Escolar Documentos

Profissional Documentos

Cultura Documentos

Press 20140321e

Enviado por

Randora LkDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Press 20140321e

Enviado por

Randora LkDireitos autorais:

Formatos disponíveis

Communications Department 30, Janadhipathi Mawatha, Colombo 01, Sri Lanka.

Tel : 2477424, 2477423, 2477311 Fax: 2346257, 2477739 E-mail: dcommunications@cbsl.lk, communications@cbsl.lk Web: www.cbsl.gov.lk

Press Release

Issued By Economic Research Department Date

21-03-2014 12-12-2012 Monetary Policy Review March 2014

The Sri Lankan economy yet again emphasised its strong potential with broadbased GDP growth taking place in all three sectors of the economy in 2013. Well sustained by low and stable inflation, the economy, which grew by 7.3 per cent in 2013 compared to 6.3 per cent in 2012, signalled a shift towards a higher and sustainable growth trajectory. According to recently released data from the Department of Census and Statistics, the final quarter of 2013 recorded a GDP growth of 8.2 per cent and exhibited a surge in performance in the Agriculture and Industry sectors, while the Services sector growth indicated some moderation. During the year, the Industry sector showed a robust growth of 9.9 per cent, while the Agriculture and Services sectors recorded growth rates of 4.7 per cent and 6.4 per cent, respectively. Substantiating the deceleration seen in consumer price inflation during the year, the GDP deflator for 2013 recorded 6.7 per cent, declining from 8.9 per cent in 2012. Buttressed by subdued demand conditions and improved domestic supply of most food items, consumer price inflation remained at mid-single digit levels in February 2014 recording the 61st consecutive month in single digits. Both year-on1

year headline and core inflation moderated in February recording 4.2 per cent and 3.1 per cent, respectively, compared to 4.4 per cent and 3.5 per cent, respectively, in January 2014. Looking ahead, inflation is expected to remain at mid single digits throughout 2014. Although the outlook for inflation remains encouraging from a demand perspective, the Central Bank will continue to closely monitor possible supply disruptions resulting from the drought conditions experienced in certain parts of the country. In the external sector, earnings from exports grew by 23.2 per cent, year-onyear, during January 2014, thus sustaining its growth momentum, which commenced in June 2013. Expenditure on imports increased by 7.9 per cent during the month. Reflecting the recovery in exports and the muted growth in imports, the trade deficit contracted by 5.9 per cent in January 2014 to US dollars 756 million. Inflows, on account of workers remittances recorded a healthy increase in January 2014 while earnings from tourism gathered momentum during the first two months of 2014. Further, supported by net inflows to the Government securities market, valuation gains, and the proceeds from the international Sovereign bond issuance in January, gross official reserves increased to US dollars 8.0 billion as at end January 2014, which is equivalent to 5.3 months of imports. In the monetary sector, broad money (M2b) expanded by 16 per cent in January 2014, primarily due to higher net credit to the government (NCG) as credit flows to the private sector and public corporations contracted. NCG from the banking system increased by around Rs. 68.3 billion in January 2014, but is expected to decline in February with the utilisation of proceeds from the Sovereign bond. Credit to the private sector by commercial banks moderated, growing only by 5.2 per cent in January 2014 in comparison to 7.5 per cent in December 2013, largely due to the settlement of short term advances by corporates during the month as well as the decline seen in pawning and trade related credit. However, the Monetary Board is of the view that the deceleration of the growth in credit to the private sector is temporary, and going forward, private sector credit is likely to rebound from the

second quarter of the year, supported by declining market lending rates, sufficient liquidity levels and increased demand for exports from the advanced economies. Considering the above, the Monetary Board, at its meeting held on 20 th March 2014, was of the view that the current monetary policy stance is appropriate, and therefore, decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank unchanged at their current levels of 6.50 per cent and 8.00 per cent, respectively. The date for the release of the next regular statement on monetary policy would be announced in due course.

Você também pode gostar

- Press Release: Communications DepartmentDocumento2 páginasPress Release: Communications DepartmentRandora LkAinda não há avaliações

- Press 20140422eDocumento2 páginasPress 20140422eRandora LkAinda não há avaliações

- Press Release: Communications DepartmentDocumento4 páginasPress Release: Communications DepartmentRandora LkAinda não há avaliações

- Press 20150127e PDFDocumento2 páginasPress 20150127e PDFRandora LkAinda não há avaliações

- First Bi-Monthly Monetary Policy Statement, 2014-15Documento8 páginasFirst Bi-Monthly Monetary Policy Statement, 2014-15FirstpostAinda não há avaliações

- Press Release: Communications DepartmentDocumento3 páginasPress Release: Communications DepartmentRandora LkAinda não há avaliações

- Press 20130117eDocumento2 páginasPress 20130117eran2013Ainda não há avaliações

- Press 20140408eaDocumento7 páginasPress 20140408eaRandora LkAinda não há avaliações

- Economic and Financial DevelopmentsDocumento25 páginasEconomic and Financial DevelopmentsConnorLokmanAinda não há avaliações

- Press 20130212eDocumento2 páginasPress 20130212eran2013Ainda não há avaliações

- DirectorDocumento49 páginasDirectorrohitkoliAinda não há avaliações

- RBI Governor Statement 1702090413Documento9 páginasRBI Governor Statement 1702090413Jyotiraditya JadhavAinda não há avaliações

- Economic Situation ReportDocumento10 páginasEconomic Situation ReportAldesaAinda não há avaliações

- Pakistan's Economic Performance and Prospects in FY2014Documento6 páginasPakistan's Economic Performance and Prospects in FY2014Abdul Ghaffar BhattiAinda não há avaliações

- MPS-Jul-2014-Eng 1 PDFDocumento41 páginasMPS-Jul-2014-Eng 1 PDFzahidmushtaq13Ainda não há avaliações

- African Markets Monthly Macro OverviewDocumento5 páginasAfrican Markets Monthly Macro OverviewAntónio Costa AmaralAinda não há avaliações

- Road MapDocumento7 páginasRoad Mapran2013Ainda não há avaliações

- Monetary Policy of PakistanDocumento16 páginasMonetary Policy of PakistanTaYmoorAltafAinda não há avaliações

- Subsidiaries of ICICI Bank Annual Report FY2014Documento356 páginasSubsidiaries of ICICI Bank Annual Report FY2014karan_w3Ainda não há avaliações

- Bank of Uganda Report Highlights Moderate GDP Growth OutlookDocumento28 páginasBank of Uganda Report Highlights Moderate GDP Growth OutlookKenneth ByangwaAinda não há avaliações

- Macroeconomic Indicators Improve: SBP's Quarterly ReportDocumento2 páginasMacroeconomic Indicators Improve: SBP's Quarterly Reportshoaib625Ainda não há avaliações

- Main Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationDocumento5 páginasMain Indicators: GDP, State Budget, Foreign Trade, Exchange Rate, InflationUrtaBaasanjargalAinda não há avaliações

- Economic Review 2023Documento31 páginasEconomic Review 202317044 AZMAIN IKTIDER AKASHAinda não há avaliações

- ABL 1st Qtry 2014Documento44 páginasABL 1st Qtry 2014Mir Zain Ul HassanAinda não há avaliações

- Equity Valuation of MaricoDocumento18 páginasEquity Valuation of MaricoPriyanka919100% (1)

- Summary of Nigeria Economic ReportDocumento5 páginasSummary of Nigeria Economic ReportAnthony EtimAinda não há avaliações

- Economic StatusDocumento29 páginasEconomic StatusAnthony EtimAinda não há avaliações

- Quarterly AnalysisDocumento3 páginasQuarterly Analysisdede.ilyasAinda não há avaliações

- Press 20130924eDocumento7 páginasPress 20130924eRandora LkAinda não há avaliações

- The Analysis in This Report Is Confined To The End of The First Quarter, and Mainly Covers The Period July-September 2013 and The OutlookDocumento12 páginasThe Analysis in This Report Is Confined To The End of The First Quarter, and Mainly Covers The Period July-September 2013 and The OutlookBaber AminAinda não há avaliações

- ZAR StatementDocumento13 páginasZAR StatementZerohedgeAinda não há avaliações

- Feb 2014 ForecastDocumento79 páginasFeb 2014 ForecastRachel E. Stassen-BergerAinda não há avaliações

- Update On Indian Economy November 2013 - Mega Ace ConsultancyDocumento10 páginasUpdate On Indian Economy November 2013 - Mega Ace ConsultancyMegaAceConsultancyAinda não há avaliações

- Nigeria Ratings Affirmed Outlook Negative On Increasing Political, Institutional, and Fiscal RisksDocumento8 páginasNigeria Ratings Affirmed Outlook Negative On Increasing Political, Institutional, and Fiscal Risksapi-228714775Ainda não há avaliações

- The World Bank Group - Tajikistan Partnership Program SnapshotDocumento31 páginasThe World Bank Group - Tajikistan Partnership Program SnapshotamudaryoAinda não há avaliações

- Press 20150123 PDFDocumento7 páginasPress 20150123 PDFRandora LkAinda não há avaliações

- Governor's StatementDocumento11 páginasGovernor's Statementvipulpandey005Ainda não há avaliações

- Monetary Policy Statement September 2013 HighlightsDocumento42 páginasMonetary Policy Statement September 2013 HighlightsScorpian MouniehAinda não há avaliações

- Third Quarter Review of Monetary Policy 2012-13 - Statement by Dr. D. Subbarao, Governor, Reserve Bank of IndiaDocumento6 páginasThird Quarter Review of Monetary Policy 2012-13 - Statement by Dr. D. Subbarao, Governor, Reserve Bank of IndiaNarayanan GopalacharyAinda não há avaliações

- India Monetary Policy Review 17 June 2013Documento3 páginasIndia Monetary Policy Review 17 June 2013Jhunjhunwalas Digital Finance & Business Info LibraryAinda não há avaliações

- Inflation Outlook and Analysis: Bank of Ghana Monetary Policy ReportDocumento7 páginasInflation Outlook and Analysis: Bank of Ghana Monetary Policy ReportMacauley SelormAinda não há avaliações

- Brief Survey of Pakistan Economy 2014Documento2 páginasBrief Survey of Pakistan Economy 2014Ahmed RazaAinda não há avaliações

- Adb2014 Sri LankaDocumento5 páginasAdb2014 Sri LankaRandora LkAinda não há avaliações

- Bank of Tanzania Mid-Year Monetary Policy ReviewDocumento58 páginasBank of Tanzania Mid-Year Monetary Policy Reviewafzallodhi736Ainda não há avaliações

- Red Jun 2014Documento38 páginasRed Jun 2014hrnanaAinda não há avaliações

- Inflation of BhutanDocumento12 páginasInflation of BhutanMarkWeberAinda não há avaliações

- Rbi Annual Policy 2013-14Documento41 páginasRbi Annual Policy 2013-14Chhavi BhatnagarAinda não há avaliações

- Acroeconomic Cenario: Source: Please See AnnexureDocumento2 páginasAcroeconomic Cenario: Source: Please See AnnexureehsankabirAinda não há avaliações

- Interim Budget 2014-15 speech highlights fiscal deficit, GDP growthDocumento14 páginasInterim Budget 2014-15 speech highlights fiscal deficit, GDP growthPrabin Kumar NathAinda não há avaliações

- Viet Nam's 2014 Economic Outlook: GDP Growth of 5.2% and Inflation of 4.5Documento2 páginasViet Nam's 2014 Economic Outlook: GDP Growth of 5.2% and Inflation of 4.5Ben KuAinda não há avaliações

- Central Bank of Nigeria Communiqué No. 146 of The Monetary Policy Committee Meeting Held On Monday 23 and Tuesday 24 JANUARY 2023Documento70 páginasCentral Bank of Nigeria Communiqué No. 146 of The Monetary Policy Committee Meeting Held On Monday 23 and Tuesday 24 JANUARY 2023QS OH OladosuAinda não há avaliações

- UBL Financial StatementsDocumento23 páginasUBL Financial StatementsUsmAn MajeedAinda não há avaliações

- Press 20130719eDocumento6 páginasPress 20130719eRandora LkAinda não há avaliações

- Pakistan's Economy Sees 5.37% Growth in 2020-21 With Industrial Sector Leading RecoveryDocumento4 páginasPakistan's Economy Sees 5.37% Growth in 2020-21 With Industrial Sector Leading RecoveryShahab MurtazaAinda não há avaliações

- State Bank of Pakistan: Monetary Policy DecisionDocumento2 páginasState Bank of Pakistan: Monetary Policy DecisionSumeet MetaiAinda não há avaliações

- HVS - 2014 - Hotels in India - Trends OpportunitiesDocumento21 páginasHVS - 2014 - Hotels in India - Trends OpportunitiesivanwoodsAinda não há avaliações

- Global Economic Outlook Prospects For The World Economy in 2014-2015 Global Growth Continues To Face HeadwindsDocumento11 páginasGlobal Economic Outlook Prospects For The World Economy in 2014-2015 Global Growth Continues To Face HeadwindsBen KuAinda não há avaliações

- Bangladesh Quarterly Economic Update: September 2014No EverandBangladesh Quarterly Economic Update: September 2014Ainda não há avaliações

- Bangladesh Quarterly Economic Update: June 2014No EverandBangladesh Quarterly Economic Update: June 2014Ainda não há avaliações

- Wei 20150904 PDFDocumento18 páginasWei 20150904 PDFRandora LkAinda não há avaliações

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocumento4 páginasWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkAinda não há avaliações

- Weekly Update 04.09.2015 PDFDocumento2 páginasWeekly Update 04.09.2015 PDFRandora LkAinda não há avaliações

- Daily 01 09 2015 PDFDocumento4 páginasDaily 01 09 2015 PDFRandora LkAinda não há avaliações

- 03 September 2015 PDFDocumento9 páginas03 September 2015 PDFRandora LkAinda não há avaliações

- Global Market Update - 04 09 2015 PDFDocumento6 páginasGlobal Market Update - 04 09 2015 PDFRandora LkAinda não há avaliações

- Global Market Update - 04 09 2015 PDFDocumento6 páginasGlobal Market Update - 04 09 2015 PDFRandora LkAinda não há avaliações

- Sri0Lanka000Re0ounting0and0auditing PDFDocumento44 páginasSri0Lanka000Re0ounting0and0auditing PDFRandora LkAinda não há avaliações

- Earnings Update March Quarter 2015 05 06 2015 PDFDocumento24 páginasEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkAinda não há avaliações

- Press 20150831ebDocumento2 páginasPress 20150831ebRandora LkAinda não há avaliações

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocumento3 páginasICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkAinda não há avaliações

- Earnings & Market Returns Forecast - Jun 2015 PDFDocumento4 páginasEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkAinda não há avaliações

- Press 20150831ea PDFDocumento1 páginaPress 20150831ea PDFRandora LkAinda não há avaliações

- CCPI - Press Release - August2015 PDFDocumento5 páginasCCPI - Press Release - August2015 PDFRandora LkAinda não há avaliações

- Results Update Sector Summary - Jun 2015 PDFDocumento2 páginasResults Update Sector Summary - Jun 2015 PDFRandora LkAinda não há avaliações

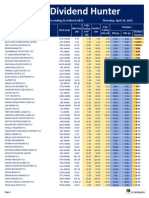

- Dividend Hunter - Mar 2015 PDFDocumento7 páginasDividend Hunter - Mar 2015 PDFRandora LkAinda não há avaliações

- Results Update For All Companies - Jun 2015 PDFDocumento9 páginasResults Update For All Companies - Jun 2015 PDFRandora LkAinda não há avaliações

- Dividend Hunter - Apr 2015 PDFDocumento7 páginasDividend Hunter - Apr 2015 PDFRandora LkAinda não há avaliações

- BRS Monthly (March 2015 Edition) PDFDocumento8 páginasBRS Monthly (March 2015 Edition) PDFRandora LkAinda não há avaliações

- Dividend Hunter - Mar 2015 PDFDocumento7 páginasDividend Hunter - Mar 2015 PDFRandora LkAinda não há avaliações

- Daily - 23 04 2015 PDFDocumento4 páginasDaily - 23 04 2015 PDFRandora LkAinda não há avaliações

- The Morality of Capitalism Sri LankiaDocumento32 páginasThe Morality of Capitalism Sri LankiaRandora LkAinda não há avaliações

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Documento5 páginasN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkAinda não há avaliações

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocumento12 páginasCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkAinda não há avaliações

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocumento9 páginasJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkAinda não há avaliações

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocumento9 páginasChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkAinda não há avaliações

- Microfinance Regulatory Model PDFDocumento5 páginasMicrofinance Regulatory Model PDFRandora LkAinda não há avaliações

- Daily Stock Watch 08.04.2015 PDFDocumento9 páginasDaily Stock Watch 08.04.2015 PDFRandora LkAinda não há avaliações

- GIH Capital Monthly - Mar 2015 PDFDocumento11 páginasGIH Capital Monthly - Mar 2015 PDFRandora LkAinda não há avaliações

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocumento4 páginasWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkAinda não há avaliações

- Chapter 3 Money MarketDocumento17 páginasChapter 3 Money MarketJuanito Dacula Jr.Ainda não há avaliações

- AdityaDocumento1 páginaAdityaankit ojhaAinda não há avaliações

- Advance Accounting - Dayag 2015. Chapter 7 Problem IIIDocumento1 páginaAdvance Accounting - Dayag 2015. Chapter 7 Problem IIIJohn Carlos DoringoAinda não há avaliações

- Mzumbe University selection results for bachelor's programsDocumento166 páginasMzumbe University selection results for bachelor's programsBISEKOAinda não há avaliações

- ENTERPRISE, Forms of Business OwnershipDocumento10 páginasENTERPRISE, Forms of Business OwnershipKristy JenacAinda não há avaliações

- Engineering Economics: Ronel E. Romero, RCE, MCEDocumento19 páginasEngineering Economics: Ronel E. Romero, RCE, MCEkate asiaticoAinda não há avaliações

- Accounting For PartnershipsDocumento3 páginasAccounting For PartnershipsRixa Doreen Antoja50% (2)

- Accounting A Level Teacher Notes SeriesDocumento47 páginasAccounting A Level Teacher Notes SeriesStad100% (1)

- Simple Discount InterestDocumento16 páginasSimple Discount InterestVivian100% (2)

- Morning Session Q&ADocumento50 páginasMorning Session Q&AGANESH MENONAinda não há avaliações

- Discuss The Qualifications and Disqualifications of Auditor of The CompanyDocumento9 páginasDiscuss The Qualifications and Disqualifications of Auditor of The CompanyDebabrata DasAinda não há avaliações

- CTS ROLES AND TOPICS ON PERCENTAGES, PROFIT AND LOSS, SIMPLE INTEREST, COMPOUND INTERESTDocumento12 páginasCTS ROLES AND TOPICS ON PERCENTAGES, PROFIT AND LOSS, SIMPLE INTEREST, COMPOUND INTERESTArunAinda não há avaliações

- QZ H70 D KHN Ut 768 ToDocumento2 páginasQZ H70 D KHN Ut 768 ToAbhishek MishraAinda não há avaliações

- Python For Finance - Course NotesDocumento27 páginasPython For Finance - Course NotesDiego RodríguezAinda não há avaliações

- CPA 1 Financial Accounting-1Documento8 páginasCPA 1 Financial Accounting-1LYNETTE NYAKAISIKIAinda não há avaliações

- Matching Funds Statement: Heather MizeurDocumento236 páginasMatching Funds Statement: Heather MizeurJeff QuintonAinda não há avaliações

- Uniswap V3 Success Surpasses V2 Volume in Under 2 WeeksDocumento6 páginasUniswap V3 Success Surpasses V2 Volume in Under 2 WeeksRoaryAinda não há avaliações

- Commentary JANUARY 2018: Grid Connected Solar Power ProjectsDocumento3 páginasCommentary JANUARY 2018: Grid Connected Solar Power ProjectsTrần Thục UyênAinda não há avaliações

- Tire City Inc.Documento6 páginasTire City Inc.Samta Singh YadavAinda não há avaliações

- 02 Task Performance 1Documento3 páginas02 Task Performance 1Ralph Louise PoncianoAinda não há avaliações

- BBLS - Risk Management - v.0.1 PDFDocumento27 páginasBBLS - Risk Management - v.0.1 PDFNitishAinda não há avaliações

- FORMULA SHEETDocumento3 páginasFORMULA SHEETJibin K JacobAinda não há avaliações

- RM Questionnaire For Bank Customer Satisfaction - Pranotee WorlikarDocumento5 páginasRM Questionnaire For Bank Customer Satisfaction - Pranotee WorlikarSasha SGAinda não há avaliações

- Development Bank of The Philippines V CA 1998Documento2 páginasDevelopment Bank of The Philippines V CA 1998Thea P PorrasAinda não há avaliações

- Sustainability Report 2009 Yuhan-KimberlyDocumento68 páginasSustainability Report 2009 Yuhan-KimberlyBermet M.k.Ainda não há avaliações

- HDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"Documento18 páginasHDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"janu_ballav9913Ainda não há avaliações

- Delta 9 Deck ApprovedDocumento23 páginasDelta 9 Deck ApprovedAnonymous xhcUYpAlAinda não há avaliações

- Solutions BD3 SM14 GEDocumento9 páginasSolutions BD3 SM14 GEAgnes Chew100% (1)

- BPO Business Registration RequirementsDocumento6 páginasBPO Business Registration RequirementsLester PaulinoAinda não há avaliações

- Tax Planning With Reference To New Business - NatureDocumento26 páginasTax Planning With Reference To New Business - NatureasifanisAinda não há avaliações