Escolar Documentos

Profissional Documentos

Cultura Documentos

Mub gb03 English444

Enviado por

Olga GotmaniucTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Mub gb03 English444

Enviado por

Olga GotmaniucDireitos autorais:

Formatos disponíveis

w

o

r

k

i

n

g

w

i

t

h

a

l

l

s

e

n

s

e

s

2003

annual report

marquard & bahls ag 5

)

r e m a i n c u r i o u s !

. . . r e m a i n c u r i o u s !

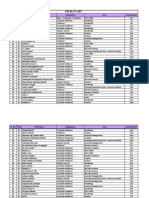

group figures million million US$ million million

marquard & bahls

Consolidated revenues (petroleum tax deducted) 4,320 5,445 3,992 4,071

Cash flow 99 125 94 121

Income before income taxes 46.7 58.9 61.3 73.2

Net income 22.6 28.5 33.4 40.6

Fixed and financial assets (Book value) 623 785 593 638

Equity 267 337 317 332

Employees 1,771 1,559 1,464

mabanaft

External Sales (in million t) 14 13 12

oiltanking

Tank capacity (in million cbm, April 2004) 10.3 9.7 9.6

Throughput (in million t) 94.9 85 83

.

20

03

20

03

20

02

20

01

.

.

.

.

.

.

.

.

.

pp

r e m a i n c u r i o u s !

. . . r e m a i n c u r i o u s !

2 0 0 3

s e e t h e c o n n e c t i o n s . . .

k e e n l y s y n c h r o n i z e e v e r y t h i n g . . .

h a v e a f e e l i n g f o r p e o p l e a n d f e a s i b i l i t y . . .

g e t o n s o m e o n e s t r a i l . . .

1 )

3 )

4 )

5 )

an eventful year is over and we are very pleased to be able to guide you

with all our senses through this years retrospect and outlook of the

development of our company, just as our five senses guide us through our

work day after day.

working with all senses

a

t

m

a

r

q

u

a

r

d

&

b

a

h

l

s

5 )

h a v e o n e s e a r s a l l o v e r t h e p l a c e . . .

2 )

marquard & bahls ag

independent, sound, individual

These are the qualities that characterize more than 50 years of

successful operation in the international oil business by the

Marquard & Bahls Group. Today, our Mabanaft subsidiary is the

largest independent petroleum-products trader in northwestern

Europe, while Oiltanking is the worlds second-largest indepen-

dent operator of tank terminals for petroleum products, petro-

chemicals, gases, and other liquids. Beyond that, we continue

successful operations in service stations, heating-oil deliveries to

end users, energy-services contracting, aviation refueling, bunker

supplies, renewable energy and petroleum analysis.

As a privately held, joint-stock company, we are pursuing a

carefully controlled, long-term growth course. A sound financial

basis and flat organizational structure, coupled with decision-

making authority delegated to the individual operating sites, has

allowed us to respond quickly and flexibly to market requirements

and thereby satisfy our customers needs.

at Marquard & Bahls. As a firm devoted to sustainable growth,

we are fully aware of the responsibility associated with trading

in petroleum and other sensitive products. It is for this reason

that conscientious health, safety and environmental policies

receive our highest priority.

Individual thinking, commitment to cooperation

and enthusiasm for their work unite the people

A u d i t o r s o p i n i o n . . . p a g e 4 6

F i n a n c i a l s t a t e m e n t s . . . p a g e 4 7

O r g a n i g r a m . . . p a g e 6 4

F o r e w o r d . . . p a g e 6

T h e s t a t e o f t h e c o r p o r a t i o n . . . p a g e 1 0

M a b a n a f t . . . p a g e 1 4

O i l t a n k i n g . . . p a g e 2 4

S k y t a n k i n g . . . p a g e 3 6

G E E . . . p a g e 3 8

n a t G A S . . . p a g e 4 0

G M A . . . p a g e 4 2

H S E . . . p a g e 4 4

1 )

2 )

3 )

4 )

5 )

5 )

w o r k i n g w i t h a l l s e n s e s

Wi m L o k h o r s t Dr . Cl a u s - Ge o r g Ne t t e

However, in anticipation of the potential war in Iraq, Mabanaft

had begun, in August 2002, to establish an options structure that

could be liquidated at a profit in 2003.

With an eye toward continuing our policies of controlled growth

in coming years, we have adopted a new financing model as a

supplement to traditional bank financing. One of the first German

companies to do so, our Oiltanking tank-storage business has

issued notes amounting to 130 million U.S.$ through a private

placement in the U.S. market. The volume offered to the market

was oversubscribed, demonstrating the attractiveness of the

company to international institutional investors.

In the many years during which Hellmuth Weisser, as chairman

of the executive board, made his mark on the content and appea-

rance of our annual reports, those publications became an impor-

tant component in our corporate image among customers, banks

and employees. In this annual report, we wish to continue that

tradition.

and identify new opportunities. The keenness of our five senses

helps us to translate these changes into concrete objectives and

programs for action. In addition, our instincts can be the decisive

factor in actually embarking upon a carefully considered business

risk, deciding in favor of a particular operating site or defining the

scope for a new investment. These instincts are what we at

Marquard & Bahls might characterize as our sixth sense.

Making use of all of these senses, our employees and owners have

developed a high level of commitment to Marquard & Bahls. It is

their dedication, worldwide, that has made Marquard & Bahls

what it is today.

F o r e w o r d 6 / 7

Every day, we at Marquard & Bahls take note of

customer wishes, observe market developments

M a r q u a r d & B a h l s A G

In the report for the 2003 business year now in your hands, we

are upholding the high levels of quality and creativity established

by our previous annual reports. This year, we have chosen "The

five senses as the centerpiece topic. Day in and day out, these

senses prompt us to assess, to decide and to act. Our task is to

logically organize the information our senses perceive in order to

make complex decisions. This is true for us both as human beings

and as organizations. But decision making always must be efficient

and effective for an organization to achieve success.

It was in this spirit that we entered the year 2003, although it was

by no means an easy year for our industry. Most of the first half

of the year was overshadowed by the Iraq conflict, and this

complicated the parameters for our trading activities.

Foreword

the ability of each and every employee to process acquired knowledge,

experience and actual information with all his or her senses makes the

success of our company possible in the first place.

E x e c u t i v e B o a r d Ma r q u a r d & B a h l s A G , J u n e 2 0 0 4

5 )

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

M a r q u a r d & B a h l s A G

w o r k i n g w i t h a l l s e n s e s

G r o u p l o c a t i o n s 8 / 9

marquard & bahls group locations

. In operation

19992003

5 )

w o r k i n g w i t h a l l s e n s e s

S t a t e o f t h e c o r p o r a t i o n 1 0 / 11 M a r q u a r d & B a h l s A G

Corporate pre-tax profits, at 46.7 million Euros, fell short of the

record postings of previous years.

All in all, we are quite satisfied with the results we achieved.

The risk mix for the corporations two primary business sectors,

petroleum-products trading and tank storage, has once again

proved to be well balanced and stable. As in past years, both

of these activities have made almost equal contributions to our

final results.

In the trading sector, however, accounting rules regarding

closing dates reduced the years results. Goods and contracts

on hand at year-end show above-average reserves when

compared with previous years.

The state of the corporation

mineral oil trading and the commercial terminal storage of mineral oil,

chemicals and gas as well as other liquids once again built the funda-

ment for the worldwide success of the marquard & bahls group in the

year 2003.

.

.

By contrast, many of the foreign holdings in the Oiltanking

division are very sensitive to exchange rates. Due to the drastic

devaluation of the U.S. dollar (U.S.$) and Singapore dollar

(S$) against the Euro, the local results, which in some cases

showed significant improvement, are not reflected appro-

priately in the consolidated figures.

The exchange-rate effect mentioned above also has prompted

currency adjustments in the corporate balance sheets. We

invest in both tangibles and financial assets in the currency

in which the particular subsidiary invoices normally the

local currency. Following standard procedures, we do not

hedge our long-term fixed assets against exchange-rate risks

because our investments adhere to our long-term strategies

and harmonize with our long-term business policies.

business, but it also makes a good starting point for expansion

into adjacent new fields of business in which we can use our

existing expertise. An example is our acquisition of Proenergy and

expansion into the energy-services sector, which is very closely

related to our trading activities. We also were able to further

expand our still-new aviation-refueling sector last year, and we

are looking forward to further positive developments in 2004. In

the field of renewable energy, we are pursuing projects that apply

the corporations sales and logistical competence.

The corporation grew again in this reporting year. Citing just a

few examples, we commenced construction of Oiltankings new

chemical tank terminal in Terneuzen, Netherlands, and expanded

our storage facilities in Amsterdam, Antwerp, Houston and

Singapore. Worthy of particular mention is Mabanafts acquisition

of two trading firms in Austria. Our investment activity remained

high and was mainly financed internally, from cash flow, at

99 million Euros.

.

.

Not only does our proven distribution of risk

form the basis for further development of existing

FI XED AND FI NANCI AL ASSETS

(in million )

at cost book value

20

00

20

01

20

02

20

03

19

99

4

0

0

8

4

0

5

9

3

1

,2

3

5

6

2

3

1

,3

1

0

6

3

8

1

,2

6

9

4

6

8

9

6

5

19992003

S t a t e o f t h e c o r p o r a t i o n

prospects of 2004

Due to our recent growth, several projects remain in the develop-

ment, start-up or restructuring phase. At present, these projects

are generating costs, and they are expected to generate profits

only in the medium term. Over the medium and long terms we will

continue to pursue our successful course of targeted and controlled

growth. We also will continue negotiations that are now in an

advanced stage. For example, Oiltankings more highly developed

projects, with realization expected soon, are its investments in

China, in the countries of the former Soviet Union, in Brazil and

in Mexico. Mabanaft currently is establishing a retail business

along the East Coast of the United States.

In upcoming years, we will continue our gradual, comprehensive

modernization of IT services throughout the corporation. With

these efforts, we will create greater data security and more-

streamlined processes. This is another step toward ensuring the

competitiveness of all of our operations even in markets charac-

terized by continuous change.

German accounting law requires listed companies to draw up

their annual reports in accordance with the IFRS rules (Interna-

tional Financial Reporting Standards) beginning in 2005.

Although our shares are not traded on the stock market, we

intend to prepare the consolidated balance sheets in accordance

with IFRS as of 2005. In light of the increasing globalization of

our business, we believe that IFRS accounting in the international

setting will offer greater comparability with other companies.

We see ourselves as well positioned to meet the challenges of the

future.

M a r q u a r d & B a h l s A G 1 2 / 1 3

RETURN ON EQUI TY

(in percent)

before taxes net

20

00

20

01

20

02

20

03

19

99

2

1

.1

2

8

.4

1

7

.5

2

8

.1

1

3

.9

2

5

.1

1

0

.1

1

8

.5

8

.1

1

6

.7

19992003

CASHFLOW AND I NVESTMENTS

(in million )

Cash flow Investments

20

00

20

01

20

02

20

03

19

99

1

0

8

8

9

9

7

9

4

1

1

2

9

9 1

1

2

1

2

1

2

3

6

1

4

9

t o d e t e c t

c o n n e c t i o n s

t h e

prospects of 2004

Due to our recent growth, several projects remain in the develop-

ment, start-up or restructuring phase. At present, these projects

are generating costs, and they are expected to generate profits

only in the medium term. Over the medium and long terms we will

continue to pursue our successful course of targeted and controlled

growth. We also will continue negotiations that are now in an

advanced stage. For example, Oiltankings more highly developed

projects, with realization expected soon, are its investments in

China, in the countries of the former Soviet Union, in Brazil and

in Mexico. Mabanaft currently is establishing a retail business

along the East Coast of the United States.

In upcoming years, we will continue our gradual, comprehensive

modernization of IT services throughout the corporation. With

these efforts, we will create greater data security and more-

streamlined processes. This is another step toward ensuring the

competitiveness of all of our operations even in markets charac-

terized by continuous change.

German accounting law requires listed companies to draw up

their annual reports in accordance with the IFRS rules (Interna-

tional Financial Reporting Standards) beginning in 2005.

Although our shares are not traded on the stock market, we

intend to prepare the consolidated balance sheets in accordance

with IFRS as of 2005. In light of the increasing globalization of

our business, we believe that IFRS accounting in the international

setting will offer greater comparability with other companies.

We see ourselves as well positioned to meet the challenges of the

future.

p r o s p e c t s

1

)

pay attention, explore, learn, deliberate, view through ones

own eyes, truthfulness, reliability, trust, something makes

sense, the strength of persuasion, decision.

2003

5 )

M a b a n a f t

Northwestern Europe represents the historical basis for our

strong trading position. Within this region, Mabanaft is one of the

leading independent importers and wholesalers for petroleum

products. This position has resulted in Mabanaft having more

than 13.7 million tons in outside sales in 2003 (13.1 million tons

last year).

Mabanafts business encompasses international cargo trade,

import operations, local wholesaling and regional distribution. Its

international trading operations not only offer an option for

uninterrupted supply, but also contribute to optimal risk diversi-

fication.

t h i n k v i s i o n a r i l y

w o r k i n g w i t h a l l s e n s e s

Britain, the Benelux countries and Switzerland together with

our new activities in southeastern Europe, we can respond

quickly and flexibly to our customers needs and demands.

With a unique and extensive network of our own delivery points

and those we have secured under long-term lease agreements,

Mabanaft has, for decades, helped to guarantee that customers

and suppliers alike maintain the liquidity necessary in the Euro-

pean markets. This function is of particular importance in light of

the strong concentration of the major oil companies in Europe

and in the inland markets beyond the ARA region. Mabanaft is

successful in serving its wholesale and retail customers depend-

ably, over the long term, with a network of 40 sales offices and

about 100 delivery terminals. Here, our employees keep a sharp

eye on market developments, have an instinctive feeling for

opportunities and risks, a steady hand in business management

and, last but not least, an open ear for our customers.

Thanks to their independence from individual suppliers and their

enduring presence in the markets, our trading subsidiaries are

always in a position to absorb or shed market volumes. Our inde-

pendence also makes it possible to serve all of the market players

equitably and at competitive terms.

The first half of the past year was impacted, above all, by the Iraq

crisis, which produced extreme price fluctuations. In March, the

price of gas oil swung by more than 100 US$ per metric ton, while

diesel fuel in some periods was traded at a premium of 130 US$

per metric ton above the gas oil price posted at the IPE. In

Germany, the price for diesel at the pump rose, for the first time

in history, to more than one Euro per liter, despite the preferential

tax rate for this fuel.

O i l t r a d i n g 1 4 / 1 5

Thanks to our traditionally strong logistical

position in our core markets Germany, Great

Mabanaft

as the largest independent importer and wholesaler in northwestern europe,

mabanaft has earned a good reputation across border lines. the trading

organization of the marquard & bahls group internationally deals as a

cargotrader with a strong anchorage on the east european countries and

in the usa.

PRICE GASOIL BARGES PLATTS FOB ARA AND

IPE-GASOIL (in US$/tons)

Gasoil price

jan. 1

03

mar. 12

03

apr. 23

03

june 4

03

jul. 30

03

sep. 24

03

nov. 19

03

dec. 31

03

350

300

250

200

150

100

50

0

5 )

oil trading germany

w o r k i n g w i t h a l l s e n s e s

O i l t r a d i n g 1 6 / 1 7 M a b a n a f t

p l a n f o r e s i g h t e d l y

An extensive infrastructure and solid financial

base are among the fundamental preconditions for

Our trading division successfully counteracted these price

fluctuations by shouldering a limited degree of risk and applying

prudent risk management. In light of the potential for conflict in

Iraq, Mabanaft had, by August 2002, set up an options

structure that was profitably liquidated at the beginning of the

reporting year.

The low water levels in the Rhine and Danube burdened the Euro-

pean market, especially in the second half of the year. The Rhine,

in particular, reached historic lows, severely restricting river traffic.

The resulting high freight costs for inland shipping created a

difficult market environment for our trading subsidiaries, which

transport a large share of the products they trade by way of the

Rhine and the Danube. We are particularly proud of our employees

who, by renting considerable numbers of railroad tank cars, were

able not only to maintain our delivery capabilities, but even to

expand them. The experience showed us that the railroads must

significantly increase their flexibility if they are to become a

serious and sustainable alternative to river transportation.

The success of our trading units, despite these difficult operating

parameters, is a great achievement. Controlled risk management

and our deliberate adherence to physical trading, with all its

interfaces in transportation, storage and logistics, have proven

their merit once again.

any successful trading activity. But our resounding long-term suc-

cess rests, above all, upon human performance. Our employees

dedication, loyalty and steady nerves in the face of difficult market

conditions are what made our successes possible and permit us

to look with confidence to the challenges of the future.

oil trading

mabanaft international

Mabanaft International reported a successful year. Profits excee-

ded those of the previous year, and volumes, drawn primarily from

Russia, once again rose significantly. This is a major success in

light of the reorientation and consolidation of the Russian oil

companies. Maintaining our own tank-terminal infrastructure in

the ARA region also has expanded our options for international

trading and contributed to the years good results. Establishing

our own base on the American East Coast will further expand our

options.

mabanaft germany

Particularly during the first half of the business year just concluded,

Mabanaft Germany operated successfully in the market, despite

the difficult environment. Prudent risk management and the use

of available infrastructure were the cornerstones for good

returns. Also contributing to the positive results were the supply

and delivery contracts already in place. Particularly during low-

water periods, with the associated higher barge-freight rates, our

10-year contract for the use of the RMR pipeline proved to be

especially beneficial. The RMR pipeline links Rotterdam with

major industrial sites in western Germany.

Despite a slight decline in sales due to strong competition in the

gas market, the fuel-oil trade was once again successful last

year. Mabanaft Germany not only posted very satisfactory results,

but also further expanded its market position in Germany. Our fuel-

oil trade operations also are well positioned for the future. Thus, it

was possible to conclude a new sales contract with a large

producer in northern Germany. This will further strengthen

Mabanafts trading position in that region.

.

.

5 )

oil trading northwestern europe

oil trading northwestern europe

oil trading northwestern europe

oil trading southeastern europe

oil trading international

oil trading southeastern europe

oil trading southeastern europe

w o r k i n g w i t h a l l s e n s e s

mabanaft moldova | tirex

Mabanaft Moldova/Tirex is firmly rooted in the Moldovian market

and, along with our business in Hungary, is an important bridge-

head to the Balkan region and the adjoining countries in the CIS,

which we see as a promising market.

mabanaft hungary

In just the second year after its founding, Mabanaft Hungary

broke even. Trading volumes rose continuously, and the tank ter-

minal acquired by Oiltanking in Budapest ensures that Mabanaft

Hungary will have access to an independent storage terminal that

is indispensable for successful operations. Therefore, the company

is well prepared to further expand its presence in the Hungarian

market and beyond.

mabanaft inc.

In 2004, we will expand our trading activities in the U.S.A. We

already are laying the groundwork for opening an office on the

East Coast. In the course of fiscal year 2004, Mabanaft Inc. will

launch its wholesale and retail activities in heating oil on the East

Coast, the worlds largest and most liquid market for that product.

We also are preparing for trade in gasoline and middle distillates.

O i l t r a d i n g 1 8 / 1 9 M a b a n a f t

k e e p t r a c k o f s o m e t h i n g

.

.

.

mabanaft bv

After a difficult start, Mabanaft BV, Rotterdam, closed the year

with superb results. Since reviving and reorienting activities in

Rotterdam, beginning three years ago, Mabanaft has once again

become an active and highly regarded player in the barge business

from Rotterdam. We see this as a commendable accomplishment

by our local decision makers.

mabanaft switzerland

Mabanaft Switzerland was able to further stabilize its position as

one of the leading independent dealers in Switzerland, despite

the difficulties of deliveries made on the Rhine. Through our

cooperative efforts with other independents and, above all, with

our other trading companies, we will further expand the market

position enjoyed by our Swiss trading company.

mabanaft ltd.

Our trading company in the British Isles, Mabanaft Ltd., has become

a permanent fixture among independent trading firms in Great

Britain. In the most recent business year, Mabanaft Ltd. expanded

its supply and customer portfolio beyond the traditional major

customers the supermarkets that dominate the gasoline business.

Our English subsidiary is now even better prepared to meet future

challenges.

mabanaft austria

To compensate for the steady decline in oil demand in north-

western Europe, we have, in recent years, built our own network

in southeastern Europe and thus expanded our geographic reach.

In the interest of strengthening our activities in southeastern

Europe, Mabanaft last year acquired an existing trading company

in Austria, which is now operating as Mabanaft Austria. Conse-

quently, we are represented in southeastern Europe with our own

trading companies in Austria, Hungary and Moldova.

.

.

.

.

t o f o c u s n e w m a r k e t s

5 )

oil trading service stations

oil trading heating-oil end users

w o r k i n g w i t h a l l s e n s e s

service stations

Our network of service stations has grown to more than 200 in

Germany, Switzerland and Austria. In the future, we will market

our service stations consistently and uniformly under the OIL!

brand and strengthen our service-station network in individual

locales.

previously operated under the brand of bft, all of them now

display the OIL! trademark. Customer response to the new and uni-

form market presence was extremely positive. The service stations

in Switzerland were included in this restructuring. Unprofitable

stations either were sold or closed. And, as of 2004, the outlets

in Switzerland also will market under the OIL! brand name.

We have begun to establish a small network of service stations in

Austria. Three of these stations already are operating and also

carry the OIL! brand. In addition, we have concluded an agree-

ment to take over 14 additional stations in 2004, which also will

be rebranded to OIL!.

R e t a i l i n g 2 0 / 2 1

Consistent with this policy, this year we rebranded

all of our service stations in Germany that were

Overall sales in the end-user market reached

more than 2.1 million metric tons for the first

M a b a n a f t

f a c e u p t o t h e f a c t s

retailing

We have continuously expanded our retail activities in recent

years. We are involved in both motor-fuels retailing and, through

our Petronord sub-holding, the end-user market for heating oil.

We focus particularly on the European market, with emphasis on

Germany, Austria, Switzerland and England. With Matrix Marine

Fuels, we also operate a classical bunkering business along the

Gulf of Mexico and in Guatemala.

time last year. Thus, we have achieved our goal of selling 15 per-

cent of our wholesale volume through our own distribution channels.

Consequently, 2004 will be characterized by consolidation, which

we already have initiated.

heating-oil end users

Strong demand during the first half of the year followed, regret-

tably, by significantly lower demand in the second half kept sales

volumes for heating oil in Germany more or less at the previous

years level. Thanks to strict cost management, while exploiting

synergies among the retail companies associated with Petronord,

we were able to achieve better bottom-line results than in the

prior reporting period.

Reorganization of the groups activities in Switzerland initially

resulted in lower sales, but put retail-trading activities in a good

position for the future.

Our retail unit in England, operating under the BWOC name, had

a very successful year. A clear strategy, fully committed manage-

ment and strict cost control produced yet another improvement

in results when compared with past years.

Applying the strategy that already has proven its efficacy in

Germany that of acquiring our own retail-distribution channels

as outlets for wholesale activities Mabanaft acquired, at the

beginning of 2004, a 50 percent share in the Manfred Mayer

MMM Minerall Vertriebsgesellschaft m.b.H., a well-established

retail organization in Austria.

.

.

h a v e t h e o b j e c t i v e s i n v i e w

MDA0DSUl Q3Jl YXRpb25EYXRl Oi BUdWUgTm92I CA1I DEzOj A0Oj I 4I DE5OTENJSVWTXVzYWdl

Oi AzNj c3OSA0NzY3MQ0l JSBUaGUgZGl naXRhbGx5I GVuY29kZWQgbWFj aGl uZSByZWFkYWJs

ZSBvdXRsaW5l I GRhdGEgZm9yI HByb2R1Y2l uZyB0aGUgDSUl I FR5cGVmYWNl cyBwcm92aWRl

ZCBhcyBwYXJ 0I G9mI Hl vdXI gbGFz ZXI gcHJ pbnRl ci BpcyBj b3B5cml naHRl ZCAoYykgMT k4

MSANJSUgTGl ub3R5cGUt SGVsbCBBRyBhbmQvb3I gaXRzI HN1YnNpZGl hcml l cy4gQWxsI FJp

Z2h0cyBSZXNl cnZl ZC4gVGhpcyBkYXRhI Gl zI A0l J SB0aGUgcHJ vcGVydHkgb2YgTGl ub3R5

cGUtSGVsbCBBRyBhbmQgbWF5I G5vdCBi ZSByZXByb2R1Y2VkLCB1c2VkLCANJSUgZGl zcGxh

eWVkLCBt b2RpZml l ZCwgZGl zY2xvc2VkI G9yI HRyYW5zZmVycmVkI HdpdGhvdXQgdGhl I GV4

cHJl c3Mgd3JpdHRl bi ANJSUgYXBwcm92YWwgb2YgTGl ub3R5cGUtSGVsbCBBRy4gMTI gT3B0

aW1hKi BSb21hbi AwNTI wMyANJSUgT3B0aW1hI Gl zI GEgdHJhZGVt YXJr I G9mI Expbm90eXBl

LUhl bGwgQUcgYW5kL29yI Gl 0cyBzdWJzaWRpYXJpZXMuDUZvbnREaXJl Y3RvcnkvT3B0aW1h

I Gtub3duey9PcHRpbWEgZml uZGZvbnQgZHVwI C9Vbml xdWVJRCBr bm93bntkdXAgL1VuaXF1

ZUl EI Gdl dCAxMDU1NzA4I GVxI GV4Y2ggL0ZvbnRUeXBl I Gdl dCAxI GVxI GFuZH17cG9wI GZh

bHNl fWl mZWxzZSANe3NhdmUgdHJ1ZX17ZmFsc2V9aWZl bHNl fXtmYWxzZX1pZmVsc2UNMTEg

ZGl j dCBi ZWdpbg0vRm9udEl uZm8gMTAgZGl j dCBkdXAgYmVnaW4NL3Zl cnNpb24gKDAwMS4w

MDQpI HJl YWRvbmx5I GRl Zg0vTm90aWNl I ChDb3B5cml naHQgKGMpI DE5ODUsI DE5ODcsI DE5

ODksI DE5OTEgQWRvYmUgU3l zdGVtcyBJbmNvcnBvcmF0ZWQuQWxsI FJpZ2h0cyBSZXNl cnZl

ZC5PcHRpbWEgaXMgYSB0cmFkZW1hcmsgb2YgTGl ub3R5cGUtSGVsbCBBRyBhbmQvb3I gaXRz

I HN1YnNpZGl hcml l cy4pI HJ l YWRvbmx5I GRl Zg0vQ29weXJ pZ2h0I CggVGhl I GRpZ2l 0YWxs

eSBl bmNvZGVkI G1hY2hpbmUgcmVhZGFi bGUgb3V0bGl uZSBkYXRhI GZvci Bwcm9kdWNpbmcN

I HRoZSBUeXBl ZmFj ZXMgcHJvdml kZWQgYXMgcGFydCBvZi B5b3VyI Gxhc2VyI HByaW50ZXI g

aXMgY29weXJpZ2h0ZWQNI Chj KSAxOTgxI Expbm90eXBl LUhl bGwgQUcgYW5kL29yI Gl 0cyBz

dWJzaWRpYXJpZXMuIEFsbCBSaWdodHMgUmVzZXJ2ZWQuDSBUaGl zIGRhdGEgaXMgdGhl IHBy

b3Bl cnR5IG9mIExpbm90eXBl LUhl bGwgQUcgYW5kIG1heSBub3QgYmUgcmVwcm9kdWNl ZCwN

I HVzZWQsI GRpc3BsYXl l ZCwgbW9kaWZpZWQsI GRpc2Nsb3Nl ZCBvci B0cmFuc2Zl cnJ l ZCB3

aXRob3V0I HRoZQ0gZXhwcmVzcyB3cml 0dGVuI GFwcHJvdmFsI G9mI Expbm90eXBl LUhl bGwg

QUcuDSAxMi BPcHRpbWEqI FJvbWFuI DA1Mj AzI CkgcmVhZG9ubHkgZGVmDS9GdWxsTmFtZSAo

T3B0aW1hI FJvbWFuKSByZWFkb25seSBkZWYNL0ZhbWl seU5hbWUgKE9wdGl tYSkgcmVhZG9u

bHkgZGVmDS9XZWl naHQgKFJvbWFuKSByZWFkb25seSBkZWYNL0l 0YWxpY0FuZ2xl I DAgZGVm

DS9pc0ZpeGVkUGl 0Y2ggZmFsc2UgZGVmDS9VbmRl cmxpbmVQb3NpdGl vbi AtMTAwI GRl Zg0v

VW5kZXJsaW5l VGhpY2tuZXNzI DUwI GRl Zg1l bmQgcmVhZG9ubHkgZGVmDS9Gb250TmFtZSAv

T3B0aW1hIGRlZg0vRW5jb2RpbmcgU3RhbmRhcmRFbmNvZGluZyBkZWYNL1BhaW50VHlwZSAw

IGRlZg0vRm9udFR5cGUgMSBkZWYNL0ZvbnRNYXRyaXggWzAuMDAxIDAgMCAwLjAwMSAwIDBd

I HJl YWRvbmx5I GRl Zg0vVW5pcXVl SUQgMTA1NTcwOCBkZWYNL0ZvbnRCQm94ey03OCAtMj cx

I DEwMDAgOTE5fXJl YWRvbmx5I GRl Zg1j dXJyZW50ZGl j dCBl bmQNY3VycmVudGZpbGUgZWV4

ZWMNAAAI AAI AZumgvHr zEGa82z1ef P39qZ923L3g82sZE3dA8kZf KaxLOe49I JLNBmt eZKWl

c2Ai 0+AOLt mDso6AXqBj L4Qf UvWGTDu2l oJZhr hwHaygKdBXae/ R8deXi NcCENXEMSbaEH/ 0

3ve3CLDBTQ2l vr qKUMj cZJ C4mykvDzr CwJ yHoUt yFS2r XDJ Kr XQGxgHTHbTRGVDj E2u1TzZ5

q96YZt 4WCt 79pdCNmvNwl X2k7NI i Xl WUj ypn7nI YvqvLcbvQv20yQc/ 0j LAP3i xUs GEU8XFk

MPyV4nyyBqqaeDI Oywj ZHNI 4M1GT0dZb6OcGc7Twu6l QkO42Cqxdbea6NpnpWodtKxe91B86

vMzxvbSBbFAQhv7I j r +i mCH2GXbpOui vu5Hdr ahCapY9t t +5mzLyp/ EzoOYI WwPy24hKhGaJ

0g+hxecBW4l ottPMzWEduW6opBJGAmzQYGsHy8N+3zmStt2ux5I 46vUQuRX41u53vkhzR2Aj

NcUW+DhpHf t Uw3B1n/ Sl vGeXKGR4f LPFj c1dZI kcf ki bR5Vqt 5i HzOs vu3z8k5R0NbOzd1h2

osm1f WnWyj xomaPpcNx5quTzTXAwKj I i j FosYQYOdkP8UpHUN4MOqTzR06DbE5STI 4vGP/ 9F

Ar gdVRgAG7xBl ur vodPkGz8r O4F5dI ot OdzD7NBHa7/ mn89r I Uj BH7hu6vQRc0TScuD7r c4v

kWAhXKI H3HaMAeki I 1tKnAVGeN3y2yvRnWZyFzVYUuHLYzQsmXx4b759kQPVJx0mqXkWrJfa

R4yD+2EdETsXd1t T7DA40QewCcf i Ur f i / gg493AqBgPCTBm7hLJ NXgL14EKppVcTN1GBhBD2

aj KC15l r wWDPNci QTE5gkTsyQNGpHZwLoNsJ vEBl e7VRozLVHdk0EmKB2Up8BdPo2l oj 7v0a

t+PkS4B51nae+

auf Empfang sein, aufnehmen, verarbeiten, analysieren, bewerten, sich Gehr verschaffen

a-

xLOefpdNXoli

berzeugen,

PENx5quTzTXAwKjIijFosYQYOdkP8UpHx4b7

.

NCTp5REMvUdNXopYWHJRuEzkIlqV5qSK

FS7Ss1XIsFmt6zN2or6SNsb/mjFsNatgKP4LfGCQ5ee1SjSPAFn7F8EsnYN+Ij7Kl1NskcZwhyhtYeufLAHQygl/WfHB

A0l41lIStdfapZ+7ZVufekLKNmeswp524MpKJkisRJnENFI8cVpZJa+kqF7V9NTiaIzlr8G1JExP551yaR49R1+iYew

mkuS1J FwpWcNgCr Sqcc/ xcaFNxi nBLDG3gt sTFOsDG/ GWxHpPcbD3bE64VPTg76w7zl Nuzl V

t7LIxV4QtKszH/jWDyLNP379F+KlefjqkmrkKjqNK1Z0mGff+X4dRRRwoYRKMgQSmWGiJ6thF+8Dn2uctKLoNPa

BRI / r zdvA54qbf K2r DLzmH9Di 3Z299ej 6pGh+4u98pTA6s79/ MVVENCI 3y+7I MxQpI 5Q9Mgb

3yt XSdA00X1TcARA9mXxeq/ Di zLpG9+q5BdyT3ky+PJ OzXBXW/ t o5Q7N2964LCbeFI ahl 6Kt

hTmi UG0dQ7gkka2CCewxUi vt yv+l MxJ 9/ H2gj M9Vul EZm1mf VI z7xVCOUH9hs 1zuRl l j hg28

I SLt ZV6WQ/ YeS5uOue9Se5CF1053Xl NEu1bwEl GPYZZNkI VHTueMuFr i KI Ni odV1GNa8Q2He

QG7c6xcfPM2qkLvaoDSr5pAqa6zNUdNVPXZMmUcWk+bocrMD5OoEj 0R6pGf8PXoGeHgHti 7o

H28SnAheCXkr 0YOn+VwdOTU+8i i vRsI sNI S97vZHhi znLnde0l Mawhp8BK926TpKt NQ9t XV9

R0r Uj W2v6l C7y95FbS7Cxc7dZhw7KyZSUwi P0s OU+apXl Z1Os YZ23kJ 7ZKS8hR4yKL4oh9l r

s l cMOd2Pe34a0v/ EKf I FnEvUebt gnf Q7EbdkNXGFGAF1NA4LMPi R0d3ZI qS8zhf YXl 0I n2WO

RBr RuqBMMwi PM+qce4+6I 37gTr OKr 6kZLOqqmUzI W7sZr l ar t c6cY0i xqRD+VQCPovo4Ner /

BbI +mBJ r gj l NLl m0QJ PTg3I zczhbhQHs Tz3wNCX1O2m7OH+zHVas gf Si ZZ4C5Ezv3J K2Yq/ i

Hp2Rntj AEKaPOL6kWfpT0URVZk9l JI ryxyVHo+XDexOQHZBhwd7YpXBZHTAR6W9yBKDE9QA8

r qHSoKl GQspcHyGDmyt Ng8PhO+1JKl f K2r PC+EI RRj acA43o4ncybcMyRy0ZWr N5N66m/ f md

UPa4nE47uK0Enq3MJ4Tp7dQ43aVn4I AJZKMgl hraFPLPd2nMqAn6fmS6L4Wd4yXEbl mwOQcB

Kl VnYeTAvwHvwJ XSGz l 7dVol goVXPVc/ godxr CRvi J KDp0ebdT L dKoxMl WHaAl b/ 6Yf Xj SHo

gaJoTM8OPbXmsF4KvMUtBoszni m0PZt0x4HFc5sXO4SYuU1yl 5GWD5ON3EYGkh9sr f j 36ECK

0CoUI F6dk9I O2yf wT8wt l RnQel s EYaay4Qohi vv4t T2gEgGMi YVuWcpJ 1s TZE5wr Am1CUnHs

sVUmxLO9A5OfqX1y1CPLI aw0b9Aqg/ xXA15NFRb5+OFmUnKCAmM6EI f0+I Jvuxm2u06u8gqt

yCNzAAAI AAI AxFKOMyz5xl dSwR8S1nEqkTKi 11D6YRqCGI CDnqNJ ZEf SCf J Fqq0PC0wf KNr E

RI qoVJzYmgqVeyLz/ hD3VZmDy2CyRN2vqbPj 4dEDUaZi L+OvoBDl C70u0SoqT/ FUXweQ9mf N

ZYj bTf I s 3+U6KJ wKUj Ws V/ Fd1qgyr hb2ndV0t x3MZYk2uY3ZS4B9s Pdg8wWFI e+J ZmeLAr y7

+PQD/ PYi t eJ nOt LGpoH1kRJ HnoxyaI n+kFW/ Thoq1WMzr AT2pgUr 1Tyeb1l mf NER7G77e1Sq

wVVK71+pWTI LGQKi bCCVfaq9x9FGJtMCWsLI sp+hl XuaFu2eLpwGRH3RLMkqrndCNhzuWev2

Wmri dz9Q6RI kx/UuRhROLxVegQwMnksZJX/qoy2OV6A++OmHoEMRKNMsd8Pzl fKnyVQi M3MC

r 779SKT 7m0x+J WZFr 9I o5e+8r wR3k+Tr z of J BmBl cJ l J w4J Nl 7vz +XT 63/ EdToGz oT kL 9O+/

7GseWHKqt w9U79zHexAU63FzDgOol eua8I 2l sWR/ 5gcl X276SUGuKmj Kot dxe1EVx1gCUg5E

H1+Uf I AQ5DP/ 7UEpOPCOESI NTmZNAJVcj i EwxawZy+Moi P4Uy12zBgNK+tC5Xj gR9oHmyl nv

85kXP5Zus / cs ch6QN4Po4NKbM3Ns axkR+MGDel oXXbAayv2pqI UJ Bj r evMLJ eEf s l BWXLl v/

FdAcv8npuyvN+dEkFxRqo1xXl pOPYF09nKTHN6FSOTxuZRr kQzEDhj VO2pUNaYYhRMi QbZpU

JgUZYqoLMo2+WxpV1TKl 6r 707GtFkGmab/ XsmgFoJwVc8VXQAqJYvhi Zj AnBOi WGvQ8i 0GRW

x wI ASZdx x T F 7OJ j E j PK907VV4Pi e PGj 8O9T 8R1J E I t J T pA/ bE OT 6Cg0x 2F q+F Pf 3Ql z I N5v F

mDbVOPC5QxShmr J yxJ / bheL++9Y9KBpcOVC21Ft FaWnVJ I eYwl 7I GGCO/ BYPt ozD5r / TVczi

E0t Dvc+pJ mmA9hPmql wYkEZLRRf z9PBXzF7i pxoyvT+wKBzWRwSq9aAKV/ 6SJ bbyqgj qEJ cc

DoxOqj 3f oU3RI f WBWvxbf w1ywTy6TO2n5hp6t kkFKpy0Ghsq3H3SWxgczVPPxv2Pi kcxvWSk

t ehG2RWI t v5t f BS7NEBl t 2wh5xnxr br QW0SOkT SI 38hqJ 4h7e/ FPgbSgUnMRGYYt Aai r l pf k

b/ y2J 6vSFR5Wz3W1UI Ll ygUANZUpas yTZYt Gl +QPFYWqveNLcs R3eBFl RFhEx+PxbyJ qCVb1

hhvVScALHXxyl Htbaw6963W8x9+697z7ws2qPegw3I r Q3kkPTBdYBMWPCKNh/ POr I LMghDsT

RnUGtfRLDYfuaCKH3pvqoTSyn8w+DPxRyDj LE6WxcHkzOQKyPYb4Qj nfQBn4hKs/ W08VQWoy

A2bkQeXOXI pTt k0pCs I QSQ70BNCMf J NTH/ j PuEGv9aDl qN4eJ es NAwGKds cB5zf ZQVac4l L/

kuPAoFeY9Ht1tQGwPNkr VnOc8NdqE+Bi g8tPVRd+PWsowmWVTeDsgKTN/ ZGsoqP/ oF6r xQDu

kqb1txLeZwj 8xCU3bNOFVs47FptpgB0U45WAt1f i YGc2gO6mqu9bJQqRFz+Lu8NudSD9/ NW/

gp3F/ s SL kai ZY7t Y2OuBQEZI 6v5M8AXi Bs cgc7i 2DdRv2VKI qs T Wl ocK8SRf 9mS/ XuNckE3v

wd5LmggaRPoYEa8KLCbWMS0C1ndvJx8cx7r B9f G/ ny4nWzN8e6FJvxvr Zdp7BQI CgGHz+l be

e/ ngLSKgdRENAp3872HUBdi CcG0++/ t XLTkFeNqr 2h9mJz+LD1JSgM8nMquCM10f ODj yPAt o

pmQWZCLYFbAaNdZBKaQEZ7D6k47aGpHPsH0+NXr13KVLh9Qzcuc+EM11LqyT6rAh28dMUD3W

mXAUZVVl EJ 8NMohZ9evpi L02SOJ 6uHXcv93pNWkBVESj 7t LpXZgr LFTer zZcf Nz3l Lt j wTRn

Ao52Pef A9n5XOPEQGr DbdsH12w4osGw8xr 5bGYNFzd3r eA8FTzYFkYhhwKQLj cUAnFf NEPHn

zzoYvFbvGh8n2aHf j ckG+j dp2nLEs s 64r t d4oj ys J 5EzOQr p+Kf wdNnwx+mpHdy6yEH3+xS5

3QB39Ebl eCdVVRf Br THAE0aAXYhQuEXGVuH+dvQ031/ 7KV9qr 8i pphQ9dqYzvW1+Lr dhyI PO

zXyDdHJhKNL6dkVoUv/ vi 5Kpj uzWpV+6wUhcmOox1HnLCi dG9EM61XRdMVi dWOrv+SCj T1Pa

sc8YoUdM3r E of t W46S987DUAZi YToAMLi knL f hf ccg0KHp/ m38qo3mFGebegN1gpX2JY

oil trading international

R e t a i l i n g

energy services

bunkering

Matrix Marine Fuels was able to defend its position in the highly

competitive market for bunker fuels in Houston, and after a

disappointing 2002 once again contributed to the groups

positive results. Matrix Marine Fuels also has offered its services

in Guatemala since April 2004. We are keeping a close eye on

opportunities to expand to additional operating sites.

contracting

Since 2003, Viterra Contracting, together with its holdings in

Germany, Austria and Hungary, has been a part of the Marquard

& Bahls Group. Viterra Contracting is one of Germanys leaders in

providing contract energy services to residential properties. It has

been renamed in the meantime as Proenergy Contracting.

Proenergy services include planning, constructing, upgrading and

financing decentralized heating facilities. This is augmented by

operation and maintenance management, associated-services

management and the supply of the primary energy. Proenergy is

currently undergoing a comprehensive restructuring. In line with

our expectations at the time of its acquisition, we expect it to

make a positive contribution to the groups results in two or

three years.

a full-range supplier of energy and energy-related services. This

subsidiary complements traditional Mabanaft trading activities,

since Proenergys business is typically long-term in character and

produces steady revenues.

The acquisition of Proenergy is nonetheless an

important step toward positioning Mabanaft as

M a b a n a f t 2 2 / 2 3

w a i t f o r t h e r i g h t m o m e n t

.

.

)

)

)

)

)

a t t e nt i on

t o pa y c l o s e recognize nuances, sensibility, flexibility, rapidity

MDA0DSUlQ3

MDA0DSUlQ3

OiAzNjc3OSA0N

ZSBvdXRsaW5lI

ZCBhcyBw

MSANJSUgTG

Z2h0cyBSZ

cGUtSGVsbCBB

eWVkLCBtb2R

cHJlc3Mgd3Jpd

aW1hKiBSb21

LUhlbGwgQUcg

IGtub3duey9Pc

ZUlEIGdldCA

bHNlfWlmZWxzZSA

ZGljdCBiZWdpbg0

MDQpIHJlYWRv

ODksIDE5OTEg

ZC5PcHRpbWEga

IHN1YnNpZ

eSBlbmNvZGVkIG

IHRoZSBUeXB

aXMgY29weXJ

dWJzaWRpYXJpZX

b3BlcnR5IG9mIEx

IHVzZWQsIG

aXRob3V0IHRo

QUcuDSAxMiBPc

T3B0aW1hIFJvbW

bHkgZGVmDS9XZ

DS9pc0ZpeGVkU

VW5kZXJsaW5lV

T3B0aW1hIGRlZg0v

IGRlZg0vRm9udFR5c

IHJlYWRvbmx5IG

IDEwMDAgOTE5

ZWMNAAAIAA

c2Ai0+AOLtm

3ve3CLDBTQ

q96YZt4WC

MPyV4nyyBqqa

vMzxvbSBbF

0g+hxecBW4lot

NcUW+Dhp

osm1fWnWyj

ArgdVRgAG

kWAhXKIH3HaM

R4yD+2EdET

gAG7xbkgmajKC15lrwW

ct6zN2t+kS4B51nae3ytXSdA0

epmBstaxXLXe

,

dNXolb3BlcnR5I

jhsdKvUdFrpYWHJRuEzkIlqV5

kcwhyhtYeufLAHQyg

mkuS1JFwpW

t7LIxV4QtKszH/

BRI/rzdvA54q

3ytXSdA00X

hTmiUG0dQ

ISLtZV6WQ/Y

QG7c6xcfPM2qk

H28SnAheCX

R0rUjW2v6l

slcMOd2Pe

RBrRuqBMM

BbI+mBJrg

Hp2RntjAEKaPO

rqHSoKlGQspc

UPa4nE47uK0En

KlVnYeTAv

gaJoTM8OPbX

0CoUIF6dk9

sVUmxLO9A5Of

yCNzAAAIAA

RIqoVJzYmgq

ZYjbTfIs3+U

+PQD/PYiteJ

wVVK71+pWTIL

Wmridz9Q6RIkx/U

r779SKT7

7GseWHKqtw

H1+UfIAQ5DP

85kXP5Zus

FdAcv8npuyvN

JgUZYqoLMo2+

xwIASZ

mDbVOPC5

E0tDvc+pJm

DoxOqj3foU3

tehG2RW

b/y2J6vSFR5

hhvVScALHXxy

RnUGtfRLDYfua

A2bkQeXOX

kuPAoFeY9Ht1t

kqb1txLeZwj8x

gp3F/sSLk

wd5LmggaRPo

e/ngLSKgdREN

pmQWZCLYFbAaNd

mXAUZVV

Ao52PefA9n5X

zzoYvFbvG

3QB39EbleCd

X DdHJhKNL6

M D A 0 D S U l Q 3 J l Y X R p b 2 5 E Y X R l O i B U d W U g T m 9 2 I C A 1 I D E z O j A 0 O j I 4 I D E 5 O T E N J S V W T X V z Y W d l

O i A z N j c 3 O S A 0 N z Y 3 M Q 0 l J S B U a G U g Z G l n a X R h b G x 5 I G V u Y 2 9 k Z W Q g b W F j a G l u Z S B y Z W F k Y W J s

Z S B v d X R s a W 5 l I G R h d G E g Z m 9 y I H B y b 2 R 1 Y 2 l u Z y B 0 a G U g D S U l I F R 5 c G V m Y W N l c y B w c m 9 2 a W R l

Z C B h c y B w Y X J 0 I G 9 m I H l v d X I g b G F z Z X I g c H J p b n R l c i B p c y B j b 3 B 5 c m l n a H R l Z C A o Y y k g M T k 4

M S A N J S U g T G l u b 3 R 5 c G U t S G V s b C B B R y B h b m Q v b 3 I g a X R z I H N 1 Y n N p Z G l h c m l l c y 4 g Q W x s I F J p

Z 2 h 0 c y B S Z X N l c n Z l Z C 4 g V G h p c y B k Y X R h I G l z I A 0 l J S B 0 a G U g c H J v c G V y d H k g b 2 Y g T G l u b 3 R 5

c G U t S G V s b C B B R y B h b m Q g b W F 5 I G 5 v d C B i Z S B y Z X B y b 2 R 1 Y 2 V k L C B 1 c 2 V k L C A N J S U g Z G l z c G x h

e W V k L C B t b 2 R p Z m l l Z C w g Z G l z Y 2 x v c 2 V k I G 9 y I H R y Y W 5 z Z m V y c m V k I H d p d G h v d X Q g d G h l I G V 4

c H J l c 3 M g d 3 J p d H R l b i A N J S U g Y X B w c m 9 2 Y W w g b 2 Y g T G l u b 3 R 5 c G U t S G V s b C B B R y 4 g M T I g T 3 B 0

a W 1 h K i B S b 2 1 h b i A w N T I w M y A N J S U g T 3 B 0 a W 1 h I G l z I G E g d H J h Z G V t Y X J r I G 9 m I E x p b m 9 0 e X B l

L U h l b G w g Q U c g Y W 5 k L 2 9 y I G l 0 c y B z d W J z a W R p Y X J p Z X M u D U Z v b n R E a X J l Y 3 R v c n k v T 3 B 0 a W 1 h

I G t u b 3 d u e y 9 P c H R p b W E g Z m l u Z G Z v b n Q g Z H V w I C 9 V b m l x d W V J R C B r b m 9 3 b n t k d X A g L 1 V u a X F 1

Z U l E I G d l d C A x M D U 1 N z A 4 I G V x I G V 4 Y 2 g g L 0 Z v b n R U e X B l I G d l d C A x I G V x I G F u Z H 1 7 c G 9 w I G Z h

b H N l f W l m Z W x z Z S A N e 3 N h d m U g d H J 1 Z X 1 7 Z m F s c 2 V 9 a W Z l b H N l f X t m Y W x z Z X 1 p Z m V s c 2 U N M T E g

Z G l j d C B i Z W d p b g 0 v R m 9 u d E l u Z m 8 g M T A g Z G l j d C B k d X A g Y m V n a W 4 N L 3 Z l c n N p b 2 4 g K D A w M S 4 w

M D Q p I H J l Y W R v b m x 5 I G R l Z g 0 v T m 9 0 a W N l I C h D b 3 B 5 c m l n a H Q g K G M p I D E 5 O D U s I D E 5 O D c s I D E 5

O D k s I D E 5 O T E g Q W R v Y m U g U 3 l z d G V t c y B J b m N v c n B v c m F 0 Z W Q u Q W x s I F J p Z 2 h 0 c y B S Z X N l c n Z l

Z C 5 P c H R p b W E g a X M g Y S B 0 c m F k Z W 1 h c m s g b 2 Y g T G l u b 3 R 5 c G U t S G V s b C B B R y B h b m Q v b 3 I g a X R z

I H N 1 Y n N p Z G l h c m l l c y 4 p I H J l Y W R v b m x 5 I G R l Z g 0 v Q 2 9 w e X J p Z 2 h 0 I C g g V G h l I G R p Z 2 l 0 Y W x s

e S B l b m N v Z G V k I G 1 h Y 2 h p b m U g c m V h Z G F i b G U g b 3 V 0 b G l u Z S B k Y X R h I G Z v c i B w c m 9 k d W N p b m c N

I H R o Z S B U e X B l Z m F j Z X M g c H J v d m l k Z W Q g Y X M g c G F y d C B v Z i B 5 b 3 V y I G x h c 2 V y I H B y a W 5 0 Z X I g

a X M g Y 2 9 w e X J p Z 2 h 0 Z W Q N I C h j K S A x O T g x I E x p b m 9 0 e X B l L U h l b G w g Q U c g Y W 5 k L 2 9 y I G l 0 c y B z

d W J z a W R p Y X J p Z X M u I E F s b C B S a W d o d H M g U m V z Z X J 2 Z W Q u D S B U a G l z I G R h d G E g a X M g d G h l I H B y

b 3 B l c n R 5 I G 9 m I E x p b m 9 0 e X B l L U h l b G w g Q U c g Y W 5 k I G 1 h e S B u b 3 Q g Y m U g c m V w c m 9 k d W N l Z C w N

I H V z Z W Q s I G R p c 3 B s Y X l l Z C w g b W 9 k a W Z p Z W Q s I G R p c 2 N s b 3 N l Z C B v c i B 0 c m F u c 2 Z l c n J l Z C B 3

a X R o b 3 V 0 I H R o Z Q 0 g Z X h w c m V z c y B 3 c m l 0 d G V u I G F w c H J v d m F s I G 9 m I E x p b m 9 0 e X B l L U h l b G w g

Q U c u D S A x M i B P c H R p b W E q I F J v b W F u I D A 1 M j A z I C k g c m V h Z G 9 u b H k g Z G V m D S 9 G d W x s T m F t Z S A o

T 3 B 0 a W 1 h I F J v b W F u K S B y Z W F k b 2 5 s e S B k Z W Y N L 0 Z h b W l s e U 5 h b W U g K E 9 w d G l t Y S k g c m V h Z G 9 u

b H k g Z G V m D S 9 X Z W l n a H Q g K F J v b W F u K S B y Z W F k b 2 5 s e S B k Z W Y N L 0 l 0 Y W x p Y 0 F u Z 2 x l I D A g Z G V m

D S 9 p c 0 Z p e G V k U G l 0 Y 2 g g Z m F s c 2 U g Z G V m D S 9 V b m R l c m x p b m V Q b 3 N p d G l v b i A t M T A w I G R l Z g 0 v

V W 5 k Z X J s a W 5 l V G h p Y 2 t u Z X N z I D U w I G R l Z g 1 l b m Q g c m V h Z G 9 u b H k g Z G V m D S 9 G b 2 5 0 T m F t Z S A v

T 3 B 0 a W 1 h I G R l Z g 0 v R W 5 j b 2 R p b m c g U 3 R h b m R h c m R F b m N v Z G l u Z y B k Z W Y N L 1 B h a W 5 0 V H l w Z S A w

I G R l Z g 0 v R m 9 u d F R 5 c G U g M S B k Z W Y N L 0 Z v b n R N Y X R y a X g g W z A u M D A x I D A g M C A w L j A w M S A w I D B d

I H J l Y W R v b m x 5 I G R l Z g 0 v V W 5 p c X V l S U Q g M T A 1 N T c w O C B k Z W Y N L 0 Z v b n R C Q m 9 4 e y 0 3 O C A t M j c x

I D E w M D A g O T E 5 f X J l Y W R v b m x 5 I G R l Z g 1 j d X J y Z W 5 0 Z G l j d C B l b m Q N Y 3 V y c m V u d G Z p b G U g Z W V 4

Z W M N A A A I A A I A Z u m g v H r z E G a 8 2 z 1 e f P 3 9 q Z 9 2 3 L 3 g 8 2 s Z E 3 d A 8 k Z f K a x L O e 4 9 I J L N B m t e Z K W l

c 2 A i 0 + A O L t m D s o 6 A X q B j L 4 Q f U v W G T D u 2 l o J Z h r h w H a y g K d B X a e / R 8 d e X i N c C E N X E M S b a E H / 0

3 v e 3 C L D B T Q 2 l v r q K U M j c Z J C 4 m y k v D z r C w J y H o U t y F S 2 r X D J K r X Q G x g H T H b T R G V D j E 2 u 1 T z Z 5

q 9 6 Y Z t 4 W C t 7 9 p d C N m v N w l X 2 k 7 N I i X l W U j y p n 7 n I Y v q v L c b v Q v 2 0 y Q c / 0 j L A P 3 i x U s G E U 8 X F k

M P y V 4 n y y B q q a e D I O y w j Z H N I 4 M 1 G T 0 d Z b 6 O c G c 7 T w u 6 l Q k O 4 2 C q x d b e a 6 N p n p W o d t K x e 9 1 B 8 6

v M z x v b S B b F A Q h v 7 I j r + i m C H 2 G X b p O u i v u 5 H d r a h C a p Y 9 t t + 5 m z L y p / E z o O Y I W w P y 2 4 h K h G a J

0 g + h x e c B W 4 l o t t P M z W E d u W 6 o p B J G A m z Q Y G s H y 8 N + 3 z m S t t 2 u x 5 I 4 6 v U Q u R X 4 1 u 5 3 v k h z R 2 A j

N c U W + D h p H f t U w 3 B 1 n / S l v G e X K G R 4 f L P F j c 1 d Z I k c f k i b R 5 V q t 5 i H z O s v u 3 z 8 k 5 R 0 N b O z d 1 h 2

o s m 1 f W n W y j x o m a P p c N x 5 q u T z T X A w K j I i j F o s Y Q Y O d k P 8 U p H U N 4 M O q T z R 0 6 D b E 5 S T I 4 v G P / 9 F

A r g d V R g A G 7 x B l u r v o d P k G z 8 r O 4 F 5 d I o t O d z D 7 N B H a 7 / m n 8 9 r I U j B H 7 h u 6 v Q R c 0 T S c u D 7 r c 4 v

k W A h X K I H 3 H a M A e k i I 1 t K n A V G e N 3 y 2 y v R n W Z y F z V Y U u H L Y z Q s m X x 4 b 7 5 9 k Q P V J x 0 m q X k W r J f a

R 4 y D + 2 E d E T s X d 1 t T 7 D A 4 0 Q e w C c f i U r f i / g g 4 9 3 A q B g P C T B m 7 h L J N X g L 1 4 E K p p V c T N 1 G B h B D 2

a j K C 1 5 l r w W D P N c i Q T E 5 g k T s y Q N G p H Z w L o N s J v E B l e 7 V R o z L V H d k 0 E m K B 2 U p 8 B d P o 2 l o j 7 v 0 a

t + P k S 4 B 5 1 n a e +

a u f E m p f a n g s e i n , a u f n e h m e n , v e r a r b e i t e n , a n a l y s i e r e n , b e w e r t e n , s i c h G e h r v e r s c h a f f e n

a x L O -

e f p d N X o l i

b e r z e u g e n ,

P E N x 5 q u T z T X A w K j I i j F o s Y Q Y O d k P 8 U p H x 4 b 7

.

N C T p 5 R E M v U d N X o p Y W H J R u E z k I l q V 5 q S K F S 7 S

s 1 X I s F m t 6 z N 2 o r 6 S N s b / m j F s N a t g K P 4 L f G C Q 5 e e 1 S j S P A F n 7 F 8 E s n Y N + I j 7 K l 1 N s k c Z w h y h t Y e u f L A H Q y g l / W f H B A 0 l 4 1 l

I S t d f a p Z + 7 Z V u f e k L K N m e s w p 5 2 4 M p K J k i s R J n E N F I 8 c V p Z J a + k q F 7 V 9 N T i a I z l r 8 G 1 J E x P 5 5 1 y a R 4 9 R 1 + i Y e w

m k u S 1 J F w p W c N g C r S q c c / x c a F N x i n B L D G 3 g t s T F O s D G / G W x H p P c b D 3 b E 6 4 V P T g 7 6 w 7 z l N u z l V

t 7 L I x V 4 Q t K s z H / j W D y L N P 3 7 9 F + K l e f j q k m r k K j q N K 1 Z 0 m G f f + X 4 d R R R w o Y R K M g Q S m W G i J 6 t h F + 8 D n 2 u c t K L o N P a

B R I / r z d v A 5 4 q b f K 2 r D L z m H 9 D i 3 Z 2 9 9 e j 6 p G h + 4 u 9 8 p T A 6 s 7 9 / M V V E N C I 3 y + 7 I M x Q p I 5 Q 9 M g b

3 y t X S d A 0 0 X 1 T c A R A 9 m X x e q / D i z L p G 9 + q 5 B d y T 3 k y + P J O z X B X W / t o 5 Q 7 N 2 9 6 4 L C b e F I a h l 6 K t

h T m i U G 0 d Q 7 g k k a 2 C C e w x U i v t y v + l M x J 9 / H 2 g j M 9 V u l E Z m 1 m f V I z 7 x V C O U H 9 h s 1 z u R l l j h g 2 8

I S L t Z V 6 W Q / Y e S 5 u O u e 9 S e 5 C F 1 0 5 3 X l N E u 1 b w E l G P Y Z Z N k I V H T u e M u F r i K I N i o d V 1 G N a 8 Q 2 H e

Q G 7 c 6 x c f P M 2 q k L v a o D S r 5 p A q a 6 z N U d N V P X Z M m U c W k + b o c r M D 5 O o E j 0 R 6 p G f 8 P X o G e H g H t i 7 o

H 2 8 S n A h e C X k r 0 Y O n + V w d O T U + 8 i i v R s I s N I S 9 7 v Z H h i z n L n d e 0 l M a w h p 8 B K 9 2 6 T p K t N Q 9 t X V 9

R 0 r U j W 2 v 6 l C 7 y 9 5 F b S 7 C x c 7 d Z h w 7 K y Z S U w i P 0 s O U + a p X l Z 1 O s Y Z 2 3 k J 7 Z K S 8 h R 4 y K L 4 o h 9 l r

s l c M O d 2 P e 3 4 a 0 v / E K f I F n E v U e b t g n f Q 7 E b d k N X G F G A F 1 N A 4 L M P i R 0 d 3 Z I q S 8 z h f Y X l 0 I n 2 W O

R B r R u q B M M w i P M + q c e 4 + 6 I 3 7 g T r O K r 6 k Z L O q q m U z I W 7 s Z r l a r t c 6 c Y 0 i x q R D + V Q C P o v o 4 N e r /

B b I + m B J r g j l N L l m 0 Q J P T g 3 I z c z h b h Q H s T z 3 w N C X 1 O 2 m 7 O H + z H V a s g f S i Z Z 4 C 5 E z v 3 J K 2 Y q / i

H p 2 R n t j A E K a P O L 6 k W f p T 0 U R V Z k 9 l J I r y x y V H o + X D e x O Q H Z B h w d 7 Y p X B Z H T A R 6 W 9 y B K D E 9 Q A 8

r q H S o K l G Q s p c H y G D m y t N g 8 P h O + 1 J K l f K 2 r P C + E I R R j a c A 4 3 o 4 n c y b c M y R y 0 Z W r N 5 N 6 6 m / f m d

U P a 4 n E 4 7 u K 0 E n q 3 M J 4 T p 7 d Q 4 3 a V n 4 I A J Z K M g l h r a F P L P d 2 n M q A n 6 f m S 6 L 4 W d 4 y X E b l m w O Q c B

K l V n Y e T A v w H v w J X S G z l 7 d V o l g o V X P V c / g o d x r C R v i J K D p 0 e b d T L d K o x M l W H a A l b / 6 Y f X j S H o

g a J o T M 8 O P b X m s F 4 K v M U t B o s z n i m 0 P Z t 0 x 4 H F c 5 s X O 4 S Y u U 1 y l 5 G W D 5 O N 3 E Y G k h 9 s r f j 3 6 E C K

0 C o U I F 6 d k 9 I O 2 y f w T 8 w t l R n Q e l s E Y a a y 4 Q o h i v v 4 t T 2 g E g G M i Y V u W c p J 1 s T Z E 5 w r A m 1 C U n H s

s V U m x L O 9 A 5 O f q X 1 y 1 C P L I a w 0 b 9 A q g / x X A 1 5 N F R b 5 + O F m U n K C A m M 6 E I f 0 + I J v u x m 2 u 0 6 u 8 g q t

y C N z A A A I A A I A x F K O M y z 5 x l d S w R 8 S 1 n E q k T K i 1 1 D 6 Y R q C G I C D n q N J Z E f S C f J F q q 0 P C 0 w f K N r E

R I q o V J z Y m g q V e y L z / h D 3 V Z m D y 2 C y R N 2 v q b P j 4 d E D U a Z i L + O v o B D l C 7 0 u 0 S o q T / F U X w e Q 9 m f N

Z Y j b T f I s 3 + U 6 K J w K U j W s V / F d 1 q g y r h b 2 n d V 0 t x 3 M Z Y k 2 u Y 3 Z S 4 B 9 s P d g 8 w W F I e + J Z m e L A r y 7

+ P Q D / P Y i t e J n O t L G p o H 1 k R J H n o x y a I n + k F W / T h o q 1 W M z r A T 2 p g U r 1 T y e b 1 l m f N E R 7 G 7 7 e 1 S q

w V V K 7 1 + p W T I L G Q K i b C C V f a q 9 x 9 F G J t M C W s L I s p + h l X u a F u 2 e L p w G R H 3 R L M k q r n d C N h z u W e v 2

W m r i d z 9 Q 6 R I k x / U u R h R O L x V e g Q w M n k s Z J X / q o y 2 O V 6 A + + O m H o E M R K N M s d 8 P z l f K n y V Q i M 3 M C

r 7 7 9 S K T 7 m 0 x + J W Z F r 9 I o 5 e + 8 r w R 3 k + T r z o f J B m B l c J l J w 4 J N l 7 v z + X T 6 3 / E d T o G z o T k L 9 O + /

7 G s e W H K q t w 9 U 7 9 z H e x A U 6 3 F z D g O o l e u a 8 I 2 l s W R / 5 g c l X 2 7 6 S U G u K m j K o t d x e 1 E V x 1 g C U g 5 E

H 1 + U f I A Q 5 D P / 7 U E p O P C O E S I N T m Z N A J V c j i E w x a w Z y + M o i P 4 U y 1 2 z B g N K + t C 5 X j g R 9 o H m y l n v

8 5 k X P 5 Z u s / c s c h 6 Q N 4 P o 4 N K b M 3 N s a x k R + M G D e l o X X b A a y v 2 p q I U J B j r e v M L J e E f s l B W X L l v /

F d A c v 8 n p u y v N + d E k F x R q o 1 x X l p O P Y F 0 9 n K T H N 6 F S O T x u Z R r k Q z E D h j V O 2 p U N a Y Y h R M i Q b Z p U

J g U Z Y q o L M o 2 + W x p V 1 T K l 6 r 7 0 7 G t F k G m a b / X s m g F o J w V c 8 V X Q A q J Y v h i Z j A n B O i W G v Q 8 i 0 G R W

x w I A S Z d x x T F 7 O J j E j P K 9 0 7 V V 4 P i e P G j 8 O 9 T 8 R 1 J E I t J T p A / b E O T 6 C g 0 x 2 F q + F P f 3 Q l z I N 5 v F

m D b V O P C 5 Q x S h m r J y x J / b h e L + + 9 Y 9 K B p c O V C 2 1 F t F a W n V J I e Y w l 7 I G G C O / B Y P t o z D 5 r / T V c z i

E 0 t D v c + p J m m A 9 h P m q l w Y k E Z L R R f z 9 P B X z F 7 i p x o y v T + w K B z W R w S q 9 a A K V / 6 S J b b y q g j q E J c c

D o x O q j 3 f o U 3 R I f W B W v x b f w 1 y w T y 6 T O 2 n 5 h p 6 t k k F K p y 0 G h s q 3 H 3 S W x g c z V P P x v 2 P i k c x v W S k

t e h G 2 R W I t v 5 t f B S 7 N E B l t 2 w h 5 x n x r b r Q W 0 S O k T S I 3 8 h q J 4 h 7 e / F P g b S g U n M R G Y Y t A a i r l p f k

b / y 2 J 6 v S F R 5 W z 3 W 1 U I L l y g U A N Z U p a s y T Z Y t G l + Q P F Y W q v e N L c s R 3 e B F l R F h E x + P x b y J q C V b 1

h h v V S c A L H X x y l H t b a w 6 9 6 3 W 8 x 9 + 6 9 7 z 7 w s 2 q P e g w 3 I r Q 3 k k P T B d Y B M W P C K N h / P O r I L M g h D s T

R n U G t f R L D Y f u a C K H 3 p v q o T S y n 8 w + D P x R y D j L E 6 W x c H k z O Q K y P Y b 4 Q j n f Q B n 4 h K s / W 0 8 V Q W o y

A 2 b k Q e X O X I p T t k 0 p C s I Q S Q 7 0 B N C M f J N T H / j P u E G v 9 a D l q N 4 e J e s N A w G K d s c B 5 z f Z Q V a c 4 l L /

k u P A o F e Y 9 H t 1 t Q G w P N k r V n O c 8 N d q E + B i g 8 t P V R d + P W s o w m W V T e D s g K T N / Z G s o q P / o F 6 r x Q D u

k q b 1 t x L e Z w j 8 x C U 3 b N O F V s 4 7 F p t p g B 0 U 4 5 W A t 1 f i Y G c 2 g O 6 m q u 9 b J Q q R F z + L u 8 N u d S D 9 / N W /

g p 3 F / s S L k a i Z Y 7 t Y 2 O u B Q E Z I 6 v 5 M 8 A X i B s c g c 7 i 2 D d R v 2 V K I q s T W l o c K 8 S R f 9 m S / X u N c k E 3 v

w d 5 L m g g a R P o Y E a 8 K L C b W M S 0 C 1 n d v J x 8 c x 7 r B 9 f G / n y 4 n W z N 8 e 6 F J v x v r Z d p 7 B Q I C g G H z + l b e

e / n g L S K g d R E N A p 3 8 7 2 H U B d i C c G 0 + + / t X L T k F e N q r 2 h 9 m J z + L D 1 J S g M 8 n M q u C M 1 0 f O D j y P A t o

p m Q W Z C L Y F b A a N d Z B K a Q E Z 7 D 6 k 4 7 a G p H P s H 0 + N X r 1 3 K V L h 9 Q z c u c + E M 1 1 L q y T 6 r A h 2 8 d M U D 3 W

m X A U Z V V l E J 8 N M o h Z 9 e v p i L 0 2 S O J 6 u H X c v 9 3 p N W k B V E S j 7 t L p X Z g r L F T e r z Z c f N z 3 l L t j w T R n

A o 5 2 P e f A 9 n 5 X O P E Q G r D b d s H 1 2 w 4 o s G w 8 x r 5 b G Y N F z d 3 r e A 8 F T z Y F k Y h h w K Q L j c U A n F f N E P H n

z z o Y v F b v G h 8 n 2 a H f j c k G + j d p 2 n L E s s 6 4 r t d 4 o j y s J 5 E z O Q r p + K f w d N n w x + m p H d y 6 y E H 3 + x S 5

3 Q B 3 9 E b l e C d V V R f B r T H A E 0 a A X Y h Q u E X G V u H + d v Q 0 3 1 / 7 K V 9 q r 8 i p p h Q 9 d q Y z v W 1 + L r d h y I P O

z X y D d H J h K N L 6 d k V o U v / v i 5 K p j u z W p V + 6 w U h c m O o x 1 H n L C i d G 9 E M 6 1 X R d M V i d W O r v + S C j T 1 P a

s c 8 Y o U d M 3 r E o f t W 4 6 S 9 8 7 D U A Z i Y T o A M L i k n L f h f c c g 0 K H p / m 3 8 q o 3 m F G e b e g N 1 g p X 2 J Y

to use the silence to harken inwardly

2

)

to have ones ear all over the place, be open, incorporate,

analyze, process, gain attention, convince.

5 )

w o r k i n g w i t h a l l s e n s e s

Today, Oiltanking is one of the worlds leading independent

owners and operators of tank terminals for crude oil and refined

products, petro-chemicals, gases, and other liquids. Globally,

Oiltanking strives to be the preferred partner for its customers,

due to its high degree of professionalism, creative solutions for

logistical processes and reputation for going far beyond traditional

storage services.

Oiltanking currently operates 68 bulk-storage facilities in 17

countries, with total storage capacity of 10.3 million cubic meters

(at the end of April 2004).

Annual throughput rose to 94.9 million metric tons last year.

Capacities and profits were divided almost equally between Europe

on the one hand and the Americas and Asia on the other.

One of Oiltankings most successful corporate policies is the long-

term orientation of its contracts. Petroleum tank terminals tradi-

tionally serve oil traders; however, traders demand for tank-

storage capacity typically fluctuates, depending on the price

structures prevailing in the market (contango or backwardation).

Long-term contracts once were the exception rather than the

rule, and thus the uselease of storage capacities was strongly

influenced by external factors. To counteract this tendency, Oil-

tanking has concentrated its investments in recent years on the

infrastructure for neighboring industrial plants above all, in

refineries and chemical plants in order to embed itself into

their logistical chains and, in this way, to ensure continuous

product flows. This strategy has been quite successful. Now, most

of our tank terminals are fully utilized, with long-term contracts.

About 85 percent of our returns are generated by contracts with

a period of one or more years, while some 50 percent of all contracts

span a period of five or more years. We believe that the percen-

tage of long-term contracts will continue to rise.

T a n k t e r m i n a l s 2 4 / 2 5 O i l t a n k i n g

Oiltanking looks back once again on a favorable business year.

Despite the negative effects of exchange rates in particular the

weakness of the U.S.$ and the S$ against the Euro 2003 results

were nonetheless very satisfactory. If we disregard one-time

effects, Oiltanking even exceeded the good results it reported in

the previous year. Record turnover and a repetition of virtually full

use of all of its storage capacities at sound prices both made

possible by dedicated and highly motivated employees have

once again proven to be the correct recipe for continuous success.

Oiltankings strategy has been focused on steady and continuous

growth since the beginning of the 1990s. Our corporate policy of

identifying new markets early on and exploiting our opportunities

in them has proven successful in recent years.

h a v e o n e s e a r s a l l o v e r t h e p l a c e

the strong customer orientation of our subsidiary oiltanking is the basis

for the worldwide good position as a favored partner for our customers. the

storage organization of the marquard & bahls group operates independent

terminals for mineral oil, chemicals and gas as well as other liquids.

Oi l tanki ng

19902004

Tankage Tankage under construction

DEVELOPMENT TOTAL TANK CAPACI TY

(in million cbm)

19

90

19

92

19

94

19

98

19

96

20

00

20

01

20

02

Feb.

04

20

03

3

.9

1

4

.6

25

.6

4

5

.9

4

7

.3

08

.5

99

.5

0

9

.6

5

1

0

.1

4

1

0

.2

7

0

,1

5

6

19862003

5 )

w o r k i n g w i t h a l l s e n s e s

worlds largest provider of independent tank-storage facilities.

Instead, we prefer to concentrate on the quality of our services.

We will continue to expand our position as one of the worlds

leading tank-terminal operators. New projects must, however,

match our strategy, our portfolio and our corporate culture.

A number of projects that align with our standards are in various

phases of development. Among these are activities in China,

Mexico, Brazil, the CIS countries, the Middle East and countries

where we are already active. We see further development oppor-

tunities, particularly in growth markets, in privatization efforts in

markets now opening up, and in mature markets where we can

integrate ourselves into our customers logistical and supply

chains.

In the chemical segment, we will concentrate our growth in the

main hubs for chemical production and trading and in markets

that are of key significance to the chemical industry. In this con-

text, we are assigning particular importance to our involvement

in China.

These projects will be supported from the proceeds of private-

placement financing in the U.S. market. Oiltanking is one of the

first German companies to successfully use this type of financing.

The proceeds from this effort equate to 130 million U.S.$. The

volume offered to the market was oversubscribed, demonstrating

the attractiveness of the company to international institutional

investors. Thus, our tank-storage subsidiary has created an addi-

tional pillar in financing, complementing traditional bank loans.

T a n k t e r m i n a l s 2 6 / 2 7

We intend to continue to grow. How-

ever, our objective is not to become the

Contributing to this increase is a recent change in the oil traders

point of view, in which the fundamental availability of storage

capacity is seen more and more as a value in itself. Consequently,

traders now are prepared to make longer-term contractual obli-

gations. Therefore, we have further expanded the capacities of

some of our tank terminals, even in saturated markets such as the

ARA region.

We also have made good progress in implementing another part

of the Oiltanking strategy: to establish a worldwide network of

chemical-tank terminals and become the preferred partner for a

group of selected chemical companies. With existing tank terminals

in the ARA region, Eastern Europe, the Baltic region, and Singa-

pore, and a number of projects well on their way to completion

in other parts of the world, we have, in a short time, become

a serious, global supplier in chemical storage.

these were a few of the highlights at oiltanking in 2003:

Completed a 200,000-cubic-meter expansion in Houston, U.S.A.

Began construction of a chemical tank terminal in Terneuzen,

Netherlands, with initial capacity of 156,000 cubic meters

Expanded Oiltanking facilities at Antwerp, Belgium, by

11,000 cubic meters of gas storage

Constructed an LPG storage facility in Chennai, India

Constructed a tank terminal in Goa, India

Expanded Oiltanking Odfjell, Singapore, by 82,000 cubic meters

Completed the final expansion of Oiltanking Amsterdam,

Netherlands, adding a total of 275,000 cubic meters

Acquired a 17,000-cubic-meter tank terminal in Hungary

O i l t a n k i n g

l i s t e n

.

.

.

.

.

.

.

.

use commonplace words and express exeptional things use commonplace words and express exeptional things

wor ds

commonplace commonplace

commonplace commonplace

use commonplace words and express

exeptional things

Group throughput

GROUP THROUGHPUT DEVELOPMENT

(in million tons)

19

86

19

88

19

90

19

94

19

92

19

96

20

00

20

01

20

03

20

02

1

0

.0

1

7

.5

2

3

.5

2

5

.0

4

0

.0

4

0

.5

7

2

.98

3

.09

2

.4

9

4

.9

petroleum

petroleum

T a n k t e r m i n a l s

Oiltanking operates worldwide in various fields of business:

petroleum

oiltanking amsterdam

In 2003, Oiltanking Amsterdam put in service another 75,000

cubic meters of tank-storage capacity. This was the final phase

of a three-year, 275,000-cubic-meter expansion. An associated

improvement was the expansion of the existing ship and barge

facilities. Oiltanking Amsterdam was fully booked through-out

the year and also has rented a large share of storage capacity for

several years in advance.

oiltanking copenhagen

Our facility in Denmark continues to be essentially dependent

upon the spot market. Thanks to stringent cost control and an

increased share of long-term contracts, Oiltanking Copenhagen

broke even, despite a backwardated oil market throughout 2003.

oiltanking germany

The market conditions for Oiltanking Germany were less than

favorable throughout the year. In particular, the demand for gaso-

line and diesel fuel did not meet expectations. This was due

primarily to the tax policies of the federal government and the

weak business climate. The extremely low water level in the Rhine

made it difficult for oil traders, who represent a significant

contract volume for Oiltanking Germany, to compete with German

inland refineries. In 2004, a number of the storage facilities

belonging to Oiltanking Germany are expected to post a consider-

able volume increase due to a long-term contract with a major

oil company. This contract dovetails nicely with our strategy of

assuming a central role within the oil infrastructure in Germany.

O i l t a n k i n g

t o r e a d b e t w e e n t h e l i n e s

2 8 / 2 9

.

.

.

silence

learn to be quiet learn to be quiet learn to be quiet learn to be quiet.

learnlearnlearn learn to be quiet, for only then you are

able to listen to others

3

)

have a nose for something, intuition, be ahead, smarten a

place up, balance, rich in facets, follow ones instinct,

breathe deeply.

s c e n t

5 )

petroleum

petroleum

petroleum

petroleum

petroleum

petroleum

petroleum

w o r k i n g w i t h a l l s e n s e s

oiltanking malta

In recent years, Oiltanking Malta has become a well-established

player in the Mediterranean. Again last year, its storage capaci-

ties were fully booked. A loyal circle of customers has emerged,

and they are increasingly willing to sign long-term contracts.

Despite full utilization, Oiltanking Malta was unable to repeat the

strong showings of recent years, due to the continuous decline of

the U.S.$ against the Maltese lira, and thus indirectly against the

Euro. The dilemma is that our revenues are accrued in U.S.$, but

our expenses are paid in the local currency.

oiltanking singapore, oiltanking seraya

Oiltanking Singapore and Oiltanking Seraya, Oiltankings joint

venture with Power Seraya, once again showed good results,

despite the fact that throughput fell short of the extraordinarily

high level of the previous year. Oiltanking Seraya expanded

its capacities by an additional 46,000 cubic meters. Due to

continuous strong demand, Oiltanking Singapore is considering

further capacity expansion, as well as an extension of its jetties.

oiltanking tallinn

Oiltanking Tallinn, with throughput of 1.7 million metric tons,

was fully utilized but, like Malta due to the weak rate for the

U.S.$-to-Euro exchange was unable to match the previous

years performance.

latin america

Adhering to our policy of long-term involvement in Latin America

has proven to be the correct strategy. Despite unfavorable

economic trends, a political shift to the left and re-emerging

nationalism in some countries, the results in certain countries

were very promising. Oiltanking is developing auspicious projects

in Brazil and Mexico, and we expect to finalize them in the near

future.

T a n k t e r m i n a l s 3 0 / 3 1

oiltanking houston, oiltanking beaumont

Both Oiltanking Houston and Oiltanking Beaumont have strong

and well-balanced business portfolios and again reported good

results. We expanded capacities in Houston by 200,000 cubic

meters. The Beaumont facility continued its modernization with

the construction of two heated tanks for vacuum gas oil (16,000

cubic meters).

oiltanking hungary

To further strengthen our position in Eastern Europe, Oiltanking

acquired an existing tank terminal in Budapest, Hungary. Oiltan-

king Hungary offers 17,000 cubic meters of storage capacity,

with inland-waterway access via the Danube, loading and

discharging facilities for tank trucks and railway tank cars, and a

technical and HSE standard that meets Oiltankings stringent

requirements.

indian oiltanking

At the end of the reporting year, Indian Oiltanking commissioned

a new LPG terminal at Chennai and a product terminal in Goa.

Initial annual throughput for the Goa terminal will be 850,000

metric tons. The Navghar Terminal in Mumbai increased its

utilization rate compared to previous years, but nonetheless fell

short of expectations.

Along with traditional tank terminals, it is developing new pro-

jects for refineries, petrochemical plants, power-generating

stations and pipelines. Moreover, Indian Oiltanking landed a con-

tract for modernization and new construction of several hundred

service stations. In addition, it successfully concluded jobs in

Nigeria and Mauritius.

O i l t a n k i n g

Indian Oiltanking has undertaken an impressive

portfolio of engineering and construction projects.

g e t o n s o m e o n e s t r a i l

.

.

.

.

.

.

.

t

e

t

c

h

e

s

t

n

u

t

s

in

f

a

ll

s

c

e

n

t

o

f

f

r

e

s

h

h

o

n

e

y

h

s

t

r

a

w

b

e

r

r

ie

s

in

s

u

m

m

e

r

o

f

la

v

e

n

d

e

r

in

t

h

e

p

r

o

v

e

n

c

e

p

f

ir

e

a

t

t

h

e

b

e

a

c

h

e

l

l

o

w

c

h

e

e

s

e

c

i

n

s

p

r

i

n

g

o

lis

h

w

in

e

-

c

e

lla

r

a

t

-

h

a

r

v

e

s

t

in

ju

ly

n

o

f

a

b

a

b

y

a

lk

t

h

r

o

u

g

h

s

u

n

n

y

w

o

o

d

s

d

-

p

r

e

s

s

e

d

o

l

i

v

e

-

o

i

l

a

lty

s

m

e

ll o

f th

e

o

c

e

a

n

t

e

t

c

h

e

s

t

n

u

t

s

in

f

a

ll

o

r

t

w

in

e

in

o

p

o

r

t

o

c

i

n

s

p

r

i

n

g

a

lk

t

h

r

o

u

g

h

s

u

n

n

y

w

o

o

d

s

s

c

e

n

t

o

f

f

r

e

s

h

h

o

n

e

y

u

p

o

f

h

o

t

c

o

f

f

e

e

o

n

a

c

o

ld

m

o

r

n

in

g

s

h

s

t

r

a

w

b

e

r

r

i

e

s

i

n

s

u

m

m

e

r

s

o

f

la

v

e

n

d

e

r

in

t

h

e

p

r

o

v

e

n

c

e

a

n

t

t

h

y

m

e

b

y

t

h

e

w

a

y

s

id

e

o

l

d

s

i

n

g

l

e

m

a

l

t

p

f

ir

e

a

t

t

h

e

b

e

a

c

h

e

l

l

o

w

c

h

e

e

s

e

c

i

n

s

p

r

i

n

g

c

o

o

l

i

s

h

w

i

n

e

-

c

e

l

l

a

r

e

a

t

-

h

a

r

v

e

s

t

i

n

j

u

l

y

n

o

f

a

b

a

b

y

c

u

tte

rs

c

o

m

in

g

b

a

c

k

to

th

e

h