Escolar Documentos

Profissional Documentos

Cultura Documentos

Stock Smart Weekly (Mar 21, 2014)

Enviado por

jhnayarDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Stock Smart Weekly (Mar 21, 2014)

Enviado por

jhnayarDireitos autorais:

Formatos disponíveis

Pakistan Weekly Update

StockSmart

AKD Equity Research / Pakistan

21 March 2014

AKD Research

Weekly Review

research@akdsecurities.net

009221 111 253 111

The KSE-100 Index closed the week at 26,765 points, down by 1.3%WoW. Investor sen-

Indices

KSE-100

KSE-30

This week 26,765.49 18,990.38

Last week 27,124.47 19,579.43

Change

-1.32%

-3.01%

timent remained subdued following no change to the DR in the Mar14 MPS and a dip in

regional markets which resulted in selling pressure towards the end of the week. Major

news flow during the week included 1) Feb14 current account registered at US$164mn

increasing the 8MFY14 deficit to more than US$2bn (1.2% of GDP) while FDI increased

Indices

KMI-30

Allshare

This week 44,606.35 20,026.10

Last week 45,588.55 20,195.28

Change

-2.15%

-0.84%

by 18%YoY to US$606mn and 2) LSM sector posted modest growth of 2.6%YoY in

Jan14, bringing 7MFY14 LSM growth to 6.05%YoY. Within the AKD Universe, major

gainers during the week were SNGP (+16.3%WoW), SSGC (+14.2%WoW) and SHEL

(+5.7%WoW) while major losers during the week included AGTL (-7.2%WoW), OGDC (-

off by 33%WoW to clock in at 188mn shares where volume leaders included FABL, TRG,

LPCL, FCCL and SSGC.

Index & Volume Chart

Universe Gainers & Losers

(Index)

(Shrs'000)

250,000

27,259

27,229

27,149

27,200

27,247

200,000

26,765

100,000

26,800

85.28

FCCL

36.26

SSGC

35.19

26,600

26,500

ReadyVolume(LHS)

5.0%

10.0%

KSE100Index(RHS)

AGTL

44.44

OGDC

LUCK

LPCL

21Mar

67.86

20Mar

19Mar

TRG

0.0%

26,700

50,000

18Mar

17Mar

FABL

5.0%

26,900

PSMC

Volum e (m n)

ICI

Sym bol

27,000

150,000

10.0%

27,100

PPL

Top-5 Volum e Leaders

15.0%

27,300

UBL

Avg. Daily Turnover ('mn shares)

This week

188.87

Last week

282.90

Change

-33.24%

6.9%WoW) and PSMC (-6.4%WoW). Average daily traded volume during the week came

SHEL

US$bn

65.80

66.45

-0.97%

SSGC

PkRbn

6,460.62

6,551.97

-1.39%

SNGP

Mkt Cap.

This week

Last week

Change

Source: KSE & AKD Research

(mn)

(Index)

700

28,000

26,700

600

25,400

500

Outlook

24,100

22,800

400

21,500

300

20,200

18,900

200

17,600

100

16,300

With the end of result season, we expect the market will continue tracking the regional

markets, at least in the near-term. Attention is also likely to remain on macros particularly

the fx reserves position (release of CSF and IMF tranche). In our view, the recent market

dip has opened up attractive investment opportunities in names such as BAFL, NBP,

Volume (LHS)

Mar-14

Jan-14

Feb-14

Oct-13

Dec-13

Sep-13

Nov-13

Sep-13

Jul-13

Aug-13

Jun-13

Apr-13

Mar-13

May-13

15,000

NML, ENGRO and HUBC which should be availed.

KSE- 100 Index

Important disclosures including investment banking relationships and analyst certification at end of this report. AKD Securities does and seeks to do business with companies

Important disclosures covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of the report. Investors

should consider this report as only a single factor in making their investment decision.

AKD SECURITIES

Member: Karachi Stock Exchange

Find AKD research on Bloomberg

(AKDS<GO>), firstcall.com

and Reuters Knowledge

Copyright2014 AKD Securities Limited. All rights reserved. The information provided on this document is not intended

for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be

contrary to law or regulation or which would subject AKD Securities or its affiliates to any registration requirement within

such jurisdiction or country. Neither the information, nor any opinion contained in this document constitutes a solicitation

or offer by AKD Securities or its affiliates to buy or sell any securities or provide any investment advice or service. AKD

Securities does not warrant the accuracy of the information provided herein.

www.akdsecurities.net

AKD Securities Limited

StockSmart

21 March 2014

Pakistan Weekly Update

This Weeks Daily Reports

Mar 21, 2014

PSMC_TPrevisionfollowingstrongerPkR,(AKDDaily,March21,2014)

27,198

27,132

27,066

27,000

26,934

26,868

26,802

26,736

16:32

15:46

15:02

14:18

13:35

12:53

12:10

11:26

9:59

10:43

9:15

26,670

Mar 20, 2014

Followingswi PkRapprecia on,subsequentincorpora onofhigherGMsandarevi

sioninvolumees mates,weraiseourEPSes matesforPSMCby6%onaverage.To

gether will rollover onto Dec'14, our target price for PSMC rises to PkR195/share

(+12%).WeforecastNPATofPkR1,892mn(EPS:PkR22.99)inCY14Fwhichrepresents

normalizedgrowthof20%YoY(exsaleoflandinCY13),leadingtoadoubledigitpro

jected5yrNPATCAGR(normalized).Thatsaid,webelievethestock's23%MTDrisehas

largelycapturedtheposi veswhereourrevisedtargetpriceimpliesaNeutralstance.

Factorsthatwouldinduceustorevisitourinvestmentcaseincludeasustainedstrong

PkR(+ve)aswellastheprovisionsoftheupcomingautopolicy.

NBP_Worstmaybeover,(AKDDaily,March20,2014))

27,356

27,316

27,276

27,236

27,196

27,156

27,116

27,076

15:31

14:39

13:47

12:56

12:05

11:14

9:30

10:22

27,036

Mar 19, 2014

27,360

27,340

27,320

27,300

FollowingNBP'sworstperformancein10yrs(CY13NPAT:PkR5.4bn,EPS:PkR2.48),we

cutourDec'14targetpricetoPkR60/sharebutretainanAccumulatestancebasedon

anan cipatedswi reboundinprofitability.WithBangladeshopera ons~60%provid

edforanddomes cimpairmentheadedlower,themainimpetustoearningsgrowth

shouldcomefromlikelylowerprovisions.Atthesame me,NBPretainssizeableunre

alizedcapitalgainsbacklogofPkR21.7bn(onlocalshares/mutualfunds)whichcanpo

ten ally result in +ve earnings surprises. Finally, sustained CAR above 16% provides

comfortthatNBPcanmaintainahighpayoutra ogoingforward(3yraverage:76%).

Havingshed8%CYTD,NBPtradesataCY14FP/Bof0.7x,P/Eof7.2xandD/Yof10.4%.

WhileNBPwilllikelycon nuetotradeatadiscounttoprivatesectorpeers,webelieve

itspriceperformancewillrecouplewithan cipatedimprovementinsequen alresults.

Ourrevisedtargetpriceoers13%upside(totalreturn:24%).

BAFL_Poisedforstronggrowth,(AKDDaily,March19,2014)

27,280

27,260

27,240

27,220

15:30

14:51

14:13

13:35

12:57

12:18

11:40

11:02

9:45

10:24

27,200

Mar 18, 2014

27,372

27,353

27,334

27,315

27,296

Followingbe erthanexpectedresultsinCY13(EPS:PkR3.47,+3%YoY)whereasharp

reduc oninNPLstockwasakeyhighlight,weli ourDec14targetpriceforBAFLto

PkR32/sharefromPkR27/share.Ourbullishstanceispremisedonaprojected5yrNPAT

CAGR of 17%, among the best in the AKD Banking Universe, coupled with consistent

payouts(cash+bonus)overthemediumterm.Earningsgrowthisexpectedtoema

nate from both higher NII and lower credit costs. At the same me, while the rapid

branch network expansion in 4QCY13 (+73 branches to 574) may impinge on CY14F

costs,webelieveeconomiesofscalewillemergeoverthemediumtermascoresta

strengthhasremainedlargelystable.BAFLtradesataCY14FP/Bof1.1xandP/Eof7.5x

whereourrevisedTP(whichdoesnota achanyvaluetoWaridstake)oersanupside

of12%(exdividend:21%).

27,277

NML_A rac vedespite2HFY14weakness,(AKDDaily,March18,2014)

27,258

27,239

15:30

14:44

13:59

13:15

12:30

11:45

11:00

9:30

10:15

27,220

Mar 17, 2014

27,314

27,296

27,278

27,260

27,242

27,224

27,206

27,188

15:25

14:34

13:43

12:53

12:02

11:12

9:30

10:21

27,170

While NML posted strong results during 1HFY14 (EPS: PkR10.96; +35%YoY), 2HFY14

resultsareexpectedtobesequen allylowerduetolowercoreincomeonastronger

PkRaswellaslikelylowerdividendincome.Thesestandtocountertheimpactofan c

ipated higher other incomefrom loan to subsidiary. Together witha strong PkR, we

downward revise our FY14F and FY15F EPS es mates to PkR18.67 (1.88%) and

PkR22.12 (4.74%) which leads us to trim our Jun14 target price to PkR137.5/share

from PkR141.4/share previously. That said, NML (FY14F P/E: 6.9x) remains our pre

ferredplayintheTex lespacegivenitsrela velylowsensi vitytoco onpricesand

strongpor olioincome.Inthisregard,webelieveanyweaknessinshareprice,par cu

larlyonfreshPkRapprecia on,shouldbetakenasanopportunitytobuildposi onsin

thisqualityname.

Source:KSE&AKDResearch

AKD Securities Limited

StockSmart

21 March 2014

Pakistan Weekly Update

This Weeks Daily Reports

PakistanEconomy:SBPtowait&see,(AKDDaily,March17,2014)

Inanotunexpectedmove,theSBPhaskepttheDiscountRateunchangedat10%for

the next two months. In this regard, while the central bank has cited lower infla on

andreboundinLSMgrowthasposi vefactors,itwishestoseefurthercomfortonthe

external front before decisively moving to cut interest rates. The la er is con ngent

upon1) melymaterializa onofforeigninflows,2)reduc oninfiscalborrowing,and

3)mee ngtheNDAtargetgivenbyIMFwhilesustainedstabilityintheexchangerateis

alsolikelytobeakeyfactor.Providedthisisachievedandinfla onremainsincheck,

webelievetheSBPmayhaveroomtocuttheDRbyasmuchas100bpsintheMay14

MPS.Intheinterim,withtheSBPmaintainingstatusquointheMar14MPS,weexpect

Bankstooutperformthisweek.Ontheflipside,leveragedCementsandselectedFer

lizers(EFERT)mayseeneartermweakness.Atthesame me,anyfreshdeprecia ng

pressure on the PkR (slippage of 1.5% vs. the US$ in the two days before MPS an

nouncement)maycauseaswitchfromAutosintoIPPs.

AKD Securities Limited

StockSmart

21 March 2014

Pakistan Weekly Update

Regional Valuations (2014)

Major World Indices Performance

EPSGrowth

Pakistan

25%

Indonesia

13%

Malaysia

17%

Philippines

9%

Vitenam

16%

India

17%

China

13%

PE(x)

8.27

11.38

12.55

14.76

15.28

13.83

7.08

Country

BloombergCode

%

Pakistan

Indonesia

Malaysia

Philippines

Vitenam

India

China

DivdYld

5.82

2.37

3.46

2.48

n.a

1.82

3.95

Pakistan

Srilanka

Thailand

Jakarta

Malaysia

Philippines

Vietnam

HongKong

Singapore

Brazil

Russia

India

China

S&P

DJIA

NASDAQComposite

UK

German

Qatar

AbuDhabi

Dubai

Kuwait

Oman

SaudiArabia

MSCIEM

MSCIFM

KSE100Index

CSEALLIndex

SETIndex

JCIIndex

FBMKLCIIndex

PCOMPIndex

VNINDEXIndex

HSIIndex

FSSTIIndex

IBXIndex

RTSSTDIndex

SENSEXIndex

SHCOMPIndex

SPXIndex

INDUIndex

CCMPIndex

UKXIndex

DAXIndex

DSMIndex

ADSMIIndex

DFMGIIndex

KWSEIDXIndex

MSM30Index

SASEIDXIndex

MXEFIndex

MXFMIndex

ROE

21.54

18.48

13.50

14.84

17.85

15.73

13.91

Source: Bloomberg & AKD Universe

21Mar14

14Mar14

26,765

5,938

1,361

4,700

1,820

6,339

602

21,437

3,073

19,617

8,745

21,754

2,048

1,872

16,331

4,319

6,563

9,336

11,367

4,785

4,304

7,557

6,933

9,306

941

617

27,124

5,896

1,372

4,879

1,805

6,391

597

21,539

3,074

18,685

8,402

21,810

2,004

1,841

16,066

4,245

6,528

9,056

11,343

4,754

3,981

7,455

7,063

9,386

938

602

WoW

CYTD

1.32%

5.96%

0.71%

0.42%

0.85%

4.76%

3.66%

9.97%

0.85%

2.49%

0.81%

7.63%

0.82%

19.25%

0.48%

8.02%

0.01%

2.97%

4.99%

7.88%

4.08%

14.07%

0.26%

2.75%

2.16%

3.23%

1.68%

1.28%

1.65%

1.48%

1.74%

3.42%

0.54%

2.75%

3.09%

2.26%

0.21%

9.52%

0.65%

11.53%

8.10%

27.71%

1.38%

0.10%

1.85%

1.43%

0.86%

9.02%

0.32%

6.18%

2.50%

3.71%

Source: Bloomberg

International Major Currencies

SPOT

21Mar14

14Mar14

DollarIndex

80.115

79.446

USD/PkR

97.879

99.023

105.0

USD/JPY

102.320

101.360

103.0

EUR/USD

1.378

GBP/USD

AUD/USD

PkR/US$ Trend

109.0

107.0

101.0

99.0

Mar-14

Jan-14

Nov-13

Sep-13

Jul-13

May-13

Mar-13

97.0

Source: Bloomberg

Chg+/

WoW

CYTD

0.669

0.84%

0.10%

1.143

1.15%

7.07%

0.960

0.95%

2.84%

1.391

0.014

0.97%

0.26%

1.649

1.665

0.015

0.93%

0.39%

0.907

0.903

0.004

0.44%

1.69%

NZD/USD

0.853

0.854

0.000

0.05%

3.90%

CHF/USD

0.884

0.872

0.012

1.34%

0.99%

CAD/USD

1.119

1.111

0.009

0.78%

5.36%

USD/KRW

1,080

1,073

7.620

0.71%

2.91%

CNY/USD

6.226

6.150

0.076

2.83%

1.23%

Source: Bloomberg

Commodities

TRJ-CRB Index

SPOT

Units

21Mar14

14Mar14

WoW

CYTD

305

TRJCRB

Points

299.95

302.88

0.97%

7.06%

300

Nymex(WTI)

US$/bbl.

99.27

98.89

0.38%

0.86%

295

ICEBrent

US$/bbl.

106.83

108.38

1.43%

3.60%

290

N.GasHenryHub

US$/Mmbtu

4.4

4.3796

0.47%

1.29%

285

280

275

Cotton

USd/Pound

97.8

97.4

0.41%

9.03%

Gold

US$/Tr.Oz

1337.64

1383.05

3.28%

10.95%

Sliver

US$/Tr.Oz

20.418

21.445

4.79%

4.88%

12.67%

Mar-14

Jan-14

Feb-14

Dec-13

Nov-13

Oct-13

Sep-13

Aug-13

Jul-13

Jun-13

Apr-13

May-13

Mar-13

270

Source: Bloomberg

Copper

US$/MT

6441

6492.5

0.79%

Platinum

US$/Oz

1437.24

1471

2.30%

4.95%

Coal

US$/MT

73.1

73.1

0.00%

13.59%

Source: Bloomberg

AKD Securities Limited

StockSmart

21 March 2014

Pakistan Weekly Update

Chart Bank

Earnings Yield vs. T-Bill (12M) Differential

Advance to Decline Ratio

(%)

1.60

12.0

1.50

10.0

1.40

8.0

1.30

6.0

1.20

4.0

0.80

FIPI Flows for the week

(US$mn)

500

10.00

70

(500)

8.00

M.Funds,

(11.11)

Ind.,0.10

6.00

(907)

(2,000)

(2,500)

4.00

(1,816)

2.00

(3,000)

(3,500)

(2,929)

NBFC,4.70

(4,000)

(4,500)

(2.00)

Co.,(1.43)

(4,372)

(5,000)

19Mar 20Mar

21Mar

KSE-100 vs. MSCI-EM & MSCI-FM

MSCIEM

Mar14

Jan14

Nov13

Sep13

MSCIFM

Jul13

Mar14

Jan14

Dec13

Nov13

AKDUniverse

KSE100

65%

55%

45%

35%

25%

15%

5%

5%

15%

May13

KSEAllShareIndex

Sep13

Aug13

Jul13

May13

Apr13

49%

43%

37%

31%

25%

19%

13%

7%

1%

5%

Mar13

AKD Universe vs. KSE-100 Index

Jan13

18Mar

Others,

(1.33)

Bank/DFI,

(1.83)

(4.00)

17Mar

Mar13

Mar13

LIPI Flows for the week

(US$'000)

(1,000)

(1,500)

Mar14

(4.0)

Dec13

0.90

Oct13

(2.0)

Jul13

1.00

Jun07

Oct07

Mar08

Aug08

Jan09

May09

Oct09

Mar10

Aug10

Dec10

May11

Oct11

Mar12

Jul12

Dec12

May13

Oct13

Mar14

May13

1.10

2.0

AKD Securities Limited

StockSmart

21 March 2014

Pakistan Weekly Update

AKD Universe Valuations

21Mar14

EPS(PkR)

EPSchg(%)

EPSchg(%)ExFinancials

BookValueperShare(PkR)

Payout(%)

Valuations

PricetoEarnings(x)

PricetoBook(x)

PER(x)ExFinancials

P/BVS(x)ExFinancials

PricetoCF(x)

EarningsYield(%)

DividendYield(%)

EV/EBITDA(x)

Profitability

ReturnonEquity(%)

ReturnonAssets(%)

ChginSales(%)

GrossMargin(%)

OperatingMargin(%)

NetMargin(%)

2011A

8.04

24.30

25.15

37.64

52.26

2012A

8.74

8.67

8.76

43.08

50.30

2013A/E

9.55

9.28

16.62

49.25

50.11

2014F

11.90

24.59

28.53

55.24

48.10

2015F

13.64

14.59

15.37

61.58

48.24

12.23

2.61

13.16

3.18

20.17

8.18

4.27

7.77

11.25

2.28

12.10

2.80

25.12

8.89

4.47

6.85

10.30

2.00

10.38

2.38

8.20

9.71

4.87

6.11

8.27

1.78

8.07

2.07

20.06

12.10

5.82

5.34

7.21

1.60

7.00

1.84

11.21

13.86

6.69

4.74

21.37

3.85

17.34

23.41

14.47

11.38

20.29

3.58

17.58

21.76

12.84

10.52

19.40

3.77

5.68

22.88

13.47

10.88

21.54

4.16

12.61

22.46

13.47

12.04

22.15

4.30

10.79

23.02

14.32

12.45

Source: AKD Research

Market PER Chart 2014F

(x)

15

11

Mar-14

Dec-12

Sep-11

Jun-10

Mar-09

Dec-07

Sep-06

Jul-05

Source: AKD Research

Market P/BVS Chart 2014F

(x)

3.5

2.6

1.7

Mar14

Dec12

Sep11

Jun10

Mar09

Dec07

Sep06

Jul05

0.8

Source: AKD Research

AKD Securities Limited

StockSmart

21 March 2014

Pakistan Weekly Update

AKD Universe Active Coverage Clusters Valuations

EPS

PE(x)

PB(x)

DY(%)

(PkR)

(PkR)

(PkR)

12A 13A/E 14F

12A 13A/E 14F 12A13A/E 14F 12A13A/E 14F

AutomobileandParts

IndusMotors

INDU

395.3 384.29 Neutral 54.7 42.7 49.17.29.38.1 1.81.8 1.68.1 6.3

PakSuzukiMotors

PSMC

190.2 194.99 Neutral 11.9 22.5 23.016.08.58.3 1.00.9 0.81.3 2.12.6

Construc onandMaterials

DGKhanCement

DGKC

93.8 106.95 Accumulate 9.4 12.6 12.910.07.57.3 1.20.9 0.81.6 3.23.5

Chemicals

EngroPolymerChemicals

EPCL

14.6 16.49 Accumulate 0.11.11.1 125.8 13.7 12.7 1.51.4 1.2

ICIPakistanLimited

ICI

332.2 228.39

Sell

10.57.4 17.831.5 44.6 18.6 3.02.9 2.71.7 1.52.7

Lo eChemicalPakistanLtd.

LOTCHEM 6.8 8.53

Buy

0.0(0.3) 0.6 n.m n.m 11.5 0.80.8 0.83.7

EngroCorpora on

ENGRO

184.3 196.20 Accumulate 2.6 18.7 22.970.79.98.1 2.21.3 1.2

EngroFer lizersLimited

EFERT

49.1 55.45 Accumulate (2.3) 4.25.6(21.7) 11.68.7 4.02.9 2.2

DawoodHerculesLimited

DAWH

79.5 71.83 Reduce 2.09.2 13.139.08.66.1 2.0 n.a n.a1.3

FaujiFert.BinQasimLtd.

FFBL

41.3 49.33 Accumulate 4.66.06.68.96.96.2 3.12.4 2.5 10.9 13.3 15.1

FaujiFer lizerCompany

FFC

108.9 138.62

Buy

16.4 15.8 16.46.66.96.6 6.35.8 5.6 14.2 14.7 14.9

Fa maFer lizer

FATIMA

31.2 35.09 Accumulate 2.94.15.010.77.76.2 2.32.0 1.76.4 6.46.4

FoodProducers

EngroFoodsLimited

EFOODS 113.1 80.92

Sell

3.40.32.633.4 410.9 43.5 8.67.6 6.4

Oil&Gas

Oil&GasDevelopmentCo.

OGDC

251.9 302.09 Accumulate 22.5 21.1 28.911.2 11.98.7 4.03.3 2.72.9 3.34.6

PakOilfields

POL

539.9 612.57 Accumulate 50.1 45.8 59.110.8 11.89.1 3.63.7 3.49.7 8.38.5

PakistanStateOil

PSO

429.2 345.59 Reduce 36.7 50.8 91.511.78.44.7 2.11.7 1.31.3 1.22.3

Electricity

HubPowerCo.

HUBC

52.5 72.19

Buy

7.18.87.07.46.07.5 2.01.8 2.0 11.4 15.2 17.1

KotAdduPowerCompany

KAPCO

58.8 64.00 Accumulate 6.98.48.08.57.07.3 2.22.1 2.1 11.7 12.7 13.2

FixedLineTelecommunica on

PakistanTelecommunica on PTC

30.5 29.71 Neutral 2.23.14.213.69.97.3 1.31.3 1.27.49.8

PersonalGoods

NishatMills

NML

122.8 137.54 Accumulate 10.0 16.6 18.712.27.46.6 1.10.7 0.72.8 3.33.9

Banks

AlliedBankLimited

ABL

84.4 95.03 Accumulate 11.4 14.2 11.07.45.97.7 1.71.5 1.47.0 6.57.1

BankAlFalah

BAFL

25.9 32.0*

Buy

3.43.53.87.77.56.8 1.21.1 1.07.7 7.75.8

HabibBankLimited

HBL

164.0 164.99 Neutral 17.0 17.1 19.19.69.68.6 1.61.5 1.44.2 4.95.5

MCBBankLimited

MCB

246.6 270.03 Accumulate 18.8 19.7 20.913.1 12.5 11.8 2.62.4 2.14.4 5.25.3

Na onalBankofPakistan

NBP

51.6 59.99 Accumulate 7.32.57.47.0 20.87.0 0.80.7 0.7 11.8 3.9 10.7

UnitedBankLtd

UBL

144.8 150.03 Neutral 15.6 15.8 16.59.39.28.8 1.71.6 1.55.9 5.96.2

*TPforBAFLrisestoPkR33.8/shareuponsuccessfulWaridstakesale

Stocks

Symbol

Price

TP

Stance

Source: AKD Research

AKD Securities Limited

StockSmart

21 March 2014

Pakistan Weekly Update

AKD Universe Coverage Clusters Performance

Stocks

Sym bol

Price

21-Mar-14

1M

CYTD

1 Year

High

1 Year

Low

26765.49

4.5

4.6

13.4

49.4

5.6

27104.70

17492.00

AGTL

MTL

212.12

469.00

-22.4

-1.4

1.4

-2.6

3.9

-4.7

-0.6

0.7

2.1

-3.1

273.49

519.58

197.00

433.73

INDU

PSMC

395.34

190.19

6.0

20.0

17.7

30.0

19.7

30.3

28.8

88.7

19.4

33.5

398.10

167.70

282.00

97.29

DGKC

LUCK

93.83

318.64

9.6

5.9

12.8

10.1

19.4

28.0

36.1

88.5

13.0

9.4

96.43

321.67

61.23

160.97

EPCL

ICI

LOTCHEM

DAWH

EFERT

ENGRO

FATIMA

FFBL

FFC

14.60

332.17

6.80

79.53

56.83

184.31

31.18

41.28

108.93

-4.6

25.5

1.2

-6.5

0.0

1.2

8.2

-5.3

-2.2

11.3

41.0

-7.7

40.0

n.a

17.4

8.2

-8.3

-5.7

12.4

66.9

-2.0

44.5

n.a

22.3

18.3

5.4

3.1

40.1

141.1

-10.1

59.4

n.a

40.5

38.5

11.4

0.9

10.8

45.7

-9.6

38.3

n.a

11.3

9.3

-7.3

-5.1

16.66

326.31

8.89

85.56

56.85

187.38

30.16

45.42

119.52

9.29

135.37

6.46

37.88

29.66

103.25

21.29

36.90

101.37

EFOODS

113.08

13.4

11.4

-1.6

-11.4

6.4

162.22

80.37

44.33

5.1

15.4

51.7

71.2

14.6

74.12

23.57

OGDC

POL

PSO

251.89

539.93

429.18

-4.1

9.1

24.8

-9.7

6.0

27.4

0.4

14.2

46.2

23.6

18.3

109.0

-8.9

9.2

27.7

287.84

539.63

367.10

197.32

428.73

184.67

HUBC

KAPCO

52.49

58.84

-3.8

3.4

-14.2

-4.5

-18.8

-8.3

-1.8

11.8

-14.8

-5.5

73.42

68.34

50.13

49.53

PTC

30.51

8.7

-2.5

11.1

54.8

-3.4

31.70

17.46

NCL

NML

48.21

122.82

-11.2

-7.5

-16.9

-1.8

-20.8

25.4

-1.3

47.7

-17.2

1.2

68.82

140.79

43.31

69.03

ABL

AKBL

BAFL

HBL

HMB

MCB

MEBL

NBP

UBL

84.42

17.20

25.86

164.01

24.55

246.55

36.95

51.56

144.83

-5.4

24.0

-7.5

2.2

1.9

-8.7

-1.2

-8.5

7.0

-8.1

18.4

-8.1

-1.1

-5.4

-17.7

-5.5

-13.1

6.3

-0.8

24.8

7.4

-3.9

0.0

-18.8

-5.4

-5.6

-4.8

41.3

11.6

66.4

70.3

59.3

30.7

45.0

29.3

71.4

-7.9

25.1

-5.6

1.5

-5.2

-13.1

-8.3

-11.2

6.3

94.51

16.15

28.66

181.57

26.16

316.87

40.87

60.01

154.21

55.01

10.76

14.77

88.00

14.61

183.00

24.11

37.66

82.16

KSE-100 Index

Absolute Perform ance (%)

3M

6M

12M

Industrial Engineering

Al-Ghazi Tractor

Millat Tractors

Autom obile and Parts

Indus Motors

Pak Suzuki Motors

Construction and Materials

DG Khan Cement

Lucky Cement

Chem icals

Engro Polymer Chemicals

ICI Pakistan Limited

Lotte Pakistan PTA Limited

Daw ood Hercules

Engro Fertilizers Ltd.

Engro Chemical

Fatima Fertilizer

Fauji Fert. Bin Qasim Ltd.

Fauji Fertilizer Company

Food Producers

Engro Foods Limited

Non Life Insurance

Adamjee Insurance

AICL

Oil & Gas

Oil & Gas Development Co.

Pak Oilfields

Pakistan State Oil

Electricity

Hub Pow er Co.

Kot Addu Pow er Company

Fixed Line Telecom m unication

Pakistan Telecommunication

Personal Goods

Nisaht (Chunian) Ltd.

Nishat Mills

Banks

Allied Bank Limited

Askari Bank Limited

Bank AlFalah

Habib Bank Limited

Habib Metropolitan Bank

MCB Bank Limited

Meezan Bank Limited

National Bank of Pakistan

United Bank Ltd

Source: KSE & AKD Research

AKD Securities Limited

StockSmart

21 March 2014

Pakistan Weekly Update

Economic Snapshot

End Month Data

Units

Apr-13 May-13 Jun-13

Jul-13 Aug-13 Sep-13

Oct-13 Nov-13 Dec-13 Jan-14 Feb-14

T-bill

3M

9.42

9.41

9.26

8.93

9.00

9.15

9.47

9.63

9.93

9.92

9.91

6M

9.44

9.42

9.16

9.01

9.20

9.35

9.68

9.88

10.02

9.98

9.95

12M

9.46

9.43

9.19

9.03

9.34

9.48

9.81

9.96

10.12

10.05

9.99

PIB 10Y

11.92

11.25

10.86

11.57

11.97

12.28

12.83

12.93

12.90

12.59

12.80

KIBOR 6M

9.58

9.60

9.39

9.08

9.15

9.29

9.55

9.52

10.13

10.14

10.15

Discount rate

9.50

9.50

9.00

9.00

9.00

9.50

9.50

10.00

10.00

10.00

10.00

Headline inflation

5.80

5.10

5.90

8.26

8.55

7.40

9.10

10.90

9.18

7.90

7.90

Core inflation

8.70

8.10

7.80

8.20

8.50

8.70

8.40

8.50

8.20

8.00

7.80

Food inflation

5.50

6.50

7.90

9.20

10.30

7.90

9.80

13.00

9.30

7.20

7.60

Export (PBS)

US$ (mn)

2,130

2,175

2,197

2,095

1,996

2,622

1,864

1,804

2,275

2,061

2,167

Import (PBS)

US$ (mn)

3,909

4,346

3,940

3,814

3,572

3,791

3,281

3,651

3,561

4,137

3,600

Trade Deficit (PBS)

US$ (mn)

Home Remittances

US$ (mn)

1,216

1,186

1,165

1,404

1,233

1,283

1,348

1,131

1,385

n.a

1,210

Current Account

US$ (mn)

(354)

(346)

(163)

46

(575)

(574)

(166)

(572)

285

(464)

164

1,779

2,171

1,743

1,719

1,576

1,169

1,417

1,847

1,286

Inflation

External Indicators

(1,779) (2,171) (1,743) (1,719) (1,576) (1,169) (1,417) (1,847) (1,286) (2,076) (1,433)

Banking Sector

Deposits

PkR (bn)

6,709

6,950

7,316

7,069

7,174

7,125

7,133

7,309

7,529

7,566

7,599

Advances

PkR (bn)

3,857

3,906

3,869

3,788

3,817

3,831

3,921

4,008

4,071

4,127

4,110

Investments

PkR (bn)

3,893

3,942

4,129

3,837

3,708

3,873

3,776

4,035

4,070

4,217

4,443

Weighted Avg. lending rate

11.42

11.49

11.36

11.28

11.11

11.10

11.10

11.13

11.07

n.a

n.a

Weighted Avg. deposit rate

5.23

5.15

5.01

4.97

4.83

4.79

4.90

4.89

5.05

n.a

n.a

Spread rate

6.19

6.34

6.35

6.31

6.28

6.31

6.20

6.24

6.02

n.a

n.a

153,199 173,268 267,608

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

60,982 128,889

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

104,737 112,286 138,719

n.a

n.a

n.a

n.a

n.a

n.a

n.a

n.a

Public Finance

Tax collection

PkR (mn)

Direct taxes

PkR (mn)

Indirect Taxes

PkR (mn)

48,462

Currency

Reserves (RHS)

US$ (mn)

11,812

11,474

11,020

10,287

9,998

9,995

9,525

8,238

8,168

8,017

8,737

USDPkR - Interbank

PkR/USD

98.48

98.52

98.94

101.90

104.51

105.24

106.89

107.56

107.13

105.47

104.89

Source: SBP, PBS & AKD Research

AKD Securities Limited

StockSmart

21 March 2014

Pakistan Weekly Update

Analyst Certification

We, the AKD Research Team, hereby individually & jointly certify that the views expressed in this research report accurately reflect our personal views about the subject securities and issuers. We also certify that no part of our compensation was, is,or will be, directly or indirectly, related

to the specific recommendations or views expressed in this research report. We further certify that we do not have any beneficial holding of the

specific securities that we have recommendations on in this report.

AKD Research Team

Analyst

Tel no.

Coverage

Naveed Vakil

Raza Jafri, CFA

Anum Dhedhi

Bilal Alvi

Qasim Anwar

Hassan Quadri

Azher Ali Quli

Nasir Khan

Tariq Mehmood

+92 111 253 111 (692)

+92 111 253 111 (693)

+92 111 253 111 (637)

+92 111 253 111 (647)

+92 111 253 111 (680)

+92 111 253 111 (639)

+92 111 253 111 (646)

+92 111 253 111 (646)

+92 111 253 111 (643)

naveed.vakil@akdsecurities.net

raza.jafri@akdsecurities.net

anum.dhedhi@akdsecurities.net

bilal.alvi@akdsecurities.net

qasim.anwar@akdsecurities.net

hassan.quadri@akdsecurities.net

azher.quli@akdsecurities.net

nasir.khan@akdsecurities.net

tariq.mehmood@akdsecurities.net

Director - Research & Business Development

Pakistan Economy & Commercial Banks

Pakistan Economy

Textiles, Cements & Chemical

Technical Analysis

Research Production / Autos

Research Production

Research Production

Library Operations

DISCLOSURES & DISCLAIMERS

This publication/communication or any portion hereof may not be reprinted, sold or redistributed without the written consent of AKD Securities

Limited. AKD Securities Limited has produced this report for private circulation to professional and institutional clients only. The information,

opinions and estimates herein are not directed at, or intended for distribution to or use by, any person or entity in any jurisdiction where doing so

would be contrary to law or regulation or which would subject AKD Securities Limited to any additional registration or licensing requirement

within such jurisdiction. The information and statistical data herein have been obtained from sources we believe to be reliable and complied by

our research department in good faith. Such information has not been independently verified and we make no representation or warranty as to

its accuracy, completeness or correctness. Any opinions or estimates herein reflect the judgment of AKD Securities Limited at the date of this

publication/ communication and are subject to change at any time without notice.

This report is not a solicitation or any offer to buy or sell any of the securities mentioned herein. It is for information purposes only and is not

intended to provide professional, investment or any other type of advice or recommendation and does not take into account the particular investment objectives, financial situation or needs of individual recipients. Before acting on any information in this publication/communication, you

should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice. Neither AKD Securities

Limited nor any of its affiliates or any other person connected with the company accepts any liability whatsoever for any direct or consequential

loss arising from any use of this report or the information contained therein.

Subject to any applicable laws and regulations, AKD Securities Limited, its affiliates or group companies or individuals connected with AKD

Securities Limited may have used the information contained herein before publication and may have positions in, may from time to time purchase or sell or have a material interest in any of the securities mentioned or related securities or may currently or in future have or have had a

relationship with, or may provide or have provided investment banking, capital markets and/or other services to, the entities referred to herein,

their advisors and/or any other connected parties.

AKD Securities Limited (the company) or persons connected with it may from time to time have an investment banking or other relationship,

including but not limited to, the participation or investment in commercial banking transaction (including loans) with some or all of the issuers

mentioned therein, either for their own account or the account of their customers. Persons connected with the company may provide corporate

finance and other services to the issuer of the securities mentioned herein, including the issuance of options on securities mentioned herein or

any related investment and may make a purchase and/or sale of the securities or any related investment from time to time in the open market or

otherwise, in each case either as principal or agent.

This document is being distributed in the United State solely to "major institutional investors" as defined in Rule 15a-6 under the U.S. Securities

Exchange Act of 1934, and may not be furnished to any other person in the United States. Each U.S. person that receives this document by its

acceptance hereof represents and agrees that it: is a "major institutional investor", as so defined; and understands the whole document. Any

such person wishing to follow-up any of the information should do so by contacting a registered representative of AKD Securities Limited.

The securities discussed in this report may not be eligible for sale in some states in the U.S. or in some countries.

Any recipient, other than a U.S. recipient that wishes further information should contact the company.

This report may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose.

10

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- UCC Redemption ProcessDocumento9 páginasUCC Redemption Processphard234597% (31)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Discussion 1 Second Sem .PDF-1Documento11 páginasDiscussion 1 Second Sem .PDF-1Io Aya100% (2)

- ASIGNACION 3 FinanzasDocumento3 páginasASIGNACION 3 FinanzasNeryvelisse MedinaAinda não há avaliações

- Boeing Financial Analysis PresentationDocumento14 páginasBoeing Financial Analysis PresentationFranky FrankAinda não há avaliações

- Stock Smart Weekly (Apr 25, 2014)Documento9 páginasStock Smart Weekly (Apr 25, 2014)jhnayarAinda não há avaliações

- Salik and KamalaDocumento3 páginasSalik and KamalajhnayarAinda não há avaliações

- 048 ADocumento3 páginas048 AjhnayarAinda não há avaliações

- Cement Dispatches Feb'14 - 8MFY14, (AKD Daily, Mar 06, 2014)Documento5 páginasCement Dispatches Feb'14 - 8MFY14, (AKD Daily, Mar 06, 2014)jhnayarAinda não há avaliações

- Kashkol E Kalimi UrduDocumento159 páginasKashkol E Kalimi UrduZeeshan Ul Haq100% (2)

- 1888 The Gate of The Hundred Sorrows Rudyard KiplingDocumento6 páginas1888 The Gate of The Hundred Sorrows Rudyard KiplingjhnayarAinda não há avaliações

- The Best Spiritual - Awakening - Dharma Films of All TimeDocumento15 páginasThe Best Spiritual - Awakening - Dharma Films of All TimejhnayarAinda não há avaliações

- Historic FrodshamDocumento1 páginaHistoric FrodshamjhnayarAinda não há avaliações

- Secretrosegarden Secret Rose GardenDocumento104 páginasSecretrosegarden Secret Rose GardenjhnayarAinda não há avaliações

- Whither Ye SadhuDocumento76 páginasWhither Ye SadhujhnayarAinda não há avaliações

- I Did Not DieDocumento1 páginaI Did Not DiejhnayarAinda não há avaliações

- Lesson 8 - The Ten Ox Herding Pictures - ExplanationDocumento5 páginasLesson 8 - The Ten Ox Herding Pictures - Explanationjhnayar100% (1)

- Hayat e QadirDocumento137 páginasHayat e Qadirmtkhusro92Ainda não há avaliações

- Audited Financial Results March 31, 2019 Reliance Jio Infocomm LimitedDocumento9 páginasAudited Financial Results March 31, 2019 Reliance Jio Infocomm Limitedaishwarya raikarAinda não há avaliações

- UBLRemittanceForm PDFDocumento2 páginasUBLRemittanceForm PDFMUHAMMAD YASIRAinda não há avaliações

- Sap Document Type Inventory: Document Types in ProductionDocumento7 páginasSap Document Type Inventory: Document Types in ProductionCristina MoldovanAinda não há avaliações

- Abhijit Deshmukh, CFA: PROFESSIONAL EXPERIENCE - Financial Markets / BankingDocumento2 páginasAbhijit Deshmukh, CFA: PROFESSIONAL EXPERIENCE - Financial Markets / BankingVishnu GautamAinda não há avaliações

- Info 7behavioral CEO S - The Role of Managerial Overconfidence 1Documento30 páginasInfo 7behavioral CEO S - The Role of Managerial Overconfidence 1Baddam Goutham ReddyAinda não há avaliações

- Want To Be A Trader?: TradersworldDocumento189 páginasWant To Be A Trader?: TradersworldLuis MásAinda não há avaliações

- Notes On SECURITIES REGULATION CODEDocumento18 páginasNotes On SECURITIES REGULATION CODEcharmagne cuevasAinda não há avaliações

- Ancol Annual Report 2010Documento199 páginasAncol Annual Report 2010Dinda KusumaaputriiAinda não há avaliações

- FINC 560 - Final ExamDocumento5 páginasFINC 560 - Final ExamLilyMSUAinda não há avaliações

- Risk, Return and Portfolio Theory: Chapter ThreeDocumento74 páginasRisk, Return and Portfolio Theory: Chapter ThreeWegene Benti UmaAinda não há avaliações

- Profile PDFDocumento4 páginasProfile PDFnickmistroAinda não há avaliações

- Aachi Spices and Foods Private Limited: Summary of Rated InstrumentDocumento6 páginasAachi Spices and Foods Private Limited: Summary of Rated Instrumentjaya_flareAinda não há avaliações

- Rakindo KovaiDocumento1 páginaRakindo KovaiRagumuthukumar AlagarsamyAinda não há avaliações

- Client Interview Questions-Finance FunctionalDocumento3 páginasClient Interview Questions-Finance FunctionalRohan KamatAinda não há avaliações

- Mba Iii Financial Risk ManagementDocumento75 páginasMba Iii Financial Risk ManagementSimran GargAinda não há avaliações

- Virata v. NG WeeDocumento4 páginasVirata v. NG WeeNino Kim AyubanAinda não há avaliações

- SAP B1 9 Fixed AssetsDocumento26 páginasSAP B1 9 Fixed AssetscreatorsivaAinda não há avaliações

- Real Estate Weekly News Letter 13 October 2014 - 19 October 2014Documento25 páginasReal Estate Weekly News Letter 13 October 2014 - 19 October 2014Aayushi AroraAinda não há avaliações

- ABM 104 Financial ManagementDocumento20 páginasABM 104 Financial ManagementGenner RazAinda não há avaliações

- Contoh Eliminasi Lap - Keu KonsolidasiDocumento44 páginasContoh Eliminasi Lap - Keu KonsolidasiLuki DewayaniAinda não há avaliações

- Sol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Documento3 páginasSol. Man. - Chapter 13 - Share Based Payments (Part 2) - 2021Nikky Bless LeonarAinda não há avaliações

- Quiz Bowlers' Society RFBT (Oblicon, Nego, Partnership) ExamDocumento7 páginasQuiz Bowlers' Society RFBT (Oblicon, Nego, Partnership) ExamsarahbeeAinda não há avaliações

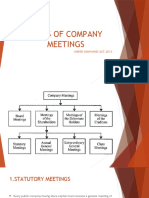

- Company Meetings NavinDocumento12 páginasCompany Meetings NavinNavin SureshAinda não há avaliações

- SD-SCD-QF72B PCIMS Account Registration Form For PS Applicants - PS - 01302019Documento1 páginaSD-SCD-QF72B PCIMS Account Registration Form For PS Applicants - PS - 01302019Chiekoi PasaoaAinda não há avaliações

- Hyperion Lite PaperDocumento13 páginasHyperion Lite PaperajdCruiseAinda não há avaliações

- College of Accountancy & FinanceDocumento5 páginasCollege of Accountancy & FinanceCecille GuillermoAinda não há avaliações