Escolar Documentos

Profissional Documentos

Cultura Documentos

India Sudar Tax File 2012-13

Enviado por

India Sudar Educational and Charitable TrustDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

India Sudar Tax File 2012-13

Enviado por

India Sudar Educational and Charitable TrustDireitos autorais:

Formatos disponíveis

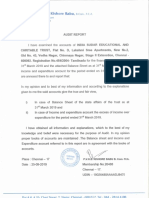

i c ITR-V

r..

Name

INDIAN INCOME TAX RETURN VERIFICATION

[Where the data ot the Return ITR-4, ITR-4S (SUGAM),

(please

FORM

ITR-2, ITR-3, digital signature)

Assessment

Year

of Income in Benefits in Form (lTR-1 (SAHAJ), transmitted electronically

Rules,

ITR-5, ITR-6

without

2013 -14

see Rule U of the Income-lax

1962)

PAN AND CHARITABLE TRUST IAAATI4288G

INDIA SUDAR EDUCATIONAL

Flatmoor/BJock NEW#2,OLD#49

No

Name OfPremiseslBuildinglVillage D, LAKSHMI SREE APARTMENTS

~--------------l---::-----------------l Area/Locality RoadiStreetfPost Office CHINMA VA NAGAR STAGE II EXTN TowniCitylDistrict CHENNAI State

Form No. which has been electrouicaUy transmitted

!ITR-7

Pin 600092

Status AOP(Trusts)

TAs.l\1ILNADV

of AO (Ww'd / Circle) Number

Designation

I ACIT(E)

III

Oliginal

or Revised

I ORIGINAL I

I

07-03-2014

-56805

E-ming Acknowledgement 1 2

GI'{)~S

1118742010070314

Date(DD-MM-VYYV) 1 2 3 3a 4

I

o

Total Income

under Cbapter-VI-A Year loss, if any

Deductions a

3

4

TotsrIneome

Current Net Tax Payable Interest Payable

-c,

-56800

o o

5 6

o o

b c d

TDS TCS Self Assessment Tax +7d) Total Taxes Paid (7a+7b+7c 7c

7

7e 8 9 VERIFICATION

e

S

o

o o

AAJPUI304Q

Tax Payable (6- 7e) Refund (7 e-6)

I, IIDHAYAKIIMAR

son! daughter of V ARADARAJAN

, holding permanent account number

solemnly declare to the best of my knowledge and belief, the information given in the rerum and the schedules thereto which have been transmitted electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income! fringe benefits and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income and fringe benefits chargeable to income-tax for the previous year relevant to the assessment year 2013-14. I further declare that I am making this return in my capacity as MANAGINGTRUSJEE and I a n also competent to make this return and verify it.

, ,.

SIGN HERE Date

+ L:i:J~~'lJQ~;::~e:;J

Place by a TrAama.J~r CHENNAI -92 (TRP) givefurtl.er details as below: No. ofTRP NameofTRP Counter Signature ofTRP

lftl,e return 'Ias been p""pa

Identification

For Office Use Only

Filed from IP address

1 84.64.63.40

Receipt No Date Seal and signature of

receiving official

AAATI4288G071187420100703143D141B8C1AOEA5C8B5356FB1C7019B7E8DFD20B9

Please send the duly signed Form ITR-V to "Income Tax Department - CPC, Post Bag No -1, Electronic City Post Office, Bengaluru560100, Karnataka", by ORDINARY POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other office of the Income-tax Department or in any other manner. The confirmation of receipt of this ITR-V at ITD-CPC will be sent to the e-mail addresss.kitnan@gmail.com

~r~~~~-----------

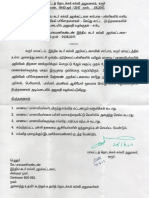

NAME

INDIA SUDAR EDUCATIONAL AND CHARITABLE TRUST D, Lakshmi Sree Apartments New #2, Old #43 Vedha Nagar, Chinmaya Nagar Stage II Extn Chennai- 600 092 AAATI4288G

ADDRESS

PAN DATE OF FORMATION

INCOME TAX 12AA Regn No. 80G Regn No. FCRA Registration No.

DIT(E) No:2(58)/04-05 DIT(E) No2(58)/04-05

c!1--

J+

~~ ~04 _~>o~

~~_ 08' ~~og

F.No.II/21022/67(0207)/2011-FCRA-1i

d-t

PREVIOUS YEAR

2012-2013

ASSESSMENT YEAR

2013-2014

COMPUTATION OF SOURCES AND APPLICATIONS SOURCES Income as per Income and Expenditure account 1,912,299

1,912,299

APPLICA TIONS Expenditure as per income and Expenditure account Before Depreciation

1,969,104

1,969,104

85% of Income Less: Actual Applied

1,625,454 1,969,104

Excess Spent

For INDIA SUDAR EDUCATIONA

(343,649)

~r

,L_"~T

.1ARITAB~?J4anaging Trustee

~,

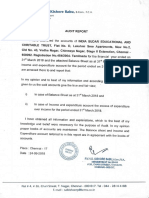

INDIA SUDAR EDUCATIONAL AND CHARITABLE TRUST D, Lakshmi Sree Apts, New NO#2,Old#43 Vedha Nagar Chinmaya Nagar Stage II Extn. Chennai- 600 092 Receipts and Payments account for the year ended 31-3-2013 Receipts Opening Balance ICICI Bank Donations - Domestic Donations - Foreign Currency Interest Received Amount Payments Amount

85,255 1,665,750 240,907 5,642

Deploying Teachers Project Distribution of Education Stationeries Awareness and Training Programm

247,350

l'

604,534 710,094 297,314

Education Aid for Individual India Sudar Computer Training Centre Expenses India Sudar Library Expenses Govt School Infrastructure Education Environment Bank Charges Closing Balance ICICI Alc No. 000901112899 ICICI FCRA Alc No. 000901123735

44,950 13,900 30,990 10,000 2,472

1,997,554

34,106 1,844 1,997,554

As per Books of Account Produced before me

P.V.H.S. KISHORE BABU,

B. Com.,F.C.A., MEMBERSHIP No. 26488 # 26, CHARI STREET, T. NAGAR, CHENNAI-600 017.

INDIA SUDAR EDUCATIONAL AND CHARITABLE TRUST D, Lakshmi Sree Apts, New No#2 Old#43, Vedha Nagar Chinmaya Nagar Stage II Extn Chennai- 600 092 Income and Expenditure Expenditure Deploying Teachers Project Distribution of Education Stationeries Awareness account for the year ended 31-3-2013 Income Donations - Domestic Donations - Foreign Currency Interest Received Excess of Expenditure over Income amount 1,665,750 240,907 5,642

amount 247,350 604,534 710,094 297,314

& Training Programm

Education Aid for Individual India Sudar Computer Training Centre Expenses India Sudar Library Expenses Govt School Infrastructure Education Environment Bank Charges Audit Fees

56,804

44,950 13,900 30,990 10,000 2,472 7,500

1,969,104

1,969,104

As per Books of Account Produced before me

v.

INDIA SUDAR EDUCATIONAL

AN D CHARITABLE

TRUST

D, Lakshmi Sree Apts, New No#2 Old#43, Vedha Nagar Chinmaya Nagar Stage" Extn. Chennai- 600 092 Balance sheet as at 31-3-2013

Liabilities Amount Assets Cash at Bank Amount

Corpus Fund Less: Excess of Expenditure Over Income Audit Fees Payable

80,255 56,804 23,450 12,500 35,950

ICICI FCRA AlC - 600901123735 ICICIAlc -000901112899

1,844 34,106

35,950

As per Books of Account Produced before me

For INDIA SUDAR EDUCATIO HARIT BL~ERUST

~

.

r-

Managin

st

P.V.H.S. KISHORE BABU, B. Com.,F.C.A.,

MEM8ERSHIP No. 26488

# 26, CHARI STREET, T. NAGAR,

CHENNAI-600 017 .

..

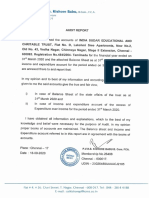

FORM NO. lOB [ See rule 17B] Audit report under section 12A(b) of the Income-tax Act, 1961, in the case of charitable

or religious trusts or institutions

I have examined the balance sheet of INDIA SUDAR EDUCATIONAL AND CHARITABLE TRUST, AAATI4288G [name and PAN of the trust or institution] as at 3110312013and the Profit and loss account for the year ended on that date which are in agreement with the books of account maintained by the said trust or institution. I have obtained all the information and explanations which to the best ofrny knowledge and belief were necessary for the purposes i of the audit. In!m: opinion, proper books of account have been kept by the head office and the branches of the abovenamed trust visited by me so far as appears from ~ examination of the books, and proper Returns adequate for the purposes of audit have been received from branches not visited by me , subject to the comments given below: NIL In ~ opinion and to the best of ~ information, and according to information given to me , the said accounts give a true and fair view(i) in the case of the balance sheet, of the state of affairs of the above named trust as at 31103/2013 and (ii) in the case of the profit and loss account, of the profit or loss of its accounting year ending on 31103/2013 The prescribed particulars are annexed hereto. Place Date chennai -17 06/03/2014

~~REB ABU

026488 # 26. CHARI STREET T.NAGAR. CHENN AI - 600017

1. Amount of incom charitable or relig ~) 2. Whether tli~~l ' .. I~ (2) of the Explanation to-se ti of the amount ~'income deeme .to ha ~.~ . ""f.,"/~ ._~ charitable or religious'purposes ij}:r . year (l(') 3. Amount of income accumulat to charitable or religious purposes, to t ent it does not exceed 15 per cent of the income derived from property held under trust wholly for such-purposes. (l(') 4. Amount of income eligible for exemption under section 11(1)(c) (Give details) 5. Amount of income, in addition to the amount referred to in item 3 above, accumulated or set apart for specified purposes under section II (2) ( ~) 6. Whether the amount of income mentioned in item 5 above has been invested or deposited in the manner laid down in 7.

No -----------------0

No ---------------------

section 11(2)(b ) ? If so, the details thereof. Whether any part of the income in respect of which an No option was exercised under clause (2) of the Explanation to --------------------section 11(1) in any earlier year is deemed to be income of the previous year under section 11(IB)? Ifso, the details thereof ( ~) 8. Whether, during the previous year, any part of income accumulated or set apart for specified purposes under section 11(2) in any earlier year(a) has been applied for purposes other than charitable or No religious purposes or has ceased to be accumulated or --------------,-------set apart for application thereto, or (b) has ceased to remain invested in any security referred to in section I 1(2)(b )(i) or deposited in any account No -----------.----------

referred to in section 11(2)(b )(ii) or section 11(2)(b) (iii), or No (c) has not been utili sed for purposes for which it was accumulated or set apart during the period for which it was to be accumulated or set apart, or in the year immediately following the expiry thereof? If so, the details thereof II. APPLICATION OR USE OF INCOME OR PROPERTY FOR THE BENEFIT OF PERSONS REFERRED 1. Whether any part of the income or property of the trust was lent, or continues to be lent, No in the previous year to any person referred to in section I 3(3Hhereinafier referred to in this Annexure as such person)? If so, give details of the amount, rate of interest charged and the nature of security, if any. 2. Whether any land, building or other property of the trust was made, or continued to be made, available for the use of any such person during the previous year? If so, give details of the property and the amount ofrent or compensation charged, if any. Whether any payment was made to any such person during the previous year by way of salary, allowance or otherwise? If so, give details Whether the services of the trust were made available to any such person during the previous year? If so, give details thereof together with remuneration or compensation received, if any No

TO IN SECTION 13(3)

3. 4.

No No

5. Whether any share, security or other property was purchased by or on behalf of the trust during the previous year from any such person? If so, give details thereof together with the consideration paid

No

..<'"~;,;.\.

s'sold b

6.

Whether any share, security or other props: during the previous year to any such per "'. consideration received

No

7.

No

8.

Place Date

chennai -17

06/03/2014

Name Membership Number FRN (Firm Registration Number) Address

~OREB ABU 026488 # 26. CHARI STREET T.NAGAR. CHENN AI- 600017

orm Filing Details evision/Original

Original

Você também pode gostar

- Career Guidance Awareness Poster - India Sudar - Part ADocumento22 páginasCareer Guidance Awareness Poster - India Sudar - Part AIndia Sudar Educational and Charitable Trust100% (1)

- Dos and Donts - Career SelectionDocumento3 páginasDos and Donts - Career SelectionIndia Sudar Educational and Charitable Trust100% (1)

- Civil Service Poster IndiasudarDocumento1 páginaCivil Service Poster IndiasudarIndia Sudar Educational and Charitable Trust100% (1)

- 05 Journalism Poster India SudarDocumento1 página05 Journalism Poster India SudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- 02 CA CMA CS Poster India SudarDocumento2 páginas02 CA CMA CS Poster India SudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- 11 Paramedical Poster IndiasudarDocumento3 páginas11 Paramedical Poster IndiasudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- 10 Medical Poster IndiaSudarDocumento1 página10 Medical Poster IndiaSudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- 06 Veterinary Poster IndiasudarDocumento1 página06 Veterinary Poster IndiasudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- 09 Fisheries Poster IndiasudarDocumento1 página09 Fisheries Poster IndiasudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- 08 B.Voc Poster IndiasudarDocumento1 página08 B.Voc Poster IndiasudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- 07 Agri Poster IndiasudarDocumento2 páginas07 Agri Poster IndiasudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- 04 Teaching Poster IndiasudarDocumento1 página04 Teaching Poster IndiasudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- India Sudar Tax Filed Statement FY 2018-19Documento8 páginasIndia Sudar Tax Filed Statement FY 2018-19India Sudar Educational and Charitable TrustAinda não há avaliações

- India Sudar CSR1 Registration Number Approval LetterDocumento1 páginaIndia Sudar CSR1 Registration Number Approval LetterIndia Sudar Educational and Charitable TrustAinda não há avaliações

- 03 Defense Poster IndiasdarDocumento4 páginas03 Defense Poster IndiasdarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- Indiasudar Science Experimental Based Learning and Awareness (SEBLA) Project Plan 2017 - 18Documento6 páginasIndiasudar Science Experimental Based Learning and Awareness (SEBLA) Project Plan 2017 - 18India Sudar Educational and Charitable TrustAinda não há avaliações

- 01 Laywer Poster India SudarDocumento1 página01 Laywer Poster India SudarIndia Sudar Educational and Charitable TrustAinda não há avaliações

- India Sudar - Rainwater Harvesting MethodDocumento16 páginasIndia Sudar - Rainwater Harvesting MethodIndia Sudar Educational and Charitable TrustAinda não há avaliações

- IndiaSudar SEBLA - Karur DT Approval From Education Dept - Elementary Section - Academic Year 2017-18Documento1 páginaIndiaSudar SEBLA - Karur DT Approval From Education Dept - Elementary Section - Academic Year 2017-18India Sudar Educational and Charitable TrustAinda não há avaliações

- India Sudar - Science Experimental Based Learning and Awareness - Ebook - OCPL - Ver 2.0Documento110 páginasIndia Sudar - Science Experimental Based Learning and Awareness - Ebook - OCPL - Ver 2.0India Sudar Educational and Charitable Trust100% (1)

- India Sudar Tax Filed Statement FY 2017-18Documento8 páginasIndia Sudar Tax Filed Statement FY 2017-18India Sudar Educational and Charitable TrustAinda não há avaliações

- India Sudar Tax Filed Statement FY 2019-20Documento8 páginasIndia Sudar Tax Filed Statement FY 2019-20India Sudar Educational and Charitable TrustAinda não há avaliações

- India Sudar Educational and Charitable TrustDocumento2 páginasIndia Sudar Educational and Charitable TrustIndia Sudar Educational and Charitable TrustAinda não há avaliações

- Indiasudar Science Experimental Based Learning and Awareness (SEBLA) BookDocumento108 páginasIndiasudar Science Experimental Based Learning and Awareness (SEBLA) BookIndia Sudar Educational and Charitable Trust100% (1)

- India Sudar Tax Filing & FCRA For 2016-17Documento12 páginasIndia Sudar Tax Filing & FCRA For 2016-17India Sudar Educational and Charitable Trust100% (1)

- IS TaxFile FCRA 2012-13Documento8 páginasIS TaxFile FCRA 2012-13India Sudar Educational and Charitable TrustAinda não há avaliações

- IndiaSudar SEBLA - Karur DT Approval From Education Dept - High Schools - Academic Year 2017-18Documento1 páginaIndiaSudar SEBLA - Karur DT Approval From Education Dept - High Schools - Academic Year 2017-18India Sudar Educational and Charitable Trust100% (1)

- 2015-16 - IS Income Tax Return and FCRA FC4Documento12 páginas2015-16 - IS Income Tax Return and FCRA FC4India Sudar Educational and Charitable TrustAinda não há avaliações

- IS TaxFile FCRA 2013-14Documento8 páginasIS TaxFile FCRA 2013-14India Sudar Educational and Charitable TrustAinda não há avaliações

- India Sudar Income Tax Return and FCRA FC4 - 2014-15 PDFDocumento11 páginasIndia Sudar Income Tax Return and FCRA FC4 - 2014-15 PDFIndia Sudar Educational and Charitable TrustAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Income Tax Individual Sample ProblemsDocumento13 páginasIncome Tax Individual Sample Problemscharlene marie goAinda não há avaliações

- Aaaaj5854c Q1 Ay201819 16aDocumento2 páginasAaaaj5854c Q1 Ay201819 16aAnonymous V0UxsCdZo9Ainda não há avaliações

- House Property-Income TaxDocumento26 páginasHouse Property-Income TaxSwetaAinda não há avaliações

- Authorization For Release of Photocopies of Tax Returns And/or Tax InformationDocumento2 páginasAuthorization For Release of Photocopies of Tax Returns And/or Tax InformationAsjsjsjsAinda não há avaliações

- Final Report RohiniDocumento31 páginasFinal Report RohiniSagar BitlaAinda não há avaliações

- AKDocumento4 páginasAKAadil KakarAinda não há avaliações

- TDG Insurance Management and Agency, Inc.: Payment InstructionDocumento2 páginasTDG Insurance Management and Agency, Inc.: Payment InstructionLj JadulcoAinda não há avaliações

- How To Configure Ebtax For Vat TaxDocumento17 páginasHow To Configure Ebtax For Vat TaxKaushik BoseAinda não há avaliações

- Buckwold20e Solutions Ch06Documento93 páginasBuckwold20e Solutions Ch06Aman Lottay100% (1)

- Aamir, M., Qayyum, A., Nasir, A., Hussain, S., Khan, K. I., & Butt, S. (2011) - Determinants of Tax Revenue A Comparative Study of Direct Taxes and Indirect Taxes of Pakistan and India. InternationDocumento1 páginaAamir, M., Qayyum, A., Nasir, A., Hussain, S., Khan, K. I., & Butt, S. (2011) - Determinants of Tax Revenue A Comparative Study of Direct Taxes and Indirect Taxes of Pakistan and India. InternationManjunathNagarajuAinda não há avaliações

- Skyquad Electronics Pay Slip TitleDocumento2 páginasSkyquad Electronics Pay Slip Titlerahul rahulAinda não há avaliações

- MySST User Manual Return and Payment 140720Documento117 páginasMySST User Manual Return and Payment 140720kutang bakasAinda não há avaliações

- RI22507945 - Dec 28 2022 - 183245Documento2 páginasRI22507945 - Dec 28 2022 - 183245vijayAinda não há avaliações

- Bahasa Inggris PPHDocumento9 páginasBahasa Inggris PPHRiska UsmawardaniAinda não há avaliações

- Interview Questions For Bir: AnswerDocumento3 páginasInterview Questions For Bir: AnswerTiffAinda não há avaliações

- Oregon Income Tax Instructions and SchedulesDocumento36 páginasOregon Income Tax Instructions and SchedulesStatesman JournalAinda não há avaliações

- Ifrs at A Glance: IAS 12 Income TaxesDocumento4 páginasIfrs at A Glance: IAS 12 Income Taxeslina_siscanu6356Ainda não há avaliações

- Tax02 04 Corporate Income Taxation EncryptedDocumento11 páginasTax02 04 Corporate Income Taxation EncryptedRalph Adian Tolentino0% (1)

- Tax Invoice: TIN#: 1000145GST501Documento1 páginaTax Invoice: TIN#: 1000145GST501aishathAinda não há avaliações

- Ds Policy Schedule 11230218156300 v1.0 Removed RemovedDocumento1 páginaDs Policy Schedule 11230218156300 v1.0 Removed RemovedBalaji ArumugamAinda não há avaliações

- (ACCLIME) Quick Guide - Vietnam Capital Gains 2023Documento1 página(ACCLIME) Quick Guide - Vietnam Capital Gains 2023Khoi NguyenAinda não há avaliações

- Tax invoice detailsDocumento1 páginaTax invoice detailsParth DamaAinda não há avaliações

- MIDTERM Long Quiz - Theories Answer KeyDocumento2 páginasMIDTERM Long Quiz - Theories Answer KeyKristine NunagAinda não há avaliações

- Philippine Legal Guide - Tax Case Digest - CIR v. Isabela Cultural Corp. (2007)Documento3 páginasPhilippine Legal Guide - Tax Case Digest - CIR v. Isabela Cultural Corp. (2007)Fymgem AlbertoAinda não há avaliações

- F 13551Documento2 páginasF 13551IRSAinda não há avaliações

- Edy Transport Limited invoices Steel Trans Ltd £7,260 for deliveriesDocumento21 páginasEdy Transport Limited invoices Steel Trans Ltd £7,260 for deliveriesDon SniperAinda não há avaliações

- VAT Concept MapDocumento9 páginasVAT Concept MapMuadz HassanAinda não há avaliações

- Quizzer Tax Percentage Tax - CompressDocumento14 páginasQuizzer Tax Percentage Tax - CompressChristian Jade Siccuan AglibutAinda não há avaliações

- OrderAck - CV AnboDocumento2 páginasOrderAck - CV AnboAndi ApriadiAinda não há avaliações

- What Is A Fiscal Deficit?: and Why You Should Care About It..Documento1 páginaWhat Is A Fiscal Deficit?: and Why You Should Care About It..Sulav SheeAinda não há avaliações