Escolar Documentos

Profissional Documentos

Cultura Documentos

Republic Act No 8282 With Sec22

Enviado por

Danielle AngelaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Republic Act No 8282 With Sec22

Enviado por

Danielle AngelaDireitos autorais:

Formatos disponíveis

Republic Act No.

8282

May 01, 1997

AN ACT FURTHER STRENGTHENING THE SOCIAL SECURITY SYSTEM THEREBY AMENDING FOR THIS PURPOSE, REPUBLIC ACT NO. 1161, AS AMENDED, OTHERWISE KNOWN AS THE SOCIAL SECURITY LAW "SEC. 22. Remittance of Contributions. -- (a) The contributions imposed in the preceding Section shall be remitted to the SSS within the first ten (10) days of each calendar month following the month for which they are applicable or within such time as the Commission may prescribe. Every employer required to deduct and to remit such contributions shall be liable for their payment and if any contribution is not paid to the SSS as herein prescribed, he shall pay besides the contribution a penalty thereon of three percent (3%) per month from the date the contribution falls due until paid. If deemed expedient and advisable by the Commission, the collection and remittance of contributions shall be made quarterly or semi-annually in advance, the contributions payable by the employees to be advanced by their respective employers:Provided, That upon separation of an employee, any contribution so paid in advance but not due shall be credited or refunded to his employer. "(b) The contributions payable under this Act in cases where an employer refuses or neglects to pay the same shall be collected by the SSS in the same manner as taxes are made collectible under the National Internal Revenue Code, as amended. Failure or refusal of the employer to pay or remit the contributions herein prescribed shall not prejudice the right of the covered employee to the benefits of the coverage. "The right to institute the necessary action against the employer may be commenced within twenty (20) years from the time the delinquency is known or the assessment is made by the SSS, or from the time the benefit accrues, as the case may be. "(c) Should any person, natural or juridical, default in any payment of contributions, the Commission may also collect the same in either of the following ways:

"1. By an action in court, which shall hear and dispose of the case in preference to any other civil action; or "2. By issuing a warrant to the Sheriff of any province or city commanding him to levy upon and sell any real and personal property of the debtor. The Sheriff's sale by virtue of said warrant shall be governed by the same procedure prescribed for executions against property upon judgments by a court of record.

"(d) The last complete record of monthly contributions paid by the employer or the average of the monthly contributions paid during the past three (3) years as of the date of filing of the action for collection shall be presumed to be the monthly contributions payable by and due from the employer to the SSS for each of the unpaid month, unless contradicted and overcome by other evidence: Provided, That the SSS shall not be barred from determining and collecting the true and correct contributions due the SSS even after full payment pursuant to this paragraph, nor shall the employer be relieved of his liability under Section Twenty-eight of this Act. "SEC. 22-A. Remittance of Contributions of Self-Employed Member. - Self-employed members shall remit their monthly contributions quarterly on such dates and schedules as the Commission may specify through rules and regulations: Provided, That no retroactive payment of contributions shall be allowed, except as Provided in this Section. "SEC. 28. Penal Clause. - (a) Whoever, for the purpose of causing any payment to be made under this Act, or under an agreement thereunder, where none is authorized to be paid, shall make or cause to be made false statement or representation as to any compensation paid or received or whoever makes or causes to be made any false statement of a material fact in any claim for any benefit payable under this Act, or application for loan with the SSS, or whoever makes or causes to be made any false statement, representation, affidavit or document in connection with such claim or loan, shall suffer the penaltiesProvided for in Article One hundred seventy-two of the Revised Penal Code. "(b) Whoever shall obtain or receive any money or check under this Act or any agreement thereunder, without being entitled thereto with intent to defraud any member, employer or the SSS, shall be fined not less than Five thousand pesos (P5,000.00) nor more than Twenty thousand pesos (P20,000.00) and imprisoned for not less than six (6) years and one (1) day nor more than twelve (12) years. "(c) Whoever buys, sells, offers for sale, uses, transfers or takes or gives in exchange, or pledges or gives in pledge, except as authorized in this Act or in regulations made pursuant thereto, any stamp, coupon, ticket, book or other device, prescribed pursuant to Section Twenty-three hereof by the Commission for the collection or payment of contributions required herein, shall be fined not less than Five thousand pesos (P5,000.00) nor more than Twenty thousand pesos (P20,000.00), or imprisoned for not less than six (6) years and one (1) day nor more than twelve (12) years, or both, at the discretion of the court.

"(d) Whoever, with intent to defraud, alters, forges, makes or counterfeits any stamp, coupon, ticket, book or other device prescribed by the Commission for the collection or payment of any contribution required herein, or uses, sells, lends, or has in his possession any such altered, forged or counterfeited materials, or makes, uses, sells or has in his possession any such altered, forged, material in imitation of the material used in the manufacture of such stamp, coupon, ticket, book or other device, shall be fined not less than Five thousand pesos (P5,000.00) non more than Twenty thousand pesos (P20,000.00) or imprisoned for not less than six years (6) and one (1) day nor more than twelve (12) years, or both, at the discretion of the court. "(e) Whoever fails or refuses to comply with the provisions of this Act or with the rules and regulations promulgated by the Commission, shall be punished by a fine of not less than Five thousand pesos (P5,000.00) nor more than Twenty thousand pesos (P20,000.00), or imprisonment for not less than six (6) years and one (1) day nor more than twelve (12) years, or both, at the discretion of the court: Provided, That where the violation consists in failure or refusal to register employees or himself, in case of the covered self-employed or to deduct contributions from the employees' compensation and remit the same to the SSS, the penalty shall be a fine of not less Five thousand pesos (P5,000.00) nor more than Twenty thousand pesos (P20,000.00) and imprisonment for not less than six (6) years and one (1) day nor more than twelve (12) years. "(f) If the act or omission penalized by this Act be committed by an association, partnership, corporation or any other institution, its managing head, directors or partners shall be liable for the penalties Providedin this Act for the offense. "(g) Any employee of the SSS who receives or keeps funds or property belonging, payable or deliverable to the SSS and who shall appropriate the same, or shall take or misappropriate, or shall consent, or through abandonment or negligence, shall permit any other person to take such property or funds, wholly or partially, or shall otherwise be guilty of misappropriation of such funds or property, shall suffer the penalties Provided in Article Two hundred seventeen of the Revised Penal Code. "(h) Any employer who, after deducting the monthly contributions or loan amortizations from his employee's compensation, fails to remit the said deduction to the SSS within thirty (30) days from the date they became due, shall be presumed to have misappropriated such contributions or loan amortizations and shall suffer the penalties Provided in Article Three hundred fifteen of the Revised Penal Code. "(i) Criminal action arising from a violation of the provisions of this Act may be commenced by the SSS or the employee concerned either under this Act or in appropriate cases under the Revised Penal Code:Provided, That such criminal action may be filed by the SSS in the city or municipality where the SSS office is located, if the violation was committed within its territorial jurisdiction or in Metro Manila, at the option of the SSS.

Você também pode gostar

- Avt 2015 029Documento11 páginasAvt 2015 029Kristavilla OlavianoAinda não há avaliações

- Quisay v. PeopleDocumento7 páginasQuisay v. PeopleDanielle AngelaAinda não há avaliações

- EcoSport BrochureDocumento3 páginasEcoSport Brochureshandzoo6029Ainda não há avaliações

- R.A. 9858 PDFDocumento10 páginasR.A. 9858 PDFDanielle AngelaAinda não há avaliações

- Acts of LasciviousnessDocumento1 páginaActs of LasciviousnessDanielle AngelaAinda não há avaliações

- Fuel, Fire, Heat, OxygenDocumento1 páginaFuel, Fire, Heat, OxygenDanielle AngelaAinda não há avaliações

- People v. GorospeDocumento16 páginasPeople v. GorospeDanielle AngelaAinda não há avaliações

- AO NO 4 s'14 Amendments To The Revised Rules and Procedures Governing AcquisitionDocumento20 páginasAO NO 4 s'14 Amendments To The Revised Rules and Procedures Governing AcquisitionJerome PaderesAinda não há avaliações

- AO No. 7 s'14 Rules and Procedures Governing The Cancellation Ofd REgistered Emancipation Patents (EPS) - ...Documento24 páginasAO No. 7 s'14 Rules and Procedures Governing The Cancellation Ofd REgistered Emancipation Patents (EPS) - ...tagadagat80% (5)

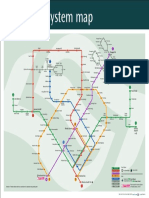

- Singapore Train System Map 2016Documento1 páginaSingapore Train System Map 2016Pinky KimAinda não há avaliações

- United States Supreme Court Decisions OnDocumento11 páginasUnited States Supreme Court Decisions OnDanielle AngelaAinda não há avaliações

- United States Supreme Court Decisions OnDocumento11 páginasUnited States Supreme Court Decisions OnDanielle AngelaAinda não há avaliações

- Jurisprudence On RapeDocumento7 páginasJurisprudence On RapeDanielle AngelaAinda não há avaliações

- Bpi v. Hon. HontanosasDocumento21 páginasBpi v. Hon. HontanosasDanielle AngelaAinda não há avaliações

- IBASCO v. CADocumento18 páginasIBASCO v. CADanielle AngelaAinda não há avaliações

- MMDA Scope of ServicesDocumento1 páginaMMDA Scope of ServicesDanielle AngelaAinda não há avaliações

- Sacred Scriptures2wsazDocumento34 páginasSacred Scriptures2wsazDanielle AngelaAinda não há avaliações

- Mendoza v. PeopleDocumento6 páginasMendoza v. PeopleDanielle AngelaAinda não há avaliações

- Convention On Law of The SeaDocumento202 páginasConvention On Law of The SeaJhonsu30100% (2)

- Republic Vs MeralcoDocumento2 páginasRepublic Vs MeralcoDanielle AngelaAinda não há avaliações

- De Gillaco Et Al V Manila Railroad CompanyDocumento2 páginasDe Gillaco Et Al V Manila Railroad CompanymodernelizabennetAinda não há avaliações

- PBA NewsDocumento79 páginasPBA NewsDanielle AngelaAinda não há avaliações

- Civ Credit Cases (Dean ALigada)Documento68 páginasCiv Credit Cases (Dean ALigada)Danielle AngelaAinda não há avaliações

- Rural Bank foreclosure dispute over redemption periodDocumento52 páginasRural Bank foreclosure dispute over redemption periodDanielle AngelaAinda não há avaliações

- Warrant The Thing SoldDocumento1 páginaWarrant The Thing SoldDanielle AngelaAinda não há avaliações

- Republic v. CagandahanDocumento2 páginasRepublic v. Cagandahanjoebanpaza1Ainda não há avaliações

- Fundamental Powers and The Bill of Rights FullDocumento46 páginasFundamental Powers and The Bill of Rights FullDanielle AngelaAinda não há avaliações

- Carlos Superdrug Corp v. DSWDDocumento2 páginasCarlos Superdrug Corp v. DSWDDanielle AngelaAinda não há avaliações

- Freedom of Religion and Liberty of AbodeDocumento28 páginasFreedom of Religion and Liberty of AbodeDanielle AngelaAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Cerulli Report - Targeting The Affluent and The Emerging AffluentDocumento25 páginasCerulli Report - Targeting The Affluent and The Emerging AffluentJoin RiotAinda não há avaliações

- Maternity LeaveDocumento4 páginasMaternity LeaveFrances LorenzoAinda não há avaliações

- Decree - CDDM001883Documento52 páginasDecree - CDDM001883thesacnewsAinda não há avaliações

- Treasurydirect Transfer Request: Fs Form 5511 (Revised June 2019)Documento6 páginasTreasurydirect Transfer Request: Fs Form 5511 (Revised June 2019)douglas jonesAinda não há avaliações

- House Hearing, 112TH Congress - Hearing On The State of Social Security's Information TechnologyDocumento169 páginasHouse Hearing, 112TH Congress - Hearing On The State of Social Security's Information TechnologyScribd Government DocsAinda não há avaliações

- 2 Case Study 2 The Pirates of The Silverland (Palm Oil Piracy)Documento9 páginas2 Case Study 2 The Pirates of The Silverland (Palm Oil Piracy)vivek1119100% (1)

- Employment Contract For Student Part-TimersDocumento5 páginasEmployment Contract For Student Part-TimersPillowsAinda não há avaliações

- Your Retirement Benefit Estimate, Retirement Estimator, Social SecurityDocumento1 páginaYour Retirement Benefit Estimate, Retirement Estimator, Social SecuritymoneyminderAinda não há avaliações

- Eligibility Review: WWW - Dshs.wa - GovDocumento7 páginasEligibility Review: WWW - Dshs.wa - GovJosh CopelandAinda não há avaliações

- Pay Stub SummaryDocumento1 páginaPay Stub SummaryamandastarAinda não há avaliações

- Ch13 Current Liabilities Provisions and ContingenciesDocumento101 páginasCh13 Current Liabilities Provisions and ContingenciesSamuel100% (1)

- Gebru ProposalDocumento26 páginasGebru Proposalasnakew huseneAinda não há avaliações

- The Morning Calm Korea Weekly - May 29, 2009Documento23 páginasThe Morning Calm Korea Weekly - May 29, 2009Morning Calm Weekly NewspaperAinda não há avaliações

- Financing Social Protection: SwedenDocumento28 páginasFinancing Social Protection: SwedenSorina LeagunAinda não há avaliações

- Periodic Interest - A Blog, by Thomas H SpittersDocumento222 páginasPeriodic Interest - A Blog, by Thomas H SpittersThomas H. SpittersAinda não há avaliações

- Pre-Screening: Tenant ApplicationDocumento10 páginasPre-Screening: Tenant ApplicationAlex ErschenAinda não há avaliações

- Payroll Project A 2022Documento38 páginasPayroll Project A 2022Felicien Man0% (2)

- Labor Law 2016Documento27 páginasLabor Law 2016Jc GalamgamAinda não há avaliações

- Sesi 6 Current Liability War22e - Ch11Documento39 páginasSesi 6 Current Liability War22e - Ch11rina.asmara asmaraAinda não há avaliações

- Somewhere in America - Shinola 101 (EditedV)Documento73 páginasSomewhere in America - Shinola 101 (EditedV)Chemtrails Equals TreasonAinda não há avaliações

- SSS v. DavacDocumento7 páginasSSS v. DavacIhna Alyssa Marie SantosAinda não há avaliações

- Fy 2014 Mayors Budget WebsiteDocumento437 páginasFy 2014 Mayors Budget WebsiteHelen BennettAinda não há avaliações

- GSIS retirement and social benefits guideDocumento40 páginasGSIS retirement and social benefits guideSweetHiezel SaplanAinda não há avaliações

- Mrunal Social Security - Meaning, Laws & Constitutional Provisions IndiaDocumento5 páginasMrunal Social Security - Meaning, Laws & Constitutional Provisions Indiaadarsh100% (1)

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocumento7 páginasWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartAinda não há avaliações

- The Green Book, Written by Muammar GaddafiDocumento154 páginasThe Green Book, Written by Muammar GaddafiPape VVhoAinda não há avaliações

- Form For Legal Aid Application in Another Member State of The European UnionDocumento8 páginasForm For Legal Aid Application in Another Member State of The European UnionebenbryAinda não há avaliações

- Questions and Answers For UPS Employees Covered by The UPS/IBT Full-Time Employee Pension PlanDocumento4 páginasQuestions and Answers For UPS Employees Covered by The UPS/IBT Full-Time Employee Pension PlanDishan ViramgamaAinda não há avaliações

- Request For Reconsideration: (Do Not Write in This Space)Documento4 páginasRequest For Reconsideration: (Do Not Write in This Space)George DawraAinda não há avaliações

- Elena Dycaico V SSS G.R. No. 161357 AdvinculaDocumento1 páginaElena Dycaico V SSS G.R. No. 161357 AdvinculaChristopher Advincula100% (1)