components of assets and liabilities, stockholders equity, statement of cash flows, revenue recognition and accounting changes. Real-life case studies will be used to evaluate firm performance. Required Textbook: Intermediate Accounting by Spiceland, Sepe, and Nelson. McGraw-Hill Irwin Seventh Edition (ISBN: 978-0-07-802532-7).

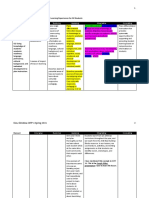

An access code for McGraw Hill comes automatically with the purchase of a new text. Supplementary cases, notes, solutions to in-class exercises and other handouts will be given posted on Blackboard. http://connect.mcgraw-hill.com/class/v_sampath_spring_2014 Grading Letter grades will be assigned for the course based on the following scale: 96-100% 91-95 86-90 A AB+ 1

80-85 75-79 70-74 60-69 59 or less Grading will be weighted as follows: Homework Assignments Midterm Exam Final Exam

B BC+ C F

30% 30% 40%

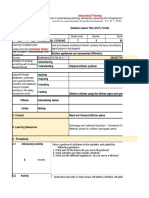

Homework Assignments The website for the assignments will be provided on the first day of class. You must log in and register as a student user. This is the website from which homework assignments are completed. All homework assignments must be submitted electronically. McGraw Hill will grade the problems for correctness; multiple attempts per question are permitted. The questions assigned and their due dates are contained in the Course Calendar below. For many of the questions, the numbers will be generated algorithmically, so the numbers WILL NOT be the same as those in your text or of other students. The homework assignment is due at 10 PM on the due date. Late submissions will not be permitted except under extraneous circumstances. Each assignment is worth the same percentage of the overall assignment grade weight, and the problems are equally weighted. The score from McGraw Hill will be converted into a percentage grade. The answers will be posted on Blackboard within 24-48 hours of the due date. You can work together on your homework assignments; however, each student must submit his/her own answer. Professor Ahmad will conduct sessions lasting 90 minutes every other week to go through problems at the back of the chapters. For this purpose, he will set up optional homework assignments. While attending these classes is not mandatory, it is highly recommended for those students who believe they need more practice with accounting.

Exams There will be two exams a midterm and a final exam. Arrangements will be made with the School to have the exam proctored. Only calculators are allowed, not PDAs, cellphones, etc. The final exam will be held during finals week. The exams will be closed book; it will be in your best interests to study and work through problems prior to the exams. In case you are not able to take the exams on the scheduled dates, you will need to the Extension School offices approval to take a late exam. Optional Paper (5%) 2

For extra credit purposes, you can write a paper performing an analysis of the latest annual financial statements for one of the public companies mentioned below. The paper should be 3-5 pages (double-spaced and Times Roman 12 font) in length and is due at the time of the final exam. Walmart Apple General Electric United Airlines Exxon Mobil Johnson & Johnson JP Morgan Chase

Attendance and Class Participation Attendance in class is expected. The course and students also benefit from active participation. Students are expected to contribute throughout the course. While there is no formal assessment of participation, students on the borderline between two grades will get the benefit of the doubt if they have actively participated. Tentative Class Schedule (BE: Brief Exercises; E: Exercises; P: Problems) DATE January 29 February 5 TOPIC Chapter 01: Introduction Chapter 02: Accounting Process Chapter 03: Balance Sheet ASSIGNMENTS No assignment due BE: 1-3, 1-5, 2-4, 2-5, 2-6 E: 1-6, 1-9, 2-4, 2-6, 2-17 DUE: 2/14 at 10 PM BE: 3-2, 3-5 E: 3-2, 3-7, 3-9 P: 3-5, 3-10 DUE: 2/21 at 10PM No assignment due

February 11 February 12

Optional class: Chapter 2 Chapter 04: The Income Statement

February 19 February 25 February 26

Chapter 04: Statement of Cash Flows Optional class: Chapters 3 and 4 Chapter 07: Cash and Receivables

March 5

Chapter 08: Inventories: Measurement

BE: 4-1, 4-2 E: 4-2 P: 4-3, 4-7 DUE: 3/7 at 10PM BE: 7-3, 7-6, 7-7 E: 7-21 P: 7-4, 7-5 3

DUE: 3/14 at 10PM March 11 March 12 March 19 March 25 March 26 Optional class: Chapter 7 Midterm Exam (Chapters 1-4, 6-7) Spring Break Optional class: Chapter 8 Chapter 10: Plant, Property and Equipment

April 2

Chapter 11: Depreciation, Impairments, and Depletion

BE: 8-4, 8-5 E: 8-8, 8-13 P:8-13 DUE: 4/4 at 10PM BE: 10-1, 10-2 E: 10-5, 10-6, 10-8 P: 10-3, 10-12 DUE: 4/11 at 10PM BE: 11-2, 11-7, 11-11 E: 11-1, 11-3 P: 11-3, 11-6 DUE: 4/18 at 10 PM BE: 13-6, 13-11, 13-13 E: 13-5, 13-14 P: 13-2 DUE: 4/25 at 10 PM BE: 14-4, 14-6 E: 14-5, 14-7 P: 14-22 DUE: 4/30 at 10 PM BE: 18-8, 18-11 E: 18-3, 18-15 P: 18-15 DUE: 5/9 at 10 PM BE: 19-10, 19-13 E: 19-11, 19-18 P: 19-12 DUE: 5/16 at 10 PM

April 8 April 9

Optional class: Chapters 10 and 11 Chapter 13: Current Liabilities and Contingencies

April 16

Chapter 14: Bonds and Long-Term Debt

April 22 April 23

Optional class: Chapters 13 and 14 Chapter 18: Shareholders Equity

April 30

Chapter 19: Share-Based Compensation and Earnings Per Share

May 6 May 7

Optional class: Chapters 18 and 19 Chapter 20: Accounting Changes and Error Corrections Final Exam Review Final Exam

May 14

Based on my experience, I would suggest that spending six hours every week should allow you to do well in this course. The six hours include the two hours of class time and doing the assigned homework (does not include the time if you choose to attend Professor Ahmads sessions). In addition to asking questions about the materials covered in class, I encourage you to reach out to me with other academic issues such as writing recommendations or advice regarding career 4

options and/or graduate work. I wish you all the best and look forward to a productive and fun semester!

Vijay Sampath

Você também pode gostar

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Application Participation in FairDocumento2 páginasApplication Participation in FairRahib JaskaniAinda não há avaliações

- FPSC Inspector Custom Intelligence OfficerDocumento47 páginasFPSC Inspector Custom Intelligence OfficerRahib JaskaniAinda não há avaliações

- Cmmercial Invice QATARDocumento1 páginaCmmercial Invice QATARRahib JaskaniAinda não há avaliações

- FPSC Inspector Custom Intelligence OfficerDocumento47 páginasFPSC Inspector Custom Intelligence OfficerRahib JaskaniAinda não há avaliações

- International Accounting Standard 2 International Accounting Standard 2Documento6 páginasInternational Accounting Standard 2 International Accounting Standard 2Rahib JaskaniAinda não há avaliações

- Lesson 1 Selecting A Research TopicDocumento1 páginaLesson 1 Selecting A Research TopicRahib JaskaniAinda não há avaliações

- Summarizing A Research ArticleDocumento3 páginasSummarizing A Research ArticleRahib JaskaniAinda não há avaliações

- IIA - Selftestengine.iia CFSA.v2015!03!19.by - Dayton.490qDocumento202 páginasIIA - Selftestengine.iia CFSA.v2015!03!19.by - Dayton.490qRahib JaskaniAinda não há avaliações

- Audit Solved MCQs (Foreign Books)Documento56 páginasAudit Solved MCQs (Foreign Books)Rahib Jaskani100% (1)

- Pakistan History MCQsDocumento5 páginasPakistan History MCQsRahib Jaskani100% (5)

- Characteristics of Islamic Economic SystemDocumento34 páginasCharacteristics of Islamic Economic SystemRahib JaskaniAinda não há avaliações

- Solved+MCQs+Comerce+and+accounting+book pdf1329027126Documento336 páginasSolved+MCQs+Comerce+and+accounting+book pdf1329027126Rahib JaskaniAinda não há avaliações

- Fiscal Policy: Presented By: SIDRA ASAD Rahma Haseeb Tayyaba AshrafDocumento58 páginasFiscal Policy: Presented By: SIDRA ASAD Rahma Haseeb Tayyaba AshrafRahib JaskaniAinda não há avaliações

- Press Note Public Relation Officer 18f2014Documento1 páginaPress Note Public Relation Officer 18f2014Rahib JaskaniAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Financial Accounting SyllabusDocumento6 páginasFinancial Accounting SyllabusIan Wang100% (1)

- IPCRF For Kindergarten TeachersDocumento13 páginasIPCRF For Kindergarten Teachersangelita dela cruzAinda não há avaliações

- English 414: Advanced Scientific Writing: Course Description and ObjectivesDocumento5 páginasEnglish 414: Advanced Scientific Writing: Course Description and ObjectivesseharrisAinda não há avaliações

- Sample Praktikum KalendarDocumento5 páginasSample Praktikum KalendarNur AzmeeraAinda não há avaliações

- Disadvantages of An Elite EducationDocumento4 páginasDisadvantages of An Elite EducationcolayaAinda não há avaliações

- Lbs 400 Lesson Plan 2Documento2 páginasLbs 400 Lesson Plan 2api-315590585Ainda não há avaliações

- Anticipated Ib Grades For Ubc: The University of British ColumbiaDocumento2 páginasAnticipated Ib Grades For Ubc: The University of British ColumbiaYifanAinda não há avaliações

- CSTP 4 Kim 5Documento11 páginasCSTP 4 Kim 5api-431376258Ainda não há avaliações

- ISE III Dolphin Communication Rubric and Answers PDFDocumento1 páginaISE III Dolphin Communication Rubric and Answers PDFAlba FernándezAinda não há avaliações

- Natural Learning Process ArticleDocumento15 páginasNatural Learning Process ArticleAna Maria PavelAinda não há avaliações

- B Ce001-Ce31fa1 15-16-2Documento68 páginasB Ce001-Ce31fa1 15-16-2Emmanuel LazoAinda não há avaliações

- RF PWR Word Families - Letter CombinationsDocumento3 páginasRF PWR Word Families - Letter Combinationsapi-278024645Ainda não há avaliações

- Collocations, Modal VerbsDocumento7 páginasCollocations, Modal VerbsValeria EviAinda não há avaliações

- Advanced Administration and SupervisionDocumento70 páginasAdvanced Administration and SupervisionHazel Montanez100% (8)

- Module 6 9 Tle - Post AssessmentDocumento3 páginasModule 6 9 Tle - Post Assessmentapi-199390118Ainda não há avaliações

- PrefaceDocumento9 páginasPrefaceRomayra Albarracin40% (5)

- Christos Simantirakis CVDocumento2 páginasChristos Simantirakis CVapi-275859815Ainda não há avaliações

- Nova SBE Handbook Students General InformationDocumento32 páginasNova SBE Handbook Students General InformationVasco TamenAinda não há avaliações

- T 134 Syllabusfall 2014 Section 17781Documento9 páginasT 134 Syllabusfall 2014 Section 17781api-251069635Ainda não há avaliações

- Regional Memorandum No.13 s.2014Documento2 páginasRegional Memorandum No.13 s.2014Gael Forbes RealAinda não há avaliações

- Edward Howard CVDocumento5 páginasEdward Howard CVEd HowardAinda não há avaliações

- Philippines EFA MDADocumento54 páginasPhilippines EFA MDARebecca Monzon100% (2)

- My Pedagogic Creed - Philosophy of Teaching Learning and CurriculumDocumento3 páginasMy Pedagogic Creed - Philosophy of Teaching Learning and Curriculumapi-322503725Ainda não há avaliações

- Types of Lesson PlanDocumento49 páginasTypes of Lesson PlanDondon100% (1)

- Proposed Common Courses For DiscussionDocumento26 páginasProposed Common Courses For Discussionasnescrib0% (1)

- Lesson Plan in LanguageDocumento4 páginasLesson Plan in LanguageBernadine Gutierrez CubacubAinda não há avaliações

- Shulman 1986Documento12 páginasShulman 1986Kátia BertolaziAinda não há avaliações

- DLP Interpret Kitchen SymbolsDocumento6 páginasDLP Interpret Kitchen SymbolsWilma S. Bentayao100% (1)

- Pages Intro Rec 3rd EdDocumento41 páginasPages Intro Rec 3rd EdzarigueiaAinda não há avaliações

- 1.3 - K - Apply Work Place Working Language Vol. 1Documento3 páginas1.3 - K - Apply Work Place Working Language Vol. 1cnoraAinda não há avaliações