Escolar Documentos

Profissional Documentos

Cultura Documentos

A2 63

Enviado por

Falak ShaikhaniDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A2 63

Enviado por

Falak ShaikhaniDireitos autorais:

Formatos disponíveis

1102574 EC104a2 Yeon Yoon The most serious British economic failure coincided with the fastest growth.

Explain and comment. What part did competition play in this outcome? The Golden Age is referred to as the period between 1950 and 1973 where European nations rapidly narrowed the gap with the USA, during this period the UK grew at an unprecedented rate but also experienced the most acute economic decline as it was overtaken by most of Western Europe. The statement is however subject to debate depending on how economic failure is measured, this could be in terms of: growth, social capability, investment and TFP growth. At this time competition was weak overall in Britain which greatly contributed to it not being able to take full advantage of the opportunity for growth presented by the Golden Age. On the other hand it is possible to argue that the most serious period of economic failure was during the late Victorian period as this was when Britain lost its position as the worlds leading economy, and this is more significant than falling behind European countries. In terms of growth during the Golden Age Britain grew very quickly at 2.4% per year, much faster than it had achieved previously, including during the industrial revolution when it was the industrial leader. However this was far lower than other European countries ranging from Ireland at 3% to Greece at 6.2%. Denmark which had the closest income per head value to Britain (at $6943 and $6939 respectively) grew at 3.1% during the Golden Age. This illustrates how despite growth being high it was well below average, even taking into account that lower income nations grew more rapidly. Weak competition, poor economic policies, weak institutions, low capital deepening and TFP growth were to blame for this. Britain was overtaken by most European nations and this can be seen as Britains most serious economic failure. On the other hand, during the late Victorian era Britain was overtaken by the USA and losing this premier position of dominance could be seen as more of an economic failure. However, in my opinion, this was an inevitable event. The US had unique advantages which Britain could not hope to compete with. The US enjoyed vast natural resources as well as an enormous market size. British manufacturing did well not to emulate US methods as they were not cost effective in Britain. A serious source of Britains downfall during the Golden Age was not investing enough in research and development or in human capital. During the golden age European countries such as Germany achieved impressive growth rates largely due to implementing Eichengreens model of funding high levels of investment with wage restraint. British workers did not accept wage restraint, it was difficult to negotiate because of the fragmented unions. In contrast in Germany there was a highly centralised wage bargaining system, allowing it to reduce the capital intensity gap with the US. In growth regressions coordinated bargaining is strongly positively correlated to investment. Evidence that research and development was too low in Britain is that the UK performed well in old industries but poorly in dynamic R&D intensive sectors, this is where the US exceled for example Ford in the motor industry. In my opinion if British firms had been competitive then they would not have let wages rise at the expense of investment. An increase in investment shifts the Solow relationship leading to a higher steady state. Innovation was discouraged through relatively weaker shareholders. No principal shareholder meant there was no one to hold managers to account, stronger competition would have solved this problem. Human capital was relatively weak during the Golden Age due to the British education system which focused too much on classics as opposed to sciences.

1102574 EC104a2 Yeon Yoon A main reason for Britain lagging behind other European countries during the Golden Age was that it did not experience a surge in TFP growth caused by a technology transfer from US multinational firms branching out into Europe. Before the Golden Age American technology was not cost effective in Europe due to differences in factor endowments, increased economic integration eroded this. The UK did not seize on this opportunity like other countries in Europe did and so had far lower TFP growth. The traditional Solow growth model assumes that tech progress is what drives long run growth. The Schumpeterian relationship states that there is a positive relationship between capital per efficiency unit of labour and technological progress, therefore productivity increases. TFP growth is also underpinned by reconstruction, transferring labour out of agriculture and economic integration, the UK was different to the rest of Europe in that it did not need to rebuild extensively following the war and it already had a highly productive agricultural sector with a very small labour force, this took away scope for TFP growth. France on the other hand achieved massive gains by moving away from peasant style farming.

Tech

Schumpeter relationship (high ) Schumpeter (low )

Solow post shift Solow relationship pre-shift K/AL Social capability is a major determinant of growth rates and therefore we can assume that Britain had a low . Europe was set back by the remnants of a traditional class structure whereas the US was egalitarian. The upper class went into civil service or the Church which was not productive for the economy. European preferences were for quality products, firms were relatively small and workers skilled in comparison to the US. Elsewhere in Europe these distinctions weakened while the UK retained them more. A large reason why the Eichengreen model could not be implemented in Britain was that wages were inflexible from increasingly generous unemployment benefits and high structural unemployment from Victorian staple industries. Policy makers did not succeed in implementing the Eichengreen model but sacrificed important supply side reforms in trying. Policy makers saw full employment as their main target. This objective interacted badly with the institutional legacies of the early start. These institutions were severely out of date, they were associated with strong fragmented unions, craft control and a great separation between ownership and control. Craft control became increasingly costly as American mass production methods improved. These restrictive practises were accepted by firms where competition was weak. Nineteenth century organisation structures became dysfunctional but employers did not find it 2

1102574 EC104a2 Yeon Yoon worthwhile to take the risk to abolish them. The rest of Europe suffered from similar problems but they were not as damaging because they did not have the institutional legacies. Having weak institutions during the Golden Age was particularly painful for Britain at a time where US technology was finally cost effective in Europe, The UK missed out on the opportunity to take advantage of this and was therefore left behind due to path dependency, institutional legacy and constraints on policy. The penalty of being the first country to achieve modern economic growth was felt slightly when the US overtook Britain but was felt most when European rivals overtook. The post depression decision to follow a managed economy policy, meant that competition was severely restricted, this was difficult to undo and its effects echoed into the Golden Age. The major cause of British failure during the Golden Age which underpinned other factors was the lack of competition in the economy. However, The Over-Commitment Hypothesis by Richardson states that Britain in fact suffered from too much competition and this was what caused its decline. He believed if Britain had not been so committed to free trade and had protected industries, then Britain would have had higher growth rates subsequently. However, in my opinion which matches that of Crafts, protectionism would not have done anything to help services, which is where the economy was lagging, and would not have affected intra-sectoral productivity. Traditional accounts blame Britains severe relative decline on competition being too weak in postwar Britain, this led to poor management of firms as well as destructive industrial relations, both of these results caused low productivity. Multiple trade unions leads to hold up problems and rent seeking which lowers productivity making Britain increasingly uncompetitive. Supernormal profits were large and persistant, indicative of weak competition. Statistics support the thesis that competition was too weak in Britain, the average manufacturing concentration ratio rose from 26% in 1935 to 41% in 1968, 35% of manufacturing was cartelized in the late 1950s. Evidence that weak competition played a significant role in Britains decline was that Thatcherite policies to increase competition led to higher productivity and therefore growth. In conclusion Britain experienced its highest growth rate in real terms at a time when it was overtaken by most of Europe. This had a lot to do with both the nature of weak competition and institutions which are related to the legacy of the early start and policy decisions. Low levels of investment, TFP growth and human capital are also to blame for Britain not growing as much as it should have at a time of such opportunity in Europe. The reasons are numerous and complex for Britains failure however it is clear to me that this was the point of greatest failure and not during the Victorian period. Word Count: 1478

1102574 EC104a2 Yeon Yoon Bibliography Crafts, EC104 Lecture notes, 2012 Crafts, N. (2012), British Relative Economic Decline Revisited: the Role of Competition,Explorations in Economic History, forthcoming Crafts, N. and Toniolo, G. (eds.) (1996), Economic Growth in Europe since 1945

Você também pode gostar

- Corporate Strategy A Lecture 1Documento64 páginasCorporate Strategy A Lecture 1Falak ShaikhaniAinda não há avaliações

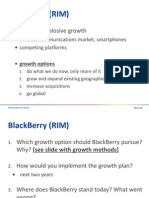

- Blackberry (Rim) : Managing Explosive GrowthDocumento9 páginasBlackberry (Rim) : Managing Explosive GrowthFalak ShaikhaniAinda não há avaliações

- 2001 Ex 1Documento1 página2001 Ex 1Falak ShaikhaniAinda não há avaliações

- Shaikh AniDocumento2 páginasShaikh AniFalak ShaikhaniAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Chapter 29Documento26 páginasChapter 29ENG ZI QINGAinda não há avaliações

- Lesson 1&2 ENTREPDocumento31 páginasLesson 1&2 ENTREPRomeo Duque Lobaton Jr.Ainda não há avaliações

- SCM Chapter 14Documento21 páginasSCM Chapter 14Urmi Mehta100% (1)

- LVMHDocumento11 páginasLVMHLucy ChonglezAinda não há avaliações

- Porters Diamond For ZaraDocumento2 páginasPorters Diamond For ZaraSunny Ramesh SadnaniAinda não há avaliações

- Seminar Assignments Multiple Choice Questions City Size Growth PDFDocumento4 páginasSeminar Assignments Multiple Choice Questions City Size Growth PDFminlwintheinAinda não há avaliações

- Entrep NotesDocumento17 páginasEntrep NotesAvril EnriquezAinda não há avaliações

- URBN218 Analysis 9Documento4 páginasURBN218 Analysis 9Liwro NacotnaAinda não há avaliações

- Iata Future Airline IndustryDocumento64 páginasIata Future Airline Industrypranzali gupta100% (2)

- Islamic Social Finance Report 2015Documento164 páginasIslamic Social Finance Report 2015Ali MehmoodAinda não há avaliações

- 13 Costs ProductionDocumento54 páginas13 Costs ProductionAtif RaoAinda não há avaliações

- Updated Date Sheet of Odd Semesters (12 Feb) - 2Documento126 páginasUpdated Date Sheet of Odd Semesters (12 Feb) - 2Gaming with Shivangi and aadityaAinda não há avaliações

- Marble IndustryDocumento6 páginasMarble IndustryPrateek ShuklaAinda não há avaliações

- Executive Summary SCIENCEDocumento68 páginasExecutive Summary SCIENCEJyotishmoi BoraAinda não há avaliações

- Difference Between Absorption Costing and Marginal CostingDocumento4 páginasDifference Between Absorption Costing and Marginal CostingIndu GuptaAinda não há avaliações

- Chap - 22.measuring A Nation's IncomeDocumento55 páginasChap - 22.measuring A Nation's IncomeellieAinda não há avaliações

- Business Economics and Financial Analysis Objective QuestionsDocumento5 páginasBusiness Economics and Financial Analysis Objective QuestionsSai Chaitanya VundrakondaAinda não há avaliações

- MBA-101 Internal and External EnvironmentDocumento19 páginasMBA-101 Internal and External EnvironmentinasapAinda não há avaliações

- Parkin Econ SM CH30 GeDocumento22 páginasParkin Econ SM CH30 GeMuri SetiawanAinda não há avaliações

- Bill's Case for Reforming the IPO ProcessDocumento3 páginasBill's Case for Reforming the IPO ProcessnancysinglaAinda não há avaliações

- Monetary EconomicsDocumento14 páginasMonetary EconomicsMarco Antonio Tumiri López0% (3)

- The Big Lie of Strategic PlanningDocumento15 páginasThe Big Lie of Strategic Planningpgp000Ainda não há avaliações

- Consumer Sovereignty and Axe Deodorants' Success in IndiaDocumento8 páginasConsumer Sovereignty and Axe Deodorants' Success in IndiamythreyakAinda não há avaliações

- Marketing Analytics For Data-Rich Environments: Michel Wedel & P.K. KannanDocumento25 páginasMarketing Analytics For Data-Rich Environments: Michel Wedel & P.K. KannanAbhinandan ChatterjeeAinda não há avaliações

- Inflation AccountingDocumento9 páginasInflation AccountingyasheshgaglaniAinda não há avaliações

- Cost Problem SetDocumento2 páginasCost Problem SetRayAinda não há avaliações

- Todaro Migration ModelDocumento3 páginasTodaro Migration ModelHamad RazaAinda não há avaliações

- Plan de EstudiosDocumento27 páginasPlan de EstudiosRobertoAinda não há avaliações

- Financing the Mozal Aluminum ProjectDocumento19 páginasFinancing the Mozal Aluminum ProjectSimran MalhotraAinda não há avaliações

- Macroeconomics Canadian 8th Edition Sayre Solutions Manual 1Documento9 páginasMacroeconomics Canadian 8th Edition Sayre Solutions Manual 1tyrone100% (52)