Escolar Documentos

Profissional Documentos

Cultura Documentos

ADM 2350 Winter 2014 Assign 1 Rev

Enviado por

Wall JohnDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

ADM 2350 Winter 2014 Assign 1 Rev

Enviado por

Wall JohnDireitos autorais:

Formatos disponíveis

Winter 2014

ADM 2350 Prof. William F. Rentz FINANCIAL MANAG M N! A""i#nment $1 Re%i"e& 'an(ar) 22* 2014

G N RAL IN+!R,C!I-N+. Your assignment must be "ent ele/troni/all) in &o/* &o/0* or 1&f format to t2e !,!-R for )o(r "e/tion. Your t(tor m("t R C I3 your assignment by no later t2an 1 PM on +at(r&a)* 'an(ar) 25* 2014 . Late assignments will N-! be accepted. To ensure that your tutor receives the assignment on time, it i" +!R-NGL4 re/ommen&e& t2at )o( ele/troni/all) "(5mit )o(r a""i#nment 5efore mi&ni#2t on t2e e%enin# of Fri&a)* 'an(ar) 24* 2014 at t2e late"t. Unless there are system problems with C-NN C!, the professors solution set will be posted on C-NN C! by no later than 6 P of the due date. This assignment counts 6.!"# of your course grade. You are encouraged to wor$ on this assignment in teams of up to " students from t2e "ame "e/tion of t2i" /o(r"e. However, you may turn in an individual assignment if you prefer. %ach assignment must be typed and contain the student name&s' and student number&s' on each page. ( scanned )tatement of *ntegrity must be electronically attached to each assignment &)ee pages ++,+! of the course syllabus'. a/2 in&i%i&(al 62o"e name a11ear" on t2e a""i#nment m("t "i#n t2e +tatement of Inte#rit). Li%e Lin7" for !(tor"8 9mail A&&re""e". )ection )ection )ection P )ection . lliott :o(r#eoi" <iao '(n =>enr)? Wan# &na Ga%an @a/2 C2retien 5o(r#eo;(otta6a./a <6an#141;(otta6a./a #a%a012;(otta6a./a @/2re0A4;(otta6a./a

+. &!/ mar$s' .obert is a fourth,year business student who wants to go on a graduation celebration0vacation in Panama, but he has no money to pay for the trip. (fter the vacation, .obert will start his career. 1is 2ob will re3uire moving to a new town and buying professional clothes and a used car. 1e as$s his parents to lend him BC*000, which he figures he will be able to pay bac$ in fo(r years as a single payment. 1is parents agree to lend him the money but will charge 3 percent interest per year with annual compounding. a. &" mar$s' 4hat amount will .obert need to pay bac$ at the end of four years5 b. &" mar$s' 1ow much interest will .obert pay at the end of four years5 c. &" mar$s' .oberts parents want to give him an incentive to pay off the loan as 3uic$ly as possible. They structure the loan so that they charge 3 1er/ent intere"t t2e fir"t )ear and in/rea"e t2e rate 1 1er/enta#e 1oint AC> )ear until the loan is paid off. -ow what will be the amount that .obert needs to pay bac$ at the end of four years5

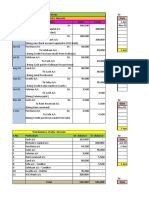

(8

!9"/

(ssignment 7+

4inter !/+6

d. &" mar$s' .oberts parents reali:e that perhaps he may need 5 years to pay off the loan. )o, they give .obert the option to ta$e 5 years. -evertheless, they still want to encourage him to pay as early as possible. )o, the interest rate on the loan will again in/rea"e 5) 1 1er/enta#e 1oint AC> )ear "o t2at it 6ill rea/2 D 1er/ent in )ear 5 . ;ompared to your answer in Part c., how much more will the loan cost .obert if he e<ercises the five, year option5 !. &!" mar$s' =>Y borrows BC0*000 under a t6o9)ear loan a#reement at an annual interest rate of 10 1er/ent. The payment schedule calls for 2 le%el ann(al en&9of9)ear 1a)ment". a. &" mar$s' !o t2e neare"t 1enn), what is the ann(al total 1a)ment that =>Y must ma$e5 b. &+/ mar$s' ;onstruct a loan amorti:ation schedule for this loan that for each year includes &+' the total payment, &!' the interest payment, &9' the principal payment, and &6' the outstanding or remaining balance. Al"o "2o6 t2e total intere"t an& total 1rin/i1al 1ai& o%er t2e life of t2e loan. &>IN!. ?irst, calculate the e3ual total payment ; using the formula for the P@ of an (nnuity Ai.e. your answer to Part a.B and insert that amount for AC> year for !otal Pa)ment on your loan amorti:ation schedule. -e<t, insert the amount originally borrowed as the :e#innin# :alan/e for 4ear 1. -ow, calculate the Intere"t Pai& for this year by multiplying the interest rate times the :e#innin# :alan/e for this year. Then, calculate the Prin/i1al Pai& in this year by subtracting the Intere"t Pai& in this year from the !otal Pa)ment for this year. -e<t, to obtain the n&in# :alan/e for this year, the Prin/i1al Pai& for this year will be subtracted from the :e#innin# :alan/e for this year This n&in# :alan/e will also be the :e#innin# :alan/e for the ne<t year. -ow, for each successive year, repeat the steps for that year to calculate the Intere"t Pai&, Prin/i1al Pai&, and n&in# :alan/e. AYou would also enter the n&in# :alan/e for this year as the :e#innin# :alan/e for the ne<t year whenever the current year is N-! the last year.B -ow chec$ the n&in# :alan/e for the last year. *f it is positive, you must INCR A+ both the !otal Pa)ment and Prin/i1al Pai& in the last year by this balance amount to e<actly amorti:e the loan. *f it is negative, reduce the both the !otal Pa)ment and Prin/i1al Pai& in the last year by the magnitude of the balance amount to e<actly amorti:e the loan. ?inally, sum individually the !otal Pa)ment, Intere"t Pai&, and Prin/i1al Pai& to get the respective !otal" for these items. )ee the amorti:ation schedule on p. +"! for an e<ample of a loan with e3ual principal payments each year. That e<ample has an n&in# :alan/e of ! cents in the last year, which means that the !otal Pa)ment and Prin/i1al Pa)ment in the last year must be INCR A+ D by ! cents to e<actly amorti:e the loan.' c. &+/ mar$s' *nstead of e3ual total payments, suppose that the loan is structured so that =>Y ma$es eE(al 1rin/i1al 1a)ment" at t2e en& of ea/2 )ear alon# 6it2 t2e intere"t 1a)ment for t2e )ear. ;onstruct a loan amorti:ation schedule for this loan that for each year includes &+' the total payment, &!' the interest payment, &9' the principal payment, !

(8

!9"/

(ssignment 7+

4inter !/+6

and &6' the outstanding or remaining balance. Al"o "2o6 t2e total intere"t an& total 1rin/i1al 1ai& o%er t2e life of t2e loan. &>IN!. ?irst, calculate the e3ual annual principal payment and insert that amount for AC> year for Prin/i1al Pai& on your loan amorti:ation schedule by dividing the amount originally borrowed by the number of years of payments. -e<t, calculate the :e#innin# :alan/e and n&in# :alan/e for each year, starting with the :e#innin# :alan/e for 4ear 1 as the amount originally borrowed. The Prin/i1al Pai& for AC> year will be subtracted from the :e#innin# :alan/e for that year to obtain the n&in# :alan/e for that year, which will be the :e#innin# :alan/e for the ne<t year. -ow, calculate the Intere"t Pai& for AC> year by multiplying the interest rate times the :e#innin# :alan/e for that year. Then, calculate the !otal Pa)ment for AC> year by summing the Intere"t Pai& and Prin/i1al Pai& for that year. ?inally, sum individually the !otal Pa)ment, Intere"t Pai&, and Prin/i1al Pai& to get the respective !otal" for these items. )ee the amorti:ation schedule on p. +"+ for an e<ample of a loan with e3ual principal payments each year.' 9. &" mar$s' )uppose that the mar$eting manager for %dgars .etail (ppliance )tore proposes a sale. ;ustomers can buy now but dont have to pay for their appliance purchases for t6ent)9 fo(r months. ?rom a time value of money perspective, selling appliances at full price with payment in t6ent)9fo(r months is e3uivalent to selling appliances at a sale, or discounted, price with immediate payment. )uppose that the interest rate is 1C percent per year with mont2l) compounding. 4hat is the eE(i%alent "ale 1ri/e to&a) of a B2*2CD.20 washer0dryer combo when the customer ta$es the full t6ent)9fo(r months to pay for it5 6. &" mar$s' )uppose that we e<pect interest rates to increase over the ne<t few years, from 1 percent this year, to 2 percent ne<t year, to 3 percent in year 9, and to 4 percent in year 6. *n this environment, what is the present value of a B200*000*000 cash flow re/ei%e& fo(r )ear" from to&a)5 ". &" mar$s' ;onsider a four,year pro2ect that /o"t" B20*000 to&a) that is e<pected to generate B0 at the end of year one, B12*000 at the end of the year two, BC*000 at the end of year three, and B4*000 at the end of year four. The pro2ects /o"t of /a1ital or reE(ire& rate of ret(rn i" F 1er/ent. 4hat is the pro2ects NP35 6. &+" mar$s' (nita Celanger wants to send her daughter ;laudette to university. ;laudette is celebrating only her si<th birthday today, but (nita feels that she needs to start saving soon. ;laudette will need BF0*000 for university e<penses on her 1Ct2* 1At2* 20t2* an& 21"t 5irt2&a)". (nita e<pects each deposit that she ma$es in ;laudettes savings account will earn 3 percent compounded annually for as long as the account remains open. a. &" mar$s' !o t2e neare"t 1enn), how much does (nita need to accumulate in ;laudettes savings account by age 1C : F-R ;laudette withdraws the first D6/,///5 b. &" mar$s' (nita plans to ma$e annual deposits on ;laudettes "e%ent2 through ei#2teent2 birthdays. 4hat is the amount of these annual deposits in order for (nita to achieve the necessary savings by ;laudettes eighteenth birthday5 9

(8

!9"/

(ssignment 7+

4inter !/+6

c. &" mar$s' )uppose that (nita wishes to buy ;laudette a 1onda ;ivic as a graduation present on her 22n& 5irt2&a). The estimated cost of the ;ivic is B25*000. !o t2e neare"t 1enn), how much larger must each annual deposit be so that (nita will be able to buy ;laudette the ;ivic on her !!nd birthday5 E. &" mar$s' ?ran$ F (ssociates had sales of B1*000*000 for fi"/al 200C. ?ran$s sales for its most recent fi"/al )ear 2013 were B1*F10*510. 4hat is ?ran$s /om1o(n& ann(al #ro6t2 rate of sales over this fi%e9)ear 1erio&5

G. &!/ mar$s' Hohn and Carbara Cet: have found the home of their dreams in (lmonte, Intario. The home costs D6//,///. The ;*C; is offering Hohn and Carbara a mortgage with a 9 percent 3uoted rate based on semi,annual compounding. The ban$ re3uires a down payment of !/# or D+!/,///, ?ortunately, the couple have the re3uired D+!/,///. The term of the loan is four years based on an amorti:ation period of !/ years. a. &" mar$s' !o t2e neare"t 1enn), what will be the 1erio&i/ total 1a)ment if the couple ma$es mont2l) payments &i.e. 12 payments per year'5 b. &" mar$s' !o t2e neare"t 1enn), what will be the 1erio&i/ total 1a)ment if the couple ma$es "emi9mont2l) payments &i.e. 24 payments per year'5 c. &" mar$s' !o t2e neare"t 1enn), what will be the 1erio&i/ total 1a)ment if the couple ma$es 5i96ee7l) payments &i.e. 2F payments per year'5 d. &" mar$s' !o t2e neare"t 1enn), what will be the 1erio&i/ total 1a)ment if the couple ma$es 6ee7l) payments &i.e. 52 payments per year'5

Você também pode gostar

- Rental-Property Profits: A Financial Tool Kit for LandlordsNo EverandRental-Property Profits: A Financial Tool Kit for LandlordsAinda não há avaliações

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)No EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Nota: 5 de 5 estrelas5/5 (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)No EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Nota: 5 de 5 estrelas5/5 (1)

- Antwaun Edgecombe Bank StatementDocumento3 páginasAntwaun Edgecombe Bank StatementDamion HollisAinda não há avaliações

- Jonathan M Luna Account Number: 5779 81XX XXXX 2560: Account Activity Since Your Last StatementDocumento4 páginasJonathan M Luna Account Number: 5779 81XX XXXX 2560: Account Activity Since Your Last StatementJonathan LunaAinda não há avaliações

- UL White Paper - Tokenization ExplainedDocumento16 páginasUL White Paper - Tokenization ExplainedacpereraAinda não há avaliações

- Time Value of Money ScriptDocumento15 páginasTime Value of Money ScriptSudheesh Murali NambiarAinda não há avaliações

- Symbiosis OnePage BusinessPlan PDFDocumento1 páginaSymbiosis OnePage BusinessPlan PDFBayu Adhika PrasetyaAinda não há avaliações

- Small Project Application FormDocumento7 páginasSmall Project Application Formfarman masih100% (1)

- 2-Marketplace Analysis For E-CommerceDocumento29 páginas2-Marketplace Analysis For E-CommerceWall John100% (1)

- High-Q Financial Basics. Skills & Knowlwdge for Today's manNo EverandHigh-Q Financial Basics. Skills & Knowlwdge for Today's manAinda não há avaliações

- 01 Time Value of Money AKDocumento4 páginas01 Time Value of Money AKXandra Faye MendozaAinda não há avaliações

- E-Commerce: Digital Markets, Digital GoodsDocumento34 páginasE-Commerce: Digital Markets, Digital Goodsfileacademy100% (1)

- Chap 006Documento133 páginasChap 006limed1Ainda não há avaliações

- Closing EntriesDocumento14 páginasClosing EntriesAlbert Moreno100% (1)

- ICF - Lecture 2 - Time Value of MoneyDocumento46 páginasICF - Lecture 2 - Time Value of Moneyioana_doncaAinda não há avaliações

- Faculty of Management Sciences, IIUI: Time Value of Money ProblemsDocumento15 páginasFaculty of Management Sciences, IIUI: Time Value of Money ProblemsSana KhanAinda não há avaliações

- Chapter 1Documento9 páginasChapter 1craig52292Ainda não há avaliações

- Chap 005Documento65 páginasChap 005sucusucu3Ainda não há avaliações

- F.A - 4: Basic Test Bank For FinanceDocumento3 páginasF.A - 4: Basic Test Bank For FinanceRAsel FaRuqueAinda não há avaliações

- Time Value of Money - FinalDocumento14 páginasTime Value of Money - FinalMohammad Tamzid SiddiqueAinda não há avaliações

- Time Value of MoneyDocumento23 páginasTime Value of Moneyaer14Ainda não há avaliações

- 1, Rcqffi: Math N"M"Documento6 páginas1, Rcqffi: Math N"M"api-240691070Ainda não há avaliações

- Tute2 TVMDocumento1 páginaTute2 TVMvivek patelAinda não há avaliações

- Exercise 3rd MeetingDocumento4 páginasExercise 3rd MeetingMariko YohanaAinda não há avaliações

- Math 1050 Mortgage ProjectDocumento5 páginasMath 1050 Mortgage Projectapi-278070559100% (1)

- Chapter 4Documento69 páginasChapter 4xffbdgngfAinda não há avaliações

- Img 20160504 0002 NewDocumento5 páginasImg 20160504 0002 Newapi-285003644Ainda não há avaliações

- Midterm I Practice: StudentDocumento40 páginasMidterm I Practice: Studentthunderwolf333Ainda não há avaliações

- FM11 CH 16 Mini-Case Cap Structure DecDocumento11 páginasFM11 CH 16 Mini-Case Cap Structure DecAndreea VladAinda não há avaliações

- Economics Simple InterestDocumento8 páginasEconomics Simple InterestbabadapbadapAinda não há avaliações

- HandoutDocumento14 páginasHandoutJuzer ShabbirAinda não há avaliações

- KidsandcashDocumento7 páginasKidsandcashapi-239373469Ainda não há avaliações

- Payment Plan & Secure ReturnDocumento3 páginasPayment Plan & Secure ReturnPrashant VermaAinda não há avaliações

- IME 301 Engineering Economy, KSK Exam 1 MODELDocumento5 páginasIME 301 Engineering Economy, KSK Exam 1 MODELmmerfeld7Ainda não há avaliações

- Assignment 1Documento7 páginasAssignment 1Camilo Andres MesaAinda não há avaliações

- A Note On AnnuityDocumento6 páginasA Note On Annuitymailbox987Ainda não há avaliações

- We're Paying Off Our Mortgage in Less Than 5 YearsDocumento3 páginasWe're Paying Off Our Mortgage in Less Than 5 YearsErwin E NadAinda não há avaliações

- Time Value of Money 1Documento17 páginasTime Value of Money 1tengyanAinda não há avaliações

- Mid-Sem Answers and SolutionsDocumento26 páginasMid-Sem Answers and SolutionsAmeer Zahar50% (2)

- Alexander Van Dyke Math 1050 Project 2 - Mortgage CostsDocumento5 páginasAlexander Van Dyke Math 1050 Project 2 - Mortgage Costsapi-233311543Ainda não há avaliações

- 1st Quiz Calculus 8-15-2018 (Time Value of Money)Documento2 páginas1st Quiz Calculus 8-15-2018 (Time Value of Money)Gletzmar IgcasamaAinda não há avaliações

- Multiple Choice Questions: Appendix II 81Documento7 páginasMultiple Choice Questions: Appendix II 81Smile LyAinda não há avaliações

- Management Accounting PMA1A - Need Solution - Ur Call Away - 9582940966Documento4 páginasManagement Accounting PMA1A - Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)Ainda não há avaliações

- Practical Accounting 1: La Consolacion University PhilippinesDocumento7 páginasPractical Accounting 1: La Consolacion University PhilippinesAnjo EllisAinda não há avaliações

- Mortgage ProjectDocumento5 páginasMortgage Projectapi-300458382Ainda não há avaliações

- Mortgage ProjectDocumento5 páginasMortgage Projectapi-295873560Ainda não há avaliações

- The Financial Study: Monetary Considerations of The Proposed BusinessDocumento5 páginasThe Financial Study: Monetary Considerations of The Proposed Businessrei_bonghanoyAinda não há avaliações

- Math 1050 ProjectDocumento5 páginasMath 1050 Projectapi-291900408Ainda não há avaliações

- Most Important Terms and Conditions (A) Schedule of Fees and Charges 1. Joining Fee, Annual Fees, Renewal FeesDocumento8 páginasMost Important Terms and Conditions (A) Schedule of Fees and Charges 1. Joining Fee, Annual Fees, Renewal FeesbashasaruAinda não há avaliações

- Iphone 5 Case StudyDocumento7 páginasIphone 5 Case Studyapi-241493839Ainda não há avaliações

- HDFC Bank Home LoanDocumento30 páginasHDFC Bank Home LoanMark MurphyAinda não há avaliações

- Ex. Chapter 7Documento13 páginasEx. Chapter 7ren 76Ainda não há avaliações

- Chap 1 MathscapeDocumento31 páginasChap 1 MathscapeHarry LiuAinda não há avaliações

- Fubuki Case Assignment FINALDocumento4 páginasFubuki Case Assignment FINALnowgamiAinda não há avaliações

- Math 1050 ProjectDocumento5 páginasMath 1050 Projectapi-316746947Ainda não há avaliações

- Cost of CapitalDocumento10 páginasCost of CapitalRobinvarshneyAinda não há avaliações

- Sdsdchow-Lin7,28 DocadcascascascascDocumento31 páginasSdsdchow-Lin7,28 DocadcascascascascMartin AragonesesAinda não há avaliações

- MathDocumento4 páginasMathapi-317213984Ainda não há avaliações

- Managerial Final ExampleDocumento8 páginasManagerial Final ExamplemgiraldovAinda não há avaliações

- Chapter 4 - Time Value of MoneyDocumento46 páginasChapter 4 - Time Value of MoneyAubrey AlvarezAinda não há avaliações

- Mg2451 Engineering Economics and Cost Analysis Questions and AnswersDocumento11 páginasMg2451 Engineering Economics and Cost Analysis Questions and AnswersVijayakumarBaskarAinda não há avaliações

- Case 06 - FinalDocumento5 páginasCase 06 - FinallittlemissjaceyAinda não há avaliações

- 991財管題庫Documento10 páginas991財管題庫zzduble1Ainda não há avaliações

- Starting A Business - Marikina CityDocumento16 páginasStarting A Business - Marikina Cityraighnejames19Ainda não há avaliações

- Economic & Budget Forecast Workbook: Economic workbook with worksheetNo EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetAinda não há avaliações

- 5 E Business StrategyDocumento27 páginas5 E Business StrategyWall JohnAinda não há avaliações

- 3 E Business InfrastructureDocumento37 páginas3 E Business InfrastructureWall JohnAinda não há avaliações

- 1 Introduction To E BusinessDocumento25 páginas1 Introduction To E BusinessWall JohnAinda não há avaliações

- Prinsip Aplikasi Jaringan: Merna Baharuddin, PHDDocumento12 páginasPrinsip Aplikasi Jaringan: Merna Baharuddin, PHDSiti NamiraAinda não há avaliações

- Montefiore Health System Q3 2019 Financial StatementsDocumento25 páginasMontefiore Health System Q3 2019 Financial StatementsJonathan LaMantiaAinda não há avaliações

- Sem1 MCQ FinancialaccountDocumento14 páginasSem1 MCQ FinancialaccountHema LathaAinda não há avaliações

- Pa 3400 SeriesDocumento6 páginasPa 3400 SeriesJesus Caño vargasAinda não há avaliações

- History PaperDocumento3 páginasHistory PaperPromothesh MondalAinda não há avaliações

- Updated Questions 350-401 2Documento16 páginasUpdated Questions 350-401 2Amila DissanayakeAinda não há avaliações

- User Guide - Optimizing Performance in Low Bandwidth EnvironmentsDocumento2 páginasUser Guide - Optimizing Performance in Low Bandwidth EnvironmentsAbdulHasanAinda não há avaliações

- For SabinaDocumento4 páginasFor SabinaBharatRajAinda não há avaliações

- Tourism Wordsearch Wordsearches - 73005Documento1 páginaTourism Wordsearch Wordsearches - 73005RosanaAinda não há avaliações

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento9 páginasDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceN.prem kumarAinda não há avaliações

- Dream Market PDFDocumento3 páginasDream Market PDFAnonymous uck3qAAinda não há avaliações

- Policy New Cheque Dishonour LATESTDocumento18 páginasPolicy New Cheque Dishonour LATESTAdam MarakAinda não há avaliações

- Introduction To Money and Financial SystemDocumento16 páginasIntroduction To Money and Financial SystemMuhammad UmairAinda não há avaliações

- A Reninvfb BCDDocumento8 páginasA Reninvfb BCDvsanders535Ainda não há avaliações

- Bank StatementDocumento2 páginasBank Statementnurulamin00023Ainda não há avaliações

- 04-3 MapDocumento54 páginas04-3 MapHarish SAinda não há avaliações

- Date Date Particulars Debit CreditDocumento13 páginasDate Date Particulars Debit Creditswarna sAinda não há avaliações

- Break Even AnalysisDocumento2 páginasBreak Even AnalysisYugal Subba YugAinda não há avaliações

- 2-The Transport LayerDocumento10 páginas2-The Transport Layer198W1A0591-SEC-B KOTHAPALLI CHAKRADHARAinda não há avaliações

- ACCT1101 Week 2 Practical SolutionsDocumento10 páginasACCT1101 Week 2 Practical SolutionskyleAinda não há avaliações

- Grade 8 Ems ConceptsDocumento5 páginasGrade 8 Ems ConceptsPrisca Nelisiwe MdluliAinda não há avaliações

- Internship Report Meezan Bank by Rehan MubeenDocumento28 páginasInternship Report Meezan Bank by Rehan MubeenrehanAinda não há avaliações

- Experience The Edge - PresentationDocumento14 páginasExperience The Edge - PresentationsujinsgeorgeAinda não há avaliações