Escolar Documentos

Profissional Documentos

Cultura Documentos

Pontifical Mission Societies - AG Agreement Executed

Enviado por

Celeste KatzTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Pontifical Mission Societies - AG Agreement Executed

Enviado por

Celeste KatzDireitos autorais:

Formatos disponíveis

STATE OF NEW YORK OFFICE OF THE ATTORNEY GENERAL

ERIC

T. SCHNEIDERMAN

ATTORNEY GENERAL

DAVID E. NACHMAN SENIOR ENFORCEMENT COUNSEL EXECUTIVE DIVISION

March 24, 2014

John A. Matthews, Jr. Gallagher & Matthews 55 Maple Avenue -- Suite 208 Rockville Center, New York 11570 Re: Society for the Propagation of the Faith, the Pontifical Mission Societies, Raymond F. Schroek Dear Jack: In September 2012, your clients the Society for the Propagation of the Faith (the "Society") and The Pontifical Mission Societies ("TPMS") of which the Society is a part, discovered that the Society's fonner Chief Financial Officer, the recently deceased Raymond F. Schroek, appeared to have embezzled TPMS charitable funds as those funds were remitted to TPMS's New York City offices from the organization's Pooled Income Fund managed by State Street Bank in Boston, Massachusetts. TPMS promptly reported its concerns to the Office ofthe Attorney General ("OAG"). Subsequent investigation by the OAG, with the active assistance ofTPMS, determined that Mr. Schroek had embezzled a total ofapproximately $1,771,000 over the years 2003 to 2012; that all or most ofthese monies were deposited into one or more joint accounts owned by the late Mr. Schroek and his wife, Kathleen A. Schroek, and used for a variety of personal and family purposes; and that, although Ms. Schroek and possibly other family members benefitted from the embezzled funds, there was insufficient evidence to establish that she or others were aware of or participated in Mr. Schroek's illegal scheme. The investigation resulted in an Assurance of Discontinuance (AOD 14-014) among the OAG, Mrs. Schroek (in her individual capacity and as executrix of her late husband's estate) and the Society pursuant to which the OAG obtained from Mrs. Schroek for the benefit of the Society restitution in the aggregate amount of approximately $1,000,000. You have advised us that the Society and TPMS have obtained further recoveries from other entities which, when combined with the recovery from Mrs. Schroek, is expected to result in a net loss from Mr. Schroek's scheme of no more than $370,000, and possibly no net loss at all.

120 Broadway, New York, NY 10271-0332 Phone (212) 416-8390. Fax (212) 416-6001 David.Nachman@ag.ny.goY

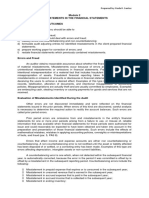

John A. Matthews, Jr. March 24, 2014 Page 2 of4 In addition to reporting Mr. Schroek's apparent embezzlement and the Society's losses to the OAG, you have advised us that TPMS management reported these matters to: its Board of Directors; Cardinal Timothy Dolan, Archbishop of New York; other Church officials in the United States and the Holy See; and to its independent auditor, Craig, Fitzsimmons & Michaels, LLP, which replaced Grant Thornton LLP as TPMS's independent auditor in September 2012 and conducted the audit of the organization's 2012 financial statements. You have further advised us that TPMS engaged the services of Grassi & Company to conduct a forensic audit to determine whether the scope of Mr. Schroek's unlawful scheme had been more extensive than TPMS and the OAG had found and whether TPMS had been victimized by any other fraud or theft, and that upon the completion of its forensic audit, Grassi & Company answered both inquiries in the negative. This letter is intended to memorialize the measures TPMS has taken or agreed to take to strengthen its governance and internal controls shortly prior to and following the discovery of Mr. Schroek's illegal scheme. We understand that some of these measures already were in place or were in planning prior to that discovery; some were refined or expanded upon as a result of the discovery of the scheme and potential weaknesses it uncovered; still others were decided upon in response to specific potential control environment deficiencies the audits and investigation brought to light. While no system of internal controls, however well designed, is failsafe, we are pleased that TPMS has implemented and agreed to take these additional measures designed to significantly reduce the organization's financial and accounting risks. A. Control Environment 1. TPMS has reconstituted separate Audit, Finance and Investment committees of its Board of Directors. 2. The National Director ofTPMS, who also serves as Board Chairman, is an ex officio member of all Board committees, but does not vote in committee. TPMS agrees to continue its policy that the Audit committee shall include not less than three members and that its Chair and all voting members of the committee shall be independent. 3. TPMS has added to its Board and to its senior executive leadership directors and managers with strong financial and administrative expertise. 4. Following the discovery of Mr. Schroek's scheme in September 2012, the Board engaged the services of an interim CFO with experience and qualifications in forensic accounting. In March, 2013 the Board engaged TPMS's current CFO, a licensed Certified Public Accountant with substantial non-profit and controllership experience. 5. Over the past year the Board has refined and improved its process for budgetary review and oversight. 6. A revised Employee Handbook has been approved and implemented. This handbook now contains a Code of Conduct and Whistleblower provisions for employees. 7. All TPMS Board Members will be required to review and sign a Conflict ofInterest Policy annually.

120 Broadway, New York, NY 10271-0332 Tel: (212) 416-8390 Fax (212) 416-6001. David.Nacbman@ag.ny.gov

John A. Matthews, Jr. March 24, 2014 Page 3 of4

B. Risk Awareness and Mitigation

I. TPMS has begun migration of the Trust Fund Administration, Annuity Fund Administration, and Pooled Income Fund Administration to outside administrators. TPMS agrees that the migration in each of these areas will be completed by October 31,2014. 2. Security cameras for areas deemed to be high risk (mail room and mail opening) have been installed. Security camera records are properly secured, archived and monitored. 3. State Street Bank will no longer issue checks to TPMS upon the maturity of contracts. AlI distributions and transfers of funds are accomplished by electronic means and reconciled promptly. 4. Reassignments of responsibilities aimed to provide for greater segregation have been tnade. In areas where strong segregation could not be achieved, measures have been taken to implement or improve detective control and oversight procedures. 5. Oversight of the mail opening and cash receipt processes, identified as areas of high risk, has been strengthened and controls enhanced. C. Control Activities

I. A Positive Pay system for cash disbursements has been established. 2. Use of petty cash is kept to a minimum and cash is secured in a safe. 3. Bank signature cards have been reviewed and appropriately updated. 4. New or improved controls and policies related to the following have been implemented: a. Purchasing and procurement policy is to provide for new vendor approvals, centralized purchasing and enhanced oversight, including an annual review of the Master Vendor List by an independent supervisor. b. Procedures for recording and tracking accounts receivable, related party receivables, beneficial interests in trusts, and legacies receivable have been implemented. c. TPMS' credit card policy has been revised to provide for enhanced control and oversight related to the use of the corporate credit cards. d. Travel advance policy and related control procedures have been implemented. e. An accounts receivable tracking, follow-up and write-off policy has been implemented. f. Wire transfer policy and approval processes have been implemented. g. Mail processing procedures have been revised to improve controls over inbound cash, checks, correspondence, invoices, banking and investment statements. h. An RFP for investment services has been issued; upon contract, new or revised investment policy statements will be implemented.

D. Information and Communications Systems

I. TPMS has revised its annual budgeting, budget monitoring and cost

120 Broadway, New York, NY 10271-0332. Tel: (212) 416-8390. Fax (212) 416-6001 Davld.Nachman@ag.ny.gov

John A. Matthews, Jr. March 24,2014 Page 4 of4 allocation procedures. 2. Management has developed a new financial reporting requirement, which calls for a monthly closing of the books and preparation of internal financial statements. These statements are to be presented to senior management and committees of the Board for their review and approval at scheduled meetings. 3. A process has been implemented to notify and train staff on the changes to operational policy and procedures. 4. A process is underway to evaluate alternative solutions for an off-the-shelf, thirdparty professional financial reporting system. Transition to an integrated professional package will allow for greater integration, scalability, user-ability and oversight by those outside ofthe accounting department. The targeted selection date for the new system is September 19,2014.

E. Control Monitoring

1. A formal process has been implemented to review and evaluate the findings and recommendations presented by external auditors. 2. A process has been implemented to provide for the continual evaluation of internal and external events, organizational activities and conditions to ensure the control framework is appropriately meeting organizational objectives. 3. On a monthly basis, the National Director and/or Assistant will meet with the Chief Financial Officer to review all transactions in excess of $1 0,000 and evaluate the implementation of the above policies and foster the implementation ofthe new accounting package noted above. Finally, on behalf of TPMS, you have agreed to provide a report to the OAG, on or before December 15, 2014, concerning TPMS's progress in carrying out the measures set forth above. Thank you for your continued cooperation in this matter.

120 Broadway, New York, NY 10271-0332 Tel: (212) 416-8390. Fax (212) 416-6001 Davld.Nachman@all.nY.1l0v

Você também pode gostar

- 2015GeneralElectionNightSummaryUnofficial 1142015 133amDocumento12 páginas2015GeneralElectionNightSummaryUnofficial 1142015 133amCeleste KatzAinda não há avaliações

- Public Financial Disclosure Report For Donald Trump 2016Documento104 páginasPublic Financial Disclosure Report For Donald Trump 2016Celeste Katz100% (4)

- Eric Ulrich: There Are Two Sides To RepublicanDocumento2 páginasEric Ulrich: There Are Two Sides To RepublicanCeleste KatzAinda não há avaliações

- Theracare AuditDocumento31 páginasTheracare AuditCeleste KatzAinda não há avaliações

- Letter BOE 2014 04 02 BK 2014 FINALDocumento2 páginasLetter BOE 2014 04 02 BK 2014 FINALCeleste KatzAinda não há avaliações

- Fiscal Brief: The Preliminary BudgetDocumento2 páginasFiscal Brief: The Preliminary BudgetCeleste KatzAinda não há avaliações

- SCOTUS Campaign Contributions Decision - April 2, 2014Documento94 páginasSCOTUS Campaign Contributions Decision - April 2, 2014Evan Buxbaum, CircaAinda não há avaliações

- BFRL Amicus BriefDocumento38 páginasBFRL Amicus BriefCeleste KatzAinda não há avaliações

- New York City Voters Back Cuomo No-Tax Pre-K Plan, Quinnipiac University Poll Finds Keep The Carriage Horses, Voters Say Almost 3-1Documento5 páginasNew York City Voters Back Cuomo No-Tax Pre-K Plan, Quinnipiac University Poll Finds Keep The Carriage Horses, Voters Say Almost 3-1Jill ColvinAinda não há avaliações

- Agenda03 27 14Documento1 páginaAgenda03 27 14Celeste KatzAinda não há avaliações

- 2013 PenniesDocumento144 páginas2013 PenniesAmanda JordanAinda não há avaliações

- Issues0214 CrosstabsDocumento9 páginasIssues0214 CrosstabsCeleste KatzAinda não há avaliações

- 1.24.14 JCOPE ComplaintDocumento14 páginas1.24.14 JCOPE ComplaintCeleste KatzAinda não há avaliações

- State Payroll 2013Documento6 páginasState Payroll 2013Celeste KatzAinda não há avaliações

- Executive Budget 2014Documento92 páginasExecutive Budget 2014Casey SeilerAinda não há avaliações

- New York Voters Back Cuomo'S No-Tax Pre-K Plan, Quinnipiac University Poll Finds Voters Closer Soul Mates To Gov Than Mayor de BlasioDocumento6 páginasNew York Voters Back Cuomo'S No-Tax Pre-K Plan, Quinnipiac University Poll Finds Voters Closer Soul Mates To Gov Than Mayor de BlasioCeleste KatzAinda não há avaliações

- Print NYC BTN 26Documento1 páginaPrint NYC BTN 26Celeste KatzAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDocumento7 páginasModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoAinda não há avaliações

- Oracle Purchasing - & - Inventory - Standard - ReportsDocumento19 páginasOracle Purchasing - & - Inventory - Standard - Reportsfarhanahmed01Ainda não há avaliações

- Acca F8 LecturesDocumento143 páginasAcca F8 LecturesANASAinda não há avaliações

- 01 Internal Audit and The Second Line of DefenseDocumento16 páginas01 Internal Audit and The Second Line of DefenseGilberto HerreraAinda não há avaliações

- Priyanka ChorageDocumento72 páginasPriyanka ChorageTasmay EnterprisesAinda não há avaliações

- Supplier Management Process OF Aci Limited, Bangladesh: Internship Report (Summer16)Documento49 páginasSupplier Management Process OF Aci Limited, Bangladesh: Internship Report (Summer16)Mohammad SharifAinda não há avaliações

- Detailed Lesson Plan - Fundamentals of Accounting 1.2Documento6 páginasDetailed Lesson Plan - Fundamentals of Accounting 1.2Karl Angelo JustineAinda não há avaliações

- Practical Guidance 8 Revenue and Purchases Cut Off On Sale of Goods Final5Documento5 páginasPractical Guidance 8 Revenue and Purchases Cut Off On Sale of Goods Final5nguyenhaihamuAinda não há avaliações

- ĐỀ-kiểm tra tacn2 hvtc Học viện tài chínhDocumento7 páginasĐỀ-kiểm tra tacn2 hvtc Học viện tài chínhMinh Anh NguyenAinda não há avaliações

- All Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestDocumento13 páginasAll Mcqs Are Compulsory Question No. 1 Is Compulsory. Attempt Any Four Questions From The RestGJ ELASHREEVALLIAinda não há avaliações

- LQMS 6Documento76 páginasLQMS 6R C MathewAinda não há avaliações

- Ais Fa1-4Documento16 páginasAis Fa1-4ninenrqzAinda não há avaliações

- Auditing Project Sem2Documento32 páginasAuditing Project Sem2madhuriAinda não há avaliações

- Gaas and SQCDocumento5 páginasGaas and SQCemc2_mcv100% (1)

- Linee Guida INNOMED-UP - IngleseDocumento18 páginasLinee Guida INNOMED-UP - IngleseGianluca CinaAinda não há avaliações

- New GL: Jyotiraditya.B 8712817833Documento12 páginasNew GL: Jyotiraditya.B 8712817833Jyotiraditya BanerjeeAinda não há avaliações

- 34.peer ReveiwDocumento7 páginas34.peer ReveiwmercatuzAinda não há avaliações

- GRC2016 Marrs HypercarehowtohandlesecurityDocumento58 páginasGRC2016 Marrs HypercarehowtohandlesecurityGoutham100% (2)

- Telecom Case StudyDocumento4 páginasTelecom Case StudyStraton MateiAinda não há avaliações

- Audit Expectation Gap: Perspectives of Auditors and Audited Account Users Olagunju, AdebayoDocumento19 páginasAudit Expectation Gap: Perspectives of Auditors and Audited Account Users Olagunju, AdebayosigiryaAinda não há avaliações

- Bank Annual ReportDocumento386 páginasBank Annual ReportumeshAinda não há avaliações

- March 2023 Atswa Examination AdvertDocumento3 páginasMarch 2023 Atswa Examination AdvertLeonardAinda não há avaliações

- Acc 205 L2 300720Documento31 páginasAcc 205 L2 300720Shubham Saurav SSAinda não há avaliações

- ,business Plan On Artificial TurfDocumento44 páginas,business Plan On Artificial TurfBappyKhan0% (2)

- Reducing Contract Target ValueDocumento12 páginasReducing Contract Target ValueraggsagileAinda não há avaliações

- CPADocumento98 páginasCPAPavan Kumar100% (1)

- Audit of Construction CompaniesDocumento2 páginasAudit of Construction Companiesnicole bancoroAinda não há avaliações

- PMT 10507Documento21 páginasPMT 10507cvg ertdAinda não há avaliações

- Sources of Credit InformationDocumento2 páginasSources of Credit InformationR100% (1)

- Problem 9-53 Cash BudgetingDocumento2 páginasProblem 9-53 Cash BudgetingKath LeynesAinda não há avaliações