Escolar Documentos

Profissional Documentos

Cultura Documentos

Crabel Capital Management, LLC Buethe-Crabel Trading

Enviado por

kran13Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Crabel Capital Management, LLC Buethe-Crabel Trading

Enviado por

kran13Direitos autorais:

Formatos disponíveis

<< Return to Advisor Index

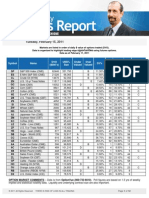

Crabel Capital Management, LLC

Buethe-Crabel Trading

Data Source: Composite

Program Start Date: January, 1998

Last Revision Date:

A N N U A L

P E R F O R M A N C E

B R E A K D O W N

Y ea r

Annual Return

VAMI Growth

98

8.7%

1,087

99

4.2%

1,133

00

9.9%

1,245

01

3.4%

1,287

02

6.9%

1,376

03

1.2%

1,393

04

0.6%

1,401

05

0.3%

1,405

A v g.

4.3%

Assets (Mil.)

Profits (Mil)

$6.00

$.44

$8.00

$.24

$5.00

$.46

$107.00

-$.44

$245.00

$12.41

$364.00

$4.24

$332.00

$1.92

$214.00

-$.18

$160.13

$2.38

Max. Runup

Max. Drawdown

8.7%

-4.8%

5.3%

-1.0%

11.9%

-3.3%

4.6%

-2.5%

6.9%

-2.1%

1.4%

-1.1%

3.1%

-1.3%

2.5%

-2.2%

5.5%

-2.3%

T R A D E R

Systematic:

Discr etionar y:

Minimum Acct.:

T akes Notional$:

Min. F unding:

100%

0%

Closed

Yes

10%

S P E C S

T r ade Categor y:

RT s/Mil./Yr .:

Mar gin/Equity:

Mgmt. F ee:

Incentive F ee:

D R A W D O W N

V AM I

L os s

-4.8%

-3.3%

-3.3%

-2.5%

-2.1%

Peak

Da te

Jul-98

Oct-04

F eb-00

Aug-01

Aug-02

V a lle y

Da te

Aug-98

Sep-05

Apr -00

Nov-01

Oct-02

T otal

96

0.4%

1.2%

Diver sified

2500

5%

2%

20%

Stocks:

Int. Rates:

Cur r encies:

Metals:

Inter bank:

R e c ov e r y

M os .

2

N/A

1

4

1

Loser s

34

-0.8%

0.9%

E q u ity

L os s

-4.8%

-3.4%

-3.3%

-2.5%

-2.1%

Jan

1.4%

3.0%

0.4%

-0.1%

-1.3%

-0.3%

F eb

0.1%

-2.0%

0.7%

1.1%

0.8%

0.3%

W I N D O W

Months

Best

Wor st

Avg.

Latest

1

5.1%

-4.8%

0.4%

1.2%

3

7.3%

-3.2%

1.1%

2.5%

Mar

-1.4%

0.3%

0.4%

-0.5%

-0.3%

-1.0%

Apr

-1.9%

2.7%

0.8%

0.4%

1.0%

0.7%

May

5.1%

0.5%

0.5%

-0.2%

0.9%

-0.1%

Jun

1.1%

-0.2%

1.1%

0.3%

0.3%

-0.2%

A N A LY S I S

6

11.1%

-2.3%

2.1%

1.0%

Dec - 0 5

Sep-05

Jun-05

Mar -05

Dec - 0 4

Sep-04

Jun-04

Mar -04

Dec - 0 3

Sep-03

Jun-03

Mar -03

Dec - 0 2

Sep-02

Win/Lose

1.8

1.3

1.0

M O N T H LY

2000

2001

2002

2003

2004

2005

12

16.3%

-2.9%

4.4%

0.3%

24

18.7%

-1.2%

9.0%

0.9%

Ener gy:

Softs:

Gr ains:

Meats:

Options:

R E T U R N

L os s

M il.

-$0.29

-$10.10

-$0.26

-$2.65

-$5.32

S U M M A R Y

Winner s

62

1.0%

0.9%

S E C T O R S

X

X

X

A N A LY S I S

L e n g th

M os .

1

11

2

3

2

M O N T H LY

Number

Aver age

Stan.Dev

T R A D E

S U M M A R Y

3 M os .

6 M os .

1 2 M os .

2 .5 %

-1.5%

0.4%

-1.1%

- 0 .2 %

-0.6%

2.2%

-0.8%

0 .4 %

-0.2%

0.5%

0.5%

2 .6 %

0.3%

1 .0 %

0 .3 %

-0.7%

- 0 .8 %

0 .6 %

1.4%

0 .3 %

1 .2 %

1.0%

2 .8 %

6 .9 %

D A T A

Jul

0.4%

-0.4%

0.5%

-1.1%

-0.7%

-0.4%

Aug

0.4%

0.7%

1.5%

0.1%

0.0%

-0.9%

Sep

1.1%

-0.8%

-1.7%

0.9%

0.2%

-0.2%

Oct

1.1%

-1.0%

-0.5%

-0.2%

0.9%

0.4%

C O R R E L A T I O N

36

29.8%

0.7%

14.7%

2.1%

Nov

0.9%

-0.6%

2.3%

0.4%

-0.3%

0.9%

Dec

1.3%

1.3%

0.8%

0.2%

-0.8%

1.2%

A N A LY S I S

S&P 500

0.21

Lehman Bonds

-0.09

Star k 300

Discr etionar y

Systematic

Diver sified

-0.01

0.01

-0.04

-0.10

Star k F unds

F in. & Metals

F inancial Only

Non-F inancial

-0.07

-0.02

0.12

0.14

STAR 300 Compiled by Daniel B. Stark & Co., Inc. 625 Broadway Street, Suite 725, San Diego, CA 92101, 619.702.1230, fax: 619.702.1225

The Disclosure Statement and the user's guide, found on page one of this report, are integral parts of this document. No part of the document should be

considered apart from the Disclosure Statement and the user's guide. 1989 - 2005 Daniel B. Stark & Co., Inc. Reproduction without permission is strictly forbidden. This report is intended for informational purposes only.

<< Return to Advisor Index

Crabel Capital Management, LLC

P R O G R A M

D E S C R I P T I O N

Buethe-Crabel Trading employs a short-term, quantitative methodology to trade a 21 market portfolio.Ten different techniques are

traded in an identical fashion in each market resulting in an even mix of short-term momentum trades and short-term reversal

rades. The holding period of each trade is 1 to 1.5 days. Approximately 2,500 separate trades are made each year and the average

marginto-equity is 5%. The strategies contain no bullish or bearish bias and have little correlation with the equity markets or other

trading managers.

T E C H N I C A L

R E T U R N

C H A R T

100

1600

1400

1200

1000

50

800

600

400

0

200

Jan-03

Jan-04

Jan-05

Equity

- 200

98

99

00

01

V AMI

02

03

M ov i n g A v er a g e

04

Annual CROR:

Monthly CROR:

05

Jan-06

VAMI

4.3%

0.4%

2 Year Equity:

Alpha Coef.:

0.6%

0.0%

M ome n tu m I n d e x

R I S K

A S S E T S V E R S U S P R O F I T S

( M I L L I O N S )

100

$400. 00

$300. 00

50

$200. 00

$100. 00

$0. 00

Profits

- $100. 00

98

99

00

01

L I N E A R

02

03

04

05

06

Jan-04

Jan-05

Chart Title

Jan-06

Standard Dev.:

1.2%

Semi-Dev.:

0.9%

T arget Dev.:

0.9%

Beta Coef.:

-0.02

RETURN/RISK

R E G R E S S I O N

1600

0

Jan-03

100

1400

1200

1000

50

800

600

400

0

Jan-03

Jan-04

Jan-05

Jan-06

200

Annual Shar pe:

Monthly Shar pe:

98

99

00

01

02

03

04

05

0.67

0.19

Ster ling Ratio:

Star k Ratio:

0.06

0.00

06

STAR 300 Compiled by Daniel B. Stark & Co., Inc. 625 Broadway Street, Suite 725, San Diego, CA 92101, 619.702.1230, fax: 619.702.1225

The Disclosure Statement and the user's guide, found on page one of this report, are integral parts of this document. No part of the document should be

considered apart from the Disclosure Statement and the user's guide. 1989 - 2005 Daniel B. Stark & Co., Inc. Reproduction without permission is strictly forbidden. This report is intended for informational purposes only.

Você também pode gostar

- Opening Range Breakout 2Documento6 páginasOpening Range Breakout 2kran13100% (1)

- Low Volatility EnvironmentsDocumento5 páginasLow Volatility Environmentskran13Ainda não há avaliações

- Chart FormationsDocumento7 páginasChart Formationskran13Ainda não há avaliações

- P FG Best Weekly Options Report 0215Documento12 páginasP FG Best Weekly Options Report 0215kran13Ainda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Product CodeDocumento32 páginasProduct CodeHimmat ChoudharyAinda não há avaliações

- Module 1 BuscomDocumento9 páginasModule 1 Buscommoon binnieAinda não há avaliações

- Capital Budgeting NPV IrrDocumento26 páginasCapital Budgeting NPV Irrkamarulz93_kzAinda não há avaliações

- Term Premium Notes ErsDocumento21 páginasTerm Premium Notes ErsElice YumiAinda não há avaliações

- Example Assignment 7003Documento14 páginasExample Assignment 7003Javeriah Arif75% (4)

- Trading With GMMADocumento5 páginasTrading With GMMAonyxperidotAinda não há avaliações

- Bayeh AsnakewDocumento126 páginasBayeh AsnakewMahmood Khan100% (2)

- UPDATES On Philippine Valuation Standards PDFDocumento74 páginasUPDATES On Philippine Valuation Standards PDFJoseph Cloyd LamberteAinda não há avaliações

- A Study On Systematic Investment Plan in Mutual FundDocumento43 páginasA Study On Systematic Investment Plan in Mutual FundParag JagtapAinda não há avaliações

- ACCA Financial InstrumentsDocumento8 páginasACCA Financial Instrumentsyung kenAinda não há avaliações

- Di OutlineDocumento81 páginasDi OutlineRobert E. BrannAinda não há avaliações

- A Study On Financial Performance of Lakshmi Vilas Edited PDFDocumento63 páginasA Study On Financial Performance of Lakshmi Vilas Edited PDFSriji VijayAinda não há avaliações

- 118 Berks Broadcasting V CraumerDocumento2 páginas118 Berks Broadcasting V CraumerJai HoAinda não há avaliações

- Tata CorusDocumento44 páginasTata Corussunit150% (2)

- Past ExamDocumento13 páginasPast ExamMinh TaAinda não há avaliações

- SPORTS WORLDS - 14 Enero 2013 - SantanderDocumento14 páginasSPORTS WORLDS - 14 Enero 2013 - SantanderArthur CahuantziAinda não há avaliações

- Thesis Property Plant and EquipmentDocumento5 páginasThesis Property Plant and Equipmentbk32j4wn100% (2)

- Afar 1stpb Exam-5.21Documento7 páginasAfar 1stpb Exam-5.21NananananaAinda não há avaliações

- MBA5001 Assignment 3 Further GuidelinesDocumento17 páginasMBA5001 Assignment 3 Further GuidelinesUpal RajAinda não há avaliações

- Lecture 3 QuestionsDocumento9 páginasLecture 3 QuestionsPubg KrAinda não há avaliações

- PDFDocumento235 páginasPDFshwetaAinda não há avaliações

- C3-Purchasing Management-PrintDocumento28 páginasC3-Purchasing Management-PrintFtu NGUYỄN THỊ NGỌC MINHAinda não há avaliações

- TOPIC 8 - Accounting Policies, Estimates and Errors (IAS 8)Documento2 páginasTOPIC 8 - Accounting Policies, Estimates and Errors (IAS 8)Hạ Nguyễn Cao NhậtAinda não há avaliações

- Q - Test Far270 Nov 2022 PDFDocumento5 páginasQ - Test Far270 Nov 2022 PDFNUR QAMARINAAinda não há avaliações

- PAS 7 Summary NotesDocumento2 páginasPAS 7 Summary NotesdaraAinda não há avaliações

- Chapter 08testing The Purchasing Power Parity TheoryDocumento30 páginasChapter 08testing The Purchasing Power Parity Theorybildy100% (1)

- Investment in Systematic Investment Plan in Satna CityDocumento71 páginasInvestment in Systematic Investment Plan in Satna CitymanuAinda não há avaliações

- Strategic Analysis For More Profitable AcquisitionsDocumento28 páginasStrategic Analysis For More Profitable AcquisitionsPratik DhakeAinda não há avaliações

- Financial Accounting: A Managerial PerspectiveDocumento22 páginasFinancial Accounting: A Managerial Perspectivegajalpeshin100% (3)

- IND As SummaryDocumento41 páginasIND As SummaryAishwarya RajeshAinda não há avaliações