Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Statistical Summary: Attock Refinery Limited

Enviado por

abrofab123Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Statistical Summary: Attock Refinery Limited

Enviado por

abrofab123Direitos autorais:

Formatos disponíveis

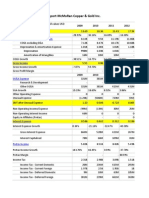

52 Annual Report 2013

SHAREHOLDERS INFORMATION

Financial Statistical Summary

Attock Refinery Limited

30 June (Rupees in Million)

2013 2012 2011 2010 2009 2008

TRADING RESULTS

Sales (Net of Govt. Levies)

Reimbursement from/(to) Government

Turnover

Cost of Sales

Gross profit

Administration and Distribution cost

Other Income

NonRefinery Income

Operating profit

Financial and other charges

Profit before tax

Taxation

Profit after tax

Dividend

Bonus shares

Transfer from/(to) special reserves

163,300.53

163,300.53

160,271.23

3,029.30

401.82

3,082.10

1,298.10

7,007.68

954.51

6,053.16

2,137.51

3,915.66

(426.47)

(2,471.76)

154,381.56

154,381.56

152,362.20

2,019.35

377.63

2,388.77

1,588.64

5,619.14

1,259.27

4,359.87

1,625.18

2,734.69

(639.70)

(1,000.25)

116,388.37

9.00

116,397.37

114,900.77

1,496.61

315.80

1,565.59

1,068.39

3,814.79

254.12

3,560.67

1,375.12

2,185.55

(170.59)

(971.36)

88,184.03

88,184.03

88,693.69

(509.66)

270.12

983.33

602.20

805.75

385.54

420.21

293.82

126.39

475.81

76,546.45

714.05

77,260.50

75,342.10

1,918.40

243.63

993.70

610.74

3,279.22

1,595.84

1,683.37

666.61

1,016.76

(260.22)

91,910.70

1,743.60

93,654.30

89,646.37

4,007.93

218.47

577.85

4,140.20

8,507.51

1,480.08

7,027.43

879.65

6,147.77

(568.52)

(142.16)

(1,861.77)

BALANCE SHEET SUMMARY

Paidup Capital

Reserves

Unappropriated Profit

Shareholders funds

Property, plant & equipment (less depreciation)

Net current assets

852.93

13,123.38

4,109.58

18,085.89

10,034.55

3,461.96

852.93

11,368.63

2,673.67

14,895.23

9,840.29

430.21

852.93

10,146.66

1,459.48

12,459.06

9,670.97

(1,743.10)

852.93

8,563.31

857.27

10,273.52

2,868.00

(3,967.43)

852.93

4,719.92

4,574.28

10,147.13

2,916.21

(4,166.56)

710.78

8,330.34

657.88

9,698.99

2,929.65

(4,578.05)

CASH FLOW SUMMARY

Cash flows from operating activities

Cash flows from investing activities

Cash flows from financing activities

Increase / (Decrease) in cash and cash equivalents

74.16

2,357.53

(1,272.12)

1,161.30

4,792.00

2,476.55

(1,292.24)

5,979.39

(1,972.58)

1,913.70

(45.43)

(104.14)

(3,741.38)

1,214.90

(308.97)

(2,833.89)

(11,543.76)

1,434.62

(2,037.95)

(12,142.33)

11,074.23

444.62

(1,471.19)

10,064.52

Profitability Ratios

Gross profit ratio

Net profit to sales

EBITDA margin to sales

Operating leverage ratio

Return on equity

Return on capital employed

%

%

%

Time

%

%

1.86

2.40

3.86

1.69

21.65

23.74

1.31

1.77

3.01

0.71

18.36

19.99

1.29

1.88

3.25

20.20

17.54

19.23

(0.58)

0.14

0.70

(5.10)

1.23

1.24

2.48

1.32

2.45

4.29

10.02

10.25

4.28

6.56

7.97

6.73

63.39

91.23

Liquidity Ratio

Current ratio

Quick / acid test ratio

Cash to current liabilities

Cash flow from operations to sales

Time

Time

Time

Time

1.09

0.76

0.29

0.00

1.01

0.84

0.14

0.03

0.96

0.69

0.09

(0.02)

0.91

0.75

0.09

(0.04)

0.87

0.70

0.21

(0.15)

0.88

0.74

0.49

0.12

Activity /Turnover Ratio

Inventory turnover ratio

No. of days in inventory

Debtor turnover ratio

No.of days in receivables

Creditor turnover ratio

No. of days in payables

Total assets turnover ratio

Fixed assets turnover ratio

Operating cycle

Time

Days

Time

Days

Time

Days

Time

Time

Time

14.31

26

5.97

61

4.08

90

2.53

16.27

(3)

14.16

26

4.90

75

3.40

107

1.65

15.69

(7)

12.73

29

5.04

73

3.78

97

1.83

12.04

5

14.72

25

4.83

77

3.31

110

1.51

30.75

(9)

15.51

24

8.16

45

2.81

130

1.74

26.49

(61)

20.61

18

13.50

27

3.70

99

1.87

31.97

(54)

Knowledge Fueled Growth

Investment / Market Ratio

Earnings per share (EPS) *

(on shares outstanding at 30 June)

Dividend **

Cash dividend per share

Bonus share issue

Price earning ratio

Dividend yield ratio

Dividend cover ratio

Dividend payout ratio

BreakUp Value (Rs per share) without Surplus

on Revaluation of Property, plant & equipment

BreakUp Value (Rs per share) with Surplus

on Revaluation of Property, plant & equipment

Highest market value per share during the year

Lowest market value per share during the year

Market value per share

53

30 June (Rupees in Million)

2013 2012 2011 2010 2009 2008

Rs

%

Rs

Rs

Time

%

Time

%

45.91

50%

5.00

5.56

1.96

9.18

10.89

32.07

75%

7.50

4.09

5.72

4.28

23.39

25.63

20%

2.00

4.68

1.67

12.82

7.81

1.48

53.96

11.92

12.99

86.49

80%

8.00

2.00

1.63

7.10

10.81

11.56

Rs

212.04

174.64

146.07

120.45

118.97

136.46

Rs

Rs

Rs

Rs

314.58

208.28

123.94

255.15

277.17

136.89

104.42

131.05

248.61

145.50

122.14

119.86

143.00

169.62

80.59

79.86

141.52

248.00

40.95

154.86

163.52

305.50

212.81

140.90

Capital Structure Ratios

Financial leverage ratio

Debt to equity ratio

Weighted average cost of debt

Interest cover ratio

* The price earning ratio is without the effect of Bonus issue.

** The Board has proposed a final cash dividend @ 25% in their meeting held on August 14, 2013.

Ratio Analysis

PROFITABILITY RATIOS

Improved Profitability of the Company is mainly attributable

to the optimised capacity utilization of 100% (June 30, 2012:

99.5%), increase in the refining capacity by 1,000 barrels

per day (bpd) and favourable trend in international prices

of petroleum products and crude oil.

Favourable effect of above mentioned factors including

increase in other income have a positive impact on net

profit, return on equity and return on capital employed.

LIQUIDITY RATIOS

The Company successfully met the challenges of circular

debt issue by keeping a balance in receivables and

payables. The recent inter-corporate circular debt settlement

arranged by the Government has helped the Company to

improve its liquidity position.

ACTIVITY TURNOVER RATIOS

Inventory management of the Company has improved because

of high product demand and effective capacity utilization. The

circular debt settlement has resulted in improved debtor

turnover ratio and number of days in receivables, however

this effect is partially mitigated by the change in creditors

turnover ratio and number of days in payables.

INVESTMENT / MARKET RATIOS

The improved profitability is the only reason for improvement

in EPS and Break-up Value with and without surplus on

revaluation ratios. The Company has declared a final

cash dividend of 25%. This is in addition to an interim cash

dividend of 25% already paid.

CAPITAL STRUCTURE RATIOS

The capital structure ratios are not applicable because the

Company does not have any debt in its capital structure.

Você também pode gostar

- 1849 1862 Statutes at Large 601-779Documento200 páginas1849 1862 Statutes at Large 601-779ncwazzyAinda não há avaliações

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosAinda não há avaliações

- Teuer Furniture A Case Solution PPT (Group-04)Documento13 páginasTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- Re Ratio AnalysisDocumento31 páginasRe Ratio AnalysisManish SharmaAinda não há avaliações

- Analysis of Apollo TiresDocumento12 páginasAnalysis of Apollo TiresTathagat ChatterjeeAinda não há avaliações

- Gears, Splines, and Serrations: Unit 24Documento8 páginasGears, Splines, and Serrations: Unit 24Satish Dhandole100% (1)

- Hand Planer PDFDocumento8 páginasHand Planer PDFJelaiAinda não há avaliações

- 20779A ENU CompanionDocumento86 páginas20779A ENU Companionmiamikk204Ainda não há avaliações

- Editing For BeginnersDocumento43 páginasEditing For BeginnersFriktAinda não há avaliações

- Boston BeerDocumento23 páginasBoston BeerarnabpramanikAinda não há avaliações

- Attock Oil RefineryDocumento2 páginasAttock Oil RefineryOvais HussainAinda não há avaliações

- Project Management PDFDocumento10 páginasProject Management PDFJamalAinda não há avaliações

- Alina NedelcuDocumento27 páginasAlina NedelcuasdasddddAinda não há avaliações

- Godrej Industries LTD - Mitesh Ojha - 10BSPHH010409Documento15 páginasGodrej Industries LTD - Mitesh Ojha - 10BSPHH010409mitesh_ojhaAinda não há avaliações

- Financial Analysis of Lucky Cement LTD For The Year 2013Documento11 páginasFinancial Analysis of Lucky Cement LTD For The Year 2013Fightclub ErAinda não há avaliações

- Accounts AssignmentDocumento7 páginasAccounts AssignmentHari PrasaadhAinda não há avaliações

- ITC Consolidated FinancialsDocumento49 páginasITC Consolidated FinancialsVishal JaiswalAinda não há avaliações

- Assignments Semester IDocumento13 páginasAssignments Semester Idriger43Ainda não há avaliações

- Redco Textiles LimitedDocumento18 páginasRedco Textiles LimitedUmer FarooqAinda não há avaliações

- 2013-5-14 FirstResources 1Q2013 Financial AnnouncementDocumento17 páginas2013-5-14 FirstResources 1Q2013 Financial AnnouncementphuawlAinda não há avaliações

- CHEM Audited Results For FY Ended 31 Oct 13Documento5 páginasCHEM Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweAinda não há avaliações

- Six Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceDocumento5 páginasSix Years at A Glance: Chairman's Review Financial Analysis Financial Statements Annual General Meeting GovernanceraviaxgAinda não há avaliações

- Adam Sugar LTD Financial AnalysisDocumento20 páginasAdam Sugar LTD Financial AnalysiswamiqrasheedAinda não há avaliações

- Trend Analysis of Ultratech Cement - Aditya Birla Group.Documento9 páginasTrend Analysis of Ultratech Cement - Aditya Birla Group.Kanhay VishariaAinda não há avaliações

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDocumento14 páginasASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)Ainda não há avaliações

- Summit Bank Annual Report 2012Documento200 páginasSummit Bank Annual Report 2012AAqsam0% (1)

- KFA - Published Unaudited Results - Sep 30, 2011Documento3 páginasKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasAinda não há avaliações

- Metro Holdings Limited: N.M. - Not MeaningfulDocumento17 páginasMetro Holdings Limited: N.M. - Not MeaningfulEric OngAinda não há avaliações

- Introduction of MTM: StatementDocumento23 páginasIntroduction of MTM: StatementALI SHER HaidriAinda não há avaliações

- Copia de FCXDocumento16 páginasCopia de FCXWalter Valencia BarrigaAinda não há avaliações

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDocumento8 páginasJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliAinda não há avaliações

- Annual Performance 2012Documento3 páginasAnnual Performance 2012Anil ChandaliaAinda não há avaliações

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Documento9 páginasMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruAinda não há avaliações

- Welcome To The Presentation SessionDocumento32 páginasWelcome To The Presentation SessionMoinul IslamAinda não há avaliações

- Hindustan Unilever LTD.: Trend AnalysisDocumento7 páginasHindustan Unilever LTD.: Trend AnalysisAnkitaBansalAinda não há avaliações

- Havells Balance Sheet (4 Years)Documento15 páginasHavells Balance Sheet (4 Years)Tamoghna MaitraAinda não há avaliações

- BMW's Financial Statements For The Year 2013Documento8 páginasBMW's Financial Statements For The Year 2013audit202Ainda não há avaliações

- Myer AR10 Financial ReportDocumento50 páginasMyer AR10 Financial ReportMitchell HughesAinda não há avaliações

- Vertical Analysis PDFDocumento12 páginasVertical Analysis PDFAbdul Rehman SafdarAinda não há avaliações

- Colgate Palmolive (India)Documento22 páginasColgate Palmolive (India)Indraneal BalasubramanianAinda não há avaliações

- Financial Report H1 2009 enDocumento27 páginasFinancial Report H1 2009 eniramkkAinda não há avaliações

- Letter To Shareholders and Financial Results September 2012Documento5 páginasLetter To Shareholders and Financial Results September 2012SwamiAinda não há avaliações

- Performance HighlightsDocumento2 páginasPerformance HighlightsPushpendra KumarAinda não há avaliações

- HDFC Bank AnnualReport 2012 13Documento180 páginasHDFC Bank AnnualReport 2012 13Rohan BahriAinda não há avaliações

- CAT ValuationDocumento231 páginasCAT ValuationMichael CheungAinda não há avaliações

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Documento17 páginasSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikAinda não há avaliações

- Data Analysis and InterpretationDocumento50 páginasData Analysis and InterpretationAnonymous MhCdtwxQIAinda não há avaliações

- Consolidated Accounts June-2011Documento17 páginasConsolidated Accounts June-2011Syed Aoun MuhammadAinda não há avaliações

- Consolidated Balance Sheet: As at March 31, 2013Documento4 páginasConsolidated Balance Sheet: As at March 31, 2013sudhak111Ainda não há avaliações

- Tata Steel 1Documento12 páginasTata Steel 1Dhwani ShahAinda não há avaliações

- Cost AccountingDocumento16 páginasCost Accountingvishal galaAinda não há avaliações

- Financials at A GlanceDocumento2 páginasFinancials at A GlanceAmol MahajanAinda não há avaliações

- Afm PDFDocumento5 páginasAfm PDFBhavani Singh RathoreAinda não há avaliações

- Project Company Subject Group Group Members: GC University FaisalabadDocumento23 páginasProject Company Subject Group Group Members: GC University FaisalabadMuhammad Tayyab RazaAinda não há avaliações

- Industry OverviewDocumento7 páginasIndustry OverviewBathula JayadeekshaAinda não há avaliações

- Financial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Documento13 páginasFinancial Modelling Assignment - Ghizal Naqvi (Attock Petroleum Limited)Ghizal NaqviAinda não há avaliações

- 2012 Annual Financial ReportDocumento76 páginas2012 Annual Financial ReportNguyễn Tiến HưngAinda não há avaliações

- Kbank enDocumento356 páginasKbank enchead_nithiAinda não há avaliações

- Lecture Common Size and Comparative AnalysisDocumento28 páginasLecture Common Size and Comparative AnalysissumitsgagreelAinda não há avaliações

- Faysal Bank Spread Accounts 2012Documento133 páginasFaysal Bank Spread Accounts 2012waqas_haider_1Ainda não há avaliações

- Financial Highlights: Hinopak Motors LimitedDocumento6 páginasFinancial Highlights: Hinopak Motors LimitedAli ButtAinda não há avaliações

- EA WilmarDocumento6 páginasEA WilmarMatthew TanAinda não há avaliações

- Operations Research Group Report: Dea AnalysisDocumento21 páginasOperations Research Group Report: Dea AnalysisVaibh SinghAinda não há avaliações

- Gul AhmedDocumento4 páginasGul AhmedDanialRizviAinda não há avaliações

- India Infoline Q2 Results 2005Documento6 páginasIndia Infoline Q2 Results 2005Shatheesh LingamAinda não há avaliações

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Documento11 páginasProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniAinda não há avaliações

- 00 Saip 76Documento10 páginas00 Saip 76John BuntalesAinda não há avaliações

- BSBMGT516 Facilitate Continuous Improvement: Summative Assessment 1Documento4 páginasBSBMGT516 Facilitate Continuous Improvement: Summative Assessment 1Mmc MixAinda não há avaliações

- Viper 5000 Installations Guide PDFDocumento39 páginasViper 5000 Installations Guide PDFvakakoAinda não há avaliações

- Call For Papers ICMIC-2016Documento1 páginaCall For Papers ICMIC-2016Zellagui EnergyAinda não há avaliações

- (English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)Documento6 páginas(English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)moAinda não há avaliações

- 2017 Directory WO Member PagesDocumento112 páginas2017 Directory WO Member PagessberkowitzAinda não há avaliações

- Class Assignment 2Documento3 páginasClass Assignment 2fathiahAinda não há avaliações

- Tingalpa Green New Townhouse Development BrochureDocumento12 páginasTingalpa Green New Townhouse Development BrochureMick MillanAinda não há avaliações

- Cortex - M1: Technical Reference ManualDocumento174 páginasCortex - M1: Technical Reference ManualSzilárd MájerAinda não há avaliações

- Defensive Driving TrainingDocumento19 páginasDefensive Driving TrainingSheri DiĺlAinda não há avaliações

- Msds 77211 enDocumento13 páginasMsds 77211 enJulius MwakaAinda não há avaliações

- Bill FormatDocumento7 páginasBill FormatJay Rupchandani100% (1)

- Business en Pre Above S+T ReadingDocumento3 páginasBusiness en Pre Above S+T Readingsvetlana939Ainda não há avaliações

- Taiwan Petroleum Facilities (1945)Documento85 páginasTaiwan Petroleum Facilities (1945)CAP History LibraryAinda não há avaliações

- A Survey Report On The Preferred RestaurDocumento22 páginasA Survey Report On The Preferred RestaurEIGHA & ASHLEIGH EnriquezAinda não há avaliações

- UnderstandingcpucoresDocumento5 páginasUnderstandingcpucoresAbdul NabiAinda não há avaliações

- DS TEGO Polish Additiv WE 50 e 1112Documento3 páginasDS TEGO Polish Additiv WE 50 e 1112Noelia Gutiérrez CastroAinda não há avaliações

- SOPDocumento2 páginasSOPDesiree MatienzoAinda não há avaliações

- BroucherDocumento2 páginasBroucherVishal PoulAinda não há avaliações

- Arab Open University B326: Advanced Financial Accounting TMA - Spring 2022-2023 V2Documento7 páginasArab Open University B326: Advanced Financial Accounting TMA - Spring 2022-2023 V2samiaAinda não há avaliações

- Lab - Report: Experiment NoDocumento6 páginasLab - Report: Experiment NoRedwan AhmedAinda não há avaliações

- Assignment of Killamsetty Rasmita Scam 1992Documento8 páginasAssignment of Killamsetty Rasmita Scam 1992rkillamsettyAinda não há avaliações

- Impact of Carding Segments On Quality of Card Sliver: Practical HintsDocumento1 páginaImpact of Carding Segments On Quality of Card Sliver: Practical HintsAqeel AhmedAinda não há avaliações

- MCA Proposal For OutsourcingDocumento2 páginasMCA Proposal For OutsourcingLazaros KarapouAinda não há avaliações