Escolar Documentos

Profissional Documentos

Cultura Documentos

VW

Enviado por

Ṭhạnwa HimaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

VW

Enviado por

Ṭhạnwa HimaDireitos autorais:

Formatos disponíveis

e u r e x circular 062/14

Date: Recipients: Authorized by: 2 April 2014 All Trading Participants of Eurex Deutschland and Eurex Zrich and Vendors Mehtap Dinc

Action required

A. Single Stock Futures: Introduction of SSFs on Ansaldo STS S.p.A., Buzzi Unicem S.p.A., Davide Campari-Milano S.p.A. and Tod's S.p.A.; B. Equity options: Introduction of a European equity option on VW preference shares

Contact: Derivatives Trading Operations, T +49-69-211-1 12 10, Michael Durica, T +49-69-211-1 59 23 Content may be most important for: Attachment: Updated Annexes A and B of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland and Eurex Zrich

All departments

Summary: The Management Board of Eurex Deutschland and the Executive Board of Eurex Zrich AG took the following decisions with effect from 7 April 2014: 1. Introduction of Single Stock Futures on Ansaldo STS S.p.A., Buzzi Unicem S.p.A., Davide CampariMilano S.p.A. and Tod's S.p.A. 2. Introduction of a European equity option on VW preference shares. The minimum number of tradable contracts for the EurexOTC Trade Entry facilities will be 250 contracts.

Eurex Deutschland Brsenplatz 4 60313 Frankfurt/Main Mailing address: 60485 Frankfurt/Main Germany

T +49-69-211-1 17 00 F +49-69-211-1 17 01 memberservices@ eurexchange.com Internet: www.eurexchange.com

Management Board: Thomas Book, Mehtap Dinc, Michael Peters, Andreas Preuss

ARBN: 101 013 361

e u r e x circular 062/14

A. Single Stock Futures: Introduction of SSFs on Ansaldo STS S.p.A., Buzzi Unicem S.p.A., Davide Campari-Milano S.p.A. and Tod's S.p.A.

1. Product overview

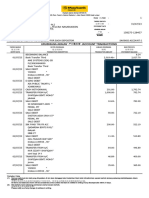

Future on Underlying ISIN Eurex Group ID Product currency Product ISIN Product code of Flexible Future Cash Physical A4SF UC4F D4CF T4DF A5SF UC5F D5CF T5DF

Product code

ANSF UCMF DVCF TODF

Ansaldo STS S.p.A. Buzzi Unicem S.p.A. Davide Campari-Milano S.p.A. Tod's S.p.A.

IT0003977540 IT0001347308 IT0003849244 IT0003007728

IT01 IT01 IT01 IT01

EUR EUR EUR EUR

DE000A11RG91 DE000A1RRTD8 DE000A1RRTE6 DE000A11RHA1

Product code ANSF UCMF DVCF TODF

Contract size 1000 1000 1000 1000

Minimum price change 0.0001 0.0001 0.0001 0.0001

Minimum size for Block Trades 1 1 1 1

Product group ENSFSE ENSFSE ENSFSE ENSFSE

2.

Contract specifications and product parameters

Generally, contract specifications for the new Single Stock Futures are in line with the existing ones with the relevant Eurex group IDs, also in terms of trading hours and trading calendar, last trading day, settlement and determination of the daily and final settlement prices. Updated Annexes A and B of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland and Eurex Zrich will be published on the Eurex website www.eurexchange.com under the following link: Resources > Rules and Regulations > Contract specifications 3. Risk parameters

You will receive the relevant risk parameters via the Theoretical Price Files after the product set-up in Eurex Exchanges T7. The parameters will also be published as of start of trading on the Eurex website under: Market data > Clearing data > Risk parameters and initial margins 4. Mistrade parameters, position limits

Mistrade ranges and position limits for the new Single Stock Futures will be published as of start of trading on the Eurex website under the link: Products > Equity Derivatives > Single Stock Futures

page 1 of 4

e u r e x circular 062/14

5.

Transaction limits

The same values apply as for existing Single Stock Futures with the respective Eurex group ID. For details, please refer to the Eurex website under the link: Technology > Excessive System Usage Fee 6. Transaction fees

The same transaction fees apply as for the corresponding existing Single Stock Futures. 7. Vendor codes

As of start of trading, data vendor codes for the new products will be published on the Eurex website under the link: Products > Vendor Product Codes 8. Prisma eligibility

All futures and options on equities and equity indexes are eligible for usage within Prisma. Please refer to Risk Control at tel. +49-69-211-1 24 52 for any questions you may have regarding Prisma eligibility of certain Eurex products.

B. Equity options: Introduction of a European equity option on VW preference shares

The Management Board of Eurex Deutschland and the Executive Board of Eurex Zrich AG decided to introduce a European equity option on VW preference shares with effect from 7 April 2014. 1. Contract specifications and product parameters

The minimum number of tradable contracts for the EurexOTC Trade Entry facilities will be 250 contracts.

Option on Product ISIN Eurex product code Contract size Maximum maturity (months) Minimum price change Currency

Introduction on 7 April 2014 German Equity Options (Group ID: DE14) VW preference shares (European) DE000A11RHB9 VO3E 100 60 0.01 EUR

2.

Maturities

The equity option will be tradable for up to 60 months, i.e. until and including the next, the second next and the third next maturity dates and including the next three consecutive quarterly maturity dates (March, June, September, December) as well as the following four semi-annual maturity dates (June and December). 3. Exercise prices

Exercise prices for the equity option follow the current Eurex standard of the respective group IDs. Please refer to the contract specifications for details. Upon introduction of the equity option contract, at least seven exercise prices are available for trading for each Call and Put for each maturity date in the respective maturities, three of which are in-the-money, one is at-themoney and three are out-of-the-money.

page 2 of 4

e u r e x circular 062/14

Contract specifications for the new equity option are available on the Eurex website under the link: Products > Equity Derivatives > Equity Options 4. Risk parameters

Margin parameters will be published in due course on the Eurex website under the link: Market data > Clearing data > Risk parameters and initial margins A separate Eurex circular will not be distributed. 5. Trading hours

Trading hours correspond with the relevant trading hours of the existing group IDs. Please refer to the contract specifications for details. 6. Mistrade ranges, position limits

Mistrade ranges and position limits for the new equity option will be published as of start of trading on the Eurex website under the link: Products > Equity Derivatives > Equity Options 7. Vendor codes

As of start of trading, data vendor codes for the new product will be published on the Eurex website under the link: Products > Vendor Product Codes 8. Trading calendar

The existing trading calendar for German equity options will apply. It can be found on the Eurex website under the link: Trading > Trading calendar 9. Transaction limits, minimum size for cross- and pre-arranged trades, transaction fees

The same values apply as for existing equity options with the respective Eurex group ID. 10. Product group The new equity option will be allocated to the following product group:

Settlement location unit Regulatory status Product currency Product segment Settlement type

German equity options

EXS

C/P (S)

Product type

Product group

Product code

Aktienoptionen

EUR

For further information on the assignment of products and product groups, please refer to Eurex circular 232/07, section 1.6.

page 3 of 4

e u r e x circular 062/14

11. EurexOTC Trade Entry facilities For the EurexOTC Block Trade and Flexible Options facilities, the minimum number of tradable contracts will be 250 contracts. The intra-day non-disclosure limit for EurexOTC Block Trades is 2,501 contracts. The Flexible Options facility will be available upon acceptance of the General Conditions for Participation. An overview of the EurexOTC Trade Entry facilities available for the products as well as detailed information on all Single Stock Futures and equity options on single product basis with regard to availability, possibility of utilisation and minimum number of tradable contracts for the various EurexOTC Trade Entry facilities is available on the Eurex website. Excel file Eurex Product List and Product Grouping contains product parameter Block Volume Publication Limit (see column Blk Vol Pub Limit) which defines the limit for volumes up to which EurexOTC Block Trades in the various products are published. Aforementioned information as well as the Excel file can be found on the Eurex website under the link: Trading > EurexOTC Trade Entry > Trade entry parameters 12. Prisma eligibility All futures and options on equities and equity indexes are eligible for usage within Prisma. Please refer to Risk Control at tel. +49-69-211-1 24 52 for any questions you may have regarding Prisma eligibility of certain Eurex products.

2 April 2014

page 4 of 4

Você também pode gostar

- I Wish That I Could Back in TimeDocumento1 páginaI Wish That I Could Back in TimeṬhạnwa HimaAinda não há avaliações

- Wolverine by Gus SantomeDocumento1 páginaWolverine by Gus SantomeṬhạnwa HimaAinda não há avaliações

- Beginner Verbs กิริยาขั้นต้น Gi-Ri-Yaa Kân-TônDocumento4 páginasBeginner Verbs กิริยาขั้นต้น Gi-Ri-Yaa Kân-TônṬhạnwa HimaAinda não há avaliações

- 001 B1 081307 Kclass101Documento6 páginas001 B1 081307 Kclass101Theyie QAinda não há avaliações

- Hemo Dynamic DisordersDocumento6 páginasHemo Dynamic DisordersṬhạnwa HimaAinda não há avaliações

- 002 B2 082007 Kclass101 LessonDocumento4 páginas002 B2 082007 Kclass101 LessonmassabrAinda não há avaliações

- Elementary - Breakup: Key VocabularyDocumento2 páginasElementary - Breakup: Key VocabularyṬhạnwa HimaAinda não há avaliações

- The Art of Urban SketchingDocumento324 páginasThe Art of Urban SketchingṬhạnwa Hima96% (26)

- Wolverine by Gus SantomeDocumento1 páginaWolverine by Gus SantomeṬhạnwa HimaAinda não há avaliações

- Cars FillmoreDocumento2 páginasCars FillmoreṬhạnwa HimaAinda não há avaliações

- Acute and Chronic InflammationDocumento8 páginasAcute and Chronic Inflammationsurfina87Ainda não há avaliações

- Basic Theories of Traditional Chinese Medicine: Francisco LozanoDocumento11 páginasBasic Theories of Traditional Chinese Medicine: Francisco LozanoṬhạnwa HimaAinda não há avaliações

- Nǐ Zǒng Shì Yī Fù Bú Zài Yì de Yàng ZǐDocumento4 páginasNǐ Zǒng Shì Yī Fù Bú Zài Yì de Yàng ZǐṬhạnwa HimaAinda não há avaliações

- A-Aleap Accomplished FormDocumento1 páginaA-Aleap Accomplished FormṬhạnwa HimaAinda não há avaliações

- UNIQADocumento9 páginasUNIQAṬhạnwa HimaAinda não há avaliações

- Chinese Characters - Basic PDFDocumento92 páginasChinese Characters - Basic PDFttsaqa868194% (17)

- Thai alphabet origins and notable featuresDocumento3 páginasThai alphabet origins and notable featuresṬhạnwa HimaAinda não há avaliações

- Speak Mandarin in Five Hundred WordsDocumento237 páginasSpeak Mandarin in Five Hundred WordsYunafi'atul Aniroh100% (4)

- Foundations of Traditional Chinese MedicineDocumento162 páginasFoundations of Traditional Chinese MedicineAndy Zou100% (19)

- Learning Chinese: A Foundation Course IN MandarinDocumento135 páginasLearning Chinese: A Foundation Course IN MandarinDos-peter John Bilbao87% (15)

- Chinese Romanization Rules and GuidelinesDocumento19 páginasChinese Romanization Rules and GuidelinesParizaca PacoAinda não há avaliações

- Test 1Documento9 páginasTest 1Parth SarthyAinda não há avaliações

- Lyrics To You and IDocumento5 páginasLyrics To You and IṬhạnwa HimaAinda não há avaliações

- Food Sponsorship LetterDocumento1 páginaFood Sponsorship LetterṬhạnwa HimaAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Chapter 13 To 15Documento13 páginasChapter 13 To 15Cherry Mae GecoAinda não há avaliações

- Ratio Analysis of Nepal Investment BankDocumento28 páginasRatio Analysis of Nepal Investment BankBijaya DhakalAinda não há avaliações

- RFBT 04 03 Law On Obligation For Discussion Part TwoDocumento15 páginasRFBT 04 03 Law On Obligation For Discussion Part TwoStephanieAinda não há avaliações

- LMT MercDocumento128 páginasLMT MercCj GarciaAinda não há avaliações

- G.R. No. 109172 August 19, 1994 Trans-Pacific Industrial Supplies, Inc., Petitioner, The COURT OF APPEALS and ASSOCIATED BANK, RespondentsDocumento3 páginasG.R. No. 109172 August 19, 1994 Trans-Pacific Industrial Supplies, Inc., Petitioner, The COURT OF APPEALS and ASSOCIATED BANK, RespondentsOnana100% (2)

- CPA Licensure Exam Syllabus for Management Advisory ServicesDocumento16 páginasCPA Licensure Exam Syllabus for Management Advisory ServiceskaderderkaAinda não há avaliações

- Project Proposal: Ato Aniley WubieDocumento26 páginasProject Proposal: Ato Aniley Wubiedawit100% (2)

- Iibf BcsbiDocumento6 páginasIibf BcsbivikramAinda não há avaliações

- M2U SA 128457 Jul 2023Documento5 páginasM2U SA 128457 Jul 2023syafiqah.mohdali38Ainda não há avaliações

- ACC101Documento8 páginasACC101Rizwana MehwishAinda não há avaliações

- A Project Report On Kotak InsuranceDocumento82 páginasA Project Report On Kotak Insurancevarun_bawa251915Ainda não há avaliações

- Salary Advances and Staff LoansDocumento3 páginasSalary Advances and Staff LoansomarelzainAinda não há avaliações

- LIC plans major shakeup of Escorts boardDocumento6 páginasLIC plans major shakeup of Escorts boardqubrex1Ainda não há avaliações

- UK Types of Bank Accounts PDFDocumento2 páginasUK Types of Bank Accounts PDFAilénVillalbaAinda não há avaliações

- Capitalized Cost Eng Econo As1Documento8 páginasCapitalized Cost Eng Econo As1Francis Valdez LopezAinda não há avaliações

- INDUE LIMITED - Current & Historical Company ExtractDocumento28 páginasINDUE LIMITED - Current & Historical Company ExtractclarencegirlAinda não há avaliações

- NFP Report 8 Mar 2019Documento4 páginasNFP Report 8 Mar 2019Dian LanAinda não há avaliações

- 300 - PEI - Jun 2019 - DigiDocumento24 páginas300 - PEI - Jun 2019 - Digimick ryanAinda não há avaliações

- Beck Fed IncomeTax OutlineDocumento106 páginasBeck Fed IncomeTax OutlineEvan Joseph100% (1)

- Chapter 18 Government GrantsDocumento6 páginasChapter 18 Government Grantsalexandra rausaAinda não há avaliações

- Understanding LiabilitiesDocumento2 páginasUnderstanding LiabilitiesXienaAinda não há avaliações

- Summary of The Contents (#1 To 10) As BelowDocumento22 páginasSummary of The Contents (#1 To 10) As BelowRajesh UjjaAinda não há avaliações

- Stamp Duty Rules ExplainedDocumento3 páginasStamp Duty Rules ExplainedSausan SaniaAinda não há avaliações

- Ebook-Forextrading-Hq DERIVDocumento86 páginasEbook-Forextrading-Hq DERIVMtashu100% (1)

- Proceedings SummitDocumento3 páginasProceedings Summitamitsh20072458Ainda não há avaliações

- Tangible and Intangible Assets: IAS 16, IAS 38Documento39 páginasTangible and Intangible Assets: IAS 16, IAS 38petitfmAinda não há avaliações

- Summer Project Report (Content)Documento28 páginasSummer Project Report (Content)Shubham soniAinda não há avaliações

- NORTHERN TRUST CORPORATION OWNS IRSDocumento3 páginasNORTHERN TRUST CORPORATION OWNS IRStravis smithAinda não há avaliações

- Employee Stock Option PlanDocumento7 páginasEmployee Stock Option Plankrupalee100% (1)

- Liquidity of Siddhartha Bank Limited: A Summer Project Report Submitted ToDocumento35 páginasLiquidity of Siddhartha Bank Limited: A Summer Project Report Submitted Tosumeet kcAinda não há avaliações