Escolar Documentos

Profissional Documentos

Cultura Documentos

2008 June Paper 1

Enviado por

zahid_mahmood3811Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

2008 June Paper 1

Enviado por

zahid_mahmood3811Direitos autorais:

Formatos disponíveis

Jun 2008 paper 1 1 2 3 C C A Payments made on 1st of each month therefore no amounts prepaid/accrued on 31 Oct Rent expense for

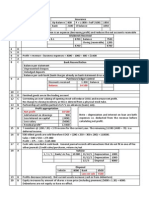

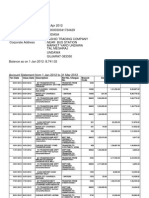

the year = (8 months x $500) + (4 months x $600) = $6400 Fixed assets (book value) Balance 16 000 Depreciation 5 000 Additions 22 000 Balance (end) 8 000 Balance (end) 25 000 38 000 38 000 Trade receivables Allowance for doubtful debts Balance 35 600 Bad debt 1 600 Income Summary 480 Balance 1 160 Balance (end) 34 000 Balance (34 x .02) 680 35 600 35 600 1 160 1 160 Therefore charge to Income statement for bad and doubtful debts = 1600 480 = $1 120 Asset Y depreciation Y1 = 20 000 x 20% = $4 000 Asset Y depreciation Y2 = (20000 4000) x 20% = $3200 Asset X depreciation = (10000 2000) / 5 years = $1 600 Total = 3200 + 1600 = $4800 depreciation is an application of the matching concept as it matches the cost of the asset with the revenue earned by the asset over its useful life. If it is after the preparation of the manufacturing account it must be the stock of loose tools. Had it been before the manufacturing account it could have been the annual charge for fixed tools. Cashbook (bank columns only) Balance (end) 4 825 Balance 4 800 Bank charges 25 48 25 4 825 Balance 4 825 X Ltd (Purchases ledger ) X Ltd (Sales ledger) X Ltd (Sales ledger) 500 Balance 500 Balance 750 X Ltd (purchases ledger) 500 A would not have been entered in either place B and C would both result in the control account balance exceeding the list of balances D the total entered in the control account is $900 less than it should be but the individual entries have all been entered correctly in the customer accounts. Marginal/absorption costing apply to the manufacture of goods only. Subscriptions Balance start (arrears) 75 Balance start (advance) 50 Income and expenditure 3 695 Bank 3 750 Balance end (advance) 150 Balance end (arrears) 120 3 920 3 920 Prime cost = direct costs of manufacturing Materials used = opening + purchases closing = 10 + 58 8 = $60 000 Direct labour $97 000 + 60 000 = $157 000 Lower of cost and net realisable value is the prudent way to measure stock. A accumulated fund is the club equivalent of the capital account B income and expenditure is the club equivalent of revenue and expenses D surplus or deficit is the club equivalent of profit or loss A goodwill is not shown in the profit appropriation B and D are distributions of profit (debited) in the appropriation Manufacturing wages should be debited in the manufacturing account therefore gross profit is overstated. There is no impact on net profit. Creditors: amounts falling due after 1 year = non-current liabilities = $30 000 + $70 000 = $100 000

6 7 8

B D B

9 10

B D

11 12

A A

13

14 15

D C

16 17 18

C A A

19

20

21 22

D A

23

24

25 26 27 28

C D A D

29

30

The share premium cannot be used for a cash dividend so this should be debited first for the bonus issue. General Journal General Journal Balance sheet (after) Share premium 80 Bank 140 Ordinary shares +300 500 Revenue 120 ordinary 100 Share premium - 80 + 40 reserves shares 40 ordinary 200 Share 40 Revenue -120 40 shares premium reserves (bonus issue) (rights issue) Debtors turnover (days) = debtors / credit sales x 360 credit sales = debtors / turnover / 360 = 26 700 / (30 / 360) = $320 400 Total sales = credit sales / .9 = $356 000 If mark-up remains unchanged the gross profit percentage will not change. Some of the fixed costs will not increase with greater volume so net profit improves Asset use = Return on total assets = operating profit / total assets. If assets increase then ROTA will decrease. Gearing = non-current liabilities : Equity and reserves. Revaluation reserve increases therefore gearing will fall. A current assets fall when the debt is written off B Non-current assets increase/decrease by same amount. No change to CA/CL C Bank (CA) decrease offset by trade payables (CL) decrease. Working capital unchanged. D Stock (CA) increase offset by trade payables increase. Working capital unchanged. Current ratio = CA : CL CA = 175 150 = $25 000 Current ratio = $25 000 : $5 000 = $5 : $1 Margin of safety = current level of output breakeven. Graph does not indicate current level of output but C is best option. Breakeven = fixed costs / (selling price variable costs). If selling price is increased and fixed.variable costs remain the same the BEP will fall. Absorbed overhead = actual overhead underabsorbed = 518 400 32 400 = $486 000 Actual output = absorbed / absorption rate = $486 / ($5.40 x 4) = 22 500 units Old price new price Selling price 25 27.50 Variable cost 15 15 Contribution (price variable costs) 10 12.50 Breakeven (fixed cost / contribution) 30 000 units 24 000 Margin of safety (50 000 BEP) 20 000 26 000 6000 increase in margin of safety is a 30% increase. Fixed costs will increase to $60 000. Therefore selling price must increase to $130 000 to maintain profit level. Old fixed costs new fixed costs Selling price/unit 120 130 Variable cost/unit 40 40 Contribution (price variable costs) 80 90 Breakeven (fixed cost / contribution) 50/80 = 625 units 60/90 = 667 Breakeven point has increased by 42 units Extra profit from X Extra profit from Y Total extra profit A 300 units x $12 $3 600 B 500 units x $12 = $6 000 1000 units x 4 = $4 000 $10 000 C 1000 units x $1 = $1 000 2000 units x $6 = $12 000 $13 000 D 1000 units x $5 = $5 000 2000 units x $5 = $10 000 $15 000

Você também pode gostar

- Revise Mid TermDocumento43 páginasRevise Mid TermThe FacesAinda não há avaliações

- Sol Q3Documento4 páginasSol Q3hanaAinda não há avaliações

- Tugas Cost-Volume-Profit Analysis (Irga Ayudias Tantri - 120301214100011)Documento5 páginasTugas Cost-Volume-Profit Analysis (Irga Ayudias Tantri - 120301214100011)irga ayudiasAinda não há avaliações

- 601 13,14 SolutionsDocumento37 páginas601 13,14 SolutionsRudi SyafputraAinda não há avaliações

- Accounting and Finance Formulas: A Simple IntroductionNo EverandAccounting and Finance Formulas: A Simple IntroductionNota: 4 de 5 estrelas4/5 (8)

- Aqa Accn4 W Ms Jun12Documento15 páginasAqa Accn4 W Ms Jun12zahid_mahmood3811Ainda não há avaliações

- Aqa Accn4 W Ms Jun13Documento12 páginasAqa Accn4 W Ms Jun13zahid_mahmood3811Ainda não há avaliações

- Aqa Accn1 W Ms Jan13Documento10 páginasAqa Accn1 W Ms Jan13zahid_mahmood3811Ainda não há avaliações

- Acctg 322Documento2 páginasAcctg 322Janine Remoroza Ü100% (1)

- Advanced Financial Accounting & Reporting JULY 21, 2019 Problem 1Documento9 páginasAdvanced Financial Accounting & Reporting JULY 21, 2019 Problem 1FelixAinda não há avaliações

- Account ClassificationDocumento2 páginasAccount ClassificationMary96% (23)

- Depreciation Schedule: Income Statement 95Documento2 páginasDepreciation Schedule: Income Statement 95zahid_mahmood3811Ainda não há avaliações

- Insurance: Balance 14 100Documento2 páginasInsurance: Balance 14 100zahid_mahmood3811Ainda não há avaliações

- 2012 Nov Paper 32Documento2 páginas2012 Nov Paper 32zahid_mahmood3811Ainda não há avaliações

- Income Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent ReceivedDocumento2 páginasIncome Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent Receivedzahid_mahmood3811Ainda não há avaliações

- Capital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation AccountDocumento2 páginasCapital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation Accountzahid_mahmood3811Ainda não há avaliações

- General Journal: Goodwill 70Documento2 páginasGeneral Journal: Goodwill 70zahid_mahmood3811Ainda não há avaliações

- Ch8 LongDocumento14 páginasCh8 LongratikdayalAinda não há avaliações

- Unit7 D (A2)Documento10 páginasUnit7 D (A2)punte77Ainda não há avaliações

- 2013 June Paper 11Documento2 páginas2013 June Paper 11zahid_mahmood3811Ainda não há avaliações

- FM Solved PapersDocumento83 páginasFM Solved PapersAjabba87% (15)

- F9 - IPRO - Mock 1 - AnswersDocumento12 páginasF9 - IPRO - Mock 1 - AnswersOlivier MAinda não há avaliações

- MANACC - NotesW - Answers - BEP - The Master BudgetDocumento6 páginasMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953Ainda não há avaliações

- LeverageDocumento22 páginasLeverageAmelia PutriAinda não há avaliações

- Corporate FinanceDocumento11 páginasCorporate FinanceShamsul HaqimAinda não há avaliações

- A) 1-Adjustment 1: Closing InventoryDocumento12 páginasA) 1-Adjustment 1: Closing InventoryTuba AkbarAinda não há avaliações

- FR 1 Set 1 (Answer Key)Documento11 páginasFR 1 Set 1 (Answer Key)Suhani PareekAinda não há avaliações

- f5 Mock SolDocumento16 páginasf5 Mock SolSalome farrenAinda não há avaliações

- Cost Volume Profit AnalysisDocumento81 páginasCost Volume Profit AnalysisLalitha Sravanthi100% (1)

- Answer 11Documento10 páginasAnswer 11kamallAinda não há avaliações

- Absorption CostingDocumento2 páginasAbsorption CostingMarusaha MP SiahaanAinda não há avaliações

- ComputeDocumento8 páginasComputeVictorKanyangaAinda não há avaliações

- Final Solution Winter 2017Documento27 páginasFinal Solution Winter 2017sunkenAinda não há avaliações

- F7 SolutionsDocumento15 páginasF7 Solutionsnoor ul anumAinda não há avaliações

- Chapter-05 CVP RelationshipDocumento29 páginasChapter-05 CVP RelationshipShahinul Kabir100% (4)

- Mcs Imp QuestionsDocumento4 páginasMcs Imp QuestionsNikhil KhobragadeAinda não há avaliações

- Cost - Chapter Two - FinalDocumento50 páginasCost - Chapter Two - FinaltewodrosbayisaAinda não há avaliações

- Case Study Break EvenDocumento20 páginasCase Study Break EvenSan Lee ChyAinda não há avaliações

- (Done) Activity-Chapter 2Documento8 páginas(Done) Activity-Chapter 2bbrightvc 一ไบร์ทAinda não há avaliações

- 2-Contribution Margin:: - WithDocumento6 páginas2-Contribution Margin:: - WithAlyn AlconeraAinda não há avaliações

- Fitriyanto - Financial Management Asignment - CH 14 15Documento6 páginasFitriyanto - Financial Management Asignment - CH 14 15iyanAinda não há avaliações

- Assignment 3 SolutionDocumento7 páginasAssignment 3 SolutionAaryaAustAinda não há avaliações

- Afm AssignmentDocumento17 páginasAfm AssignmentHabtamuAinda não há avaliações

- CVP AnalysisDocumento11 páginasCVP AnalysisPratiksha GaikwadAinda não há avaliações

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocumento22 páginasAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedAinda não há avaliações

- Absorption & Marginal Costing and Break Even Point Problems and Solutions - Morshedul Alam SouravDocumento7 páginasAbsorption & Marginal Costing and Break Even Point Problems and Solutions - Morshedul Alam SouravMoon130Ainda não há avaliações

- Tutorial 3 AnswerDocumento4 páginasTutorial 3 Answerwilliamnyx100% (1)

- Quiz 2 Solutions...Documento34 páginasQuiz 2 Solutions...Esmer AliyevaAinda não há avaliações

- MA Chap 5Documento19 páginasMA Chap 5Lan Tran HoangAinda não há avaliações

- Non-Financial Liabilities HomeworDocumento6 páginasNon-Financial Liabilities HomeworIsabelle Guillena60% (5)

- 1244 - Roshan Kumar Sahoo - Assignment 2Documento3 páginas1244 - Roshan Kumar Sahoo - Assignment 2ROSHAN KUMAR SAHOOAinda não há avaliações

- Homework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Documento6 páginasHomework Week 1 Dawna Berry Acc401 Professor Peter Mcdanel 1-18-2013Dawna Lee BerryAinda não há avaliações

- Sol ch13Documento6 páginasSol ch13Kailash KumarAinda não há avaliações

- Chapter 06 (From Our Text Book) : Understanding Cash Flows and Statement of Cash FlowDocumento15 páginasChapter 06 (From Our Text Book) : Understanding Cash Flows and Statement of Cash FlowmostakAinda não há avaliações

- Chapter 6 (Part I) Cost-Volume-Profit Analysis: A Simple Model For Planning & Decision-MakingDocumento10 páginasChapter 6 (Part I) Cost-Volume-Profit Analysis: A Simple Model For Planning & Decision-MakingKhaled Abo YousefAinda não há avaliações

- Chapter 4 Sample BankDocumento18 páginasChapter 4 Sample BankWillyNoBrainsAinda não há avaliações

- EXERCISE 12-2 (15 Minutes)Documento9 páginasEXERCISE 12-2 (15 Minutes)Mari Louis Noriell MejiaAinda não há avaliações

- Chapter 7Documento10 páginasChapter 7Eki OmallaoAinda não há avaliações

- Cv. Chapter 5Documento23 páginasCv. Chapter 5VidhiAinda não há avaliações

- Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions ManualDocumento25 páginasFinancial Management For Decision Makers Canadian 2nd Edition Atrill Solutions ManualMrTaylorPowellaidq100% (48)

- Chapter 9Documento22 páginasChapter 9Glynes NaboaAinda não há avaliações

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsAinda não há avaliações

- CPA Review Notes 2019 - BEC (Business Environment Concepts)No EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Nota: 4 de 5 estrelas4/5 (9)

- 7110 s03 QP 1Documento12 páginas7110 s03 QP 1zahid_mahmood3811Ainda não há avaliações

- Question Paper Unit f012 01 Accounting ApplicationsDocumento28 páginasQuestion Paper Unit f012 01 Accounting Applicationszahid_mahmood3811Ainda não há avaliações

- 7110 s03 Ms 1Documento1 página7110 s03 Ms 1zahid_mahmood3811Ainda não há avaliações

- 7110 s04 Ms 1Documento1 página7110 s04 Ms 1zahid_mahmood3811Ainda não há avaliações

- Aqa Accn1 QP Jun12Documento16 páginasAqa Accn1 QP Jun12zahid_mahmood3811Ainda não há avaliações

- Aqa Accn1 QP Jun13 2Documento20 páginasAqa Accn1 QP Jun13 2zahid_mahmood3811Ainda não há avaliações

- Aqa 2121 Accn3 W MS Jan 12Documento14 páginasAqa 2121 Accn3 W MS Jan 12zahid_mahmood3811Ainda não há avaliações

- Lasania Real TasteDocumento6 páginasLasania Real Tastezahid_mahmood3811Ainda não há avaliações

- 2013 June Paper 11Documento2 páginas2013 June Paper 11zahid_mahmood3811Ainda não há avaliações

- Profit (50:50 Split) 16: RealisationDocumento3 páginasProfit (50:50 Split) 16: Realisationzahid_mahmood3811Ainda não há avaliações

- General Journal: Goodwill 70Documento2 páginasGeneral Journal: Goodwill 70zahid_mahmood3811Ainda não há avaliações

- Diet PlanDocumento1 páginaDiet Planzahid_mahmood3811Ainda não há avaliações

- (Normal Probability) (Discrete Probability) : Xy Xy X yDocumento1 página(Normal Probability) (Discrete Probability) : Xy Xy X yzahid_mahmood3811Ainda não há avaliações

- GoodmorningDocumento17 páginasGoodmorningzahid_mahmood3811Ainda não há avaliações

- Guidelines For Foreign Exchange Transactions - Bangladesh BankDocumento441 páginasGuidelines For Foreign Exchange Transactions - Bangladesh BankAshiq RayhanAinda não há avaliações

- Tax Audit Clauses PDFDocumento13 páginasTax Audit Clauses PDFSunil KumarAinda não há avaliações

- 8901 Audit of Shareholders Equity Self TestDocumento6 páginas8901 Audit of Shareholders Equity Self TestYahlianah LeeAinda não há avaliações

- Partnership Formation Partnership AccountingDocumento14 páginasPartnership Formation Partnership AccountingJesseca JosafatAinda não há avaliações

- Chap 4 MNGT Acctng PDFDocumento4 páginasChap 4 MNGT Acctng PDFRose Ann YaboraAinda não há avaliações

- 03 Joint ArrangementsxxDocumento62 páginas03 Joint ArrangementsxxAnaliza OndoyAinda não há avaliações

- Migration Guide SD Revenue Recognition V2 - Version - 12.04.2019Documento29 páginasMigration Guide SD Revenue Recognition V2 - Version - 12.04.2019damarAinda não há avaliações

- Tijani Ademola Usman: Customer StatementDocumento71 páginasTijani Ademola Usman: Customer StatementRhoda TylerAinda não há avaliações

- LTCC Work BookDocumento49 páginasLTCC Work BookHannah NolongAinda não há avaliações

- PDFDocumento23 páginasPDFSandeep ShahAinda não há avaliações

- Sage Computerised AccountsDocumento29 páginasSage Computerised AccountsvimmakAinda não há avaliações

- C02 Financial Accounting Fundamentals - Control AccountsDocumento7 páginasC02 Financial Accounting Fundamentals - Control AccountsAlfred MakonaAinda não há avaliações

- Fundamentals of Financial Accounting - CIMA Financial Management MagazineDocumento5 páginasFundamentals of Financial Accounting - CIMA Financial Management MagazineLegogie Moses AnoghenaAinda não há avaliações

- Partnership ReviewerDocumento11 páginasPartnership Reviewerbae joohyun0% (1)

- Reviewer in Intermediate Accounting (Midterm)Documento9 páginasReviewer in Intermediate Accounting (Midterm)Czarhiena SantiagoAinda não há avaliações

- CAT-CB Questionnaires (Encoded)Documento13 páginasCAT-CB Questionnaires (Encoded)Anob Ehij100% (1)

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDocumento5 páginasThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburAinda não há avaliações

- School of Business & Management: Course Outline & Accompanying Teaching & Learning PlanDocumento6 páginasSchool of Business & Management: Course Outline & Accompanying Teaching & Learning PlanGurmanjot KaurAinda não há avaliações

- Exercises For Midterm PDFDocumento10 páginasExercises For Midterm PDFThanh HằngAinda não há avaliações

- Sbi PDFDocumento4 páginasSbi PDFMufaddal RashidAinda não há avaliações

- 6018-P1-Lembar Kerja AkuntansiDocumento57 páginas6018-P1-Lembar Kerja AkuntansiToyStoryAinda não há avaliações

- PRC4 Vol II MCQs by Sir JahanzaibDocumento232 páginasPRC4 Vol II MCQs by Sir JahanzaibAayesha Noor100% (1)

- BBA I Sem SyllabusDocumento6 páginasBBA I Sem SyllabusSethabishAinda não há avaliações

- Cambridge IGCSE: Accounting 0452/11Documento12 páginasCambridge IGCSE: Accounting 0452/11Tamer AhmedAinda não há avaliações

- Ppacct II Chapter 4Documento13 páginasPpacct II Chapter 4Nigussie BerhanuAinda não há avaliações

- Trieu BuiDocumento77 páginasTrieu BuiNam CaoAinda não há avaliações

- Sales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankDocumento10 páginasSales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankUmar SageerAinda não há avaliações