Escolar Documentos

Profissional Documentos

Cultura Documentos

Chap 014

Enviado por

limed1Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chap 014

Enviado por

limed1Direitos autorais:

Formatos disponíveis

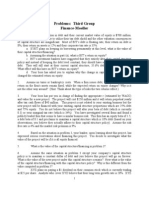

Chapter 14 - Cost of Capital

Chapter 14 Cost of Capital

Multiple Choice Questions

1. A group of individuals got together and purchased all of the outstanding shares of common stock of DL Smith, Inc. hat is the return that these individuals re!uire on this investment called" A. dividend #ield $. cost of e!uit# C. capital gains #ield D. cost of capital %. income return

&. 'e(tile )ills *orro+s mone# at a rate of 1,.- percent. 'his interest rate is referred to as the. A. compound rate. $. current #ield. C. cost of de*t. D. capital gains #ield. %. cost of capital.

,. 'he average of a firm/s cost of e!uit# and afterta( cost of de*t that is +eighted *ased on the firm/s capital structure is called the. A. re+ard to risk ratio. $. +eighted capital gains rate. C. structured cost of capital. D. su*0ective cost of capital. %. +eighted average cost of capital.

14-1

Chapter 14 - Cost of Capital

4. hen a manager develops a cost of capital for a specific pro0ect *ased on the cost of capital for another firm +hich has a similar line of *usiness as the pro0ect, the manager is utili1ing the 22222 approach. A. su*0ective risk $. pure pla# C. divisional cost of capital D. capital ad0ustment %. securit# market line

-. A firm/s cost of capital. A. +ill decrease as the risk level of the firm increases. $. for a specific pro0ect is primaril# dependent upon the source of the funds used for the pro0ect. C. is independent of the firm/s capital structure. D. should *e applied as the discount rate for an# pro0ect considered *# the firm. %. depends upon ho+ the funds raised are going to *e spent.

3. 'he +eighted average cost of capital for a +holesaler. A. is e!uivalent to the afterta( cost of the firm/s lia*ilities. $. should *e used as the re!uired return +hen anal#1ing a potential ac!uisition of a retail outlet. C. is the return investors re!uire on the total assets of the firm. D. remains constant +hen the de*t-e!uit# ratio changes. %. is unaffected *# changes in corporate ta( rates.

4. hich one of the follo+ing is the primar# determinant of a firm/s cost of capital" A. de*t-e!uit# ratio $. applica*le ta( rate C. cost of e!uit# D. cost of de*t %. use of the funds

14-&

Chapter 14 - Cost of Capital

5. Scholastic 'o#s is considering developing and distri*uting a ne+ *oard game for children. 'he pro0ect is similar in risk to the firm/s current operations. 'he firm maintains a de*t-e!uit# ratio of 6.46 and retains all profits to fund the firm/s rapid gro+th. 7o+ should the firm determine its cost of e!uit#" A. *# adding the market risk premium to the afterta( cost of de*t $. *# multipl#ing the market risk premium *# 81 - 6.469 C. *# using the dividend gro+th model D. *# using the capital asset pricing model %. *# averaging the costs *ased on the dividend gro+th model and the capital asset pricing model

:. All else constant, +hich one of the follo+ing +ill increase a firm/s cost of e!uit# if the firm computes that cost using the securit# market line approach" Assume the firm currentl# pa#s an annual dividend of ;1 a share and has a *eta of 1.&. A. a reduction in the dividend amount $. an increase in the dividend amount C. a reduction in the market rate of return D. a reduction in the firm/s *eta %. a reduction in the risk-free rate

16. A firm/s overall cost of e!uit# is. A. is generall# less that the firm/s ACC given a leveraged firm. $. unaffected *# changes in the market risk premium. C. highl# dependent upon the gro+th rate and risk level of the firm. D. generall# less than the firm/s afterta( cost of de*t. %. inversel# related to changes in the firm/s ta( rate.

11. 'he cost of e!uit# for a firm. A. tends to remain static for firms +ith increasing levels of risk. $. increases as the uns#stematic risk of the firm increases. C. ignores the firm/s risks +hen that cost is *ased on the dividend gro+th model. D. e!uals the risk-free rate plus the market risk premium. %. e!uals the firm/s preta( +eighted average cost of capital.

14-,

Chapter 14 - Cost of Capital

1&. 'he dividend gro+th model can *e used to compute the cost of e!uit# for a firm in +hich of the follo+ing situations" I. firms that have a 166 percent retention ratio II. firms that pa# a constant dividend III. firms that pa# an increasing dividend I<. firms that pa# a decreasing dividend A. I and II onl# $. I and III onl# C. II and III onl# D. I, II, and III onl# %. II, III, and I< onl#

1,. 'he dividend gro+th model. A. is onl# as relia*le as the estimated rate of gro+th. $. can onl# *e used if historical dividend information is availa*le. C. considers the risk that future dividends ma# var# from their estimated values. D. applies onl# +hen a firm is currentl# pa#ing dividends. %. uses *eta to measure the s#stematic risk of a firm.

14. hich one of the follo+ing statements related to the S)L approach to e!uit# valuation is correct" Assume the firm uses de*t in its capital structure. A. 'his model considers a firm/s rate of gro+th. $. 'he model applies onl# to non-dividend pa#ing firms. C. 'he model is dependent upon a relia*le estimate of the market risk premium. D. 'he model generall# produces the same cost of e!uit# as the dividend gro+th model. %. 'his approach generall# produces a cost of e!uit# that e!uals the firm/s overall cost of capital.

14-4

Chapter 14 - Cost of Capital

1-. hich of the follo+ing statements are correct" I. 'he S)L approach is dependent upon a relia*le measure of a firm/s uns#stematic risk. II. 'he S)L approach can *e applied to firms that retain all of their earnings. III. 'he S)L approach assumes a firm/s future risks are similar to its past risks. I<. 'he S)L approach assumes the re+ard-to-risk ratio is constant. A. I and III onl# $. II and I< onl# C. III and I< onl# D. I, II, and III onl# %. II, III, and I< onl#

13. 'he pre-ta( cost of de*t. A. is *ased on the current #ield to maturit# of the firm/s outstanding *onds. $. is e!ual to the coupon rate on the latest *onds issued *# a firm. C. is e!uivalent to the average current #ield on all of a firm/s outstanding *onds. D. is *ased on the original #ield to maturit# on the latest *onds issued *# a firm. %. has to *e estimated as it cannot *e directl# o*served in the market.

14. 'he afterta( cost of de*t generall# increases +hen. I. a firm/s *ond rating increases. II. the market rate of interest increases. III. ta( rates decrease. I<. *ond prices rise. A. I and III onl# $. II and III onl# C. I, II, and III onl# D. II, III, and I< onl# %. I, II, III, and I<

15. 'he cost of preferred stock is computed the same as the. A. pre-ta( cost of de*t. $. return on an annuit#. C. afterta( cost of de*t. D. return on a perpetuit#. %. cost of an irregular gro+th common stock.

14--

Chapter 14 - Cost of Capital

1:. 'he cost of preferred stock. A. is e!ual to the dividend #ield. $. is e!ual to the #ield to maturit#. C. is highl# dependent on the dividend gro+th rate. D. is independent of the stock/s price. %. decreases +hen ta( rates increase.

&6. 'he capital structure +eights used in computing the +eighted average cost of capital. A. are *ased on the *ook values of total de*t and total e!uit#. $. are *ased on the market value of the firm/s de*t and e!uit# securities. C. are computed using the *ook value of the long-term de*t and the *ook value of e!uit#. D. remain constant over time unless the firm issues ne+ securities. %. are restricted to the firm/s de*t and common stock.

&1. )orris Industries has a capital structure of -- percent common stock, 16 percent preferred stock, and 4- percent de*t. 'he firm has a 36 percent dividend pa#out ratio, a *eta of 6.5:, and a ta( rate of ,5 percent. =iven this, +hich one of the follo+ing statements is correct" A. 'he afterta( cost of de*t +ill *e greater than the current #ield-to-maturit# on the firm/s *onds. $. 'he firm/s cost of preferred is most likel# less than the firm/s actual cost of de*t. C. 'he firm/s cost of e!uit# is unaffected *# a change in the firm/s ta( rate. D. 'he cost of e!uit# can onl# *e estimated using the S)L approach. %. 'he firm/s +eighted average cost of capital +ill remain constant as long as the capital structure remains constant.

&&. 'he afterta( cost of de*t. A. varies inversel# to changes in market interest rates. $. +ill generall# e(ceed the cost of e!uit# if the relevant ta( rate is 1ero. C. +ill generall# e!ual the cost of preferred if the ta( rate is 1ero. D. is unaffected *# changes in the market rate of interest. %. has a greater effect on a firm/s cost of capital +hen the de*t-e!uit# ratio increases.

14-3

Chapter 14 - Cost of Capital

&,. 'he +eighted average cost of capital for a firm ma# *e dependent upon the firm/s. I. rate of gro+th. II. de*t-e!uit# ratio. III. preferred dividend pa#ment. I<. retention ratio. A. I and III onl# $. II and I< onl# C. I, II, and I< onl# D. I, III, and I< onl# %. I, II, III, and I<

&4. 'he +eighted average cost of capital for a firm is the. A. discount rate +hich the firm should appl# to all of the pro0ects it undertakes. $. rate of return a firm must earn on its e(isting assets to maintain the current value of its stock. C. coupon rate the firm should e(pect to pa# on its ne(t *ond issue. D. minimum discount rate the firm should re!uire on an# ne+ pro0ect. %. rate of return shareholders should e(pect to earn on their investment in this firm.

&-. hich one of the follo+ing statements is correct for a firm that uses de*t in its capital structure" A. 'he ACC should decrease as the firm/s de*t-e!uit# ratio increases. $. hen computing the ACC, the +eight assigned to the preferred stock is *ased on the coupon rate multiplied *# the par value of the preferred. C. 'he firm/s ACC +ill decrease as the corporate ta( rate decreases. D. 'he +eight of the common stock used in the computation of the ACC is *ased on the num*er of shares outstanding multiplied *# the *ook value per share. %. 'he ACC +ill remain constant unless a firm retires some of its de*t.

14-4

Chapter 14 - Cost of Capital

&3. If a firm uses its ACC as the discount rate for all of the pro0ects it undertakes then the firm +ill tend to. I. re0ect some positive net present value pro0ects. II. accept some negative net present value pro0ects. III. favor high risk pro0ects over lo+ risk pro0ects. I<. increase its overall level of risk over time. A. I and III onl# $. III and I< onl# C. I, II, and III onl# D. I, II, and I< onl# %. I, II, III, and I<

&4. >reston Industries has t+o separate divisions. %ach division is in a separate line of *usiness. Division A is the largest division and represents 46 percent of the firm/s overall sales. Division A is also the riskier of the t+o divisions. Division $ is the smaller and least risk# of the t+o. hen management is deciding +hich of the various divisional pro0ects should *e accepted, the managers should. A. allocate more funds to Division A since it is the largest of the t+o divisions. $. fund all of Division $/s pro0ects first since the# tend to *e less risk# and then allocate the remaining funds to the Division A pro0ects that have the highest net present values. C. allocate the compan#/s funds to the pro0ects +ith the highest net present values *ased on the firm/s +eighted average cost of capital. D. assign appropriate, *ut differing, discount rates to each pro0ect and then select the pro0ects +ith the highest net present values. %. fund the highest net present value pro0ects from each division *ased on an allocation of 46 percent of the funds to Division A and ,6 percent of the funds to Division $.

&5. )arkle# and Stearns is a multi-divisional firm that uses its ACC as the discount rate for all proposed pro0ects. %ach division is in a separate line of *usiness and each presents risks uni!ue to those lines. =iven this, a division +ithin the firm +ill tend to. A. receive less pro0ect funding if its line of *usiness is riskier than that of the other divisions. $. avoid risk# pro0ects so it can receive more pro0ect funding. C. *ecome less risk# over time *ased on the pro0ects that are accepted. D. have e!ual pro*a*ilit# of receiving funding as compared to the other divisions. %. prefer higher risk pro0ects over lo+er risk pro0ects.

14-5

Chapter 14 - Cost of Capital

&:. 'he discount rate assigned to an individual pro0ect should *e *ased on. A. the firm/s +eighted average cost of capital. $. the actual sources of funding used for the pro0ect. C. an average of the firm/s overall cost of capital for the past five #ears. D. the current risk level of the overall firm. %. the risks associated +ith the use of the funds re!uired *# the pro0ect.

,6. Assigning discount rates to individual pro0ects *ased on the risk level of each pro0ect. A. ma# cause the firm/s overall +eighted average cost of capital to either increase or decrease over time. $. +ill prevent the firm/s overall cost of capital from changing over time. C. +ill cause the firm/s overall cost of capital to decrease over time. D. decreases the value of the firm over time. %. negates the firm/s goal of creating the most value for the shareholders.

,1. hich one of the follo+ing statements is correct" A. ?irms should accept lo+ risk pro0ects prior to funding high risk pro0ects. $. )aking su*0ective ad0ustments to a firm/s ACC +hen determining pro0ect discount rates unfairl# punishes lo+-risk divisions +ithin a firm. C. A pro0ect that is unaccepta*le toda# might *e accepta*le tomorro+ given a change in market returns. D. 'he pure pla# method is most fre!uentl# used for pro0ects involving the e(pansion of a firm/s current operations. %. ?irms that elect to use the pure pla# method for determining a discount rate for a pro0ect cannot su*0ectivel# ad0ust the pure pla# rate.

14-:

Chapter 14 - Cost of Capital

,&. >hil/s is a sit-do+n restaurant that speciali1es in home-cooked meals. 'heresa/s is a +alkin deli that speciali1es in specialt# soups and sand+iches. $oth firms are currentl# considering e(panding their operations during the summer months *# offering pre-+rapped donuts, sand+iches, and +raps at a local *each. >hil/s currentl# has a ACC of 14 percent +hile 'heresa/s ACC is 16 percent. 'he e(pansion pro0ect has a pro0ected net present value of ;1&,366 at a 16 percent discount rate and a net present value of -;&,656 at a 14 percent discount rate. hich firm or firms should e(pand and offer food at the local *each during the summer months" A. >hil/s onl# $. 'heresa/s onl# C. *oth >hil/s and 'heresa/s D. neither >hil/s nor 'heresa/s %. cannot *e determined from the information provided

,,. ilderness Adventures speciali1es in *ack-countr# tours and resort management. 'ravel %(citement speciali1es in making travel reservations and promoting vacation travel. ilderness Adventures has an afterta( cost of capital of 1, percent and 'ravel %(citement has an afterta( cost of capital of 11 percent. $oth firms are considering *uilding +ilderness campgrounds complete +ith man-made lakes and hiking trails. 'he estimated net present value of such a pro0ect is estimated at ;54,666 at a discount rate of 11 percent and -;1&,-66 at a 1, percent discount rate. hich firm or firms, if either, should accept this pro0ect" A. ilderness Adventures onl# $. 'ravel %(citement onl# C. *oth ilderness Adventures and 'ravel %(citement D. neither ilderness Adventures nor 'ravel %(citement %. cannot *e determined +ithout further information

,4. 'he su*0ective approach to pro0ect anal#sis. A. is used onl# +hen a firm has an all-e!uit# capital structure. $. uses the ACC of firm @ as the *asis for the discount rate for a pro0ect under consideration *# firm A. C. assigns discount rates to pro0ects *ased on the discretion of the senior managers of a firm. D. allo+s managers to randoml# ad0ust the discount rate assigned to a pro0ect once the pro0ect/s *eta has *een determined. %. applies a lo+er discount rate to pro0ects that are financed totall# +ith e!uit# as compared to those that are partiall# financed +ith de*t.

14-16

Chapter 14 - Cost of Capital

,-. hich one of the follo+ing statements is correct" A. 'he su*0ective approach assesses the risks of each pro0ect and assigns an ad0ustment factor that is uni!ue 0ust for that pro0ect. $. Bverall, a firm makes *etter decisions +hen it uses the su*0ective approach than +hen it uses its ACC as the discount rate for all pro0ects. C. ?irms +ill correctl# accept or re0ect ever# pro0ect if the# adopt the su*0ective approach. D. )andator# pro0ects should onl# *e accepted if the# produce a positive C>< +hen the firm/s ACC is used as the discount rate. %. 'he pure pla# approach should onl# *e used +ith lo+-risk pro0ects.

,3. hen a firm has flotation costs e!ual to 4 percent of the funding need, pro0ect anal#sts should. A. increase the pro0ect/s discount rate to offset these e(penses *# multipl#ing the firm/s ACC *# 1.64. $. increase the pro0ect/s discount rate to offset these e(penses *# dividing the firm/s ACC *# 81 - 6.649. C. add 4 percent to the firm/s ACC to get the discount rate for the pro0ect. D. increase the initial pro0ect cost *# multipl#ing that cost *# 1.64. %. increase the initial pro0ect cost *# dividing that cost *# 81 - 6.649.

,4. 'he flotation cost for a firm is computed as. A. the arithmetic average of the flotation costs of *oth de*t and e!uit#. $. the +eighted average of the flotation costs associated +ith each form of financing. C. the geometric average of the flotation costs associated +ith each form of financing. D. one-half of the flotation cost of de*t plus one-half of the flotation cost of e!uit#. %. a +eighted average *ased on the *ook values of the firm/s de*t and e!uit#.

,5. Incorporating flotation costs into the anal#sis of a pro0ect +ill. A. cause the pro0ect to *e improperl# evaluated. $. increase the net present value of the pro0ect. C. increase the pro0ect/s rate of return. D. increase the initial cash outflo+ of the pro0ect. %. have no effect on the present value of the pro0ect.

14-11

Chapter 14 - Cost of Capital

,:. ?lotation costs for a levered firm should. A. *e ignored +hen anal#1ing a pro0ect *ecause the# are not an actual pro0ect cost. $. *e spread over the life of a pro0ect there*# reducing the cash flo+s for each #ear of the pro0ect. C. onl# *e considered +hen t+o pro0ects are mutuall# e(clusive. D. *e +eighted and included in the initial cash flo+. %. *e totall# ignored +hen internal e!uit# funding is utili1ed.

46. Chelsea ?ashions is e(pected to pa# an annual dividend of ;6.56 a share ne(t #ear. 'he market price of the stock is ;&&.46 and the gro+th rate is - percent. hat is the firm/s cost of e!uit#" A. 4.-5 percent $. 4.:1 percent C. 5.&4 percent D. 5.-4 percent %. :.66 percent

41. 'he Shoe Butlet has paid annual dividends of ;6.3-, ;6.46, ;6.4&, and ;6.4- per share over the last four #ears, respectivel#. 'he stock is currentl# selling for ;&3 a share. hat is this firm/s cost of e!uit#" A. 4.-3 percent $. 4.:, percent C. 16.,5 percent D. 16.-, percent %. 11.4: percent

4&. S+eet 'reats common stock is currentl# priced at ;1:.63 a share. 'he compan# 0ust paid ;1.1- per share as its annual dividend. 'he dividends have *een increasing *# &.- percent annuall# and are e(pected to continue doing the same. hat is this firm/s cost of e!uit#" A. 3.6, percent $. 3.15 percent C. 5.44 percent D. 5.35 percent %. 5.5& percent

14-1&

Chapter 14 - Cost of Capital

4,. 'he common stock of )etal )olds has a negative gro+th rate of 1.- percent and a re!uired return of 15 percent. 'he current stock price is ;11.46. hat +as the amount of the last dividend paid" A. ;&.64 $. ;&.11 C. ;&.1: D. ;&.&& %. ;&.&3

44. 7igh+a# %(press has paid annual dividends of ;1.13, ;1.&6, ;1.&-, ;1.16, and ;6.:- over the past five #ears respectivel#. hat is the average dividend gro+th rate" A. -4.-1 percent $. -,.36 percent C. &.&5 percent D. &.44 percent %. 4.,: percent

4-. Southern 7ome Cookin/ 0ust paid its annual dividend of ;6.3- a share. 'he stock has a market price of ;1, and a *eta of 1.1&. 'he return on the D.S. 'reasur# *ill is &.- percent and the market risk premium is 3.5 percent. hat is the cost of e!uit#" A. :.:5 percent $. 16.64 percent C. 16.1& percent D. 16.,4 percent %. 16.4- percent

43. Cational 7ome Eentals has a *eta of 1.,5, a stock price of ;1:, and recentl# paid an annual dividend of ;6.:4 a share. 'he dividend gro+th rate is 4.- percent. 'he market has a 16.3 percent rate of return and a risk premium of 4.- percent. hat is the firm/s cost of e!uit#" A. 4.6- percent $. 5.34 percent C. :.1, percent D. 16.,6 percent %. 11.-3 percent

14-1,

Chapter 14 - Cost of Capital

44. 7enesse# )arkets has a gro+th rate of 4.5 percent and is e!uall# as risk# as the market. 'he stock is currentl# selling for ;14 a share. 'he overall stock market has a 16.3 percent rate of return and a risk premium of 5.4 percent. hat is the e(pected rate of return on this stock" A. 5.4 percent $. :.& percent C. 16.3 percent D. 11., percent %. 11.4 percent

45. 'ide+ater ?ishing has a current *eta of 1.45. 'he market risk premium is 5.: percent and the risk-free rate of return is ,.& percent. $# ho+ much +ill the cost of e!uit# increase if the compan# e(pands its operations such that the compan# *eta rises to 1.36" A. 6.55 percent $. 1.64 percent C. 1.-6 percent D. &.16 percent %. &.&3 percent

4:. ind >o+er S#stems has &6-#ear, semi-annual *onds outstanding +ith a - percent coupon. 'he face amount of each *ond is ;1,666. 'hese *onds are currentl# selling for 114 percent of face value. hat is the compan#/s pre-ta( cost of de*t" A. ,.:5 percent $. 4.4& percent C. 4.41 percent D. -.,3 percent %. -.-- percent

-6. $oulder ?urniture has *onds outstanding that mature in 1, #ears, have a 3 percent coupon, and pa# interest annuall#. 'hese *onds have a face value of ;1,666 and a current market price of ;1,646. hat is the compan#/s afterta( cost of de*t if its ta( rate is ,& percent" A. &.:4 percent $. ,.&4 percent C. ,.45 percent D. -.&1 percent %. -.-, percent

14-14

Chapter 14 - Cost of Capital

-1. 7and# )an, Inc. has 1ero coupon *onds outstanding that mature in 5 #ears. 'he *onds have a face value of ;1,666 and a current market price of ;346. hat is the compan#/s pre-ta( cost of de*t" A. &.-- percent $. -.6: percent C. -.33 percent D. 4.,1 percent %. 4.45 percent

-&. Dog =one =ood %ngines has a *ond issue outstanding +ith 14 #ears to maturit#. 'hese *onds have a ;1,666 face value, a : percent coupon, and pa# interest semi-annuall#. 'he *onds are currentl# !uoted at 54 percent of face value. hat is the compan#/s pre-ta( cost of de*t if the ta( rate is ,5 percent" A. 4.16 percent $. 4.4& percent C. 3.31 percent D. 5.:6 percent %. 16.34 percent

-,. 'he Corner $aker# has a *ond issue outstanding that matures in 4 #ears. 'he *onds pa# interest semi-annuall#. Currentl#, the *onds are !uoted at 161.4 percent of face value and carr# a : percent coupon. hat is the firm/s afterta( cost of de*t if the ta( rate is ,6 percent" A. 4.55 percent $. -.,3 percent C. -.4- percent D. 3.11 percent %. 5.44 percent

-4. 'he outstanding *onds of 'ech %(press are priced at ;:5: and mature in 5 #ears. 'hese *onds have a 3 percent coupon and pa# interest annuall#. 'he firm/s ta( rate is ,: percent. hat is the firm/s afterta( cost of de*t" A. ,.61 percent $. ,.&& percent C. ,.,- percent D. ,.44 percent %. 4.41 percent

14-1-

Chapter 14 - Cost of Capital

--. Simple ?oods has a 1ero coupon *ond issue outstanding that matures in : #ears. 'he *onds are selling at 4& percent of par value. hat is the compan#/s afterta( cost of de*t if the ta( rate is ,5 percent" A. -.45 percent $. -.4, percent C. 3.1& percent D. 4.4, percent %. :.55 percent

-3. =rill orks and )ore has 5 percent preferred stock outstanding that is currentl# selling for ;4: a share. 'he market rate of return is 14 percent and the firm/s ta( rate is ,4 percent. hat is the firm/s cost of preferred stock" A. 14.44 percent $. 1-.&: percent C. 1-.34 percent D. 13.,, percent %. 13.-4 percent

-4. Samuelson >lastics has 4.- percent preferred stock outstanding. Currentl#, this stock has a market value per share of ;-& and a *ook value per share of ;,5. hat is the cost of preferred stock" A. 4.-6 percent $. 1,.55 percent C. 14.4& percent D. 1:.&: percent %. 1:.44 percent

-5. Ce+ Aork Deli/s has 4 percent preferred stock outstanding that sells for ;,3 a share. 'his stock +as originall# issued at ;-6 per share. hat is the cost of preferred stock" A. 1,.35 percent $. 14.66 percent C. 14.&: percent D. 1:.44 percent %. 1:.56 percent

14-13

Chapter 14 - Cost of Capital

-:. Celson/s Landscaping has 1,&66 *onds outstanding that are selling for ;::6 each. 'he compan# also has &,-66 shares of preferred stock at a market price of ;&5 a share. 'he common stock is priced at ;,4 a share and there are &5,666 shares outstanding. hat is the +eight of the common stock as it relates to the firm/s +eighted average cost of capital" A. 4,.65 percent $. 4-.13 percent C. 44.11 percent D. -4.66 percent %. --.4- percent

36. )angrove ?ruit ?arms has a ;&66,666 *ond issue outstanding that is selling at :& percent of face value. 'he firm also has 1,-66 shares of preferred stock and 1-,666 shares of common stock outstanding. 'he preferred stock has a market price of ;,- a share compared to a price of ;&4 a share for the common stock. hat is the +eight of the preferred stock as it relates to the firm/s +eighted average cost of capital" A. 3.4- percent $. 4.&6 percent C. 4.4- percent D. 5.,6 percent %. 5.56 percent

31. %lectronics =alore has :-6,666 shares of common stock outstanding at a market price of ;,5 a share. 'he compan# also has 46,666 *onds outstanding that are !uoted at 163 percent of face value. hat +eight should *e given to the de*t +hen the firm computes its +eighted average cost of capital" A. 4& percent $. 43 percent C. -6 percent D. -4 percent %. -5 percent

14-14

Chapter 14 - Cost of Capital

3&. >hillips %!uipment has 56,666 *onds outstanding that are selling at par. $onds +ith similar characteristics are #ielding 3.4- percent. 'he compan# also has 4-6,666 shares of 4 percent preferred stock and &.- million shares of common stock outstanding. 'he preferred stock sells for ;-, a share. 'he common stock has a *eta of 1.,4 and sells for ;4& a share. 'he D.S. 'reasur# *ill is #ielding &.5 percent and the return on the market is 11.& percent. 'he corporate ta( rate is ,5 percent. hat is the firm/s +eighted average cost of capital" A. 16.,: percent $. 16.34 percent C. 11.15 percent D. 11.,6 percent %. 11.-3 percent

3,. a#co Industrial Suppl# has a pre-ta( cost of de*t of 4.3 percent, a cost of e!uit# of 14., percent, and a cost of preferred stock of 5.- percent. 'he firm has &&6,666 shares of common stock outstanding at a market price of ;&4 a share. 'here are &-,666 shares of preferred stock outstanding at a market price of ;41 a share. 'he *ond issue has a face value of ;--6,666 and a market !uote of 161.&. 'he compan#/s ta( rate is ,4 percent. hat is the firm/s +eighted average cost of capital" A. 16.15 percent $. 16.54 percent C. 11.,& percent D. 1&.36 percent %. 1&.51 percent

34. Central S#stems, Inc. desires a +eighted average cost of capital of 5 percent. 'he firm has an afterta( cost of de*t of 4.5 percent and a cost of e!uit# of 1-.& percent. hat de*t-e!uit# ratio is needed for the firm to achieve its targeted +eighted average cost of capital" A. 6.,5 $. 6.44 C. 1.6& D. &.&%. &.3,

14-15

Chapter 14 - Cost of Capital

3-. E.S. =reen has &-6,666 shares of common stock outstanding at a market price of ;&5 a share. Ce(t #ear/s annual dividend is e(pected to *e ;1.-- a share. 'he dividend gro+th rate is & percent. 'he firm also has 4,-66 *onds outstanding +ith a face value of ;1,666 per *ond. 'he *onds carr# a 4 percent coupon, pa# interest semiannuall#, and mature in 4.- #ears. 'he *onds are selling at :5 percent of face value. 'he compan#/s ta( rate is ,4 percent. hat is the firm/s +eighted average cost of capital" A. -.4 percent $. 3.& percent C. 4.- percent D. 5.- percent %. :.3 percent

33. Felso/s has a de*t-e!uit# ratio of 6.-- and a ta( rate of ,- percent. 'he firm does not issue preferred stock. 'he cost of e!uit# is 14.- percent and the afterta( cost of de*t is 4.5 percent. hat is the +eighted average cost of capital" A. 16.43 percent $. 16.34 percent C. 11.63 percent D. 11.,5 percent %. 11.-4 percent

34. =ranite orks maintains a de*t-e!uit# ratio of 6.3- and has a ta( rate of ,& percent. 'he firm does not issue preferred stock. 'he pre-ta( cost of de*t is :.5 percent. 'here are &-,666 shares of stock outstanding +ith a *eta of 1.& and a market price of ;1: a share. 'he current market risk premium is 5.- percent and the current risk-free rate is ,.3 percent. 'his #ear, the firm paid an annual dividend of ;1.16 a share and e(pects to increase that amount *# & percent each #ear. Dsing an average e(pected cost of e!uit#, +hat is the +eighted average cost of capital" A. 5.44 percent $. 5.45 percent C. 5.:3 percent D. :.1, percent %. :.&6 percent

14-1:

Chapter 14 - Cost of Capital

35. Delta Lighting has ,6,666 shares of common stock outstanding at a market price of ;14.-6 a share. 'his stock +as originall# issued at ;,1 per share. 'he firm also has a *ond issue outstanding +ith a total face value of ;&56,666 +hich is selling for 53 percent of par. 'he cost of e!uit# is 13 percent +hile the afterta( cost of de*t is 3.: percent. 'he firm has a *eta of 1.45 and a ta( rate of ,6 percent. hat is the +eighted average cost of capital" A. 11.64 percent $. 1,.14 percent C. 14.,3 percent D. 1-.&: percent %. 1-.44 percent

3:. 'he )arket Butlet has a *eta of 1.,5 and a cost of e!uit# of 14.:4- percent. 'he risk-free rate of return is 4.&- percent. hat discount rate should the firm assign to a ne+ pro0ect that has a *eta of 1.&-" A. 1,.-4 percent. $. 1,.4& percent. C. 1,.:4 percent. D. 14.14 percent. %. 14.,3 percent.

46. Silo )ills has a *eta of 6.54 and a cost of e!uit# of 11.: percent. 'he risk-free rate of return is &.5 percent. 'he firm is currentl# considering a pro0ect that has a *eta of 1.6, and a pro0ect life of 3 #ears. hat discount rate should *e assigned to this pro0ect" A. 1,.,, percent. $. 1,.-4 percent. C. 1,.3& percent. D. 1,.54 percent. %. 14.6: percent.

14-&6

Chapter 14 - Cost of Capital

41. 'ravis G Sons has a capital structure +hich is *ased on 46 percent de*t, - percent preferred stock, and -- percent common stock. 'he pre-ta( cost of de*t is 4.- percent, the cost of preferred is : percent, and the cost of common stock is 1, percent. 'he compan#/s ta( rate is ,: percent. 'he compan# is considering a pro0ect that is e!uall# as risk# as the overall firm. 'his pro0ect has initial costs of ;,&-,666 and annual cash inflo+s of ;54,666, ;&4:,666, and ;113,666 over the ne(t three #ears, respectivel#. hat is the pro0ected net present value of this pro0ect" A. ;35,&11.64 $. ;35,54:.:4 C. ;3:,,31.65 D. ;44,&65.15 %. ;43,611.&,

4&. >anelli/s is anal#1ing a pro0ect +ith an initial cost of ;16&,666 and cash inflo+s of ;3-,666 in #ear one and ;44,666 in #ear t+o. 'his pro0ect is an e(tension of the firm/s current operations and thus is e!uall# as risk# as the current firm. 'he firm uses onl# de*t and common stock to finance its operations and maintains a de*t-e!uit# ratio of 6.4-. 'he afterta( cost of de*t is 4.5 percent, the cost of e!uit# is 1&.4 percent, and the ta( rate is ,- percent. hat is the pro0ected net present value of this pro0ect" A. ;1-,411 $. ;1-,56: C. ;13,,,, D. ;13,:,5 %. ;14,546

4,. Carson %lectronics uses 46 percent common stock and ,6 percent de*t to finance its operations. 'he afterta( cost of de*t is -.4 percent and the cost of e!uit# is 1-.4 percent. )anagement is considering a pro0ect that +ill produce a cash inflo+ of ;,3,666 in the first #ear. 'he cash inflo+s +ill then gro+ at , percent per #ear forever. hat is the ma(imum amount the firm can initiall# invest in this pro0ect to avoid a negative net present value for the pro0ect" A. ;&::,6,& $. ;,5&,:4: C. ;411,463 D. ;4,4,653 %. ;441,414

14-&1

Chapter 14 - Cost of Capital

44. 'he $aker# is considering a ne+ pro0ect it considers to *e a little riskier than its current operations. 'hus, management has decided to add an additional 1.- percent to the compan#/s overall cost of capital +hen evaluating this pro0ect. 'he pro0ect has an initial cash outla# of ;3&,666 and pro0ected cash inflo+s of ;14,666 in #ear one, ;&5,666 in #ear t+o, and ;,6,666 in #ear three. 'he firm uses &- percent de*t and 4- percent common stock as its capital structure. 'he compan#/s cost of e!uit# is 1-.- percent +hile the afterta( cost of de*t for the firm is 3.1 percent. hat is the pro0ected net present value of the ne+ pro0ect" A. -;3,&65 $. -;-,:34 C. -;&,,65 D. ;1,4&4 %. ;1,-4,

4-. 'he Bil Derrick has an overall cost of e!uit# of 1,.3 percent and a *eta of 1.&5. 'he firm is financed solel# +ith common stock. 'he risk-free rate of return is ,.4 percent. hat is an appropriate cost of capital for a division +ithin the firm that has an estimated *eta of 1.15" A. 1&.,4 percent $. 1&.41 percent C. 1&.-4 percent D. 1&.34 percent %. 1&.56 percent

43. )iller Sisters has an overall *eta of 6.34 and a cost of e!uit# of 11.& percent for the firm overall. 'he firm is 166 percent financed +ith common stock. Division A +ithin the firm has an estimated *eta of 1.65 and is the riskiest of all of the firm/s operations. hat is an appropriate cost of capital for division A if the market risk premium is :.- percent" A. 1-.1& percent $. 1-.,5 percent C. 1-.3, percent D. 1-.44 percent %. 13.61 percent

14-&&

Chapter 14 - Cost of Capital

44. Deep )ining and >recious )etals are separate firms that are *oth considering a silver e(ploration pro0ect. Deep )ining is in the actual mining *usiness and has an afterta( cost of capital of 1&.5 percent. >recious )etals is in the precious gem retail *usiness and has an afterta( cost of capital of 16.3 percent. 'he pro0ect under consideration has initial costs of ;-4-,666 and anticipated annual cash inflo+s of ;16&,666 a #ear for ten #ears. hich firm8s9, if either, should accept this pro0ect" A. Compan# A onl# $. Compan# $ onl# C. *oth Compan# A and Compan# $ D. neither Compan# A or Compan# $ %. cannot *e determined +ithout further information

45. Sister >ools sells outdoor s+imming pools and currentl# has an afterta( cost of capital of 11.3 percent. Al/s Construction *uilds and sells +ater features and fountains and has an afterta( cost of capital of 16.5 percent. Sister >ools is considering *uilding and selling its o+n +ater features and fountains. 'he sales manager of Sister >ools estimates that the +ater features and fountains +ould produce &6 percent of the firm/s future total sales. 'he initial cash outla# for this pro0ect +ould *e ;5-,666. 'he e(pected net cash inflo+s are ;13,666 a #ear for 4 #ears. hat is the net present value of the Sister >ools pro0ect" A. -;11,644 $. -;:,11C. -;4,&3& D. -;4,-65 %. ;1,&1:

4:. Decker/s is a chain of furniture retail stores. ?urniture ?ashions is a furniture maker and a supplier to Decker/s. Decker/s has a *eta of 1.,5 as compared to ?urniture ?ashion/s *eta of 1.1&. 'he risk-free rate of return is ,.- percent and the market risk premium is 5 percent. hat discount rate should Decker/s use if it considers a pro0ect that involves the manufacturing of furniture" A. 1&.43 percent $. 1&.:& percent C. 1,.-6 percent D. 14.65 percent %. 14.-4 percent

14-&,

Chapter 14 - Cost of Capital

56. $leakl# %nterprises has a capital structure of -- percent common stock, 16 percent preferred stock, and ,- percent de*t. 'he flotation costs are 4.- percent for de*t, 4 percent for preferred stock, and :.- percent for common stock. 'he corporate ta( rate is ,4 percent. hat is the +eighted average flotation cost" A. -.5 percent $. 3.& percent C. 3.4 percent D. 4.6 percent %. 4.- percent

51. Hustice, Inc. has a capital structure +hich is *ased on ,6 percent de*t, - percent preferred stock, and 3- percent common stock. 'he flotation costs are 11 percent for common stock, 16 percent for preferred stock, and 4 percent for de*t. 'he corporate ta( rate is ,4 percent. hat is the +eighted average flotation cost" A. 5.:4 percent $. :.45 percent C. :.3& percent D. :.4- percent %. 16.66 percent

5&. 'he Dail# $re+ has a de*t-e!uit# ratio of 6.4&. 'he firm is anal#1ing a ne+ pro0ect +hich re!uires an initial cash outla# of ;4&6,666 for e!uipment. 'he flotation cost is :.3 percent for e!uit# and -.4 percent for de*t. hat is the initial cost of the pro0ect including the flotation costs" A. ;,6&,466 $. ;,35,:&4 C. ;4--,4,5 D. ;4-3,466 %. ;-5,,,,,

14-&4

Chapter 14 - Cost of Capital

5,. Aou are evaluating a pro0ect +hich re!uires ;&,6,666 in e(ternal financing. 'he flotation cost of e!uit# is 11.3 percent and the flotation cost of de*t is -.4 percent. hat is the initial cost of the pro0ect including the flotation costs if #ou maintain a de*t-e!uit# ratio of 6.4-" A. ;&45,4:4 $. ;&4:,6&1 C. ;&-4,3,5 D. ;&--,--1 %. ;&--,343

54. estern ear is considering a pro0ect that re!uires an initial investment of ;&44,666. 'he firm maintains a de*t-e!uit# ratio of 6.46 and has a flotation cost of de*t of 4 percent and a flotation cost of e!uit# of 16.- percent. 'he firm has sufficient internall# generated e!uit# to cover the e!uit# portion of this pro0ect. hat is the initial cost of the pro0ect including the flotation costs" A. ;&4:,-:& $. ;&51,463 C. ;&55,66D. ;&:4,444 %. ;,6&,43&

5-. Aester#ear >roductions is considering a pro0ect +ith an initial start up cost of ;:36,666. 'he firm maintains a de*t-e!uit# ratio of 6.-6 and has a flotation cost of de*t of 3.5 percent and a flotation cost of e!uit# of 11.4 percent. 'he firm has sufficient internall# generated e!uit# to cover the e!uit# cost of this pro0ect. hat is the initial cost of the pro0ect including the flotation costs" A. ;:4:,414 $. ;:5&,&3C. ;::&,,53 D. ;1,6,5,-1, %. ;1,63-,65:

Essay Questions

14-&-

Chapter 14 - Cost of Capital

53. hat role does the +eighted average cost of capital pla# +hen determining a pro0ect/s cost of capital"

54. hat are some advantages of the su*0ective approach to determining the cost of capital and +h# do #ou think that approach is utili1ed"

55. =ive an e(ample of a situation +here a firm should adopt the pure pla# approach for determining the cost of capital for a pro0ect.

5:. Suppose #our *oss comes to #ou and asks #ou to re-evaluate a capital *udgeting pro0ect. 'he first evaluation +as in error, he e(plains, *ecause it ignored flotation costs. 'o correct for this, he asks #ou to evaluate the pro0ect using a higher cost of capital +hich incorporates these costs. Is #our *oss/ approach correct" h# or +h# not"

14-&3

Chapter 14 - Cost of Capital

:6. %(plain ho+ the use of internal e!uit# rather than e(ternal e!uit# affects the anal#sis of a pro0ect.

Multiple Choice Questions

:1. 'he Cit# Street Corporation/s common stock has a *eta of 1.&. 'he risk-free rate is ,.percent and the e(pected return on the market is 1, percent. hat is the firm/s cost of e!uit#" A. 11.4 percent $. 1&.5 percent C. 14.: percent D. 14.3 percent %. 1:.1 percent

:&. Stock in Countr# Eoad Industries has a *eta of 6.:4. 'he market risk premium is 16 percent +hile '-*ills are currentl# #ielding -.- percent. Countr# Eoad/s most recent dividend +as ;1.46 per share, and dividends are e(pected to gro+ at a 4 percent annual rate indefinitel#. 'he stock sells for ;,& a share. hat is the estimated cost of e!uit# using the average of the CA>) approach and the dividend discount approach" A. 1,.:4 percent $. 14.63 percent C. 14.&1 percent D. 14.,5 percent %. 14.-6 percent

14-&4

Chapter 14 - Cost of Capital

:,. 7oldup $ank has an issue of preferred stock +ith a ;- stated dividend that 0ust sold for ;:& per share. hat is the *ank/s cost of preferred" A. 4.36 percent $. 4.34 percent C. -.,: percent D. -.4, percent %. -.-4 percent

:4. Decline, Inc. is tr#ing to determine its cost of de*t. 'he firm has a de*t issue outstanding +ith 1- #ears to maturit# that is !uoted at 164 percent of face value. 'he issue makes semiannual pa#ments and has an em*edded cost of 11 percent annuall#. hat is the afterta( cost of de*t if the ta( rate is ,, percent" A. 3.43 percent $. 3.:6 percent C. 4.14 percent D. 4.,4 percent %. 4.4& percent

:-. Himin#/s Cricket ?arm issued a ,6-#ear, 5 percent, semiannual *ond 3 #ears ago. 'he *ond currentl# sells for 114 percent of its face value. hat is the afterta( cost of de*t if the compan#/s ta( rate is ,1 percent" A. 4.3, percent $. 4.46 percent C. 4.4- percent D. 4.5& percent %. 4.53 percent

:3. )ullineau( Corporation has a target capital structure of 41 percent common stock, 4 percent preferred stock, and -- percent de*t. Its cost of e!uit# is 1: percent, the cost of preferred stock is 3.- percent, and the pre-ta( cost of de*t is 4.- percent. hat is the firm/s ACC given a ta( rate of ,4 percent" A. :.54 percent $. 16.4, percent C. 16.44 percent D. 1,.,5 percent %. 1-.14 percent

14-&5

Chapter 14 - Cost of Capital

:4. Cookie Dough )anufacturing has a target de*t-e!uit# ratio of 6.-. Its cost of e!uit# is 1percent, and its cost of de*t is 11 percent. hat is the firm/s ACC given a ta( rate of ,1 percent" A. 1&.-, percent $. 1&.45 percent C. 1,.11 percent D. 1,.45 percent %. 1,.34 percent

:5. ?ama/s Llamas has a +eighted average cost of capital of 16.- percent. 'he compan#/s cost of e!uit# is 1-.- percent, and its preta( cost of de*t is 5.- percent. 'he ta( rate is ,4 percent. hat is the compan#/s target de*t-e!uit# ratio" A. 6.5: $. 6.:& C. 6.:5 D. 1.61 %. 1.6&

::. Hungle, Inc. has a target de*t-e!uit# ratio of 6.4&. Its ACC is 11.- percent and the ta( rate is ,4 percent. hat is the cost of e!uit# if the afterta( cost of de*t is -.- percent" A. 1,.4- percent $. 1,.54 percent C. 14.41 percent D. 14.4: percent %. 1-.5& percent

14-&:

Chapter 14 - Cost of Capital

166. 'itan )ining Corporation has 14 million shares of common stock outstanding, :66,666 shares of : percent preferred stock outstanding and &16,666 ten percent semiannual *onds outstanding, par value ;1,666 each. 'he common stock currentl# sells for ;,4 per share and has a *eta of 1.1-, the preferred stock currentl# sells for ;56 per share, and the *onds have 14 #ears to maturit# and sell for :1 percent of par. 'he market risk premium is 11.- percent, '*ills are #ielding 4.- percent, and the firm/s ta( rate is ,& percent. hat discount rate should the firm appl# to a ne+ pro0ect/s cash flo+s if the pro0ect has the same risk as the firm/s t#pical pro0ect" A. 14.-: percent $. 14.4& percent C. 1-.14 percent D. 1-.-4 percent %. 13.41 percent

161. Suppose #our compan# needs ;14 million to *uild a ne+ assem*l# line. Aour target de*t-e!uit# ratio is 6.54. 'he flotation cost for ne+ e!uit# is :.- percent, *ut the floatation cost for de*t is onl# &.- percent. hat is the true cost of *uilding the ne+ assem*l# line after taking flotation costs into account" A. 14.5& million $. 14.:4 million C. 1-.64 million D. 1-.1& million %. 1-.&, million

14-,6

Chapter 14 - Cost of Capital

Chapter 14 Cost of Capital Ans+er Fe#

Multiple Choice Questions

1. A group of individuals got together and purchased all of the outstanding shares of common stock of DL Smith, Inc. hat is the return that these individuals re!uire on this investment called" A. dividend #ield B. cost of e!uit# C. capital gains #ield D. cost of capital %. income return Eefer to section 14.&

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

&. 'e(tile )ills *orro+s mone# at a rate of 1,.- percent. 'his interest rate is referred to as the. A. compound rate. $. current #ield. C. cost of de*t. D. capital gains #ield. %. cost of capital. Eefer to section 14.,

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

14-,1

Chapter 14 - Cost of Capital

,. 'he average of a firm/s cost of e!uit# and afterta( cost of de*t that is +eighted *ased on the firm/s capital structure is called the. A. re+ard to risk ratio. $. +eighted capital gains rate. C. structured cost of capital. D. su*0ective cost of capital. E. +eighted average cost of capital. Eefer to section 14.4

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%# 'o(ic: +eig,ted a!erage cost of ca(ital

4. hen a manager develops a cost of capital for a specific pro0ect *ased on the cost of capital for another firm +hich has a similar line of *usiness as the pro0ect, the manager is utili1ing the 22222 approach. A. su*0ective risk B. pure pla# C. divisional cost of capital D. capital ad0ustment %. securit# market line Eefer to section 14.-

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%'o(ic: .ure .lay

14-,&

Chapter 14 - Cost of Capital

-. A firm/s cost of capital. A. +ill decrease as the risk level of the firm increases. $. for a specific pro0ect is primaril# dependent upon the source of the funds used for the pro0ect. C. is independent of the firm/s capital structure. D. should *e applied as the discount rate for an# pro0ect considered *# the firm. E. depends upon ho+ the funds raised are going to *e spent. Eefer to section 14.1

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%" 'o(ic: Cost of ca(ital

3. 'he +eighted average cost of capital for a +holesaler. A. is e!uivalent to the afterta( cost of the firm/s lia*ilities. $. should *e used as the re!uired return +hen anal#1ing a potential ac!uisition of a retail outlet. C. is the return investors re!uire on the total assets of the firm. D. remains constant +hen the de*t-e!uit# ratio changes. %. is unaffected *# changes in corporate ta( rates. Eefer to section 14.1

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%" 'o(ic: +ACC

14-,,

Chapter 14 - Cost of Capital

4. hich one of the follo+ing is the primar# determinant of a firm/s cost of capital" A. de*t-e!uit# ratio $. applica*le ta( rate C. cost of e!uit# D. cost of de*t E. use of the funds Eefer to section 14.1

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%" 'o(ic: Cost of ca(ital

5. Scholastic 'o#s is considering developing and distri*uting a ne+ *oard game for children. 'he pro0ect is similar in risk to the firm/s current operations. 'he firm maintains a de*t-e!uit# ratio of 6.46 and retains all profits to fund the firm/s rapid gro+th. 7o+ should the firm determine its cost of e!uit#" A. *# adding the market risk premium to the afterta( cost of de*t $. *# multipl#ing the market risk premium *# 81 - 6.469 C. *# using the dividend gro+th model D. *# using the capital asset pricing model %. *# averaging the costs *ased on the dividend gro+th model and the capital asset pricing model Eefer to section 14.&

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

14-,4

Chapter 14 - Cost of Capital

:. All else constant, +hich one of the follo+ing +ill increase a firm/s cost of e!uit# if the firm computes that cost using the securit# market line approach" Assume the firm currentl# pa#s an annual dividend of ;1 a share and has a *eta of 1.&. A. a reduction in the dividend amount $. an increase in the dividend amount C. a reduction in the market rate of return D. a reduction in the firm/s *eta E. a reduction in the risk-free rate Eefer to section 14.&

AACSB: N/A Bloom's: Com(re,ension Difficulty: /ntermediate Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: CA.0

16. A firm/s overall cost of e!uit# is. A. is generall# less that the firm/s ACC given a leveraged firm. $. unaffected *# changes in the market risk premium. C. highl# dependent upon the gro+th rate and risk level of the firm. D. generall# less than the firm/s afterta( cost of de*t. %. inversel# related to changes in the firm/s ta( rate. Eefer to section 14.&

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

14-,-

Chapter 14 - Cost of Capital

11. 'he cost of e!uit# for a firm. A. tends to remain static for firms +ith increasing levels of risk. $. increases as the uns#stematic risk of the firm increases. C. ignores the firm/s risks +hen that cost is *ased on the dividend gro+th model. D. e!uals the risk-free rate plus the market risk premium. %. e!uals the firm/s preta( +eighted average cost of capital. Eefer to section 14.&

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

1&. 'he dividend gro+th model can *e used to compute the cost of e!uit# for a firm in +hich of the follo+ing situations" I. firms that have a 166 percent retention ratio II. firms that pa# a constant dividend III. firms that pa# an increasing dividend I<. firms that pa# a decreasing dividend A. I and II onl# $. I and III onl# C. II and III onl# D. I, II, and III onl# E. II, III, and I< onl# Eefer to section 14.&

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Di!idend growt, model

14-,3

Chapter 14 - Cost of Capital

1,. 'he dividend gro+th model. A. is onl# as relia*le as the estimated rate of gro+th. $. can onl# *e used if historical dividend information is availa*le. C. considers the risk that future dividends ma# var# from their estimated values. D. applies onl# +hen a firm is currentl# pa#ing dividends. %. uses *eta to measure the s#stematic risk of a firm. Eefer to section 14.&

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Di!idend growt, model

14. hich one of the follo+ing statements related to the S)L approach to e!uit# valuation is correct" Assume the firm uses de*t in its capital structure. A. 'his model considers a firm/s rate of gro+th. $. 'he model applies onl# to non-dividend pa#ing firms. C. 'he model is dependent upon a relia*le estimate of the market risk premium. D. 'he model generall# produces the same cost of e!uit# as the dividend gro+th model. %. 'his approach generall# produces a cost of e!uit# that e!uals the firm/s overall cost of capital. Eefer to section 14.&

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: S0L a((roac,

14-,4

Chapter 14 - Cost of Capital

1-. hich of the follo+ing statements are correct" I. 'he S)L approach is dependent upon a relia*le measure of a firm/s uns#stematic risk. II. 'he S)L approach can *e applied to firms that retain all of their earnings. III. 'he S)L approach assumes a firm/s future risks are similar to its past risks. I<. 'he S)L approach assumes the re+ard-to-risk ratio is constant. A. I and III onl# $. II and I< onl# C. III and I< onl# D. I, II, and III onl# E. II, III, and I< onl# Eefer to section 14.&

AACSB: N/A Bloom's: Com(re,ension Difficulty: /ntermediate Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: S0L a((roac,

13. 'he pre-ta( cost of de*t. A. is *ased on the current #ield to maturit# of the firm/s outstanding *onds. $. is e!ual to the coupon rate on the latest *onds issued *# a firm. C. is e!uivalent to the average current #ield on all of a firm/s outstanding *onds. D. is *ased on the original #ield to maturit# on the latest *onds issued *# a firm. %. has to *e estimated as it cannot *e directl# o*served in the market. Eefer to section 14.,

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

14-,5

Chapter 14 - Cost of Capital

14. 'he afterta( cost of de*t generall# increases +hen. I. a firm/s *ond rating increases. II. the market rate of interest increases. III. ta( rates decrease. I<. *ond prices rise. A. I and III onl# B. II and III onl# C. I, II, and III onl# D. II, III, and I< onl# %. I, II, III, and I< Eefer to section 14.,

AACSB: N/A Bloom's: Com(re,ension Difficulty: /ntermediate Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

15. 'he cost of preferred stock is computed the same as the. A. pre-ta( cost of de*t. $. return on an annuit#. C. afterta( cost of de*t. D. return on a perpetuit#. %. cost of an irregular gro+th common stock. Eefer to section 14.,

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: Cost of (referred

14-,:

Chapter 14 - Cost of Capital

1:. 'he cost of preferred stock. A. is e!ual to the dividend #ield. $. is e!ual to the #ield to maturit#. C. is highl# dependent on the dividend gro+th rate. D. is independent of the stock/s price. %. decreases +hen ta( rates increase. Eefer to section 14.,

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%* 'o(ic: Cost of (referred

&6. 'he capital structure +eights used in computing the +eighted average cost of capital. A. are *ased on the *ook values of total de*t and total e!uit#. B. are *ased on the market value of the firm/s de*t and e!uit# securities. C. are computed using the *ook value of the long-term de*t and the *ook value of e!uit#. D. remain constant over time unless the firm issues ne+ securities. %. are restricted to the firm/s de*t and common stock. Eefer to section 14.4

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%# 'o(ic: +ACC

14-46

Chapter 14 - Cost of Capital

&1. )orris Industries has a capital structure of -- percent common stock, 16 percent preferred stock, and 4- percent de*t. 'he firm has a 36 percent dividend pa#out ratio, a *eta of 6.5:, and a ta( rate of ,5 percent. =iven this, +hich one of the follo+ing statements is correct" A. 'he afterta( cost of de*t +ill *e greater than the current #ield-to-maturit# on the firm/s *onds. $. 'he firm/s cost of preferred is most likel# less than the firm/s actual cost of de*t. C. 'he firm/s cost of e!uit# is unaffected *# a change in the firm/s ta( rate. D. 'he cost of e!uit# can onl# *e estimated using the S)L approach. %. 'he firm/s +eighted average cost of capital +ill remain constant as long as the capital structure remains constant. Eefer to section 14.4

AACSB: N/A Bloom's: Com(re,ension Difficulty: /ntermediate Learning Ob ecti!e: "#$* Section: "#%# 'o(ic: +ACC

&&. 'he afterta( cost of de*t. A. varies inversel# to changes in market interest rates. $. +ill generall# e(ceed the cost of e!uit# if the relevant ta( rate is 1ero. C. +ill generall# e!ual the cost of preferred if the ta( rate is 1ero. D. is unaffected *# changes in the market rate of interest. E. has a greater effect on a firm/s cost of capital +hen the de*t-e!uit# ratio increases. Eefer to section 14.,

AACSB: N/A Bloom's: Com(re,ension Difficulty: /ntermediate Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

14-41

Chapter 14 - Cost of Capital

&,. 'he +eighted average cost of capital for a firm ma# *e dependent upon the firm/s. I. rate of gro+th. II. de*t-e!uit# ratio. III. preferred dividend pa#ment. I<. retention ratio. A. I and III onl# $. II and I< onl# C. I, II, and I< onl# D. I, III, and I< onl# E. I, II, III, and I< Eefer to section 14.4

AACSB: N/A Bloom's: Com(re,ension Difficulty: /ntermediate Learning Ob ecti!e: "#$* Section: "#%# 'o(ic: +ACC

&4. 'he +eighted average cost of capital for a firm is the. A. discount rate +hich the firm should appl# to all of the pro0ects it undertakes. B. rate of return a firm must earn on its e(isting assets to maintain the current value of its stock. C. coupon rate the firm should e(pect to pa# on its ne(t *ond issue. D. minimum discount rate the firm should re!uire on an# ne+ pro0ect. %. rate of return shareholders should e(pect to earn on their investment in this firm. Eefer to section 14.4

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%# 'o(ic: +ACC

14-4&

Chapter 14 - Cost of Capital

&-. hich one of the follo+ing statements is correct for a firm that uses de*t in its capital structure" A. 'he ACC should decrease as the firm/s de*t-e!uit# ratio increases. $. hen computing the ACC, the +eight assigned to the preferred stock is *ased on the coupon rate multiplied *# the par value of the preferred. C. 'he firm/s ACC +ill decrease as the corporate ta( rate decreases. D. 'he +eight of the common stock used in the computation of the ACC is *ased on the num*er of shares outstanding multiplied *# the *ook value per share. %. 'he ACC +ill remain constant unless a firm retires some of its de*t. Eefer to section 14.4

AACSB: N/A Bloom's: Com(re,ension Difficulty: /ntermediate Learning Ob ecti!e: "#$* Section: "#%# 'o(ic: +ACC

&3. If a firm uses its ACC as the discount rate for all of the pro0ects it undertakes then the firm +ill tend to. I. re0ect some positive net present value pro0ects. II. accept some negative net present value pro0ects. III. favor high risk pro0ects over lo+ risk pro0ects. I<. increase its overall level of risk over time. A. I and III onl# $. III and I< onl# C. I, II, and III onl# D. I, II, and I< onl# E. I, II, III, and I< Eefer to section 14.4

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%# 'o(ic: +ACC

14-4,

Chapter 14 - Cost of Capital

&4. >reston Industries has t+o separate divisions. %ach division is in a separate line of *usiness. Division A is the largest division and represents 46 percent of the firm/s overall sales. Division A is also the riskier of the t+o divisions. Division $ is the smaller and least risk# of the t+o. hen management is deciding +hich of the various divisional pro0ects should *e accepted, the managers should. A. allocate more funds to Division A since it is the largest of the t+o divisions. $. fund all of Division $/s pro0ects first since the# tend to *e less risk# and then allocate the remaining funds to the Division A pro0ects that have the highest net present values. C. allocate the compan#/s funds to the pro0ects +ith the highest net present values *ased on the firm/s +eighted average cost of capital. D. assign appropriate, *ut differing, discount rates to each pro0ect and then select the pro0ects +ith the highest net present values. %. fund the highest net present value pro0ects from each division *ased on an allocation of 46 percent of the funds to Division A and ,6 percent of the funds to Division $. Eefer to section 14.-

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%'o(ic: Di!isional cost of ca(ital

&5. )arkle# and Stearns is a multi-divisional firm that uses its ACC as the discount rate for all proposed pro0ects. %ach division is in a separate line of *usiness and each presents risks uni!ue to those lines. =iven this, a division +ithin the firm +ill tend to. A. receive less pro0ect funding if its line of *usiness is riskier than that of the other divisions. $. avoid risk# pro0ects so it can receive more pro0ect funding. C. *ecome less risk# over time *ased on the pro0ects that are accepted. D. have e!ual pro*a*ilit# of receiving funding as compared to the other divisions. E. prefer higher risk pro0ects over lo+er risk pro0ects. Eefer to section 14.-

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%'o(ic: Di!isional cost of ca(ital

14-44

Chapter 14 - Cost of Capital

&:. 'he discount rate assigned to an individual pro0ect should *e *ased on. A. the firm/s +eighted average cost of capital. $. the actual sources of funding used for the pro0ect. C. an average of the firm/s overall cost of capital for the past five #ears. D. the current risk level of the overall firm. E. the risks associated +ith the use of the funds re!uired *# the pro0ect. Eefer to section 14.-

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%'o(ic: Di!isional cost of ca(ital

,6. Assigning discount rates to individual pro0ects *ased on the risk level of each pro0ect. A. ma# cause the firm/s overall +eighted average cost of capital to either increase or decrease over time. $. +ill prevent the firm/s overall cost of capital from changing over time. C. +ill cause the firm/s overall cost of capital to decrease over time. D. decreases the value of the firm over time. %. negates the firm/s goal of creating the most value for the shareholders. Eefer to section 14.-

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%'o(ic: .ro ect cost of ca(ital

14-4-

Chapter 14 - Cost of Capital

,1. hich one of the follo+ing statements is correct" A. ?irms should accept lo+ risk pro0ects prior to funding high risk pro0ects. $. )aking su*0ective ad0ustments to a firm/s ACC +hen determining pro0ect discount rates unfairl# punishes lo+-risk divisions +ithin a firm. C. A pro0ect that is unaccepta*le toda# might *e accepta*le tomorro+ given a change in market returns. D. 'he pure pla# method is most fre!uentl# used for pro0ects involving the e(pansion of a firm/s current operations. %. ?irms that elect to use the pure pla# method for determining a discount rate for a pro0ect cannot su*0ectivel# ad0ust the pure pla# rate. Eefer to section 14.-

AACSB: N/A Bloom's: Com(re,ension Difficulty: /ntermediate Learning Ob ecti!e: "#$Section: "#%'o(ic: Cost of ca(ital

,&. >hil/s is a sit-do+n restaurant that speciali1es in home-cooked meals. 'heresa/s is a +alkin deli that speciali1es in specialt# soups and sand+iches. $oth firms are currentl# considering e(panding their operations during the summer months *# offering pre-+rapped donuts, sand+iches, and +raps at a local *each. >hil/s currentl# has a ACC of 14 percent +hile 'heresa/s ACC is 16 percent. 'he e(pansion pro0ect has a pro0ected net present value of ;1&,366 at a 16 percent discount rate and a net present value of -;&,656 at a 14 percent discount rate. hich firm or firms should e(pand and offer food at the local *each during the summer months" A. >hil/s onl# $. 'heresa/s onl# C. *oth >hil/s and 'heresa/s D. neither >hil/s nor 'heresa/s %. cannot *e determined from the information provided Eefer to section 14.-

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%'o(ic: .ro ect cost of ca(ital

14-43

Chapter 14 - Cost of Capital

,,. ilderness Adventures speciali1es in *ack-countr# tours and resort management. 'ravel %(citement speciali1es in making travel reservations and promoting vacation travel. ilderness Adventures has an afterta( cost of capital of 1, percent and 'ravel %(citement has an afterta( cost of capital of 11 percent. $oth firms are considering *uilding +ilderness campgrounds complete +ith man-made lakes and hiking trails. 'he estimated net present value of such a pro0ect is estimated at ;54,666 at a discount rate of 11 percent and -;1&,-66 at a 1, percent discount rate. hich firm or firms, if either, should accept this pro0ect" A. ilderness Adventures onl# $. 'ravel %(citement onl# C. *oth ilderness Adventures and 'ravel %(citement D. neither ilderness Adventures nor 'ravel %(citement %. cannot *e determined +ithout further information Eefer to section 14.-

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%'o(ic: .ro ect cost of ca(ital

,4. 'he su*0ective approach to pro0ect anal#sis. A. is used onl# +hen a firm has an all-e!uit# capital structure. $. uses the ACC of firm @ as the *asis for the discount rate for a pro0ect under consideration *# firm A. C. assigns discount rates to pro0ects *ased on the discretion of the senior managers of a firm. D. allo+s managers to randoml# ad0ust the discount rate assigned to a pro0ect once the pro0ect/s *eta has *een determined. %. applies a lo+er discount rate to pro0ects that are financed totall# +ith e!uit# as compared to those that are partiall# financed +ith de*t. Eefer to section 14.-

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%'o(ic: .ro ect cost of ca(ital

14-44

Chapter 14 - Cost of Capital

,-. hich one of the follo+ing statements is correct" A. 'he su*0ective approach assesses the risks of each pro0ect and assigns an ad0ustment factor that is uni!ue 0ust for that pro0ect. B. Bverall, a firm makes *etter decisions +hen it uses the su*0ective approach than +hen it uses its ACC as the discount rate for all pro0ects. C. ?irms +ill correctl# accept or re0ect ever# pro0ect if the# adopt the su*0ective approach. D. )andator# pro0ects should onl# *e accepted if the# produce a positive C>< +hen the firm/s ACC is used as the discount rate. %. 'he pure pla# approach should onl# *e used +ith lo+-risk pro0ects. Eefer to section 14.-

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$Section: "#%'o(ic: Sub ecti!e a((roac,

,3. hen a firm has flotation costs e!ual to 4 percent of the funding need, pro0ect anal#sts should. A. increase the pro0ect/s discount rate to offset these e(penses *# multipl#ing the firm/s ACC *# 1.64. $. increase the pro0ect/s discount rate to offset these e(penses *# dividing the firm/s ACC *# 81 - 6.649. C. add 4 percent to the firm/s ACC to get the discount rate for the pro0ect. D. increase the initial pro0ect cost *# multipl#ing that cost *# 1.64. E. increase the initial pro0ect cost *# dividing that cost *# 81 - 6.649. Eefer to section 14.3

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$# Section: "#%1 'o(ic: 2lotation costs

14-45

Chapter 14 - Cost of Capital

,4. 'he flotation cost for a firm is computed as. A. the arithmetic average of the flotation costs of *oth de*t and e!uit#. B. the +eighted average of the flotation costs associated +ith each form of financing. C. the geometric average of the flotation costs associated +ith each form of financing. D. one-half of the flotation cost of de*t plus one-half of the flotation cost of e!uit#. %. a +eighted average *ased on the *ook values of the firm/s de*t and e!uit#. Eefer to section 14.3

AACSB: N/A Bloom's: Knowledge Difficulty: Basic Learning Ob ecti!e: "#$# Section: "#%1 'o(ic: 2lotation costs

,5. Incorporating flotation costs into the anal#sis of a pro0ect +ill. A. cause the pro0ect to *e improperl# evaluated. $. increase the net present value of the pro0ect. C. increase the pro0ect/s rate of return. D. increase the initial cash outflo+ of the pro0ect. %. have no effect on the present value of the pro0ect. Eefer to section 14.3

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$# Section: "#%1 'o(ic: 2lotation costs

14-4:

Chapter 14 - Cost of Capital

,:. ?lotation costs for a levered firm should. A. *e ignored +hen anal#1ing a pro0ect *ecause the# are not an actual pro0ect cost. $. *e spread over the life of a pro0ect there*# reducing the cash flo+s for each #ear of the pro0ect. C. onl# *e considered +hen t+o pro0ects are mutuall# e(clusive. D. *e +eighted and included in the initial cash flo+. %. *e totall# ignored +hen internal e!uit# funding is utili1ed. Eefer to section 14.3

AACSB: N/A Bloom's: Com(re,ension Difficulty: Basic Learning Ob ecti!e: "#$# Section: "#%1 'o(ic: 2lotation costs

46. Chelsea ?ashions is e(pected to pa# an annual dividend of ;6.56 a share ne(t #ear. 'he market price of the stock is ;&&.46 and the gro+th rate is - percent. hat is the firm/s cost of e!uit#" A. 4.-5 percent $. 4.:1 percent C. 5.&4 percent D. 5.-4 percent %. :.66 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

14--6

Chapter 14 - Cost of Capital

41. 'he Shoe Butlet has paid annual dividends of ;6.3-, ;6.46, ;6.4&, and ;6.4- per share over the last four #ears, respectivel#. 'he stock is currentl# selling for ;&3 a share. hat is this firm/s cost of e!uit#" A. 4.-3 percent B. 4.:, percent C. 16.,5 percent D. 16.-, percent %. 11.4: percent 8;6.46 - ;6.3-9I;6.3- J 6.643:&, 8;6.4& - ;6.469I;6.46 J 6.6&5-41 8;6.4- - ;6.4&9I;6.4& J 6.641334 g J 86.643:&, K 6.6&5-41 K 6.6413349I, J .64:6-4 Ee J L8;6.4- 1.64:6-49I;&3M K .64:6-4 J 4.:, percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

4&. S+eet 'reats common stock is currentl# priced at ;1:.63 a share. 'he compan# 0ust paid ;1.1- per share as its annual dividend. 'he dividends have *een increasing *# &.- percent annuall# and are e(pected to continue doing the same. hat is this firm/s cost of e!uit#" A. 3.6, percent $. 3.15 percent C. 5.44 percent D. 5.35 percent %. 5.5& percent e J L8;1.1- 1.6&-9I;1:.63M K 6.6&- J 5.35 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

14--1

Chapter 14 - Cost of Capital

4,. 'he common stock of )etal )olds has a negative gro+th rate of 1.- percent and a re!uired return of 15 percent. 'he current stock price is ;11.46. hat +as the amount of the last dividend paid" A. ;&.64 $. ;&.11 C. ;&.1: D. ;&.&& E. ;&.&3 D1 J L86.15 - 8-6.61-99 ;11.46M J ;&.&&,N D6 J ;&.&&,I81 - 6.61-9 J ;&.&3

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Di!idend growt,

44. 7igh+a# %(press has paid annual dividends of ;1.13, ;1.&6, ;1.&-, ;1.16, and ;6.:- over the past five #ears respectivel#. hat is the average dividend gro+th rate" A. -4.-1 percent $. -,.36 percent C. &.&5 percent D. &.44 percent %. 4.,: percent 8;1.&6 - ;1.139I;1.13 J 6.6,445, 8;1.&- - ;1.&69I;1.&6 J 6.641334 8;1.16 - ;1.&-9I;1.&- J -6.1& 8;6.:- - ;1.169I;1.16 J -6.1,3,34 g J 86.6,445, K 6.641334 - 6.1& - 6.1,3,349I4 J -4.-1 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Di!idend growt,

14--&

Chapter 14 - Cost of Capital

4-. Southern 7ome Cookin/ 0ust paid its annual dividend of ;6.3- a share. 'he stock has a market price of ;1, and a *eta of 1.1&. 'he return on the D.S. 'reasur# *ill is &.- percent and the market risk premium is 3.5 percent. hat is the cost of e!uit#" A. :.:5 percent $. 16.64 percent C. 16.1& percent D. 16.,4 percent %. 16.4- percent Ee J 6.6&- K 81.1& 6.6359 J 16.1& percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

43. Cational 7ome Eentals has a *eta of 1.,5, a stock price of ;1:, and recentl# paid an annual dividend of ;6.:4 a share. 'he dividend gro+th rate is 4.- percent. 'he market has a 16.3 percent rate of return and a risk premium of 4.- percent. hat is the firm/s cost of e!uit#" A. 4.6- percent $. 5.34 percent C. :.1, percent D. 16.,6 percent E. 11.-3 percent Ee J 86.163 - 6.64-9 K 81.,5 6.64-9 J 6.1,4Ee J L8;6.:4 1.64-9I;1:M K 6.64- J 6.6:34 Ee Average J 86.1,4- K 6.6:349I& J 11.-3 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

14--,

Chapter 14 - Cost of Capital

44. 7enesse# )arkets has a gro+th rate of 4.5 percent and is e!uall# as risk# as the market. 'he stock is currentl# selling for ;14 a share. 'he overall stock market has a 16.3 percent rate of return and a risk premium of 5.4 percent. hat is the e(pected rate of return on this stock" A. 5.4 percent $. :.& percent C. 16.3 percent D. 11., percent %. 11.4 percent Ee J 86.163 - 6.6549 K 81.66 6.6549 J 16.3 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

45. 'ide+ater ?ishing has a current *eta of 1.45. 'he market risk premium is 5.: percent and the risk-free rate of return is ,.& percent. $# ho+ much +ill the cost of e!uit# increase if the compan# e(pands its operations such that the compan# *eta rises to 1.36" A. 6.55 percent B. 1.64 percent C. 1.-6 percent D. &.16 percent %. &.&3 percent Increase in cost of e!uit# J 81.36 - 1.459 6.65: J 1.64 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$" Section: "#%& 'o(ic: Cost of e)uity

14--4

Chapter 14 - Cost of Capital

4:. ind >o+er S#stems has &6-#ear, semi-annual *onds outstanding +ith a - percent coupon. 'he face amount of each *ond is ;1,666. 'hese *onds are currentl# selling for 114 percent of face value. hat is the compan#/s pre-ta( cost of de*t" A. ,.:5 percent $. 4.4& percent C. 4.41 percent D. -.,3 percent %. -.-- percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

-6. $oulder ?urniture has *onds outstanding that mature in 1, #ears, have a 3 percent coupon, and pa# interest annuall#. 'hese *onds have a face value of ;1,666 and a current market price of ;1,646. hat is the compan#/s afterta( cost of de*t if its ta( rate is ,& percent" A. &.:4 percent $. ,.&4 percent C. ,.45 percent D. -.&1 percent %. -.-, percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

14---

Chapter 14 - Cost of Capital

-1. 7and# )an, Inc. has 1ero coupon *onds outstanding that mature in 5 #ears. 'he *onds have a face value of ;1,666 and a current market price of ;346. hat is the compan#/s pre-ta( cost of de*t" A. &.-- percent $. -.6: percent C. -.33 percent D. 4.,1 percent %. 4.45 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

-&. Dog =one =ood %ngines has a *ond issue outstanding +ith 14 #ears to maturit#. 'hese *onds have a ;1,666 face value, a : percent coupon, and pa# interest semi-annuall#. 'he *onds are currentl# !uoted at 54 percent of face value. hat is the compan#/s pre-ta( cost of de*t if the ta( rate is ,5 percent" A. 4.16 percent $. 4.4& percent C. 3.31 percent D. 5.:6 percent E. 16.34 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

14--3

Chapter 14 - Cost of Capital

-,. 'he Corner $aker# has a *ond issue outstanding that matures in 4 #ears. 'he *onds pa# interest semi-annuall#. Currentl#, the *onds are !uoted at 161.4 percent of face value and carr# a : percent coupon. hat is the firm/s afterta( cost of de*t if the ta( rate is ,6 percent" A. 4.55 percent $. -.,3 percent C. -.4- percent D. 3.11 percent %. 5.44 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

-4. 'he outstanding *onds of 'ech %(press are priced at ;:5: and mature in 5 #ears. 'hese *onds have a 3 percent coupon and pa# interest annuall#. 'he firm/s ta( rate is ,: percent. hat is the firm/s afterta( cost of de*t" A. ,.61 percent $. ,.&& percent C. ,.,- percent D. ,.44 percent %. 4.41 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

14--4

Chapter 14 - Cost of Capital

--. Simple ?oods has a 1ero coupon *ond issue outstanding that matures in : #ears. 'he *onds are selling at 4& percent of par value. hat is the compan#/s afterta( cost of de*t if the ta( rate is ,5 percent" A. -.45 percent $. -.4, percent C. 3.1& percent D. 4.4, percent %. :.55 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of debt

-3. =rill orks and )ore has 5 percent preferred stock outstanding that is currentl# selling for ;4: a share. 'he market rate of return is 14 percent and the firm/s ta( rate is ,4 percent. hat is the firm/s cost of preferred stock" A. 14.44 percent $. 1-.&: percent C. 1-.34 percent D. 13.,, percent %. 13.-4 percent Ep J 86.65 ;1669I;4: J 13.,, percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of (referred

14--5

Chapter 14 - Cost of Capital

-4. Samuelson >lastics has 4.- percent preferred stock outstanding. Currentl#, this stock has a market value per share of ;-& and a *ook value per share of ;,5. hat is the cost of preferred stock" A. 4.-6 percent $. 1,.55 percent C. 14.4& percent D. 1:.&: percent %. 1:.44 percent Ep J 86.64- ;1669I;-& J 14.4& percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of (referred

-5. Ce+ Aork Deli/s has 4 percent preferred stock outstanding that sells for ;,3 a share. 'his stock +as originall# issued at ;-6 per share. hat is the cost of preferred stock" A. 1,.35 percent $. 14.66 percent C. 14.&: percent D. 1:.44 percent %. 1:.56 percent Ep J 86.64 ;1669I;,3 J 1:.44 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$& Section: "#%* 'o(ic: Cost of (referred

14--:

Chapter 14 - Cost of Capital

-:. Celson/s Landscaping has 1,&66 *onds outstanding that are selling for ;::6 each. 'he compan# also has &,-66 shares of preferred stock at a market price of ;&5 a share. 'he common stock is priced at ;,4 a share and there are &5,666 shares outstanding. hat is the +eight of the common stock as it relates to the firm/s +eighted average cost of capital" A. 4,.65 percent B. 4-.13 percent C. 44.11 percent D. -4.66 percent %. --.4- percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%# 'o(ic: +eig,ted a!erage

14-36

Chapter 14 - Cost of Capital

36. )angrove ?ruit ?arms has a ;&66,666 *ond issue outstanding that is selling at :& percent of face value. 'he firm also has 1,-66 shares of preferred stock and 1-,666 shares of common stock outstanding. 'he preferred stock has a market price of ;,- a share compared to a price of ;&4 a share for the common stock. hat is the +eight of the preferred stock as it relates to the firm/s +eighted average cost of capital" A. 3.4- percent $. 4.&6 percent C. 4.4- percent D. 5.,6 percent E. 5.56 percent

AACSB: Analytic Bloom's: A((lication Difficulty: Basic Learning Ob ecti!e: "#$* Section: "#%# 'o(ic: +eig,t of (referred

14-31

Chapter 14 - Cost of Capital