Escolar Documentos

Profissional Documentos

Cultura Documentos

BAM Balyasny 200809

Enviado por

jackefellerDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

BAM Balyasny 200809

Enviado por

jackefellerDireitos autorais:

Formatos disponíveis

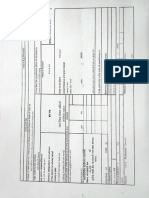

Q3.

2008 Investor Letter

PERFORMANCE RESULTS

Unrestricted "IPO Eligible"

Performance of Atlas Global Investments LTD ( January 21, 2004 - present)

Composite Performance (Inception to January 20, 2004 - proprietary capital managed by BAM prior to creating the Atlas Fund Structures

The Com posite Perform ance does not break out IPO profits which were accretive to net performance in 2002, 2003 and January 2004 by 0%, 1.7% and .02% respectiv

Year

2008 2007 2006 2005 2004 2003 2002

Jan

-2.38% +2.69% +6.32% -0.19% +7.02% -6.14% +2.59%

Feb

+3.90% +0.53% +4.46% +3.40% +3.36% -0.60% -0.23%

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

+1.57% +2.26% +7.07% +6.25% +2.74% +1.19%

YTD

+4.02% +27.18% +25.15% +17.17% +25.23% +59.49% +74.86%

-1.15% +1.43% +3.38% +0.90% +1.24% +1.41% +3.06% +4.05% -1.71% +1.49% -8.91% -1.02% +3.59% +2.02% -1.63% -1.30% +13.38% +8.17% +7.30% -2.74% +0.48%

+1.70% +1.15% +1.43% +2.04% +2.31% -0.33% +2.24% +4.62% +1.95% -4.80% +4.56% +9.66% +5.39% +33.93%

-0.61% -3.23%* +0.94% +2.22% +6.13% +3.31% -1.00% -0.65% +2.44% +1.76% +4.25% +1.57% +0.42% +1.89% -8.10% +4.52% +2.14% +7.64% +6.68% +1.47% +5.45% +5.02% +4.93% +10.13% -1.23% -0.07%

Restricted "non-IPO Eligible"

Performance of Atlas Global Investments LTD ( January 21, 2004 - present)

Composite Performance (Inception to January 20, 2004 - proprietary capital managed by BAM prior to creating the Atlas Fund Structures)

The Composite Performance does not break out IPO profits which were accretive to net performance in 2002, 2003 and January 2004 by 0%, 1.7% and .02% respectively

Year

2008 2007 2006 2005 2004 2003 2002

Jan

-2.37% +2.54% +5.76% -0.68% +6.22% -6.14% +2.59%

Feb

+3.90% -0.21% +3.69% +2.96% +1.15% -0.60% -0.23%

Mar

Apr

May

Jun

Jul

+1.15% +1.71% -0.34% +4.75% -5.53% +9.66% +33.93%

Aug

Sep

Oct

+5.42% +1.53% +0.09% -3.61% +5.45% -1.23%

Nov

+2.67% +1.44% +1.20% +5.71% +5.02% -0.07%

Dec

+1.49% +1.60% +6.72% +6.46% +2.74% +1.19%

YTD

+3.74% +22.05% +18.61% +11.78% +2.69% +59.49% +74.86%

-1.32% +1.34% +3.36% +1.70% +0.65% +0.78% +1.20% +1.26% +2.72% +3.15% -2.10% +2.02% +1.39% -9.86% -1.34% +1.10% +1.98% +0.14% -1.39% +1.40% -1.30% +13.38% +8.17% +4.56% +7.30% -2.74% +0.48% +5.39%

-0.61% -3.23%* +0.67% +2.04% -1.11% -0.90% +3.99% +1.84% -10.65% +2.24% +6.68% +1.47% +4.93% +10.13%

* Estimated return.

*The information presented is estimated, unaudited , net of applicable fees, and is subject to change. Please see the last page of this update for important disclosure information.

ATLAS GLOBAL / AT A GLANCE Market Cap ATLAS MASTER AUM (10/1/08 estimate) Gross Equity Exposure $2 2 Billi $2.2 Billion Large Cap Mid Cap Small Cap Total Equity Exposure Longs Shorts TOTAL 20.5% 9.1% 15.4% 11.8% 34.8% 8.3% 70.7% 29.3% 29.6% 27.3% 43.2% 100%

$487 Million ($316 long + $171 short)

7% (% AUM) 30% (% Gross) Net Equity Exposure Avg daily volatility (MTD) 0.59% Monthly correlation to S&P (ITD) -0.03 Daily correlation to S&P (MTD) 0.08 Avg daily correlation amongst Portfolio Mgrs (MTD) 0.10 Portfolio Turnover for the month (daily % of aum) 46% Total number of positions (excludes macro) Largest long equity position Largest short equity position Top 10 largest longs Top 10 largest shorts

As a % of Gross Exposure

Includes US domestic and Intl equities, delta adjusted options, OTC equity swaps and private deals

Liquidity Profile (days trading volume)

(% AUM) (% Gross)

682 2.79% 1.15% 14.53% 8.25%

< 1 Day 1-3 Days 3-10 Days Over 10 Days

10.10% 0.60% 1.00% 10.60%

45.20% 2.70% 4.30% 47.80%

Includes US domestic and Intl equities, delta adjusted options, OTC equity swaps and private deals

Portfolio VaR (% of AUM) Total VaR 0.17% Equity VaR 0.16% Global Macro VaR 0.01%

VAR: Estimated for 99%; 1 day horizon; 2 yr look-back. Stress Tests: Data from internal sources, Bloomberg. Calculations using RiskMetrics.

Average Risk Adjusted Capital Allocation &. P/L Contribution * (% of Total. 2008 Year-to-Date)

70% 50% 30% 10% -10% -30% Commodity Consumer Energy Europe Financial Generalist Healthcare Industrial Asia Event Macro Media Other Tech

% Total P/L % Total Risk Adjusted Capital Allocation

Risk Adjusted Capital Allocation by Portfolio Sector (CURRENT Oct 1 08)

Tech Other 12% 7% Media 3% Asia 4% Commodity 2% Consumer 17%

*represents p p percentages g ofcurrenttotalPLnotabsolutereturnsonallocatedcapital p

Macro Energy 7% 14% Industrial Europe 5% 5% Healthcare Event 3% Generalist Financial 1% 12% 8%

THIS UPDATE IS INTENDED ONLY FOR THE PERSON OR ENTITY TO WHICH IT HAS BEEN DELIVERED. THIS IS NOT AN OFFER OR SOLICITATION WITH RESPECT TO THE PURCHASE OR SALE OF ANY SECURITY. THIS UPDATE IS STRICTLY CONFIDENTIAL AND MAY NOT BE REPRODUCED OR REDISTRIBUTED IN WHOLE OR IN PART NOR MAY ITS CONTENTS BE DISCLOSED TO ANY OTHER PERSON OR ENTITY. PLEASE SEE IMPORTANT DISCLOSURE INFORMATION ON THE FOLLOWING PAGE OF THIS UPDATE.

Q3.2008 Investor Letter

MANAGER COMMENTARY The Atlas Global Fund was down -3.23% (net unrestricted and restricted) in September taking returns for the third quarter to -2.71% (net unrestricted and restricted) and year-to-date to +4.03% and +3.76% (net unrestricted and restricted). Updated comparison below:

(annualized)

Atlas 15.84% 9.48% 21.95% 7.98% 32.77% 17.76%

Tremont Multistrat** -11.28% 8.73% 4.02% 6.61% 6.79% 4.89%

S&P 500*** -23.62% 14.78% -1.72% 11.40% 0.23% 12.74%

1YR

ROR Volatility

3YR

ROR Volatility

Jan 2002 present * ROR (Atlas Strategy ITD) Volatility

*Performancestatisticsinclude theBAMComposite Returns andtheAtlasGlobal Investment, LtdUnrestricted performance. Pleaseseethelastpageofthisdocument forimportant disclosure information **Source:Tremont L/Sand MultiStrategyindices fromwww.hedgeindex.com. ***S&P500fromBloomberg SPXreturns

THE STATE OF THE HEDGE FUND INDUSTRY

Last year we were nominated by Alpha magazine for their multi-strategy fund of the year award. Five other funds were nominated, all with excellent returns and Sharpe ratios, and we lost out to a larger competitor. As I write this, all five of the other funds nominated are negative for the year with an average return of -16% YTD. These are some of the best funds in the industry with many years of strong returns so it is not surprising that the returns of many other funds are far worse. returns, worse I am not pointing this out to celebrate our small positive return this year, but to illustrate the difficulty of picking hedge fund managers in this environment. Those living in glass houses should not throw stones, however discussing the issues behind the industrys recent performance will help us do a better job of allocating your capital in the future. When I began trading, I was taught that making money in the markets depends on three factors: stock selection, timing, and money management. Of the three, stock selection was by far the least important factor. First you had to get the market right, then the sector call, then manage to enter and exit in a timely manner, and most importantly, size your positions right and manage risk well. Subsequently, picking the best individual longs and shorts was a bonus not a requirement. Now lets fast forward to the last five years a gilded age for the industry. Volatility was generally low. Capital was flooding into the industry boosting risk taking appetites for all strategies. Major long term thematic bets worked with very brief interruptions. In this environment the money making factors were turned upside down. Stock selection went from last to first in importance. Long term analysts and fundamental investors ruled supreme. Managers prided themselves on their ability to ignore short-term market fluctuations. Timing was irrelevant as real investors focused only on long-term fundamentals and intrinsic business values. Money management skills were reduced to small degrees of variance in gross and net exposures. Every decline in the consensus themes was viewed as an opportunity to add exposure - and it worked. Many of the best performing managers were those who played the most aggressively doubling down whenever energy, mining and materials, emerging markets, or google and apple dipped. More and more money was raised and promptly invested in the same themes and names. As this self-reinforcing cycle kicked into high gear, some managers grew so big that they frequently owned 5%, 10% or even 15% of major companies making it impossible for them to exit in an orderly way. Many of the analysts and portfolio managers we interviewed focused their questions not on our firms culture, team interaction, or growth prospects, but on making sure we were not too short-term because they didnt want market noise to affect their investment decisions or the overly tight risk management to hold them back. Similar to the debacle in the mortgage markets, this type of investing was highly rewarded the last few years and encouraged participants to constantly play bigger. Then as occasionally happens in the markets something changed. Starting in July, many of the major trends ran into problems. The extreme bearish positioning in the dollar combined with market participants judging that the U.S. was going to deal with its problems before other countries ignited a fierce dollar rally. In part as a result of the dollar reversal, fears of China slowing and general economic weakness, commodities broke their long up-trends. Various government actions contributed to sharp squeezes in shares of beaten down and overly shorted financial stocks. Emerging markets, which were geared to both commodity demand and dollar weakness, went into a freefall. Consensus hedge fund positioning fueled the volatility in these reversals which contributed to terrible industry wide performance. This led to investor redemptions which led to more dreadful performance and increasing correlation among strategies. (CONTINUED ON NEXT PAGE)

Q3.2008 Investor Letter

MANAGER COMMENTARY (continued)

In retrospect, the managers who performed best this time cut these bets the most quickly or even played the other way. However, in the last five years, managers were rewarded for viewing every contra move as an opportunity to add. Many had never been so severely wrong and had no experience with quickly cutting losses unless their long-term fundamental view had changed. Many managers increased their gross exposure by adding to shorts only to see their crowded hedge fund favorite names continue to underperform. As the volatility continued to increase the high gross exposures, surprising government interventions, failure of Lehman, and generally poor risk management combined to create a toxic cocktail of losses. This situation exposed the main problem with long term fundamentals being the primary component of an investment strategy how to decide when to exit? We ask this question all the time in interviews and when our portfolio managers are in a losing position what are you looking for to get out? The problem is long-term fundamentals take a long time to change. Is China still a global growth engine for the next twenty years? Probably. Have we found a lot more crude oil recently or advanced alternative energy sources in the last few months? Probably not. Is the financial sector going to experience a long and painful downsizing? Sure. The point being if one sticks around waiting for long term fundamentals to change before exiting losing positions, most of the time the strategy will work, but at inflection points the strategy will blow up. If a manager has edge in long term stock selection as opposed to trading or market timing, what should he do as volatility increases? We all know that correlations increase with volatility, and as a result most risk assets behave in a similar way. If the V.I.X. goes from 25 to 50 like it did in September and a portfolio manager does not change his gross exposure he effectively doubled the amount of risk he is taking. If it goes to 75 as it has recently in October, risk effectively has tripled. Simultaneously stock picking or strategy selection alpha disappears as correlations on risk assets go to one and the main differentiator in performance depends how widely held the particular assets are. As managers who were previously successful as a result of riding out market fluctuations came to realize that this time the bounce was not coming, but redemptions were, they all hit the sell button and found that there was no one on the other side. I have h a few f t k takeaways f from th recent the t experience: i 1. Fundamental long/short, similar to statistical arbitrage last year, became a victim of its own success. The self-reinforcing cycle of more and more money going to firms with similar bets and strategies caused excessive crowding in positions, styles, and approaches. Regardless of strategy, what separates money managers is their ability to adapt, their flexibility, and their humility. While stock selection generally works, by itself it is not sufficient to succeed in different market environments. Timing, market feel, and risk management skills are vastly more important and these are what investors should be paying for. In the ultimate example of market timing by a long only investor, Warren Buffett became extraordinarily wealthy by going to cash prior to the massive bear market in the 1970s. The hedge fund industry is going to experience a massive wash out with many firms closing. In our last letter, we said that several firms might go out of business due to the unwind of the long energy/short financials bet. Now we think it will be more than 50% of all funds led by the overcrowded long/short equity space. It is similar to the consolidation we are seeing in the banking sector. There is no need for 8,000 banks in this country or 8,000 hedge funds. After the de-risking period is over and positioning is clean, the returns for the survivors are likely to be extraordinary. We went back and looked at the returns of major hedge fund strategies including converts, merger arb, emerging markets, event, long/short, multi-strategy, etc., over the past twenty years in the year following negative performance in that strategy. There were 22 occurrences of down years between the various strategies. In 21 of the 22 cases, the following years performance was positive with an average return of 22%. History is no guarantee, but I would bet on above average returns in long/short and other fundamental strategies next year.

2.

3.

4.

HOW DID WE WEATHER SEPTEMBER & WHAT WILL DIFFERENTIATE HEDGE FUNDS? We view our job as generating attractive returns with reasonable risk running a true all-weather fund. We do not view our job as practicing some particular brand of investing such as, buying good companies and selling bad ones, or having to maintain some sort of market exposure. We have the capabilities to hire and manage experienced investment teams across strategies, conduct high quality fundamental research, actively trade the markets during volatile periods, and to make moderate macro bets when the timing is right. Our focus has always been on liquid securities, diversification of portfolios and decision makers and disciplined risk limits which were recently put to the test. (CONTINUED ON NEXT PAGE)

Q3.2008 Investor Letter

MANAGER COMMENTARY (continued) As the environment for fundamental long/short deteriorated in August and September we systematically took down our risk and leverage while continuing to allocate capital to our more macro and trading oriented strategies. Through a combination of risk limits being triggered and our teams recognizing that fundamental strategies were not working, by the middle of September we were down to running an unlevered book well outside our usual gross exposure range of 2-4x. A few days after the Lehman bankruptcy, we had a Partners meeting at which we unanimously decided to take the portfolio almost entirely to cash for a period of time. We were concerned that the political bailouts, rule changes, counterparty risks, end-of-month industry wide redemptions, and already high volatility, which was making the markets even more difficult and illiquid, was not a situation where we were likely to add much value in picking stocks. Within 48 hours, at an estimated cost of 40bps, we took the fund almost entirely to cash and cash equivalents While we were unable to escape the September carnage completely unharmed, we feel taking down risk really controlled the losses. We had positive contributions from our financials, macro, and trading strategies while we suffered losses in energy, healthcare, industrials, European equities, and event. Importantly, no one blew through their stops and drawdown limits which helped to limit the damage. One major determining factor in which firms emerge stronger or fall by the wayside is going to be the quality of their non-investment teams. I would not want to be in the seat of a fund manager who in addition to managing the portfolio in these wild markets, needs to manage counterparty risk, legal and regulatory changes, personnel problems and investor issues. We have been fortunate to have the same outstanding core management team for the last eight years leading deep teams in all business areas including seven in legal/compliance with 24 hour global coverage to help with recent short-sale rule changes in real time, extensive operations, recruiting, accounting, I.T, investor relations and risk management. Although, in contrast to most hedge fund firms, we have yet to generate profits from our management fee - the investments we continue to make in the infrastructure and management talent of our firm have served the fund well. Another important p factor is our ability y to attract and retain talent. The last several y years the competition p for top p PMs was fierce. Many y large funds and platforms were growing and hiring aggressively, private equity firms were starting well funded hedge funds, bank prop desks were all bidding for talent, and it was fairly easy to raise capital for start-up funds. Today the situation could not be more different. Most established multi-strategy players are busy dealing with internal personnel and risk management issues. The other options are pretty much shut down. We offer top talent a unique proposition: clear risk and capital guidelines with substantial room for growth, partnership potential, assistance in building and managing investment teams, and a positive, collaborative firm culture. It is also substantially easier to evaluate portfolio managers today as the single biggest question we had in years past has been answered, namely, how they would do in a bear market? Given the changing market dynamics of the last three years, teams that generated good returns and managed risk well from 2006-2008 have shown that they are real performers capable of adapting their approach as markets dictate. We think this is a great opportunity for us to add several top managers to the team. We are looking for investment talent in sectors and geographies where we are not as strong as we would like so please feel free to refer teams that are looking for a new home or having a difficult time scaling a good small fund. MARKET OUTLOOK & POSITIONING The trends behind the recent acceleration of the credit crunch are not easy to reverse. While Fed stimulus and government interventions will hopefully keep somewhat of a floor underneath the markets, they are unlikely to lead to sustained strength. Even after the October selloff equities look expensive relative to credit. With many bank loans trading in the 50s, 60s, and 70s, being significantly long equities doesnt look great. Given the fund flows in the credit markets this year and the fact that we are just entering what is likely to be a deep recession I would not bet on a large credit rally soon. So stocks are likely to continue to have wild short-term rallies fueled with the hope that things are getting better -followed by declines as the latest dreadful economics and earnings numbers hit. We continue to be nimble and conservative with risk in this environment. With the V.I.X. in the 70s being levered makes no sense. Our current gross exposure is at 35% with a small net long. As volatility comes down, possibly post the election, and investors start to refocus on individual company fundamentals we will continue to scale our risk back up. The majority of the capital we have on is being managed by the partners in the firms largest portfolios with an emphasis on the more trading oriented strategies for the time being. To emphasize once again, we believe the environment for our style of investing after this de-risking period is going to be awesome. We are not burdened by far away high water marks, illiquid portfolios, unstable capital, or unhappy investment teams. We feel that we have the right strategy, team, and skill-set to earn very attractive returns for you in the years ahead.

(CONTINUED ON NEXT PAGE)

Q3.2008 Investor Letter

MANAGER COMMENTARY (continued) COUNTERPARTY/EXPOSURE UPDATES As discussed in our September mid-month update, as the fund has grown, we have made efforts to diversify our prime broker and banking relationships in order to protect capital and retain trading flexibility. Over the last few months we have been more aggressive in diversifying cash holdings amongst select counterparts which include more traditional custodial institutions. We have moved over 60% of our excess cash to these large non-investment banking institutions and custodians such as the Bank of New York and Northern Trust to hold exclusively cash and US Treasuries. Approximately 0.16% or $3.5M of Atlas Global capital remained with Lehman which we have valued at zero, which is higher than initial estimates. We continue to maintain our main prime brokerage relationships at Morgan Stanley, Goldman Sachs and JP Morgan and secondary relationships with BNP and CSFB. The counterparty credit committee, which is made up of senior members of Trading, Legal, Compliance, Operations and Accounting, continues to manage and evaluate on a daily basis all of our counterparty relationships, including over-the-counter, execution and prime brokerage. WHAT WORRIES US? The biggest concern I have is the environment for capitalism in general and hedge funds in particular going forward. While not a perfect system, capitalism and free markets have served the world quite well for a long time and I worry that the backlash from the credit and financial mess is going to turn the tide back towards socialism. Of course it will not be called socialism, but the regulations, taxes, decision making and government involvement in the private sector will leave no doubt as to the policy. Having been born in Russia, I can say with high conviction that this is not a direction that will lead to better living standards, a stronger economy or a higher level of gross national or global happiness. The behavior of some seasoned businessmen and CEOs in the public eye is particularly disturbing. When executives go on TV or give interviews in the papers where they blame short selling or mark-to-market accounting for their companies fundamental problems it really sends a very strong message to policy makers. The message is that business people are fair weather capitalists who want all the upside when times are good and then lots of new regulations and bailouts when they have to deal with their previous mistakes. When we ask politicians to solve our problems they are rightly going to assume that we dont know what we are doing and need to be managed and regulated at all times. I want my kids to have the same kinds of opportunities to build businesses or be successful in their chosen careers that we have enjoyed. I do not want them to have to worry about windfall profit taxes being levied against their successful industry, having to gain government approval every time they wish to expand their business or having their hard earned income redistributed more fairly. If they should choose to go into the hedge fund industry some day, I hope they do not have to ask us why we did not proudly point to all the good things the industry has done: from generating superior long-term returns for many pensions, endowments and families, to providing capital and liquidity to our markets, to being perhaps the most philanthropic industry on earth. This is one of those times where words are important if we do not point out all the good our industry has done I can assure you there will plenty of others who will not be as reticent to blame us for a lot of bad things. What the leaders of our industry and capitalist economy say and do in the months ahead will really matter to the future of the financial system. If you missed our Q3 Investor Call we hosted a couple weeks ago we encourage you to listen to the replay which will be available through this quarter (replay dial-in instructions below). Playback dial in Numbers: U.S. Toll Free: 800-355-2355 International Toll: 402-220-2946 Playback access code: 30554# Thank you for your continued confidence.

Dmitry Balyasny Managing Partner & CIO

Q3.2008 Investor Letter

FUND TERMS

Fees: Management Fee: 2% Performance Fee: 20% Other Costs: Pass through of investment team compensation & expenses. Liquidity: 12 month soft lock with 5% break fee. Redemptions quarterly & each anniversary of share issuance with 65 days notice. 20% gate Subscriptions: Monthly Minimum Investment: $5M institutions & $1M qualified individuals Structure: Master / Feeder with Onshore & Offshore funds. Offshore fund is a Cayman Corporation Fund Status: OPEN

CONTACT For further information please contact:

Stephanie Mesheski-Genke Managing Director Investor Relations US+ (312) 499-2995 (direct) US+ (917) 216-0720 (cell) Investorrelations@bamfunds.com Doug Amacher Managing Director, Institutional Sales US+ (312) 499-2988 (direct) US+ (312) 961-7641 (cell)

Chicago: 181 West Madison St. Suite 3600 Chicago, IL 60602 (312) 499-2999 (main) (312) 499-2998 (fax) London 28 King St. 3rd Floor London,SW1Y 6SL UK 44 (0) 207 149 0000 (main) 44 (0) 207 149 0002 (fax) Mumbai BAM India Advisory Private Ltd. 1007, Embassy Center Nariman Point Mumbai 400 021, India +91 2266226400 (main)

New York: 135 East 57th St. 27th Floor New York, NY 10021 (212) 808-2300 (main) (212) 808-2301 (fax) Greenwich 73 Arch St. Greenwich, CT 06830 (203) 863-5400 (main) (203) 863-5433 (fax) Hong Kong: Balyasny Asset Management (Hong Kong) Ltd. Cheung Kong Center Unit 63, Level 16 2 Queen's Road, Central, Hong Kong +852 3965 2688 (main)

DISCLOSURE

The information presented is estimated, unaudited and is subject to adjustment. Historical performance for the period January 1, 2002 to January 20, 2004 represents the composite results of BAMs proprietary funds and a separate account managed by BAM on behalf of a broker-dealer (the Composite Returns). The Composite Returns include the reinvestment of earnings and are presented net of all fees and expenses including an implied fee of 57% of gross profits, consisting of a direct allocation of operating expenses, traders compensation and an incentive fee. New issue profits were accretive to net unrestricted performance in 2002, 2003 and January 2004 by 0%, 1.7% and .02% respectively. From January 20, 2004 to present the performance results represent that of Atlas Global Investments, Ltd. (the Fund Returns). The Fund Returns include the reinvestment of earnings and are presented net of all fees and expenses. Incentive compensation in 2005 forward will be a straight 20% of Net Profit versus 0-30% sliding scale in 2004. From January 20, 2004 through October 31, 2005 BAM has passed through its expenses, including portfolio manager compensation, to investors. In 2004, less than 10% of capital in Atlas Global Investments, Ltd. was unrestricted. For presentation purposes the January 1st January 20th 2004 returns (the Stub Period) from the Composite Returns are included in the Fund Returns. The Stub Period Composite Returns were +5.95% and +5.91% for unrestricted and restricted respectively. The Fund Returns for January were +1.07% and +0.31% for unrestricted and restricted respectively. The 2004 Fund Returns without the Composite Returns Stub Period were +18.24% and -3.04% for the unrestricted and restricted respectively. September 2005 performance results reflect a redemption fee which was paid by investors who redeemed on September 30 prior to the expiration of their lock-up. The redemption fee was credited to non-redeeming investors, and was accretive to both restricted and unrestricted performance by 0.94% for the month. The unrestricted shares do but the restricted shares do not, participate in the gains and losses attributable to new issues (formerly hot issues). During certain periods, new issues may make a material contribution to BAMs performance. Performance figures include the reinvestment of dividends and other earningsParticular investors returns will vary from the historical performance due to the Stub Period, the timing of subscriptions, withdrawals and redemptions. Past performance is not indicative of future results. There can be no assurances that investors will have returns on invested capital similar to the returns presented because of, among other reasons, differences in economic conditions, regulatory climate, portfolio size, leverage, expenses and structure, as well as investment policies and techniques. An investment in the funds managed by BAM is speculative and involves a high degree of risk. BAM will employ certain trading techniques, such as short selling and the use of leverage, which may increase the risk of investment loss. As a result, performance may be volatile, and an investor could lose all or a substantial amount of his or her investment. Further, the funds managed by BAM have substantial limitations on an investors ability to redeem or transfer their shares, and there is no secondary market for an interest in the funds and none is expected to develop. Finally, the funds fees and expenses may offset trading profits. These risks and other important risks are described in detail in a Confidential Private Offering Memorandum available for each of the funds. Prospective investors are strongly urged to review the relevant Confidential Private Offering Memorandum carefully, and consult with their own financial, legal and tax advisors before making an investment in the funds. The Standard & Poors 500 Index (S&P 500) is an index of publicly traded common stocks. We have included the results of the S&P 500 to show the historical performance of the U.S. equity market. Comparison of the Fund's performance to he benchmark's returns has limitations. The index's volatility and other material characteristics may differ from the Fund's investments and strategies. Furthermore, the Fund may hold substantially more or fewer positions than the S&P 500 and, in fact, certain or all of securities held by the index may not be held by the Fund and certain or all of the securities held by the Fund may not be held by the index. This summary is intended only for the person or entity to which it has been delivered. This summary is not an offer or solicitation with respect to the purchase or sale of any security. An offering of interests in the funds managed by BAM will be made only by means of a Confidential Private Offering Memorandum and in such jurisdictions where permitted by law. Any investment decision in connection with the funds should be made only on the information contained in the Confidential Private Offering Memorandum that will be provided to prospective investors. This summary is not intended to constitute legal, tax or accounting advice, or investment recommendations.

Você também pode gostar

- Chamath Amazon Sohn 2016Documento54 páginasChamath Amazon Sohn 2016jackefeller100% (1)

- PdfsDocumento9 páginasPdfsjoeAinda não há avaliações

- When Collateral Is KingDocumento12 páginasWhen Collateral Is KingCoolidgeLowAinda não há avaliações

- Paulson Credit Opportunity 2007 Year EndDocumento16 páginasPaulson Credit Opportunity 2007 Year EndjackefellerAinda não há avaliações

- PzenaCommentary Second Quarter 2013Documento3 páginasPzenaCommentary Second Quarter 2013CanadianValueAinda não há avaliações

- Bridgewater: Daily ObservationsDocumento15 páginasBridgewater: Daily Observationssidg29100% (1)

- 3 Crispin Odey PresentationDocumento23 páginas3 Crispin Odey PresentationWindsor1801Ainda não há avaliações

- Third Point Q2 2010 Investor LetterDocumento9 páginasThird Point Q2 2010 Investor Lettereric695Ainda não há avaliações

- Mark Yusko's Presentation at iCIO: Year of The AlligatorDocumento123 páginasMark Yusko's Presentation at iCIO: Year of The AlligatorValueWalkAinda não há avaliações

- PIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsNo EverandPIPE Investments of Private Equity Funds: The temptation of public equity investments to private equity firmsAinda não há avaliações

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNo EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketAinda não há avaliações

- Schroder GAIA Egerton Equity: Quarterly Fund UpdateDocumento7 páginasSchroder GAIA Egerton Equity: Quarterly Fund UpdatejackefellerAinda não há avaliações

- Hillhouse-Zhang-Value Investing Congress West 2010Documento24 páginasHillhouse-Zhang-Value Investing Congress West 2010jackefellerAinda não há avaliações

- Q4 2010 GlenviewDocumento22 páginasQ4 2010 GlenviewaviAinda não há avaliações

- Cal Homeowners Insurance Valuation V2Documento77 páginasCal Homeowners Insurance Valuation V2Melissa Maher100% (1)

- Income Tax Lessons July 2019 0 PDFDocumento124 páginasIncome Tax Lessons July 2019 0 PDFHannah YnciertoAinda não há avaliações

- Third Point Q3 2019 LetterDocumento13 páginasThird Point Q3 2019 LetterZerohedge100% (2)

- The Investment ClockDocumento25 páginasThe Investment ClockIvy LopezAinda não há avaliações

- Global Economics Weekly - Goldman Sachs 02.10.13Documento13 páginasGlobal Economics Weekly - Goldman Sachs 02.10.13Martin Tsankov100% (1)

- BridgewaterDocumento7 páginasBridgewaterkirksoAinda não há avaliações

- Deutsche Bank - US ETF Market Weekly Review: $35bn Removed From ETP AUM After Market Sell-OffDocumento38 páginasDeutsche Bank - US ETF Market Weekly Review: $35bn Removed From ETP AUM After Market Sell-OffRussell FryAinda não há avaliações

- China Strategy 2011Documento178 páginasChina Strategy 2011Anees AisyahAinda não há avaliações

- Bridgewater ReportDocumento12 páginasBridgewater Reportw_fibAinda não há avaliações

- Anatomy of A CrisisDocumento17 páginasAnatomy of A CrisisgautamnarulaAinda não há avaliações

- Consumer Closeup - Goldman SachsDocumento60 páginasConsumer Closeup - Goldman SachsRichardAinda não há avaliações

- Basis Points Fixed Income StrategyDocumento11 páginasBasis Points Fixed Income StrategyPhilip LeonardAinda não há avaliações

- Chanos Wine Country ConferenceDocumento19 páginasChanos Wine Country ConferenceZerohedge100% (2)

- 3-17-2020 Jeffrey Gundlach Total Return Presentation-UnlockedDocumento82 páginas3-17-2020 Jeffrey Gundlach Total Return Presentation-UnlockedZerohedge100% (3)

- Vanguard Asset AllocationDocumento19 páginasVanguard Asset AllocationVinicius QueirozAinda não há avaliações

- Bridgewater: Daily ObservationsDocumento15 páginasBridgewater: Daily Observationsdanielkps2903Ainda não há avaliações

- Gs Macro Out Look 20171Documento62 páginasGs Macro Out Look 20171VladimirAinda não há avaliações

- BridgewaterDocumento17 páginasBridgewaterMatthew Cain100% (2)

- Global Macro BarcapDocumento16 páginasGlobal Macro BarcapvishwachandraAinda não há avaliações

- Gundlach 6-14-16 Total Return Webcast Slides - Final - UnlockedDocumento73 páginasGundlach 6-14-16 Total Return Webcast Slides - Final - UnlockedZerohedge100% (1)

- CS Global Money Notes 2Documento26 páginasCS Global Money Notes 2rockstarliveAinda não há avaliações

- 2011 11 22 China BridgewaterDocumento12 páginas2011 11 22 China Bridgewaternicholas.khuu492100% (3)

- BarCap Credit Research 110312Documento32 páginasBarCap Credit Research 110312Henry WangAinda não há avaliações

- Third Point Q3 2011Documento5 páginasThird Point Q3 2011thereader2100% (1)

- Modeling Peak ProfitabiliytDocumento23 páginasModeling Peak ProfitabiliytBrentjaciow100% (1)

- Ubs Investor Guide 5.27Documento44 páginasUbs Investor Guide 5.27shayanjalali44Ainda não há avaliações

- How Big Is China's Real Estate Bubble and Why Hasn't It Burst Yet? PDFDocumento10 páginasHow Big Is China's Real Estate Bubble and Why Hasn't It Burst Yet? PDFEdivaldo PaciênciaAinda não há avaliações

- Wachovia MLP PrimerDocumento100 páginasWachovia MLP PrimerpframpAinda não há avaliações

- Add To Primex Longs: Securitization ResearchDocumento8 páginasAdd To Primex Longs: Securitization ResearchMaxim TalonAinda não há avaliações

- Transforming Office Depot: A Plan For Renewal and ReinvigorationDocumento113 páginasTransforming Office Depot: A Plan For Renewal and ReinvigorationAnonymous Feglbx5Ainda não há avaliações

- Moore CapitalDocumento1 páginaMoore CapitalZerohedgeAinda não há avaliações

- Global Macro Trends and Strategies - BloombergDocumento70 páginasGlobal Macro Trends and Strategies - Bloombergdrewmx100% (1)

- G10 Annual OutlookDocumento27 páginasG10 Annual OutlookansarialiAinda não há avaliações

- US Fixed Income Markets WeeklyDocumento96 páginasUS Fixed Income Markets Weeklyckman10014100% (1)

- Chris Cole Artemis Vega - Grants Interest Rate Observer Oct232012 - FINAL - v8Documento34 páginasChris Cole Artemis Vega - Grants Interest Rate Observer Oct232012 - FINAL - v8augtour4977100% (1)

- Ers. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewDocumento10 páginasErs. Co M: JANA Master Fund, Ltd. Performance Update - December 2010 Fourth Quarter and Year in ReviewVolcaneum100% (2)

- Steve Eisman - Ira Sohn Conference - May 2010Documento47 páginasSteve Eisman - Ira Sohn Conference - May 2010Terry Tate Buffett100% (2)

- Owls Creek's Fourth Quarter Letter To InvestorsDocumento14 páginasOwls Creek's Fourth Quarter Letter To InvestorsDealBook100% (14)

- Bwa M 033116Documento10 páginasBwa M 033116Chungsrobot Manufacturingcompany100% (1)

- Goldman Sachs 2018 PDFDocumento16 páginasGoldman Sachs 2018 PDFNinad KutheAinda não há avaliações

- Nomura FX ReportDocumento6 páginasNomura FX Reportmgroble3Ainda não há avaliações

- Gic WeeklyDocumento12 páginasGic WeeklycampiyyyyoAinda não há avaliações

- FX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HigherDocumento25 páginasFX Compass: Looking For Signs of Pushback: Focus: Revising GBP Forecasts HighertekesburAinda não há avaliações

- Gundlach Prez 9.8.2016Documento59 páginasGundlach Prez 9.8.2016ZerohedgeAinda não há avaliações

- There'S Something' Weird Going OnDocumento33 páginasThere'S Something' Weird Going OnZerohedge100% (7)

- Financial Soundness Indicators for Financial Sector Stability in Viet NamNo EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamAinda não há avaliações

- Tech Stock Valuation: Investor Psychology and Economic AnalysisNo EverandTech Stock Valuation: Investor Psychology and Economic AnalysisNota: 4 de 5 estrelas4/5 (1)

- Financial Fine Print: Uncovering a Company's True ValueNo EverandFinancial Fine Print: Uncovering a Company's True ValueNota: 3 de 5 estrelas3/5 (3)

- Guaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinanceNo EverandGuaranteed to Fail: Fannie Mae, Freddie Mac, and the Debacle of Mortgage FinanceNota: 2 de 5 estrelas2/5 (1)

- Across the Great Divide: New Perspectives on the Financial CrisisNo EverandAcross the Great Divide: New Perspectives on the Financial CrisisAinda não há avaliações

- JPM Weekly MKT Recap 3-05-12Documento2 páginasJPM Weekly MKT Recap 3-05-12Flat Fee PortfoliosAinda não há avaliações

- DMG Small CapsDocumento9 páginasDMG Small Capscentaurus553587Ainda não há avaliações

- Egerton 2018 Q3Documento9 páginasEgerton 2018 Q3jackefellerAinda não há avaliações

- On Falling Neutral Real Rates Fiscal Policy and The Risk of Secular StagnationDocumento68 páginasOn Falling Neutral Real Rates Fiscal Policy and The Risk of Secular StagnationjackefellerAinda não há avaliações

- Schroder GAIA Egerton Equity: Quarterly Fund UpdateDocumento8 páginasSchroder GAIA Egerton Equity: Quarterly Fund UpdatejackefellerAinda não há avaliações

- Schroder GAIA Egerton Equity: Quarterly Fund UpdateDocumento8 páginasSchroder GAIA Egerton Equity: Quarterly Fund UpdatejackefellerAinda não há avaliações

- Owl Creek Q2 2010 LetterDocumento9 páginasOwl Creek Q2 2010 Letterjackefeller100% (1)

- Egerton 2017 Q2 UpdateDocumento7 páginasEgerton 2017 Q2 UpdatejackefellerAinda não há avaliações

- Egerton 2017 Q1 UpdateDocumento8 páginasEgerton 2017 Q1 UpdatejackefellerAinda não há avaliações

- Bloomberg Top Hedge Funds 2010Documento14 páginasBloomberg Top Hedge Funds 2010jackefeller100% (1)

- Einhorn Greenlight Capital July 07 2011Documento7 páginasEinhorn Greenlight Capital July 07 2011Old School ValueAinda não há avaliações

- DanLoeb BloombergDocumento9 páginasDanLoeb BloombergbillcaneAinda não há avaliações

- June 2011 TrialDocumento21 páginasJune 2011 TrialjackefellerAinda não há avaliações

- Green Light Capital Q1 LetterDocumento5 páginasGreen Light Capital Q1 LetterKatya WachtelAinda não há avaliações

- The Case For Agriculture From Hedge Fund Passport CapitalDocumento36 páginasThe Case For Agriculture From Hedge Fund Passport CapitaljackefellerAinda não há avaliações

- Reaction Paper Estate Tax Valencia, Reginald GDocumento2 páginasReaction Paper Estate Tax Valencia, Reginald GReginald ValenciaAinda não há avaliações

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento4 páginasStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAishwarya SenthilAinda não há avaliações

- Competitive Market Benchmark Analysis For Financial ServicesDocumento2 páginasCompetitive Market Benchmark Analysis For Financial Servicesapi-3809857Ainda não há avaliações

- Financial Analysis - WalmartDocumento3 páginasFinancial Analysis - WalmartLuka KhmaladzeAinda não há avaliações

- Offer LetterDocumento3 páginasOffer LetterAditya GadgilAinda não há avaliações

- Contract of LeaseDocumento4 páginasContract of LeaseKim GarridAinda não há avaliações

- Resume - Aansh DesaiDocumento2 páginasResume - Aansh Desaisiddhant jainAinda não há avaliações

- Khali Tin ChallanDocumento2 páginasKhali Tin ChallanNimeshAinda não há avaliações

- Ats Taxation PDFDocumento372 páginasAts Taxation PDFOlawaleAinda não há avaliações

- Fraud Prevention and DetectionDocumento3 páginasFraud Prevention and DetectionTahir AbbasAinda não há avaliações

- Holiday Homework Class XI Accountancy PDFDocumento8 páginasHoliday Homework Class XI Accountancy PDFAlokAinda não há avaliações

- Workbook Week 7 SolutionsDocumento11 páginasWorkbook Week 7 SolutionsThi Van Anh VUAinda não há avaliações

- Forex & CFD Trading On Stocks, Indices, Oil, Gold by XM™Documento1 páginaForex & CFD Trading On Stocks, Indices, Oil, Gold by XM™sipho gumbiAinda não há avaliações

- Why Finkulp 18.08Documento7 páginasWhy Finkulp 18.08Yadav VineetAinda não há avaliações

- Real Estate Black BookDocumento9 páginasReal Estate Black BookVishal Dhekale0% (2)

- Course OtamDocumento4 páginasCourse Otamkam456Ainda não há avaliações

- BAFACR16 01 Problem IllustrationsDocumento2 páginasBAFACR16 01 Problem Illustrationsmisssunshine112Ainda não há avaliações

- The Economics of Tourism and HospitalityDocumento38 páginasThe Economics of Tourism and HospitalityStraichea Mae TabanaoAinda não há avaliações

- Company Accounts Notes - CA Anand BhangariyaDocumento17 páginasCompany Accounts Notes - CA Anand BhangariyaAagam ShahAinda não há avaliações

- Investment FundamentalsDocumento82 páginasInvestment Fundamentalshyunsuk fhebieAinda não há avaliações

- CA Inter Paper 2 All Question PapersDocumento175 páginasCA Inter Paper 2 All Question PapersNivedita SharmaAinda não há avaliações

- Money, Banking, and Monetary Policy: ObjectivesDocumento9 páginasMoney, Banking, and Monetary Policy: ObjectivesKamalpreetAinda não há avaliações

- MIT15 S12F18 Ses21Documento22 páginasMIT15 S12F18 Ses21teo2005Ainda não há avaliações

- COVID-19 Outbreak: Impact On Sri Lanka and RecommendationsDocumento19 páginasCOVID-19 Outbreak: Impact On Sri Lanka and RecommendationsMohamed FayazAinda não há avaliações

- β β X, X σ X X X: Simposium Nasional Akuntansi ViDocumento12 páginasβ β X, X σ X X X: Simposium Nasional Akuntansi ViNicholas AlexanderAinda não há avaliações

- Admission of A Partner: Namma KalviDocumento15 páginasAdmission of A Partner: Namma KalviAakaash C.K.Ainda não há avaliações

- SraDocumento49 páginasSraAditya GhagAinda não há avaliações

- Management Accounting Module - VDocumento11 páginasManagement Accounting Module - Vdivya kalyaniAinda não há avaliações