Escolar Documentos

Profissional Documentos

Cultura Documentos

Assignment QP MBA Taxation Management MF0012 Summer 2013

Enviado por

Arvind KDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Assignment QP MBA Taxation Management MF0012 Summer 2013

Enviado por

Arvind KDireitos autorais:

Formatos disponíveis

For Solved SMU Assignment and Project Contact: +91- 9873 9!"!

#mail : m$a818%&gmail'com (tt):**+++'sm,assignments'in-o

Master of BusinessAdministration- MBA Semester 3 MF0012 Taxation Management -4 Credits

Note: Assignment (60 marks) must be written within 6-8 pages. Answer all questions. Kindl note that !0 marks questions should not e"#eed $00 words and % marks should not e"#eed &00 words. '!. ("plain the ob)e#ti*es o+ ta" planning. ,is#uss the +a#tors to be #onsidered in ta" planning. (Objectives of tax planning 5 marks; Factors in tax planning 5 marks) '&. 10 marks

("plain the #ategories in -apital assets. .r. - a#quired a plot o+ land on !% th /une0 !112 +or !00000000 and sold it on % th /anuar 0 &0!0 +or $!0000000. 3he e"penses o+ trans+er were !0000000. .r. - made the +ollowing in*estments on $ th 4ebruar 0 &0!0 +rom the pro#eeds o+ the plot. a) 5onds o+ 6ural (le#tri+i#ation -orporation redeemable a+ter a period o+ three ears0 !&0000000. b) ,eposits under -apital 7ain 8#heme +or pur#hase o+ a residential house 80000000 (he does not own an house). -ompute the #apital gain #hargeable to ta" +or the A9&0!0-!!. (Explanation of categories of capital assets 4 marks ; Calc lation of in!exe! cost of ac" isition # marks; Calc lation of long term capital gain # marks; calc lation of taxable long term capital gain # marks) 10marks

'2.

: ;td. has <nit - whi#h is not +un#tioning satis+a#toril . 3he +ollowing are the details o+ its +i"ed assets:

Asset ;and 7oodwill (raised in books on 2! .ar#h0 &00%) .a#hiner =lant % April0 !111 !& April0 &00$

th th st

Date of ac uisition !0 4ebruar 0 &002

th

Boo! "a#ue $.s' #a!%& 20 !0 &0 $0

3he written down *alue (>,?) is Rs. &% lakh +or the ma#hiner 0 and 6s.!% lakh +or the plant. 3he liabilities on this <nit on 2! st .ar#h0 &0!! are 6s.2% lakh. 3he +ollowing are two options as on 2!st .ar#h0 &0!!: @ption !: 8lump sale to 9 ;td +or a #onsideration o+ 8% lakh. Rs.$8 lakh0 goodwill Rs.&0 lakh0

@ption &: Andi*idual sale o+ assets as +ollows: ;and ma#hiner 6s.2& lakh0 =lant 6s.!B lakh.

3he other units deri*e ta"able in#ome and there is no #arr +orward o+ loss or depre#iation

Summer 2013

+or the #ompan as a whole. <nit - was started on !st /anuar 0 &00%. >hi#h option would ou #hoose0 and wh C (Comp tation of capital gain for bot$ t$e options 4 marks ; Comp tation of tax liabilit% for bot$ t$e options 4 marks ; Concl sion # marks) 10marks '$. >hat do ou understand b #ustoms dut C ("plain the ta"able e*ents +or

imported0warehoused and e"ported goods. ;ist down the t pes o+ duties in #ustoms. An importer imports goods +or subsequent sale in Andia at D!00000 on assessable *alue basis. 6ele*ant e"#hange rate and rate o+ dut are as +ollows: (xc%ange )ate Dec#ared *+CB(,C Rs.$%ED )ate of Basic Customs Dut+ 8F

'articu#ars

Date &%th 4ebruar 0 &0!0 %th .ar#h0 &0!0

,ate o+ submission o+ bill o+ entr ,ate o+ entr inwards granted to the *essel

Rs.$1ED

!0F

-al#ulate assessable *alue and #ustoms dut . (&eaning an! explanation of c stoms ! t% # marks; Explanation of taxable events for importe!'(are$o se! an! exporte! goo!s ) marks; *isting of ! ties in c stoms # marks; Calc lation of assessable val e an! c stoms ! t% )marks) '%. 10marks

("plain the 8er*i#e 3a" ;aw in Andia and #on#ept o+ negati*e list. >rite about the e"emptions and rebates in 8er*i#e 3a" ;aw. (Explanation of +ervice ,ax *a( in -n!ia 5 marks ; explanation of concept of negative list #marks; Explanation of exemptions an! rebates in +ervice ,ax *a( ) marks) 10marks

'6.

("plain ma)or #onsiderations in #apital stru#ture planning. >rite about the di*idend poli# and +a#tors a++e#ting di*idend de#isions. (Explanation of factors of capital str ct re planning . marks; Explanation of !ivi!en! polic% # marks; factors affecting !ivi!en! !ecisions # marks) !0marks

Summer 2013

Você também pode gostar

- Mba205 - Winter - 2017 Solved SMU Assignment/projectDocumento3 páginasMba205 - Winter - 2017 Solved SMU Assignment/projectArvind KAinda não há avaliações

- MB0048 - Fall - 2017 Solved SMU Assignment/projectDocumento5 páginasMB0048 - Fall - 2017 Solved SMU Assignment/projectArvind KAinda não há avaliações

- Mba205 - Fall - 2017 Solved SMU Assignment/projectDocumento3 páginasMba205 - Fall - 2017 Solved SMU Assignment/projectArvind KAinda não há avaliações

- Solved SMU Assignment MBA104Documento2 páginasSolved SMU Assignment MBA104Arvind KAinda não há avaliações

- FOR Project and Assignment: EmailDocumento2 páginasFOR Project and Assignment: EmailArvind KAinda não há avaliações

- MBA104 - NEW - Fall - 2017 Solved SMU AssignmentDocumento4 páginasMBA104 - NEW - Fall - 2017 Solved SMU AssignmentArvind KAinda não há avaliações

- Mba103 - Fall - 2017 Solved SMU AssignmentDocumento2 páginasMba103 - Fall - 2017 Solved SMU AssignmentArvind KAinda não há avaliações

- Mba202 - Financial ManagementDocumento3 páginasMba202 - Financial ManagementArvind KAinda não há avaliações

- MBA205 Solved SMU AssignmentDocumento4 páginasMBA205 Solved SMU AssignmentArvind KAinda não há avaliações

- MBA106 Solved SMU AssignmentDocumento1 páginaMBA106 Solved SMU AssignmentArvind KAinda não há avaliações

- MBA101 Solved SMU AssignmentDocumento3 páginasMBA101 Solved SMU AssignmentArvind KAinda não há avaliações

- Solved SMU Assignment MBA103Documento4 páginasSolved SMU Assignment MBA103Arvind KAinda não há avaliações

- Solved SMU Assignment and Project: Contact PHDocumento2 páginasSolved SMU Assignment and Project: Contact PHArvind KAinda não há avaliações

- Solved SMU AssignmentDocumento4 páginasSolved SMU AssignmentArvind KAinda não há avaliações

- Solved SMU Assignment / ProjectDocumento3 páginasSolved SMU Assignment / ProjectArvind KAinda não há avaliações

- Solved Mba0048 SMU AssignmentDocumento2 páginasSolved Mba0048 SMU AssignmentArvind KAinda não há avaliações

- FOR Project and Assignment: EmailDocumento2 páginasFOR Project and Assignment: EmailArvind KAinda não há avaliações

- FOR Project and Assignment: EmailDocumento2 páginasFOR Project and Assignment: EmailArvind KAinda não há avaliações

- Solved SMU Assignment and Project: Contact PHDocumento2 páginasSolved SMU Assignment and Project: Contact PHArvind KAinda não há avaliações

- FOR Project and Assignment: EmailDocumento2 páginasFOR Project and Assignment: EmailArvind KAinda não há avaliações

- Solved SMU Assignment and Project: Contact PHDocumento2 páginasSolved SMU Assignment and Project: Contact PHArvind KAinda não há avaliações

- FOR Project and Assignment: EmailDocumento2 páginasFOR Project and Assignment: EmailArvind KAinda não há avaliações

- Solved SMU Assignment and Project: Contact PHDocumento1 páginaSolved SMU Assignment and Project: Contact PHArvind KAinda não há avaliações

- FOR and +91 - 9873669404: Solved SMU Assignment Project Contact EmailDocumento2 páginasFOR and +91 - 9873669404: Solved SMU Assignment Project Contact EmailArvind KAinda não há avaliações

- Solved SMU AssignmentDocumento4 páginasSolved SMU AssignmentArvind KAinda não há avaliações

- FOR and +91 - 9873669404: Solved SMU Assignment Project Contact EmailDocumento2 páginasFOR and +91 - 9873669404: Solved SMU Assignment Project Contact EmailArvind KAinda não há avaliações

- Solved SMU Assignment and Project: Contact PHDocumento2 páginasSolved SMU Assignment and Project: Contact PHArvind KAinda não há avaliações

- Solved MU0015 - Compensation and Benefits AssignmentDocumento3 páginasSolved MU0015 - Compensation and Benefits AssignmentArvind KAinda não há avaliações

- Solved Mba0045 SMU AssignmentDocumento2 páginasSolved Mba0045 SMU AssignmentArvind KAinda não há avaliações

- MB0052 Solved SMU AssignmentDocumento3 páginasMB0052 Solved SMU AssignmentArvind KAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Lembar Jawaban Siswa - Corona-2020Documento23 páginasLembar Jawaban Siswa - Corona-2020Kurnia RusandiAinda não há avaliações

- EXIDEIND Stock AnalysisDocumento9 páginasEXIDEIND Stock AnalysisAadith RamanAinda não há avaliações

- List of applicants for admission to Non-UT Pool categoryDocumento102 páginasList of applicants for admission to Non-UT Pool categoryvishalAinda não há avaliações

- TaclobanCity2017 Audit Report PDFDocumento170 páginasTaclobanCity2017 Audit Report PDFJulPadayaoAinda não há avaliações

- CASES IN LOCAL and REAL PROPERTY TAXATIONDocumento3 páginasCASES IN LOCAL and REAL PROPERTY TAXATIONTreblif AdarojemAinda não há avaliações

- MOWILEX Balinese Woodcarving A Heritage To Treasure LatestDocumento85 páginasMOWILEX Balinese Woodcarving A Heritage To Treasure LatestBayus WalistyoajiAinda não há avaliações

- Lecture 3 SymposiumDocumento20 páginasLecture 3 SymposiumMakkAinda não há avaliações

- AquaTemp - Submersible Temperature SensorDocumento10 páginasAquaTemp - Submersible Temperature SensorwebadminjkAinda não há avaliações

- In Re: Grand Prix Fixed Lessee LLC, Case No. 10-13825, (Jointly Administered Under Case No 10-13800)Documento3 páginasIn Re: Grand Prix Fixed Lessee LLC, Case No. 10-13825, (Jointly Administered Under Case No 10-13800)Chapter 11 DocketsAinda não há avaliações

- Psac/Sait Well Testing Training ProgramDocumento1 páginaPsac/Sait Well Testing Training Programtidjani73Ainda não há avaliações

- The Swordfish Islands The Dark of Hot Springs Island (Updated)Documento200 páginasThe Swordfish Islands The Dark of Hot Springs Island (Updated)Edward H71% (7)

- PMLS Professional Organization ActivityDocumento4 páginasPMLS Professional Organization ActivityHershei Vonne Baccay100% (1)

- PHILIP MORRIS Vs FORTUNE TOBACCODocumento2 páginasPHILIP MORRIS Vs FORTUNE TOBACCOPatricia Blanca SDVRAinda não há avaliações

- People vs. Aruta Case DigestDocumento3 páginasPeople vs. Aruta Case DigestRhea Razo-Samuel100% (1)

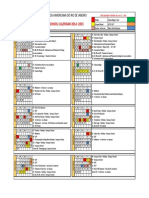

- CalendarDocumento1 páginaCalendarapi-277854872Ainda não há avaliações

- Mitul IntreprinzatoruluiDocumento2 páginasMitul IntreprinzatoruluiOana100% (2)

- St. Edward The Confessor Catholic Church: San Felipe de Jesús ChapelDocumento16 páginasSt. Edward The Confessor Catholic Church: San Felipe de Jesús ChapelSt. Edward the Confessor Catholic ChurchAinda não há avaliações

- People Vs CA G.R. No. 140285Documento2 páginasPeople Vs CA G.R. No. 140285CJ FaAinda não há avaliações

- CH8 OligopolyModelsDocumento37 páginasCH8 OligopolyModelsJeffrey LaoAinda não há avaliações

- Complex Property Group Company ProfileDocumento3 páginasComplex Property Group Company ProfileComplex Property GroupAinda não há avaliações

- MMEP 613 - Assignment No. 1 Canoy, Niña Angelika R. - SN 2022433104Documento35 páginasMMEP 613 - Assignment No. 1 Canoy, Niña Angelika R. - SN 2022433104Niña Angelika CanoyAinda não há avaliações

- 3 Macondray - Co. - Inc. - v. - Sellner20170131-898-N79m2kDocumento8 páginas3 Macondray - Co. - Inc. - v. - Sellner20170131-898-N79m2kKobe Lawrence VeneracionAinda não há avaliações

- Complete Spanish Grammar 0071763430 Unit 12Documento8 páginasComplete Spanish Grammar 0071763430 Unit 12Rafif Aufa NandaAinda não há avaliações

- Use Case Template (Cockburn) PDFDocumento8 páginasUse Case Template (Cockburn) PDFjulian pizarroAinda não há avaliações

- Procter &gamble: Our PurposeDocumento39 páginasProcter &gamble: Our Purposemubasharabdali5373Ainda não há avaliações

- History Project: (For Ist Semester)Documento27 páginasHistory Project: (For Ist Semester)Jp YadavAinda não há avaliações

- HDFC BankDocumento6 páginasHDFC BankGhanshyam SahAinda não há avaliações

- Hannover Messe 2011: New Marke New Con NEWDocumento16 páginasHannover Messe 2011: New Marke New Con NEWsetzen724Ainda não há avaliações

- Toward Plurality in American Acupuncture 7Documento10 páginasToward Plurality in American Acupuncture 7mamun31Ainda não há avaliações

- Problem IsDocumento5 páginasProblem IsSharra Vesta Llana ValeraAinda não há avaliações