Escolar Documentos

Profissional Documentos

Cultura Documentos

Lecture 1

Enviado por

Fanny Chan0 notas0% acharam este documento útil (0 voto)

15 visualizações68 páginasACF Lecture notes week 1

Direitos autorais

© © All Rights Reserved

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoACF Lecture notes week 1

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

15 visualizações68 páginasLecture 1

Enviado por

Fanny ChanACF Lecture notes week 1

Direitos autorais:

© All Rights Reserved

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 68

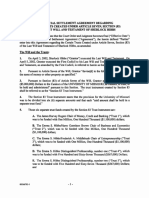

llnS3623

Applled CorporaLe llnance

LecLure 1 (ChapLers 6 & 9)

!ared SLaneld

March 3, 2014

ChapLer CuLllne

1. 8ond valuauon: 8efresher

2. SLock valuauon: ulvldend ulscounL

3. SLock valuauon: ayouL Model, lCl Model

4. SLock valuauon: Comparables

!"#$ &'()'*+"#

A refresher

uenluons

MaLurlLy: llnal 8epaymenL uaLe

1erm: 1lme remalnlng unul repaymenL

Coupon: romlsed lnLeresL paymenLs

lace value: nouonal amounL used Lo compuLe

lnLeresL aymenLs

Coupon 8aLe: ueLermlnes Lhe amounL of each

coupon paymenL, expressed as an A8

Coupon Rate Face Value

Number of Coupon Payments per Year

!

= CPN

Zero Coupon 8ond valuauon

Zero Coupon: Lasy-easy

CapLaln Cbvlous would llke Lo remlnd you LhaL

zero coupon bonds don'L have any coupons

Lxample: u.S. 1-8llls (<1 year)

Pow do we value?

Slmple v formula:

(1 )

=

+

n

n

FV

P

YTM

Coupon 8ond valuauon

1hese bonds have coupons!" yells CapLaln

Cbvlous

Lxample: CorporaLe, uS noLes and 8onds (>1

year), AusLrallan 8onds

Pow do we value?

1 1

1

(1 ) (1 )

! "

= # $ +

% &

+ +

' (

N N

FV

P CPN

y y y

1akeaways

8oLh of Lhese bond Lypes are sLandard plug-

n-chug" lf you have Lhe necessary lnpuLs.

l'll asslgn some problems lf anyone needs a

refresher on calculaung elLher of Lhese.

LeL's move on Lo some non-Lrlvlal uses of

Lhese models

Solvlng for ?leld Lo MaLurlLy

Solvlng for ?1M of a zero coupon ls sLralghuorward

Solvlng for ?1M of a coupon bond? noL so much.

Clven Lhere ls no closed-form" soluuon, we use

compuLers or calculaLors Lo calculaLe Lhls.

1

1

! "

= #

$ %

& '

n

n

FV

YTM

P

(1 )

=

+

n

n

FV

P

YTM

1 1

1

(1 ) (1 )

! "

= # $ +

% &

+ +

' (

N N

FV

P CPN

y y y

?1M

lmporLanL Lhlng Lo remember: ?1M ls lmplled

by bond prlces and noL Lhe oLher way around

So where do we geL bond prlces?

1erm SLrucLure of lnLeresL 8aLes

racucally, lnvesLors have expecLauons abouL

fuLure lnLeresL raLes, Lhese are facLored ln Lo bond

prlclng. An easy way Lo geL Lhe Lerm-sLrucLure ls

Lhrough zero-coupons

Calculaung Lhe 1erm SLrucLure

1he followlng are prlces (per $100 lace value) of uS Zero-

Coupon 8onds:

uslng:

We can Lhen use Lhese raLes Lo value a Lhree-year coupon

bond.

1hls ls where prlces come from, we calculaLe ?1M aer we have Lhe

prlce

MaLurlLy 1 year 2 year 3 year

rlce $98.04 $93.18 $91.31

1

1

! "

= #

$ %

& '

n

n

FV

YTM

P

lmplled 8aLe 2 2.3 3

llnal 8ond 1houghLs

We generally Lhlnk of uS Cov

bonds as rlsk-free"

8lsk of defaulL ls very low

lncorporaLe credlL rlsk Lhrough

ylelds, keep cash ows as promlsed

1he longer amounL of ume unul Lhe bond's maLurlLy

(longer durauon"), Lhe hlgher Lhe bond's lnLeresL

raLe rlsk. 1he shorLer, Lhe hlgher Lhe bond's

renanclng rlsk

,*"-. &'()'*+"#

ulvldend ulscounL Model

ulvldend ulscounL

1he prlce of any securlLy ls equal Lo Lhe presenL value of

Lhe expecLed fuLure cash-ows lL wlll pay.

WhaL are Lhe cash ows of a sLock?

ulvldends, so applylng Lhe above

1he prlce of any sLock ls equal Lo Lhe presenL value of Lhe

expecLed fuLure dlvldends lL wlll pay.

WhaL abouL a sLock LhaL currenLly doesn'L pay a

dlvldend? WhaL abouL a sLock LhaL wlll never pay money

Lo shareholders?

3 1 2

0

2 3

1

E E E E

1 (1 ) (1 ) (1 )

!

=

= + + + =

+ + + +

"

!

n

n

n

Div Div Div Div

P

r r r r

ConsLanL ulvldend CrowLh Model

(or CuCM Lo lLs frlends)

g" ls Lhe consLanL growLh raLe

nouce LhaL Lhe prlce equauon ls a growlng

perpeLulLy". ?ou'll wanL Lo become frlends wlLh Lhls

one.

1he value of Lhe rm depends on Lhe dlvldend nexL

year, Lhe cosL of equlLy, and Lhe growLh raLe.

1

0

E

=

!

Div

P

r g

CuCM roblem

A1&1 plans Lo pay $1.44 per share ln dlvldends ln Lhe

comlng year.

lLs equlLy cosL of caplLal ls 8 and dlvldends are expecLed

Lo grow by 4 per year ln Lhe fuLure

WhaL ls Lhe value of A1&1's sLock?

WhaL ls Lhe value of A1&1's sLock lf Lhey lnsLead

declded Lo delay Lhe rsL dlvldend unul 2 years from

now (assumlng Lhe growLh and lnlual dlvldend

amounL remaln Lhe same)?

Soluuons

1.

2.

1

0

E

$1.44

$36.00

.08 .04

= = =

! !

Div

P

r g

P

1

=

Div

2

r

E

! g

=

$1.44

.08 !.04

= $36.00

P

0

=

P

1

1+ r

E

=

$36.00

1.08

= $33.33

CrowLh

lf reLenuon raLe ls consLanL Lhan earnlngs growLh

equals dlvldend growLh

Change in Earnings New Investment Return on New Investment = !

New Investment Earnings Retention Rate = !

Change in Earnings

Earnings Growth Rate

Earnings

Retention Rate Return on New Investment

=

= !

Retention Rate Return on New Investment = ! g

WhaL lf growLh ls non-consLanL?

1he CuCM only works lf Lhe growLh raLe ls

consLanL.

lor a blg chunk of rms, Lhls ls noL Lhe case

(younger, hlgh growLh rms)

WhaL do we do?

We can model Lhe non-consLanL poruon of Lhe

growLh dlrecLly, Lhen use Lhe growlng

perpeLulLy once Lhe growLh levels ouL

non-consLanL ulvldend CrowLh

ulvldend-ulscounL Model wlLh ConsLanL Long-

1erm CrowLh (see example 9.3 ln Lhe LexL)

1

E

+

=

!

N

N

Div

P

r g

1 1 2

0

2

E E E E E

1

1 (1 ) (1 ) (1 )

+

! "

= + + + +

# $

+ + + + %

& '

!

N N

N N

Div Div Div Div

P

r r r r r g

LlmlLauons of Lhe ulvldend-ulscounL

Model

very large uncerLalnLy assoclaLed wlLh

forecasung a rm's fuLure dlvldends and

dlvldend growLh raLe.

Who knew Apple would sLarL paylng dlvldends

Lwo years ago?

Small changes ln Lhe assumed dlvldend

growLh raLe can lead Lo blg changes ln Lhe

esumaLed sLock prlce.

,*"-. &'()'*+"#

ayouL and lree Cash llow Models

1oLal ayouL Model

More rms are reLurnlng money Lo shareholders Lhrough

repurchases. lL makes sense Lo Lake Lhls lnLo accounL:

1oLal ayouL Model

values all of Lhe rms equlLy, raLher Lhan a slngle share. ?ou dlscounL

LoLal dlvldends and share repurchases and use Lhe growLh raLe of earnlngs

(raLher Lhan earnlngs per share) when forecasung Lhe growLh of Lhe

rms LoLal payouLs.

0

0

(Future Total Dividends and Repurchases)

Shares Outstanding

=

PV

PV

1he ulscounLed lree Cash llow Model

1he ulscounLed lree Cash llow Model focuses on Lhe cash

ows Lo all of Lhe rms lnvesLors, boLh debL and equlLy

holders.

Why mlghL valulng Lhe enLerprlse of Lhe rm be beneclal?

Enterprise Value Market Value of Equity Debt Cash = + !

1he ulscounLed lree Cash llow Model

valulng Lhe LnLerprlse

1o esumaLe a rms enLerprlse value, we

compuLe Lhe presenL value of Lhe rms free cash

ow avallable Lo pay all lnvesLors (boLh debL and

equlLy).

FreeCash Flow (1 Tax Rate) Depreciation

Capital Expenditures Increasesin Net WorkingCapital

EBIT = ! " +

" "

1he ulscounLed lree Cash llow Model

ulscounLed lree Cash llow Model

Clven Lhe enLerprlse value, Lhe value of equlLy

and dlvlde by Lhe LoLal number of shares

ouLsLandlng.

0 0 0

0

V Cash Debt

P

SharesOutstanding

+ !

=

0

(Future Free Cash Flow of Firm) = V PV

1he ulscounLed lree Cash llow Model

lmplemenung Lhe Model

Slnce we are dlscounung Lhe cash ows Lo all

lnvesLors, we use Lhe welghLed average cosL of

caplLal (WACC), denoLed by r

wacc

lorecasL free cash ow up Lo some horlzon,

LogeLher wlLh a Lermlnal value of Lhe enLerprlse:

1 2 N N

0

2 N N

V

V ...

1 (1 ) (1 ) (1 )

wacc wacc wacc wacc

FCF FCF FCF

r r r r

= + + + +

+ + + +

1he ulscounLed lree Cash llow Model

LsumaLe Lhe Lermlnal value by assumlng a

consLanL long-run growLh raLe g

lCl

for free

cash ows beyond year n.

1he long-run growLh raLe g

lCl

ls Lyplcally based on

expecLed long-run growLh raLe of revenues

N 1

N

FCF 1

V

FCF

N

wacc FCF wacc FCF

g

FCF

r g r g

+

! " +

= = #

$ %

& &

' (

valulng nlke, lnc., SLock uslng lree

Cash llow

?ou're a blg fan of MesuL Czll, Lhe 1urklsh-born playmaker LhaL plles hls

Lrade for Arsenal. ?ou [usL found ouL LhaL he slgned wlLh nlke and wanL Lo

supporL Lhe company by purchaslng some of Lhelr sLock. Slnce you had a

chance Lo Lake llnS3623, you gure lL mlghL be fun Lo do a uCl calculauon

Lo gure ouL how much you would be wllllng Lo buy a share of nlke sLock

for.

valulng nlke, lnc., SLock uslng lree

Cash llow

nlke had sales of $19.2 bllllon ln 2013 and you expecL lLs sales Lo grow aL a

raLe of 8 ln 2014, buL Lhen slow by 1 per year Lo Lhe long-run growLh

raLe LhaL ls characLerlsuc of Lhe apparel lndusLry-3-by 2017.

8ased on nlkes pasL proLablllLy an lnvesLmenL needs, you expecL:

L8l1 Lo be 9 of sales,

lncreases ln neL worklng caplLal requlremenLs Lo be 10 of any lncrease ln sales

caplLal expendlLures Lo equal depreclauon expenses.

lf nlke has:

$2.3 bllllon ln cash, $32 mllllon ln debL, 486 mllllon shares ouLsLandlng

a Lax raLe of 24

a welghLed average cosL of caplLal of 10

WhaL ls your esumaLe of Lhe value of nlkes sLock ln early 2014?

uslng lree Cash llow

1he spreadsheeL below presenLs a slmplled pro forma for nlke based on

Lhe lnformauon we have:

?ear 2013 2014 2013 2016 2017

/-/ /0123456 78 9:;;:0<=

Sales 19,200.0 20,736.0 22,187.3 23,318.8 24,694.7

!"#$%& ()"*+* ,"-#" .)/" 8.0 7.0 6.0 3.0

>!+* 7?@ 0A 54;25= 1,866.2 1,996.9 2,116.7 2,222.3

Less: lncome 1ax (24) 447.9 479.3 308.0 333.4

lus: uepreclauon - - - -

Less: CaplLal LxpendlLures - - - -

Less: lncrease ln nWC (10 of Asales) 133.6 143.2 133.1 117.6

/122 -45B /;0C 1,264.7 1,372.3 1,473.6 1,371.3

valulng nlke, lnc., SLock uslng lree

Cash llow

8ecause caplLal expendlLures are expecLed Lo equal

depreclauon, Lhese llnes ln Lhe spreadsheeL cancel ouL. We

can seL Lhem boLh Lo zero raLher Lhan expllclLly forecasL

Lhem.

Clven our assumpuon of consLanL 3 growLh ln free cash

ows aer 2016 and a welghLed average cosL of caplLal of

10, we can compuLe a Lermlnal enLerprlse value:

V

2016

=

FCF

2017

r

wacc

! g

FCF

!

"

#

$

%

&

=

1,571.5

0.10'0.05

!

"

#

$

%

&

= $31, 430million

valulng nlke, lnc., SLock uslng lree

Cash llow

nlkes currenL enLerprlse value ls Lhe presenL value of lLs free

cash ows plus Lhe rms Lermlnal value:

Lsumaung nlke's sLock value:

V

0

=

1, 264.7

1.10

+

1,372.5

1.10

2

+

1, 475.6

1.10

3

+

31, 430

1.10

3

= $27,006million

P

0

=

27,006+2,300!32

486

= $60.23

valulng nlke, lnc., SLock uslng lree

Cash llow

1he LoLal value of all of Lhe clalms, boLh debL and equlLy, on

Lhe rm musL equal Lhe LoLal presenL value of all cash ows

generaLed by Lhe rm, ln addluon Lo any cash lL currenLly has.

1he LoLal presenL value of all cash ows Lo be generaLed by

nlke ls 27,006 mllllon and lL has 2,300 mllllon ln cash.

SubLracung o Lhe value of Lhe debL clalms (32 mllllon),

leaves us wlLh Lhe LoLal value of Lhe equlLy clalms and dlvldlng

by Lhe number of shares produces Lhe value per share.

1he ulscounLed lree Cash llow Model

Connecuon Lo CaplLal 8udgeung

lree cash ow ls Lhe sum of Lhe free cash ows

from Lhe rms currenL and fuLure lnvesLmenLs,

so enLerprlse value ls Lhe sum of Lhe presenL value

of exlsung pro[ecLs and Lhe nv of fuLure new

ones.

nv of any lnvesLmenL represenLs lLs conLrlbuuon Lo

Lhe rms enLerprlse value.

1o maxlmlze share prlce, we should accepL pro[ecLs

LhaL have a posluve nv.

1he ulscounLed lree Cash llow Model

We musL forecasL all Lhe lnpuLs Lo free cash

ow.

1hls process glves us exlblllLy Lo lncorporaLe

many deLalls

Powever, some uncerLalnLy surrounds each

assumpuon

Clven Lhls facL, sensluvlLy analysls ls lmporLanL

1ranslaLes Lhe uncerLalnLy lnLo a range of values

for Lhe sLock.

SensluvlLy Analysls for SLock valuauon

nlkes L8l1 was assumed Lo be 9 of sales. lf nlke

managemenL belleves Lhere ls a chance LhaL operaung

expenses wlll lncrease because ln Lhe exclLemenL of slgnlng

Czll, everyone forgeLs Lo do acLual work, whlch would cause

L8l1 Lo be 8 of sales.

Pow would Lhe esumaLe of Lhe sLocks value change?

SensluvlLy Analysls for SLock valuauon

ln Lhls scenarlo, L8l1 wlll decrease by 1 of sales compared Lo

Lhe prevlous example. lnsLead of re-calculaung lCls we can

slmply calculaLe Lhe change ln lCl.

We can use Lhe Lax raLe (24) Lo compuLe Lhe eecL on Lhe

free cash ow for each year. Cnce we have Lhe new free cash

ows, we repeaL Lhe approach ln Lhe prevlous example Lo

arrlve aL a new sLock prlce.

SensluvlLy Analysls for SLock valuauon

ln year 2014, L8l1 wlll be 1 x $20,736.0 mllllon = $207.4 mllllon lower.

Aer Laxes, Lhls decllne wlll decrease Lhe rms free cash ow ln year 1 by

(1-0.24) x $207.4 mllllon = $137.6 mllllon, Lo $1,107.1 mllllon.

uolng Lhe same calculauon for each year, we geL Lhe followlng revlsed lCl

esumaLes:

Year 2014 2015 2016 2017

FCF 1,107.1 1,203.9 1,296.8 1,383.8

SensluvlLy Analysls for SLock valuauon

We can now reesumaLe Lhe sLock prlce as ln Lhe prevlous

example.

1hls ls a dlerence of abouL -11 compared Lo Lhe resulL

found ln Lhe prevlous example

V

0

=

1,107.1

1.10

+

1, 203.8

1.10

2

+

1, 296.8

1.10

3

+

27,676

1.10

3

= $23,769million

V

2016

=

FCF

2017

r

wacc

! g

FCF

!

"

#

$

%

&

=

1,383.8

0.10'0.05

!

"

#

$

%

&

= $27,676million

P

0

=

23,769+2,300!32

486

= $53.57

A Comparlson of ulscounLed Cash llow

Models of SLock valuauon

,*"-. &'()'*+"#

Comparables

valuauon 8ased on Comparable llrms

AnoLher appllcauon of Lhe valuauon prlnclple

ls Lhe meLhod of comparables (comps).

LsumaLe Lhe value of Lhe rm based on Lhe value

of oLher, comparable rms or lnvesLmenLs LhaL we

expecL wlll generaLe very slmllar cash ows ln Lhe

fuLure.

valuauon 8ased on Comparable llrms

Conslder Lhe case of a new rm LhaL ls

ldenucal Lo an exlsung publlcly Lraded rm.

1he valuauon rlnclple lmplles LhaL Lwo securlues

wlLh ldenucal cash ows musL have Lhe same

prlce.

lf Lhese rms wlll generaLe ldenucal cash ows,

we can use Lhe markeL value of Lhe exlsung

company Lo deLermlne Lhe value of Lhe new rm.

We can ad[usL for scale dlerences uslng valuauon

muluples.

valuauon 8ased on Comparable llrms

valuauon Muluples

A rauo of a rms value Lo some measure of Lhe

rms scale or cash ow.

rlce-Larnlngs rauo

LnLerprlse value Muluples

CLher muluples

Muluples of sales

rlce-Lo-book value of equlLy

lndusLry- speclc rauos

valuauon 8ased on Comparable llrms

rlce-Larnlngs 8auo

MosL common valuauon muluple

usually lncluded ln baslc sLausucs compuLed for a sLock

Share prlce dlvlded by earnlngs per share

SLock rlce

CuoLe for

nlke (nkL)

valuauon uslng Lhe rlce-Larnlngs

8auo

Suppose l8M has earnlngs per share of $13.17.

Suppose Lhe average /L of comparable compuLer

hardware sLocks ls 23.2,

LsumaLe a value for l8Ms sLock uslng Lhe /L as a

valuauon muluple.

WhaL are Lhe assumpuons underlylng Lhls esumaLe?

valuauon uslng Lhe rlce-Larnlngs

8auo

We can esumaLe a share prlce for l8M by muluplylng

lLs LS by Lhe /L of comparable rms:

EPS!P / E = Earnings per Share !(Price per Share Earnings per Share)

=Price per share

valuauon uslng Lhe rlce-Larnlngs

8auo

0

=$13.17 23.2 = $303.34.

1hls esumaLe assumes LhaL l8M wlll have slmllar

fuLure rlsk, payouL raLes, and growLh raLes Lo

comparable rms ln Lhe lndusLry.

AlLhough valuauon muluples are slmple Lo use, Lhey

rely on some very sLrong assumpuons abouL Lhe

slmllarlLy of Lhe comparable rms Lo Lhe rm you are

valulng.

lLs lmporLanL Lo see how well Lhese work ouL on a case-by-

case basls

valuauon 8ased on Comparable llrms

We can compuLe a rms /L rauo uslng:

1ralllng earnlngs

lorward earnlngs

1he resulung rauo ls elLher:

1ralllng /L

lorward /L

lor valuauon purposes, Lhe forward /L ls generally

preferred, as we are mosL concerned abouL fuLure

earnlngs. Why?

valuauon 8ased on Comparable llrms

/L rauos are relaLed Lo oLher valuauon

Lechnlques.

ln Lhe case of consLanL dlvldend growLh we had

ulvldlng Lhrough by LS

1

:

1

0

E

Div

P

r - g

=

0 1

E E

/ DividendPayout Rate

ForwardP / E

1

1

P Div EPS

EPS r - g r - g

= = =

8elaung Lhe /L 8auo Lo LxpecLed

luLure CrowLh

CrowLh rospecLs and Lhe rlce-

Larnlngs 8auo

Apple and Mlcroso are boLh soware

(and hardware) compeuLors. As of

March 2012, Apple had a prlce of

$343.18 and forward earnlngs per share

of $33.11. Mlcroso had a prlce of

$32.08 and forward earnlngs of $2.76

per share.

CalculaLe Lhelr forward /L rauos and

explaln Lhe dlerence.

CrowLh rospecLs and Lhe rlce-

Larnlngs 8auo

lorward /L for Apple = $343.18/$33.11 = 13.33

lorward /L for Mlcroso's = $32.08/$2.76 = 11.62

ln March 2012, Apple's /L rauo was hlgher because

lnvesLors expecL lLs earnlngs Lo grow more Lhan

Mlcroso's.

CrowLh rospecLs and Lhe rlce-

Larnlngs 8auo

AlLhough boLh companles are reLallers, Lhey had very

dlerenL growLh prospecLs, as reecLed ln Lhelr /L

rauos.

lnvesLors ln Apple were wllllng Lo pay 13 umes Lhls

years expecLed earnlngs because Lhey are also

buylng Lhe presenL value of hlgh fuLure earnlngs

creaLed by expecLed growLh.

Apples currenL (as of a couple days ago) lorward /L

ls 11.19 whlle Mlcroso's ls 12.88. WhaL does Lhls

mean ln Lerms of Lhe growLh prospecLs of boLh

companles?

valuauon 8ased on Comparable llrms

LnLerprlse value Muluples

/L rauo relaLes excluslvely Lo equlLy, lgnorlng Lhe

eecL of debL.

WhaL does Lhls mean you are eecuvely assumlng?

LnLerprlse value muluples use a measure of

earnlngs before lnLeresL paymenLs are made

L8l1

L8l1uA

lree cash ow

8ecause caplLal expendlLures can vary beLween years, lLs mosL

common ls Lo use enLerprlse value Lo L8l1uA muluples

valuauon 8ased on Comparable llrms

When expecLed free cash ow growLh ls

consLanL, we can wrlLe Lv Lo L8l1uA as:

1

0

1 1

/

1 1 wacc FCF

wacc FCF

FCF

V FCF EBITDA r g

EBITDA EBITDA r g

!

= =

!

valuauon uslng Lhe LnLerprlse value

Muluple

Cu8 lndusLrles ls a manufacLurer and dlsLrlbuLer of

nlLrogen and phosphaLe ferullzer producLs.

lL has an L8l1uA of $2,893 mllllon, cash of $1,207

mllllon, debL of $1,617 mllllon, and 63 mllllon shares

ouLsLandlng.

1he ferullzer lndusLry as a whole has an average

Lv/L8l1uA rauo of 4.8.

WhaL ls one esumaLe of Cu8's enLerprlse value?

WhaL ls a correspondlng esumaLe of lLs sLock prlce?

valuauon uslng Lhe LnLerprlse value

Muluple

Cu8's enLerprlse value ls $2,893 mllllon 4.8 = $13,896

mllllon

nexL, subLracL Lhe debL from lLs enLerprlse value and add ln

lLs cash:

$13,896 mllllon - $1,617 mllllon + $1,207 mllllon = $13,486

mllllon, whlch ls Lhe equlLy value.

lLs sLock prlce ls equal Lo lLs equlLy value dlvlded by Lhe

number of shares ouLsLandlng:

$13,486 mllllon - 63 mllllon = $207.48

valuauon uslng Lhe LnLerprlse value

Muluple

lf we assume LhaL Cu8 lndusLrles should be valued

slmllarly Lo Lhe resL of Lhe lndusLry, Lhen $207.48 ls a

reasonable esumaLe of lLs sLock prlce.

Powever, we are relylng on Lhe assumpuon LhaL Cu8

lndusLrles' expecLed free cash ow growLh ls slmllar

Lo Lhe lndusLry average.

lf LhaL assumpuon ls wrong, so ls our valuauon.

valuauon 8ased on Comparable llrms

CLher muluples

Muluples of sales can be useful lf lL ls reasonable

Lo assume marglns are slmllar ln Lhe fuLure.

rlce-Lo-book value of equlLy can be used for rms

wlLh subsLanual Langlble asseLs.

Some muluples are speclc Lo an lndusLry

e.g. Cable 1v LnLerprlse value per subscrlber

valuauon 8ased on Comparable llrms

LlmlLauons of Muluples

llrms are noL ldenucal

usefulness of a valuauon muluple wlll depend on Lhe

naLure of Lhe dlerences and Lhe sensluvlLy of Lhe

muluples Lo Lhe dlerences.

ulerences ln muluples can be relaLed Lo dlerences ln

LxpecLed fuLure growLh raLe

8lsk (cosL of caplLal)

ulerences ln accounung convenuons beLween counLrles

valuauon 8ased on Comparable llrms

LlmlLauons of Muluples

Comparables provlde only lnformauon regardlng

Lhe value of Lhe rm relauve Lo oLher rms ln Lhe

comparlson seL

CannoL help deLermlne wheLher an enure lndusLry ls

overvalued.

lnLerneL boom example

valuauon 8ased on Comparable llrms

Comparlson wlLh ulscounLed Cash llow

MeLhods

valuauon muluple does noL Lake lnLo accounL

maLerlal dlerences beLween rms.

1alenLed managers

More eclenL manufacLurlng processes

aLenLs on new Lechnology

valuauon 8ased on Comparable llrms

Comparlson wlLh ulscounLed Cash llow

MeLhods

ulscounLed cash ow meLhods allow us Lo

lncorporaLe speclc lnformauon abouL cosL of

caplLal or fuLure growLh

oLenual Lo be more accuraLe

valuauon 8ased on Comparable llrms

SLock valuauon 1echnlques: 1he llnal Word

no slngle Lechnlque provldes a nal answer

regardlng a sLocks Lrue value

racuuoners use a comblnauon of Lhese

approaches

Condence comes from conslsLenL resulLs from a

varleLy of Lhese meLhods

Lxample of oLenual 8ange of valuauons for nlke SLock

uslng varlous valuauon MeLhods

nexL 1lme

Pomework:

ChapLer 6: 23, also browse Lhrough Lhe earller

problems (1-7) and see lf you need a refresher.

ChapLer 9: 6-8, 11-12, 13-16, 19, 21, 27-28

8evlew ChapLer 2 (lf you undersLand Lhe rauos

you can sklm lL)

8ead ChapLer 19, Secuons 1-3, and Lhe

Conunuauon value" poruons of Secuon 3

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Seminar 9 Self-Made NotesDocumento1 páginaSeminar 9 Self-Made NotesFanny ChanAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Seminar 5 Self-Made NotesDocumento2 páginasSeminar 5 Self-Made NotesFanny ChanAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Ten Questions Every Investor Should Ask PDFDocumento4 páginasTen Questions Every Investor Should Ask PDFFanny ChanAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- FINS3625 Course OutlineDocumento18 páginasFINS3625 Course Outlineriders29Ainda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Seminar 2 Self-Made NotesDocumento3 páginasSeminar 2 Self-Made NotesFanny ChanAinda não há avaliações

- UNSW FINS3650 Course OutlineDocumento14 páginasUNSW FINS3650 Course OutlineFanny ChanAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Ten Questions Every Investor Should Ask PDFDocumento4 páginasTen Questions Every Investor Should Ask PDFFanny ChanAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Paul McCulley - Learning From The Bank of Dad May10Documento8 páginasPaul McCulley - Learning From The Bank of Dad May10Fanny ChanAinda não há avaliações

- Introduction to AuditingDocumento31 páginasIntroduction to AuditingFanny ChanAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- ACCT3563 Issues in Financial Reporting & Analysis - Part A - S12013Documento13 páginasACCT3563 Issues in Financial Reporting & Analysis - Part A - S12013Fanny ChanAinda não há avaliações

- Tut 1 AnsDocumento6 páginasTut 1 AnsFanny ChanAinda não há avaliações

- PM Unit IiiDocumento106 páginasPM Unit IiiAnonymous kwi5IqtWJAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Death of Big LawDocumento55 páginasDeath of Big Lawmaxxwe11Ainda não há avaliações

- Accounting Concepts ApplicationDocumento2 páginasAccounting Concepts Applicationmarygrace carbonelAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Singapore Illustrative Financial Statements 2016Documento242 páginasSingapore Illustrative Financial Statements 2016Em CaparrosAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Proposal Tanaman MelonDocumento3 páginasProposal Tanaman Melondr walferAinda não há avaliações

- Partnership Fundamentals 2Documento6 páginasPartnership Fundamentals 2sainimanish170gmailcAinda não há avaliações

- Tax Related Thesis TopicsDocumento8 páginasTax Related Thesis Topicsafkodpexy100% (1)

- Clarkson QuestionsDocumento5 páginasClarkson QuestionssharonulyssesAinda não há avaliações

- Adecco India Pvt. LTD.: Payslip For The Month of September 2017Documento1 páginaAdecco India Pvt. LTD.: Payslip For The Month of September 2017Sajal RathoreAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Ici PakistanDocumento154 páginasIci PakistanAmber MunirAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Cost - Management Accounting - A - B - Vineet SwarupDocumento3 páginasCost - Management Accounting - A - B - Vineet SwarupAbhishek RaghavAinda não há avaliações

- Strategic Cost Management Coordinated Quiz 1Documento7 páginasStrategic Cost Management Coordinated Quiz 1Kim TaehyungAinda não há avaliações

- HAL Presentation Jan 2017Documento31 páginasHAL Presentation Jan 2017Sujatha LokeshAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Uy Law Office Balance SheetDocumento2 páginasUy Law Office Balance SheetA c100% (1)

- Amway Business Plan STP by Mandeep Kaur and Kulwinder SinghDocumento22 páginasAmway Business Plan STP by Mandeep Kaur and Kulwinder SinghKulwinder SinghAinda não há avaliações

- Module 13 Regular Deductions 3Documento16 páginasModule 13 Regular Deductions 3Donna Mae FernandezAinda não há avaliações

- Abm 1 - Module Part 1Documento7 páginasAbm 1 - Module Part 1Alvin Ryan CaballeroAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Bab1014 Financial Accounting AssignmentDocumento28 páginasBab1014 Financial Accounting AssignmentAinaasyahirah RosidanAinda não há avaliações

- NLC Payroll EtcDocumento8 páginasNLC Payroll EtcJessica CrisostomoAinda não há avaliações

- Economy 1 PDFDocumento163 páginasEconomy 1 PDFAnil Kumar SudarsiAinda não há avaliações

- Taxsmile Notes On Income TaxDocumento46 páginasTaxsmile Notes On Income Taxaman16755747Ainda não há avaliações

- Sibanye Gold - BNP Cadiz Initiating ReportDocumento40 páginasSibanye Gold - BNP Cadiz Initiating ReportGuy DviriAinda não há avaliações

- 9 14 2015 Canaccord UADocumento6 páginas9 14 2015 Canaccord UAWilliam HarrisAinda não há avaliações

- Asm 2670Documento3 páginasAsm 2670Pushkar MittalAinda não há avaliações

- Glencore Plc Annual Report 2021Documento2 páginasGlencore Plc Annual Report 2021Dayu adisaputraAinda não há avaliações

- Settlement Terms Between Mizzou, Hillsdale Over Conservative Donor's InstructionsDocumento74 páginasSettlement Terms Between Mizzou, Hillsdale Over Conservative Donor's InstructionsThe College FixAinda não há avaliações

- MTN Group Business Report Highlights Cellular Growth Across AfricaDocumento170 páginasMTN Group Business Report Highlights Cellular Growth Across AfricaMercy OfuyaAinda não há avaliações

- Istilah-Istilah Akuntansi & Pajak Dalam Bahasa InggrisDocumento24 páginasIstilah-Istilah Akuntansi & Pajak Dalam Bahasa Inggrisgaluh vindriarsoAinda não há avaliações

- LK Juni 2017 Unaudited PDFDocumento210 páginasLK Juni 2017 Unaudited PDFnandiwardhana aryagunaAinda não há avaliações

- F6.TX-irl-j23-d23 Syllabus and Study GuideDocumento22 páginasF6.TX-irl-j23-d23 Syllabus and Study GuideJÉSSICA PEREIRA LOPES COSTAAinda não há avaliações