Escolar Documentos

Profissional Documentos

Cultura Documentos

Hedge Fund Survey by FCA, UK

Enviado por

Eduardo PetazzeDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Hedge Fund Survey by FCA, UK

Enviado por

Eduardo PetazzeDireitos autorais:

Formatos disponíveis

Financial Conduct Authority

Hedge Fund Survey

March 2014

Financial Conduct Authority

HFS

Table of contents

I. II. III. IV. Introduction ........................................................................................................ 4 Highlights ........................................................................................................... 5 About the survey ................................................................................................. 7 Size and scale of the hedge fund industry ..............................................................10 A) B) C) D) E) F) G) V. A) B) C) D) E) F) G) H) I) J) VI. A) B) C) D) E) Global hedge fund assets under management ..................................................10 Hedge funds compared to other alternative investments ....................................11 Fund domicile ...............................................................................................11 Investors in hedge funds ...............................................................................12 Hedge fund strategies ...................................................................................13 Industry concentration ..................................................................................14 Trading and clearing .....................................................................................14 Foreword .....................................................................................................15 Trends in the use of leverage .........................................................................16 How leverage translates into market exposure .................................................17 Range of leverage ratios ...............................................................................17 Structure of leverage ....................................................................................18 Concentration of exposure .............................................................................19 Fund exposures by instrument type ................................................................20 Interest rate derivatives ................................................................................21 Use of leverage by strategy ...........................................................................22 Turnover or trading activity ............................................................................23 Risk ............................................................................................................25 Value at risk per fund ....................................................................................25 Sources of finance ........................................................................................26 Portfolio complexity ......................................................................................27 1) Nature of assets and instruments ................................................................28 2) Range of positions by strategy ...................................................................29 Liquidity ......................................................................................................30 1) Unencumbered cash ..................................................................................30 2) Investor liquidity ......................................................................................33 3) Re-hypothecation or the re-use of assets......................................................34

Size and scale of hedge fund activity in financial markets ........................................15

Portfolio characteristics of hedge funds ..................................................................25

VII.

Afterword ..........................................................................................................35

Public report

Page 2 / 35

Financial Conduct Authority

HFS

Abbreviations used in this paper

AIFMD AUM CCP CTA FCA FSB FX GAAP GMV GNE HFI HFR HFS HNW IRD IFRS NAV OTC IOSCO UC VaR Alternative Investment Managers Directive assets under management Central Clearing Counterparty Commodity trading advisor Financial Conduct Authority Financial Stability Board foreign exchange generally accepted accounting principles gross market value gross notional exposure Hedge Fund Intelligence Global Review HFR Global Hedge Fund Industry Report Hedge Fund Survey high net worth interest rate derivatives International Financial Reporting Standards net asset value over the counter International Organisation of Securities Commissions unencumbered cash Value at Risk

Public report

Page 3 / 35

Financial Conduct Authority

HFS

I. Introduction

The Financial Conduct Authoritys role The Financial Conduct Authority (FCA) supervises hedge fund managers operating in the UK. The FCA collects data from hedge funds and hedge fund managers to inform its supervisory activity, with the aim of ensuring markets work well and of promoting market integrity. The FCA also plays a leading role in assessing the systemic risks posed by hedge funds, and developing potential policy measures to assess these risks, working closely with the Financial Stability Board (FSB), the UK Financial Policy Committees (FPC) and the International Organisation of Securities Commissions (IOSCO). Hedge fund assets under management in the UK The hedge fund survey presents an aggregated picture of industry activity in the UK, illustrating key trends and risks. Approximately USD 470bn of hedge fund assets are managed in the UK, with 450 hedge fund management firms registered with the FCA. The survey contains data from 49 management firms, which collectively manage USD 481bn of hedge fund assets globally, of which USD 206bn is managed in the UK. At fund level, the data collected is for 106 funds, which have aggregated net assets under management of USD 345bn. Data is reported as at September 2013. Risk identification and mitigation Hedge funds fail or close down on a regular basis without causing a significant impact on the financial system, but very large hedge funds potentially pose a risk. A large hedge fund which fails in a disorderly way might impact wider financial markets in two ways: by causing losses to its transaction counterparties (the credit channel) or by disrupting markets as its positions are closed out or counterparties rush to sell collateral at the same time (the market channel). The impact on markets could be greater, if a fund has highly complex positions across a range of markets. Hedge funds use leverage to increase the size of the positions taken in financial markets. In some cases, the use of leverage allows them to become large enough to suggest they could impact the wider financial system in certain situations. Hedge funds obtain leverage either by borrowing money or securities from counterparties (known as financial leverage) or by using derivative instruments such as options, futures or swaps. Our survey highlights that, by far, the largest proportion of total leverage used by hedge funds in the UK is acquired using derivatives. Derivative transactions allow hedge funds to acquire market/economic exposures (which this report refers to as the Gross Notional Exposure) that are many times bigger than the capital of the fund: for example a hedge fund may pay or receive USD 1m to buy or sell an option with an underlying market exposure of USD 100m. Almost all of the institutions which enter derivative transactions with hedge funds require the funds to provide collateral. This protects the counterparty against losses on the transaction if the hedge fund defaults on its commitments under the transaction. Most counterparties will not transact with hedge funds without collateral. Identifying the probability of failure Hedge funds which are highly leveraged using derivatives can fail if they run out of cash or similar liquid assets to post as collateral. The amount of liquid and unencumbered assets in a hedge fund portfolio is a key indicator of its financial health and of its ability to absorb losses. The FCA expects hedge funds to monitor the characteristics of their portfolios and to identify and appropriately manage risks. In addition to oversight of individual funds and firms, the FCA seeks to identify funds or trends with the potential to pose risks to wider financial markets, and to manage these risks.

Public report

Page 4 / 35

Financial Conduct Authority

HFS

II. Highlights

Size and scale of the hedge fund industry Based on the top 100 global alternative investment firms, hedge funds appear to be the third largest type of alternative investments, after real estate and private equity (based on assets under management). The UKs share of global hedge fund assets under management has been increasing over the past ten years to around 18% today. The firms in the survey reported total global hedge fund assets of USD 481bn, of which USD 206bn is managed in the UK. The assets of the funds covered by the survey (investment vehicles where size and nature meet the definition set out for the survey) represent USD 345bn. The survey found that 69% of funds are domiciled in the Cayman Islands. Equity strategies are the most popular among the funds in the survey, making up 34% of the total number of funds. Institutional investors have become the dominant type of investors in hedge fund vehicles, while high net worth individuals have declined as a proportion of hedge fund investors since 2008.

Size and scale of hedge fund activity in financial markets Gross notional exposure is one measure of leverage that is provided by the survey. It captures the total size of long and short positions. It does not take into account hedging or the risk profile of the instruments it relates to, but it does provide a measure of hedge fund activity in markets (which we refer to as market footprint). We do not use this measure to assess the investment or market risk of portfolios. The survey reveals the gross size, interconnectedness and complexity of operations. This information helps us identify entities that warrant conducting further research. The top ten funds each managed an average of USD 1.9tn in gross notional exposure, accounting collectively for 87% of the samples total . However, comparing the mean and median use of leverage shows the majority of hedge funds exhibit low levels of leverage. The most recent data showed most hedge funds have raised their total gross leverage. Collectively, the funds in our survey have a total gross leverage equal to 64x fund assets (measured as a ratio of gross notional exposure to net asset value (NAV)). This has increased from 54x NAV in March 2013. Of the total leverage, 98% is obtained using derivatives to gain market exposure, driven by a few large funds. Overall, the funds in the survey turned over USD 210tn over one rolling year. The ten most active funds represent 84% of portfolio turnover in the survey sample. The most active funds turned over the equivalent of more than 1,000 times their net asset value over a rolling 12 month period. This reflects the rolling of short term interest rate positions by some funds. Interest rate derivatives make up the largest proportion of the market exposure and portfolio turnover of hedge funds (collectively market footprint). This reflects that this market is large and liquid.

Public report

Page 5 / 35

Financial Conduct Authority

HFS

Portfolio characteristics of hedge funds Of the 106 funds in the survey, 79 reported data on Value at Risk (VaR). The median reported VaR was lower than 14% of NAV while a small number of funds reported an annual VaR figure above 40%. In aggregate, hedge fund portfolios remain fairly liquid and easily valued. The median fund holds very few positions that are valued on a mark-to-model basis or held at cost. Some large funds specialise in illiquid investments, especially distressed debt. The median number of open positions per fund has increased considerably for some strategies (e.g. macro and multi-strategy) since March 2012, but declined for others (e.g. managed futures and equity). There is significant variation in the number of open positions per fund in the survey the most complex funds had more than 10,000, while a number of funds had fewer than 100 open positions. The proportion of unencumbered cash relative to gross exposure exhibits similar divergence across strategies. It has increased across the sample as whole, but it has declined for macro funds, which have increased their leverage and exposures. Funds in aggregate continue to hold investments that are more liquid than the terms they offer their investors. However, there are some signs that investors are requiring more favourable liquidity terms from funds. Of the surveyed funds, 71% permit re-hypothecation of fund assets, compared to 69% in March 2013.

Public report

Page 6 / 35

Financial Conduct Authority

HFS

III. About the survey

What is a hedge fund? Hedge funds are one of a category of funds known as alternative investment funds. Alternative funds invest in a variety of global assets, including property and commodities. They often have a high degree of flexibility around how they invest. Hedge funds are a type of alternative fund which use this freedom to pursue a wide variety of strategies in many different asset classes: some run very concentrated portfolios; others pursue complex trading strategies characterised by high levels of turnover; and others employ high levels of leverage. What is captured in this edition of the survey? This survey reflects voluntary responses from 49 firms and 106 qualifying funds, with data reported at the end of September 2013. Global data is collected at the level of the firm (Section 1) and the qualifying funds (Section 2), reflecting the international structure of the industry. Our analysis primarily focuses on the 106 qualifying funds, and considers how their global assets of USD 345bn are managed rather than focussing on assets managed in the UK. Some information about the firms surveyed is set out below. Information is presented in US dollars (USD) for comparability; AUM indicates net assets under management or net asset value (NAV). To qualify for the survey, funds must be: identified as hedge funds by firms using a range of criteria, such as the use of leverage, the complexity of strategies or the application of performance fees at least partially managed by a UK regulated entity or marketed in the UK able to demonstrate total global net assets under management (net AUM or NAV) of at least USD 500 million. This includes the sum of all accounts managed to the same strategy (for example including pooled funds and separately managed accounts), to ensure the product is fully captured. single-manager funds, i.e. fund of funds (or multimanager funds) are excluded

Future of the hedge fund survey To date, this data has been reported on a voluntary basis, however, the FCA survey will be replaced by new reporting requirements introduced by the European Alternative Investment Fund Managers Directive (AIFMD), which will provide comparable data on a broader range of funds and firms. The FCA will continue to use data collected from the hedge fund survey and new reporting requirement to identify risks and inform our approach to supervision. International regulatory cooperation Hedge funds operate across national boundaries and national regulators are cooperating closely to respond to these risks. The FCA engages in domestic and international policy initiatives to better assess and manage the risks posed by hedge funds, including work led by the International Organisation of Securities Commissions (IOSCO), the Financial Stability Board (FSB) and the UKs Financial Poli cy Committee. The EU Alternative Investment Managers Directive (the AIFMD) will also make significant changes to how EU authorities regulate hedge funds.

Public report

Page 7 / 35

Financial Conduct Authority

HFS

The sample of firms in the survey has evolved. The response rate has remained broadly stable over the last two years. To put the survey data in perspective, 450 firms registered in the UK are engaged in hedge fund management activity1. Figure 1 - Survey participants Number of Surveyed Firms 120 100 80 60 40 20 0 Oct-09 Apr-10 Sep-10 Mar-11 Sep-11 Mar-12 Sep-12 Mar-13 Sep-13 Number of Funds

September 2013 data showed the 49 firms in the survey managed global hedge fund assets worth USD 481bn, of which USD 206bn (43%) are directly managed by staff in UK regulated entities. The main place of business for most firms was in the UK. The median firm in the survey manages 99% of its AUM in the UK, which suggests a small number of very large firms have smaller UK operations with headquarters abroad.

Figure 2 - Location of management UK-managed AUM Global hedge fund assets under managerment (AUM) (USD billions) 600 500 400 Non UK-managed AUM

275 (57%)

300 200 100 -

206 (43%)

1 Source: FCA internal databases, March 2013. Public report Page 8 / 35

Financial Conduct Authority

HFS

HFS sample compared to the industry (sources: FCA, HFI, and HFR):2

Market data public sources (global)

Total global single manager hedge fund assets: c. USD 2.6tn Total global number of single manager hedge fund vehicles: c. 8,000 Total global number of single manager hedge fund management firms: c. 2,500

Market data public sources and FCA (UK)

Hedge fund assets managed in the UK: c. USD 470bn Total number of FCA-registered hedge fund management firms: c. 450

UK FCA Hedge Fund Survey perimeter:

FCA HFS

49 management firms, with global hedge fund assets of USD 481bn of which USD 206bn managed in the UK 106 hedge funds/vehicles, representing overall USD 345bn in AUM

In addition to FCA proprietary data sources, the diagram uses and crosses the following external sources, which are also used later in the report, when referring to external sources: Hedge Fund Intelligence Global Review, Autumn 2013 Hedge Fund Intelligence Database (data.hedgefundintelligence.com) HFR Global Hedge Fund Industry Report, Q4 2013

Public report

Page 9 / 35

Financial Conduct Authority

HFS

IV. Size and scale of the hedge fund industry

A. Global hedge fund assets under management

We have used data from the survey and public sources (e.g. HFI, HFR and TheCityUK). Data across providers is not consistent, but does illustrate key trends. Figure 3 - Global hedge fund AUM - Source: FCA, HFR

3,000 2,500 2,000 1,500 1,000 500 0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

USD billions

Funds under management in the UK have steadily increased from 10% of total global hedge fund AUM in the early 2000s to 18-19% of the total today. The US remains the largest hedge fund management centre.

Public report

Page 10 / 35

Financial Conduct Authority

HFS

B.

Hedge funds compared to other alternative investments

Figure 4 - Global top 100 alternatives industry managers Source: HFI % of top 100 total AUM 40% 30% 20% 10% 0%

Real Estate Private Equity Hedge Funds

PE fund of funds

Fund of HFs Infrastructure Commodities

Using data from HFI3 on the top 100 global alternative industry managers, pure hedge fund assets were the third largest type of alternative investment in early 2013, behind real estate and private equity.

C.

Fund domicile

The majority of sampled funds are domiciled offshore, with the Cayman Islands retaining the largest share (Figure 5). Figure 5 - Breakdown by juisdiction (number of funds) British Virgin Islands 6% Ireland 10% Luxembourg 1% US 10% Bermuda 3% Cayman Islands 67%

Bahamas 3%

See Hedge Fund Intelligence Global Review, Autumn 2013 Page 11 / 35

Public report

Financial Conduct Authority

HFS

To date, there is little evidence that recently implemented regulations, such as Alternative Investment Managers Directive (AIFMD), have encouraged firms to move their funds domicile from offshore jurisdictions.

D.

Investors in hedge funds

Figure 6 - Breakdown of ownership (% of NAV) Other sources, 9% Employees and staff of the investment manager, 9% High net worth individuals and family offices, 13%

Other investment funds (e.g. fund of funds), 21%

Sovereign wealth funds, 7%

Institutional investors, 42%

Since the financial crisis, institutional investors (largely pension funds and endowment like institutions) have become the largest source of new money for hedge funds. In contrast, funds of hedge funds have diminished in relative terms from 29% in September 2010 to 21% in September 2013. This is because a number of medium and larger size pension funds are choosing to manage their own hedge fund portfolios. Similarly, high net worth (HNW) individuals and family offices have declined to 13% of hedge fund assets.

Public report

Page 12 / 35

Financial Conduct Authority

HFS

E.

Hedge fund strategies

Long/short equity and multi-strategy funds remain the most popular fund strategies, accounting for a combined 48% of the total number of funds. Figure 7 - Number of funds by strategy (% of total) Credit Long/ Short Equity Hedge: Long / Short Equity Hedge: Long Bias Equity Hedge: Market Neutral Event Driven: Distressed/ Restructuring Macro: Commodity Macro: Global Macro Managed Futures/ CTA: Fundamental Managed Futures/ CTA: Quantitative Multi-Strategy Other Relative Value: Fixed Income Arbitrage 0.0% Sep-12 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% Sep-13

Mar-13

Public report

Page 13 / 35

Financial Conduct Authority

HFS

F.

Industry concentration

Over time, the industry has become more concentrated. The survey shows that the 20 largest firms control 82% of the samples NAV (net AUM). The concentration ratio rises significantly when considering gross notional exposure (GNE) at the fund level. The 20 largest funds account for 94% of the sample GNE. These 20 funds are managed by 12 different firms. Figure 8 - Concentration of industry (% of NAV) % of aggregate sample NAV 100.0% 80.0% 60.0% 40.0% 20.0% 0.0% Sep-10 Sep-11 Top 10 firms Sep-12 Top 20 firms Sep-13

Figure 9 - Concentration of industry (% of GNE) % of aggregate sample GNE 100.0% 80.0% 60.0% 40.0% 20.0% 0.0% Sep-10 Sep-11 Top 10 funds Sep-12 Top 20 funds Sep-13

G.

Trading and clearing

Over the counter (OTC) derivatives trading continues to outpace derivatives traded on exchanges. Figure 10 - Percentage of derivatives that were traded: (mean sample trade volumes per fund) Sep-11 On a regulated exchange OTC 54% 46% Sep-12 47% 53% Sep-13 37% 63%

Over 59% of OTC derivatives trade volumes were centrally cleared by a Central Clearing Counterparty (CCP) as at September 2013.

Page 14 / 35

Public report

Financial Conduct Authority

HFS

V. Size and scale of hedge fund activity in financial markets

A. Foreword

The different measures of size and market impact used in the HFS are defined below.

Net assets under management (AUM) Gross notional exposure (GNE) Or net asset value (NAV) of all fund assets The absolute sum of all long and short positions, including gross notional value (delta-adjusted when applicable) for derivatives. This measure provides a complete appreciation of all the leverage that is employed by a fund to gain market exposure, i.e. financial leverage (repos, prime broker financing, secured and unsecured lending) and synthetic leverage (exposure through derivatives, including the resulting exposure to the underlying asset or reference). GNE does not directly represent an amount of money (or value) that is at risk of being lost. It is a reference figure used to calculate profits and losses. But it still represents a fairer appreciation than NAV of the economic or market exposure that the position represents by looking through to the underlying asset or reference. The fact that hedge funds use risk management techniques to net out directional exposures does not reduce the overall gross size of the positions they are taking in the markets, which constitutes their market footprint. Gross leverage Gross market value (GMV) Turnover The ratio of GNE to NAV The absolute sum of all long and short positions, considering fair market value for all positions. This measure will usually be larger than NAV and smaller than GNE. A measure of transaction volumes or trading activity. The absolute sum (in US dollars) of all trades (on a rolling one-year basis), using market value or gross notional exposure (where applicable) and only the premiums paid or received for options. This measure provides the degree of activity of a fund in markets, which we then compare with the funds static size as measured by NAV.

Public report

Page 15 / 35

Financial Conduct Authority

HFS

B.

Trends in the use of leverage

Leverage can be one way of highlighting how a hedge fund could be important to a market. One measure of leverage is gross leverage as described above. Figure 11 shows the average gross leverage ratios per fund (mean and median).

Figure 11 - Fund gross leverage trend 50.0 Average gross leverage per fund (multiples of NAV) 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 Oct-09 Apr-10 Sep-10 Mar-11 Sep-11 Mar-12 Sep-12 Mar-13 Sep-13 Mean Median 2.3 4.7 5.4 4.5 4.9 4.7 4.2 27.3 25.7 30.3 29.0 45.6 40.0

28.9

26.9 20.3

3.3

3.6

The mean tends to be skewed by a few very large funds that make use of a significant amount of leverage, while the median demonstrates the vast majority of hedge fund vehicles tend to use relatively low levels of leverage. As shown in the chart above, previous editions of the survey had highlighted a notable deleveraging since 2010-2011 by a small number of large users of leverage mostly macro funds. While the median leverage has remained relatively stable on six months ago, the largest funds have increased leverage thus pulling the mean higher. The high speed with which funds can alter their market exposure is an important part of our assessment of the systemic risk posed by this sector. The increase in leverage at the largest funds over the course of 2013 is mostly due to an increase in Interest Rate Derivative (IRD) positions.

Public report

Page 16 / 35

Financial Conduct Authority

HFS

C.

How leverage translates into market exposure

Figure 12 illustrates the gross notional exposures of the 106 hedge funds in our survey relative to their total net assets under management (AUM). These funds have an aggregate gross leverage of 64x NAV. Figure 12 - Total net AUM versus Total gross notional exposure as at September 2013 25,000

22,226

20,000

USD billions

15,000

Aggregate gross leverage in the UK FCA Hedge Fund Survey (HFS) sample = 64x NAV

10,000

5,000

345

0 Total net AUM (NAV) Total gross notional exposure (GNE)

D.

Range of leverage ratios

Funds differ in several ways, including their use of leverage and overall exposure. The top ten funds managed an average of USD 1.9tn in gross notional exposure. Figure 13 presents the range of gross leverage per fund, measured as a ratio of NAV. Figure 13 - Range of gross leverage per fund (GNE/NAV) in the HFS sample (in percentage of funds) > 50x 12.3% 25x - 50x 8.5% 10x - 25x 15.1% 5x - 10x 9.4% < 5x 54.7%

Public report

Page 17 / 35

Financial Conduct Authority

HFS

E.

Structure of leverage

There are two ways to leverage the net asset value into a broader market exposure: financial leverage (repo transactions, prime broker financing, or unsecured lending) synthetic leverage (using derivatives to obtain market exposure) direct secured

Our survey shows that size and exposure are driven by derivatives activity rather than financial leverage. Unsecured lending is very small as most counterparties demand some form of collateral for any financing of hedge fund positions. Figure 14 shows the split between aggregate financial and synthetic leverage. Figure 14 - Sources of leverage (USD billions) Financial leverage 446 2% Synthetic leverage 20,141 98%

Figure 15 shows the effect of both types of leverage on the overall sample exposure, compared to net AUM (NAV). Most of the synthetic exposure is generated by a few funds. Figure 15 - Effects of financial and synthetic leverage on funds` exposure 25,000 20,000 USD billions 15,000 10,000 5,000 345 Total net AUM (NAV) of the sample Total net AUM + financial Total gross notional leverage exposure (delta-adjusted) 791 22,226

Public report

Page 18 / 35

Financial Conduct Authority

HFS

F.

Concentration of exposure

Figures 16 and 17 show the concentration of the industry in terms of net AUM (NAV) and gross notional exposure (GNE).

Figure 16 - Concentration by net AUM (USD billions) Rest of funds 195 57%

Figure 17 - Concentration by GNE (USD billions) Rest of funds 2,945 13%

Top 10 funds 150 43%

Top 10 19,281 87%

Public report

Page 19 / 35

Financial Conduct Authority

HFS

G.

Fund exposures by instrument type

Figure 18 shows the point-in-time positions of the sample portfolio, by types of instruments used, using gross (long + short in absolute terms) and net measures. This excludes foreign exchange (FX) and interest rate derivatives (IRD) because these are computed only on a gross basis.

Figure 18 - Total fund exposures by instrument type for the sample Gross 700 600 USD billions 500 400 300 200 100 (100) Net

Public report

Page 20 / 35

Financial Conduct Authority

HFS

H.

Interest rate derivatives

The market for interest rates and interest rate derivatives is broad, deep and typically offers the liquidity hedge funds need to conduct their trading strategies. IRDs are by far the most important instrument used by hedge funds to generate both exposure and turnover. Time series data helps to show the speed and size of shifts in IRD exposures. The survey, together with other similar exercises, is an important part of understanding the current and potential impact on financial stability. Figure 19 shows the incremental impact of different instruments on gross leverage, highlighting the predominant role of interest rate derivatives in generating exposure and leverage.

Figure 19 - Effect of select instruments on exposure and leverage 25,000 Gross notional exposure (USD billions) 64x NAV

20,000

15,000

10,000 8.5x NAV 5,000 4.6x NAV 5.9x NAV

Total Gross Total Gross Total Gross Exposure excluding Exposure excluding Exposure excluding (IRD + FX + (IRD + FX) IRD Sovereign Bonds) Total Gross Exposure

Public report

Page 21 / 35

Financial Conduct Authority

HFS

I.

Use of leverage by strategy

Interest rate derivatives tend to be used mostly in relative value, macro and managed futures strategies. This is reflected in their relatively high use of gross leverage, as set out in Figure 20.

Figure 20 - Gross leverage by strategy (median) Median gross leverage per fund ( x NAV) 60.0 50.0 40.0 30.0 20.0 10.0 0.0

Public report

Page 22 / 35

Financial Conduct Authority

HFS

J.

Turnover or trading activity

We also use the turnover of portfolios to assess a funds potential impact on markets, which we defined earlier as a combination of gross size and trading activity. The survey shows the total trading activity for all funds over a one year rolling period ending in September 2013. This can be compared with the net AUM that investors have invested in the fund (the shareholders equity in the fund). Figure 21 -Total portfolio turnover versus total net AUM (NAV) as at September 2013 250,000 210,899 200,000 USD billions

150,000

100,000

50,000

345 Total net AUM (NAV) Total portfolio turnover

Figure 22 - Range of turnover per fund (US dollars) in the HFS sample (in percentage of funds) > 1trn 20% 100bn-1trn 28% 10bn - 100bn 28% < 10bn 24% The top ten funds represent 84% of the sample total portfolio turnover. In terms of turnover as a ratio of fund NAV, the most active funds turned over their portfolio more than 1,000 times over the last rolling year. This includes the impact of rolling short term interest rate positions.

Public report

Page 23 / 35

Financial Conduct Authority

HFS

Figure 23 - Sample turnover of portfolio by instrument type Annual Turnover (USD billions) 150,000 120,000 90,000 60,000 30,000 0 8,000 6,000 4,000 2,000 0

Figure 23 shows that IRD represent 70% of the total annual turnover of the sample in our survey. The panel chart above uses different scales to illustrate the difference in magnitude between IRD and the rest (i.e. the bottom panel uses a smaller scale to evidence lower volume instruments). Several strategies (including macro and relative value) are based on active trading. This means that the impact these strategies have on the wider markets is generally much greater in terms of portfolio turnover than their net AUM would imply. Other strategies tend to generate relatively less trading activity, resulting in a smaller difference between their market exposure and turnover.

Public report

Page 24 / 35

Financial Conduct Authority

HFS

VI. Portfolio characteristics of hedge funds

A. Risk

The survey gathers some information on the investment/market risks within funds, including traditional measures such as Value at Risk (VaR), counterparty risk and financing. Together, these metrics indicate sensitivity to external shocks and ultimately reflect the probability of failure. We use these measures to identify higher risk funds and to assess firms technical capabilities and their approach to risk management.

B.

Value at Risk (VaR) per fund

VaR measures the potential loss of a portfolio at a given level of confidence. We asked firms to provide us with their own VaR calculations for their funds. This helps us to understand how firms evaluate their own risk appetite. We are aware that VaR has a number of issues, particularly when analysing risks in stressed scenarios. Of the funds surveyed, 79 reported a VaR figure. A comparison between these figures is not perfect as firms tend to report at different confidence intervals. We have annualised the data from the funds in the survey to produce an indicative range. Respondents reported a wide range of annualised VaR figures for their funds. The median fund reported a VaR lower than 14% of net asset value (NAV), while a number of funds reported a VaR above 40% of NAV.

Public report

Page 25 / 35

Financial Conduct Authority

HFS

C.

Sources of financing

Figure 24 indicates the use of financial leverage and synthetic exposure through derivatives for the mean and median fund in the survey. Both highlight the impact of a few funds that use these types of leverage. Figure 24 - Leverage by source (in multiples of NAV) 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 Mean fund Financial Leverage ratio ( x NAV) Median fund Synthetic Leverage atio (( xx NAV) Synthetic Leverage ratio NAV)

35.1

1.7

1.3

2.8

As noted in section V, very little, if any, unsecured (uncollateralised) hedge fund financing is provided by market counterparties and prime brokers. Figure 25 also illustrates that a large number of funds make little use of financial leverage altogether (difference between the median and the mean). Figure 25 - Financial borrowing breakdown per fund Median Type of borrowing Collateralized borrowing via Other Collateralized borrowing via Repo Collateralized borrowing via PB Unsecured cash borrowing 0.0 0.5 1.0 1.5 2.0 2.5 3.0 Mean

Average borrowing per fund (USD billions) The top ten funds (in borrowing amounts) made up 79% of the total financial borrowings reported.

Public report

Page 26 / 35

Financial Conduct Authority

HFS

D.

Portfolio complexity

The complexity of portfolios is another indicator of potential systemic risk for funds. This is distinct from probability of failing (or propensity to fail), which is more closely linked to risk and liquidity (see section VIII). Complexity can help us understand the impact that a fund failure would have on wider financial markets. Complexity acts as a magnifier of size and leverage: the more complex a fund is, the more difficult, time consuming and potentially financially detrimental its eventual wind up would be. Complexity can be assessed by looking at factors such as: the nature of assets and instruments invested the structure of portfolio (including number of open positions) portfolio concentration

Hedge funds are by definition complex portfolios, which makes the analysis more complicated. Defining the composition of positions can be challenging. As a result, this type of analysis may not always provide clear and immediate conclusions on concentration or risk.

Public report

Page 27 / 35

Financial Conduct Authority

HFS

1. Nature of assets and instruments

Most hedge funds deal in liquid markets and in instruments which can be easily valued using public data. For a number of strategies, notably those using high turnover, liquidity is key. Therefore, they need markets with both depth and breadth in order to trade efficiently.

Figure 26 - Median fund asset classification (based on gross market value (GMV)) 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% Level 1 fair value assets Level 2 fair value assets

57.2%

15.4% 0.2%

Level 3 fair value assets

0.0%

Cost-based assets

Note: The numbers in the chart will not necessarily add up to 100%, because they represent the median value for the cross section. The average portfolio of the surveyed funds is largely made up of liquid and easily valued instruments (levels 1 and 2). Figure 26 illustrates the median asset classification distribution, based on the asset classification rules of International Financial Reporting Standards (IFRS) or US Generally Accepted Accounting Principles (GAAP).

Public report

Page 28 / 35

Financial Conduct Authority

HFS

2. Range of positions by strategy

The survey asked firms to report on the total number of positions in their funds. Data collected as at September 2013 shows that the median number of open positions has fallen back after surging both in September 2012 and March 2013 (Figure 28). However, the number of positions and portfolio complexity has actually increased in macro and multi-strategy funds. This could indicate a rise in risk appetite for those funds as they see more trading opportunities in the markets. Figure 27 - Number of open positions per fund broken down by fund strategy (median) Number of open positions 4000 3500 3000 2500 2000 1500 1000 500 0

Figure 28 - Number of open positions per fund (median) 1000 900 Number of open positions 800 700 600 500 400 300 200 100 0 Oct-09 Apr-10 Sep-10 Mar-11 Sep-11 Mar-12 Sep-12 Mar-13 Sep-13

Public report

Page 29 / 35

Financial Conduct Authority

HFS

E.

Liquidity risk

For strategies with extensive derivative and synthetic exposure, the risks around fund liquidity are crucial metrics. They include the liquidity of the assets held, the cash positions of the fund and the liquidity offered to investors. Liquidity is a measure of a funds ability to absorb loss. Liquidity of instruments can change over time, so current liquidity is only a guide to risk. The following sections will address the aspects of liquidity risk we are monitoring.

1. Unencumbered cash

Where a fund has derivatives positions, a portion of its cash is held by its counterparties as margin or collateral. This cash is described as encumbered, and the cash that is not being used for such purposes is described as the unencumbered cash held by the portfolio. The Financial Conduct Authority (FCA) considers the liquidity of a hedge fund (in particular its unencumbered cash position) as particularly important when evaluating a funds risk profile. During a period of market stress, a number of t hings may happen to a hedge funds liquidity. As markets move against the fund, the fund will experience losses that will need to be met through the payment of margin to its counterparties. At the same time, the counterparties may demand higher margin payments, further reducing the unencumbered cash available to the fund. Where the fund has financial borrowings as well as synthetic leverage, lenders may call in loans or refuse to roll them over, further reducing liquidity. Investors in the fund may also seek to redeem (to the extent that they are able). Figure 29 shows the unencumbered cash (UC) ratio of funds in the Hedge Fund Survey (HFS) sample over time. This ratio is shown as a percentage of net AUM (NAV) and gross notional exposure (GNE), to illustrate the impact of some highly leveraged funds. For the median fund, unencumbered cash has increased as a proportion of GNE in the most recent survey, but remained stable as a proportion of NAV. However, in the specific cases of macro, relative value and multi-strategy funds, unencumbered cash has actually fallen as a proportion of GNE. Figure 29 - Unencumbered cash (UC) ratio per fund (median) 38% 40.0% 35% 34% 35.0% 30% 30% 30% 27% 27% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% Oct-09 Apr-10 Sep-10 Mar-11 Sep-11 Mar-12 Sep-12 Mar-13 Sep-13 Ratio of UC to GNE Ratio of UC to NAV 7% 4% 5% 6% 3% 4% 5% 6%

Unencumbered cash ratio (% of GNE or NAV)

30%

3%

Public report

Page 30 / 35

Financial Conduct Authority

HFS

Figure 30 illustrates that derivatives based strategies retain a high proportion of their NAV in cash. They also have the highest GNE figures and therefore low cash as a proportion of their market exposure (Figure 31). Figure 30 - Median fund unencumbered cash to NAV ratio by strategy 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% UC ratio (as % of NAV)

Figure 31 - Median fund unencumbered cash to GNE ratio by strategy 20.0% UC ratio (as % of GNE)

15.0%

10.0%

5.0%

0.0%

The protection hedge fund firms/funds have against liquidity risk is created by strong risk management and the diversification of their positions.

Public report

Page 31 / 35

Financial Conduct Authority

HFS

Figure 32 presents the range of unencumbered cash as a proportion of GNE across the surveyed funds.

Figure 32- Range of unencumbered cash ratio per fund (as % of GNE) in the HFS sample (in percentage of funds) > 10% of GNE 5% - 10% 2% - 5% 1% - 2% 50bps - 1% < 50bps of GNE 31% 22% 12% 9% 9% 16%

Public report

Page 32 / 35

Financial Conduct Authority

HFS

2. Investor liquidity

Hedge funds have to monitor the risk caused by an imbalance between the liquidity of their portfolios and that which is offered to the investors in the fund. In general, hedge fund vehicles are perceived as illiquid and investors accept less favourable redemption terms. Typically, hedge funds also offer significantly lower correlation ratios to traditional assets, particularly when compared to mainstream investment funds that do not have access to the same sophisticated strategies for regulatory reasons or business rationale. As a result, hedge funds continue to report a strong ability to manage the liquidity mismatch between their assets and liabilities. The survey asks firms to estimate the liquidity of both assets and liabilities for various time frames (Figure 33), as at the time of reporting. The difference between the two curves represents the liquidity buffer or days of spare liquidity. When negative, it means a fund would be exposed to the risk of redemption outpacing its capacity to free up enough cash to meet its obligations (risk of run on the fund). Figure 33 - Average liquidity profile per fund in the HFS sample 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1 day or less 2-7 days 8-30 days 31-90 days 91-180 days 181-365 Longer than days 365 days

Portfolio liquidity

Investor liquidity

We have observed a reduction in the liquidity buffer in recent editions of the HFS, possibly driven by institutional investors requiring better terms and liquidity conditions. We will continue to monitor developments in this area, in particular the potential liquidity pressure some hedge funds may be facing in the future.

Public report

Page 33 / 35

Financial Conduct Authority

HFS

3. Re-hypothecation or the re-use of assets

Asset recycling (or re-hypothecation) by the counterparties to hedge funds (banks, prime brokers) can act as a generator of market liquidity and a source of potential risk. The failure of Lehman Brothers International in 2008 highlights how uncapped re-hypothecation can complicate recovery and resolution regimes for failed entities. The survey seeks appropriate ways to measure re-hypothecation. Practices and contract terms can vary regionally and according to the type of firm and the impact of implementing new regulations and directives such as the Alternative Investment Fund Managers Directive (AIFMD) for example. Assessing how much collateral could be or has been reused by prime brokers is made more complex by pooling of assets and collateral at prime brokers and re-hypothecation contracts that are often based on net indebtedness and not on the actual amount of collateral. At a high level, we note that 71% of surveyed funds permit some form of re-hypothecation of their assets, which is similar to the 69% figure in March 2013.

Public report

Page 34 / 35

Financial Conduct Authority

HFS

VII. Afterword

We would like to thank all the participants in the survey for committing time and effort to this valuable exercise. We believe their input will help us to refine our approach to monitoring and managing risk in the investment industry, and to do so in a proportionate and informed manner. One of the objectives of this report has been to show the investment community how we intend to analyse the data that we will obtain from future regulatory reporting. We envisage that there will be at least two more versions of this survey, with data reported as at March 2014 and September 2014. AIFMD and its reporting framework are then expected to supersede the FCA survey, providing similar data on a broader range of firms and funds. As part of our ongoing commitment to monitor the risks posed by hedge funds, we plan to remain actively involved in the Financial Stability Board (FSB) and the Securities Commissions (IOSCO) work streams to improve the consistency of data gathering and analysis of the sector at a global level.

Public report

Page 35 / 35

Você também pode gostar

- Daniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostDocumento97 páginasDaniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostMarketsWikiAinda não há avaliações

- The Complete Guide to Portfolio Construction and ManagementNo EverandThe Complete Guide to Portfolio Construction and ManagementAinda não há avaliações

- Investing in Hedge Funds: A Guide to Measuring Risk and Return CharacteristicsNo EverandInvesting in Hedge Funds: A Guide to Measuring Risk and Return CharacteristicsAinda não há avaliações

- The Future of Hedge Fund Investing: A Regulatory and Structural Solution for a Fallen IndustryNo EverandThe Future of Hedge Fund Investing: A Regulatory and Structural Solution for a Fallen IndustryAinda não há avaliações

- Alternatives in Todays Capital MarketsDocumento16 páginasAlternatives in Todays Capital MarketsjoanAinda não há avaliações

- Global Equity MarketsDocumento20 páginasGlobal Equity MarketsMohsin JavedAinda não há avaliações

- Long Term Capital Management The Dangers of LeverageDocumento25 páginasLong Term Capital Management The Dangers of LeveragepidieAinda não há avaliações

- Consultative Document (2nd) : Assessment Methodologies For Identifying Non-Bank Non-Insurer Global Systemically Important Financial InstitutionsDocumento16 páginasConsultative Document (2nd) : Assessment Methodologies For Identifying Non-Bank Non-Insurer Global Systemically Important Financial Institutionsapi-249785899Ainda não há avaliações

- Triton Presentation 1Documento28 páginasTriton Presentation 1yfatihAinda não há avaliações

- The Alpha Masters: Unlocking the Genius of the World's Top Hedge FundsNo EverandThe Alpha Masters: Unlocking the Genius of the World's Top Hedge FundsNota: 4 de 5 estrelas4/5 (15)

- Hedge Funds and Financial StabilityDocumento5 páginasHedge Funds and Financial StabilityAshish Live To WinAinda não há avaliações

- Wealth Global Navigating the International Financial MarketsNo EverandWealth Global Navigating the International Financial MarketsAinda não há avaliações

- Portfolio Optimization With International DiversificationDocumento23 páginasPortfolio Optimization With International DiversificationGulboddin MuradiAinda não há avaliações

- EN EN: and Participants Are Regulated or Subject To Oversight, As Appropriate To Their Circumstance'Documento8 páginasEN EN: and Participants Are Regulated or Subject To Oversight, As Appropriate To Their Circumstance'Manikanta ChintalaAinda não há avaliações

- A Project Report On Technical Analysis at Share KhanDocumento105 páginasA Project Report On Technical Analysis at Share KhanBabasab Patil (Karrisatte)100% (3)

- A Project Report On Technical Analysis at Cement Sector in Share KhanDocumento105 páginasA Project Report On Technical Analysis at Cement Sector in Share KhanBabasab Patil (Karrisatte)100% (1)

- A ProjectreportontechnicalanalysisDocumento102 páginasA ProjectreportontechnicalanalysisAnkita DoddamaniAinda não há avaliações

- Mastering the Market: A Comprehensive Guide to Successful Stock InvestingNo EverandMastering the Market: A Comprehensive Guide to Successful Stock InvestingAinda não há avaliações

- Overview of The Mutual Fund IndustryDocumento5 páginasOverview of The Mutual Fund Industry29_ramesh170Ainda não há avaliações

- Risky Business An Empirical Analysis of Foreign Exchange Risk Exposure in MicrofinanceDocumento36 páginasRisky Business An Empirical Analysis of Foreign Exchange Risk Exposure in MicrofinanceKafigi Nicholaus JejeAinda não há avaliações

- Title:: Duarte, Jefferson Longstaff, Francis A. Yu, FanDocumento53 páginasTitle:: Duarte, Jefferson Longstaff, Francis A. Yu, FanawylegalskiAinda não há avaliações

- Hedge FundsDocumento9 páginasHedge FundsSagar TanejaAinda não há avaliações

- Internet Stock Trading and Market Research for the Small InvestorNo EverandInternet Stock Trading and Market Research for the Small InvestorAinda não há avaliações

- Overview of Hedge Funds PERACDocumento21 páginasOverview of Hedge Funds PERACNirmal PatidarAinda não há avaliações

- An Introduction To Hedge Funds: Pictet Alternative InvestmentsDocumento16 páginasAn Introduction To Hedge Funds: Pictet Alternative InvestmentsGauravMunjalAinda não há avaliações

- Misclassification of Bond Mutual Funds 2021 ABDCDocumento32 páginasMisclassification of Bond Mutual Funds 2021 ABDCAnushi AroraAinda não há avaliações

- Wealth: How the World's High-Net-Worth Grow, Sustain, and Manage Their FortunesNo EverandWealth: How the World's High-Net-Worth Grow, Sustain, and Manage Their FortunesNota: 1 de 5 estrelas1/5 (1)

- Finance Questions Generally Asked in Interview On Equity MarketDocumento26 páginasFinance Questions Generally Asked in Interview On Equity MarketshubhamAinda não há avaliações

- Stock Market Income Genesis: Internet Business Genesis Series, #8No EverandStock Market Income Genesis: Internet Business Genesis Series, #8Ainda não há avaliações

- An easy approach to common investment funds: The introductory guide to mutual funds and the most effective investment strategies in the field of asset managementNo EverandAn easy approach to common investment funds: The introductory guide to mutual funds and the most effective investment strategies in the field of asset managementAinda não há avaliações

- Working Paper 1011Documento28 páginasWorking Paper 1011Thibaut AokiAinda não há avaliações

- A Guide To Hedge Funds PDFDocumento39 páginasA Guide To Hedge Funds PDFman downAinda não há avaliações

- Accounting for Derivatives: Advanced Hedging under IFRSNo EverandAccounting for Derivatives: Advanced Hedging under IFRSAinda não há avaliações

- INVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)No EverandINVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)Ainda não há avaliações

- Danger of Hedge Funds: Economic and Political Weekly August 20, 2005Documento6 páginasDanger of Hedge Funds: Economic and Political Weekly August 20, 2005Anand BansalAinda não há avaliações

- The Index Revolution: Why Investors Should Join It NowNo EverandThe Index Revolution: Why Investors Should Join It NowAinda não há avaliações

- MFX Risky-Business 2011Documento36 páginasMFX Risky-Business 2011Mario CruzAinda não há avaliações

- The Development of Mutual Funds Around The World: Leora Klapper, Víctor Sulla and Dimitri VittasDocumento43 páginasThe Development of Mutual Funds Around The World: Leora Klapper, Víctor Sulla and Dimitri VittasKamalakar ReddyAinda não há avaliações

- Teaching Notes FMI 342Documento162 páginasTeaching Notes FMI 342Hemanth KumarAinda não há avaliações

- Investments Complete Part 1 1Documento65 páginasInvestments Complete Part 1 1THOTslayer 420Ainda não há avaliações

- Teaching Notes-FMI-342 PDFDocumento162 páginasTeaching Notes-FMI-342 PDFArun PatelAinda não há avaliações

- In Search of Returns 2e: Making Sense of Financial MarketsNo EverandIn Search of Returns 2e: Making Sense of Financial MarketsAinda não há avaliações

- Mutual Funds: Portfolio Structures, Analysis, Management, and StewardshipNo EverandMutual Funds: Portfolio Structures, Analysis, Management, and StewardshipJohn A. HaslemAinda não há avaliações

- An Overview of Hedge Funds and Structured Products: Issues in Leverage and RiskDocumento20 páginasAn Overview of Hedge Funds and Structured Products: Issues in Leverage and RiskxuhaibimAinda não há avaliações

- Portfolio Mastery: Navigating the Financial Art and ScienceNo EverandPortfolio Mastery: Navigating the Financial Art and ScienceAinda não há avaliações

- Hedge FundsDocumento59 páginasHedge FundsjinalvikamseyAinda não há avaliações

- Structure : Securities and Exchange Commission Board of Directors Board of TrusteesDocumento8 páginasStructure : Securities and Exchange Commission Board of Directors Board of Trusteestanya tanwarAinda não há avaliações

- Structure : Securities and Exchange Commission Board of Directors Board of TrusteesDocumento17 páginasStructure : Securities and Exchange Commission Board of Directors Board of Trusteestanya tanwarAinda não há avaliações

- A Study On Technical Analysis At: Industry Overview Company ProfileDocumento109 páginasA Study On Technical Analysis At: Industry Overview Company ProfilePrathamesh TaywadeAinda não há avaliações

- Strategic Risk Management: A Practical Guide to Portfolio Risk ManagementNo EverandStrategic Risk Management: A Practical Guide to Portfolio Risk ManagementNota: 5 de 5 estrelas5/5 (1)

- HFF Hedge FundsDocumento34 páginasHFF Hedge Fundsaba3abaAinda não há avaliações

- Aprojectreportontechnicalanalysisatsharekhan 120809060800 Phpapp02Documento109 páginasAprojectreportontechnicalanalysisatsharekhan 120809060800 Phpapp02touffiqAinda não há avaliações

- The Complete Guide to Hedge Funds and Hedge Fund StrategiesNo EverandThe Complete Guide to Hedge Funds and Hedge Fund StrategiesNota: 3 de 5 estrelas3/5 (1)

- Turkey - Gross Domestic Product, Outlook 2016-2017Documento1 páginaTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeAinda não há avaliações

- Germany - Renewable Energies ActDocumento1 páginaGermany - Renewable Energies ActEduardo PetazzeAinda não há avaliações

- WTI Spot PriceDocumento4 páginasWTI Spot PriceEduardo Petazze100% (1)

- Highlights, Wednesday June 8, 2016Documento1 páginaHighlights, Wednesday June 8, 2016Eduardo PetazzeAinda não há avaliações

- Analysis and Estimation of The US Oil ProductionDocumento1 páginaAnalysis and Estimation of The US Oil ProductionEduardo PetazzeAinda não há avaliações

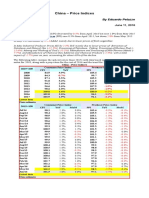

- China - Price IndicesDocumento1 páginaChina - Price IndicesEduardo PetazzeAinda não há avaliações

- India - Index of Industrial ProductionDocumento1 páginaIndia - Index of Industrial ProductionEduardo PetazzeAinda não há avaliações

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDocumento1 páginaChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeAinda não há avaliações

- U.S. Employment Situation - 2015 / 2017 OutlookDocumento1 páginaU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeAinda não há avaliações

- U.S. New Home Sales and House Price IndexDocumento1 páginaU.S. New Home Sales and House Price IndexEduardo PetazzeAinda não há avaliações

- Reflections On The Greek Crisis and The Level of EmploymentDocumento1 páginaReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeAinda não há avaliações

- India 2015 GDPDocumento1 páginaIndia 2015 GDPEduardo PetazzeAinda não há avaliações

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Documento1 páginaCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeAinda não há avaliações

- Singapore - 2015 GDP OutlookDocumento1 páginaSingapore - 2015 GDP OutlookEduardo PetazzeAinda não há avaliações

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDocumento1 páginaUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeAinda não há avaliações

- South Africa - 2015 GDP OutlookDocumento1 páginaSouth Africa - 2015 GDP OutlookEduardo PetazzeAinda não há avaliações

- México, PBI 2015Documento1 páginaMéxico, PBI 2015Eduardo PetazzeAinda não há avaliações

- US Mining Production IndexDocumento1 páginaUS Mining Production IndexEduardo PetazzeAinda não há avaliações

- Highlights in Scribd, Updated in April 2015Documento1 páginaHighlights in Scribd, Updated in April 2015Eduardo PetazzeAinda não há avaliações

- U.S. Federal Open Market Committee: Federal Funds RateDocumento1 páginaU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeAinda não há avaliações

- China - Power GenerationDocumento1 páginaChina - Power GenerationEduardo PetazzeAinda não há avaliações

- European Commission, Spring 2015 Economic Forecast, Employment SituationDocumento1 páginaEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeAinda não há avaliações

- Mainland China - Interest Rates and InflationDocumento1 páginaMainland China - Interest Rates and InflationEduardo PetazzeAinda não há avaliações

- Chile, Monthly Index of Economic Activity, IMACECDocumento2 páginasChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeAinda não há avaliações

- US - Personal Income and Outlays - 2015-2016 OutlookDocumento1 páginaUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeAinda não há avaliações

- Japan, Indices of Industrial ProductionDocumento1 páginaJapan, Indices of Industrial ProductionEduardo PetazzeAinda não há avaliações

- Japan, Population and Labour Force - 2015-2017 OutlookDocumento1 páginaJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeAinda não há avaliações

- Brazilian Foreign TradeDocumento1 páginaBrazilian Foreign TradeEduardo PetazzeAinda não há avaliações

- South Korea, Monthly Industrial StatisticsDocumento1 páginaSouth Korea, Monthly Industrial StatisticsEduardo PetazzeAinda não há avaliações

- United States - Gross Domestic Product by IndustryDocumento1 páginaUnited States - Gross Domestic Product by IndustryEduardo PetazzeAinda não há avaliações

- GBC Jot Case Study FINALDocumento29 páginasGBC Jot Case Study FINALSharmin Lisa100% (1)

- Group 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplDocumento13 páginasGroup 2 Case 1 Assignment Bubble Bee Organic The Need For Pro Forma Financial Modeling SupplSarah WuAinda não há avaliações

- Learning From Dr. Michael J. Burrys Investment Philosophy 2Documento25 páginasLearning From Dr. Michael J. Burrys Investment Philosophy 2Leonard WijayaAinda não há avaliações

- Abacus Securities Corp. VS. AmpilDocumento21 páginasAbacus Securities Corp. VS. AmpilYour Public ProfileAinda não há avaliações

- Fortress FundDocumento5 páginasFortress FundTuriyaAinda não há avaliações

- AxasxDocumento26 páginasAxasxГал БадрахAinda não há avaliações

- Acct 260 CHAPTER 8Documento25 páginasAcct 260 CHAPTER 8John Guy0% (1)

- Banking Survey 2014Documento52 páginasBanking Survey 2014Hassan TariqAinda não há avaliações

- 07 X07 A Responsibility Accounting and TP Decentralization and Performance EvaluationDocumento11 páginas07 X07 A Responsibility Accounting and TP Decentralization and Performance EvaluationNora Pasa100% (1)

- Excel Margin Call CalculationsDocumento1 páginaExcel Margin Call Calculationsapi-27174321100% (1)

- Financial Management - Compilation of Financial RatiosDocumento6 páginasFinancial Management - Compilation of Financial RatiosIce AlojaAinda não há avaliações

- Financial Analysis On Investment Banks of BDDocumento76 páginasFinancial Analysis On Investment Banks of BDAnika TabassumAinda não há avaliações

- BVADocumento15 páginasBVAJasonAinda não há avaliações

- (1936) New Stock Trend DetectorDocumento52 páginas(1936) New Stock Trend DetectorBellwetherSataraAinda não há avaliações

- Licence To TradeDocumento92 páginasLicence To TradeImrana Saleh67% (3)

- Answer To The Case StudyDocumento11 páginasAnswer To The Case StudyNahidul Islam IU100% (3)

- A Project ReportDocumento30 páginasA Project ReportPRANAT GUPTAAinda não há avaliações

- Objectives and Functions of Alco: Bank Assets and LiabilitiesDocumento8 páginasObjectives and Functions of Alco: Bank Assets and LiabilitiesAlee OvaysAinda não há avaliações

- A Revolutionary Way To Achieve Wealth in UgandaDocumento118 páginasA Revolutionary Way To Achieve Wealth in UgandatwhyAinda não há avaliações

- Assignment On Financial Institution: Dhanlaxmi BankDocumento12 páginasAssignment On Financial Institution: Dhanlaxmi BankAkshay Thampi RCBSAinda não há avaliações

- Fin Exam 1Documento14 páginasFin Exam 1tahaalkibsiAinda não há avaliações

- FinancialPlan - 2013 Version - Prof DR IsmailDocumento129 páginasFinancialPlan - 2013 Version - Prof DR IsmailSyukur Byte0% (1)

- Margin of SafetyDocumento5 páginasMargin of SafetyGerald Handerson100% (1)

- Financial Analysis ProtonDocumento9 páginasFinancial Analysis Protonmoonernest100% (2)

- Accounting AnswersDocumento6 páginasAccounting AnswersSalman KhalidAinda não há avaliações

- Estimating Working CapitalDocumento36 páginasEstimating Working CapitalKylaa Angelica de LeonAinda não há avaliações

- Risk Hedging Instruments and MechanismDocumento11 páginasRisk Hedging Instruments and Mechanism03 TYBMS Prajakta ChoratAinda não há avaliações

- Canara Bank ChargesDocumento8 páginasCanara Bank Chargesaca_trader100% (1)

- Angel One LTD.: Applica On Number: Applica On Type : o New KYC o Modifica On KYCDocumento29 páginasAngel One LTD.: Applica On Number: Applica On Type : o New KYC o Modifica On KYCnm3456008Ainda não há avaliações

- Tata Steel Key Financial Ratios, Tata Steel Financial Statement & AccountsDocumento3 páginasTata Steel Key Financial Ratios, Tata Steel Financial Statement & Accountsmohan chouriwarAinda não há avaliações