Escolar Documentos

Profissional Documentos

Cultura Documentos

190 Financial Math and Analysis Concepts-Open R 2014

Enviado por

api-250674550Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

190 Financial Math and Analysis Concepts-Open R 2014

Enviado por

api-250674550Direitos autorais:

Formatos disponíveis

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 1 of 10

FINANCIAL MATH & ANALYSIS CONCEPTS

(190)

OPEN EVENT REGIONAL 2014 DO NOT WRITE ON TEST BOOKLET

TOTAL POINTS ___________ (500)

Failure to adhere to any of the following rules will result in disqualification: 1. Contestant must hand in this test booklet and all printouts. Failure to do so will result in disqualification. 2. No equipment, supplies, or materials other than those specified for this event are allowed in the testing area. No previous BPA tests and/or sample tests or facsimile (handwritten, photocopied, or keyed) are allowed in the testing area. 3. Electronic devices will be monitored according to ACT standards.

No more than 60 minutes testing time

Property of Business Professionals of America. May be reproduced only for use in the Business Professionals of America Workplace Skills Assessment Program competition.

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 2 of 10

GENERAL INSTRUCTIONS

The number of decimal places used in calculations and in the reporting of your answers is very important. Below are guidelines to use as you take this test. If a problem varies from these guidelines, it will be noted in the problem.

PAYROLL QUESTIONS

Do not round the overtime rate. Overtime is paid for any hours over 40 worked in a week, unless otherwise stated in the problem. Normal work week is 40 hours, unless otherwise stated in the problem.

PERCENTAGE PROBLEMS

Round to the nearest tenth when working with percentages. Example: Example: Use 2.3% NOT 2% An answer of .9638 should be written as 96.4%

FRACTIONS INTEREST

All interest rates are stated in one-year simple interest, unless otherwise noted. Interest is to be calculated on 365 days. All problems with fractions are to be reduced to their lowest terms.

DOLLAR AMOUNTS

All dollar amounts must be rounded to the second place (nearest cent). Example: $35.9765 to $35.98

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 3 of 10

1. If an automated welding machine can produce 35 welds in one hour, how many welds can be produced in a 24-hour period? A. 830 B. 840 C. 850 D. 860 2. A small plane burns 16 gallons of fuel per hour. What is the flight time for 128 gallons? A. 2 B. 4 C. 6 D. 8 3. A cook measures 5 cups of flour for bread, 4 cups for cookies, and 3 cups for pancakes. If this amount could be taken from the bag every day for seven days before it was empty, how many cups of flour were in the bag? A. 80 B. 82 C. 84 D. 86 4. A worker makes $3,500 for one months pay. Total deductions for taxes, insurance, etc., amount to $540. Rent is $880; food is $320; car expense is $290; utilities cost $85. How much money remains at the end of the month after these expenses are paid? A. $1,385 B. $1,485 C. $1,545 D. $1,635 5. AKB Electronics is looking into renting additional warehouse space. The floor space AKB is considering needs to measure 125 feet by 84 feet. What is the square foot requirement for the additional warehouse? A. 10,100 B. 10,500 C. 12,400 D. 14,500 6. The Arctic Omega Health Foods Co. plans to operate a kiosk in an upscale shopping mall. The space the kiosk will occupy is 17 feet by 22 feet. The monthly rental charge is $413.00. What is the annual price per square foot? A. $13.25 B. $22.00 C. $34.42 D. $39.00 7. Gs Soft Toys needs 1,200 more square feet of storage space in its distribution center. The store is willing to pay $9,000 a year for this space. What is the monthly rent Gs is willing to pay? A. $570 B. $600 C. $750 D. $900

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 4 of 10

8. Fine Gifts hired Rauls Remodeling to paint their new store. Since the job was done over a weekend, the painters were paid time and a half. They normally receive $25 per hour. Four painters worked 19 hours on the project. They used 38 gallons of paint. Each gallon of paint costs $27.50. What was the total charge for painting the new store? A. $2,850 B. $2,945 C. $3,895 D. $4,135 9. Aretha Morgan runs a janitorial service that contracts directly with owners of large office buildings. One building has 4,225 square f eet per floor and 32 stories of office space. Morgans rate for janitorial services is $5.35 per square foot annually. To the nearest cent, what is the monthly charge for cleaning this office building? A. $11,266.67 B. $22,603.75 C. $30,138.34 D. $60,276.67 10. If a worker makes $850.00 per week and is paid twice a month, what is the amount of her gross pay (to the nearest dollar) each pay period? A. $1,700 B. $1,842 C. $3,400 D. $3,684 11. Jones Grocery had new flooring laid in its bakery area. The space measures 24 feet by 18 feet. Ceramic tiles for the area cost $3.15 per square foot. Two tile layers worked 7.5 hours each to lay the tile and the tile layers were paid time-and-a-half for their work. Their normal rate is $22.25 per hour. What was the total cost of the new flooring (to the nearest dollar)? A. $1,611 B. $1,695 C. $1,861 D. $2,542 12. Someone makes a salary of $2,400 per month. If they are paid every week, what is their gross pay per pay period (to the nearest dollar)? A. $554 B. $600 C. $820 D. $1,600 13. Jocelyn works as a hair stylist and earns $10.50 per hour. She worked 18 hours in one week and 24 hours the next week, what is her pay for the two weeks? A. $189 B. $252 C. $360 D. $441

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 5 of 10

14. A worker provides child care in his home. He charges $5 per hour per child. On one day he cared for Amy for 3 hours, Joshua for 4 hours, Jasmine for 4 hours, and Kaylee for 6 hours. What was his total pay for that day? A. $45 B. $65 C. $85 D. $95 15. Cindy works at the Medical Institute 2 days each week. If she works from 6:15 4:45 on Tuesday and from 6:15 5:15 on Thursday, what are her total hours for the week? (Cindy gets a half hour lunch break that she is not paid for each day she works more than 5 hours.) A. 19.5 B. 20.5 C. 21.5 D. 22.5 16. The monthly electricity usage for Ramirez Photo Studio is 2,135 kilowatts, and the fuel adjustment charge is $0.0155 per kilowatt hour. The energy charge for the first 1,000 kilowatt hours is $0.077 per kWh. The cost for remaining kilowatt hours is $0.059 per kWh. What is the total cost of electricity? A. $143.97 B. $159.06 C. $177.06 D. $197.48 17. Gerald earns a 3 percent commission on all sales. He also receives a $1,100 bonus if his sales exceeds $75,000. His total sales were $85,500. What was his total pay? A. $2,565 B. $3,450 C. $3,665 D. $4,865 18. Clarence rents out commercial real estate. He earns 2 percent commission on the first $25,000 in rentals, 4 percent on the next $25,000, and 8 percent on rentals over $50,000. Last month he was responsible for $118,000 worth of rentals. What was his total commission? A. $5,860 B. $6,700 C. $6,860 D. $6,940 19. Nellies monthly budget allows her to spend $150 for entertainment. In February she spent $27. What is the difference between the budgeted and actual amounts? A. $123 more B. $123 less C. $133 more D. $133 less

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 6 of 10

20. Betty is a manufacturers representative and travels all over the country selling her companys products. Her total monthly expenses for August, September and October were $2,756.11, $7,111.20, and $5,080.70. What was her average monthly expenditure? A. $3,898.01 B. $3,983.45 C. $4,567.76 D. $4,982.67 21. Tony budgeted $4,550 to buy a car for his son. He spent $6,788. What was the difference in his budgeted and actual amount spent? A. $2,238 less B. $2,238 more C. $2,338 less D. $2,338 more 22. Lisa had a balance of $541.82 in her checking account. She wrote a check for $27.19. What is her new balance? A. $494.63 B. $514.63 C. $569.01 D. $578.63 23. A cabin tent retails for $899.95. Included in the retail price is $75.00 for advertising. What percent of the retail price of the tent is for advertising? A. 8.3 percent B. 10.4 percent C. 15.0 percent D. None of the above 24. Lourdes deposits the following in her checking account: 3 ten-dollar bills, 6 five-dollar bills, 9 one-dollar bills, 9 quarters, 11 dimes, 2 nickels, 47 pennies, and a check for $19.76. What is her total deposit? A. $72.68 B. $72.92 C. $92.21 D. $92.68 25. Dental Services occupies 30,000 square feet in the Medical Arts Building with 100,000 square feet. Annual cost of security is $30,000. The Medical Arts Building apportions the cost based on square feet occupied. What does Dental Services pay? A. $1,200 B. $5,782 C. $9,000 D. $9,900

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 7 of 10

26. The Francesco Company apportions the annual cost of utilities among its departments. The total cost for the year was $198,000. The total area of the building is 320,000 square feet. The companys research and development department occupies an area that is 100 feet by 300 feet. What does the research and development department pay for utilities for the year? A. $17,925.00 B. $19,883.60 C. $18,562.50 D. $16,783.25 27. Sally is a representative for a window manufacturing company. She uses a van entirely for business. She trades in her van every 4 years. Sally paid $35,000 for her van and expects to receive $11,000 for the van when she trades it in after 4 years. Using the straight-line method, what is the annual depreciation? A. $3,500 B. $6,000 C. $7,000 D. $8,750 28. The card store purchased 5 new card-display racks for a total cost of $4,625. The racks have an estimated life of 5 years. The salvage value for each rack is expected to be $45. Using the straight-line method, what is the total annual depreciation? A. $880 B. $925 C. $995 D. $1,000 29. The bakery purchased a new oven at a cost of $1,200. The estimated life of the oven is 10 years and the salvage value is $300. What is the book value for the oven at the end of the first year? A. $850 B. $900 C. $1,000 D. $1,110 30. Assets are $13,000 cash and $78,000 merchandise. Owners equity is $35,000. Find the amount of liabilities. A. $34,000 B. $50,000 C. $56,000 D. $65,000

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 8 of 10

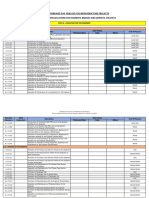

For problems 31 through 35, fill in the missing values based on the markup of the wholesale cost. Wholesale Cost 31. 32. 33. 34. 35. 23.1 cents $5.25 B. 100% B. $0.72 B. $1.875 B. 425% B. $8.88 C. 120% C. $0.82 C. $1.90 C. 463% C. $9.88 D. 220% D. $0.85 D. $1.955 D. 475% D. $10.50 $125.00 $0.39 $4.50 $1.30 50% Retail Price $275.00 85% 130% Percent Markup

31. A. 20% 32. A. $0.62 33. A. $1.855 34. A. 400% 35. A. $7.88

36. Total assets are $98,000 and total liabilities are $49,000. Find the current ratio of assets to liabilities. A. 1:1 current ratio B. 3:1 current ratio C. 2:1 current ratio D. 4:1 current ratio

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 9 of 10

For problems 37 41, fill in the missing fraction value in terms of the other forms. PERCENT 37. 38. 39. 40. 41. 25% 50% 33 1/3% 12.5% 187.5% B. 1/5 B. 1/3 B. 1/3 B. 1/6 B. 1 7/8 DECIMAL .25 0.5 .333 .125 1.875 C. 1/6 C. 1/4 C. 1/4 C. 1/7 C. 1 5/7 D. 1/7 D. 1/5 D. 1/5 D. 1/8 D. 1 6/7 FRACTION

37. A. 1/4 38. A. 1/2 39. A. 1/2 40. A. 1/5 41. A. 1 5/8

42. The coin shop had sales this month of $35,758 and returned merchandise of $4,500. Cost of goods sold was $12,000 and total operating expenses were $7,453. Find the gross profit on sales. A. $19,258 B. $20,389 C. $12,385 D. $31,258 43. Sales returns at the camera shop were $349.55 and net sales were $13,982.00. What are the sales returns as a percent of net sales? A. 2.5 percent B. 8.2 percent C. 1.5 percent D. 2.2 percent 44. Mike purchased the following items: a lawnmower for $328.61; a sprinkler for $13.27; and a hose reel for $27.96. If the state sales tax is 5.5%, the county tax 1.5% and the city tax is 2%, what is his total purchase price? A. $332.90 B. $369.84 C. $403.13 D. $415.08

FINANCIAL MATH & ANALYSIS CONCEPTS-OPEN - REGIONAL 2014 Page 10 of 10

45. If an 8-ounce tube of toothpaste cost $1.69, what is the unit price (per ounce) to the nearest tenth of a cent? A. $0.221 B. $0.091 C. $0.182 D. $0.211 46. The bait and tackle shop borrowed $50,000 from the bank to pay for remodeling costs. The bank lent the money at 6 percent ordinary interest for 90 days. What is the maturity value of the loan? A. $50,379.73 B. $50,499.73 C. $50,739.73 D. $53,000.00 47. James borrowed $200,000 to purchase a new office building at 5 percent ordinary interest for 120 days. Find the maturity value of the loan. A. $199,712.33 B. $203,287.67 C. $203,333.33 D. $203,340.67 48. A car lists for $17,465 and has $700 of options. The dealers cost is 89% of the list price and 86% of the options. The destination is $690. What is the dealers cost? A. $16,589.85 B. $16,835.85 C. $16,945.85 D. $16,955.85 49. Ashley prepared 10 2/3 gallons of punch. The guests consumed 8 3/4 gallons. How many gallons of punch was left? Express fractional part in lowest terms. A. 1 11/12 B. 1 C. 2 1/8 D. 2 1/2 50. Divide 19.76 by 0.227. Round the answer to 3 places. A. 87.044 B. 87.047 C. 87.048 D. 87.084

Você também pode gostar

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)No EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Nota: 5 de 5 estrelas5/5 (1)

- Basic Arithmetic Study Guide & Sample Test Questions: Lisa M. Garrett, Director of PersonnelDocumento15 páginasBasic Arithmetic Study Guide & Sample Test Questions: Lisa M. Garrett, Director of PersonnelRavi balanAinda não há avaliações

- 1 Ass-2Documento13 páginas1 Ass-2Kim SooanAinda não há avaliações

- 102 Bmidterm 2Documento19 páginas102 Bmidterm 2grrarrAinda não há avaliações

- Final Exam - Fall 2007Documento9 páginasFinal Exam - Fall 2007jhouvanAinda não há avaliações

- Bus146 Mock Exam Fall 2020Documento32 páginasBus146 Mock Exam Fall 2020shahverdyanarevik1Ainda não há avaliações

- Ma1 Test 1Documento6 páginasMa1 Test 1shahabAinda não há avaliações

- TT08Documento8 páginasTT0822002837Ainda não há avaliações

- Bizcalculations and BizcommDocumento9 páginasBizcalculations and Bizcommapi-196202713Ainda não há avaliações

- Af201 Fe PDFDocumento15 páginasAf201 Fe PDFマーチンMartinAinda não há avaliações

- CH 8 and 9Documento37 páginasCH 8 and 9hamdanmakAinda não há avaliações

- F5 RM QuestionsDocumento16 páginasF5 RM Questionsmaria1990Ainda não há avaliações

- Mock Mid Sem Test 2Documento12 páginasMock Mid Sem Test 2Himanshu PatelAinda não há avaliações

- InvestmentDocumento9 páginasInvestmentgoerginamarquezAinda não há avaliações

- NameDocumento13 páginasNameNitinAinda não há avaliações

- Week 5 - Tutorial Questions-1Documento4 páginasWeek 5 - Tutorial Questions-1Đan Thanh Nguyễn NgọcAinda não há avaliações

- EBE1063 LU7 8 Practise QuestionsDocumento5 páginasEBE1063 LU7 8 Practise Questions史迪奇Ainda não há avaliações

- Lecture Engineering Economics FE Review ProblemsDocumento23 páginasLecture Engineering Economics FE Review ProblemsLee Song HanAinda não há avaliações

- Practice Problems For The Final - 2 - UpdatedDocumento8 páginasPractice Problems For The Final - 2 - Updatedmaroo566100% (1)

- Exam176 10Documento5 páginasExam176 10Rabah ElmasriAinda não há avaliações

- Chartered University College: Cat Paper 2Documento17 páginasChartered University College: Cat Paper 2Mohsena MunnaAinda não há avaliações

- Introductory Chemistry A Foundation 7th Edition Test Bank Steven S ZumdahlDocumento36 páginasIntroductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahldiesnongolgothatsczx100% (39)

- Full Download Introductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahl PDF Full ChapterDocumento23 páginasFull Download Introductory Chemistry A Foundation 7th Edition Test Bank Steven S Zumdahl PDF Full Chaptervergencyooelite.vafrzk100% (19)

- CVP Review QuestionsDocumento6 páginasCVP Review QuestionsCharlie True FriendAinda não há avaliações

- Chap008 A SOLDocumento13 páginasChap008 A SOLKaif Mohammad HussainAinda não há avaliações

- EXERCISECHAPTER6Documento5 páginasEXERCISECHAPTER6Bạch ThanhAinda não há avaliações

- Business MathematicsDocumento2 páginasBusiness Mathematicsmanuel gallosAinda não há avaliações

- MA - Practice Questions PDFDocumento13 páginasMA - Practice Questions PDFSagunaChopraAinda não há avaliações

- Math Summative TestDocumento4 páginasMath Summative TestBryan QuiboAinda não há avaliações

- Exam135 08Documento3 páginasExam135 08Rabah ElmasriAinda não há avaliações

- Do Not Turn Over This Question Paper Until You Are Told To Do SoDocumento17 páginasDo Not Turn Over This Question Paper Until You Are Told To Do SoMin HeoAinda não há avaliações

- Mock BoardDocumento9 páginasMock BoardChristian Rey Sandoval DelgadoAinda não há avaliações

- Answers Homework # 13 Cost MGMT 2Documento6 páginasAnswers Homework # 13 Cost MGMT 2Raman AAinda não há avaliações

- Bai Tap Chuong 4Documento2 páginasBai Tap Chuong 4viettiennguyenAinda não há avaliações

- Practice Version - Advanced Problem Solving Test: Mckinsey & CompanyDocumento12 páginasPractice Version - Advanced Problem Solving Test: Mckinsey & CompanyPavel TsarevskyAinda não há avaliações

- Bus MathDocumento100 páginasBus MathApple Michaela Asiatico PaloAinda não há avaliações

- Mat116 Appendix CDocumento2 páginasMat116 Appendix CTammy PirkleAinda não há avaliações

- Exam 21082011Documento8 páginasExam 21082011Rabah ElmasriAinda não há avaliações

- Business Problems Based On DSSDocumento4 páginasBusiness Problems Based On DSSShivam SinghAinda não há avaliações

- Breakeven and EOQ Exercises (With Answers)Documento6 páginasBreakeven and EOQ Exercises (With Answers)Charlene ChorAinda não há avaliações

- Sample Final 11BDocumento11 páginasSample Final 11Bjosephmelkonian1741100% (1)

- Final Exam - Practice FinalDocumento12 páginasFinal Exam - Practice FinalShi FrankAinda não há avaliações

- Accounting and FinanceDocumento6 páginasAccounting and FinanceAisha KhanAinda não há avaliações

- Review QuestionsDocumento3 páginasReview QuestionsJEZICAH MAE DE JESUSAinda não há avaliações

- Chapter 2 Interest and DepreciationDocumento32 páginasChapter 2 Interest and DepreciationJojobaby51714Ainda não há avaliações

- 3 Test 3 AnswersDocumento9 páginas3 Test 3 AnswersRoger WilliamsAinda não há avaliações

- Latihan UAS Manacc TUTORKU (Answered)Documento10 páginasLatihan UAS Manacc TUTORKU (Answered)Della BianchiAinda não há avaliações

- AF201 REVISION PACKAGE s1, 2023 - StudentsDocumento9 páginasAF201 REVISION PACKAGE s1, 2023 - StudentsMiss SlayerAinda não há avaliações

- Management Advisory Services - MidtermDocumento7 páginasManagement Advisory Services - MidtermROB101512Ainda não há avaliações

- 106fex 2nd Sem 21 22Documento9 páginas106fex 2nd Sem 21 22Trine De LeonAinda não há avaliações

- Test 1 - Ma1 Practice in ClassDocumento8 páginasTest 1 - Ma1 Practice in ClassNgaka MokakeAinda não há avaliações

- Additional - Chapter 13Documento12 páginasAdditional - Chapter 13Gega XachidEAinda não há avaliações

- Acct500 Mock Final Exam QuestionsDocumento177 páginasAcct500 Mock Final Exam QuestionsDalal KwtAinda não há avaliações

- 4 5852725223857587726Documento6 páginas4 5852725223857587726survivalofthepolyAinda não há avaliações

- Exam 1 - VI SolutionsDocumento9 páginasExam 1 - VI Solutionssyeda hifzaAinda não há avaliações

- Additional QuestionsDocumento6 páginasAdditional QuestionsApoorva DhimarAinda não há avaliações

- SolutionDocumento18 páginasSolutionrajgupta100% (1)

- Module 10 ExercisesDocumento5 páginasModule 10 Exercisesomsfadhl50% (2)

- 160 S-Economic Research Team Technical Rubric 2014Documento1 página160 S-Economic Research Team Technical Rubric 2014api-250674550Ainda não há avaliações

- 155 S-Economic Research Individual Presentation Rubric 2014Documento3 páginas155 S-Economic Research Individual Presentation Rubric 2014api-250674550Ainda não há avaliações

- 191 Insurance Concepts-Open R 2014Documento6 páginas191 Insurance Concepts-Open R 2014api-250674550Ainda não há avaliações

- 145 Banking Finance R 2014Documento6 páginas145 Banking Finance R 2014api-250674550Ainda não há avaliações

- Balance Sheet 8-31Documento1 páginaBalance Sheet 8-31api-250674550Ainda não há avaliações

- 445 S-Broadcast News Production Team Rubric 2014Documento4 páginas445 S-Broadcast News Production Team Rubric 2014api-250674550Ainda não há avaliações

- 100 S-Fundamental Accounting R 2014Documento9 páginas100 S-Fundamental Accounting R 2014api-250674550Ainda não há avaliações

- 230 Fundamental Spreadsheet Applications R 2014Documento5 páginas230 Fundamental Spreadsheet Applications R 2014api-250674550Ainda não há avaliações

- 435 Web Site Design Team Technical Rubric 2014Documento1 página435 Web Site Design Team Technical Rubric 2014api-250674550Ainda não há avaliações

- 430 Video Production Team Presentation Rubric 2014Documento3 páginas430 Video Production Team Presentation Rubric 2014api-250674550Ainda não há avaliações

- 420 Digital Media Production Presentation Rubric 2014Documento3 páginas420 Digital Media Production Presentation Rubric 2014api-250674550Ainda não há avaliações

- 405 Fundamentals of Web Design R 2014Documento6 páginas405 Fundamentals of Web Design R 2014api-250674550Ainda não há avaliações

- 400 Fundamental Desktop Publishing R 2014Documento5 páginas400 Fundamental Desktop Publishing R 2014api-250674550Ainda não há avaliações

- 240 Database Applications R 2014Documento5 páginas240 Database Applications R 2014api-250674550Ainda não há avaliações

- 250 Medical Office Procedures R 2014Documento6 páginas250 Medical Office Procedures R 2014api-250674550Ainda não há avaliações

- 245 Legal Office Procedures R 2014Documento6 páginas245 Legal Office Procedures R 2014api-250674550Ainda não há avaliações

- 215 Integrated Office Applications R 2014Documento9 páginas215 Integrated Office Applications R 2014api-250674550Ainda não há avaliações

- Ekspedisi Central - Google SearchDocumento1 páginaEkspedisi Central - Google SearchSketch DevAinda não há avaliações

- Appendix 14 - Instructions - BURSDocumento1 páginaAppendix 14 - Instructions - BURSthessa_starAinda não há avaliações

- India of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDocumento2 páginasIndia of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDITSAAinda não há avaliações

- Voltas Case StudyDocumento27 páginasVoltas Case Studyvasistakiran100% (3)

- Percentage and Its ApplicationsDocumento6 páginasPercentage and Its ApplicationsSahil KalaAinda não há avaliações

- Cfa - Technical Analysis ExplainedDocumento32 páginasCfa - Technical Analysis Explainedshare757592% (13)

- Seller Commission AgreementDocumento2 páginasSeller Commission AgreementDavid Pylyp67% (3)

- Forex Fluctuations On Imports and ExportsDocumento33 páginasForex Fluctuations On Imports and Exportskushaal subramonyAinda não há avaliações

- Nissan Leaf - The Bulletin, March 2011Documento2 páginasNissan Leaf - The Bulletin, March 2011belgianwafflingAinda não há avaliações

- (Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayDocumento3 páginas(Dilg Memorandum Circular No. 2014-81) For The 2nd Quarter of C.Y. 2019 Region: HUC: BarangayYuri VillanuevaAinda não há avaliações

- JDocumento2 páginasJDMDace Mae BantilanAinda não há avaliações

- 2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Documento103 páginas2023 DPWH Standard List of Pay Items Volume II DO 6 s2023Alaiza Mae Gumba100% (1)

- Manual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesDocumento15 páginasManual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesAlbert ChangAinda não há avaliações

- Coconut Oil Refiners Association, Inc. vs. TorresDocumento38 páginasCoconut Oil Refiners Association, Inc. vs. TorresPia SottoAinda não há avaliações

- A View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)Documento17 páginasA View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)(FPTU HCM) Phạm Anh Thiện TùngAinda não há avaliações

- Vtiger Software For CRMDocumento14 páginasVtiger Software For CRMmentolAinda não há avaliações

- Design Analysis of The Lotus Seven S4 (Type 60) PDFDocumento18 páginasDesign Analysis of The Lotus Seven S4 (Type 60) PDFChristian Villa100% (4)

- Annex 106179700020354Documento2 páginasAnnex 106179700020354Santosh Yadav0% (1)

- PaySlip 05 201911 5552Documento1 páginaPaySlip 05 201911 5552KumarAinda não há avaliações

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesDocumento14 páginasLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaAinda não há avaliações

- EOQ HomeworkDocumento4 páginasEOQ HomeworkCésar Vázquez ArzateAinda não há avaliações

- Smart Home Lista de ProduseDocumento292 páginasSmart Home Lista de ProduseNicolae Chiriac0% (1)

- Table 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDocumento11 páginasTable 1. Different Modules of Training Proposed On Mushroom Cultivation Technology DetailsDeepak SharmaAinda não há avaliações

- Measure of Eco WelfareDocumento7 páginasMeasure of Eco WelfareRUDRESH SINGHAinda não há avaliações

- Sample Business ProposalDocumento10 páginasSample Business Proposalvladimir_kolessov100% (8)

- Indian Contract ActDocumento8 páginasIndian Contract ActManish SinghAinda não há avaliações

- Financial Astrology by Mahendra SharmaDocumento9 páginasFinancial Astrology by Mahendra SharmaMahendra Prophecy33% (3)

- Hard Work and Black Swans - Economists Are Turning To Culture To Explain Wealth and Poverty - Schools Brief - The EconomistDocumento9 páginasHard Work and Black Swans - Economists Are Turning To Culture To Explain Wealth and Poverty - Schools Brief - The EconomistMaría Paula ToscanoAinda não há avaliações

- Designing For Adaptation: Mia Lehrer + AssociatesDocumento55 páginasDesigning For Adaptation: Mia Lehrer + Associatesapi-145663568Ainda não há avaliações

- CMACGM Service Description ReportDocumento58 páginasCMACGM Service Description ReportMarius MoraruAinda não há avaliações